NO FEES UNTIL WE WIN

FREE CONSULTATION

NO FEES UNTIL WE WIN

FREE CONSULTATION

Many American investors living abroad worry that their physical distance from the U.S. puts their investments in a legal gray area. It’s a common misconception that once you move overseas, the robust protections of U.S. securities laws no longer apply to you. That simply isn’t true. If you have an account with a U.S.-based brokerage firm, you are still shielded by the rules of the SEC and FINRA. This article will demystify your rights and provide a clear roadmap for how American expats in Japan can pursue claims against US brokers for issues like negligence, unsuitable recommendations, or fraud, proving that accountability has no borders.

Living abroad doesn’t mean you give up your rights as an investor. If you have an account with a U.S.-based brokerage firm, you are still protected by a robust system of federal and state securities laws. These rules are in place to ensure that brokers act in your best interest and treat you fairly, no matter where you are in the world. Think of these laws as your safety net, designed to shield you from misconduct like unauthorized trading, unsuitable recommendations, or outright fraud.

Many American expats worry that their distance creates a gray area, leaving them vulnerable. It’s true that living overseas can introduce complications. You might have seen news about U.S. brokerage firms restricting or closing accounts for Americans abroad, often citing complex regulations like the Foreign Account Tax Compliance Act (FATCA). While these actions can be frustrating and disruptive, they don’t strip you of your fundamental protections. If a U.S. broker mismanages your funds or provides negligent advice that leads to losses, you have the right to hold them accountable. The key is understanding which rules apply and how to use them to your advantage.

Even though you’re in Japan, your relationship with your U.S. broker is governed by U.S. law. This means that the Securities and Exchange Commission (SEC) and other regulatory bodies are still on your side. These agencies create and enforce rules that demand transparency and fair dealing from financial professionals. For you, this means your broker has a duty to recommend investments that are suitable for your financial situation and goals. They can’t just put your money into a high-risk venture without your informed consent. If you suspect broker fraud and negligence, these are the laws that give you a foundation to build a case and seek recovery for your losses.

The Financial Industry Regulatory Authority (FINRA) is a critical player in protecting your investments. It’s a private, self-regulatory organization that oversees virtually all brokerage firms doing business in the United States. Your broker and their firm must be registered with FINRA and adhere to its extensive rules of conduct. When disputes arise, FINRA provides a forum to resolve them, most commonly through a process called securities arbitration. This is often a faster and more cost-effective alternative to going to court. Essentially, FINRA acts as the watchdog of the brokerage industry, ensuring its members operate ethically and giving you a clear path to justice if they don’t.

It’s important to know that there is no U.S. law that requires brokerage firms to close the accounts of American expats. These decisions are based on the firm’s internal policies, often to reduce their own compliance burdens. While this is a major headache for many expats, it doesn’t give your broker a free pass to act improperly. If your account was closed without proper notice, or if the process of transferring your assets caused you financial harm, you may have grounds for a complaint. Your legal standing is solid; you were a client who was owed a professional duty of care. Any financial harm resulting from a broker’s actions—whether it’s a sudden account closure or other investment issues—is something you have the right to question.

Living abroad as an American in Japan comes with its own set of financial complexities, and managing your U.S. investment accounts is a big one. While you might assume your relationship with your broker remains the same, distance can introduce unique challenges and risks. It’s not just about converting yen to dollars; it’s about ensuring your broker is still acting in your best interest from thousands of miles away. Unfortunately, some brokers may become less attentive, offer unsuitable advice, or even make decisions that put your investments at risk because of your expat status. This isn’t always malicious; sometimes it’s simple neglect or a lack of understanding of the rules governing expat accounts. But the result is the same: your financial security is compromised.

