NO FEES UNTIL WE WIN

FREE CONSULTATION

NO FEES UNTIL WE WIN

FREE CONSULTATION

That sinking feeling in your stomach is hard to ignore. You trusted a financial professional with your future, but now the numbers don’t add up, and the promises feel hollow. Discovering you might be a victim of investment fraud is a deeply personal and stressful experience, leaving you unsure of where to turn. You don’t have to sort through this confusion alone. The path to recovery begins with understanding your rights and knowing what steps to take next. This guide is designed to give you clarity and direction, from identifying the red flags of misconduct to understanding how a dedicated Birmingham, Alabama investment fraud attorney can help you fight for what you’ve lost.

Investment fraud happens when someone uses deceptive practices to trick investors into giving them money. It’s a serious offense that can cause devastating financial losses and emotional distress. At its core, fraud involves a lie or a misrepresentation designed to convince you to part with your hard-earned money under false pretenses. This isn’t just about a bad investment that didn’t pan out; it’s about intentional deceit.

These schemes can be incredibly sophisticated, making it difficult for even savvy investors to see the truth until it’s too late. Fraudsters are skilled at building trust and creating a sense of urgency or exclusivity around an opportunity. They might present you with professional-looking documents, impressive (but fake) credentials, and a compelling story that plays on your financial goals and fears. They know how to make an offer sound legitimate and irresistible. Understanding the different forms this deception can take is the first step toward protecting yourself and knowing when to seek help. If you believe you’ve encountered any questionable investment issues, it’s important to know that you have rights and potential paths to recovery. You are not alone, and there are legal avenues available to hold wrongdoers accountable.

Fraud can wear many different masks, but some schemes are more common than others. A Ponzi scheme, for example, uses money from new investors to pay “returns” to earlier ones, creating the illusion of a profitable enterprise when no real business activity is happening. Another tactic is the “pump-and-dump,” where scammers artificially inflate a stock’s price with false positive news, sell their shares at the peak, and leave other investors with worthless stock when the price crashes. You might also encounter broker fraud and negligence, where a financial professional mismanages your funds, makes unauthorized trades, or puts their own interests ahead of yours. Being familiar with these patterns can help you identify a dangerous situation before you suffer a major loss.

Trusting your intuition is one of your strongest defenses against fraud. If an investment opportunity sounds too good to be true, it probably is. Be wary of anyone promising guaranteed high returns with little to no risk—that’s a classic red flag. Another warning sign is high-pressure sales tactics. A legitimate advisor will give you time to think and do your research; a fraudster will often push you to invest immediately, claiming the opportunity is limited. A lack of transparency is also a major concern. If you can’t get clear, straightforward answers about the investment strategy or where your money is going, it’s time to walk away. If you’re seeing these signs, it may be time to contact a legal professional for guidance.

