NO FEES UNTIL WE WIN

FREE CONSULTATION

NO FEES UNTIL WE WIN

FREE CONSULTATION

Suddenly coming into a massive fortune is like being given the keys to a high-performance jet with no flight training. It’s thrilling, but also incredibly dangerous without the right instructions. A lottery trust is your instruction manual. It’s a legal structure you design to provide clear rules for managing, investing, and distributing your winnings. This framework protects you from making impulsive decisions and shields your assets from outside pressures. A crucial chapter in this manual is learning how to create lottery trust for anonymity, which allows you to stay in the pilot’s seat without broadcasting your flight path to the entire world, ensuring a safe and successful journey.

Winning the lottery is a life-changing event, but it can also bring a wave of unexpected challenges. Suddenly, your name could be public, and everyone from long-lost relatives to strangers might come asking for a piece of your newfound fortune. This is where a lottery trust comes in. It’s a powerful legal tool designed to help you manage your winnings discreetly and securely. Think of it as your first line of defense, creating a buffer between you and the overwhelming attention that often follows a big win.

A trust allows you to claim your prize without your name being plastered across news headlines, offering a crucial layer of anonymity. Beyond privacy, it provides a structured way to handle the money, protecting it from frivolous lawsuits, poor financial decisions, and opportunistic scammers. It’s about taking control of the situation from day one, ensuring your windfall becomes a lasting source of security rather than a short-lived headache. Establishing a trust is one of the most important first steps you can take to address the complex investment issues that arise with sudden wealth. It sets the foundation for smart financial planning and helps you build a secure future for yourself and your family, giving you peace of mind as you begin this new chapter.

So, what exactly is a lottery trust? At its core, it’s a legal arrangement you create to have a third party—the trustee—hold and manage your lottery winnings on your behalf. It’s not some obscure, complicated vehicle; it’s typically a standard living trust that’s specifically set up to handle the prize money. You get to set the rules for how the money is managed and distributed. This structure allows the trust itself, rather than you as an individual, to be the official winner. This simple change is the key to maintaining your privacy and taking a proactive approach to managing your new assets from the very beginning.

The advantages of using a trust go far beyond just cashing the check. First and foremost is privacy. In many states, a trust can claim the prize, which helps keep your identity confidential and avoids unwanted attention. Second is protection. An irrevocable trust, in particular, can shield your winnings from future creditors, lawsuits, and even pressure from friends or family. It also helps you create a long-term plan for the money. You decide how the funds are distributed over time, both during your life and for your beneficiaries later on. This thoughtful planning can also lead to significant tax benefits, helping you avoid probate and reduce potential estate taxes down the road.

It’s crucial to understand that the rules for claiming lottery prizes through a trust are not the same everywhere. Each state has its own specific laws. Some states fully permit a trust to claim the prize anonymously, giving you the privacy you want. Other states might allow a trust to claim the winnings but will still make the name of the trust public. And in a few states, you may be required to claim the prize as an individual first before you can transfer the money into a trust. Because these regulations vary so widely, getting clear guidance is essential. Understanding the local rules is the first step in any sound legal strategy, whether you’re dealing with a lottery win or pursuing a securities arbitration claim.

