Financial predators sometimes view American expats as easier targets, assuming they are less likely to notice misconduct or take legal action from afar. This can lead to brokers making unauthorized trades or recommending unsuitable investments, believing the distance provides them with cover. But being out of the country doesn’t mean you’re out of options. Recognizing these red flags is your first line of defense, and knowing what to do next is your most powerful tool. This article will not only help you identify the signs of investment fraud but will also provide a detailed framework for how Americans in Mexico can pursue claims against US brokerage firms to hold them accountable.

Key Takeaways

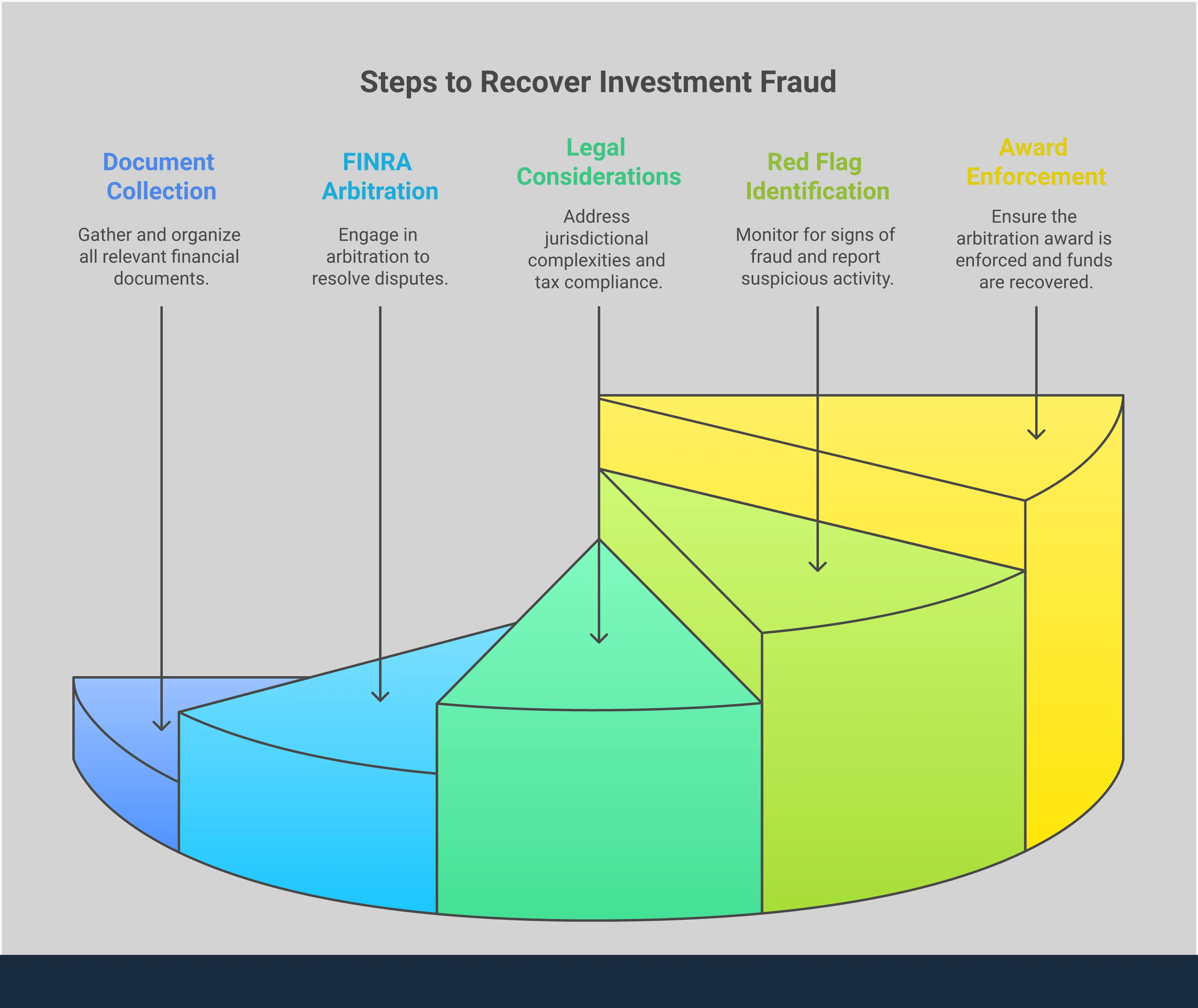

- Proactive monitoring is your first defense: Regularly review your account statements for unauthorized trades or odd fees, and don’t hesitate to question your broker about any activity that seems unclear. Recognizing red flags like guaranteed high returns is crucial to stopping fraud before it starts.