Being aware of the common pitfalls is your first line of defense. Many of the issues that arise stem from a combination of logistical hurdles, communication breakdowns, and a complex regulatory landscape that many brokers are not equipped to handle for clients living overseas. From suddenly losing access to your account to being sold products that have serious tax implications in Japan, the problems can be significant. Understanding these specific issues will help you identify red flags early and take action to protect your financial future. We’ll walk through the most frequent problems expats face, including account access, communication gaps, unsuitable investments, and compliance headaches, so you know what to look for.

One of the most immediate challenges you’ll face is the sheer logistics of managing your account from a different country. The significant time difference between Japan and the U.S. can make it incredibly difficult to speak with your broker during market hours or get timely help from customer service. Beyond that, you might find your access to services is limited. While many U.S. brokers allow expats to keep their accounts, some restrict services or even move toward account closure due to the increased regulatory burdens of serving non-resident clients. It’s crucial to proactively confirm your brokerage firm’s policies for clients living abroad to avoid being caught off guard by a sudden account freeze.

When you’re not in the same country as your broker, clear and consistent communication is more important than ever. Unfortunately, distance can sometimes lead to neglect. Your broker might be less proactive with updates, fail to consult you on important decisions, or be hard to reach when you need them. This communication breakdown can be more than just an inconvenience; it can be a warning sign of bigger problems. Some firms are even restricting or closing the accounts of Americans living abroad with little warning. If you feel like you’re being ignored or kept in the dark, it could be a sign of broker fraud and negligence.

A broker has a duty to recommend investments that are suitable for your specific financial situation, and that includes your status as an expat. The investment products that make sense for a U.S. resident can be entirely inappropriate—or even unavailable—for someone living in Japan. For example, while many U.S. mutual funds are not available for sale to non-U.S. residents, your broker should be aware of alternatives like certain exchange-traded funds (ETFs) that fit your needs. If your broker is pushing products without considering your residency, tax status in Japan, or risk tolerance, they may be breaching their duty to you. This is a serious issue that can lead to significant financial losses and tax complications.

The regulatory landscape for American expats is complicated, largely due to laws like the Foreign Account Tax Compliance Act (FATCA). This legislation has made it more difficult for Americans abroad to maintain U.S. brokerage accounts because of the reporting requirements it places on foreign financial institutions and the compliance checks it requires from U.S. firms. While these regulations are complex, they are not an excuse for your broker to provide poor service or make mistakes with your account. You need a broker who understands these rules, but you also need to be aware that this complexity can sometimes be used to justify actions that are not in your best interest. Staying informed about these investment issues is key.

