Financial advisors often use complicated language and strategies that can leave you feeling intimidated. Scammers rely on this confusion, hoping you won’t ask questions about high-risk products or excessive fees. If you’ve ever felt pressured into an investment you didn’t fully understand or noticed unusual activity in your accounts, your instincts are likely correct. This isn’t about being a financial whiz; it’s about your right to honest and suitable advice. This guide will break down the common types of misconduct, from unsuitable recommendations to outright churning, and explain how to build a strong case to reclaim your financial security. Taking the first step by contacting a Florida investing fraud lawyer can make all the difference.

Key Takeaways

- Recognize the Red Flags and Document Everything: High-pressure sales tactics and promises of guaranteed high returns are major warning signs. If you feel suspicious, stop all new investments immediately and gather all related documents, from account statements to emails.

- Understand That Time is a Factor in Your Recovery: You have legal avenues to pursue your lost funds, like FINRA arbitration, but strict deadlines apply. Waiting too long to file a claim can mean losing your right to seek compensation altogether.

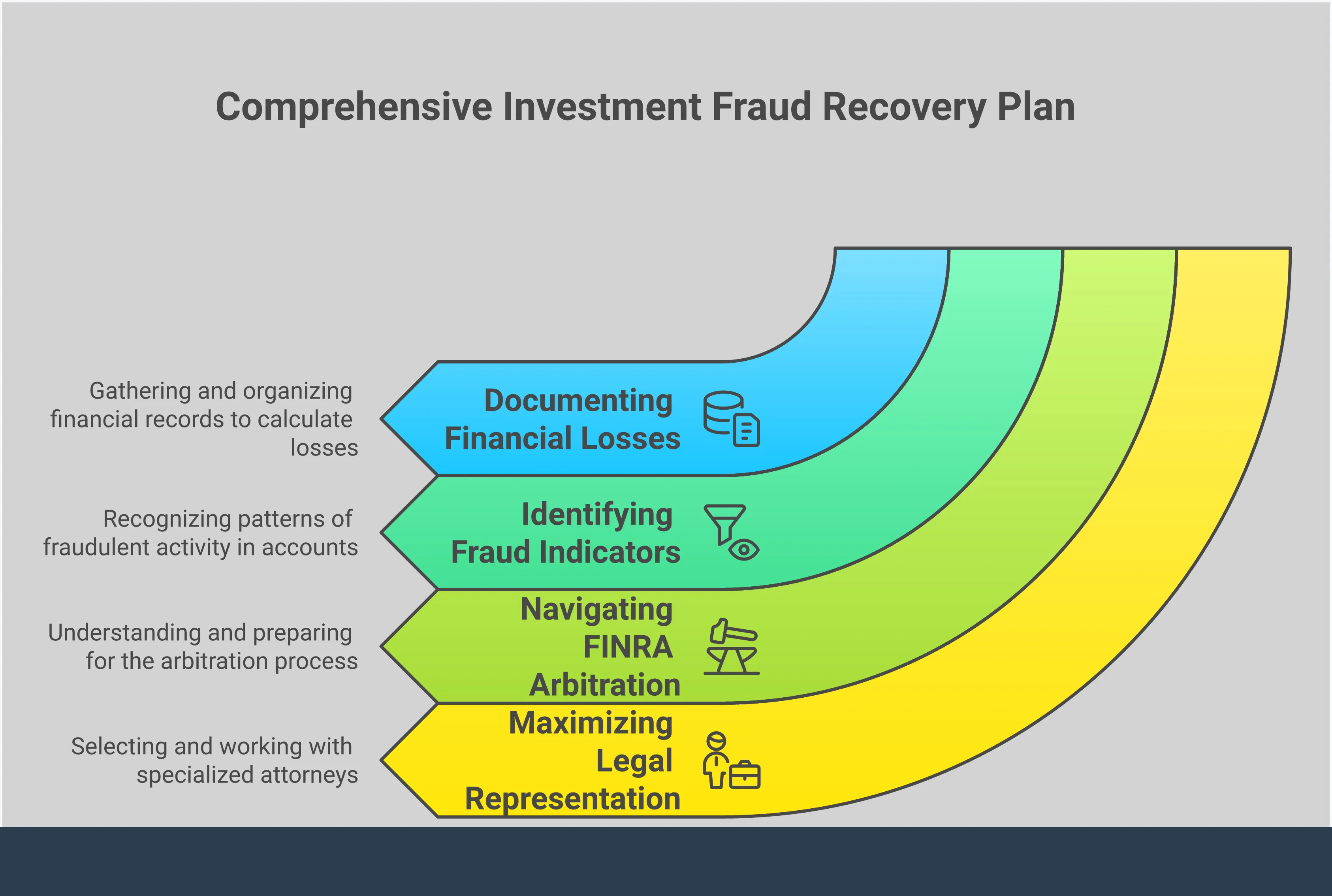

- Find the Right Legal Representation: An attorney focused on investment fraud can build your case and manage the legal process for you. Many work on a contingency fee basis, meaning you only pay if they successfully recover your money.

