Trust is the cornerstone of any relationship with a financial advisor. You hand over your hard-earned money with the expectation that they will act in your best interest. But what happens when that trust is misplaced? Public records exist for a reason—they provide a transparent look into an advisor’s professional history, including any client disputes or regulatory actions. The case of former Charles Schwab & Co, Inc. Broker Chad Faulkenberry serves as a critical reminder of why this due diligence is so important. His record includes multiple client disputes and a significant regulatory sanction from the state of Florida. This article will examine the details of his career, helping you understand the red flags and what you can do if you believe your investments were mishandled.

Key Takeaways

- An Advisor’s History Matters More Than Credentials: Certifications don’t tell the whole story. Always review an advisor’s public record for client disputes or regulatory actions, like those associated with Chad Faulkenberry, using FINRA’s BrokerCheck tool.

- Identify Red Flags in Your Account and Advice: Pay close attention to investment recommendations that don’t align with your financial goals. Unauthorized trades, downplayed risks, and an advisor’s failure to follow state registration rules are serious warning signs of potential misconduct.

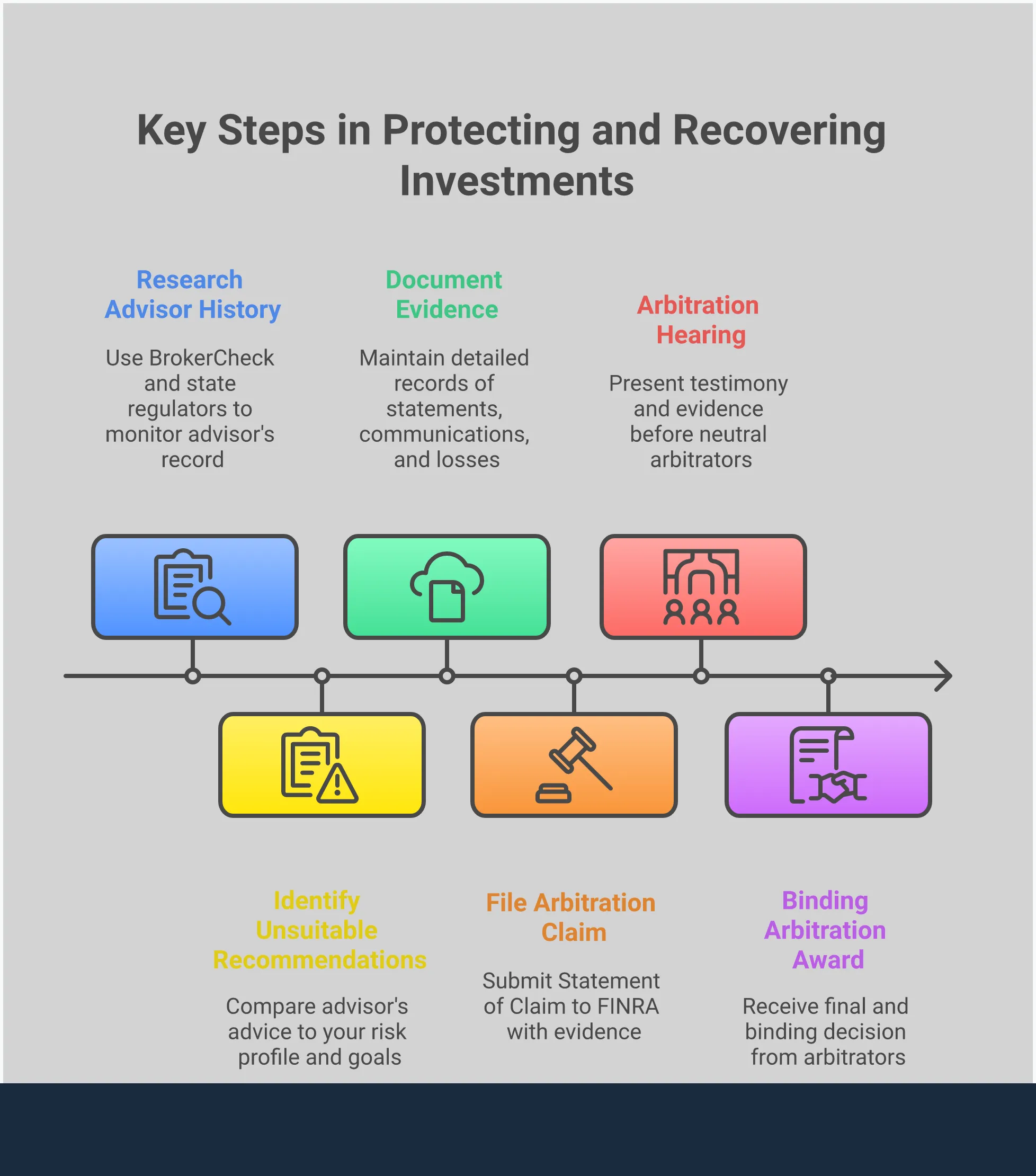

- Follow a Clear Process to Reclaim Your Money: If you’ve lost money due to poor advice, take action by gathering all your documents, filing a complaint with FINRA, and consulting a securities attorney. These steps are the foundation for recovering your losses through the securities arbitration process.

Who Is Chad Faulkenberry?

Understanding a financial advisor’s professional history is a critical step for any investor. Chad Faulkenberry has worked in the financial industry for two decades, holding positions at major firms and now serving as a managing director at a wealth management company. A closer look at his career path, including his time at Charles Schwab, reveals important details for anyone who has worked with him.

A Look at His Financial Planning Career

Chad Faulkenberry began his career in wealth management in 2004, shortly after graduating from college. According to his biography at Journey Strategic Wealth, he initially intended to pursue a law degree. However, he discovered a passion for financial planning during an internship and decided to build his career in that field instead. This path led him to work with clients on complex financial matters, eventually taking on senior roles at prominent financial institutions.

His Time at Charles Schwab

Faulkenberry was a financial advisor with Charles Schwab & Co. Inc. from July 2014 to June 2024. During this decade-long tenure, his record came under regulatory scrutiny. The Florida Office of Financial Regulation found that Faulkenberry provided investment advice in the state without being properly registered, a violation that can put investors at risk. In a separate matter, a client at Charles Schwab filed a claim alleging that Faulkenberry’s actions led to financial losses. Charles Schwab settled this case, which points to a serious instance of alleged broker fraud and negligence.