- Document everything to build a strong claim: If you suspect misconduct, your power lies in your records. Methodically gather all account statements, trade confirmations, and communications with your broker to create a clear, chronological timeline of events. This evidence is the foundation of any successful recovery effort.

- You have clear pathways to recover losses: You are not without options. Most disputes with U.S. brokerage firms are resolved through FINRA arbitration, a formal process designed for investors. Seeking a securities attorney who works on a contingency basis can help you pursue your claim without upfront legal fees.

What Are Your Legal Rights Under USMCA?

When you’re an American living in Mexico, your investments are at the intersection of international law. The United States-Mexico-Canada Agreement (USMCA), which replaced NAFTA, sets the ground rules for how investments are treated across borders. While this agreement primarily deals with disputes between investors and the host country’s government, understanding its principles gives you a clearer picture of the protections that support your financial activities abroad.

The USMCA establishes a framework intended to create a stable and predictable environment for cross-border investments. It carries over certain protections from NAFTA, ensuring that American investors receive a baseline level of fairness. While you wouldn’t typically use the USMCA to directly sue your U.S.-based brokerage firm—that process usually falls under U.S. jurisdiction through bodies like FINRA—the agreement reinforces the legitimacy of your position as a U.S. investor operating from Mexico. It’s an important piece of the puzzle that helps define the landscape for resolving complex investment issues that span international borders.

Your Right to Fair Treatment

A core principle of the USMCA is the “Minimum Standard of Treatment.” This might sound like legal jargon, but it’s a straightforward concept. The agreement requires that all parties provide fair and equitable treatment to foreign investments, consistent with international law. This means your investments should be protected from arbitrary or discriminatory government actions. While this standard applies to how the host country treats your investment, it establishes a powerful precedent for fairness that underpins all cross-border financial dealings. It’s a foundational right that helps ensure your capital isn’t subjected to unjust practices, setting a tone of security for your financial future abroad.

How USMCA Protects Your Investments

The USMCA is designed to protect genuine investors, not entities created simply to exploit legal loopholes. The agreement includes a “denial of benefits” clause that prevents shell companies from taking advantage of its protections. This is good news for you as a legitimate investor. It means the treaty’s safeguards are reserved for individuals and businesses with substantial operations and real capital at risk. This focus on authentic investment activity strengthens the protections for those who, like you, are making real financial commitments. It helps filter out bad actors and ensures the system is there for those who need it, especially when facing potential broker fraud and negligence.

Safeguards for Cross-Border Investing

The USMCA also outlines specific procedures for resolving disputes, which highlights the complexities of international claims. For instance, if a U.S. investor has a claim against the Mexican government, they are generally barred from bringing an international claim if they have already sought a resolution in Mexican domestic courts. This is often referred to as the “exhaustion of local remedies” rule. While this applies to investor-state disputes, it underscores an important point: the path to resolution is highly specific. For a dispute with your U.S. brokerage firm, your most effective path is almost always through U.S. channels, such as securities arbitration, rather than an international treaty claim.

Recognizing Common Investment Fraud Tactics

Protecting your financial future starts with knowing what to look for. Fraudsters often rely on a set of predictable tactics designed to build false trust and pressure you into making poor decisions. They can be incredibly persuasive, using sophisticated methods to appear legitimate. They might forge official-looking documents or create professional websites that mimic real financial institutions. Understanding their playbook is your first line of defense.

These tactics aren’t always obvious. They can be subtle manipulations mixed with just enough truth to seem plausible. A broker might downplay the risks of a certain stock or conveniently forget to mention high fees. They might create a sense of urgency, making you feel like you’ll miss out on a once-in-a-lifetime opportunity if you don’t act now. By learning to identify these red flags, you can better protect your portfolio from those who seek to exploit your trust. If you suspect you’ve encountered any of these behaviors, it’s important to document everything and consider your legal options for recovering potential losses.

