NO FEES UNTIL WE WIN

FREE CONSULTATION

NO FEES UNTIL WE WIN

FREE CONSULTATION

It might sound strange, but winning a massive jackpot can be one of the most stressful experiences of your life. This phenomenon, known as “Sudden Wealth Syndrome,” can trigger anxiety, guilt, and paranoia, clouding your judgment when you need it most. These intense emotions often lead to disastrous financial choices. Protecting your wealth isn’t just about numbers; it’s about managing the psychology of money. To help you stay grounded, we’ve created a practical guide to the most significant Mistakes Lottery Winners Make and How to Avoid Them. Think of this as your anchor, helping you make rational decisions while you adapt to your new reality.

Winning the lottery is a life-altering event, but not always in the ways you might imagine. While it opens a door to financial freedom, it also brings a unique set of challenges that can be surprisingly difficult to handle. The transition from a normal life to one of immense wealth is often jarring, and without careful preparation, it can lead to more problems than it solves. Many winners find themselves unprepared for the psychological and social pressures that accompany their new fortune, making them vulnerable to both internal and external threats.

The sudden influx of cash can strain relationships, attract unwanted attention, and create an overwhelming sense of responsibility. It’s not just about managing the money; it’s about managing a completely new life. From dealing with endless requests from family and friends to fending off opportunistic scammers and dishonest advisors, the experience can be isolating and stressful. The emotional weight of these changes, combined with the complexities of financial management, can lead to poor decisions with lasting consequences. Understanding these risks is the first step toward protecting yourself and your assets. It’s about building a foundation that ensures your newfound wealth becomes a source of long-term security, not a short-lived dream that ends in regret.

It might sound strange to think that having a lot of money could be a source of anxiety, but that’s the core of Sudden Wealth Syndrome. This term describes the psychological distress people often feel after a massive financial windfall. Instead of pure joy, you might experience a confusing mix of guilt, anxiety, and even fear. You may feel undeserving of the money or worry constantly about losing it. This stress can lead to paranoia about your relationships and uncertainty about your identity. It’s a disorienting experience where you feel like you’ve lost control, and these intense emotions can cloud your judgment when making critical financial decisions.

The stories you’ve heard are often true: a shocking number of lottery winners face financial trouble within a few years. This usually isn’t because they are irresponsible, but because they lack a solid financial plan. One of the biggest mistakes is making drastic life changes immediately. Buying a mansion, a fleet of luxury cars, and quitting your job without a budget can drain your funds faster than you think. It’s easy to underestimate how quickly millions can disappear when you’re not tracking expenses or accounting for taxes and long-term costs. Without a clear strategy, you risk making impulsive decisions that can lead to financial ruin.

The emotional side of sudden wealth is just as risky as the financial one. Many winners report feeling completely overwhelmed by the sudden attention and the constant requests for money. Friends, family, and even strangers may come forward with expectations, putting you in an uncomfortable position. This can lead to feelings of isolation, as you start to question who you can trust. The pressure to say yes, combined with the guilt of saying no, can drive you to make financial choices based on emotion rather than logic. Giving away too much money or getting involved in unsuitable investment issues to please others are common reactions that can jeopardize your long-term security.

The moment you realize you’ve won is exhilarating, but the decisions you make in the following days and weeks are what will truly shape your future. Before you do anything else, take a deep breath and pause. The urge to shout the news from the rooftops or make big purchases is strong, but your first priority is to protect yourself and your newfound wealth. The initial steps are less about spending and more about creating a secure foundation.

This is the time to move slowly and deliberately. Sudden wealth can attract opportunists, and making rushed decisions without proper guidance can lead to serious financial trouble. Many people fall victim to poor advice that results in devastating losses from problems like broker fraud and negligence. By taking a methodical approach from the very beginning, you can set the stage for long-term financial security and peace of mind. Think of this period as building a fortress around your assets before you decide how to furnish the castle. It’s about creating a buffer between your windfall and the world, giving you the space to think clearly and assemble a team of trusted professionals who can help you make sound choices for the long haul.