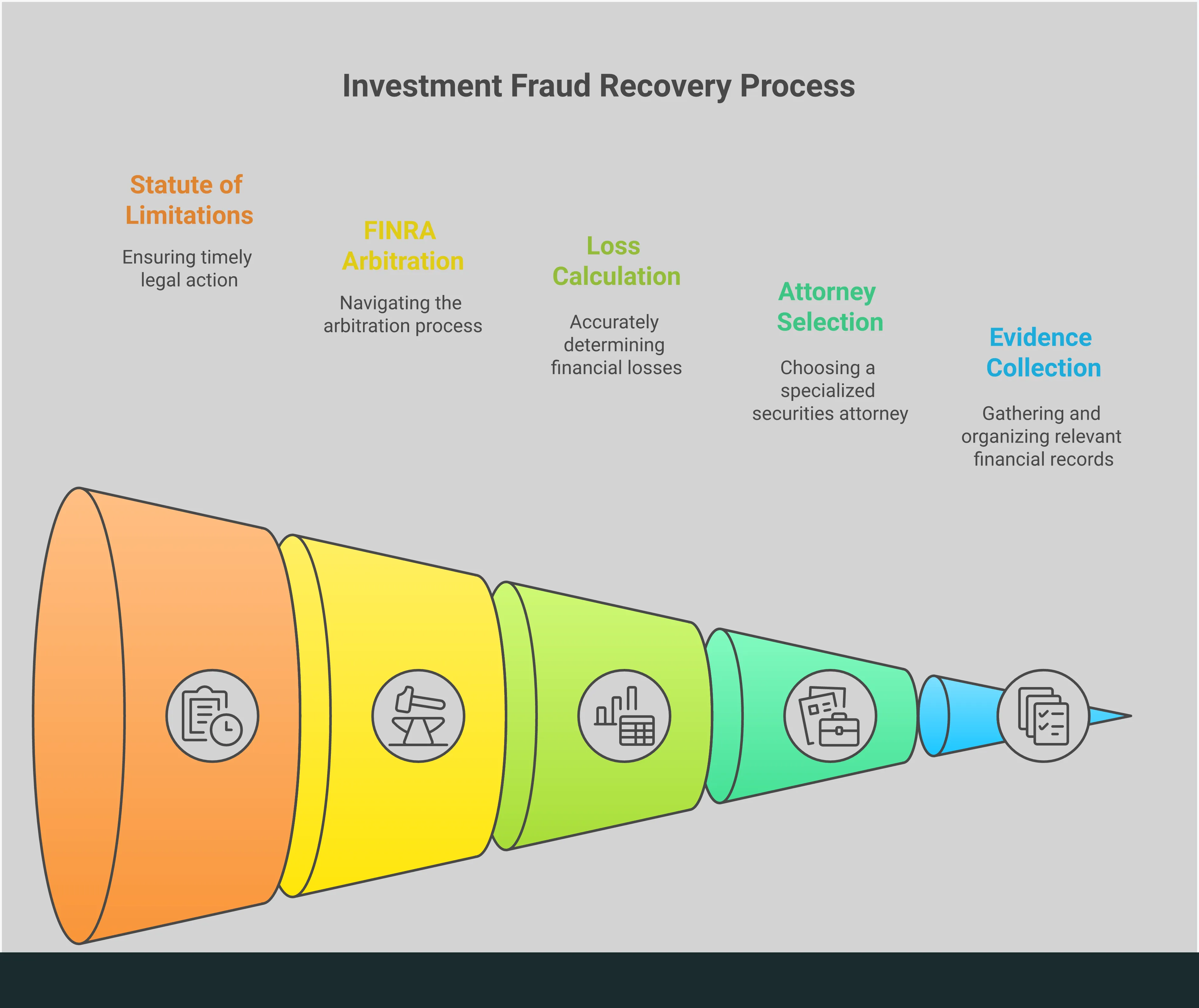

If you suspect you’ve been victimized, your first move should be to gather and preserve every piece of evidence you can find. This documentation is the foundation of any potential legal claim. Start by collecting all contracts, account statements, and transaction records related to the investment. Save every email, text message, and letter you exchanged with the individual or firm. Take notes on phone calls, including the date, time, and what was discussed. The goal is to create a clear timeline that shows what you were told, how your money was handled, and how it resulted in your financial loss. This information will be vital for an attorney evaluating your case for a process like securities arbitration.

Finding the right legal partner is a critical step toward recovering your losses. When you’re dealing with the fallout of financial misconduct, you need an attorney who not only understands the law but also understands what you’re going through. The right firm will have a specific focus on investment fraud cases and a clear process for helping clients. Let’s walk through what to look for, what to ask, and how to prepare so you can feel confident in your choice.

When you start your search, concentrate on firms that specialize in securities and investment law. A general practice lawyer might not have the specific knowledge needed for these complex cases. Look for a legal team with a solid history of representing investors and helping them recover their funds. You want someone who is familiar with the tactics used in cases of broker fraud and negligence. A firm that dedicates its practice to this area of law will be better equipped to handle the nuances of your situation and fight for your financial recovery.

