Some investments are like building a foundation for your future, while others are more like a trip to the casino. The Credit Suisse DGAZ ETN fell squarely into the latter category. It was a high-stakes gamble on the daily price swings of natural gas, amplified three times over. This level of volatility and risk is inappropriate for most investors, yet many were encouraged to buy it by financial advisors. The product’s collapse was not just bad luck; it was the predictable outcome of a flawed design. We’ll explore the mechanics that made DGAZ so dangerous and discuss the legal duties your broker had to protect you from such a hazardous product.

Key Takeaways

- DGAZ Was a Speculative Tool, Not a Long-Term Investment: This product was a complex, triple-leveraged ETN designed for daily trading. Its structure made it inherently risky and unsuitable for most investors’ portfolios, especially those with buy-and-hold strategies.

- Your Advisor Had a Duty to Ensure Suitability: Financial professionals are required to recommend investments that align with your specific financial goals and risk tolerance. Pushing a volatile product like DGAZ without a clear explanation of its dangers may have been a breach of that duty.

- You Have a Limited Time to Pursue Recovery: If you lost money in DGAZ due to poor advice, your first steps are to gather your account records and get a professional case review. Strict deadlines apply for filing claims, so it’s critical to act quickly to protect your right to explore your options.

What Was the Credit Suisse DGAZ ETN?

If you invested in the Credit Suisse DGAZ ETN, you might be trying to understand what happened to your money. This was not a straightforward stock investment; it was a complex financial product with a very specific and risky goal. Understanding how it was designed is the first step in figuring out if it was an appropriate investment for you in the first place. Let’s break down what this product was, how it was tied to the natural gas market, and why its structure was so unusual.

What Is an Exchange-Traded Note (ETN)?

First, it’s important to know that DGAZ was an Exchange-Traded Note, or ETN. Unlike a stock, which represents ownership in a company, an ETN is more like a bond. It’s an unsecured debt security that a financial institution issues. This means you’re essentially lending money to the issuer (in this case, Credit Suisse), and they promise to pay you a return based on the performance of a specific market index. Because they are unsecured, if the issuer has financial trouble, you could lose your entire investment. These complex investment issues can often catch investors by surprise if not properly explained by their financial advisor.

DGAZ and the Natural Gas Market

The DGAZ ETN was specifically tied to the natural gas market, but with a twist. It was designed to deliver three times the inverse daily returns of the S&P GSCI Natural Gas Index. In simple terms, it was a bet against natural gas prices. If the natural gas index went down by 1% on a given day, DGAZ was designed to go up by about 3%. Conversely, if the index went up by 1%, DGAZ was supposed to drop by 3%. This triple-leveraged structure made it a tool for short-term speculation on the daily movements of natural gas prices, not a long-term investment.

Its Key Features and Structure

The core feature of DGAZ was its leveraged structure. By aiming for three times the inverse performance of its underlying index, it amplified both potential gains and, more critically, potential losses. This design made it an incredibly high-risk product, especially in a market as volatile as natural gas. When a broker recommends such a complex and risky product, it raises serious questions about whether they fulfilled their duty to act in their client’s best interest. This type of situation can sometimes be a case of broker fraud and negligence, especially if the risks were not fully disclosed or the investment was unsuitable for the investor’s financial goals.

How Did DGAZ Work?

DGAZ wasn’t a straightforward investment like a stock or a mutual fund. It was a complex financial product designed for a very specific purpose, and understanding how it worked is the first step in figuring out what went wrong. Its structure involved a few key mechanics that made it incredibly risky, especially for everyday investors who may have been led to believe it was a suitable hold for their portfolio.

The Triple Inverse Exposure Mechanism

At its core, DGAZ was built to do the opposite of the natural gas market—but on steroids. It was designed to deliver triple the daily inverse returns of a specific natural gas index. In simple terms, if the natural gas index dropped by 1% on a given day, DGAZ was supposed to go up by 3%. On the flip side, if the index rose by 1%, DGAZ was set to fall by 3%. This leveraged exposure meant that small movements in natural gas prices could lead to huge swings in DGAZ’s value, amplifying both potential gains and, more often, devastating losses. This design made it a tool for short-term speculation, not a stable, long-term investment.