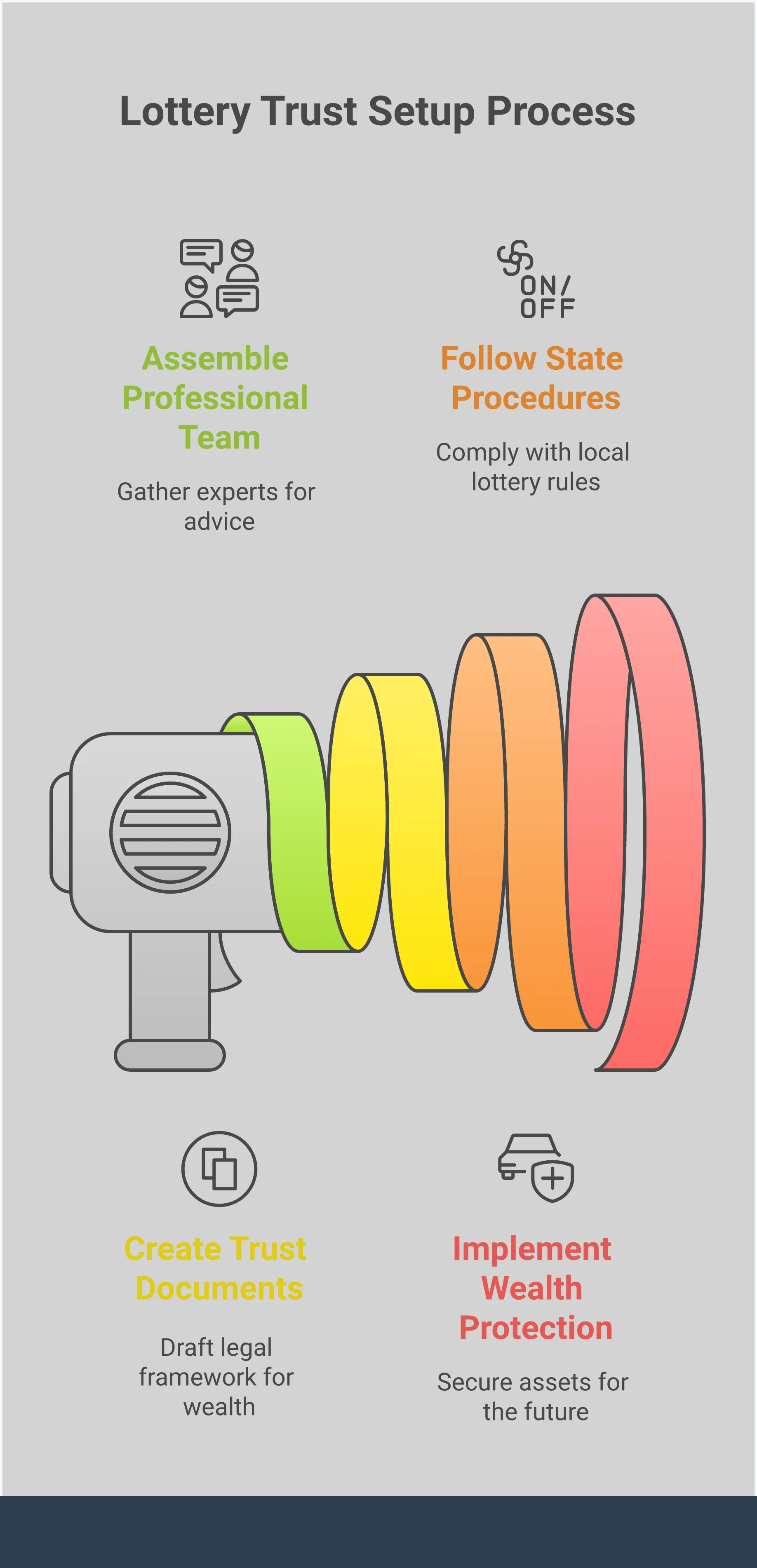

Setting up a lottery trust might sound complicated, but it’s a manageable process when you break it down into clear steps. Think of it as building a protective financial house for your winnings, brick by brick. By following a structured approach, you can ensure your privacy and assets are secure from the very beginning. This guide will walk you through the essential actions you need to take to establish your trust correctly and confidently.

Your first move, even before you think about claiming your prize, should be to assemble a team of trusted advisors. The initial step is consulting with an estate planning attorney who will help you draft the trust document. This legal professional will be your guide in structuring the trust to meet your specific goals for privacy and asset management. You’ll also want to find a financial planner and a tax advisor to help you manage the complexities of sudden wealth. Having the right people in your corner ensures you make informed decisions from day one. Our team can provide guidance on protecting your investments from potential broker fraud and negligence.

Once you’ve confirmed what your state allows, you can start the process to create a trust to claim your winnings. Your attorney will need several key documents to get started. First and foremost, secure your winning lottery ticket—sign the back of it and make copies. You will also need personal identification, such as your driver’s license and Social Security number. It’s also helpful to come prepared with some initial thoughts, like a name for your trust and a list of potential trustees and beneficiaries. Having this information ready will make the process smoother and more efficient, allowing your attorney to draft a document that accurately reflects your wishes.