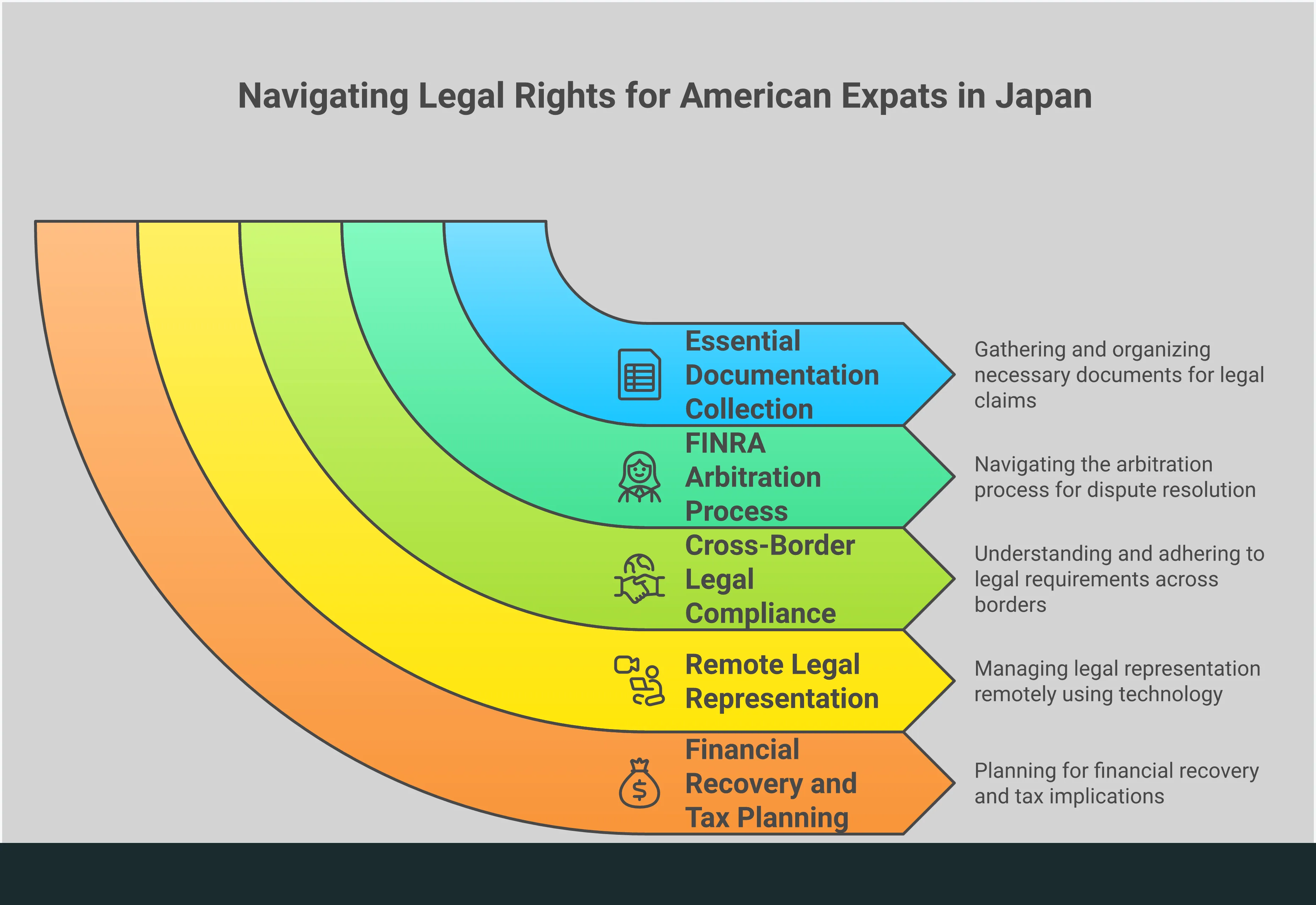

When you’re preparing to file a claim against a US broker from Japan, gathering the right paperwork is your first and most important step. Think of yourself as a detective building a case—every document tells a piece of the story. A well-organized file of evidence not only strengthens your claim but also makes the legal process smoother. Before you can effectively challenge misconduct, you need a clear, documented history of your relationship with the broker and your financial accounts. Start by collecting everything you can find related to your investments. It’s better to have too much information than not enough.

Your brokerage account statements are the foundation of your case. You’ll want to gather every monthly and quarterly statement for the entire period you’ve held the account. These documents provide a detailed timeline of every transaction, fee, and change in your portfolio’s value. They are the primary evidence used to identify unauthorized trades, excessive fees, or unsuitable investment choices. Given that some U.S. brokerage firms are closing accounts for Americans living abroad, having your own complete set of records is more important than ever. This paper trail is essential for demonstrating patterns of broker fraud and negligence.

Your communication history with your broker is just as critical as your financial statements. Collect every email, formal letter, and even handwritten note you have. If you had phone conversations, create a log with the date, time, and a summary of what was discussed. This correspondence can prove what your broker promised, what you authorized, and whether they followed your instructions. These records can highlight misrepresentations or failures to disclose important information. In a formal process like securities arbitration, written evidence of your conversations can make all the difference in validating your side of the story.

As an American living in Japan, your residency status is a key element of your case. Your broker has specific compliance responsibilities when working with clients overseas. Gather documents that prove your physical address and legal status in Japan, such as your residence card, apartment lease, utility bills, and employment contracts. Some expats continue to use a U.S. mailing address, which can complicate matters. Clear proof of your life abroad helps establish the legal framework your broker should have been operating under. This documentation is crucial for addressing many common investment issues that affect expatriates.