What is Investment Fraud in Florida?

Investment fraud happens when someone uses deception, misrepresentation, or other fraudulent practices to convince you to make an investment. It’s a serious problem that can strip away a lifetime of savings in an instant. Florida, with its large community of retirees and investors, unfortunately sees many of these cases. Scammers often present complex strategies or promise guaranteed high returns to lure people in, but their real goal is to take your money. Understanding what this misconduct looks like is the first step toward protecting yourself and knowing when to seek help.

These schemes are designed to be confusing, making you feel like you’re the one who doesn’t understand. But the truth is, when your money is on the line, you have a right to clear, honest answers. If you feel pressured, rushed, or confused by a financial professional, it’s a sign that something might be wrong. Recognizing the tactics used in financial scams can help you identify a bad situation before it gets worse and take action to protect your financial future.

Common Investment Scams to Watch For

Investment fraud shows up in a few common ways, often disguised as legitimate opportunities. One well-known type is a Ponzi scheme, where money from new investors is used to pay earlier ones, creating the illusion of a profitable business when, in reality, it’s all just a shell game. Another frequent issue involves unsuitable investment recommendations. This occurs when a broker pushes you into a high-risk investment that doesn’t match your financial goals or risk tolerance, simply because it earns them a higher commission.

You should also be aware of excessive trading, also known as churning. This is when a broker makes frequent trades in your account not to benefit you, but to generate commissions for themselves. Finally, outright misrepresentation—where a broker lies about a security’s risk, potential return, or other key details—is a clear form of broker fraud and negligence.

Recognizing the Warning Signs

Knowing the red flags of investment fraud can save you from significant financial loss. Be wary of anyone who uses high-pressure sales tactics or creates a false sense of urgency to get you to invest quickly. Scammers often insist you must “act now” to prevent you from having time to think or do your own research. Another major warning sign is the promise of overly-consistent or guaranteed high returns. Legitimate investments always carry some level of risk and their returns fluctuate.

Fraudulent schemes are also frequently characterized by offers of unregistered securities and overly complex strategies that are difficult to understand. If your broker can’t explain an investment to you in simple terms, it may be because the strategy is designed to be deceptive. These types of investment issues should prompt you to ask more questions and proceed with caution.

How Fraud Affects Investors Like You

The impact of investment fraud goes far beyond just a financial number on a page. It can be devastating, wiping out retirement funds, college savings, and the financial security you’ve worked your entire life to build. As mentioned, Ponzi schemes create a false reality by using new investors’ capital to pay earlier ones, making everything seem profitable until the whole structure collapses. When it does, investors are often left with nothing.

These schemes have cost Florida residents millions, frequently targeting vulnerable individuals, including retirees who can least afford to lose their savings. The emotional toll can be just as damaging as the financial one, leaving you feeling betrayed, embarrassed, and uncertain about the future. It’s important to remember that you are not to blame. These scams are run by skilled manipulators. If you believe you’ve been affected, it’s crucial to understand that you have rights and options for seeking recovery. The first step is to contact a legal professional to discuss your situation.

Your Legal Options for Recovering Losses

Discovering you’ve been a victim of investment fraud can feel overwhelming, but it’s important to know you have clear legal pathways to pursue justice and recover your hard-earned money. Depending on the specifics of your situation, you can take action against the individuals and firms responsible for your financial losses. Understanding these options is the first step toward holding them accountable.

Your primary avenues for recovery typically involve filing a lawsuit, entering into arbitration, or reporting the misconduct to regulatory bodies. Each path serves a different purpose, and an attorney can help you determine the right strategy for your case. The key is to act decisively, as time is a critical factor in your ability to reclaim what you’ve lost. Let’s walk through what each of these options entails.

