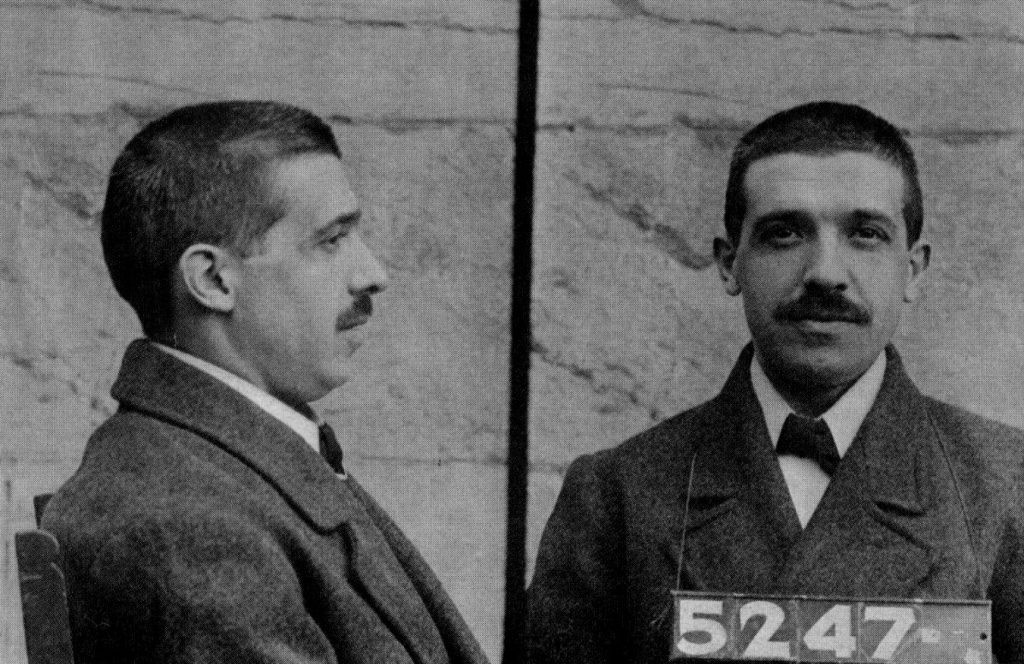

Charles Ponzi, an Italian businessman for whom the term “Ponzi scheme” was named

The state of Alabama has witnessed an epidemic of Ponzi schemes in recent years, as a flurry of investors across the state have experienced losses after unwittingly participating in these schemes.

In May 2014, Chief U.S. District Judge William Steele in Mobile sentenced three men for their part in an enormous Ponzi scheme that cost investors nearly $3 million. Stephen Merry, David Petersen, and Yaman Sencan were each convicted on 20 different counts during a December 2013 jury trial. The three men were ordered by Steele to pay $2,891,898 in restitution to the victims, serve five years in prison, serve three years of probation, and pay $2,000 in fees. In their scheme, they promised high profits in exchange for low risks due to a computer program designed to utilize temporary price differences among different stock markets, according to the prosecution. For nearly three years, investors, including three in Mobile and Baldwin counties, poured money into the scheme, encouraged by fake profits. However, the computer program did not exist, and the profits some investors received were simply re-routed payments from others.

Dothan man, Edward Lincoln Forehand, was sentenced in August 2013 for his participation in a Ponzi scheme that cost 87 investors nearly $3 million. Forehand was sentenced to 90 months in prison for securities fraud, mail fraud, wire fraud, and money laundering. He used the business name “USA Marketing” to solicit investments from people primarily in South Alabama and the Florida panhandle between 2007 and November 2009, promising extremely high rates of return on their investments of up to 700%. Forehand used much of the money investors gave him to pay prior investors and to purchase property and other items for himself.

A former business partner of former Auburn University head football coach Tommy Tuberville was sentenced to ten years in prison in November 2013 and ordered to pay $2.14 million to 12 investors. John David Stroud was convicted after defrauding investors out of millions of dollars. According to the Alabama Securities Commission, Stroud portrayed himself as a commodities trader and raised $5.2 million between 2008 and 2012 through various Auburn investment companies, using the money gained to pay back returns to other investors and for personal and unauthorized business expenses.

In January 2013, Spero X. Vourliotis of Birmingham, who operated a Ponzi scheme involving investors from Hoover, was sentenced to serve 10 years in prison. Vourliotis was also ordered to pay over $5 million in restitution to 26 victims who lost money related to the offering and sale of investments through self-described investments clubs identified as The Cornerstone Investment Group, The Capstone Group, and the Tri-Stone Group. The February 2012 indictment against Vourliotis charged that Vourliotis, acting in a management capacity, formed the Cornerstone Investment Group to pool investor capital to facilitate investments. He hid investment losses and produced fraudulent account statements to conceal investor losses. Records from the Alabama Securities Commission showed that neither Vourliotis nor the companies he represented were registered with the Commission to conduct securities business in Alabama, which is required by the Alabama Securities Act. Vourliotis pleaded guilty to one felony count of Securities Fraud in September 2012.

Ponzi schemes have not been a stranger to Alabama’s neighboring states either. Former University of Georgia head football coach Jim Donnan was charged with orchestrating a Ponzi scheme, convincing former colleagues and players to invest in a fake wholesale liquidation business and costing them $80 million in the process. Donnan, however, was found not guilty by a Georgia federal jury in May 2014. Florida has been hit harder by Ponzi schemes than any other state in the southeast. According to Forbes, between 2008 and 2013 the Sunshine State trails only New York in total number of dollars lost to Ponzi schemes and only California in total number of Ponzi schemes uncovered. A number of investors in Mississippi fell victim to one of the largest Ponzi schemes in U.S. history. Former jet-setting Texas tycoon R. Allen Stanford is currently awaiting sentencing after defrauding investors out of more than $7 billion over two decades and faces a maximum sentencing of 230 years.

The Frankowski Firm is currently investigating yet another potential Ponzi scheme involving Bryan Anderson, a former employee of Met Life and Prudential. The firm’s eight clients allege that Mr. Anderson convinced them to invest in a “box trade hedge fund”, providing them with a promissory note that guaranteed a certain rate of return. On information and belief, Anderson never invested any of the clients’ funds, but simply used the funds to pay off other investors.

If you or someone you know has lost money as a result of an investment or Ponzi scheme, please contact Richard Frankowski at 888-741-7503 to discuss your potential legal remedies.