Its Daily Reset and Tracking

A critical feature of DGAZ was its daily reset. Every single day, the ETN’s performance was recalibrated to maintain that 3x inverse relationship. This means the returns you saw one day didn’t simply stack on top of the next. Because of this daily reset, the long-term performance could become completely disconnected from the overall trend of the natural gas market. For example, in a choppy market where natural gas prices go up one day and down the next, an investor holding DGAZ could lose money even if the natural gas index ended up right where it started. This compounding effect is one of the most misunderstood and dangerous aspects of leveraged investment issues.

Trading Mechanics and Liquidity

The combination of leverage and the daily reset made DGAZ incredibly volatile. As one investigation noted, the ETN once swung from trading at $400 to $24,000 and then back down to $13,000—all within a single week. This kind of extreme price movement is a massive red flag. It’s not the sign of a sound investment but of a high-risk trading instrument. When brokers recommended these products without fully explaining the risks, they may have engaged in broker fraud and negligence. Furthermore, when Credit Suisse decided to delist DGAZ, investors faced serious liquidity problems, making it difficult to sell their shares and get their money out before suffering even greater losses.

What Were the Major Risks of DGAZ?

DGAZ was a complex product with significant dangers that were often poorly explained. Its structure combined high leverage, debt-like characteristics, and a volatile commodity, creating a perfect storm for losses. If your broker recommended this product, you may have been a victim of broker fraud and negligence if it was unsuitable for your financial goals.

Leverage and Volatility Dangers

DGAZ used 3x leverage, meaning it aimed to move 3% for every 1% change in natural gas prices—in the opposite direction. This magnified losses just as much as gains, making it incredibly volatile. In one week, its price swung from $400 to $24,000 and back down to $13,000. This level of risk is more like a casino than a sound investment and is unsuitable for most investors’ portfolios.

Credit and Counterparty Risks

Unlike a stock, an ETN is an unsecured loan to the issuing bank. You were buying a promise from Credit Suisse, not an asset. This introduced serious counterparty risk; if the bank faced financial trouble, DGAZ’s value could have dropped to zero, regardless of the market. You were betting on the bank’s ability to pay. This is one of many complex investment issues that can arise with sophisticated products.

Problems with Market Tracking

DGAZ often failed to track its underlying index. During market stress, its price became “completely dislocated” from the natural gas index it was meant to follow. This happened when Credit Suisse suspended the creation of new notes, creating an artificial supply shortage that drove the price up. Investors who bought during these periods paid a massive premium, only to see the price crash once the issuer resumed creations, creating a trap for unsuspecting buyers.

The Potential for a Total Loss

The combination of high leverage, daily resets, and tracking problems meant investors could easily lose everything. These products are meant for “short-term trading by experienced investors, not for long-term holding.” The daily reset mechanism caused value to decay over time, making it a poor choice for a buy-and-hold strategy. If your broker recommended holding DGAZ, you may have a strong case for a securities arbitration claim to recover your losses.

Why Did Investors Buy DGAZ?

Given the immense risks we’ve covered, you might be wondering why anyone would purchase DGAZ in the first place. The reality is that complex financial products are often presented as sophisticated tools for specific strategies. For many investors, DGAZ was recommended as a way to achieve certain financial goals, from speculating on market movements to protecting their existing investments.

Unfortunately, the true dangers of these products were not always made clear. Many investors were drawn to DGAZ for one of three main reasons, each carrying its own set of assumptions and potential pitfalls. Understanding these motivations is the first step in figuring out what went wrong and whether the investment was truly suitable for your financial situation. If you were sold DGAZ without a full understanding of its mechanics, you may have been a victim of broker fraud or negligence.

Speculating on Natural Gas Prices

The primary appeal of DGAZ was its potential to profit from falling natural gas prices. The ETN was designed to deliver three times the inverse performance of a natural gas index. In simple terms, it was a way to bet that the price of natural gas would go down. If the index dropped by 1% on a given day, DGAZ was structured to increase by 3%, minus fees. This leveraged exposure made it an attractive, albeit risky, tool for traders looking to capitalize on short-term price movements in the volatile natural gas market.