Filing a Civil Lawsuit

One of the most direct ways to seek justice is by filing a civil lawsuit in court. This legal action allows you to formally sue the brokers, brokerage firms, or financial advisors who caused your losses. The goal of a lawsuit is to get a legal judgment that holds the responsible parties accountable and compels them to provide financial compensation for the damages you’ve suffered. This process involves presenting evidence, arguing your case before a judge or jury, and demonstrating how the broker fraud and negligence directly led to your financial harm. A lawsuit can be a powerful tool for getting back on your feet and ensuring those who wronged you face consequences.

Pursuing FINRA Arbitration

Many investors find that their customer agreements require them to resolve disputes through arbitration instead of a traditional lawsuit. Most of these cases are handled by the Financial Industry Regulatory Authority (FINRA). Securities arbitration is a formal process where your claim is presented to an impartial arbitrator or a panel of arbitrators who will issue a legally binding decision. While it happens outside of a courtroom, it’s still a serious legal proceeding where evidence is presented and arguments are made. For many investors, arbitration is the primary and often mandatory route for resolving claims against their investment firms and recovering their losses in a timely and efficient manner.

Filing a Complaint with Regulators

In addition to seeking personal compensation, you can also report the fraud to government regulators. When you file a complaint with bodies like the Securities and Exchange Commission (SEC) or state securities regulators, you help them identify and stop fraudulent activities. This action can trigger official investigations and prevent the same individuals from harming other investors. While filing a complaint doesn’t directly recover your money, it plays a crucial role in policing the industry and can sometimes support your individual case. In some instances, you may even be eligible for a reward through an SEC whistleblower claim if your information leads to a successful enforcement action.

Why You Shouldn’t Wait to File a Claim

If you suspect you are a victim of investment fraud, it is critical to act quickly. Strict deadlines, known as statutes of limitations, limit the amount of time you have to file a claim. If you wait too long, you could lose your right to pursue legal action and recover your losses altogether. Delaying can also make it harder to build a strong case, as documents can be lost and memories can fade over time. The sooner you take action, the better your chances are of holding the responsible parties accountable and reclaiming your financial security. Don’t let time run out on your opportunity for justice—contact us to understand the specific deadlines that apply to your situation.

How to Build a Strong Case

Taking action after investment fraud can feel overwhelming, but building a strong case starts with a few manageable steps. By organizing your information and understanding the process, you can create a solid foundation for recovering your losses. A methodical approach provides your legal team with the necessary tools to effectively represent you and hold the responsible parties accountable for their actions.

Document Your Losses

The first step is to get a clear and precise picture of your financial damages. Gather all your account statements, trade confirmations, and any other financial records that show the money you invested and the amount you lost. Calculating the total loss is a critical starting point. If you’ve lost a significant amount of money—especially $100,000 or more—due to what you believe was fraud, it’s a clear sign that you should seek legal guidance. This documentation not only substantiates your claim but also illustrates the full impact of the various investment issues you have faced.

Gather Key Evidence

Your case is built on the evidence you can provide. Think of it as creating a timeline of your interactions with your broker or financial advisor. Collect every piece of communication you have, including emails, text messages, and personal notes from phone calls or meetings. Account opening documents, prospectuses for the investments you were sold, and any marketing materials you received are also vital. This paper trail helps to tell the story of what happened and can be crucial in demonstrating cases of broker fraud and negligence. This evidence shows what you were told versus what actually occurred.

How Financial Professionals Can Help

You don’t have to go through this alone. An attorney who concentrates on investment fraud cases can analyze your documents and help you understand the strength of your claim. They know what to look for in your evidence and can identify the specific rules or laws that may have been violated. Bringing in a legal professional provides you with a knowledgeable partner who can guide you through the complexities of the financial industry and the legal system. If you are ready to discuss your situation, you can contact us for a confidential review of your case.

What to Expect from the Recovery Process

It’s important to know that most investment disputes are not resolved in a traditional courtroom. Instead, they are often handled through a process called arbitration. The Financial Industry Regulatory Authority (FINRA) runs the largest forum for this. Many law firms that handle these cases work on a contingency fee basis, which means you won’t pay any legal fees unless they successfully recover money for you. This arrangement allows you to pursue justice without worrying about upfront costs. Understanding the path to recovery, including the specifics of securities arbitration, can give you peace of mind as you move forward.

How an Investment Fraud Attorney Can Help

When you realize you’ve been a victim of investment fraud, the path forward can feel overwhelming. This is where an investment fraud attorney steps in. Their role is to guide you through the legal process, handle the complexities of your case, and work to recover the money you lost. They become your advocate, using their knowledge of securities law to build a strong claim on your behalf.

