NO FEES UNTIL WE WIN

FREE CONSULTATION

NO FEES UNTIL WE WIN

FREE CONSULTATION

Raising $1.8 billion from 17,000 investors is no small feat. GPB Capital built an empire on the promise of high returns from private companies, presenting itself as an exclusive and stable investment. But behind the curtain, regulators found a house of cards. Executives were allegedly using new investor money to pay earlier ones, all while falsifying financial statements to hide the truth. The fallout has been devastating, particularly for those who invested in its largest funds. Understanding the mechanics of this massive fraud is the first step toward recovery. This article breaks down the scheme and explores how a GPB Automotive Portfolio and GPB Holdings II lawsuit can be a powerful tool for investors seeking to reclaim their hard-earned money.

GPB Capital Holdings was a New York-based asset management firm that raised an astonishing $1.8 billion from investors nationwide. The company’s strategy was to buy private companies in industries like automotive retail and waste management. To fund these acquisitions, GPB offered what are known as private placements—investments that aren’t publicly traded on an exchange. These were marketed as exclusive opportunities with the promise of high, stable returns.

The problem is that private placements are inherently risky and illiquid, meaning you can’t easily sell them and get your money back. They are typically suitable only for very wealthy, sophisticated investors who understand these risks and can afford to lose their entire investment. Despite this, GPB Capital’s funds were sold through a network of more than 60 brokerage firms to everyday investors, including retirees. Many were lured by the promise of a consistent 8% annual payout, which seemed like a safe and reliable income stream. This sales pitch masked the underlying instability of the funds and the truth about how GPB was really operating behind the scenes. For thousands of people, what started as a promising investment turned into a financial nightmare.

One of the largest funds offered by GPB was the GPB Automotive Portfolio. This fund pooled investor money to purchase and manage car dealerships. On the surface, this seemed like a straightforward and appealing investment. Most people understand the car dealership business model, which made the investment feel more tangible and less abstract than other complex financial products. Investors were told their money was being used to build a profitable portfolio of dealerships, generating consistent income. This fund alone raised hundreds of millions of dollars from investors who believed they were buying into a growing and stable industry.

GPB Holdings II was another major fund, structured as a limited partnership. This structure was designed to be particularly attractive to certain investors, including those using retirement accounts like IRAs. The firm claimed this setup would allow people to invest indirectly in GPB’s portfolio of companies without creating certain tax complications. By presenting a complex structure with perceived tax benefits, GPB made the investment seem sophisticated and well-planned. For many investors, this added a layer of legitimacy, making them feel more secure in their decision to invest significant sums of money, often from their retirement savings.

GPB Capital didn’t sell its funds directly to most investors. Instead, it relied on a nationwide network of financial advisors and their brokerage firms to recommend these investments to clients. These advisors were incentivized with unusually high commissions—sometimes as much as 8%—to push GPB products. This created a serious conflict of interest. When a broker stands to make a large commission, it can cloud their judgment about whether an investment is truly suitable for their client. This sales strategy is a key reason why so many individuals ended up in these high-risk private placements, often without fully understanding the potential for broker fraud and negligence.

While GPB was reporting impressive returns to investors, regulators allege that the company’s financial success was a mirage. According to an SEC complaint, GPB executives were creating “the false appearance of illusory profits.” For example, they allegedly directed payments from one of their own dealership acquisitions back into the fund to inflate its performance numbers. It’s also alleged that GPB used money from new investors to pay distributions to earlier investors. This practice can make a fund appear healthy and profitable, but it’s an unsustainable model that often collapses, leaving later investors with devastating losses.

The story of GPB Capital is a cautionary tale of how a promising investment can hide a complex web of deceit. From the outside, the company projected an image of success, attracting thousands of investors with the promise of steady returns from its private equity funds. Behind the scenes, however, executives were allegedly engaged in a coordinated effort to mislead investors, misrepresent the company’s financial health, and enrich themselves. The fraud wasn’t a single act but a series of calculated deceptions that unfolded over several years, ultimately leading to significant financial losses for those who trusted them. Understanding how this scheme was orchestrated is the first step for investors seeking to reclaim their assets and hold the responsible parties accountable.