Before you tell a soul, your first action is to secure the winning ticket. Sign the back of it immediately to establish ownership. Then, make digital and physical copies and store the original ticket in a safe, private location, like a safe deposit box. Your next move is to stay quiet. Resist the urge to post on social media or tell friends and family right away. News of a major windfall can bring a flood of unwanted attention. Some states offer a grace period of anonymity for winners, which gives you valuable time to plan without public pressure. Use this time to get organized before claiming your prize.

When you claim your winnings, you’ll face a critical, irreversible decision: Do you take the money as a single lump sum or as an annuity? A lump sum gives you the entire post-tax prize money at once, offering you immediate control. An annuity, on the other hand, provides you with annual payments spread out over about 30 years, creating a steady and predictable income stream. Each option has significant financial and tax implications. This choice will affect your financial life for decades, so it’s essential to understand both paths fully before you commit.

Your lottery winnings are considered taxable income, and a large prize will place you in the highest federal tax bracket. Be prepared for a substantial tax bill. The federal government can tax your winnings up to 37%, and you’ll also owe state taxes, which vary by location. While the lottery will automatically withhold 24% for federal taxes from a large prize, this is only a portion of what you’ll actually owe. It’s crucial to set aside enough money to cover the remaining tax liability to avoid any surprises when it’s time to file.

Your first financial goal should be preservation, not aggressive growth. Before making any significant investments or purchases, work with your financial team to establish a robust emergency fund. This should be a liquid account with enough cash to cover at least a year’s worth of living expenses. This safety net ensures that you can handle unexpected costs without dipping into your core investments. Once that’s in place, you can focus on developing a diversified plan that provides steady income and protects your principal from common investment issues.

Winning the lottery isn’t just about getting a check; it’s about becoming the CEO of a new company: You, Inc. And no successful CEO runs a company alone. Before you make any big financial decisions, your first priority should be to build a team of qualified professionals to guide you. Think of them as your personal board of directors, dedicated to protecting your wealth and helping you make sound choices for the future. This group will provide the objective advice you need to handle the complexities of sudden wealth, acting as a crucial buffer between you and the flood of requests and questionable opportunities that will inevitably come your way.

Rushing into decisions without professional guidance is one of the biggest mistakes new winners make. The emotional high of winning can cloud your judgment, making you vulnerable to bad advice or outright scams. Instead, take a deep breath and use the first few months to carefully select the right people for your team. A strong team will help you create a solid foundation, protecting you from potential broker fraud and negligence and ensuring your windfall lasts for generations. They bring years of experience in areas you’re likely unfamiliar with, from complex tax laws to sophisticated investment strategies, allowing you to make informed choices rather than emotional ones.

A financial advisor will be your day-to-day guide for managing your new wealth. It’s critical to find a “fiduciary,” which means they are legally required to act in your best interest at all times. This isn’t just a suggestion; it’s a legal standard that ensures their advice is tailored to your goals, not their own commissions. Your advisor will help you map out a long-term financial plan, create a realistic budget, and develop an investment strategy that aligns with your risk tolerance and life goals. They are your strategic partner in turning a lottery ticket into lasting financial security.

While a financial advisor manages your growth strategy, a lawyer protects what you have. You need an attorney with a deep understanding of investment issues and securities law. This legal professional will review contracts, vet potential investments, and help you set up legal structures like trusts to protect your assets from creditors and frivolous lawsuits. They are your first line of defense against the sophisticated scams and high-pressure tactics often aimed at lottery winners. Don’t sign anything or agree to any deals without having your lawyer review it first. Their job is to spot the red flags you might miss.

The tax man will be your first and biggest bill. Lottery winnings are taxed as income, and a large prize will instantly place you in the highest federal and state tax brackets. A Certified Public Accountant (CPA) is essential for managing this. They will help you calculate exactly how much to set aside for taxes and make sure you meet all payment deadlines. At the same time, an estate planning attorney will help you think about the future. They can help you establish trusts and create a plan to provide for your loved ones and support the causes you care about, minimizing tax burdens for your heirs.

