NO FEES UNTIL WE WIN

FREE CONSULTATION

NO FEES UNTIL WE WIN

FREE CONSULTATION

Not all investment losses are the result of a volatile market. Sometimes, they are the direct outcome of illegal or unethical actions, like misrepresentation, unauthorized trading, or unsuitable recommendations. The key is learning to tell the difference. If you have a nagging feeling that something is wrong with your portfolio, it’s worth looking closer. This guide will help you identify the red flags of financial misconduct and understand the steps you can take to pursue justice. You don’t have to accept devastating losses without a fight. A skilled investment fraud lawyer Atlanta can investigate your claim, uncover the facts, and determine the best strategy for recovering your hard-earned money.

Investment fraud happens when someone uses deception, misrepresentation, or other dishonest tactics to convince you to make an investment. At its core, it’s about taking your hard-earned money under false pretenses. These schemes can be incredibly sophisticated, making it difficult for even savvy investors to spot the danger before it’s too late. Whether it involves a stockbroker pushing an unsuitable product or a more elaborate scam, the goal is always the same: to enrich the fraudster at your expense. Understanding what investment fraud looks like is the first step toward protecting yourself and seeking justice if you’ve been wronged.

Fraudulent schemes come in many forms, but some are more common than others. You may have heard of Ponzi schemes, where money from new investors is used to pay earlier investors, creating the illusion of a profitable enterprise. Another type is a “pump-and-dump” scheme, where scammers artificially inflate the price of a stock through false statements and then sell their own shares at the peak, leaving other investors with worthless stock. Affinity fraud is also prevalent, where fraudsters target members of identifiable groups, such as religious or ethnic communities, exploiting the trust that exists within the group. These are just a few of the complex investment issues that can cause significant financial harm.