His Current Role at Journey Strategic Wealth

Currently, Chad Faulkenberry is a Financial Advisor and Managing Director at Journey Strategic Wealth. His professional biography states that his focus is on simplifying complex financial issues for the clients he serves. For investors who have previously worked with Faulkenberry, particularly during his time at Charles Schwab, it’s wise to review your accounts and statements carefully. Understanding his professional background is an important part of assessing the advice you received and protecting your financial interests. If you have concerns about your investments, it may be time to explore your legal options.

What Are Chad Faulkenberry’s Qualifications?

When you trust someone with your financial future, you expect them to have the right credentials and a client-first mindset. Understanding an advisor’s background is a critical step for any investor. On paper, Chad Faulkenberry presents a profile of a highly qualified wealth management professional. His career is marked by several industry certifications and a stated commitment to helping families with complex financial matters.

This information provides a baseline for what clients might expect from his services. However, an advisor’s qualifications are just one piece of the puzzle. It’s also important to look at their professional history, including any client disputes or regulatory actions, to get a complete picture. For now, let’s review the qualifications and professional focus that Chad Faulkenberry promotes to his clients. This context is helpful when evaluating whether an advisor’s actions align with their credentials and promises.

A Breakdown of His Certifications

Chad Faulkenberry holds multiple financial certifications, each indicating specialized training in different areas of wealth management. According to his professional biography, he is a Certified Financial Planner (CFP®), a designation that requires extensive training in financial planning, retirement, and investments. He is also a Certified Private Wealth Advisor (CPWA®), which focuses on the life cycle of wealth for high-net-worth clients.

Additionally, he holds the Chartered Life Underwriter (CLU®) and Certified Wealth Strategist (CWS®) credentials. These certifications suggest a deep knowledge of life insurance and estate planning, as well as broader wealth management strategies. Together, these qualifications paint a picture of an advisor with a comprehensive education in managing significant financial assets and complex investment issues.

His Stated Focus in Wealth Management

In his role, Chad Faulkenberry emphasizes building strong connections with clients and their families. He states that his goal is to simplify complicated financial topics, making them easier for clients to understand and act on. His approach is described as client-centric, with a focus on helping people achieve their financial objectives and make the most of their resources.