Building your team is the first step, but managing your wealth is an ongoing process. Your life and goals will change, and your financial plan needs to adapt along with them. Plan to meet with your entire team of advisors at least once or twice a year to review your portfolio, budget, and long-term strategy. These regular check-ups keep everyone on the same page and ensure your financial plan remains aligned with your vision for the future. This proactive approach helps you stay in control of your finances and make adjustments before small issues become big problems.

Winning a large sum of money instantly changes your life, and unfortunately, it can make you a target. Suddenly, everyone from distant relatives to complete strangers may feel entitled to a piece of your fortune. Protecting your privacy isn’t about being secretive; it’s about safeguarding your financial future and personal well-being. Before you make any public announcements or major decisions, your first priority should be to create a buffer between your newfound wealth and the outside world. This involves carefully managing who knows about your win, securing your digital footprint, and thinking proactively about your physical safety. By taking these steps, you can control the narrative and give yourself the time and space needed to plan your next moves without undue pressure or risk.

Your first instinct might be to shout your good news from the rooftops, but it’s wise to resist that urge. News of a lottery win travels fast and can bring a flood of unwanted attention. Before you tell anyone, sign your ticket and put it in a secure location. Then, speak with your legal and financial team to understand your state’s publicity requirements for lottery winners. Some states allow you to claim your prize anonymously, while others don’t. Keeping your circle of trust small in the beginning gives you the breathing room to make a solid plan without being bombarded by requests and unsolicited advice from every direction.

In many states, you can claim your prize through a legal entity like a trust. This is a powerful strategy for maintaining your privacy, as the trust’s name—not yours—appears on public records. Your legal team can help you set this up correctly. Beyond that, it’s a good time for a digital security audit. Update the passwords on your financial and email accounts, enable two-factor authentication everywhere you can, and be extremely cautious about sharing personal information online. Scammers often target individuals who have recently come into money, so be on high alert for phishing emails and suspicious messages.

A sudden influx of wealth can unfortunately make you a target for scams, fraudulent investment schemes, and other threats. People you know and people you don’t will come forward with business proposals and investment opportunities. While some may be legitimate, many will not be. It’s crucial to vet every single proposal with your financial and legal advisors. Learning to recognize the common investment issues that can arise is a key step in protecting your assets. Your safety is paramount, and that includes protecting yourself from those who would take advantage of your new financial situation.

Once the news is out, you will inevitably face requests for money from family, friends, and charities. It’s emotionally taxing to say no, so it helps to have a plan in place beforehand. Work with your financial team to decide how you want to handle charitable giving and requests from loved ones. You can then create a clear, consistent response. A simple, polite statement like, “We are so grateful for this opportunity, and we’re working with our advisors to create a long-term plan. Until that’s in place, we can’t make any financial commitments,” can help manage expectations and set healthy boundaries from the start.

When you suddenly have a lot of money, everyone seems to have an opinion on how you should spend it. While some advice may be well-intentioned, your new financial status makes you a target for requests, bad investment ideas, and outright scams. Setting clear, firm boundaries from the very beginning is one of the most important things you can do to protect your wealth, your well-being, and even your relationships.

This isn’t about being selfish or secretive; it’s about being smart. You need time and space to process your new reality and work with your professional team to create a solid financial plan. Without boundaries, you can quickly feel overwhelmed by the pressure to give, lend, and invest. This can lead to financial losses and strained relationships with the people you care about most. Learning to say “no,” or at least “not right now,” is a skill you’ll need to develop quickly. It allows you to take control of your finances and make decisions that align with your long-term goals, not someone else’s immediate wants.