An attorney will manage communications with brokerage firms, regulators, and other parties, allowing you to focus on moving forward. They understand the tactics that firms use to deny responsibility and know how to counter them effectively. From the initial investigation to the final resolution, they manage every detail of your case, ensuring your rights are protected at every turn. Their goal is to demand financial compensation and justice from those who wronged you.

What They Do for You

First and foremost, an investment fraud attorney works to get your money back. They represent your interests against the stockbrokers, brokerage firms, or advisors who caused your financial harm. This involves more than just filing paperwork; they act as your voice, clearly articulating how you were misled or taken advantage of. They will handle all negotiations and legal proceedings, shielding you from the stress of confronting the responsible parties directly. By managing your case, they give you the space to regroup while they pursue the compensation you deserve. If you believe you have a claim, you can contact us to discuss your situation.

How They Investigate Your Claim

A successful claim starts with a thorough investigation. Your attorney will dig deep into the details of your case to uncover the facts. This process involves gathering critical evidence, such as account statements, trade confirmations, and correspondence with your broker. They will analyze your investment portfolio to determine if the recommendations were unsuitable for your financial situation and risk tolerance. This detailed analysis helps identify specific instances of broker fraud and negligence, forming the foundation of your legal argument. They piece together the story of what happened to build a compelling case for recovery.

Creating Your Legal Strategy

Every investment fraud case is unique, so your attorney will develop a legal strategy tailored to your specific circumstances. After investigating your claim, they will identify the strongest arguments and decide on the best course of action. This may involve filing a claim through securities arbitration with the Financial Industry Regulatory Authority (FINRA), which is a common path for resolving disputes with brokerage firms. Your lawyer will explain the pros and cons of each option, helping you make an informed decision. The strategy will focus on highlighting the key indicators of fraud and presenting your case in the most effective way to achieve a favorable outcome.

Understanding Legal Fees and Costs

Worries about legal fees shouldn’t stop you from seeking justice. Most investment fraud attorneys handle cases on a contingency fee basis. This means you do not pay any attorney’s fees upfront. Instead, the law firm’s fee is a percentage of the money they recover for you. If they don’t win your case, you don’t owe them a fee. This arrangement aligns your attorney’s interests with yours, as they are only compensated if they succeed in getting your money back. It allows you to pursue a claim without taking on additional financial risk, which is especially important when you’re already dealing with significant investment issues.

How to Protect Your Rights as an Investor

Realizing something might be wrong with your investments is a stressful experience, but it’s important to know you have rights and there are clear steps you can take to protect yourself. Acting thoughtfully and deliberately can make a significant difference in the outcome. Think of this as taking back control of your financial situation, one step at a time. The key is to move forward with a clear plan to safeguard your assets and hold the right people accountable.

Your First Steps After Suspecting Fraud

If your gut tells you something is off, listen to it. The most important thing you can do is act immediately. The first step is simple: stop sending money. Don’t make any new investments or follow any additional instructions from the broker or advisor you’re concerned about. Avoid the temptation to “wait and see” if things turn around. Instead, start documenting everything. Write down what made you suspicious, including dates, specific conversations, and any promises that were made. Taking these initial actions puts you in a stronger position and helps prevent the situation from getting worse while you figure out your next move.

What Documents You Need to Keep

Your financial records are the foundation of your case. Start gathering every piece of paper and digital file related to your investments. This isn’t just about finding a single “smoking gun”; it’s about building a complete picture of your relationship with the broker or firm. You’ll want to collect account statements, trade confirmations, prospectuses, and any marketing materials you received. Don’t forget to save all communications, including emails, text messages, and even notes you took during phone calls. This evidence is crucial for demonstrating cases of broker fraud and negligence and showing exactly how your money was handled.

Who to Talk to (and Who to Avoid)

When you suspect fraud, your broker or financial advisor is not the person to turn to for advice. They may try to downplay your concerns, blame the market, or pressure you into staying quiet with promises of making the money back. Instead of talking to them, your first call should be to a lawyer who focuses on securities law. An attorney can provide an objective assessment of your situation and explain your legal options without any conflict of interest. They work for you, not the brokerage firm. If you’re ready to understand your rights, you can contact us for a confidential review of your case.

How to Prevent Further Financial Harm

Beyond pausing any new investments with the advisor in question, it’s wise to get a second opinion on your entire portfolio. A different, carefully vetted financial professional can review your holdings and help you understand if they align with your goals and risk tolerance. Many investment issues arise because the investments were unsuitable for the client from the start. For example, a retiree needing stable income shouldn’t be in high-risk, speculative stocks. Taking this step not only helps you identify existing problems but also empowers you to build a healthier, more secure financial strategy for the future.

