Seeing your financial advisor featured in magazines like D Magazine or Texas Monthly can be incredibly reassuring. Awards and public recognition often build a strong foundation of trust. But what do these accolades really mean for your portfolio? It’s important to look past the headlines and understand the specific strategies being used with your money. We’re taking a closer look at Cetera Advisor Networks, LLC Broker David Rhodes, an advisor who has received such recognition. This review will cover his qualifications, his firm’s investment philosophy, and the critical details that matter most when it comes to protecting your financial future.

Key Takeaways

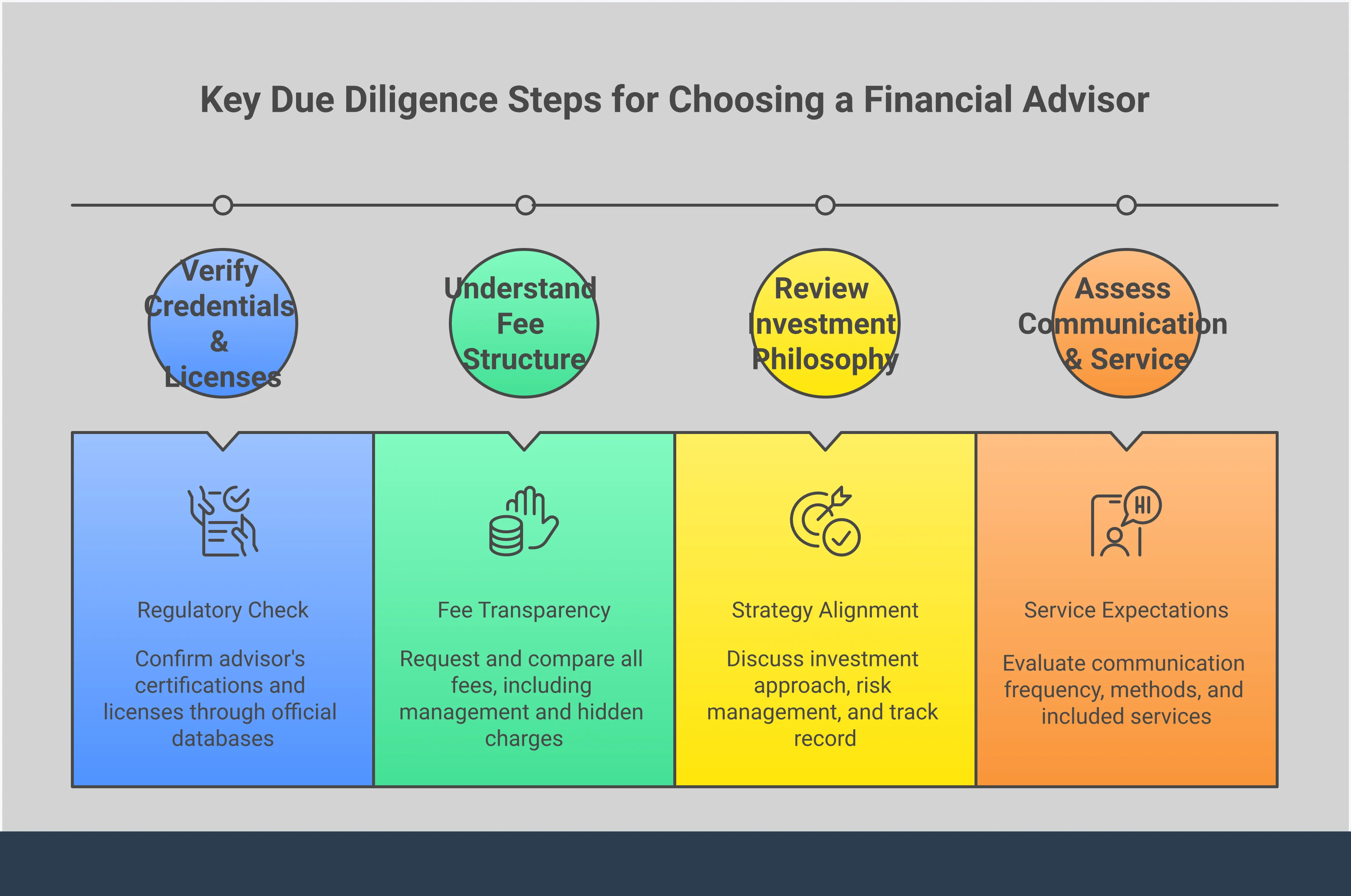

- Independently Verify Your Advisor’s Record: Use free tools like FINRA’s BrokerCheck to see an advisor’s real history, including licenses and any customer disputes. This provides an objective view that goes beyond what a firm’s website might show.

