Winning the lottery isn’t the finish line; it’s the starting line of a completely new race, and you’ve been given a high-performance car without any driving lessons. The statistics on lottery winners who lose it all are sobering, and it’s rarely due to a single bad decision. It’s a series of small missteps made without proper guidance. Your first priority should be creating a plan to protect yourself and your assets from the many risks that come with sudden wealth. This article will serve as your practical guide, covering everything from securing your ticket to assembling a professional team. We’ll walk through the foundational principles of lottery winner safety so you can avoid the common pitfalls and ensure your windfall provides security for generations to come.

Key Takeaways

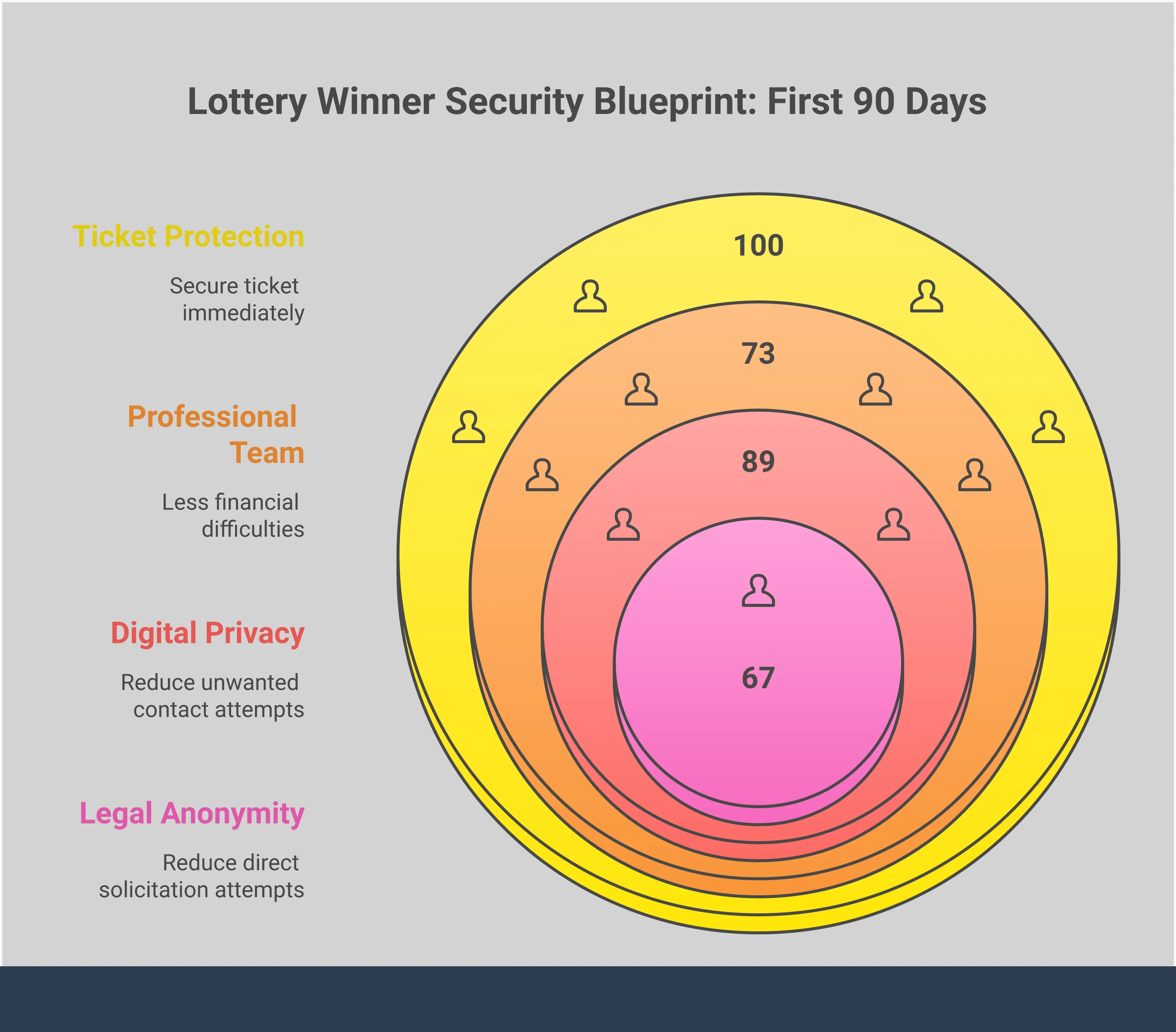

- Assemble your professional team before you do anything else: Your first call shouldn’t be to family, but to an attorney, a CPA, and a fiduciary financial advisor. This team provides the objective guidance needed to protect your assets and act as a buffer between you and outside requests.