Using It for Portfolio Hedging

Some investors used DGAZ as a hedging instrument. Think of hedging as a form of insurance for your investment portfolio. If an investor held significant long positions in natural gas or related energy stocks, they might buy DGAZ to offset potential losses. The idea was that if natural gas prices fell, the gains from DGAZ would help cushion the losses from their other investments. ETNs were sometimes promoted as efficient ways to access these kinds of strategies, but understanding the complexities of these notes was critical—a fact that was often overlooked when they were recommended to retail investors.

Seeking Short-Term Trading Gains

The extreme volatility of DGAZ was a major draw for day traders and those with a high tolerance for risk. The potential for rapid, substantial gains was undeniable. For example, in one instance, DGAZ’s price reportedly skyrocketed from around $400 to $24,000 in just one week. This kind of dramatic price swing created what appeared to be a massive opportunity for anyone who could time the market correctly. However, this high-reward potential came with an equally high, and often devastating, level of risk, making it a purely speculative instrument that was unsuitable for most investors’ long-term goals.

What Led to DGAZ’s Delisting?

The delisting of the DGAZ ETN wasn’t caused by a single event. Instead, a combination of extreme market volatility, a strategic exit by its issuer, and the inherent flaws of the product itself created a perfect storm. For investors holding DGAZ, the result was often confusion and significant financial loss. Understanding how these factors came together is key to seeing why this investment was so problematic and what your options might be if you were affected.

Shifting Market Conditions

The natural gas market is known for its price swings, but the period leading up to DGAZ’s delisting saw extraordinary volatility. This created a treacherous environment for a triple-leveraged product designed to move in the opposite direction of natural gas futures. The ETN’s value fluctuated wildly; in one instance, its price shot up from around $400 to $24,000, only to fall back to $13,000 within a week. This level of instability is far beyond what most retail investors are prepared for. When you magnify these market shifts with 3x leverage, even small price movements can lead to catastrophic losses, highlighting the serious investment issues tied to such complex financial products.

Why Credit Suisse Exited

Ultimately, the decision to pull the plug on DGAZ came from its issuer, Credit Suisse. The bank announced it was delisting DGAZ along with eight other ETNs, signaling a move away from these types of risky products. Reports suggest that Credit Suisse’s own actions contributed to the chaos, causing DGAZ’s price to become “completely dislocated” from the natural gas index it was supposed to track. This created a situation where the ETN was no longer functioning as intended. When an issuer decides to delist a product, it underscores the counterparty risk investors take on—a risk that financial advisors have a duty to explain. The failure to disclose such risks can sometimes be a form of broker fraud and negligence.

The Delisting Process

The delisting wasn’t immediate. Credit Suisse announced its plans in June, with the official delisting from the exchange taking place on July 12. After that date, DGAZ was no longer available on major exchanges like the NYSE. Instead, it began trading “over-the-counter” (OTC) under a new ticker symbol, DGAZF. For investors, this transition often means trouble. OTC markets typically have far less trading volume and liquidity, making it much harder to sell your shares at a fair price. The gap between what buyers are willing to pay and what sellers are asking for can widen significantly, trapping remaining investors in a position that’s difficult to exit without taking a major loss.

The Impact on Investors

The delisting forced the hands of everyone holding DGAZ. Investors were left scrambling to figure out their next move, whether it was selling immediately into a chaotic market or holding on and facing the uncertainties of OTC trading. Many who were advised to buy DGAZ as a hedge or a short-term trade found themselves with devastating losses they never anticipated. The sudden acceleration of the ETN and its subsequent delisting left little time for a measured response. For those who lost a significant portion of their savings, the path to recovery can feel unclear. One potential avenue for holding negligent brokers accountable is through securities arbitration, a process designed to resolve investment disputes.

Know Your Legal Rights as an Investor

If you’ve faced significant losses from the Credit Suisse DGAZ ETN, it’s completely understandable to feel frustrated and unsure of what to do next. The complexity of products like ETNs can make it seem like you have no recourse. However, it’s important to remember that as an investor, you have rights. The financial industry is regulated, and brokers and financial advisors have specific duties to their clients.

When these duties are breached—for example, by recommending an investment that is too risky for your financial situation or by failing to explain the potential for a total loss—you may have legal options. Understanding these rights is the first step toward potentially recovering your investment. This isn’t about assigning blame; it’s about holding financial professionals accountable and seeking the protection you are entitled to. Let’s walk through what you need to know to move forward.