One of the core deceptions was how GPB Capital explained its investor payouts. The company’s owner, David Gentile, and the owner of its primary seller, Jeffry Schneider, allegedly told investors that the monthly distributions they received were generated from the profits of the businesses GPB owned. This created the illusion of a healthy, income-producing portfolio. In reality, the SEC found that GPB Capital was using money from new investors to make these payments to earlier investors. This practice not only misrepresented the funds’ performance but also concealed their inability to generate sufficient revenue, lulling investors into a false sense of security while the scheme continued to grow.

Beyond misrepresenting performance, GPB executives allegedly engaged in undisclosed, self-serving business deals. These transactions were designed to benefit the executives personally at the expense of investors. For example, federal investigators found that GPB Capital failed to disclose that payments from one of its auto dealerships were being funneled to an entity owned by Gentile and another executive. In another instance, a separate dealership acquired by GPB assumed loan obligations from that same private entity. These hidden deals are a classic example of the complex investment issues that can arise when executives prioritize their own interests over their fiduciary duties to investors.

To support their false claims of success, GPB executives resorted to falsifying financial statements. According to the Department of Justice, they used fake, back-dated “performance guarantees” to artificially inflate the income of two of their largest funds, GPB Holdings I and GPB Automotive Portfolio. This accounting manipulation made the funds appear more profitable than they actually were, which helped them attract new capital and retain existing investors. By creating fraudulent documents, the executives painted a picture of financial strength that simply wasn’t real. This is a clear instance of the kind of broker fraud and negligence that can devastate an investor’s portfolio.

At its core, the GPB fraud involved a massive misuse of investor capital. People put their money into the funds with the understanding that it would be used to acquire and operate profitable companies, primarily car dealerships and waste management businesses. Instead, a significant portion of their money was used improperly. As prosecutors revealed, about $100 million of investor capital was used not for investment but to make distribution payments back to other investors. This circular payment structure kept the scheme afloat and concealed the poor performance of the underlying assets. It was a classic case of robbing Peter to pay Paul, all while executives collected handsome management fees.

The collapse of GPB Capital had a widespread and devastating impact, affecting approximately 17,000 investors across the country. Many of these individuals were retirees or people who had invested their life savings, trusting that their money was in good hands. Since 2018, their funds have been frozen, leaving them unable to access their capital and uncertain about their financial future. The emotional and financial toll has been immense, turning dreams of a secure retirement into a nightmare of uncertainty and stress. If you are one of the thousands affected, it’s important to know that you are not alone and that you have options to protect your rights.

When a massive investment fund like GPB Capital collapses under the weight of fraud, it sets off a chain reaction of legal and regulatory actions. Federal agencies, state regulators, and criminal prosecutors all stepped in to investigate the wrongdoing, hold the executives accountable, and begin the long process of recovering money for investors. Understanding these actions can help you see the path forward and know that you are not alone in seeking justice. This is a look at the key legal developments that followed the exposure of the GPB scheme.

The U.S. Securities and Exchange Commission (SEC) was one of the first major bodies to take action. Their investigation cut through the complex paperwork to find a simple, damning truth. The SEC discovered that GPB Capital’s CEO, David Gentile, and an associate, Jeffry Schneider, had fundamentally misled investors. They told investors that the steady monthly distribution payments were coming from the profits of the businesses GPB owned. In reality, a significant portion of that money was just funds from new investors being used to pay earlier ones. This practice concealed the funds’ poor performance, created a false sense of security, and is a classic sign of a fraudulent operation.

The evidence uncovered by regulators was so strong that it led to criminal charges. A federal investigation resulted in the convictions of David Gentile and Jeffry Schneider for securities fraud and wire fraud. These weren’t just fines or slaps on the wrist; the consequences were severe. Gentile was sentenced to seven years in prison, and Schneider received a six-year sentence. These prison sentences send a clear message that the justice system takes investment fraud seriously and that individuals who prey on investors will be held personally responsible for their actions. For the thousands of people affected, seeing the perpetrators face jail time is a crucial step toward justice.

