Many investors first heard about GPB Capital from a financial advisor they trusted. These brokers recommended the funds as a solid investment, often highlighting the high commissions they earned in the process. Now, regulators are scrutinizing the actions of the 60-plus brokerage firms that sold these high-risk, illiquid products. The central question is whether they performed their due diligence or simply pushed a product that was unsuitable for their clients. The widespread GPB Capital Alternative Asset Litigation isn’t just about the fund’s managers; it’s also about holding negligent brokers accountable. Let’s examine their role and your options for taking action.

Key Takeaways

- Distributions Weren’t From Profits: GPB Capital allegedly paid investors with money from new investors, not from actual business earnings. This is a critical red flag for fraud, especially in complex, illiquid investments that lack transparency.

- You Have Multiple Recovery Options: The court-ordered distribution of funds is just one path. You can also file a separate securities arbitration claim against the brokerage firm that sold you the investment for making an unsuitable recommendation.

- Vet Both the Advisor and the Investment: Protect yourself by using FINRA’s BrokerCheck to research your advisor’s history, demanding clear documentation for any investment, and questioning any promises of high, guaranteed returns.

What Was GPB Capital’s Investment Strategy?

To understand the issues surrounding GPB Capital, it’s helpful to first look at how they presented their investment strategy. GPB Capital Holdings positioned itself as a manager of alternative assets, attracting investors who were looking for opportunities outside of the traditional stock and bond markets. They promised consistent, high returns by investing in private companies that weren’t publicly traded. This approach was appealing because it seemed to offer a way to grow wealth without the daily volatility of the stock market. The strategy was built on acquiring income-producing companies in specific industries, with the goal of providing investors with regular monthly distributions. Let’s break down what that actually means for your portfolio.

The Alternative Assets They Managed

GPB Capital focused on what are known as “alternative assets.” These are investments that fall outside of conventional categories like publicly traded stocks and bonds. GPB’s funds primarily held private equity in middle-market companies, with a heavy concentration in automotive dealerships, waste management services, and technology-enabled services. For many investors, this was presented as a chance to get in on the ground floor of established, cash-flowing businesses that weren’t accessible to the general public. The idea was that these private companies would provide a steady and reliable source of income, separate from the fluctuations of the broader market.

How They Claimed to Invest

GPB Capital told investors and their financial advisors that it would use their money to purchase private companies, manage them to increase their value, and then pay out a portion of the profits as an 8% annual dividend. This high, fixed rate of return was a major selling point, particularly for retirees and others seeking a dependable income stream. The company raised over $1.8 billion from investors with this promise. However, these were illiquid investments, meaning investors could not easily access their money for years. This lack of liquidity is a common feature in many complex investment issues that can leave investors stuck in a failing fund.

How GPB Differed from Traditional Investments

Unlike traditional investments such as stocks, which are traded on public exchanges with transparent pricing, GPB’s funds were private placements. This means they lacked the same level of transparency and regulatory oversight. While alternative assets can sometimes offer higher returns, they also come with greater risks that must be fully disclosed. The lack of transparency made it difficult for investors to know the true value of their holdings or the financial health of the companies in the portfolio. When brokers recommend such complex and risky products without proper disclosure, it can be a form of broker fraud and negligence.

What Are the GPB Capital Fraud Allegations?

At the heart of the GPB Capital case are serious allegations of a widespread scheme that misled thousands of investors. The central figures named in the complaints include GPB Capital itself, its owner David Gentile, and Jeffry Schneider of Ascendant Capital. According to regulators, these parties orchestrated a plan that misrepresented the health and performance of the company’s investment funds. They are accused of creating a false picture of profitability to attract new money and keep existing investors from asking tough questions.

The allegations paint a picture of a company that was not generating the returns it promised. Instead of paying investors from the profits of its portfolio companies, GPB Capital was allegedly using money from new investors to make payments to earlier ones. This created an illusion of success and steady income, which is a classic red flag for investment fraud. The U.S. Securities and Exchange Commission (SEC) and other authorities have stepped in, filing charges that detail a multi-year deception that ultimately cost investors dearly. These actions aim to hold the responsible parties accountable and recover what is possible for those who were harmed.