It’s natural to want to share your good fortune, but making promises you can’t keep can cause serious problems. Letting friends and family believe you’ll pay off their debts or fund their dreams can lead to disappointment and resentment if your help doesn’t meet their expectations. Instead of making immediate commitments, be honest. Let them know you need time to create a thoughtful financial plan with your advisors before making any major decisions. This approach manages expectations without shutting anyone down, giving you the breathing room to think clearly and act strategically rather than emotionally. It’s a way to protect your relationships for the long haul.

Your new wealth puts a giant target on your back. Suddenly, you’ll be approached by people with “once-in-a-lifetime” opportunities. Many lottery winners become the focus of scammers who pitch bad investments or fraudulent schemes. Be wary of anyone who pressures you to act quickly, promises guaranteed high returns, or offers unsolicited advice. These are classic red flags for investment issues that can drain your accounts. Trust your instincts. If an offer sounds too good to be true, it almost certainly is. A healthy dose of skepticism is your best defense against those looking to take advantage of your new financial situation.

Just because an investment idea comes from a friend doesn’t mean it’s a good one. It’s crucial to vet every single proposal, no matter who it comes from. Never put money into a business or investment you don’t fully understand. This is where your team of financial professionals is essential. They have the experience to analyze opportunities, identify risks, and spot the warning signs of broker fraud and negligence. Your regular accountant might not be equipped to handle this level of wealth, so make sure your advisors have specific experience with high-net-worth clients. They can help you distinguish between legitimate opportunities and potential disasters.

Requests for money are going to happen, so it’s best to have a plan in place before they start rolling in. Decide ahead of time how you want to handle charitable giving and financial assistance to family and friends. Working with your financial team, you can establish a clear, consistent strategy. This might involve setting up a trust, creating a foundation, or simply allocating a specific amount for gifts each year. Having a system allows you to respond to requests thoughtfully instead of reactively. It also gives you a polite way to decline requests that don’t fit within your plan, preserving both your capital and your relationships.

Winning the lottery gives you a financial windfall, but turning that windfall into lasting wealth requires a strategic shift in mindset. The initial excitement is understandable, but the choices you make in the first year will set the foundation for the rest of your financial life. This isn’t about just spending money; it’s about becoming a steward of your newfound resources. A sustainable strategy moves beyond immediate gratification and focuses on long-term preservation and growth, protecting you from the pitfalls that have cost many winners their fortunes.