How to Choose the Right Attorney for Your Case

Finding the right legal partner after experiencing investment fraud is a critical step toward recovery. This isn’t just about hiring a lawyer; it’s about finding an advocate who understands the complexities of your situation and is committed to fighting for you. The attorney you choose can significantly influence the outcome of your case, so it’s important to make an informed decision. Taking the time to find someone with the right qualifications and experience will give you the confidence that your case is in capable hands.

Key Qualifications to Look For

When you start your search, focus on attorneys who specialize in securities and investment law. A general practice lawyer may not have the specific knowledge required for these types of claims. Look for a firm with a clear history of handling cases of broker fraud and negligence similar to yours. Establishing your specific legal needs is the first step toward finding effective representation. You want a team that not only understands the financial details but also appreciates the stress and uncertainty you’re facing. A good fit means finding someone who is not only qualified but also makes you feel heard and supported.

Why Securities Law Experience Matters

Securities law is a highly specialized field with its own set of rules and procedures. An attorney with direct experience in this area will be familiar with the common tactics used by financial firms and how to effectively counter them. Their primary goal is to recover losses for investors. Attorneys with a proven track record in complex financial disputes are better equipped to handle the intricacies of your case, whether it involves going through the securities arbitration process with FINRA or pursuing other legal avenues. This specific experience means they won’t be learning the ropes on your case; they’ll be applying years of focused knowledge to protect your interests.

Questions to Ask During Your Consultation

Your initial consultation is your opportunity to interview a potential attorney. Effective communication is essential for a strong attorney-client relationship, so use this time to see if their style works for you. Come prepared with questions like: “What is your experience with cases like mine?” “How do you typically communicate updates to your clients?” and “Who will be my main point of contact at the firm?” You should also ask about their fee structure and what costs you can expect. This conversation is as much about getting answers as it is about gauging whether you feel comfortable and confident with their approach.

What to Expect After You Hire an Attorney

Once you’ve chosen an attorney, they will take the lead on your case. Their first step is to conduct a thorough investigation, which includes analyzing your financial documents, gathering evidence, and building a strong claim on your behalf. They will handle all communications with the opposing party, manage all legal filings, and represent you in any proceedings. Your attorney’s role is to be your advocate, guiding you through the legal process and working to secure the best possible outcome. If you’re ready to discuss your situation, you can contact us for a confidential consultation.

Related Articles

- Investment Fraud in Florida: Steps to Recover Your Losses | The Frankowski Firm

- Your Rights When a Broker Steals Funds or Misleads

- Palm Beach Investment Fraud Lawyer: Guide to Recovery | The Frankowski Firm

- Safeguard Finances: Role of Stock Broker Fraud Attorneys

- Protect Your Investments: Recognizing Warning Signs of Fraud in the Miami Area. – The Frankowski Firm

Frequently Asked Questions

What is the very first thing I should do if I think I’m a victim of investment fraud? Before you do anything else, stop sending money to the person or firm you are concerned about. Do not follow any more of their advice. Your next step should be to gather all your relevant documents, like account statements and emails, in one place. Then, you should speak with an attorney who concentrates on securities law to get a clear assessment of your situation.

How much does it cost to hire an investment fraud attorney? Most law firms that handle these types of cases work on a contingency fee basis. This means you don’t pay any legal fees unless they successfully recover money for you. The firm’s fee is taken as a percentage of the amount they win on your behalf. This approach allows you to pursue a claim without needing to pay for a lawyer out of pocket.

My broker says the losses are just due to the market. How do I know if it’s actually fraud? While all investments carry risk and can lose value, fraud involves specific misconduct. It’s less about the market’s performance and more about the broker’s actions. If you were pushed into investments that were too risky for your financial situation, if your account was traded excessively to generate commissions, or if you were misled about the nature of an investment, you may have a valid claim regardless of market conditions.

How long does the process of recovering my money usually take? The timeline for resolving an investment fraud claim can vary quite a bit depending on the details of your case. A straightforward case might be resolved in several months, while more complex situations can take a year or longer. The process often involves a thorough investigation, filing a claim, and potentially going through the FINRA arbitration process.

What if I don’t have a lot of written proof? Can I still build a case? Yes, you can still have a strong case even if you don’t have a perfect paper trail. While emails and written documents are helpful, they aren’t the only form of evidence. An experienced attorney can build a case using your account statements, trading data, and your own testimony about conversations and promises that were made. They know how to piece together the story of what happened from various sources.