- Confirm Your Portfolio Reflects Your Needs: Your investment plan should be tailored specifically to your financial goals, timeline, and comfort with risk. If the strategies being used don’t feel right or seem overly complex, it’s a sign to ask more questions.

- Treat Awards as Just One Piece of the Puzzle: While local recognition and client satisfaction awards can seem reassuring, they don’t guarantee suitable advice. Your focus should always be on whether the actual investment performance and strategies align with the promises made.

Who is David Rhodes of Cetera Advisor Networks?

When you trust someone with your financial future, it’s important to understand their background and how they operate. David Rhodes is a financial professional associated with Cetera Advisor Networks and his own firm, The Rhodes Financial Group. Understanding his history, his relationship with his brokerage firm, and his stated investment philosophy can give you a clearer picture of how he handles his clients’ money. This information is a critical first step for any investor looking to protect their assets and make informed decisions.

A Look at His Professional History

David Rhodes holds a Bachelor’s degree in Engineering from Texas A&M University and a Master’s degree in Finance from the University of Dallas. He is also a CERTIFIED FINANCIAL PLANNER™ (CFP®) professional. The CFP® designation is granted to financial planners who meet specific requirements for education, examination, experience, and ethics. This background in engineering and finance, combined with his professional certification, forms the foundation of his career in the financial services industry. Understanding these qualifications can help you gauge the knowledge and training a financial advisor brings to the table when managing your portfolio.

His Role at Cetera Advisor Networks

David Rhodes offers securities through Cetera Advisor Networks LLC, a member of both FINRA and SIPC. This means Cetera Advisor Networks is the broker-dealer firm that supervises his securities-related activities. Broker-dealers have a legal duty to supervise their representatives to prevent misconduct. When an advisor is affiliated with a firm like Cetera, that firm can be held responsible for failing to prevent broker fraud and negligence. His advisory services are offered through a separate entity, Summit Financial Group, Inc., which is a Registered Investment Adviser. This dual registration is common but adds a layer of complexity for investors to understand.

Leadership at The Rhodes Financial Group

At his own firm, The Rhodes Financial Group, the stated philosophy is to focus on comprehensive financial planning. According to the firm, its process involves gathering detailed financial information from clients to understand their goals, time horizon, and tolerance for risk. The group claims to analyze this information objectively to develop personalized recommendations for each client. This approach is meant to ensure that all financial advice is tailored to an individual’s specific situation. If you feel that the advice you received did not align with your stated goals, it could be a sign of a larger problem with your investment issues.

What Are David Rhodes’ Qualifications?

When you trust someone with your financial future, it’s smart to look at their background and credentials. Understanding a financial professional’s qualifications helps you see the training and standards they are held to, including their education, licenses, and where they are registered to do business. This information isn’t hidden; it’s publicly available for your protection through tools provided by financial regulators. Taking the time to review these details is a fundamental step in safeguarding your investments and making informed decisions. It helps you verify that the person you’re working with has the necessary permissions and background to offer the advice and products they are selling.

Understanding His CFP® Designation

One of the key credentials David Rhodes holds is the CERTIFIED FINANCIAL PLANNER™ (CFP®) designation. To earn this, professionals must meet rigorous requirements in education, examination, experience, and ethics. According to his firm’s website, Mr. Rhodes has a Bachelor’s degree in Engineering from Texas A&M University and a Master’s degree in Finance from the University of Dallas. The CFP® certification builds on this foundation, requiring individuals to demonstrate their ability to create comprehensive financial plans. It’s a voluntary certification that signifies a commitment to a high standard of professional conduct.

A Breakdown of His Licenses and Credentials

Beyond professional designations, financial advisors must hold specific licenses to sell securities or offer investment advice. You can verify this information for any broker using FINRA’s BrokerCheck tool. This free resource shows where a professional has worked, what exams they have passed, and the licenses they currently hold. It’s an essential step in vetting anyone you’re considering working with. If you have concerns about how your accounts are being handled, understanding the rules your broker must follow is the first step. Cases of broker fraud and negligence often arise when these standards are not met.

