For families across Alabama, investment fraud isn’t just a headline—it’s a devastating reality that can erase a lifetime of hard work and careful planning. When your retirement or savings are on the line, the stakes couldn’t be higher. If you’ve suffered significant financial losses and believe a broker’s misconduct is to blame, it’s important to know that our state has specific laws designed to protect you. This guide is for Alabama investors who need clear answers and a path forward. We’ll cover your rights, the steps to take, and how to build a strong case. Finding the right local advocate, like a Mobile, Alabama investment fraud attorney, is a critical part of that journey.

Key Takeaways

- Trust your instincts and verify everything: Before investing, research financial professionals using tools like FINRA’s BrokerCheck and be wary of common red flags like guaranteed high returns or high-pressure sales tactics.

- Preserve evidence if you suspect fraud: Your first move should be to gather all account statements, emails, and notes from conversations to create a detailed timeline that can serve as the foundation for your case.

- A specialized attorney is your strongest advocate: Investment fraud cases follow specific legal paths, like FINRA arbitration, and working with a lawyer who focuses on securities law ensures your rights are protected and you have a clear strategy for recovery.

Spotting the Red Flags of Investment Fraud

Trusting someone with your hard-earned money is a big step, and unfortunately, not everyone in the financial world has your best interests at heart. Learning to recognize the warning signs of a bad deal is your first line of defense. Scammers often use similar tactics, and knowing what to look for can help you protect your savings from potential harm. It’s about being informed and cautious, not paranoid. When you can identify the tell-tale signs of a fraudulent scheme, you empower yourself to walk away before any damage is done.

Common Investment Scams to Know

Investment fraud can show up in many different ways, from complex Ponzi schemes to straightforward broker fraud and negligence. You might hear about pump-and-dump schemes, where fraudsters artificially inflate a stock’s price only to sell it off, leaving other investors with worthless shares. Another common issue is when a broker recommends investments that are completely wrong for your financial situation or risk tolerance. The common thread in these situations is often a promise of unusually high returns with little to no risk. If an opportunity sounds too good to be true, it’s wise to take a step back and look closer.

Key Warning Signs to Watch For

Fraudsters often rely on pressure and confusion to get what they want. Be wary of anyone who guarantees high returns—all legitimate investments carry some level of risk. Another major red flag is pressure to invest immediately. Scammers create a false sense of urgency to prevent you from doing your research or thinking things through. They might also present overly complex strategies that are difficult to understand or provide very little paperwork. A legitimate investment adviser will give you clear, written information and the time you need to review it. If you feel rushed or confused about any investment issues, it’s a sign to proceed with caution.

How Fraud Affects Alabama Investors

The consequences of investment fraud go far beyond a number on a bank statement. For families across Alabama, it can mean the loss of a life’s savings, a retirement fund that disappears overnight, or a college fund that’s suddenly gone. The financial loss is devastating, but the emotional toll—the stress, the feeling of betrayal, and the uncertainty about the future—can be just as difficult. These scams don’t just happen to other people; they affect our neighbors and community members right here. If you’ve experienced significant financial losses and suspect you were misled, it’s important to know that you are not alone and that you have options. You can contact us to discuss your situation.

What to Do if You Suspect Investment Fraud

Realizing that your hard-earned money might be at risk due to fraud is a deeply unsettling experience. It’s easy to feel overwhelmed or unsure of what to do next. The most important thing is to act deliberately and strategically to protect yourself and your assets. Taking a few key steps right away can make a significant difference in your ability to address the situation and work toward a resolution.