- Prioritize privacy and security above all: Your newfound wealth can make you a target, so your first job is to become harder to find. Use legal structures like trusts to claim the prize, manage your digital footprint, and set firm boundaries to protect your peace of mind.

- Create a long-term plan before you spend: The key to making wealth last is to avoid emotional decisions. Give yourself a cooling-off period of at least six months to work with your advisors on a sustainable budget and estate plan, ensuring your money works for you for generations to come.

What Are Your First Steps After Winning?

The moments after discovering you’ve won the lottery are a whirlwind of excitement. While it’s tempting to shout the news from the rooftops, your first moves should be quiet and strategic. Taking a few immediate steps to protect yourself and your prize will set the foundation for a secure financial future. Before you claim anything, focus on these three critical tasks.

Secure Your Winning Ticket

Your first priority is to protect the winning ticket. Before doing anything else, sign the back of it to establish yourself as the owner. Next, make several copies—both digital and physical—and store the original ticket somewhere incredibly safe, like a bank’s safe-deposit box. Treat it as the most valuable piece of paper you own. Avoid posting a picture of it online or showing it to anyone outside of your most trusted circle. Protecting the physical ticket is your main job until you can officially claim your prize.

Assemble Your Professional Team

Don’t rush to the lottery office. You usually have plenty of time to claim your prize, so use it wisely. Your first move should be to build a team of professionals to guide you. This team should include a financial planner who is a fiduciary (meaning they are legally required to act in your best interest), a certified public accountant (CPA), and an attorney. Your lawyer should be your first call. They can help you understand the claiming process and work with your other advisors to handle the complex investment issues that come with sudden wealth. This team is your foundation for making smart decisions.

Establish Your Privacy Plan

Winning the lottery is exciting, but the public attention can be overwhelming. That’s why creating a privacy plan is essential. Talk to your attorney about legal ways to claim your prize while protecting your identity, such as setting up a trust. In many states, this allows the trust’s name to be made public instead of yours. Even if you can’t remain completely anonymous, you can still guard your privacy. Consider changing your phone number and deactivating social media accounts before the news breaks. Keeping your circle small at the beginning can save you a lot of stress later on.

How to Protect Your Identity and Privacy

Winning the lottery instantly changes your life, but it can also make you a target. Suddenly, everyone from long-lost relatives to opportunistic strangers may try to contact you. Protecting your identity is one of the most important things you can do to safeguard your newfound wealth and personal security. Before you even claim your prize, you need a solid plan to manage your public exposure. This isn’t about being paranoid; it’s about being prepared. By taking control of your privacy from the start, you can significantly reduce the risk of scams, harassment, and other investment issues that often follow a public windfall. A quiet, private life is one of the greatest luxuries your winnings can afford you, but it requires careful and immediate action. The steps you take in the first few days and weeks will set the tone for your future, helping you avoid unwanted attention and maintain peace of mind.

Explore Legal Ways to Stay Anonymous

The ability to remain anonymous depends entirely on your state’s laws. Some states require lottery commissions to release winners’ names to the public, while others allow you to claim your prize anonymously. If your state doesn’t permit anonymity, you still have options. You can often claim the prize through a legal trust, which puts the trust’s name on public records instead of your own. In some places, like Michigan, you can form a “lottery club” with at least two members, allowing a lawyer to claim the prize on the club’s behalf. It’s crucial to understand the specific rules in your state and explore these legal structures with an attorney before you sign your ticket or go to the lottery office. For guidance on forming a trust or exploring other legal avenues, you should contact us to discuss your specific situation.

Manage Your Digital Footprint

In an age where personal information is easily accessible online, managing your digital footprint is essential. Before your name becomes public, it’s wise to delete or deactivate your social media accounts—Facebook, Instagram, X (formerly Twitter), LinkedIn, and anything else. This makes it much harder for strangers, reporters, and scammers to find you, learn about your life, and contact you or your family. Wiping your social media presence for at least six to twelve months can create a valuable buffer. Even with a private profile, scammers can create fake accounts impersonating you to solicit money from others. By removing your online presence, you take away their source material and make it more difficult to fall victim to the kinds of broker fraud and negligence that can arise from unsolicited contact.