Where He Is Authorized to Practice

A broker must be registered in each state where they have clients, and this information is also available on their BrokerCheck profile. According to his public profiles, David Rhodes focuses on tax-conscious investing and creating retirement income streams, often through annuity products. While these can be legitimate tools, it’s important for investors to fully understand them. Annuities can be complex, and it’s crucial that they are suitable for your specific financial situation. Misunderstandings or unsuitable recommendations related to such products can lead to significant investment issues down the road.

A Review of David Rhodes’ Financial Strategies

Understanding how a financial advisor approaches their work is key to knowing if they are a good fit for you. Let’s look at the financial strategies and services associated with David Rhodes.

His Stated Approach to Financial Planning

When you sit down with an advisor, you expect them to get a full picture of your financial life. David Rhodes and The Rhodes Financial Group state they use a comprehensive approach, gathering key information from clients to build a plan. This includes understanding your time horizon, need for asset protection, risk tolerance, and specific financial goals. Their philosophy is to analyze this data objectively to create recommendations that are in a client’s best interests. This process is fundamental, as any breakdown can lead to unsuitable recommendations and potential broker negligence.

How He Manages Investment Portfolios

Your investment portfolio should be a direct reflection of your personal financial situation—your goals, how much risk you’re comfortable with, and when you’ll need your money. According to his firm, David Rhodes manages investment portfolios by using principles and strategies that align with these unique client factors. The aim is to create a balanced investment strategy tailored to your specific circumstances. When an advisor deviates from this personalized approach, it can expose an investor to unnecessary risk and significant financial losses.

What His Discretionary Services Involve

Handing over the day-to-day decisions for your portfolio can feel like a big step. To address this, David Rhodes offers discretionary management services, which means he can make investment decisions on your behalf without seeking prior approval for each transaction. This service is intended to offer convenience and professional oversight. However, this type of arrangement requires a very high level of trust and clear communication about your financial objectives to ensure your portfolio is managed appropriately.

Strategies for Wealth Management and Asset Protection

Feeling informed and confident about your finances is crucial. Part of David Rhodes’ stated mission is to empower clients through education and advanced strategies for wealth management and asset protection. The goal is to help clients understand complex financial landscapes so they can make sound decisions. While education is valuable, it’s also important that the strategies themselves are suitable and properly implemented. If complex or high-risk products are misrepresented, it can lead to serious investment issues for the investor.

Has David Rhodes Received Awards or Recognition?

When you’re vetting a financial advisor, it’s common to look for awards and accolades. They can paint a picture of a professional who is respected in their field and trusted by clients. David Rhodes has received recognition from local publications, which has likely contributed to his professional standing in the Dallas area. While these awards can seem reassuring, it’s important to remember they are just one part of a much larger picture. They don’t replace the need for thorough due diligence, like reviewing a broker’s public record and understanding their investment strategies. Let’s look at the specific recognition he has received.

Recognition from D Magazine

David Rhodes has been featured in D Magazine as one of “The Best Financial Planners in Dallas.” This type of local recognition can significantly build an advisor’s reputation within a community. For many investors, seeing a familiar name in a respected local publication provides a sense of trust and credibility. It suggests that the advisor is well-regarded by their peers and the local business community. However, it’s always a good idea to understand the criteria for such lists and not rely on them as the sole reason for choosing an advisor to manage your finances.

Awards from Texas Monthly

In 2009 and 2010, David Rhodes also received the “Five Star: Best in Client Satisfaction Wealth Managers” award from Texas Monthly magazine. Awards focused on client satisfaction can be particularly appealing because they suggest that an advisor is attentive and responsive to their clients’ needs. This kind of recognition often relies on feedback from clients and peers, aiming to highlight professionals who provide quality service. While positive client feedback is a good sign, it doesn’t provide insight into the suitability of the investments recommended or the performance of a portfolio over time.

Examining His Professional Reputation

Beyond media recognition, David Rhodes’ professional reputation is built on a solid educational foundation, including a Bachelor’s in Engineering from Texas A&M and a Master’s in Finance from the University of Dallas. He also holds the CERTIFIED FINANCIAL PLANNER™ designation and has taught finance at the University of North Texas. His insights have appeared in publications like USA Today and The Dallas Morning News. These credentials show a commitment to the financial field, but they don’t immunize an investor from risk or potential broker fraud and negligence. It’s crucial to look past the resume and scrutinize an advisor’s actual practices.