Your Options for Protection

Exchange-traded notes like DGAZ are complex and carry substantial risk. Financial advisors have a responsibility to ensure that any investment they recommend is suitable for your specific financial goals and risk tolerance. Unfortunately, some brokers may have pushed these products without properly disclosing the dangers involved. If your advisor misrepresented the DGAZ ETN or failed to provide a clear picture of its risks, you may have grounds for a claim based on broker fraud and negligence. You have the right to expect that your advisor is acting in your best interest, and when that trust is broken, there are avenues for seeking recovery.

What Documents You’ll Need

To build a strong case, you’ll need to gather all the paperwork related to your DGAZ investment. Think of it as creating a complete timeline of your financial story. Start by collecting your account statements, trade confirmations, and any written or email communication you had with your financial advisor about the ETN. These documents are crucial because they provide concrete evidence of when you invested, how much you lost, and what you were told about the product. Having a detailed record helps your legal team accurately assess the situation and strengthens your position when pursuing a claim.

How to File a Claim

If you believe your DGAZ losses were due to poor advice, the next step is to speak with a legal professional who handles these types of investment issues. Many firms that focus on securities law offer a free review of your case to help you understand your options. During this consultation, you can share your story and documents, and they can determine if you have a viable claim. Most of these firms work on a contingency fee basis, which means you don’t pay any legal fees unless they successfully recover money for you. This approach allows you to seek justice without facing upfront costs.

Where to Find Legal Resources

When dealing with complex financial products, it’s helpful to work with a law firm that concentrates on securities law. These firms have the resources and understanding to handle the intricate process of securities arbitration, which is the common forum for resolving disputes between investors and brokerage firms. They can guide you through each step, from filing the initial claim to representing you in hearings. Finding a dedicated legal team to advocate for your rights can make a significant difference in the outcome of your case and help you feel more in control of the situation.