Handle Media and Public Attention

Once you claim your prize, you may be required to participate in a press conference. Beyond any mandatory appearances, you should avoid seeking further media attention. The more you appear in interviews or news articles, the more you invite requests for money and other unwanted solicitations. Before claiming, decide with your family and professional team exactly how much information you are willing to share. Keep the circle of people who know about your win as small as possible. The media can be incredibly intrusive; some winners have had helicopters fly over their homes and their new addresses published online. Limiting your public exposure from day one is key to protecting your family’s safety and your own peace of mind.

How to Strengthen Your Security

Winning the lottery brings incredible opportunities, but it can also make you a target. Suddenly, your personal and financial security are more important than ever. It’s not just about protecting your assets; it’s about protecting yourself and your family from unwanted attention and potential threats. Taking proactive steps to secure your physical and digital life isn’t about being paranoid—it’s about being prepared. This means thinking differently about your daily routines, your home, and your online presence. The goal is to create layers of security that deter potential problems before they start.

This might feel like a big shift, but these measures are what allow you to build a safe environment where you can enjoy your new wealth with peace of mind. From upgrading your home alarm system to cleaning up your digital footprint, each step you take reduces your vulnerability. It’s about taking control of your new situation and ensuring that you and your loved ones are protected from those who might try to take advantage. While your financial team helps protect your money, it’s up to you to secure your personal world. Let’s walk through some practical ways to do just that, so you can focus on what truly matters.

Prioritize Your Personal Safety

Becoming a publicly known lottery winner can attract a lot of unwanted attention. You might face risks from criminals, con artists, and people looking for a handout. Your first priority should be to acknowledge these new dangers and adjust your mindset accordingly. Be cautious about who you trust and the information you share, even with casual acquaintances. Scammers are skilled at exploiting newfound wealth, and it’s crucial to be aware of the various investment issues that can arise from unsolicited offers. Staying vigilant and maintaining a low profile are your best defenses as you get used to your new circumstances.

Secure Your Home

Your home should be your sanctuary, and it’s worth investing in measures to keep it that way. Start by installing a robust, professionally monitored security system with cameras and alarms. Upgrading locks, reinforcing doors and windows, and improving outdoor lighting can also make a significant difference. Depending on your situation and comfort level, you might even consider hiring a security consultant to assess your property for vulnerabilities. While it may seem extreme, these measures provide a critical layer of protection for you and your loved ones, allowing you to feel safe and secure in your own space.

Protect Your Digital Life

In our connected world, your digital footprint can be a major vulnerability. To reduce your exposure, consider deactivating your social media accounts for at least six to twelve months. This simple step makes it much harder for strangers and scammers to find you, learn about your life, or impersonate you online. It also gives you a break from the public eye while the initial excitement dies down. Beyond social media, review the privacy settings on all your online accounts. Use strong, unique passwords and enable two-factor authentication wherever possible. These practices help shield you from online schemes that can lead to serious financial harm, including forms of broker fraud and negligence.

Travel Safely

If your name becomes public, creating some physical distance can be a smart move. Consider changing your phone number to cut off unwanted calls and texts. You might even want to relocate temporarily, whether it’s an extended vacation or a short-term rental in a new city. This gives you the space to process everything away from the constant attention of your local community and the media. When you do travel, be discreet about your plans. Avoid posting your location in real time and be mindful of who you share your itinerary with. These precautions help you maintain control over your privacy and ensure your safety while you adjust to your new life.

How to Protect Your New Wealth

Coming into a large sum of money is life-changing, but the real work begins after the initial excitement fades. Protecting your new wealth requires a proactive and strategic approach. It’s not just about making smart investments; it’s about building a fortress around your assets to shield them from potential threats, including lawsuits, scams, and mismanagement. By taking deliberate steps to structure your finances, you can ensure your windfall provides security for years to come. The following strategies will help you create a solid foundation for your financial future, giving you peace of mind as you adjust to your new circumstances.