Spotting Unauthorized Trades

One of the most direct forms of broker misconduct is the unauthorized trade. This happens when a broker buys or sells securities in your account without your explicit permission. Unless you have granted discretionary authority in writing, your broker must obtain your approval for every single transaction. Regularly reviewing your account statements and trade confirmations is critical. If you see a trade you didn’t approve, question it immediately. Fraudsters sometimes use complex strategies, such as mimicking legitimate entities’ email addresses, to make their actions seem official. This type of broker fraud and negligence is a serious violation of your rights as an investor.

Identifying Misrepresentation and Omissions

Misrepresentation is when a broker provides you with false information, while an omission is the failure to disclose critical facts about an investment. This could involve exaggerating potential returns, downplaying risks, or failing to mention fees and commissions. For example, the SEC charged a company that was running a Ponzi scheme by promising investors monthly returns as high as 10 percent on fake real estate and mining operations. Always be skeptical of promises of high, guaranteed returns with little to no risk. Legitimate investments always carry some level of risk, and any broker who tells you otherwise is not being truthful.

Resisting High-Pressure Sales Tactics

If you feel rushed or pressured to make an immediate investment decision, take a step back. Fraudsters often create a false sense of urgency to prevent you from doing your research or consulting with a trusted advisor. They might say an offer is only available for a limited time or that you have to “get in now” before the opportunity is gone. This is a common tactic used in timeshare fraud schemes that target Americans in Mexico. A reputable financial professional will give you the time and space you need to make an informed choice. Never let anyone rush you into a decision about your money.

Questioning Unsuitable Investment Recommendations

Your broker has a responsibility to recommend investments that are suitable for your specific financial situation, investment goals, and risk tolerance. An unsuitable recommendation is one that doesn’t align with your profile—for instance, putting a retiree’s nest egg into a highly speculative startup. Deceptive practices are often used to lure victims into making unsuitable investments that benefit the broker more than the client. Don’t be afraid to ask pointed questions: Why is this investment right for me? What are the specific risks involved? How does this fit into my long-term financial plan? If the answers are vague or don’t make sense, it’s a major red flag.

How to Build Your Investment Claim

When you realize your investments may have been mishandled, it’s easy to feel overwhelmed. The key is to channel that concern into action. Building a strong claim against a U.S. brokerage firm starts with organized, methodical preparation. Think of yourself as the lead investigator of your own case. Your goal is to gather all the facts and present them in a clear, undeniable way. By taking a step-by-step approach, you can construct a solid foundation for recovering your losses. The following steps will help you gather the evidence needed to support your claim and hold the responsible parties accountable for their actions.

Gather Your Essential Documents

Your first move is to collect every piece of paper and digital file related to your investment accounts. This includes monthly or quarterly account statements, trade confirmations, new account forms, and any prospectuses or marketing materials you received. Don’t forget to include correspondence, such as letters or official notices from the firm. Having a complete set of records is crucial for piecing together what happened. These documents provide an official record of your financial history with the firm and are the primary evidence used to identify and prove any investment issues that may have occurred, from unauthorized trades to unsuitable recommendations.

Document All Communications

Next, create a comprehensive log of every interaction you’ve had with your broker or anyone at the firm. Go through your emails, text messages, and phone records. For each communication, note the date, the person you spoke with, and a summary of what was discussed. If you took handwritten notes during or after a call, include them. This record is vital for establishing a pattern of behavior, especially when it comes to verbal promises or high-pressure sales tactics. A detailed communication log can be powerful evidence in cases of broker fraud and negligence, as it helps reconstruct conversations that were not otherwise recorded.

Analyze Your Financial Statements

With your documents in hand, it’s time to review your financial statements line by line. Look for anything that seems out of place or that you don’t remember authorizing. Pay close attention to transaction histories, fees, and the performance of individual investments. Do the trades align with your stated risk tolerance and investment goals? Are there signs of excessive trading, also known as churning? Identifying these discrepancies is essential for quantifying your financial losses. A thorough analysis will help you pinpoint exactly where and how things went wrong, which is a critical component of building your case.