Your tax filings can provide powerful evidence of financial damages. Under the Foreign Account Tax Compliance Act (FATCA), you already have specific reporting obligations for your foreign assets. Gather your U.S. and Japanese tax returns for the years in question. These documents can show the financial impact of your broker’s actions, such as unexpected capital gains taxes from excessive trading or losses that affected your income. In some cases, tax documents can uncover compliance failures or misrepresentations about the tax implications of certain investments. This information can be especially relevant if your situation involves broader reporting concerns, similar to those handled in an SEC whistleblower case.

Beyond direct communication with your broker, any correspondence with other financial advisors involved is also valuable. This includes initial planning documents, risk tolerance questionnaires, and written investment proposals. These materials help establish your original financial goals and the strategy you agreed to. If your broker’s actions deviated from this plan, these documents serve as proof of their failure to act in your best interest. Dealing with these issues from abroad can be a major headache, but having this paperwork organized gives you a solid starting point. If you’re ready to discuss your situation, you can contact us to see how we can help.

When you realize something is wrong with your investments, figuring out what to do next can feel like a huge challenge, especially when you’re an ocean away. The good news is that there are clear pathways for holding U.S. brokers accountable. Many U.S. brokerage firms are making things difficult for expats by restricting or closing accounts, but that doesn’t mean you’ve lost your rights. This response from financial institutions has caused countless headaches for American expat investors. The key is to understand your options and take a methodical approach to resolving the issue. Let’s walk through the primary avenues available for filing a claim.

If you have a dispute with your U.S. brokerage firm, you’ll likely find yourself on the path to FINRA arbitration. Most account agreements you sign when opening an account include a clause that requires you to resolve disputes through the Financial Industry Regulatory Authority (FINRA) rather than in court. This process is designed to be a faster and more cost-effective way to handle claims of broker fraud and negligence. An arbitrator or a panel of arbitrators will hear your case and make a binding decision. This is often the most direct route for investors seeking to recover financial losses from misconduct.

Another important step you can take is to file a complaint with the U.S. Securities and Exchange Commission (SEC). While the SEC’s primary role is to enforce federal securities laws and regulate the industry, it doesn’t typically represent individual investors to recover their money. However, your complaint provides the agency with valuable information. It can trigger an investigation and helps the SEC identify patterns of wrongdoing. If you have information about widespread fraud, you might also explore the SEC whistleblower program, which rewards individuals who report misconduct.

Don’t overlook the power of state-level regulators. Every U.S. state has its own securities agency responsible for protecting investors and licensing brokers within its borders. You can file a complaint with the regulator in the state where the brokerage firm or your specific broker is based. These agencies can conduct their own investigations and take disciplinary action, which can include fines, suspensions, or even revoking a broker’s license. The North American Securities Administrators Association (NASAA) provides a helpful directory to find the correct state regulator for your situation.

As you move forward, you may face a choice between mediation and arbitration. Mediation is a voluntary, non-binding process where a neutral third party helps you and the brokerage firm try to reach a mutually agreeable settlement. It’s more informal and collaborative. If you can’t reach an agreement, you can still proceed to arbitration. Securities arbitration, on the other hand, is a more formal process where an arbitrator hears evidence from both sides and issues a final, legally binding decision. Often, mediation is a required first step before an arbitration hearing can be scheduled.

When you’re living abroad and dealing with a financial dispute back in the States, it’s easy to feel isolated. The good news is you’re not alone, and there are several organizations and resources designed to help you. Knowing where to turn for information and assistance is the first step toward resolving your issue and protecting your investments.

Whether you need initial guidance on your rights, information about regulatory bodies, or are ready to seek legal counsel, these resources can point you in the right direction. Think of this as your starting point for gathering the support you need to move forward with confidence. Taking action can feel overwhelming, but these organizations can provide clarity and direction when you need it most.