This is where you lay down the rules for your winnings. A lottery trust is designed to protect your assets and privacy, and it gives you control over how your money is invested, distributed, and taxed. Working with your attorney, you will define the trust’s key terms. This includes officially naming the trust (something anonymous is usually recommended), appointing a trustee to manage it, and naming the beneficiaries who will receive the funds. These terms are legally binding instructions that your trustee must follow, ensuring your wealth is managed exactly as you intend for years to come. This is a critical step in avoiding future investment issues.

Timing is everything when it comes to setting up your lottery trust. For maximum benefit, it’s best to create your trust before you claim your lottery winnings. When the trust, not you, is the entity claiming the prize, you can more effectively shield your identity from the public. Each state has a specific window for claiming lottery prizes—often 180 days to a year—so you have time to act, but you shouldn’t delay. Contacting an attorney immediately after your win gives you the runway needed to get the trust established properly before heading to the lottery commission. This single step is one of the most important for protecting your privacy and your newfound wealth.

Once you’ve decided to use a trust, the next step is figuring out which type fits your specific situation. Trusts aren’t a one-size-fits-all solution; they are highly customizable tools designed to meet different goals. Your primary objective will guide your choice. Are you looking for flexibility and control, or is maximum asset protection and privacy your top priority? The answer will point you toward the right structure.

The main types you’ll encounter are revocable and irrevocable trusts. Each comes with its own set of rules and benefits. Another popular option for lottery winners is a blind trust, which is specifically designed for anonymity. Understanding the fundamental differences between these options is the first step in building a solid plan to protect your winnings. Because this decision has long-term financial and legal implications, it’s a conversation you should have with your legal and financial team. An attorney can help you weigh the pros and cons and create a trust that aligns with your wishes for the future.

The names give you a big clue: a revocable trust can be changed or canceled, while an irrevocable trust generally cannot. With a revocable trust, you maintain control. You can alter the terms, change beneficiaries, or even dissolve the trust entirely if your circumstances change. However, this flexibility comes at a cost. A revocable trust offers less protection from lawsuits or creditors because the assets are still legally accessible to you.

An irrevocable trust provides much stronger protection. Once you transfer your winnings into it, the money isn’t legally yours anymore. This separation shields the assets from creditors and legal claims and can help reduce estate taxes down the road. The trade-off is a loss of control; you can’t easily amend the trust’s terms. Choosing between them means deciding what you value more: flexibility or fortification against potential investment issues.

If your main goal is to remain anonymous, a blind trust is an excellent option. As the name suggests, it’s designed to keep the identity of the beneficiary—you—private. A blind trust can help you stay anonymous because you give your winning ticket to the trust, and the trust claims and manages the money without your daily involvement. This structure puts a wall between you and the assets, making it difficult for the public to connect you to the winnings.

In a blind trust, you appoint a trustee who has full discretion over managing and investing the funds. You won’t be involved in the day-to-day decisions, which helps maintain your privacy and shields you from the constant requests and pitches that often follow a public lottery win. This separation can also protect you from potential broker fraud and negligence by placing management in the hands of a trusted fiduciary.

It’s a common misconception that putting your lottery winnings in a trust will make your tax problems disappear. Unfortunately, that’s not the case. While a trust won’t lower the income tax you pay on the lottery prize itself, it can help manage how the money is invested and distributed over time, which might reduce estate taxes later. The initial prize money is considered income, and you’ll owe taxes on it whether it’s paid to you directly or to your trust.

Where a trust really shines is in long-term tax strategy. By structuring how and when assets are distributed to beneficiaries, you can minimize future gift and estate taxes. For example, the trust can be set up to make distributions that fall within the annual gift tax exclusion. This is a complex area of law, and tax rules are always changing. Working with a financial advisor and an attorney is essential to create a tax-efficient plan for your wealth.