Claims of Financial Misrepresentation

The most significant claim against GPB Capital is that it lied about where investor distributions were coming from. The company and its leaders allegedly told investors that their monthly payments were generated by the profits of the businesses GPB owned. However, the SEC alleges that this was not the case. Instead, GPB Capital was reportedly using new investors’ capital to make these payments. This practice concealed the poor performance of its underlying assets and made the funds appear much more successful and stable than they actually were. By masking financial troubles, the firm was able to continue raising money under false pretenses.

Alleged Securities Law Violations

Federal regulators have formally accused GPB Capital, David Gentile, and Jeffry Schneider of committing fraud and violating securities laws. These are not just minor infractions; the SEC’s complaint outlines a deliberate effort to deceive investors. The charges include breaking anti-fraud provisions and failing to register securities offerings properly. This type of broker fraud and negligence can cause devastating losses for investors who trusted that their funds were being handled legally and ethically. The legal actions taken by regulators underscore the severity of the alleged misconduct and the failure to adhere to fundamental rules designed to protect the investing public.

The Role of Whistleblowers

The allegations also extend to GPB Capital’s treatment of potential whistleblowers. According to the SEC, the company actively tried to silence individuals who might report wrongdoing. They allegedly included language in separation and consulting agreements that prohibited people from coming forward to the SEC with information. Furthermore, the company is accused of retaliating against at least one known whistleblower. These actions are a direct violation of rules created to protect those who expose fraud. If you believe you have information about financial misconduct, it’s important to understand your rights as an SEC whistleblower.

Signs of a Ponzi-Like Scheme

The methods GPB Capital allegedly used are characteristic of a Ponzi-like scheme. Between 2013 and 2018, the firm raised more than $1.8 billion from investors by selling shares in private funds with high fees. They lured investors with the promise of consistent, high monthly returns, claiming the funds’ profits would easily cover these payments. In reality, the money from new investors was being used to pay earlier investors. This cycle of using new capital to pay off old promises is an unsustainable model that inevitably collapses, leaving the most recent investors with significant losses. This is a clear example of the kind of financial wrongs that securities laws are designed to prevent.

How Regulators Responded to GPB Capital

When serious allegations of fraud surfaced, several government and regulatory bodies took action to protect investors and hold GPB Capital accountable. The response was not a single event but a series of investigations and legal proceedings at both the federal and state levels. These actions aimed to uncover the truth behind GPB’s operations, stop the misconduct, and create a path for investors to recover their losses. Understanding how regulators stepped in is key to seeing the full picture of the GPB Capital case and what it means for you as an investor. The coordinated efforts of these agencies underscore the severity of the allegations and the commitment to addressing the harm caused to thousands of investors nationwide.

What the SEC Investigation Found

The U.S. Securities and Exchange Commission (SEC) was at the forefront of the regulatory response. After a thorough investigation, the SEC charged GPB Capital and its leaders with running a Ponzi-like scheme. The agency found that the firm falsified financial statements and used new investor money to pay distributions to earlier investors, all while misrepresenting the health of its funds. In a significant move, a U.S. District Court approved the SEC’s request in December 2023 to convert the court-appointed monitor into a receiver. This change gave the receiver full control over GPB’s assets, a crucial step toward untangling its finances. The SEC’s findings confirmed that GPB Capital committed fraud and violated federal securities laws.

Criminal Charges and Proceedings

The consequences for GPB Capital’s leadership went beyond civil penalties. Federal prosecutors brought criminal charges against key figures for their roles in the scheme. In August 2024, a federal jury found GPB Capital’s founder, David Gentile, and Jeffry Schneider, the CEO of its placement agent Ascendant Capital, guilty of securities fraud, wire fraud, and conspiracy. This verdict was a major development, establishing that the misconduct was not just a regulatory violation but a criminal enterprise. The convictions hold the individuals personally responsible for the scheme that misled investors and caused significant financial harm. These proceedings send a clear message that orchestrating this type of investment fraud carries severe legal consequences.

How States Took Action

The federal investigations were complemented by actions at the state level. Securities regulators in multiple states launched their own probes into GPB Capital and the brokerage firms that sold its funds to investors. These state-level actions often focused on the sales practices of financial advisors and whether they performed adequate due diligence before recommending such a high-risk, illiquid investment to their clients. Agencies like the Financial Industry Regulatory Authority (FINRA) and even the FBI joined the effort, investigating potential violations of investment laws. This widespread scrutiny highlights the extensive network of broker negligence that allowed GPB funds to be sold to so many unsuspecting investors across the country.