Your local U.S. embassy or consulate can be a valuable first stop. While they can’t offer legal advice or represent you in a dispute, they serve as a crucial resource for American citizens abroad. The staff can provide a list of local attorneys and help you understand the resources available to you as an expat. For instance, the U.S. Embassy & Consulates in Japan can offer guidance to American citizens who are having trouble with their U.S. brokerage firms. They can help you get your bearings and connect you with the right people to assist with your specific situation, which is an invaluable service when you’re trying to figure out your next steps from another country.

Legal aid organizations are another excellent resource, especially if you’re looking for initial guidance on your rights. These groups can help you understand the complexities of U.S. financial regulations and how they apply to your situation as an expat. The American Bar Association provides directories and information on legal aid services that can offer support. While these organizations may not handle complex securities claims directly, they can provide foundational knowledge and referrals. This can help you build a better understanding of your case before you decide to hire a specialized securities attorney to handle your claim.

Understanding the agencies that regulate the financial industry is important for any investor. The Securities and Exchange Commission (SEC) and the Internal Revenue Service (IRS) are two key bodies whose rules can impact your investments. Regulations like the Foreign Account Tax Compliance Act (FATCA) have made it more complicated for Americans abroad to manage U.S. brokerage accounts, sometimes leading to broker fraud and negligence. Knowing that these agencies exist to protect investors gives you a framework for understanding your rights. If you suspect misconduct, these are the institutions that set and enforce the rules your broker is supposed to follow.

To prevent future problems, it’s essential to work with financial advisors who understand the unique challenges faced by American expats. A qualified advisor should be well-versed in cross-border investment issues and regulatory requirements. When things go wrong, however, you need a different kind of support. If you believe you’ve already been a victim of unsuitable advice or investment fraud, the next step isn’t more financial advice—it’s legal action. An experienced securities attorney can review your case and explain your options for recovering your losses. If you’re ready to discuss your situation, you can contact our firm for a confidential consultation.

Living in Japan doesn’t mean you have to face a U.S. broker dispute alone. With today’s technology, you can work effectively with a securities attorney from anywhere in the world. The key is to find the right firm and understand how the remote process works. It’s entirely possible to build a strong case, attend meetings, and move your claim forward without ever setting foot in the United States. A good legal team will have systems in place to manage your case seamlessly across time zones, ensuring you feel supported and informed every step of the way. Let’s walk through what you can expect when you hire legal help from overseas.

When you’re an expat, you need a legal partner who understands the unique challenges you face. Look for a firm with a deep understanding of broker fraud and negligence and a history of representing clients across the country and internationally. While some brokerage firms have restrictions for expat investors, a knowledgeable attorney can help you sort through the complexities of your situation. During your search, prioritize lawyers who focus specifically on securities law. Ask them about their experience with clients living abroad and how they handle communication across different time zones. You want a team that is accessible, responsive, and prepared to manage your case remotely from start to finish.

Your first meeting with a securities attorney will likely happen over a video call. To make the most of this consultation, gather all your relevant documents beforehand, including account statements, emails with your broker, and any notes you’ve taken. Be ready to tell your story in chronological order. The attorney will listen, ask clarifying questions, and give you an initial assessment of your claim. This is your opportunity to see if the attorney is a good fit. A qualified advisor will help you understand your rights and the potential paths forward, such as securities arbitration. Don’t hesitate to ask about their process, communication style, and what they’ll need from you.

In some cases, it may be helpful to grant a power of attorney (POA) to a trusted person in the U.S. or to your legal counsel. A POA is a legal document that allows someone else to act on your behalf in specific financial or legal matters. This can be particularly useful for an expat who needs someone to handle paperwork or other tasks in a U.S. time zone. The most important rule here is transparency. You should be open with both your attorney and your brokerage firm about any POA you establish. Your lawyer can help you understand if a POA is necessary for your case and guide you through the process of setting one up correctly.