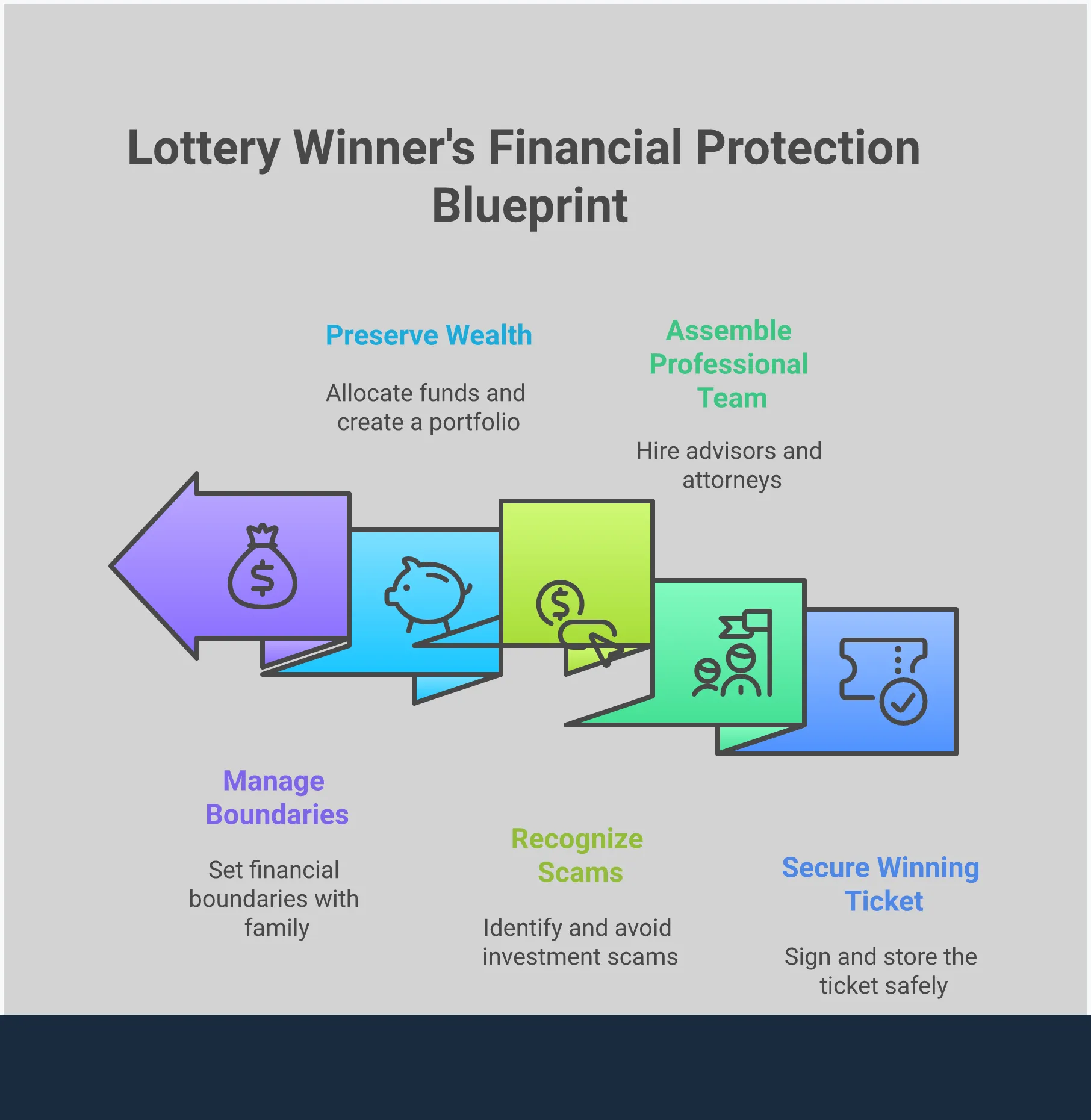

Building this strategy involves four key pillars: creating a realistic budget to understand your new financial reality, developing a smart investment plan to protect and grow your assets, establishing an estate plan to protect your legacy, and planning for future generations to ensure your wealth has a lasting positive impact. Each of these steps requires careful thought and guidance from your team of professionals. Rushing into major financial decisions without a comprehensive plan is one of the most common ways sudden wealth is lost. By taking a measured, deliberate approach, you can create a financial future that is secure, stable, and aligned with your personal values and goals.

Before you make any life-altering decisions, take a deep breath and create a budget. The first six months are critical, and it’s wise to avoid impulsive buys or quitting your job until you have a clear picture of your long-term financial situation. A budget isn’t about limiting your fun; it’s about empowering you with knowledge. It helps you understand what you can truly afford after taxes, fees, and initial expenses are accounted for. Work with your financial advisor to map out your income, essential costs, and discretionary spending. This simple exercise provides the clarity needed to make smart choices that support your wealth for years to come, rather than depleting it in a matter of months.

With significant wealth, your primary goal should shift from rapid growth to capital preservation. You’ve already won the jackpot; now, the objective is to keep it. A smart investment plan is your best defense against risky ventures and predatory schemes. Work closely with your financial advisor to build a diversified portfolio designed for steady, reliable income. Be cautious of anyone promising unusually high returns, as this is a common red flag for investment issues. A well-thought-out plan protects your principal while allowing for reasonable growth, ensuring your financial security isn’t gambled away on speculative opportunities. This disciplined approach is the cornerstone of responsible wealth management.