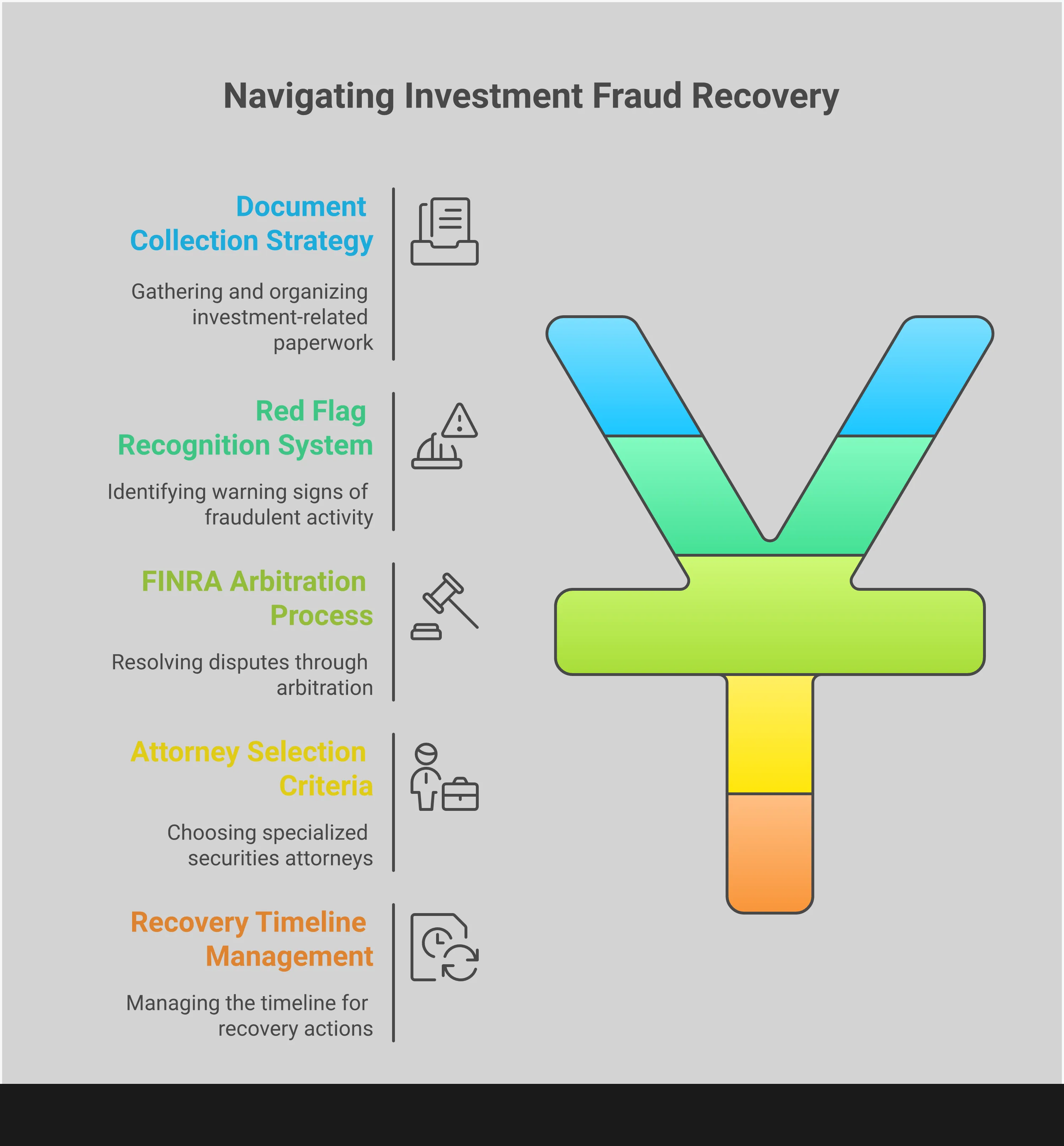

Recognizing the warning signs of investment fraud can help you protect your assets. Be wary of anyone who promises high, guaranteed returns with little to no risk—every investment carries some level of risk. Another major red flag is high-pressure sales tactics. If you feel rushed to make a decision or are told an opportunity is “once in a lifetime,” it’s wise to step back and ask questions. Scammers often create a sense of urgency to prevent you from doing your due diligence. These tactics are often a clear sign of broker fraud and negligence and should not be ignored.

If you believe you’ve been a victim of investment fraud, it’s important to know that you have rights. Georgia has specific state laws designed to protect consumers and investors from deceptive and fraudulent practices. These regulations provide a legal framework for holding wrongdoers accountable and recovering your losses. A lawyer who understands both federal securities laws and Georgia’s state-level protections can help you determine the best course of action. You don’t have to face this situation alone; legal support is available to help you stand up for your rights. If any of this sounds familiar, we encourage you to contact us to discuss your situation.

Discovering you’ve been a victim of investment fraud can be a deeply unsettling experience. The path to recovering your losses might seem complicated and overwhelming, but you don’t have to face it alone. A dedicated investment fraud lawyer can provide the clarity and support you need to move forward. Their role is to handle the legal complexities so you can focus on your financial well-being.

From the moment you hire an attorney, they begin working to protect your interests. They will thoroughly investigate your claim, gather evidence, and identify the responsible parties. Whether your case involves a dishonest stockbroker, a misleading investment opportunity, or corporate misconduct, a lawyer specializing in broker fraud and negligence understands the specific laws designed to protect investors. They will build a strong case on your behalf, representing you in negotiations, arbitration, or court proceedings. Their primary goal is to recover the money you lost and hold the wrongdoers accountable for their actions. With a legal professional in your corner, you gain a powerful advocate committed to fighting for your financial future.

When you open an account with a brokerage firm, you likely sign an agreement that requires any disputes to be settled through arbitration instead of a traditional lawsuit. The Financial Industry Regulatory Authority (FINRA) oversees this process. An investment fraud lawyer can manage your securities arbitration claim from start to finish. They will file the necessary paperwork, present evidence, and argue your case before a panel of arbitrators. This forum is specifically designed for securities-related disputes, and having a lawyer who understands its unique rules and procedures is crucial for a successful outcome. They will ensure your story is heard and your rights are protected throughout the entire process.