It’s completely normal to have questions about the cost of hiring an attorney. Most securities fraud lawyers work on a contingency fee basis. This means you don’t pay any legal fees unless they successfully recover money for you. The firm’s fee is then a percentage of the amount recovered. Before you agree to anything, make sure you receive a clear explanation of the fee structure. Ask about any other potential costs, like filing fees or administrative expenses. A trustworthy firm will always put your interests first and provide a transparent breakdown of all fees and costs. Don’t be afraid to contact a firm directly to ask these important questions upfront.

When you’re living abroad, the legal details of filing a claim against a US-based broker can feel overwhelming. You’re not just dealing with a financial dispute; you’re also managing different time zones, legal systems, and a whole lot of paperwork. It’s easy to feel like the deck is stacked against you. But taking the time to understand the key legal and procedural requirements is one of the most powerful steps you can take to protect your financial future.

Think of this as your roadmap. We’ll walk through the critical deadlines you can’t afford to miss, the jurisdictional rules that apply to you even in Japan, and the practical steps for getting your documents in order. While US brokerage firms are increasingly closing the accounts of Americans living abroad due to complex regulations, your rights as an investor remain protected under US law. Paying close attention to these details ensures that your claim is built on a solid foundation, giving you the best possible chance of a successful outcome.

Think of the statute of limitations as a countdown timer on your right to file a legal claim. If you wait too long, you could lose your ability to seek recovery, no matter how strong your case is. These deadlines vary depending on the state and the specific type of claim, but they are always strict. For example, FINRA, the body that oversees most broker disputes, has an eligibility rule that generally bars claims if six years have passed since the event that caused your losses. This makes it absolutely critical to act quickly once you suspect something is wrong with your investments. Don’t delay in seeking advice on the specific time limits that apply to your situation.

A common question for expats is, “Which country’s laws apply to me?” When you have an account with a US brokerage firm, your agreement almost certainly states that any disputes will be governed by US laws and handled in the United States. This means that even though you live in Japan, your claim will proceed through American regulatory channels like FINRA arbitration. This is actually good news, as it means you are protected by US investor protection laws. The challenge lies in the logistics, but legally, your case rests on American soil, where firms are held accountable for broker fraud and negligence.

While your claim against a US broker falls under American jurisdiction, your life in Japan can still play a role. For instance, Japanese financial regulations may be why your broker is restricting or closing your account, which could be a factor in a negligence claim. Additionally, any communication issues or advice you received that touched on your residency status in Japan could be relevant. It’s important to work with a legal team that understands the unique challenges expats face. They can help frame how your circumstances in Japan contributed to the investment problems you experienced.

When you’re preparing a legal claim from another country, paperwork is key. You may need to have certain documents, like affidavits or a power of attorney, authenticated to be legally valid in the US. This can often be done at a US embassy or consulate. Some expats try to simplify things by using a US mailing address for their accounts, but this can sometimes backfire if a dispute arises. It’s always better to be transparent about your residency. An experienced attorney can guide you on exactly what’s needed to ensure all your evidence is properly prepared and accepted. If you have questions about your specific documents, it’s a good idea to reach out for a consultation.

Winning a claim against your broker is a huge step, but it’s not the end of the story. The aftermath involves sorting out your finances, understanding your tax duties, and planning your next steps. It can feel like a lot to handle, especially from abroad, but breaking it down makes it much more manageable. You’ll need to consider the immediate costs of the dispute, your ongoing tax responsibilities as an expat, and how a potential settlement will affect your long-term financial health.

Many American expats face the frustrating reality of US banks and brokerage firms closing their accounts simply because they live overseas. This is often a reaction to complex regulations like the Foreign Account Tax Compliance Act (FATCA), which places extra reporting burdens on these institutions. Losing your long-standing investment account is a significant financial disruption, and it’s one of the many challenges you might be dealing with on top of any misconduct by your broker. Thinking through these financial and tax details will help you get back on solid ground after a dispute.