This stated mission is common among financial advisors, as it builds trust and communicates a commitment to the client’s best interests. An advisor’s ability to live up to this promise is what truly matters. When an advisor’s recommendations seem to conflict with your stated goals, it can be a sign that their actions aren’t matching their words, potentially leading to issues of broker fraud and negligence.

A History of Notable Client Disputes

When you’re entrusting someone with your financial future, their professional history matters. An advisor’s record of client disputes, which is publicly available, can offer valuable insight into their practices and how their firm handles conflicts. While a single complaint doesn’t automatically signal a problem, a pattern of disputes or regulatory actions can be a serious red flag for investors. It’s important to look at these events to understand the context and potential risks involved.

The records associated with Chad Faulkenberry include several client disputes and a regulatory action that are worth examining. These incidents provide a clearer picture of the concerns raised by both clients and state regulators during his time at Charles Schwab. Understanding the nature of these complaints can help you identify similar warning signs in your own financial dealings. If you ever feel that an advisor’s actions have led to unexpected losses, it’s crucial to know that there are avenues for addressing broker fraud and negligence. Looking at past cases helps you see what that process can look like.

Investor Claims and Settlement Agreements

In one documented case, a client filed a claim stating that Chad Faulkenberry’s actions resulted in financial losses. In response to this dispute, his employing firm, Charles Schwab, agreed to a settlement and compensated the client with $5,944.04. It’s worth noting that a settlement is not an admission of guilt or wrongdoing. Firms often choose to settle claims to avoid the costs and time associated with a prolonged legal fight. However, the existence of a settlement does show that a client raised a serious enough concern to warrant a financial resolution from the brokerage firm.

Allegations of Unsuitable Investment Advice

Another client lodged a more serious accusation against Mr. Faulkenberry, claiming he provided unsuitable investment advice that led to significant financial harm. This is one of the most common investment issues investors face, as advisors have a duty to recommend strategies that align with their client’s goals and risk tolerance. This particular claim was not settled by Charles Schwab. The situation was further complicated by a finding from Florida’s Office of Financial Regulation, which determined that Mr. Faulkenberry had provided investment advice in the state without the required registration, adding a layer of regulatory concern to his client interactions.

Dispute Resolutions Involving Charles Schwab

The outcomes of these disputes varied. Following its investigation, the Florida regulator fined Mr. Faulkenberry $7,500 for his unregistered activity. This type of regulatory action is a formal sanction and becomes a permanent part of an advisor’s record. In a separate client dispute, an investor requested $132,000 in compensation for alleged damages. However, this claim was ultimately denied by the firm. This highlights that not all client complaints result in a financial recovery, which is why understanding the securities arbitration process is so important for investors seeking to recover losses.

Has Chad Faulkenberry Faced Regulatory Action?

Yes. According to public records, Chad Faulkenberry has faced disciplinary action from a state regulator. The Florida Office of Financial Regulation investigated his conduct and found that he provided investment advice to clients in the state without holding the necessary registration. This kind of oversight failure can expose investors to unnecessary risks and is a serious breach of industry rules. The investigation resulted in specific sanctions and fines against Faulkenberry, highlighting the importance of state-level compliance for financial professionals.

Sanctions from Florida’s Office of Financial Regulation

The Florida Office of Financial Regulation took formal action against Chad Faulkenberry after determining he engaged in activities that required proper state registration, which he had failed to secure. While associated with Charles Schwab, the regulator found his actions in Florida fell outside the scope of his credentials. State registration laws are designed to protect consumers by ensuring advisors meet specific standards. When an advisor sidesteps these requirements, it can be a red flag indicating potential broker fraud and negligence.

Violations for Unauthorized Investment Advice

The core of the regulatory action centered on Faulkenberry providing investment advice to Florida residents without being registered in the state. Financial industry regulations are clear: advisors must be properly licensed in every state where they conduct business to ensure they are accountable to state authorities. Operating without the correct registration means an advisor is not subject to the state’s direct oversight, which can leave clients vulnerable. These compliance failures are among the common investment issues that can lead to financial harm for unsuspecting investors.

Fines and Compliance Penalties

As a result of these violations, Florida regulators ordered Faulkenberry to pay a $7,500 fine and cease all unauthorized advisory activities in the state. Beyond the direct penalties, the case also involved client compensation. Records show Charles Schwab paid one client $5,944.04 to resolve a complaint connected to Faulkenberry’s conduct. Another client dispute seeking $132,000 in damages was also filed, though this claim was ultimately denied. When investors suffer losses from an advisor’s misconduct, resolving the dispute often involves a process like securities arbitration to recover damages.