Your Next Steps as an Affected Investor

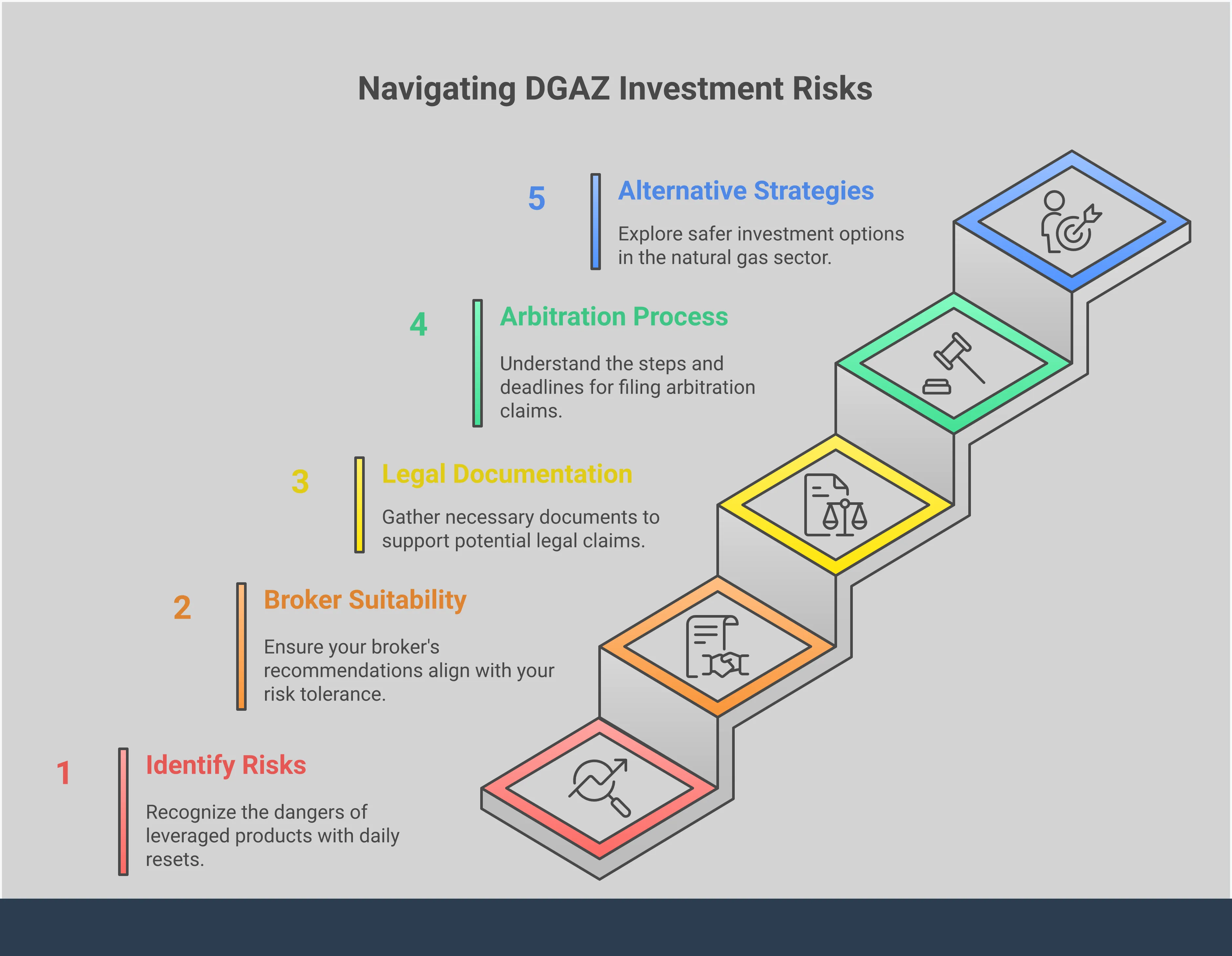

If you’ve suffered losses from an investment like the Credit Suisse DGAZ ETN, it’s completely normal to feel overwhelmed and unsure of what to do next. Taking small, deliberate steps can help you regain a sense of control and understand your options. Think of the following points as a straightforward plan to help you move forward with confidence.

Gather Your Investment Records

Your first move is to collect every document related to your DGAZ investment. This includes monthly account statements, transaction confirmations showing when you bought and sold, and any emails or written correspondence you had with your broker about this product. Having a complete and organized file makes it much easier to review your situation accurately. These records provide a clear timeline of events and serve as the factual foundation for any potential recovery efforts you might pursue. They are the most powerful tool you have at this stage, so take the time to gather everything you can find.

Seek Professional Guidance

You don’t have to figure this all out alone. Complex investment products often involve equally complex legal issues, and getting a professional opinion can provide much-needed clarity. Speaking with a law firm that handles investment issues can help you understand the specifics of your situation. During a consultation, an attorney can review your documents, listen to your story, and explain your rights as an investor in plain language. This step is about arming yourself with information so you can make a truly informed decision about what is best for your financial future.

Explore Your Recovery Options

It’s important to know that you may have avenues for recovering your losses. Often, investors can file a claim if the investment was unsuitable for their financial goals or if the associated risks were not properly disclosed. For example, a highly speculative product like DGAZ may not have been appropriate for an investor focused on retirement preservation. Many of these disputes are resolved through securities arbitration, a formal process designed to handle conflicts between investors and brokerage firms. Understanding these options is a critical step in deciding how you want to proceed.

Know the Deadlines

Time is a critical factor when it comes to investment-related claims. There are strict time limits, known as statutes of limitation, for filing legal actions. If you miss a deadline, you could permanently lose your right to pursue a recovery of your losses, regardless of the strength of your case. This is why acting promptly is so important. The clock often starts ticking from the moment you knew, or should have known, that something was wrong with your investment. Seeking guidance early ensures you can make thoughtful decisions without the added pressure of a looming deadline.

Lessons for Future Investments

The DGAZ situation, while difficult for many, provides some clear lessons that can help you protect your portfolio going forward. Understanding the mechanics of complex financial products and knowing what questions to ask are your best defense against unsuitable investments. By learning to spot the red flags, assess risk properly, and evaluate products critically, you can make more informed decisions and safeguard your financial future. The key is to move forward with a healthy dose of skepticism and a commitment to due diligence.

How to Spot Similar High-Risk Products

High-risk products often share common traits. Be wary of investments that use leverage, such as “2x” or “3x” multipliers, as these amplify both gains and losses. Exchange-Traded Notes (ETNs) themselves carry unique risks because they are essentially unsecured debt notes from a bank—if the issuer fails, you could lose everything. Always question products designed for short-term, daily trading unless that fits your specific, high-risk strategy. If a product’s prospectus is dense and confusing, or if it seems to promise returns that are too good to be true, take it as a sign to proceed with caution. These are often the types of complex investment issues that can lead to significant financial harm.