Appointing a Monitor to Oversee Assets

Before the court appointed a full receiver, it first put a monitor in place in February 2021. The monitor’s job was to oversee GPB Capital’s assets and operations to prevent further harm to investors while the SEC’s case proceeded. However, this initial measure proved insufficient. The SEC later argued that GPB Capital was not cooperating with the monitor and was actively obstructing their oversight. This failure to comply with the court’s orders prompted the SEC to request a receivership, a much more drastic measure that strips the company of control. This transition was a critical turning point, ensuring that an independent party could manage the assets for the benefit of defrauded investors seeking recovery through processes like securities arbitration.

Where Does Investor Recovery Stand Today?

For investors affected by the GPB Capital situation, the question of financial recovery is front and center. While the legal process can feel slow, there are significant developments aimed at returning money to those who were harmed. The court has taken decisive action by appointing a neutral third party to manage GPB’s remaining assets and oversee a distribution plan. This is a critical step forward in untangling the company’s complex finances and ensuring that investors’ interests are prioritized.

The path to recovery involves several key stages, from securing the company’s assets to creating a fair system for distributing funds. A court-appointed receiver is now in control, tasked with creating an organized process out of a chaotic situation. This oversight is designed to prevent further loss and begin the work of making investors whole. While the process is not yet complete, recent court orders have established a clear framework and timeline for an initial distribution, offering a measure of hope for those who have been waiting for answers. Understanding these developments can help you see where things stand and what to expect next.

Managing Assets Under a Receivership

To protect the remaining assets, the court has appointed a receiver, Joseph T. Gardemal III, to take full control of GPB Capital. Think of a receiver as a court-supervised manager whose primary job is to act in the best interest of the harmed investors. His responsibilities include locating and securing all of the company’s funds and properties. After completing a thorough accounting, the receiver will propose a formal plan to distribute the remaining capital back to investors. This is a standard procedure in complex investment issues and is designed to ensure an orderly and equitable process for everyone involved.

Plans to Distribute Funds to Investors

The initial distribution plan is not a blanket payout to all GPB investors. Instead, it specifically targets those who invested in three particular funds. According to the court-approved plan, the money will be allocated to investors in GPB Automotive Portfolio, GPB Holdings II, and GPB Cold Storage. If you invested in other GPB funds, you might not be part of this initial distribution, but the receiver’s work is ongoing. This targeted approach is the first step in a larger effort to liquidate assets and return capital. It’s important to identify which fund your investment is in to understand how this development affects you directly.

Details on the Initial Fund Release

In a major step forward, a judge has ordered an initial release of $400 million to be paid to wronged GPB Capital investors. This is not a settlement offer; it is a distribution of the company’s existing funds that the receiver has managed to secure. This initial payment represents a significant portion of the recoverable assets identified so far. For investors in the designated funds, this order turns the possibility of recovery into a reality. It’s a tangible outcome of the ongoing regulatory and legal actions, marking the first time that a substantial amount of money has been formally allocated for investor returns.

What Is the Timeline for Recovering Funds?

The court has set a clear deadline for this first wave of payments. The funds are scheduled to be distributed by April 29, 2025. However, it’s important to know that this timeline could be delayed if any parties file appeals to the court’s order. Barring any legal challenges, investors in the three specified funds can expect the process to be completed by that date. If you have questions about your specific situation or want to explore other avenues for recovery, such as filing a direct claim for broker fraud and negligence, it is wise to seek legal guidance.

What Are Your Legal Options as an Investor?

If you’ve lost money in GPB Capital funds, it’s easy to feel overwhelmed and unsure of what to do next. The good news is that you have rights and potential avenues for recovering your losses. With government agencies like the SEC and FINRA investigating GPB Capital for potential securities law violations, the path to recovery is becoming clearer. The key is to understand your options and take deliberate, informed steps to reclaim your financial future. Pursuing a legal claim may feel daunting, but it is often the most effective way to hold responsible parties accountable and work toward getting your money back.