Don’t hesitate to ask about payment upfront. Understanding how a firm charges is essential, especially when you’re already facing financial strain. Many reputable investment fraud attorneys work on a contingency fee basis. This means they only get paid if they successfully recover money for you. This structure aligns their goals with yours—they are motivated to win your case. At The Frankowski Firm, for example, you won’t see any hourly fees or hidden costs. If they don’t win, you owe nothing. This approach allows you to seek justice without any financial risk.

Your initial consultation is your opportunity to interview the attorney and see if they’re the right fit. Go into the meeting with a list of questions. Ask about their experience with cases similar to yours, who will be handling your case, and what the legal process looks like. You should also be prepared to explain your situation clearly. A good attorney will listen carefully and provide a straightforward assessment of your options. Understanding the path forward, such as the securities arbitration process, will help you feel more in control. A free consultation is a great way to get these answers without any commitment.

Before you can move forward, it’s helpful to take stock of your situation. Evaluating your potential case gives you a clearer picture of what happened and what’s at stake. This process involves looking at the financial impact, gathering your records, and getting a sense of the legal grounds you might stand on. Taking these steps will not only help you understand your position but also prepare you for a productive conversation with an attorney. It’s about organizing the facts so you can tell your story clearly and effectively. This initial assessment is a powerful first move toward seeking resolution and holding the responsible parties accountable for their actions.

The first step in evaluating your case is to figure out the exact amount of money you’ve lost. To build a case, you need to demonstrate a clear financial injury. Start by pulling together all your account statements, trade confirmations, and any other financial records from before, during, and after the period the fraud occurred. Tally up your total investments and subtract the current value to find the net loss. Be meticulous and document every transaction related to the questionable investment. This number is more than just a figure; it’s the foundation of your claim and will be a critical piece of information throughout the legal process.

Evidence is crucial, and it often lives in the documents you’ve collected over time. Your goal is to gather any and all records that can help tell the story of what happened. This includes emails, text messages, official account statements, prospectuses, and any promotional materials you were given. If you took notes during conversations with your broker or advisor, those are important, too. This documentation helps establish a timeline and can prove what you were told versus what actually happened. Organizing these records is a vital step in preparing to address broker fraud and negligence. A well-documented case is a stronger case.

Once you have your losses calculated and your documents in order, you can begin to see if you have solid grounds for a claim. A strong case often involves proving things like misrepresentation, a breach of fiduciary duty, or negligence. Did your advisor recommend investments that were clearly unsuitable for your financial situation? Were you misled about the risks involved? While you can get a preliminary sense of your case’s strength, financial legal matters are complex. Understanding which investment issues apply to your situation is best done with professional guidance. An experienced attorney can review your evidence and provide a clear assessment of your legal options.

Taking legal action can feel overwhelming, especially when you’re already dealing with the stress of financial loss. Understanding the steps involved can make the process feel more manageable. Once you’ve chosen an attorney, they will guide you through each stage, from the initial review of your situation to the final resolution. The goal is to build a strong case on your behalf and work toward recovering your hard-earned money. Here’s a look at what you can generally expect as you move forward.

The first step is a detailed discussion about your situation. This is your opportunity to share your story and present the documents you’ve gathered. During this initial consultation, your attorney will listen carefully, ask clarifying questions, and assess the details of your potential claim. Think of it as a strategy session where you and your legal team determine the strength of your case and the best path forward. The Frankowski Firm offers a free and private consultation to help you understand your options without any upfront commitment. This conversation is the foundation for all the work that follows.

After the initial evaluation, if you and your attorney decide to proceed, the next step is to formally file a claim. This is the official start of your legal action to recover your losses. The process of suing for investment fraud can be intricate, involving specific legal documents and strict deadlines. Your attorney will handle the complexities of drafting and filing the necessary paperwork, ensuring that your claim is presented clearly and accurately. They will articulate the misconduct that occurred and the financial damages you suffered, setting the stage for the legal proceedings to come.