It wasn’t just federal agencies that took notice. Regulators in multiple states also launched their own investigations into GPB Capital’s practices. They focused on how the firm’s high-risk private placements were sold to individual investors, often with misleading information. A major red flag for state regulators was the unusually high commissions paid to the brokers who sold these investments. These high fees created a powerful incentive for brokers to push GPB funds on their clients, regardless of whether the investments were actually suitable for them. This highlights a significant conflict of interest that put investors’ financial well-being at risk for the sake of a broker’s payday.

Beyond prison time, the court ordered the convicted executives to give up the money they made from their illegal activities. Both Gentile and Schneider were ordered to forfeit assets gained through the fraud. While the exact amounts and the process for returning these funds to investors are still being finalized, this is a critical step in the recovery process. The goal of legal actions like securities arbitration and litigation is not just to punish wrongdoers but also to claw back as much of the stolen money as possible for the victims. This financial penalty aims to strip away the profits from the fraud and return them to their rightful owners.

So, where does all of this leave the investors? Fortunately, there has been real progress. A court-appointed receiver is managing what’s left of GPB Capital and has established a plan to distribute funds back to investors. As of now, the GPB Capital Receivership Estate has successfully distributed nearly $400 million to approximately 13,700 investors in GPB Holdings II, GPB Automotive Portfolio, and GPB Cold Storage. This process of compensating affected investors is ongoing, representing a significant and hopeful step toward financial recovery for thousands of families. While it doesn’t make up for the entire loss, it is a tangible result of the legal actions taken against the firm.

If you’re one of the thousands of investors affected by the GPB Capital fraud, your primary concern is likely getting your money back. The legal and financial fallout is complex, but there have been significant developments toward recovering investor funds. A court-appointed receiver is now managing GPB’s assets and has begun the process of distributing money back to investors. While this process takes time, it’s a crucial step forward. Understanding where things stand can help you determine your next steps and protect your financial interests. Below is a breakdown of the current recovery efforts, the distribution plans, and the legal options available to you.

There is some positive news for investors. A federal judge has approved the release of a substantial amount of money to be returned to those who invested in GPB Capital. Recently, a court approved a plan to distribute $400 million in recovered funds to investors in several of the GPB funds. This initial distribution is a major milestone in the recovery process, providing some financial relief to many who have been waiting for years. While this doesn’t represent the total amount lost, it is a significant and encouraging step in the right direction for holding GPB accountable and returning capital to its rightful owners.

When a company like GPB is accused of widespread fraud, the court often appoints a receiver. Think of the receiver as a neutral third party whose job is to take control of the company’s assets, manage its affairs, and oversee a fair process for returning money to investors and creditors. For this case, the GPB Capital Holdings, LLC Receivership is managing the process. The receiver is responsible for implementing the court-approved Distribution Plan, which includes identifying eligible investors and sending out payments. This oversight ensures that the remaining assets are handled transparently and in the best interest of the harmed investors.

The court-appointed receiver has a clear plan for getting money back to investors. The initial distribution of nearly $400 million has already begun, with checks being mailed to approximately 13,700 investors in GPB Holdings II, LP, GPB Automotive Portfolio, LP, and GPB Cold Storage, LP. It’s important to know that the process is ongoing. For instance, the receiver has extended the deadline for investors in the GPB Automotive Income Fund, Ltd (“AIF”) to file their proofs of claim. This gives those investors more time to formally register their losses and participate in future distributions.

The receivership distribution is not the only path to recovering your losses. Many investors were sold GPB funds by financial advisors who downplayed the risks. These were high-risk, private-placement securities that were unsuitable for many retail investors. If your broker recommended GPB without properly explaining the risks, you may have a claim against the brokerage firm for negligence or misrepresentation. Pursuing a securities arbitration claim is a separate action that can help you recover losses directly from the firm that sold you the investment. This allows you to address the specific misconduct that led to your financial harm.

Recovering funds from a large-scale investment fraud is a marathon, not a sprint. The timeline is influenced by ongoing legal proceedings and investigations by multiple agencies, including the SEC, FINRA, and the FBI. While the first round of distributions from the receiver is a welcome development, the full recovery process will likely extend over several years as more assets are liquidated and legal issues are resolved. The timeline for any individual investment fraud claim you file against a brokerage firm will depend on its specific details. Speaking with a securities attorney can help you understand the potential timeline for your unique situation.