If arbitration isn’t required or appropriate for your situation, your lawyer may pursue securities litigation by filing a lawsuit in state or federal court. This legal action allows you to sue the individuals or companies responsible for your financial losses. Private investment fraud attorneys focus on recovering funds for investors who have been deceived. Your lawyer will handle every aspect of the lawsuit, from drafting the initial complaint to representing you in court. The objective of litigation is not only to reclaim your money but also to hold fraudulent actors accountable, which can help prevent them from harming other investors in the future.

Every investment fraud case is different, and a one-size-fits-all approach rarely works. A skilled lawyer will develop a personalized strategy tailored to the specifics of your situation. They begin by carefully analyzing your financial records, communications, and investment agreements to understand the full scope of the fraud. Based on this information, they will outline the most effective legal path to recover your lost investments. This strategic planning involves identifying the strongest legal arguments, anticipating the opposing side’s tactics, and deciding whether to pursue a settlement or take the case to a hearing. This thoughtful approach gives you the best possible chance of a favorable result.

Government agencies like the Securities and Exchange Commission (SEC) work to enforce securities laws and protect the investing public. While their enforcement actions can penalize wrongdoers, they don’t always result in direct compensation for individual victims. However, an investment fraud lawyer can interact with these regulatory bodies on your behalf. They can report misconduct, which may trigger an official investigation that uncovers valuable evidence for your case. Sometimes, a lawyer can also help you file a claim as an SEC whistleblower. This collaboration can strengthen your personal claim for financial recovery while contributing to broader market integrity.

Finding the right legal partner after experiencing investment fraud can feel overwhelming, but it’s a critical step toward financial recovery. You need someone who not only understands the complexities of securities law but also listens to your story and makes you feel heard. The right attorney will be your advocate, guiding you through the legal process with clarity and purpose. Think of this as a partnership. You’re looking for a professional who can translate your experience into a strong legal claim and fight for your interests.

When you start your search, focus on firms that dedicate their practice to investment issues. Just as choosing a personal injury attorney requires looking for someone who understands medical evidence and liability law, finding the right investment fraud lawyer means selecting a professional with deep experience in financial regulations, industry practices, and the arbitration process. Taking the time to find the right fit will give you confidence as you move forward. You can also find a reputable attorney network that connects you with vetted professionals experienced in securities law and investor protection, ensuring you start your case with trusted legal support.

When you’re vetting potential attorneys, clear and consistent communication should be at the top of your list. You need a lawyer who can explain complex legal strategies in a way that makes sense to you. A successful attorney-client relationship is built on trust, and that starts with being able to convey your concerns and understand the path forward. Pay attention to how they respond to your initial inquiry. Are they prompt? Do they answer your questions directly? This initial interaction often sets the tone for how they’ll communicate throughout your case.

Look for an attorney with a history of handling cases similar to yours. Whether you’re dealing with broker fraud and negligence or another type of financial misconduct, a lawyer’s direct experience is invaluable. During your initial consultation, don’t hesitate to ask about their track record with similar claims. While no attorney can guarantee a specific outcome, they should be able to discuss potential results and outline a clear strategy based on their past work. This conversation will help you gauge their familiarity with the challenges your case might present.

It’s essential to have a clear understanding of how your attorney will be paid. Most investment fraud lawyers work on a contingency fee basis. This means you won’t pay any attorney’s fees unless they successfully recover money for you. The fee is typically a percentage of the amount recovered. This structure is beneficial because it aligns your attorney’s goals with yours—they are motivated to secure the best possible outcome for you. Be sure to discuss the fee structure, along with any other potential costs, during your initial meeting. You can contact us for a free and confidential consultation to discuss your case.

To make the most of your first meeting with an attorney, a little preparation goes a long way. Start by gathering all the documents related to your investment, including account statements, trade confirmations, and any correspondence you have with your broker. Write down a timeline of events as you remember them. Also, prepare a list of questions to ask the attorney. You might ask about their experience, their approach to securities arbitration, and what you can expect from the process. This initial consultation is your opportunity to tell your story and decide if the attorney is the right advocate for you.