Develop a Clear Timeline

Now, organize the events into a clear, chronological timeline. Start from your very first interaction with the brokerage firm and move forward to the present day. Note key dates, such as when you opened the account, when specific investments were purchased, when you had important conversations, and when you first noticed a problem. A timeline transforms a confusing series of events into a straightforward narrative that is easy for others to understand. This organized story is incredibly effective in legal settings like securities arbitration, where clarity and context are essential for making a compelling argument.

Preserve Your Evidence

Finally, make sure all the evidence you’ve gathered is kept in a safe and secure place. Treat every document, email, and note as an indispensable part of your claim. It’s a good idea to make digital copies of all physical documents by scanning them and to back up all digital files. Do not discard anything, even if you’re unsure of its relevance. What might seem like a minor detail could become a key piece of evidence later on. Once you have everything organized, the next step is to have a legal professional review it. You can contact us to help you understand your options.

What Are Your Options for Recovering Losses?

Discovering you may have lost money due to fraud or negligence is a heavy burden, but you don’t have to carry it alone. Fortunately, there are established legal pathways to help you pursue the recovery of your investment losses. The right path for you depends on the specifics of your case, including the agreements you signed with your brokerage firm. Understanding your main options—arbitration, litigation in U.S. courts, and alternative dispute resolution—is the first step toward taking control of the situation.

The FINRA Arbitration Process

Most agreements with brokerage firms include a clause that requires you to resolve disputes through arbitration rather than in court. The Financial Industry Regulatory Authority (FINRA) provides a specific forum for this. FINRA arbitration is often faster and less expensive than a traditional lawsuit. It’s a formal process where an impartial arbitrator or a panel hears both sides of the dispute and makes a binding decision. If your broker’s misconduct caused your losses, pursuing a securities arbitration claim is a common and effective way to seek financial recovery. It’s a structured process designed specifically for investor-broker disputes.

Taking Your Case to U.S. Court

If your agreement doesn’t mandate arbitration, or in certain other circumstances, filing a lawsuit in a U.S. court is another powerful option. As a U.S. citizen, your location in Mexico doesn’t prevent you from holding a U.S. brokerage firm accountable for its actions. You can file lawsuits for violations of securities laws, fraud, or misrepresentation. The U.S. Securities and Exchange Commission affirms that investors have these rights. This path involves the public court system, with formal procedures for discovery, motions, and potentially a trial by judge or jury. It can be a longer and more complex process than arbitration but may be the most appropriate route for certain cases.

Using Alternative Dispute Resolution

Beyond arbitration and court, you can also explore other forms of alternative dispute resolution (ADR). The most common method is mediation, which is a more collaborative and flexible process. Unlike an arbitrator or judge, a mediator doesn’t make a decision. Instead, they are a neutral third party who facilitates a negotiation between you and the brokerage firm to help you reach a mutually agreeable settlement. The American Bar Association notes that ADR can provide a quicker resolution. Mediation is voluntary and confidential, offering a less adversarial way to resolve your dispute and recover your funds without a formal ruling.

Handling Jurisdictional Issues

Living in Mexico while pursuing a claim against a U.S. firm introduces a layer of complexity known as jurisdiction. In simple terms, jurisdiction is the court’s authority to hear a case and make a legally binding decision. The court must determine if it has power over the parties involved, which can be complicated by your international residence. These issues can impact where and how you can file your claim. An attorney can analyze the specifics of your situation—like where you signed agreements and where the misconduct occurred—to build a strong argument for why a U.S. forum is appropriate. Successfully handling these complexities is critical to moving your case forward.

How to File and Pursue Your Claim

Taking the step to file a claim against a U.S. brokerage firm can feel like a monumental task, especially when you’re living in Mexico. But it’s a structured process, and understanding the path forward can make it feel much more manageable. Pursuing a claim isn’t about jumping into a complex legal battle unprepared; it’s about methodically building your case and following a clear set of procedures. The key is to be organized and deliberate from the very beginning, ensuring every action you take is purposeful and moves you closer to a resolution.