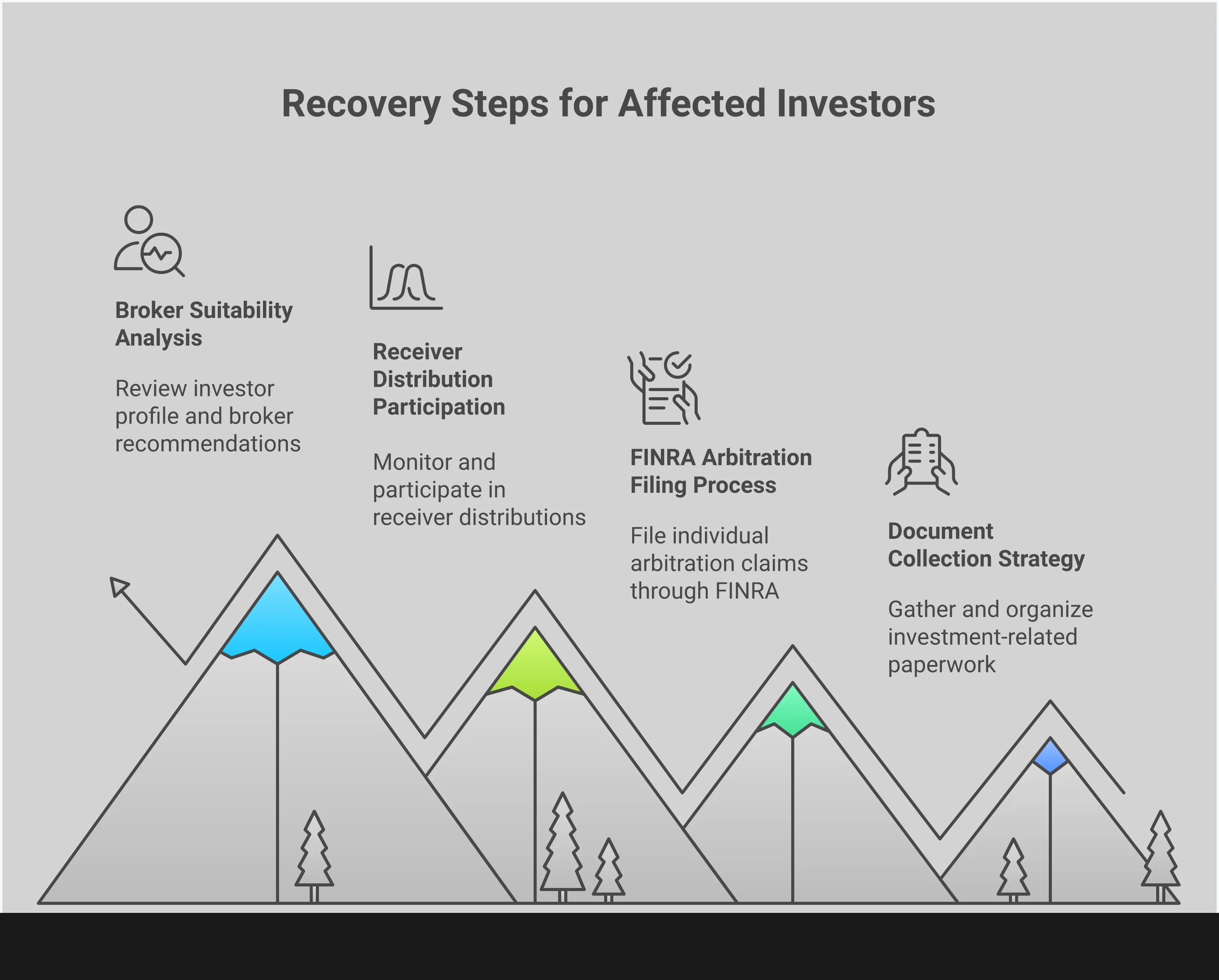

Discovering you’ve been impacted by investment fraud can feel overwhelming, but it’s important to remember that you have rights and there are clear steps you can take to protect them. The situation with GPB Capital is a stark reminder that even sophisticated-looking investments can hide serious issues. If you find yourself in a similar position, knowing how to move forward is the first step toward seeking recovery. Taking control of the situation starts with understanding your rights, organizing your information, and seeking qualified legal guidance. The following steps can help you build a case and pursue the compensation you deserve.