Winning a significant amount of money is a life-changing event, but it can also make you a target for scams, unwanted attention, and financial predators. The excitement of winning can quickly be overshadowed by the stress of managing your newfound wealth and privacy. Taking immediate and deliberate steps to protect yourself is crucial. This isn’t just about hiding your identity; it’s about creating a secure foundation for your future so you can enjoy your winnings without constant worry. By putting the right structures in place, you can maintain control over your assets and your life.

Before you do anything else, sign the back of your winning ticket. This simple act helps establish you as the owner. Once signed, put the ticket in a secure location, like a safe deposit box or a fireproof safe at home. Your next move should be to assemble a team of trusted advisors before you claim the prize. A lottery trust is one of the most effective tools for protecting both your assets and your privacy. A trust can help you control how your winnings are invested, distributed, and taxed, all while keeping your name out of the public record, depending on your state’s laws.

A trust is a primary strategy for keeping your identity private and managing your winnings effectively. An irrevocable trust, for example, offers strong protection because the assets are legally transferred to the trust, shielding them from future creditors and helping to minimize estate taxes. This structure is not just about anonymity; it’s about long-term wealth preservation. It helps you avoid common investment issues that can arise with sudden wealth. Having a solid legal and financial plan in place from day one is your best defense against mismanagement and potential broker fraud and negligence.

One of the most difficult challenges lottery winners face is managing financial requests from loved ones. These situations can strain even the strongest relationships. Staying anonymous through a trust is a powerful first step, as it prevents many of these requests from ever happening. For those that do come through, having a professional team and a trust creates a helpful buffer. Instead of giving an immediate answer, you can refer requests to your trustee or financial advisor. This approach depersonalizes the decision and allows you to support your family in a structured, thoughtful way that aligns with your long-term financial plan. If you need guidance, it’s wise to contact a legal professional to help you set these boundaries.

Creating a trust is a fantastic first step, but the real work begins once it’s funded. Managing a trust effectively is what ensures your newfound wealth supports you and your family for generations. It’s about moving from winning the lottery to building lasting financial security. This involves making smart, deliberate decisions about who manages the money, how it’s distributed, how it’s invested, and how it’s taxed.

Think of your trust as a business with a single mission: to protect and grow your assets according to your wishes. Like any successful business, it needs a solid plan and the right people in place. By establishing clear rules and strategies from the start, you create a framework that prevents impulsive decisions and protects your winnings from mismanagement or people who might try to take advantage of you. This proactive management is the difference between a windfall that disappears and a legacy that endures. Let’s walk through the key components of a successful long-term trust management plan that will help you safeguard your future.

Choosing a trustee is one of the most critical decisions you’ll make. This person or institution is legally responsible for managing the trust’s assets according to the rules you’ve set. You can appoint yourself, a trusted family member, or a professional trustee like a lawyer or a bank’s trust department. While it might be tempting to handle it yourself, remember that a trustee has a fiduciary duty to act in the best interest of the beneficiaries. If you choose someone else, make sure they are responsible, financially savvy, and completely trustworthy. Sadly, even well-intentioned trustees can make mistakes, and it’s important to have safeguards against potential broker fraud and negligence.

Your trust document should clearly outline how and when money is paid out to beneficiaries, including yourself. This is your distribution strategy. You have complete control here. Do you want to receive a set monthly “salary”? Should your children receive funds for education or a down payment on a house? You can decide how the money is given out during your life and after you pass away. Planning this carefully helps ensure the money lasts and is used for its intended purposes. A well-defined strategy prevents beneficiaries from demanding large, unplanned sums and helps the trustee manage the funds responsibly over the long term.

Without clear instructions, a trustee might invest your winnings too conservatively, failing to grow the funds, or too aggressively, risking significant losses. That’s why you need to set clear investment guidelines. These instructions, often detailed in an Investment Policy Statement (IPS), outline the trust’s financial goals, risk tolerance, and preferred investment types. This provides a roadmap for the trustee and helps protect your wealth from impulsive spending or unsuitable investment choices. Addressing these investment issues from the start ensures your money is managed in a way that aligns with your long-term vision and protects you from financial mismanagement.