How to Spot Potential Advisor Misconduct

Trust is the foundation of your relationship with a financial advisor, but it’s also important to stay informed and vigilant. Protecting your financial future means knowing how to recognize when something isn’t right. Advisor misconduct isn’t always as dramatic as a blockbuster movie plot; often, it’s a series of subtle red flags that can add up to significant losses. These warning signs can appear in the recommendations you receive, the activity in your account, or your advisor’s general behavior.

Understanding these signs is your first line of defense. It’s about being an active participant in your financial journey, not just a passenger. When an advisor fails to act in your best interest, whether through deliberate action or carelessness, the consequences can be devastating. The case involving Chad Faulkenberry, who faced regulatory action for giving investment advice in Florida without proper registration, highlights how crucial it is for advisors to follow the rules. When they don’t, investors are the ones who pay the price. Learning to spot potential broker fraud and negligence can help you take action before the damage becomes irreversible.

Receiving Unsuitable Recommendations

One of the most common signs of trouble is receiving investment advice that just doesn’t feel right for you. An advisor has a duty to recommend investments that align with your specific financial situation, goals, age, and risk tolerance. If you’re a conservative investor nearing retirement, being pushed into high-risk, speculative stocks is a major red flag. This is known as an “unsuitable recommendation.” It can also happen when an advisor operates outside of regulatory bounds, like when Chad Faulkenberry was found to be giving advice without being properly registered in the state. This shows a disregard for the very regulations designed to protect you.

Noticing Unauthorized Trades or Hidden Risks

You should always be aware of the activity in your investment accounts. If you see trades that you never approved, that’s a serious violation called unauthorized trading. Your advisor must have your permission before making any transaction on your behalf unless you have specifically given them discretionary authority in writing. Similarly, be wary if your advisor seems to downplay the risks of an investment or isn’t transparent about potential downsides. Client disputes alleging that an advisor’s guidance led to losses often stem from these types of investment issues, where the full picture of risk was not clearly communicated.

Recognizing the Red Flags of Negligence

Misconduct isn’t always about bad intentions; sometimes, it’s simply about carelessness or a failure to perform required duties. This is financial negligence. It can include a lack of due diligence on an investment, failing to monitor your portfolio, or not following industry rules and regulations. When an advisor, like Chad Faulkenberry, is fined by a state regulator, it’s a clear signal that they failed to meet professional standards. These regulatory actions are public information for a reason—they serve as a warning to investors. If you suspect negligence, you may have grounds to recover your losses through a process like securities arbitration.

What to Do If You Lost Money from His Advice

Realizing you may have lost money because of your financial advisor’s guidance can be incredibly stressful. It’s easy to feel overwhelmed or unsure of what to do next. The good news is that you have options, and there are concrete steps you can take to address the situation. Taking action starts with gathering your information and understanding the paths available for seeking recovery. If you believe Chad Faulkenberry’s advice led to financial harm, it’s important to act methodically to build your case. The following steps can help you get organized and prepare for what comes next, whether that’s filing a formal complaint or pursuing a legal claim.

Document Your Losses and Gather Evidence

Your first move should be to create a clear paper trail. Meticulously documenting your losses is the foundation of any potential claim. Start by gathering all relevant paperwork, including account statements, trade confirmations, performance reports, and any written correspondence like emails or letters you exchanged with Mr. Faulkenberry. If you have notes from phone calls or meetings, collect those as well. This evidence is critical. For instance, a former client at Charles Schwab alleged that Faulkenberry’s actions resulted in significant financial losses, a claim that ultimately led to a settlement. A well-documented case provides a clear picture of what happened and strengthens your position.

File a Complaint with FINRA

If you suspect misconduct, you should consider filing a complaint with the Financial Industry Regulatory Authority (FINRA). FINRA is the organization responsible for regulating brokerage firms and their representatives in the United States. Submitting a formal complaint can trigger an investigation into an advisor’s practices and creates an official record of your experience. This is an important step in holding advisors accountable. Chad Faulkenberry has previously faced sanctions for providing financial advice without the required registration in Florida, which shows that regulatory bodies do take action against violations. Your complaint could not only help your own case but also protect other investors from potential harm.