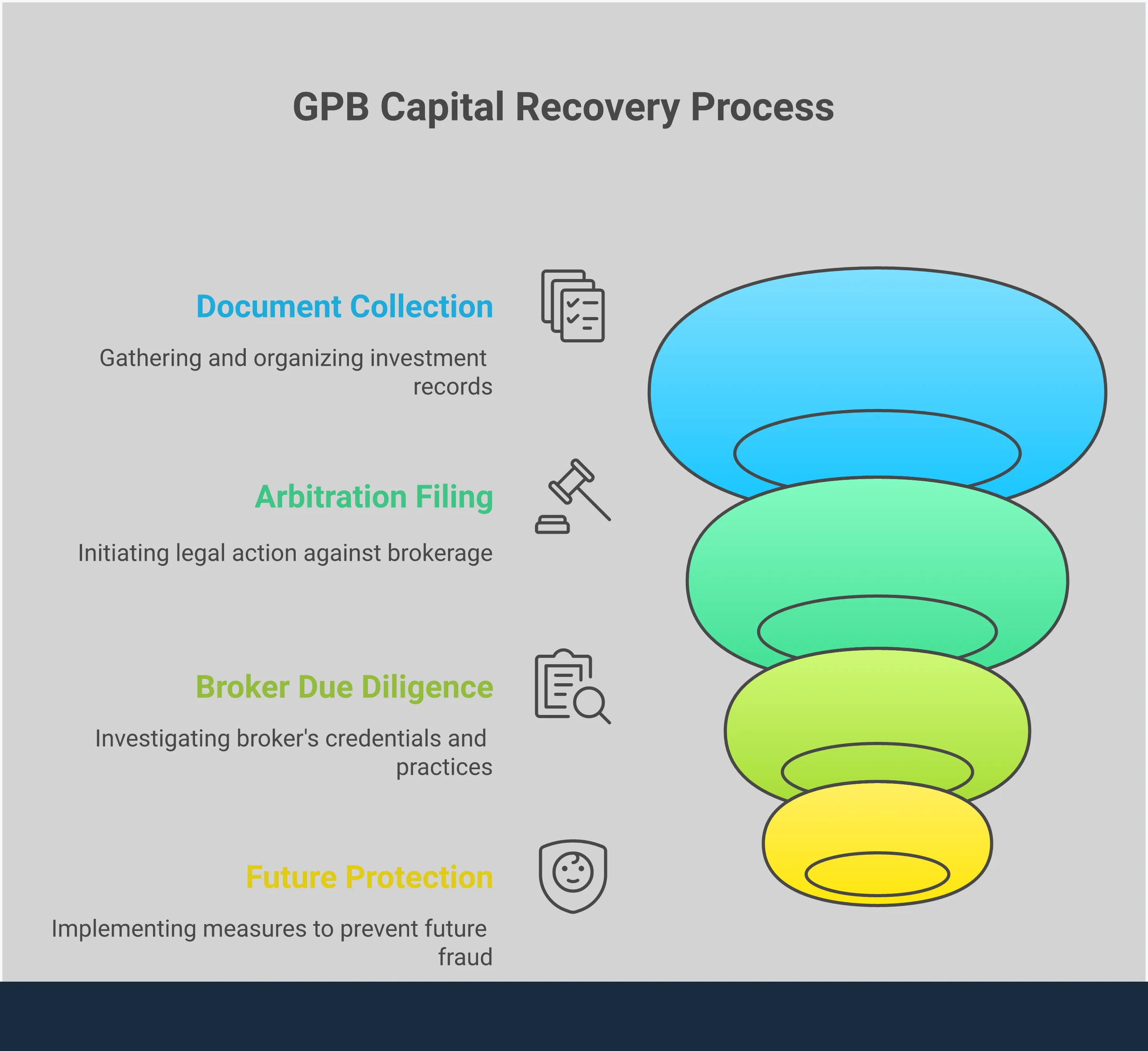

Explore Your Paths to Recovery

When your investments go wrong due to misconduct, you aren’t left without recourse. One of the primary ways investors can seek to recover losses is by filing a claim through securities arbitration. This is a formal process where you can present your case against the brokerage firm that sold you the investment. Given that lawsuits allege GPB Capital may have misrepresented its financials and operated a fraudulent scheme, you may have a strong case if you were misled. Exploring this path allows you to formally seek compensation for the damages you’ve suffered and hold the firm that advised you accountable for its recommendations.

Why You Need a Securities Attorney

Handling a claim against a large financial firm can be incredibly complex. A securities attorney acts as your advocate, managing the intricate legal procedures so you can focus on moving forward. Many investors who lost money in GPB Capital did so because of unsuitable advice or misrepresentation by their financial advisors. An attorney can help you build a case to demonstrate broker fraud and negligence, showing how the investment was not appropriate for your financial situation or how the risks were downplayed. They will manage the entire process, from filing the claim to representing you in hearings, giving you a dedicated partner in the fight to recover your funds.