Set Up Legal Structures and Trusts

One of the smartest moves you can make is to establish legal structures, like a trust, to hold your assets. Claiming a large prize through a trust can help you maintain a degree of privacy by keeping your name out of public records. This anonymity is your first line of defense against unwanted attention and solicitations. A trust also serves as a powerful tool for asset protection. Sudden wealth can unfortunately make you a target for frivolous lawsuits or people looking to take advantage of your situation. Placing your assets in a trust separates them from you personally, making them more difficult to reach in a legal dispute.

Safeguard Your Investments

The temptation to make big, splashy investments right away can be strong, but patience is your greatest ally. Before making any decisions, take a step back and create a long-term financial plan. This isn’t the time for impulsive buys or funding a friend’s risky business venture. Start with conservative investments while you learn the ropes. It’s crucial to work with a team of vetted professionals, including a financial advisor and an attorney who can help you identify sound investment opportunities. Be wary of anyone promising unusually high returns or pressuring you to act quickly, as these are common red flags for broker fraud and negligence.

Plan Your Insurance Coverage

With greater assets comes greater liability. It’s essential to review and update your insurance policies to reflect your new financial status. A standard policy won’t be enough to protect you anymore. You should secure a substantial umbrella liability policy, which provides extra coverage beyond the limits of your existing home and auto insurance. This type of policy is designed to protect your assets from major claims and lawsuits. If someone were to get injured on your property or you were found at fault in a serious accident, an umbrella policy could prevent your new wealth from being wiped out by a legal judgment.

Prepare for Taxes

The tax man will be your first and most significant new acquaintance. A large financial windfall is considered taxable income, and it will almost certainly push you into the highest federal and state tax brackets. Before you spend a single dollar, you need a clear plan for handling your tax obligations. Work closely with a CPA or tax attorney to calculate how much you’ll owe. It’s wise to set this amount aside in a separate, secure account immediately. Your tax professional can also help you make estimated tax payments throughout the year to avoid any unpleasant surprises or penalties when it’s time to file.

How to Manage Personal Relationships

Winning the lottery is a life-changing event, and it will inevitably affect your relationships. While you might dream of sharing your good fortune, the reality can be complicated. Suddenly, friends, family, and even acquaintances may see you differently. Navigating these new dynamics requires careful thought and clear communication. The goal is to protect your relationships and your well-being, which means preparing for difficult conversations and learning to say “no” when necessary. By setting clear expectations from the start, you can manage the social pressures that come with sudden wealth and preserve the connections that matter most.

Set Boundaries with Family and Friends

It’s natural for your loved ones to be excited, but their excitement can quickly turn into expectations. To avoid straining your relationships, it’s important to set boundaries early. Let your family and friends know that you need time to process the win and create a solid financial plan before making any commitments. You can explain that you’re working with a team of advisors to make responsible decisions. This approach allows you to use your legal and financial team as a neutral third party, which can be helpful when you need to decline requests for money or business investments. This isn’t about pushing people away; it’s about creating a sustainable plan that protects both your financial future and your relationships.

Handle Requests for Money

Once news of your win gets out, you can expect to hear from people asking for financial help. These requests can come from close relatives, old friends, and complete strangers. To manage this, limit who knows about your winnings for as long as possible. Before you even claim your prize, decide who you will tell and stick to that small circle. Avoid seeking media attention beyond what is required. The less public your profile is, the fewer unsolicited “opportunities” and requests will come your way. When faced with these requests, a polite but firm “no” or “I’m not making any financial decisions right now” is a complete answer. Be wary of any pressure to invest in ventures that seem too good to be true, as these can be signs of potential investment issues.

Build a Trusted Support System

You don’t have to handle these challenges alone. In fact, you shouldn’t. One of the most important steps you can take is to build a team of trusted professionals before you claim your prize. This team will provide objective advice and help you make sound decisions. Your support system should include a financial planner who acts as a fiduciary (meaning they are legally obligated to act in your best interest), a CPA with experience in sudden wealth, and an estate planning attorney. These professionals can help you create a financial roadmap and provide a buffer between you and the many requests you’ll receive. If you need help finding qualified legal assistance, you can contact us to discuss your situation.