Taxes will be a significant part of your new financial life, and a trust can be a powerful tool for managing them. An irrevocable trust, for example, can remove assets from your estate, which may help reduce future estate taxes. The trust itself will also have to pay taxes on its income. It’s important to work with your financial team to develop a tax plan that is both efficient and compliant. A smart strategy can help you keep more of your winnings and ensure your family inherits what you intend, without being burdened by an unnecessarily large tax bill.

Setting up a lottery trust isn’t just about signing a piece of paper; it’s about creating a formal legal structure to protect your winnings and your identity. Getting the details right from the start is crucial. A small mistake in the setup process could create major headaches down the road, potentially exposing your identity or causing tax complications. Think of it as building a fortress for your newfound wealth—every stone needs to be placed correctly for it to stand strong.

Following the proper legal procedures ensures your trust is valid and functions exactly as you intend. This involves understanding your state’s specific laws, filing the correct paperwork, and getting the necessary identification for the trust itself. While it might seem like a lot of administrative work, each step is designed to safeguard your assets and give you control over your financial future. Properly handling these requirements is the key to turning a winning ticket into lasting security and peace of mind, helping you avoid common investment issues that can arise with sudden wealth.

The first thing to understand is that lottery and trust laws are not the same everywhere. Each state has its own set of rules, and they can vary significantly. For example, some states require lottery winners to be publicly identified, while others permit a trust to claim the prize, allowing you to remain anonymous. It’s essential to figure out what your state allows before you do anything else. Ideally, you’ll want to set up the trust before you claim your prize. Doing so allows you to take full advantage of the privacy and asset protection a trust can offer from the very beginning.

Once you know your state’s rules, the next step is to create the trust document. This is the legal blueprint that outlines how your winnings will be managed, who the trustee is, and who the beneficiaries are. You’ll want to work with an attorney to draft this document to ensure it reflects your wishes and complies with all legal standards. This isn’t a time for DIY legal work. A carefully drafted trust document ensures your instructions are clear and legally binding, which is critical for managing the funds and distributing them according to your plan. If you need guidance, you can contact us to discuss your situation.

A trust is considered a separate legal entity, which means it needs its own tax identification number (TIN) from the IRS. This is sometimes called an Employer Identification Number (EIN). This number is essential for the trust to operate. You’ll need it to open a bank account in the trust’s name, file its tax returns, and manage its investments. Obtaining a TIN is a straightforward but critical step that officially establishes your trust with the government. It ensures that your lottery winnings are handled properly for tax purposes, helping you stay compliant and in control of your assets from day one.

When it comes to managing a sudden windfall, you’ll hear a lot of conflicting advice. Lottery trusts, in particular, are surrounded by myths that can make them seem more complicated or less effective than they really are. Let’s clear up some of the most common misconceptions so you can make informed decisions about protecting your winnings and your future. Understanding the facts is the first step toward building a secure financial foundation.

One of the biggest myths is that a trust guarantees you can remain completely anonymous. While a trust is a powerful tool for privacy, the reality depends heavily on your state’s laws. In many cases, you can claim the prize as the trustee of your trust, keeping your individual name out of the initial headlines. This creates a crucial buffer between you and the public. However, some states have “sunshine laws” that may require the winner’s name to be disclosed eventually. A trust still provides a significant layer of protection, making it harder for people to find you and helping you control the flow of information.

Many people worry that putting their winnings into a trust means handing over control of their money to someone else. This isn’t necessarily true. When you set up the trust, you decide who the trustee will be. You can name yourself as the trustee, giving you direct control over how the funds are managed and distributed. Alternatively, you can appoint a professional trustee, like a bank or a trust company. This can offer an additional layer of privacy and financial guidance, but the ultimate decisions are still guided by the rules you established when you created the trust. You set the terms; the trustee just executes them.

A common and dangerous myth is that a trust can help you avoid taxes on your lottery winnings. Let’s be clear: you will have to pay taxes. A lottery win is considered income, and it will be taxed at the highest federal and state rates. A trust doesn’t eliminate this initial tax bill. Where a trust helps is in managing future tax liabilities, like estate and gift taxes. For example, if you plan to share your winnings with family, giving them shares in a trust can have significant gift tax implications. Understanding these nuances is critical to avoiding future investment issues.