This involves understanding your legal obligations before you even file, being acutely aware of critical deadlines, gathering the right paperwork to substantiate your claim, and knowing when to bring in specialized support. Each step is designed to ensure your claim is presented clearly and effectively, giving you the strongest possible chance of recovering your losses. The process is designed to be fair, but it requires diligence. While the details can be intricate, you don’t have to figure them out alone. A securities attorney can guide you through the requirements, help you prepare a compelling case, and represent your interests every step of the way. If you’re ready to explore your options, you can contact our firm for a confidential consultation.

Know the Pre-Filing Requirements

Before you file a claim, it’s important to have your own financial affairs in order. As a U.S. citizen living abroad, you are required by law to report your worldwide income, which includes earnings from foreign trusts and investments. Fulfilling these obligations demonstrates that you are a responsible investor and can add to your credibility. Think of it as setting a strong foundation. When you present your case, you want to show that you’ve followed the rules, which helps highlight how your broker or firm failed to do the same. Addressing these investment issues and ensuring you are compliant is a practical first step in the process.

Understand the Time Limits

When it comes to filing an investment fraud claim, time is not on your side. There are strict deadlines, known as statutes of limitations, that dictate how long you have to take legal action. If you miss this window, you could lose your right to recover your losses forever. These time limits vary depending on the state and the specific forum, like securities arbitration, where you file your claim. That’s why it’s so important to act as soon as you suspect something is wrong with your accounts. Don’t wait, assuming you have plenty of time. The clock starts ticking from the moment you discover—or should have discovered—the misconduct.

Prepare the Required Documentation

A successful claim is built on solid evidence. Arbitrators and courts need to see clear proof of what happened, so your ability to provide thorough documentation is essential. This is where the work you did to build your claim pays off. You’ll need to gather all relevant paperwork, including account statements, trade confirmations, prospectuses, and any written communication you had with your broker, such as emails or letters. This documentation creates a factual record that supports your narrative of broker fraud and negligence. The more organized and complete your records are, the easier it will be to demonstrate how you were wronged.

Consider the Role of Expert Testimony

In many investment fraud cases, the subject matter is highly complex. Your broker may have used sophisticated strategies or recommended products that are difficult for the average person to understand. This is where testimony from a financial professional can be invaluable. An authority on financial matters can analyze your portfolio, explain industry standards of conduct, and show an arbitration panel exactly how your broker’s actions were unsuitable or fraudulent. As seen in major SEC cases involving large-scale fraud, breaking down complex financial schemes is key to proving misconduct. This kind of testimony can translate complicated financial data into a clear, compelling argument for your case.

Finding the Right Securities Attorney

Choosing a legal representative is one of the most critical steps you’ll take. When you’re an American living in Mexico facing off against a U.S. brokerage firm, you need someone who understands the specific challenges of your situation. The right attorney will not only have a deep knowledge of securities law but will also be equipped to handle the cross-border elements of your case. Think of this process as a job interview—you are hiring someone for a very important role, and it’s essential to find the right fit for your specific needs. Taking the time to carefully vet potential attorneys will give you confidence as you move forward with your claim.

How to Find Qualified Legal Counsel

When you start your search, focus on attorneys and firms that concentrate on securities law. General practice lawyers, while skilled in many areas, may not have the specific background required for these complex cases. Look for a legal team with a track record of handling investment issues similar to yours. You want someone who is familiar with the tactics used by brokerage firms and understands the rules and procedures of the Financial Industry Regulatory Authority (FINRA). A qualified attorney can explain the process clearly and set realistic expectations from the beginning, helping you understand the strengths and potential weaknesses of your claim.

Why Cross-Border Legal Experience Matters

Living in Mexico while pursuing a claim in the U.S. adds a layer of complexity. While your case will be governed by U.S. securities laws, your attorney should be comfortable working with international clients. They need to have systems in place for secure communication, document exchange, and virtual meetings across borders. An attorney with experience representing Americans abroad will anticipate potential hurdles, such as obtaining notarized documents or preparing for remote testimony. This experience ensures that your location doesn’t become a disadvantage in your fight for justice. They will know how to keep your case moving forward smoothly, regardless of where you are.