Taking the first step toward financial recovery can feel overwhelming, but building a strong case is a structured process. It begins with organizing what you already have and understanding the road ahead. With a clear plan and the right legal partner, you can confidently move forward. The strength of your claim often rests on the quality of the evidence and your active participation in the process. Your attorney will guide you, but your involvement is key to piecing together the full story of what happened.

This process involves gathering documents, understanding the legal timeline, knowing your role, and appreciating how your lawyer will investigate the claim on your behalf. Each step is designed to build a comprehensive and compelling argument to help you pursue the compensation you deserve.

The foundation of any investment fraud case is solid documentation. These records tell the story of your investment and the promises that were made. Start by collecting every piece of paper and digital communication related to your investment. This includes account statements, trade confirmations, contracts, and any promotional materials you received. Emails, text messages, and even handwritten notes from conversations with your broker or advisor are incredibly valuable.

Understanding what constitutes fraud is crucial for protecting yourself and taking action. This type of misconduct isn’t always as obvious as a blatant scam, which is why your documents are so important. They provide a factual timeline and can reveal inconsistencies or misrepresentations. Don’t worry if you feel something is missing; your attorney can often help obtain additional records. The goal is to create a complete picture of your investment issues for your legal team to analyze.

Patience is important, as the legal process doesn’t happen overnight. After your initial consultation, your attorney will begin a thorough investigation. If they determine you have a strong claim, the next step is typically filing a formal complaint. For many investors, this means entering into securities arbitration through the Financial Industry Regulatory Authority (FINRA). This is a common alternative to a traditional court trial.

The timeline includes several phases: filing the claim, a discovery period where both sides exchange information, and finally, a hearing where your case is presented. Investment fraud occurs when individuals or companies deceive investors for financial gain, and a dedicated attorney’s primary goal is to recover your losses. Throughout this process, your legal team will handle the complex procedures and keep you informed, allowing you to focus on what matters most.

While your attorney handles the legal heavy lifting, your role as the client is vital. Your primary responsibilities are to be truthful, responsive, and organized. Provide your lawyer with all the documents and information you have, even if you’re unsure of its relevance. Effective communication is necessary for a successful attorney-client relationship, as it impacts how well you can convey your concerns and understand their legal strategies.

Be prepared to answer questions about your investment history, your financial goals, and your conversations with the financial professional involved. Your firsthand account is a powerful part of the case. By maintaining open and honest communication, you empower your legal team to represent you effectively. If you ever have questions or new information comes to light, don’t hesitate to contact us and share it.

Once you provide the initial documents, your legal team begins a deep investigation to uncover the facts. This goes far beyond simply reviewing your statements. Attorneys will analyze the investment products you were sold, research the background of the broker or firm involved, and identify any patterns of misconduct. They may also consult with financial analysts to assess the suitability of the investments for your stated goals and risk tolerance.

Fraudulent schemes can be complex, but a detailed investigation can expose them. Your lawyer will look for evidence of broker fraud and negligence, such as unauthorized trading, misrepresentation, or the recommendation of unsuitable products. This meticulous due diligence is aimed at building a powerful argument that demonstrates how you were wronged and quantifies the financial damages you suffered as a result.

Discovering you may be a victim of investment fraud can be overwhelming, but it’s important to know that you have options. The path to financial recovery involves understanding the legal avenues available, the types of compensation you can pursue, and the critical timelines you need to follow. A dedicated investment fraud attorney focuses on one primary goal: recovering your losses. By working with a legal professional, you can create a clear strategy to reclaim your financial stability and hold the responsible parties accountable for their actions.

When you’ve lost money due to fraud, there are specific legal remedies designed to help you get it back. These aren’t just abstract concepts; they are concrete actions you can take through the legal system. The main objective is to recover the funds that were wrongfully taken from you. An investment fraud attorney’s job is to use their knowledge of securities law to pursue these remedies on your behalf. They will handle the complexities of your case, from filing claims to representing you in legal proceedings, so you can focus on moving forward. The right legal support can make all the difference when dealing with complex investment issues.