An estate plan is an essential tool for managing your assets and protecting your loved ones. Without one, your wealth could become a source of conflict, leading to messy court battles and strained family relationships after you’re gone. The first step is often to create a revocable living trust, which allows you to control your assets while you are alive and ensures they are distributed according to your wishes without going through the public probate process. This not only protects your privacy but also provides a clear roadmap for your heirs. Consulting with an estate planning attorney early on will help you structure your assets in a way that minimizes taxes and prevents future legal headaches.

Ensuring your wealth benefits your family for generations to come requires thoughtful planning. Simply leaving a large inheritance without structure can sometimes do more harm than good. Trusts are a powerful tool for this purpose, as they allow you to set specific rules for how and when your heirs receive their inheritance. You can stipulate that funds be used for education, a home purchase, or starting a business, which can help prevent reckless spending. By using trusts to manage larger gifts, you can control the distribution over time, giving your beneficiaries the opportunity to learn financial responsibility. This approach helps you create a lasting legacy that supports your family’s well-being long into the future.

Even with a solid plan, the pressures of sudden wealth can lead you astray. Staying vigilant and recognizing the early signs of financial trouble is key to protecting your future. It’s not about being paranoid; it’s about being prepared. When you can identify a potential problem before it grows, you have the power to correct your course and keep your financial foundation secure. Pay attention to shifts in your spending habits, the quality of investment advice you receive, and your own emotional responses to money. These are often the first indicators that something isn’t right.

It’s natural to want to enjoy your new wealth, but it’s easy for small upgrades to spiral into unsustainable spending. This is often called lifestyle inflation, where your spending increases just because your income has. One day you’re buying a slightly nicer car, and the next you’re maintaining a mansion and a fleet of luxury vehicles. According to Forbes, this compulsion to spend more can create immense financial strain. The biggest red flag is a lack of budgeting. If you aren’t tracking your expenses or find yourself consistently spending more than you planned, it’s time to reassess. A clear, written budget is your best defense against letting your lifestyle consume your winnings.

With new wealth comes a flood of investment opportunities, and the pressure to act fast can be intense. However, many lottery winners lose millions by rushing into investments without proper guidance. You might encounter brokers pushing complex products you don’t understand or feel pressured to invest in a “sure thing” presented by a friend. These situations are ripe for broker fraud and negligence. A major warning sign is any investment proposal that promises guaranteed high returns with little to no risk. Always take your time, conduct thorough due diligence, and have every proposal vetted by your trusted financial and legal advisors. Never sign anything you don’t fully comprehend.

The psychological impact of winning the lottery is immense. Many winners experience “sudden wealth syndrome,” which can bring on feelings of guilt, anxiety, and isolation. These emotions can trigger irrational financial decisions, like giving away large sums of money to appease a demanding relative or spending lavishly to feel a sense of normalcy. This can cause winners to spend emotionally rather than rationally. If you notice yourself making financial choices based on guilt, fear, or the desire for approval, take a step back. Acknowledge the emotion and consult your financial plan or a trusted advisor before acting.

You will likely face an overwhelming number of requests for money from friends, family, and even strangers. Saying “no” can be incredibly difficult, and the stress can lead to poor financial management. It is not a sign of weakness to admit you need help managing these complex situations. In fact, it’s one of the smartest things you can do. If you feel pressured, manipulated, or are concerned about potential investment issues, it is time to lean on your professional team. Your lawyer and financial advisor can act as a buffer, helping you field requests and vet opportunities. If you suspect you’ve been misled by a financial professional, you should contact a securities fraud attorney immediately.

Winning the lottery isn’t the finish line; it’s the starting point of a new financial life. The choices you make from here on out will determine whether this windfall provides lasting security or becomes a source of stress. Maintaining your financial well-being requires a proactive and thoughtful approach. It’s about shifting your mindset from winning a prize to managing a significant asset. This means creating sustainable habits, adapting to your new reality with care, and always prioritizing the long-term health of your finances over short-term thrills. By staying grounded and intentional, you can ensure your good fortune truly lasts a lifetime.