Many investors don’t realize that when they open a brokerage account, they often sign an agreement that requires disputes to be settled through arbitration rather than in a traditional court. The Financial Industry Regulatory Authority (FINRA) runs the largest forum for this process. Securities arbitration is a legally binding method of resolving disputes where an impartial arbitrator or panel hears both sides and makes a decision. Your attorney will represent you throughout this entire process, from selecting arbitrators to presenting evidence and making arguments on your behalf at the final hearing.

It’s natural to wonder how long it will take to resolve your case. While there’s no one-size-fits-all answer, it’s important to act quickly. The sooner you address potential broker fraud and negligence, the better your chances of a successful recovery. Statutes of limitations can bar claims that are not filed in a timely manner. The legal process itself requires patience, as it can involve extensive document review, discovery, and scheduling with arbitrators. Your attorney will keep you informed of the progress and manage the timeline, but remember that these cases are often a marathon, not a sprint.

When you put your hard-earned money into an investment, you’re placing a great deal of trust in a financial professional. Fortunately, you aren’t alone in this. A robust set of state and federal laws exists specifically to protect you from fraudulent or negligent practices. If you suspect you’ve been misled and have lost money as a result, you have the right to seek legal recourse. These protections are designed to hold brokers and firms accountable for their actions. Understanding that these rules are in your corner is the first step toward taking control of the situation and exploring your options for recovery.

If you’ve been wronged, you have several avenues for legal action. The right path depends on the specifics of your situation. For example, you might have a case based on securities fraud, a breach of fiduciary duty (meaning your broker didn’t act in your best interest), or negligent misrepresentation. These are just a few examples of the complex investment issues that can arise. Because these cases involve detailed financial regulations and legal standards, it’s often difficult to handle them on your own. An attorney can help you identify the strongest grounds for your claim and build a solid case.

This is incredibly important: time is not on your side when it comes to investment fraud. There are strict deadlines, known as statutes of limitations, for filing a claim. If you miss this window, you could lose your right to recover your losses forever, no matter how strong your case is. The clock often starts ticking from the moment you discovered—or should have discovered—the fraud. This is why it’s so critical to act quickly if you suspect something is wrong. Don’t wait and hope the situation improves. The sooner you seek legal advice, the better your chances of meeting these crucial deadlines.

The primary goal of taking legal action is to get your money back. If you pursue a claim and win, you may be able to recover the full amount of your lost investment. In some cases, you might also be awarded additional funds to cover interest, legal fees, or even punitive damages, which are meant to punish the wrongdoer. The process, which often involves securities arbitration, is designed to make you whole again. While no outcome is guaranteed, a successful case can put you back on the path to financial stability and give you a sense of justice.

Once you’ve chosen an attorney, the work of building your case begins. This process is a partnership. Your active participation is just as important as your lawyer’s legal knowledge. A strong attorney-client relationship is built on clear communication, thorough preparation, and a shared understanding of your goals. By working together effectively, you create a solid foundation for your claim. Here’s how you can be an effective partner in your own legal case.

Open communication is the cornerstone of your relationship with your attorney. Don’t hesitate to ask questions or voice concerns. Your lawyer is there to explain your options and guide you, but they need your input to do so effectively. Set expectations early about how you’ll receive updates, whether it’s a weekly email or a bi-weekly call. Remember to be just as forthcoming. If you remember a new detail or find another document, let your legal team know right away. This two-way dialogue ensures everyone is on the same page and working toward the same outcome.

Your attorney builds the legal arguments, but you hold the evidence. Your main role is to gather all documents related to your investments and interactions with the broker. This includes account statements, trade confirmations, emails, and notes from conversations. The more thorough your documentation, the clearer the picture of the broker fraud and negligence becomes. Organize these materials chronologically to help your legal team review them efficiently. Providing this information promptly allows your attorney to build the strongest possible case on your behalf from the start.

Losing money to fraud is more than a financial setback; it affects your retirement, creates stress, and strains relationships. A good attorney understands this and will work with you to develop a legal strategy that aligns with your goals. Be clear about what you hope to achieve—are you focused on recovering losses, or is holding the responsible party accountable also a priority? Your lawyer will outline the potential paths, such as filing a claim through securities arbitration, and explain the risks. Your perspective is essential in shaping a strategy that feels right for you.