Speak with a Securities Attorney

While filing a complaint is a key step, you don’t have to handle this process alone. Consulting with a lawyer who focuses on investment issues is one of the most effective actions you can take. An attorney can review the details of your situation, help you understand the complexities of securities law, and explain your legal options in plain language. They can determine if you have a strong case for securities arbitration and represent your interests throughout the process. Getting professional guidance can make a significant difference in your ability to recover your losses.

What Is Securities Arbitration?

If you have a dispute with your broker or their firm, you might assume your only option is a lengthy and expensive court battle. However, most investor agreements include a clause that requires you to resolve conflicts through a different method. This is where securities arbitration comes in. Think of it as a specialized, private court system for the investment world. Instead of a judge and jury, your case is heard by a neutral third party, called an arbitrator, who is knowledgeable about financial matters.

This process is designed to be more efficient and less formal than traditional litigation. It allows you to present your case and seek recovery for losses caused by issues like negligence or unsuitable advice. The Financial Industry Regulatory Authority (FINRA) oversees the largest forum for this type of dispute resolution. For many investors, arbitration is the primary path to holding a broker or firm accountable for financial misconduct and recovering their hard-earned money. It provides a structured setting to address your grievances and work toward a final, binding decision.

The FINRA Arbitration Process Explained

The FINRA arbitration process follows a clear, structured path. It begins when you, the investor, file a “Statement of Claim.” This document outlines the details of your dispute, explaining what happened and how you were financially harmed. Your broker or their firm then has a chance to respond with their side of the story in a document called the “Answer.” Once both sides have made their initial filings, an arbitrator (or a panel of three arbitrators for larger claims) is selected to hear the case. The process includes discovery, where both parties exchange relevant documents and information. The final step is a hearing where you and your attorney present evidence and witness testimony.

What to Expect: Timelines and Potential Outcomes

While arbitration is generally faster than going to court, it’s not an overnight process. From filing the initial claim to receiving a final decision, the timeline can take several months or even more than a year, depending on the complexity of your case. After the hearing, the arbitrator or panel will review all the evidence and issue a final, binding decision known as an “Award.” This document will state who won the case and detail any monetary damages you are entitled to recover. It’s important to understand that arbitration awards are very difficult to appeal. This finality provides closure and a clear resolution to disputes involving broker fraud and negligence.

How to Protect Yourself from High-Risk Advisors

Entrusting your financial future to an advisor is a significant decision. While most professionals are trustworthy, it’s essential to do your homework to avoid those who might not have your best interests at heart. Taking a few proactive steps can safeguard your investments and give you peace of mind. It’s about being an informed and empowered investor, and these practices can help you identify potential red flags before they become serious problems. Protecting your assets starts with knowing who is managing them and how they operate.

Research an Advisor’s Background

Before signing any paperwork, conduct a thorough background check. A great starting point is FINRA’s free BrokerCheck tool. This database provides a snapshot of an advisor’s employment history, licenses, certifications, and—most importantly—any customer disputes or regulatory actions. For instance, a Florida regulator found that financial advisor Chad Faulkenberry gave investment advice without being properly registered in the state. This kind of information is publicly available and can be a critical warning sign of potential broker fraud and negligence. A few minutes of research can reveal a history that an advisor might not willingly share.

Ask for References and Get a Second Opinion

Don’t hesitate to ask for references, but also remember that an advisor will likely provide you with their happiest clients. It’s equally important to seek a second opinion from another financial professional you trust. In the case of Chad Faulkenberry, one client at Charles Schwab alleged his actions led to financial losses, and the firm ultimately settled the case. While a settlement isn’t an admission of guilt, a pattern of client disputes can indicate underlying issues. Discussing a proposed investment strategy with another advisor can help you determine if the recommendations are sound or if they expose you to unnecessary risk.

Understand How Your Advisor Is Paid

Knowing how your advisor makes money is fundamental to understanding their motivations. Are they fee-only, meaning you pay them directly? Or are they commission-based, earning money when you buy or sell specific products? The latter can create a conflict of interest, incentivizing them to recommend products that pay them a higher commission rather than what’s best for you. An advisor may hold impressive certifications, like the CFP® or CPWA®, but that doesn’t eliminate potential conflicts. Always ask for a clear, written explanation of all fees and compensation structures. This transparency is crucial for avoiding unsuitable investment issues down the road.