Reviewing David Rhodes’ Public Record

When you entrust someone with your financial future, it’s wise to do your homework. Public records offer a window into a broker’s background, qualifications, and history. For any financial professional, including David Rhodes, these records are a fundamental part of your due diligence as an investor. They provide objective information that can help you verify credentials and check for any red flags. Taking the time to review these details helps you make informed decisions and ensures you have a clear picture of the person managing your investments. It’s a straightforward step that can provide significant peace of mind.

Publicly Available Contact Information

According to information from his firm, David Rhodes earned a Bachelor’s degree in Engineering from Texas A&M University and a Master’s degree in Finance from the University of Dallas. He is also listed as a CERTIFIED FINANCIAL PLANNER™ (CFP®) professional. This designation requires adherence to certain ethical standards and ongoing education in financial planning. This type of background information is typically available on a firm’s website or a professional’s public profile and can give you a basic understanding of their educational and professional history before you dig deeper into their regulatory record.

Understanding His BrokerCheck Record

One of the most valuable resources for any investor is FINRA’s BrokerCheck. This free tool allows you to see a broker’s employment history, licenses, and, most importantly, any reported customer disputes, regulatory actions, or disciplinary events. Reviewing a BrokerCheck report should be a standard step before working with any financial advisor. It provides a transparent look at their professional conduct over the years. A clean record is what you hope to see, but any disclosures or complaints listed should be carefully examined as you assess whether an advisor is the right fit for you.

What to Do If You Have Concerns About Your Investments

If you have reviewed your account statements and something doesn’t feel right, it’s important to ask questions. If your conversations with your broker leave you with more questions than answers, or if you feel your concerns are being dismissed, it’s time to take another step. You have a right to understand every transaction and strategy used in your account. When you suspect there may be issues of broker fraud and negligence, getting a second opinion from a qualified professional is a reasonable course of action. Understanding the process of securities arbitration can also clarify your options for recovering potential losses. If you are worried about your investments, please contact us for a confidential consultation.

Related Articles

- Cetera Broker Patrick Siria: Investor Complaints & Allegations – The Frankowski Firm

- FINRA Complaint Alleges Unsuitable Advice by Tsikitas

- Edward Jones Broker Joshua Marino (CRD# 6141373): Investor Guide | The Frankowski Firm

Frequently Asked Questions

What does it mean that an advisor offers securities through a firm like Cetera Advisor Networks? Think of Cetera Advisor Networks as the supervisory firm that David Rhodes works with for his securities business. Broker-dealer firms like Cetera have a legal responsibility to oversee the advisors who use their platform. This is meant to ensure that advisors follow industry rules and regulations. If an advisor engages in misconduct, the supervising firm can sometimes be held accountable for failing to prevent it.

Are awards from magazines a guarantee that my money is in good hands? While recognition from publications like D Magazine or Texas Monthly can indicate a positive reputation in the local community, they aren’t a complete picture of an advisor’s practice. These awards often have specific criteria that may not relate to investment performance or suitability. It’s always wise to view awards as just one piece of information and to continue your own research by reviewing an advisor’s public record and asking detailed questions about their strategies.

Why is it so important to look at a broker’s public record? Reviewing a public record, especially through a tool like FINRA’s BrokerCheck, gives you an unbiased look at a financial professional’s history. It’s where you can verify their licenses, see their employment history, and check for any customer complaints or disciplinary actions. This isn’t about being suspicious; it’s about being an informed investor. It helps you confirm that the person you’re trusting with your finances has a clean and transparent professional background.

My portfolio isn’t doing well. Does that automatically mean there’s a problem? Not necessarily. All investments come with risk, and market fluctuations can cause portfolio values to go down. However, a problem might exist if your losses are due to unsuitable investment recommendations that didn’t match your stated goals and risk tolerance. If your portfolio is filled with high-risk products you didn’t understand or agree to, or if the strategy seems completely wrong for your situation, it’s worth taking a closer look.

What are the first steps I should take if I’m worried about my investments? If you have concerns, the first step is to gather your account statements and any communications you have from your advisor. Try to pinpoint exactly what is worrying you—is it a specific investment, a lack of communication, or a strategy that doesn’t seem right? Once you have your thoughts organized, seeking a confidential second opinion from a legal professional who specializes in investment-related issues can help you understand your rights and options.