Investment fraud claims can be a long process, and it’s natural to feel anxious. Your law firm should be a source of steady support throughout the entire timeline. They will handle complex legal filings, communicate with the opposing side, and represent you in all proceedings. While they manage the legal work, they should also keep you informed of significant developments. If you feel unsure about your case’s status, don’t hesitate to reach out. The first step in getting this support is often a simple conversation. You can contact us for a private consultation to discuss your situation.

Discovering that you may be a victim of investment fraud is a deeply unsettling experience. The financial loss is significant, but the emotional toll can be just as heavy, affecting your sense of security and your plans for the future. While the path forward can seem daunting, there are concrete steps you can take to regain control, seek justice, and protect yourself from future harm. The key is to act deliberately and get the right support on your side.

The moment you suspect something is wrong with your investments, it’s time to act. The most critical first step is to get a clear-headed assessment of your situation from a legal professional. If you believe you’ve lost money due to investment fraud or broker misconduct, stop all communication with the person or firm you suspect of wrongdoing. Avoid making new decisions until you’ve spoken with an attorney. We recommend you contact The Frankowski Firm for a free and private consultation to understand your rights and explore your options without any obligation.

You can sue for investment fraud. If you’ve been misled and lost money, you have legal options, though it’s often a complex process. The goal is to recover what was taken from you. A successful legal claim can help you get back your lost investments, and in some cases, you may be awarded additional money for other damages. Pursuing a claim through a process like securities arbitration can provide both financial restitution and a sense of closure. Working with a lawyer who focuses on these cases will help you build a strategy for your financial recovery.

Investment fraud can have a devastating impact, going beyond financial loss to affect retirement plans, family life, and emotional well-being. Protecting your financial future means learning from this experience and putting safeguards in place. Always conduct thorough due diligence before making new investments and be wary of promises that sound too good to be true. It’s important to work with a lawyer who specializes in investment issues to understand your options and vet future opportunities. Building a relationship with a trusted legal advisor is one of your strongest defenses against fraud.

What’s the difference between a bad investment and actual fraud? It’s a common question. A bad investment is one that simply doesn’t perform well due to market forces or other legitimate business reasons—risk is a natural part of investing. Fraud, on the other hand, involves intentional deception. This could be a broker lying about the risks, misrepresenting information, or recommending a product that was completely unsuitable for you just to earn a commission. The key difference is the element of deceit or negligence.

I feel embarrassed that I was tricked. Should I still seek legal help? Absolutely. Please know that you are not alone in feeling this way. The people who run these schemes are incredibly skilled at manipulation and building false trust. They create situations that can fool even the most careful investors. Feeling embarrassed is a normal reaction, but it shouldn’t prevent you from taking action. Your focus should be on holding the responsible parties accountable and working to recover your financial stability.

How much does it cost to hire an investment fraud attorney? This is a major concern for anyone who has already lost money, and it’s important to ask about fees upfront. Many firms that specialize in this area, including The Frankowski Firm, work on a contingency fee basis. This means you don’t pay any attorney’s fees unless they successfully recover money for you. This approach ensures your legal team is motivated to win and allows you to pursue justice without any upfront financial risk.

Will I have to go to court to get my money back? It’s unlikely. Most disputes between investors and brokerage firms are resolved through a process called FINRA arbitration, not in a traditional courtroom. When you open a brokerage account, the paperwork you sign usually includes a clause agreeing to this process. Arbitration is a formal, legally binding process, but it is generally more private and less complex than a court trial. Your attorney will represent you every step of the way.

What if I don’t have a lot of paperwork? Can I still have a case? Even if you don’t have a perfect paper trail, you should still explore your options. While documents like account statements and emails are very helpful, they aren’t the only form of evidence. An experienced attorney can often help uncover the necessary proof through the legal discovery process. Don’t let a lack of organized records stop you from seeking a professional opinion on your situation.