Some people think of a trust as a simple, one-time setup. The reality is that a trust is an active legal tool that requires ongoing management. It’s designed to protect your assets from future creditors, lawsuits, and instances of potential broker fraud and negligence. With certain types of trusts, like an irrevocable trust, the assets you place inside are no longer legally considered yours. This separation is what shields your wealth. But it also means the trust must be managed according to its legal terms, which involves record-keeping, filing taxes, and making distributions as you outlined. It’s a long-term commitment to safeguarding your financial future.

Winning the lottery is a life-changing event, but it doesn’t come with an instruction manual. Suddenly managing a large sum of money brings complex financial, legal, and personal challenges. Trying to handle it all on your own can lead to costly mistakes. The smartest first step you can take is to assemble a team of qualified professionals. These advisors will provide the guidance you need to protect your winnings, maintain your privacy, and build a secure future. Think of them as your personal board of directors, each with a specific role in helping you succeed.

Your first call should be to an attorney who understands trusts and complex financial matters. This professional is essential for drafting the trust document, which is the legal foundation for your anonymity and financial strategy. They will translate your wishes into a legally sound plan, outlining exactly how your winnings will be managed and distributed. An attorney also acts as your advocate, helping you understand your state’s specific laws and ensuring all legal procedures are followed correctly. This step is critical for protecting your assets from future claims and making sure your long-term goals are secure.

A trustworthy financial planner will help you create a comprehensive roadmap for your new wealth. It’s vital to work with a fiduciary—a professional who is legally obligated to act in your best interest. They will help you move from the initial shock of winning to creating a sustainable financial life. This includes setting clear goals, developing an investment strategy, and planning for long-term needs. A good planner also helps shield you from the risks of broker fraud and negligence by providing unbiased advice tailored to your unique situation, ensuring your money works for you for years to come.

The tax implications of winning the lottery are significant, and a tax advisor is the person who can help you make sense of them. Whether you take a lump sum or annuity payments, you’ll face a substantial tax bill. A tax advisor will explain your obligations and help you develop a strategy to manage them effectively. They can provide personalized advice based on current tax laws and your specific financial picture. Getting this right from the start can have a major impact on your net winnings and overall financial plan, so it’s a conversation you’ll want to have before you even claim your prize.

Why is a trust better than just claiming the prize myself? Claiming the prize in your own name immediately makes your identity public, which can lead to a flood of unwanted attention, security risks, and financial requests from everyone you’ve ever met. A trust acts as a shield. By having the trust claim the winnings, you can often keep your name out of the headlines, giving you the time and privacy you need to create a solid financial plan without outside pressure.

What’s the first thing I should do after realizing I’ve won? Before you tell anyone or rush to the lottery office, your very first step should be to sign the back of your ticket and put it in a secure place. Your next call should be to an attorney who has experience with trusts and wealth management. Getting professional advice before you claim the prize is the single most important move you can make to protect yourself and your winnings from the start.

Do I lose control of my money if I put it in a trust? Not at all. This is a common worry, but you are the one who sets the rules. When you create the trust, you define all the terms, including who manages the money (the trustee) and how it’s distributed. You can even name yourself as the trustee of a revocable trust, giving you direct control. The trust is simply a legal structure designed to follow your specific instructions.

Can I still set up a trust if I’ve already told a few people I won? Yes, you absolutely can. While it’s ideal to keep the news quiet, telling a few close friends or family members doesn’t prevent you from using a trust. The main goal is to keep your name out of the public record when the prize is officially claimed. A trust can still achieve this, protecting you from the much wider attention that comes with a public announcement.

Does a trust automatically protect my money from bad investments? A trust provides a legal structure for protection, but it doesn’t manage the money on its own. You still need to set clear investment guidelines and work with a trustworthy financial advisor. The trust document can outline your risk tolerance and financial goals, which helps guide the trustee. This structure, combined with a team of vetted professionals, is your best defense against mismanagement or potential fraud.