You may be able to recover more than just your initial investment. Depending on the details of your case, compensation can include the principal amount you invested, any interest or profits you were promised but never received, and other financial damages. An experienced investment fraud lawyer understands the nuances of securities law and can build a strong case to help you recover your lost investments. They will thoroughly assess your situation to determine the full extent of your losses and fight for the maximum compensation you are entitled to. This is especially critical in cases involving broker fraud and negligence, where a professional’s misconduct directly caused your financial harm.

Your case may be resolved in one of two ways: through a settlement or through litigation, such as arbitration. A settlement is a negotiated agreement between you and the opposing party, which avoids a formal hearing. Litigation involves presenting your case before a panel of arbitrators or a court. Many investment fraud cases are resolved through settlement, but your attorney should always be prepared to take your case to a hearing if a fair agreement cannot be reached. During your initial consultation, a lawyer can help you understand which path is more suitable for your specific circumstances and what to expect from the securities arbitration process.

Time is a critical factor in any investment fraud case. The law sets strict deadlines, known as statutes of limitations, for filing a claim. If you miss this window, you could lose your right to recover your losses forever. Since misconduct isn’t always as obvious as a blatant scam, it’s essential to take action as soon as you suspect something is wrong. Don’t wait for the situation to resolve itself. Protecting your financial interests means acting promptly. If you believe you have been cheated in an investment, you should contact a law firm immediately to ensure you don’t miss any important deadlines.

After discovering you may be a victim of investment fraud, your focus naturally shifts to recovery. But it’s also a critical time to put safeguards in place for the future. Taking control of your financial life involves developing new habits and strategies to protect your assets and ensure you’re never in this position again. These steps can help you build a more secure financial foundation while you work toward resolving your current situation.

Understanding what constitutes fraud is the first step, but proving it requires documentation. Misconduct isn’t always as obvious as a blatant scam; sometimes it’s hidden in the fine print or a series of misleading conversations. This is why keeping detailed records is so important. Hold onto every document related to your investments, including account statements, trade confirmations, prospectuses, and any written communication like emails or letters. It’s also a good idea to keep a log of phone calls, noting the date, time, and what was discussed. These records are the building blocks of a strong case and can help clarify complex investment issues.

Clear and direct communication is essential, both with your financial professionals and your legal team. Don’t hesitate to ask questions if something is unclear, and always request that important promises or recommendations be put in writing. Effective communication is necessary for a successful attorney-client relationship, as it impacts how well you can convey your concerns and understand their legal strategies. When you first contact us, being able to clearly articulate your situation helps us understand how we can best assist you. This habit of open dialogue will serve you well in all your future financial dealings.

Learning to spot the warning signs of fraud is one of the most powerful tools you can have. Con artists often use high-pressure tactics and discourage questions because they don’t want you to look too closely at their claims. A reputable professional, on the other hand, will welcome your questions and provide clear, verifiable answers. Moving forward, make it a rule to thoroughly vet any investment opportunity or advisor. Be wary of promises of guaranteed high returns with little to no risk. Taking these precautions can help you avoid instances of broker fraud and negligence and help you avoid scammers and reduce the risk of broker fraud and negligence in the future.

Investment fraud occurs when individuals or companies deceive investors for financial gain, and the path to getting your money back can feel overwhelming. Working with an investment fraud attorney is a key step in creating a solid plan for financial recovery. We prioritize recovering losses for investors by exploring all available legal avenues. This may involve filing a claim through securities arbitration or pursuing other legal actions. While the process takes time, having a clear strategy in place provides a roadmap and helps you regain a sense of control over your financial future.

Working with a lawyer on an investment fraud claim can feel intimidating, but it doesn’t have to be. The right attorney will guide you through the process with clarity and support, making you a partner in your own case. Knowing what to expect from the beginning helps build a foundation of trust and sets you up for a productive relationship. From the initial case evaluation to making key decisions together, every step is designed to move you toward a resolution and help you regain a sense of control over your financial future.