How to Avoid Common Scams and Pitfalls

A sudden windfall can make you a target for dishonest people and fraudulent schemes. Protecting your new wealth means staying vigilant and learning to spot the warning signs of a bad deal. Your best defense is a healthy dose of skepticism and a commitment to due diligence before making any financial decisions. Taking a slow, measured approach will help you distinguish genuine opportunities from traps designed to part you from your money. Remember, you are in control, and you have the right to say “no” or “I need more time” to any offer, no matter how appealing it sounds.

Recognize Financial Schemes

Winning the lottery can attract scams and people trying to take your money. It’s critical to be cautious of anyone asking for money or offering “investment opportunities” that seem too good to be true. Unsolicited offers, whether they come from strangers or acquaintances, should be examined carefully. Watch out for high-pressure sales tactics that rush you into a decision or promise guaranteed, high returns with little to no risk. These are common red flags for broker fraud and negligence. Always vet any financial professional or investment opportunity with your team of trusted advisors before committing any funds. A legitimate advisor will welcome your questions and provide transparent documentation.

Secure Your Bank Accounts

Before making any long-term investment decisions, your first priority is to place your winnings in a secure location. A good initial step is to put some of your winnings into a high-yield savings account. This strategy helps you build an emergency fund and allows your money to earn interest while you and your team create a comprehensive financial plan. To maximize protection, consider spreading the money across multiple accounts at different federally insured banks. This ensures your deposits remain within the FDIC insurance limits, which protects your funds in the event of a bank failure. This simple move safeguards your capital while you take the necessary time to think clearly about your future.

Keep Detailed Records

Meticulous record-keeping is one of the most powerful habits you can adopt to protect your wealth. Work with a tax specialist to understand and pay your taxes correctly, and find ways to save money on taxes. Keeping detailed records of your winnings and expenditures is crucial for managing your finances effectively. This documentation is not just for tax season; it gives you a clear picture of your cash flow and helps you stick to your financial plan. Furthermore, should you ever face disputes related to investment issues, having a thorough paper trail of every transaction, conversation, and agreement will be an invaluable asset for resolving the matter.

How to Preserve Your Wealth for the Long Term

Winning the lottery is a life-changing event, but the real work begins after the initial excitement fades. The goal isn’t just to enjoy your new wealth, but to make it last for your lifetime and for future generations. This requires a shift in mindset from short-term celebration to long-term preservation. Building a secure financial future depends on a few key pillars: creating a solid legal foundation for your assets, developing a realistic spending strategy, and surrounding yourself with a team of professionals you can trust. By focusing on these areas, you can protect your wealth from risks and ensure it continues to grow.

Create an Estate Plan

One of the first and most important steps is to create a comprehensive estate plan. Without one, your assets could become the subject of public court proceedings and create conflict among your loved ones after you’re gone. A well-structured plan ensures your wishes are carried out privately and efficiently. A great starting point is a revocable living trust, which allows you to manage your assets during your lifetime while keeping your financial affairs out of the public eye. This legal tool can help you avoid the lengthy and costly probate process, protecting your wealth and your family’s privacy.

Establish a Sustainable Spending Plan

It might seem impossible to run out of millions of dollars, but it happens more often than you’d think. The key to long-term wealth is to live off the earnings your money generates, not the principal amount itself. Before making any major purchases, work with a financial advisor to create a sustainable annual budget. For example, if your winnings generate a few million dollars a year in investment income after taxes, that becomes your spending allowance. It’s wise to wait at least six months before making significant life changes, like quitting your job or buying a mansion. This cooling-off period gives you time to adjust and make rational, informed decisions rather than emotional ones.

Maintain Your Professional Network

You cannot manage this level of wealth alone. It’s essential to build a team of trustworthy professionals who can guide you. This team should include a financial planner who acts as a fiduciary (meaning they are legally required to act in your best interest), a certified public accountant (CPA) to handle complex tax strategies, and an attorney to structure your legal and estate plans. These advisors will help you handle the complexities of your new financial situation and protect you from potential pitfalls, including cases of broker fraud and negligence. If you need help finding legal representation, you can contact us for guidance.

How to Maintain Your Well-being

Sudden wealth changes everything, not just your financial situation. It can reshape your relationships, your daily routine, and your sense of self. While the financial aspects are critical, your personal well-being is the foundation for a happy and fulfilling future. Managing the emotional and psychological shifts that come with a lottery win is just as important as managing the money. This means learning to live with your new reality in a way that feels authentic and sustainable. It’s about finding a new balance, protecting your peace of mind, and ensuring your windfall contributes to a life you genuinely love, not one filled with stress and anxiety. The initial euphoria can quickly give way to pressure from others and the weight of making perfect decisions. Taking deliberate steps to care for your mental and emotional health will help you make clear-headed choices and protect you from those who may not have your best interests at heart. This is your new life, and you deserve to enjoy it without being overwhelmed.