As an investor, you have the right to receive suitable investment recommendations from your financial advisor. This means any investment should align with your financial goals, age, and risk tolerance. In the GPB Capital case, brokers sold high-risk private placements that were inappropriate for many investors, often motivated by high commissions of nearly 9.3%. This is a classic example of broker fraud and negligence. Your broker has a duty to act in your best interest, and when they fail to do so by recommending unsuitable products, they can be held accountable for your losses. Understanding this fundamental right is the foundation of your case.

Documentation is your best friend when building a case. Start by collecting every piece of paper and digital file related to your investment. This includes account statements, trade confirmations, prospectuses, private placement memorandums, and any email or written correspondence with your broker. For the 17,000 GPB investors whose funds were frozen, having these documents is critical for navigating the liquidation process and proving their claims. This evidence creates a clear timeline and demonstrates what you were told versus what actually happened. Organizing these materials will be immensely helpful when you discuss your investment issues with an attorney.

You don’t have to face this situation alone. A securities attorney can assess the details of your case, explain your legal options, and represent your interests. Many firms are already representing investors to recover losses from the brokerage firms that sold GPB funds based on inappropriate advice. An attorney who focuses on this area of law understands the specific rules and procedures for these claims, including the securities arbitration process through the Financial Industry Regulatory Authority (FINRA). They will handle the complexities of the legal filings, allowing you to focus on moving forward.

The path to recovering your losses typically involves filing a legal claim against the responsible parties. In the GPB case, legal actions include both a GPB class action lawsuit and many individual arbitration claims filed against the broker-dealers who sold the funds. While a class action can provide a recovery for a large group, filing an individual claim often allows you to present the unique details of your situation, which may lead to a more favorable outcome. A securities lawyer can help you determine the most appropriate strategy for your specific circumstances and guide you through every step of the process.

It’s easy to feel isolated after experiencing investment fraud, but remember that you are not alone. Financial advisors at more than 80 different brokerage firms recommended unsuitable investments in GPB Capital. This means thousands of other investors are in the same position. Connecting with a legal team can provide not only representation but also a valuable resource for information and support. If you believe your broker’s misconduct led to your GPB investment losses, the first step is to contact us for a confidential consultation to discuss your situation and learn how we can help.

What exactly did GPB Capital do wrong? In simple terms, GPB Capital misrepresented the health of its funds. Executives told investors that the monthly payments they received were profits generated by the car dealerships and other businesses the company owned. In reality, they were often using money from new investors to pay earlier ones. This practice concealed the funds’ poor performance and created a false sense of security, allowing the scheme to continue long after it should have collapsed.

Why would my financial advisor recommend such a risky investment? GPB Capital offered unusually high commissions—sometimes close to 9%—to the brokers and financial advisors who sold their funds. This created a significant conflict of interest. For some advisors, the large payday may have influenced their decision to recommend these high-risk, illiquid private placements, even when they were not a suitable match for their clients’ financial goals or ability to handle risk.

I heard a receiver is distributing money. Does this mean I’ll get all my investment back? The court-appointed receiver is making progress in returning money to investors, and the initial distributions are a very positive development. However, it is unlikely that these payments will cover the full amount of every investor’s losses. Recovering assets from a large-scale fraud is a long and complicated process, and the total amount recovered will depend on the value of the assets that can be liquidated.

What’s the difference between the receiver’s payment and filing a claim against my broker? These are two separate paths for recovery. The receiver’s distribution comes from the remaining assets of GPB Capital itself. Filing a separate legal claim, such as a FINRA arbitration case, is an action you can take directly against the brokerage firm that sold you the investment. This type of claim focuses on holding the firm accountable for providing unsuitable advice and can be an additional avenue for recovering your losses.

I invested in GPB. What is the most important thing I can do right now? The most important first step is to gather all of your investment documents. This includes account statements, trade confirmations, the private placement memorandum, and any emails or notes from conversations with your advisor. Having this information organized will create a clear record of your investment history and will be essential if you decide to discuss your situation with a securities attorney to explore your legal options.