Your role is to provide information and ask questions, while your lawyer’s role is to offer legal guidance and manage the complexities of your claim. This partnership works best when communication is open and expectations are clear. You should feel confident that your attorney understands your goals and is committed to keeping you informed about every development. We believe that a well-informed client is an empowered client. Let’s walk through the key phases of the attorney-client relationship so you know exactly what to anticipate as you move forward with your case. This transparency is fundamental to how we approach every client’s situation, ensuring you are comfortable and confident from start to finish.

When you first meet with us, our primary goal is to understand the specifics of your situation. This initial evaluation is a critical first step where we listen to your story, review your documents, and assess your legal needs. We’ll discuss the details of your investments, the advice you received, and the losses you’ve incurred. This conversation allows us to identify the core issues of your case, whether it involves broker fraud and negligence or other complex investment matters. Think of this meeting as the foundation for our entire strategy; it’s where we begin to map out the most effective path forward for you.

A successful legal case is built on a strong partnership between you and your attorney. Effective, two-way communication is the key. We need you to share your concerns, memories, and documents openly, and in return, we are committed to explaining our legal strategies in a way that makes sense to you. This collaborative approach ensures that you are always part of the process, not just a bystander. When you feel heard and understood, you can have more confidence in the direction your case is heading. Your insights are invaluable, and a solid partnership ensures they are integrated into our legal plan.

Once you decide to work with our firm, you can expect to receive regular updates about the status of your case. We believe it’s vital to keep you informed and engaged, so you’ll never have to wonder what’s happening behind the scenes. Whether we’re filing a claim, preparing for securities arbitration, or negotiating with the opposing side, we will let you know. Clear and consistent communication reduces stress and helps you feel in control during a challenging time. Our commitment is to provide you with the information you need, when you need it, so you can have peace of mind.

Throughout your case, you will face important decisions. Our job is to give you the legal context and professional insight you need to make choices that are right for you. We will discuss the potential outcomes, risks, and benefits of each option. We encourage you to ask questions and approach every decision with an open mind. This collaborative process ensures that you are the one guiding your case, armed with the information to do so confidently. By working together, we can pursue a resolution that aligns with your personal and financial goals. If you’re ready to start this process, please contact us to schedule a consultation.

How long does an investment fraud case usually take? The timeline for an investment fraud case can vary quite a bit. It really depends on the specifics of your situation, like how complex the fraud was and whether the other side is willing to negotiate. Some cases might resolve in a few months through a settlement, while others that go to a full arbitration hearing could take a year or more. Your attorney will give you a clearer picture of what to expect once they’ve reviewed your claim, and they’ll keep you updated as the process moves forward.

I’m worried I don’t have all the necessary paperwork. Can I still build a case? Yes, you absolutely can. It’s very common for people to not have every single document, so please don’t let that stop you from seeking help. Bring whatever you have to your initial consultation, even if it feels incomplete. Your legal team has methods for obtaining missing records, like account statements or trade confirmations, directly from the financial institutions. The most important thing is to get started with what you have.

Do I have to pay any money upfront to hire an attorney? Most investment fraud attorneys, including our firm, work on a contingency fee basis. This means you don’t pay any attorney’s fees unless we successfully recover money for you. The fee is a percentage of the amount we recover. We cover the costs of building and pursuing your case, so you won’t have to worry about paying out of pocket to get the legal help you need. We’ll go over the fee agreement in detail during your free consultation so everything is clear from the start.

What if the person who gave me the bad investment advice is a friend or someone from my community? This is a difficult and surprisingly common situation. It’s important to remember that financial professionals have a legal and ethical duty to act in your interest, regardless of your personal relationship. When that trust is broken, you have the right to hold them and their employer accountable. An attorney can handle the situation with professionalism and discretion, focusing on the financial firm’s responsibility to supervise its employees and ensuring the process is as comfortable as possible for you.

Is it possible to recover my money without hiring a lawyer? While it’s technically possible to file a claim on your own, the process is complex and the financial industry has experienced legal teams on its side. An attorney who focuses on securities law understands the specific rules of FINRA arbitration and knows how to build a compelling case by gathering evidence and presenting legal arguments. Having a dedicated professional represent you significantly improves your chances of recovering your losses and ensures your rights are protected every step of the way.