When you’re dealing with broker issues, the costs can come from a few different directions. First, there’s the potential loss of your investment account itself. Some US brokerage firms are actively closing the accounts of Americans living abroad, which can force you to sell investments at an inconvenient time and disrupt your financial strategy. Then, there are the legal fees associated with pursuing a claim. Many securities law firms, including ours, work on a contingency fee basis, which means you don’t pay unless we recover money for you. It’s always a good idea to schedule a consultation to get a clear picture of the potential costs before you commit to a course of action.

Living in Japan doesn’t get you off the hook with the IRS. As a US citizen, you’re required to report your worldwide income, and that includes any money held in foreign accounts or earned from overseas investments. This often means filing more than just the standard Form 1040. You may need to complete several additional US tax forms for expats to report your assets and business interests correctly. If you receive a settlement from a securities claim, that money is typically considered income and will also need to be reported. Staying on top of these responsibilities is crucial to avoid any future trouble with the IRS.

Your primary path to getting your money back after broker misconduct is through a formal legal claim, often through the securities arbitration process. This allows you to present your case to a neutral panel that can award damages. Beyond legal action, some expats try to find workarounds to keep their US accounts open, like using a US mailing address or working through a third-party advisory firm. While these might seem like quick fixes, they can be complicated and may not be sustainable long-term. Pursuing a formal claim addresses the root problem of misconduct and is the most direct way to recover financial losses you’ve suffered.

Receiving a settlement can bring a huge sense of relief, but it’s important to plan for what comes next. This new capital can help rebuild your portfolio, but as an expat, you may still face hurdles in finding institutions willing to work with you. These brokerage account restrictions can make it challenging to invest your settlement funds wisely. You’ll also need to consider the tax implications of the settlement amount and report it properly. Thinking ahead about these investment issues will help you make the most of your recovery and secure your financial future.

My U.S. broker is closing my account because I live in Japan. Is that legal? This is a frustratingly common issue. While there’s no U.S. law forcing them to close your account, brokerage firms can set their own internal policies. They often do this to avoid the complex compliance rules that come with having clients abroad. However, this doesn’t give them a free pass to be negligent. If the closure was handled improperly—without enough notice or in a way that caused you financial harm—you may have grounds for a claim. The key is how they managed the process, not just the decision to close the account itself.

How can I realistically file a claim from Japan? Do I need to travel to the U.S.? You absolutely do not need to travel to the U.S. to pursue a claim. Modern law firms are well-equipped to handle cases for clients living anywhere in the world. Consultations, meetings, and document sharing can all be done securely online through video calls and client portals. The entire legal process, including FINRA arbitration hearings, can often be managed remotely, allowing you to build your case without disrupting your life in Japan.

What are the most common red flags I should watch for with my broker? The biggest warning signs often start with communication breakdowns. If your broker becomes hard to reach, isn’t proactive with updates, or seems to be ignoring your instructions, pay close attention. Another major issue is unsuitable investment advice. Your broker should be recommending products that make sense for your specific situation as an expat, considering your tax status in Japan and risk tolerance. Any push toward high-risk or inappropriate investments is a serious red flag.

I think my broker made a mistake a few years ago. Is it too late to do anything? There are strict deadlines, known as statutes of limitations, for filing claims, so it’s important to act quickly. These time limits can vary, but for FINRA arbitration, the general rule is that you cannot bring a claim more than six years after the event that caused the loss. Because these deadlines are firm, you should speak with a securities attorney as soon as you suspect a problem to understand the specific time frame that applies to your situation.

What will it cost to hire a lawyer to handle my case? Most securities attorneys handle these types of cases on a contingency fee basis. This means you don’t pay any legal fees upfront. The law firm only gets paid if they successfully recover money for you, and their fee is a percentage of that recovery. This approach allows you to pursue a valid claim without worrying about out-of-pocket legal costs. Always ask for a clear explanation of the fee structure during your initial consultation.