Adapt to Your New Lifestyle

The urge to immediately quit your job, buy a mansion, and travel the world is understandable, but the wisest move is to pause. Give yourself at least six months before making any life-altering decisions. This “cooling-off” period allows the initial shock and excitement to settle, giving you time to think clearly about what you truly want. Your life will change, but whether it’s for the better depends on the choices you make early on. Work with your financial team to understand the long-term implications of your winnings. They can help you see if your dream lifestyle is sustainable and help you avoid common investment issues that new winners often face.

Prioritize Your Mental Health

Winning the lottery can feel like a dream, but it can also bring a surprising amount of stress, pressure, and anxiety. Suddenly, you may face difficult conversations with family, requests from strangers, and the overwhelming weight of managing a fortune. The biggest challenge is often controlling your emotions and not making impulsive decisions. Before you do anything else, take a deep breath. Park your winnings in a secure, interest-earning account while you process this massive change. Protecting your mental health is crucial, as emotional decision-making can make you vulnerable to poor advice and even broker fraud and negligence. A clear mind is your best defense.

Create Your New Normal

Your old life is gone, and it’s up to you to build a new one. This process starts with establishing privacy and boundaries from day one. Before you even claim your prize, decide who in your inner circle you will tell. After you claim it, consider limiting your social media presence to make it harder for people to find and solicit you. Working with an attorney to claim your prize through a trust can help keep your name out of public records, offering a vital layer of anonymity. Your wealth can be a powerful tool for good, but only if you protect it with a clear plan. If you need guidance on setting up these legal protections, you can contact us for a confidential consultation.

Related Articles

- Lottery Winner Consultations: Protecting Your Windfall | The Frankowski Firm

- Experienced Lottery Attorneys | Protect Jackpot & Anonymity

- Lottery Lawyer for Jackpot Winners | Legal Help & Advice

- Lottery Lawyer: Expert Help for Winners to Claim Safely

- Lottery Winner Legal Representation: Protecting Your Jackpot | The Frankowski Firm

Frequently Asked Questions

Do I really need to hire a lawyer before I even claim my prize? Yes, absolutely. Think of an attorney as the first member of your essential support team. Before you even sign the ticket, a lawyer can help you understand the specific rules for claiming your prize in your state. They are critical for setting up legal structures, like a trust, which is one of the best ways to protect your identity and your assets from the very beginning. Making this your first call ensures you start off on the most secure footing possible.

Is it possible to stay completely anonymous after winning? This really depends on where you live, as each state has its own laws about disclosing lottery winners’ identities. Some states allow you to claim your prize anonymously, while others require your name to be made public. However, even in states that require disclosure, you can often gain a significant layer of privacy by claiming the prize through a legal trust. This puts the trust’s name in the public record instead of your own, making it much harder for people to find you.

What’s the biggest mistake most lottery winners make? The most common pitfall is making major decisions too quickly. The urge to quit your job, buy a new house, and start handing out money is strong, but acting on impulse before you have a solid plan is what gets people into trouble. The wisest winners take a step back for several months, assemble their professional team, and create a detailed financial plan before their lifestyle changes at all. Patience is your most valuable asset in the beginning.

How can I protect myself from scams and bad investment advice? Your best defense is to adopt a healthy sense of skepticism and slow down. Scammers and dishonest advisors thrive on creating a sense of urgency, pressuring you to act now before a “once-in-a-lifetime” opportunity disappears. A legitimate opportunity will still be there after you’ve had time to review it with your financial and legal advisors. Never commit to any investment without thorough vetting from your trusted team.

My family and friends are already asking for money. How do I handle this without ruining my relationships? This is one of the toughest challenges, and the best approach is to set clear boundaries from the start. It’s helpful to have a prepared response, explaining that you are working with a team of professionals to create a long-term financial plan and that you won’t be making any financial decisions for at least six months. This allows you to use your advisory team as a buffer, which depersonalizes the “no” and helps preserve your relationships while you get your bearings.