Just as you see a doctor for regular health check-ups, your finances need consistent attention to stay in good shape. It’s wise to build a team of qualified professionals to help you manage your new wealth. This team should include a financial planner, a tax professional, and a lawyer who can act as your guides. They can help you make smart choices and avoid common pitfalls. Schedule meetings with them quarterly or semi-annually to review your financial plan, assess your investments, and adjust for any life changes. These regular check-ins keep everyone on the same page and ensure your strategy remains aligned with your long-term goals, protecting you from potential investment issues down the road.

The temptation to start spending immediately can be overwhelming, but one of the smartest moves you can make is to pause. Give yourself at least six months, or even a full year, before making any major financial decisions like buying a mansion or a fleet of luxury cars. This cooling-off period allows the initial shock and excitement to fade, so you can think more clearly. Work with your financial planner to understand what your new budget can realistically sustain for the rest of your life. This isn’t about depriving yourself; it’s about creating a spending plan that allows you to enjoy your wealth without risking it. Thoughtful planning prevents you from becoming a victim of the kind of broker fraud and negligence that preys on impulsive decisions.

While your bank account has changed overnight, the rest of your life will take time to catch up. It’s important not to rush into drastic lifestyle changes, like quitting your job or buying expensive things, without knowing what you can truly afford long-term. A sudden shift can be jarring and may lead to isolation or poor decisions. Instead, make gradual adjustments. Maybe you reduce your work hours instead of quitting, or you upgrade your home instead of buying a sprawling estate right away. This measured approach gives you time to adapt emotionally and practically to your new circumstances. If you need guidance on the legal implications of these changes, you can always contact us for a consultation.

Your primary goal should be to keep the money you’ve won, not just to grow it as fast as possible. Aggressive, high-risk investments might promise quick returns, but they also carry the potential for devastating losses. True financial freedom comes from stability and security. Work with your financial advisor to build a safe, diversified investment portfolio designed to provide steady, reliable income for decades to come. This conservative approach protects your principal and ensures your wealth will be there for you and future generations. If an investment strategy ever goes wrong due to misconduct, understanding the securities arbitration process is crucial for recovering your losses.

Do I really need a whole team of professionals? A good financial advisor seems like enough. Think of it this way: a financial advisor is like a general contractor for your wealth, but you still need specialists like an electrician and a plumber. Your advisor helps create the overall financial plan, but an attorney specializing in securities law protects you from bad deals and fraud, while a CPA manages the complex tax implications. Each professional plays a distinct role, and together they create a complete safety net to protect your assets from every angle.

What is the single most important thing I should do in the first week? The most important thing you can do is almost nothing at all. After you’ve signed and secured your ticket, your only job is to stay quiet. Don’t quit your job, don’t buy a new house, and don’t tell everyone you know. This quiet period is your most valuable asset, giving you the time and space to think clearly and assemble your professional team before making any irreversible decisions under pressure.

How can I say “no” to family and friends asking for money without causing a fight? Instead of a flat “no,” you can frame your response around your process. A calm and consistent reply like, “I’m working with my advisors to create a long-term financial plan, and I can’t make any commitments until that’s in place,” can be very effective. This shifts the focus from a personal rejection to a responsible financial strategy, which helps manage expectations and gives you the space to make thoughtful decisions later on.

Is it better to take the lump sum or the annuity payments? There isn’t a one-size-fits-all answer, as the best choice depends on your personality and long-term goals. A lump sum gives you immediate control over the entire amount, which is great for large investments but also carries the risk of mismanagement. An annuity provides a steady, predictable income for decades, acting as a built-in safeguard against overspending. This is a critical decision that you should explore in depth with your financial and legal team before you claim your prize.

My broker is recommending an investment with very high returns. How do I know if it’s legitimate? A promise of unusually high returns with little to no risk is one of the biggest red flags in the financial world. Legitimate investments always carry a level of risk that is proportional to their potential return. Before you agree to anything, you should have the proposal thoroughly reviewed by your attorney and a fiduciary financial advisor. They can analyze the fine print and help you identify the warning signs of a bad investment or potential broker misconduct.