Your Legal Options for Recovering Investment Losses

Discovering that you’ve lost money due to your financial advisor’s advice can feel overwhelming and isolating. It’s easy to blame yourself, but it’s important to remember that your advisor has professional and ethical obligations to you. When those obligations aren’t met, you have rights and clear pathways to recover your losses. The key is understanding what those options are and how to take the first step.

Whether your advisor failed to register properly, recommended unsuitable investments, or simply didn’t act in your best interest, there are established legal frameworks to hold them accountable. These processes are designed to protect investors like you. You don’t have to accept your losses as a sunk cost. Instead, you can explore filing a formal claim to seek financial recovery. Let’s walk through some of the most common legal avenues available to you.

Filing a Claim for Securities Fraud or Negligence

When a financial advisor fails to follow industry rules, it can be a form of negligence. For example, some advisors have been sanctioned by state regulators for giving investment advice without being properly registered. This kind of oversight is a serious compliance failure. If an investor suffers losses because of advice from an unregistered advisor, they may have a strong case for broker fraud and negligence. This applies to situations where an advisor misrepresents information, omits crucial facts, or simply fails to perform their duties with the required level of care, causing you financial harm.

Pursuing a Breach of Fiduciary Duty Case

Many financial advisors are held to a fiduciary standard, which legally requires them to act in your best interest at all times. This means they must prioritize your financial well-being over their own profits or their firm’s. When an advisor recommends high-risk or unsuitable investments that don’t align with your goals, it can be a breach of this duty. In some disputes, clients have alleged their advisor’s advice was detrimental and led to significant losses. When you can show that your advisor’s actions were not in your best interest and caused you harm, you may be able to pursue a claim for these types of investment issues.

Why You Should Consider an Investment Fraud Attorney

Trying to recover investment losses on your own can be incredibly difficult. The financial industry has complex rules, and brokerage firms have teams of lawyers to defend their interests. Working with an investment fraud attorney levels the playing field. A lawyer who understands this specific area can review your case, explain your options, and handle the entire legal process for you, which often involves securities arbitration. They can build a strong case on your behalf and work to recover the money you lost. If you believe you have been wronged by an advisor, it’s worth discussing your situation with a legal professional. You can contact us for a confidential consultation to understand your rights.

Related Articles

- Investor Alert: UBS Broker Thomas Jenkins’ Record

- Sicheng Tao at Fidelity: Investor Complaints & Allegations

- LPL Broker Kenneth South (CRD# 1387390): Investor Allegations & Disputes

- Patrick Pistor (CRD# 7579589): What Investors Need to Know

- UBS Broker William Meador: Investigating Investment Loss Claims

Frequently Asked Questions

Why does it matter if a financial advisor isn’t registered in my state? State registration is a critical layer of protection for investors. When an advisor is registered, they are subject to the state’s specific rules and oversight, which helps ensure they are meeting professional standards. An advisor operating without the proper registration is sidestepping this accountability, which can leave you vulnerable if a problem arises with your investments.

My advisor has impressive certifications. Doesn’t that guarantee they’ll act in my best interest? Certifications like the CFP® or CPWA® show that an advisor has completed extensive training and passed rigorous exams. While these credentials are a good sign, they are only one part of the story. An advisor’s complete professional history, including any client disputes or regulatory actions, gives you a much clearer picture of how they actually conduct business and treat their clients.

I worked with Chad Faulkenberry and I’m worried about my investments. What is the very first thing I should do? Your first step should be to gather all your documents. Start collecting your account statements, trade confirmations, and any emails or written communication you have. This creates a detailed record of the advice you received and the performance of your portfolio. Having a clear paper trail is the essential foundation for evaluating your situation and deciding what to do next.

What exactly is “unsuitable advice”? Unsuitable advice is any investment recommendation that doesn’t align with your personal financial situation, goals, and tolerance for risk. For example, if you told your advisor you have a low risk tolerance because you’re nearing retirement, and they recommended you put a large portion of your savings into a volatile, speculative stock, that would likely be considered an unsuitable recommendation.

If I have a dispute with my advisor, is going to court my only option? Actually, for most investors, the path to resolving a dispute is through securities arbitration. When you open a brokerage account, the agreement you sign usually includes a clause requiring you to use arbitration instead of the court system. This process is overseen by FINRA and is specifically designed to handle investment-related conflicts in a more streamlined way than a traditional lawsuit.