Understanding Fee Structures

Concerns about cost should never prevent you from seeking legal advice. Most reputable securities fraud attorneys work on a contingency fee basis. This means you don’t pay any attorney’s fees unless they successfully recover money for you. The firm’s fee is a percentage of the amount recovered. This arrangement aligns your interests with your attorney’s, as they are motivated to secure the largest possible award for you. Be sure to ask for a clear explanation of the fee structure and any potential case-related costs during your initial consultation. A transparent firm will be happy to provide a detailed breakdown so there are no surprises.

What to Ask in an Initial Consultation

Your initial consultation is your opportunity to gather information and assess whether an attorney is the right partner for you. Come prepared with a list of questions to guide the conversation. You might ask about their experience with cases involving broker fraud and negligence or their success rate in securities arbitration. Inquire about their communication style and how they will keep you updated on your case’s progress from Mexico. Ask them for an honest assessment of your claim and what the legal process will look like. A straightforward conversation will help you make an informed decision and find a legal team you can trust.

What to Expect During the Resolution Process

After you’ve built your case and filed a claim, the resolution process begins. This phase can feel long and complicated, but knowing the key stages can help you feel more in control. The journey typically involves developing a solid strategy with your legal team, entering into negotiations, and, if successful, enforcing the final award. Each step is designed to move you closer to recovering your losses and holding the responsible parties accountable.

While every case is unique, the path generally follows a structured progression. Your attorney will guide you through the legal mechanics, from initial discussions with the opposing side to the final steps of securing your funds. It’s important to stay engaged and communicate openly with your legal counsel throughout this period. They will be your advocate, working to protect your interests whether your case is resolved through a settlement or proceeds to a formal hearing. Understanding what’s ahead can demystify the process and prepare you for the road to resolution.

Developing a Case Strategy

The first step in the resolution process is creating a clear and effective case strategy. This is the roadmap for your claim. Together with your attorney, you will decide on the best course of action, which includes identifying the right parties to pursue. You may have the option to file a claim against an individual broker, the entire brokerage firm, or other entities involved in your financial losses. A thoughtful strategy considers the strengths and weaknesses of your case, the applicable laws, and the most likely path to a successful outcome. This foundational work is critical for building a strong case of broker fraud and negligence.

Engaging in Settlement Negotiations

Many investment disputes are resolved before they ever reach a formal arbitration hearing. Settlement negotiations are a common and often preferred way to settle claims. During this phase, your attorney will communicate with the brokerage firm’s legal team to try and reach a fair agreement without a lengthy legal battle. Because U.S. securities firms are active in the international market, they are often motivated to resolve disputes quietly. These negotiations involve a series of offers and counteroffers aimed at finding a middle ground. Having a skilled negotiator on your side is essential to ensure you receive a just settlement for the harm you’ve suffered.

Enforcing a Favorable Award

Winning your case is a major victory, but the process isn’t complete until you’ve received your funds. Enforcing a favorable award is the final step. Fortunately, legal frameworks are in place to ensure these decisions are honored. International agreements like the United States-Mexico-Canada Agreement (USMCA) help ensure that investors receive fair and equitable treatment and that legal awards are respected across borders. Your attorney will handle the necessary steps to collect the award from the brokerage firm, making sure the judgment is fulfilled and the money is transferred to you.

Managing International Payments

Receiving a large sum of money while living abroad comes with its own set of logistical challenges. Many U.S. banks and brokerage firms have become stricter with the accounts of Americans living in Mexico, sometimes even closing them. This can complicate the process of receiving your settlement or award. It’s important to plan for these potential hurdles. Your legal team can help you anticipate issues with international payments and work with you to establish a secure method for transferring and accessing your recovered funds. Planning ahead ensures you can manage your money without unnecessary delays or complications.

How to Protect Your Investments in the Future

After going through the process of recovering your losses, the last thing you want is to face the same situation again. Taking control of your financial future means being proactive and vigilant. By adopting a few key habits, you can create a strong defense against potential fraud and mismanagement, ensuring your investments are secure for years to come. It’s about building a framework of awareness and documentation that serves as your first line of defense.