Other Approaches to Natural Gas Investing

If you’re interested in a specific sector like natural gas, remember that complex products like DGAZ are not your only option. Simpler, more transparent avenues often exist. You could consider traditional ETFs that track the price of natural gas without using leverage or inverse mechanics. Another approach is investing in mutual funds that focus on the broader energy sector. You can also directly invest in the stocks of established natural gas companies. While every investment carries risk, these alternatives are generally more straightforward and don’t involve the daily resets and structural complexities that made DGAZ so hazardous for long-term investors. Exploring these options allows you to participate in a market without taking on unnecessary structural risk.

Strategies for Assessing Investment Risk

Before making any investment, it’s crucial to assess the potential risks involved. Start by understanding the product’s intended holding period. Leveraged and inverse products are typically meant for daily trading, not for a buy-and-hold strategy. Ask your financial advisor direct questions about the worst-case scenario and the specific risks associated with the investment. If they can’t explain it to you in simple terms, that’s a major red flag. A broker has a duty to recommend suitable investments, and pushing a high-risk product on an investor with a conservative profile can be a sign of broker fraud and negligence. Always ensure an investment aligns with your personal risk tolerance and financial goals.

How to Evaluate Today’s Investment Products

When evaluating a new investment, look beyond the marketing materials and examine the institution behind it. As the DGAZ case showed, the issuer’s actions can dramatically affect an investment’s performance, sometimes causing it to become “dislocated” from its underlying index. Research the financial health and reputation of the issuing bank or firm. Understand the product’s structure and what could cause it to fail or be delisted. If you find yourself in a dispute over a complex product that was misrepresented or unsuitable, you may need to pursue securities arbitration to recover your losses. A trustworthy investment should be transparent in both its strategy and its structure.

Related Articles

- Rapid Price Decline Closes Two Leveraged MLP ETNs

- FINRA Warns Against Leveraged ETFs

- FINRA Warned of Risks of VIX-Linked Exchange Traded Products

- FINRA SANCTIONS FOUR FIRMS $9.1 MILLION OVER ETF SALES

- GE Sues AIG For Securities Fraud, Rejects $960M Settlement

Frequently Asked Questions

What was DGAZ in the simplest terms? Think of DGAZ as a high-stakes, short-term bet that the price of natural gas would drop. It wasn’t a stock that gave you ownership in a company, but rather a type of loan you made to the bank Credit Suisse. The product was designed to move three times as much as the natural gas market, but in the opposite direction, on a daily basis. This structure made it incredibly risky and completely unsuitable for a typical investment portfolio.

My broker told me to hold DGAZ for the long term. Was that bad advice? Products like DGAZ were specifically designed for professional traders making daily bets, not for everyday investors looking to build wealth over time. Because its performance was reset every single day, its value could decay significantly, especially in a market with ups and downs. Recommending DGAZ as a buy-and-hold investment raises serious questions about whether that advice was suitable for your financial goals.

Why did I lose so much money even if natural gas prices didn’t crash? This is one of the most confusing parts of DGAZ. Because of its daily reset feature, the long-term performance could become disconnected from the overall trend of natural gas. In a choppy market where prices went up one day and down the next, the compounding effect of the daily resets could erode the ETN’s value. This means you could lose money even if the natural gas market ended up right back where it started.

What did it mean for my investment when DGAZ was “delisted”? When Credit Suisse delisted DGAZ, it was removed from major stock exchanges. This made it extremely difficult for investors to sell their shares. The ETN moved to a less regulated “over-the-counter” market where there were very few buyers. This lack of liquidity effectively trapped many remaining investors, often forcing them to sell at a massive loss or hold onto an investment they couldn’t easily get rid of.

I think I was given poor advice about DGAZ. What should my first step be? Your first step is to gather all the paperwork you have related to this investment. This includes account statements that show when you bought and sold DGAZ, as well as any emails or notes from conversations with your broker. Once you have your documents organized, you can seek a professional opinion from a law firm that concentrates on securities and investment fraud to understand what your options are.