Gather the Right Documents

A successful claim depends on strong evidence. Before you even begin, start gathering all documents related to your GPB Capital investments. This includes account statements, trade confirmations, promotional materials or brochures you were given, and any emails or written correspondence between you and your broker. Since GPB Capital raised $1.8 billion from investors, with a significant portion going to brokers as commissions, your documents can help establish a clear timeline and show exactly what you were told. These records are fundamental to building your case and proving the extent of your financial losses.

Understand the Deadlines to File a Claim

It’s critical to know that your time to take legal action is limited. Strict deadlines, known as statutes of limitation, apply to filing investment fraud claims. If you miss this window, you could lose your right to recover your money forever. In the GPB Capital case, a court has already ordered an initial distribution of funds to be completed by April 29, 2025, which highlights that the recovery process is moving forward. Don’t wait to see what happens. The sooner you act, the better your position will be. To understand the specific deadlines that apply to your situation, it’s important to contact a legal professional right away.

How to Protect Your Investments in the Future

The GPB Capital case is a stark reminder of what can go wrong, but it also provides valuable lessons for safeguarding your portfolio. Being a proactive and informed investor is your best defense against potential fraud. By learning to identify red flags, thoroughly vetting opportunities, and understanding the rules of the road, you can make more confident decisions and protect your financial future. The following steps can help you build a stronger, more resilient investment strategy.

Spot the Warning Signs of a Bad Investment

Trust your gut—if an investment opportunity feels off, it probably is. Be wary of anyone promising guaranteed high returns with little to no risk; this is one of the most common signs of broker fraud and negligence. High-pressure sales tactics that rush you into making a decision are another major red flag. A legitimate advisor will give you time to think and do your research.

Pay close attention to liquidity. Ask yourself, “How easily can I get my money out if I need it?” Many alternative investments are less liquid than traditional stocks and bonds, meaning they can’t be sold quickly. If an advisor is vague about how or when you can access your funds, proceed with caution. Finally, demand clear and complete documentation. If you can’t get a straight answer or a prospectus, walk away.

How to Vet Investment Opportunities

Always do your own homework before committing your hard-earned money. While some alternative investments promise impressive returns, these often come with significant risks that aren’t immediately obvious. Your first step should be to research both the investment itself and the people selling it. Use FINRA’s BrokerCheck tool to review the professional history of your broker and their firm, including any customer complaints or disciplinary actions.

Ask for the offering documents, like a prospectus or private placement memorandum, and take the time to read through them. If the language is confusing or the strategy seems overly complex, that’s a concern. Don’t be afraid to ask tough questions and seek a second opinion from a trusted, independent financial professional or an attorney—not the person trying to make the sale. A thorough vetting process is crucial to separating sound opportunities from potential problems.

Manage Your Investment Risk

A well-managed portfolio is a diversified one. Concentrating too much of your money in a single investment, especially a high-risk or illiquid one, can expose you to devastating losses. A healthy strategy typically involves a mix of different asset classes. While traditional investments like stocks and bonds can offer stability, a small allocation to alternative investments may provide growth. The key is finding the right balance for your personal financial situation, goals, and risk tolerance.

This concept is known as suitability. An investment might be legitimate, but that doesn’t mean it’s right for you. Your broker has a responsibility to recommend products that align with your profile. Regularly review your portfolio to ensure it still matches your objectives and that you haven’t become over-exposed to any single investment issue.

Know the Regulatory Compliance Standards

Legitimate investments operate within a framework of rules established by regulators like the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). As the GPB Capital case shows, when a firm is being investigated by the SEC, FINRA, and even the FBI, it’s a clear sign that something is seriously wrong. Before you invest, verify that the offering is properly registered with the SEC or that it qualifies for a legitimate exemption.

You can search the SEC’s EDGAR database to find disclosures and registration information for public companies. Brokers and investment advisors must also be registered and adhere to strict conduct rules. If an investment or advisor isn’t following these standards, it puts your money at risk. Understanding these compliance basics helps you identify operations that are cutting corners or breaking the law.

Take Steps to Safeguard Your Portfolio

After learning about a situation like the GPB Capital case, it’s natural to feel concerned about your own investments. The good news is that you can take proactive steps to protect your financial future. It starts with being an engaged and informed investor. By asking the right questions, carefully reviewing your documents, and understanding the systems in place to protect you, you can build a more secure portfolio and feel confident in your financial decisions.