Take Preventive Measures

As an American living abroad, you face unique challenges. Some U.S. brokerage firms are becoming more restrictive, even closing accounts for non-U.S. residents due to regulations like the Foreign Account Tax Compliance Act (FATCA). Be proactive and have a clear conversation with your brokerage about your residency status. Understand their policies for expat clients and get any agreements in writing. If a firm seems unwilling to accommodate your situation, it may be a sign to find one that is. Consolidating your accounts with a single, reputable firm that understands your circumstances can also make monitoring your investments much simpler.

Learn the Red Flags of Fraud

Scammers often rely on sophisticated tactics to appear legitimate. The FBI has warned about fraudsters using high-pressure sales tactics and mimicking official documents to build false trust. Be wary of any investment opportunity that promises guaranteed high returns with little to no risk—this is a classic red flag. Also, be cautious of unsolicited offers and intense pressure to “act now.” If a broker or advisor is pushing you to make a quick decision or is being evasive about the details of an investment, it’s time to step back. Recognizing the signs of broker fraud and negligence is a critical skill for any investor.

Monitor Your Portfolio Regularly

It’s easy to “set and forget” your investments, but regular monitoring is essential for your financial health. Make it a habit to review your account statements every single month. Don’t just glance at the summary; check for any unauthorized trades, unexpected fees, or activity that doesn’t align with your investment strategy. Compare the official statements with your own records to ensure everything matches up. If you see something you don’t understand or didn’t approve, contact your broker immediately for a clear explanation. Consistent oversight helps you spot problems early before they have a chance to grow.

Keep Impeccable Records

Thorough documentation is one of your most powerful tools. Keep a detailed file of every interaction and transaction related to your investments. This includes emails, notes from phone calls, trade confirmations, and monthly or quarterly statements. Good records are not only crucial for building a legal claim if something goes wrong, but they are also necessary for tax purposes. As a U.S. citizen, you are required to report your worldwide income, including earnings from foreign investments. Having organized records makes this process straightforward and provides a clear paper trail if you ever need to dispute an issue. If you uncover discrepancies, it’s important to contact a legal professional to understand your options.

Related Articles

- Your Rights When a Broker Steals Funds or Misleads

- Understanding the Legal Tools Against Investment Misconduct

- Broker Fraud and Misconduct: Signs and Red Flags – The Frankowski Firm

- Canadian Trader Charged For Short Selling

Frequently Asked Questions

I live in Mexico, so can I even take legal action against my U.S. brokerage firm? Yes, absolutely. Your physical location in Mexico does not prevent you from holding a U.S.-based firm accountable for its actions. Since your claim involves a U.S. company and is governed by U.S. securities laws, the case is typically handled through American legal channels like FINRA arbitration or U.S. courts. An attorney experienced with cross-border cases can manage the logistical details to ensure your location isn’t a barrier to pursuing your claim.

I think my broker mishandled my money. What is the absolute first thing I should do? The very first thing you should do is start gathering and organizing your documents. Collect all your account statements, trade confirmations, and any emails or letters you have from the firm. At the same time, create a timeline of your interactions with your broker, noting dates and what was discussed. This organized evidence is the foundation of a strong claim and will be essential when you speak with a legal professional about your situation.

What’s the main difference between FINRA arbitration and a lawsuit? Think of FINRA arbitration as a private, more streamlined process designed specifically for investment disputes. It’s usually faster and less formal than a public court case. A lawsuit, on the other hand, takes place in the traditional court system and can be a longer, more complex process. Most brokerage account agreements require you to use arbitration, making it the most common path for investors seeking to recover losses.

I’m worried about the cost of hiring an attorney. How does that work? This is a very common concern, but you shouldn’t let it stop you from seeking help. Most securities law firms handle these cases on a contingency fee basis. This means the law firm fronts the costs of the case, and you only pay attorney’s fees if they successfully recover money for you. The fee is then a percentage of what you receive, so the firm is directly motivated to get you the best possible result.

How long do I have to act if I suspect there’s a problem with my investments? You need to act quickly. There are strict deadlines, called statutes of limitations, for filing investment-related claims. This time limit can vary, but it begins from the moment you either discovered the problem or reasonably should have discovered it. If you wait too long and miss the deadline, you could permanently lose your right to pursue a claim, so it is critical to explore your options as soon as you suspect something is wrong.