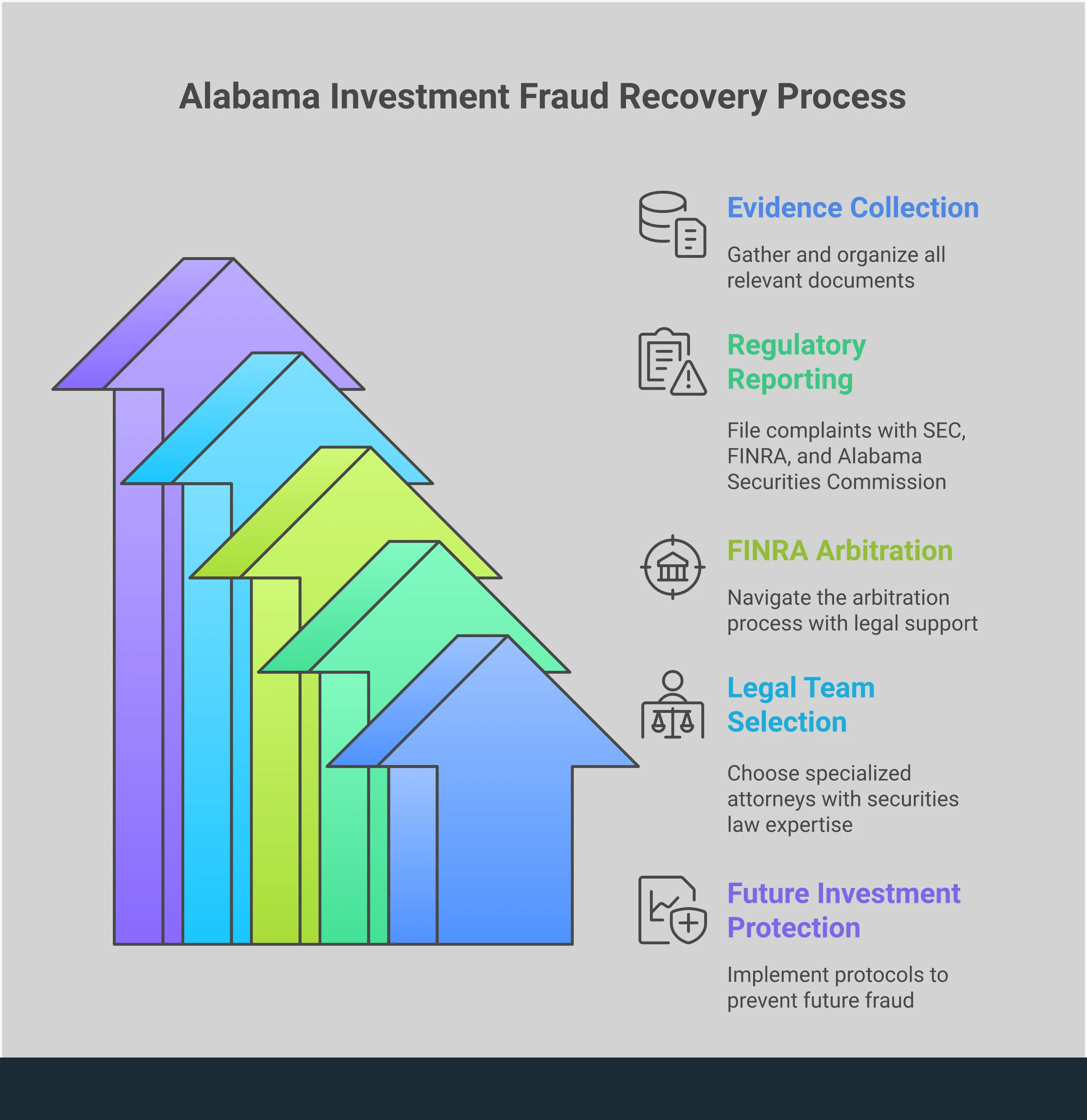

Your immediate actions should focus on preserving evidence, alerting the proper authorities, and getting sound legal advice. By following a clear plan, you can move forward with confidence, knowing you are taking the right steps to protect your financial future. This process begins with careful documentation and ends with finding the right professional to guide you through the complexities of your claim. Each step is designed to build a foundation for a strong case and help you understand your options for recovering your losses from broker fraud and negligence.

Document Everything

Your first move should be to gather every piece of paper and digital communication related to your investment. Think of yourself as a detective building a case file. Collect account statements, trade confirmations, emails, text messages, and any promotional materials you received. If you had phone calls or meetings, write down your memories of those conversations, including dates, topics discussed, and any promises that were made. Creating a detailed timeline of your interactions and transactions is incredibly helpful. This meticulous record-keeping is crucial because it provides the factual backbone for any future legal action you might take.

Report the Fraud to Authorities

Reporting suspected fraud to regulatory bodies is a critical step. You can file a complaint with the U.S. Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA), and your state’s securities regulator. These organizations investigate misconduct and can take disciplinary action against brokers and firms, which helps protect other investors from falling into the same trap. While reporting to authorities is important for the industry at large, keep in mind that their primary role is enforcement, not necessarily recovering your individual losses. You may even be eligible to become an SEC whistleblower, which has its own specific process and potential outcomes.

Protect Your Financial Records

While you are gathering documents, it’s equally important to protect them. Secure all original hard copies in a safe place and make digital backups by scanning or photographing them. This ensures that your evidence is preserved, even if the originals are lost or damaged. It’s also a good idea to monitor your other financial accounts for any unusual activity as a precaution. These records are the primary evidence you will use to demonstrate how the fraud occurred and the extent of your financial damages. Protecting them is fundamental to building a strong case and addressing the investment issues you are facing.