Understand Current Investor Protections

It’s helpful to know the landscape of modern investing, which often includes alternative assets. These are investments that fall outside of traditional stocks and bonds, such as private equity or real estate funds. While they can offer diversification, they also come with different risk profiles and are often less liquid than conventional investments. Understanding the nature of these complex investment issues is the first step. Protections exist through regulatory bodies like the SEC and FINRA, which set rules for how these products can be sold, but it’s your awareness that serves as your primary line of defense.

Demand Transparency from Advisors

You have a right to completely understand where your money is going. Don’t hesitate to ask your financial advisor direct questions about any investment they recommend. If they suggest an alternative asset, ask them to explain the strategy, the fees, the risks, and why it’s a suitable choice for your specific financial goals. A trustworthy advisor will provide clear, straightforward answers. If you receive vague responses or feel pressured, it could be a red flag for broker fraud and negligence. True transparency is non-negotiable when it comes to your financial security.

Review Reporting and Account Statements

Your account statements are more than just routine mail—they are vital reports on the health of your portfolio. Make it a habit to review them carefully every time they arrive. Look for anything that seems unusual, such as unexpected fees, transactions you don’t recognize, or performance that drastically differs from what you were led to expect. With alternative investments, reporting can sometimes be less frequent or more complex, making your review even more critical. If something doesn’t add up or the documentation is consistently unclear, bring it to your advisor’s attention immediately and ask for a detailed explanation.

How Regulatory Oversight Works

Regulatory bodies like the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) create and enforce the rules of the investment industry. They conduct examinations, bring enforcement actions against bad actors, and work to maintain fair markets. However, they can’t catch every instance of fraud before it happens. Often, misconduct is brought to light by brave individuals who become an SEC whistleblower. When wrongdoing is uncovered, regulators can take action, but recovering your losses often requires a separate legal process, such as filing a claim through FINRA’s dispute resolution forum.

Related Articles

- GPB Capital CEO Indicted in $1.8B Investment Fraud Case

- GPB Capital Holdings Under FBI & SEC Investigation

- GPB Capital Holdings: Investigating Claims | The Frankowski Firm

- GWG L Bonds Guide | Expert GWG Bonds Lawyers

- Private Placement Investments – The Frankowski Firm

Frequently Asked Questions

I invested in a GPB fund. What does the receivership and fund distribution actually mean for me? The court has appointed a receiver to take control of GPB Capital’s remaining assets. This is a positive step because it means an independent party is now managing the company’s finances with the goal of returning as much money as possible to investors. The initial distribution is the first phase of this process, where the receiver will pay out a portion of the recovered funds to investors in specific GPB funds. This action confirms that recovery is underway, but it is not the final outcome.

If the court is already distributing money, why would I need to file a separate legal claim? The court-ordered distribution is a process to divide GPB’s remaining assets among all investors in certain funds. However, this amount may only represent a fraction of your total losses. Filing a separate securities arbitration claim against the brokerage firm that sold you the investment allows you to pursue recovery for the full extent of your damages. This claim focuses on the firm’s failure to perform due diligence or its unsuitable recommendation, holding them directly accountable for their role in your losses.

How could my financial advisor have recommended this investment if it was so problematic? Financial advisors and their firms have a duty to conduct thorough due diligence on the investments they recommend. They are supposed to ensure that an investment is suitable for your specific financial situation and risk tolerance. In the case of GPB, many brokerage firms allegedly failed in this duty, attracted by the high commissions offered for selling the funds. They may have overlooked the significant risks and lack of transparency, which is a form of broker negligence.

What are the most important red flags I should have looked for with GPB Capital? The promise of consistently high, guaranteed returns, like the 8% dividend GPB offered, is a classic warning sign. Investments with high returns always come with high risk, and any claim to the contrary should be questioned. Another major red flag was the lack of liquidity, which meant your money was tied up for years with no easy way to access it. Finally, the lack of transparency and clear financial reporting made it impossible for investors to know the true health of the funds.

Is it too late to take action if I lost money in GPB Capital? There are strict time limits, known as statutes of limitation, for filing legal claims to recover investment losses. While the court-ordered distribution is moving forward, the window to file your own individual claim against your brokerage firm is not open indefinitely. The sooner you explore your options, the better your chances are of meeting the required deadlines. It is important to act promptly to preserve your right to pursue a claim.