Schedule a Legal Consultation

Investment fraud cases are complex, and the rules governing them are highly specific. This is not a situation you should handle on your own. Scheduling a consultation with an attorney who concentrates on securities law will give you a clear understanding of your rights and legal options. An attorney can review your documentation, assess the strength of your claim, and explain the process for seeking recovery, which often involves securities arbitration. This initial conversation can provide you with a clear path forward and the support you need during a difficult time. Don’t hesitate to contact a law firm to get the guidance you deserve.

How an Investment Fraud Attorney Can Help

When you realize your investments have been compromised by fraud, it can feel overwhelming and isolating. You might not know where to turn or what steps to take first. This is where an investment fraud attorney comes in. Their role is to guide you through the legal process, stand up for your rights, and work to recover the money you’ve lost. These cases are often incredibly complex, involving specific industry rules and powerful financial firms. Trying to handle it alone can be a significant challenge.

An attorney who focuses on investment issues can level the playing field. They understand the tactics brokerage firms use and know how to build a strong case against them. From investigating your claim and gathering evidence to representing you in legal proceedings, they manage every detail. An investment fraud lawyer’s role is to hold accountable those who break the law or violate their duties to you as an investor. They act as your advocate, ensuring your story is heard and that you have a dedicated professional fighting for your financial future. Having this support allows you to focus on moving forward while they handle the legal complexities.

What to Expect During a Case Evaluation

Your first step is usually a case evaluation. Think of this as a confidential conversation where you can share your story and get a clear picture of your options. You’ll discuss what happened with your investments, review any documents you have, and ask any questions that are on your mind. The attorney will listen carefully to understand the details of your situation.

During this meeting, the attorney will assess the merits of your claim and explain the potential paths forward. An investment fraud attorney can help ensure you don’t make critical errors that could end your case prematurely or limit your recovery. This initial consultation is a crucial, no-pressure step to determine if you have a case and to understand how a law firm can help you.

Representing You in FINRA Arbitration

Most disputes between investors and brokerage firms are resolved through a process called securities arbitration, which is overseen by the Financial Industry Regulatory Authority (FINRA). This is a specialized legal forum with its own set of rules and procedures, and it’s very different from a typical courtroom trial. Your attorney will handle the entire arbitration process for you.

This includes filing the official claim, conducting discovery to gather evidence from the brokerage firm, and presenting your case before a panel of arbitrators. Having a lawyer who is well-versed in FINRA rules is essential. They will advocate on your behalf during hearings, question witnesses, and make a compelling argument for why you deserve to be compensated for your losses.

Negotiating a Fair Settlement

Not every case goes to a final arbitration hearing. In many instances, it’s possible to reach a settlement with the brokerage firm beforehand. An experienced attorney knows how to negotiate effectively to secure a fair outcome for you. They will build a strong case from the very beginning, putting pressure on the opposing side to come to the table with a reasonable offer.

Your lawyer will handle all communications and negotiations, protecting you from the stress of dealing directly with the firm that wronged you. They can evaluate any settlement offers, advise you on whether they are fair, and counter with a demand that accurately reflects your financial damages. Their goal is to resolve your case efficiently while making sure your losses are properly addressed.

Creating a Strategy to Recover Your Losses

From the moment you decide to work with an attorney, they will begin developing a comprehensive strategy tailored to your unique situation. Investment fraud occurs when a financial professional uses deceptive practices to mislead investors and cause financial harm. Your lawyer’s strategy will focus on proving this misconduct and demonstrating its impact on you.

This plan involves a deep dive into your financial records, communication logs, and the broker’s history. The attorney will identify the specific rules that were broken and build a narrative that clearly shows how you were wronged. Every action taken—from the initial claim to the final resolution—is part of a deliberate strategy designed to recover your hard-earned money and hold the responsible parties accountable for their actions.

Know Your Rights as an Alabama Investor

When you discover you’ve been a victim of investment fraud, it can feel isolating and overwhelming. But you are not alone, and more importantly, you have rights. A robust system of state and federal laws exists specifically to protect investors from deceptive and harmful practices. Understanding these protections is the first step toward holding the responsible parties accountable and working to recover your hard-earned money.

Investment fraud happens when a financial professional uses misleading information or deceptive tactics to cause you financial harm. This isn’t just a breach of trust; it’s a violation of the law. Both Alabama and the federal government have established rules that brokers and financial advisors must follow. When they break these rules, you have legal options. These laws provide a framework for you to take action, whether through securities arbitration or another legal avenue. Knowing your rights empowers you to move forward with confidence and seek the justice you deserve.

Alabama’s Securities Laws

Here in Alabama, you are protected by specific state laws designed to police the financial industry and shield investors from wrongdoing. The Alabama Securities Act is the primary legislation that governs the sale of securities in our state. Its main goal is to ensure a fair and honest market by requiring transparency and holding financial professionals to a high standard of conduct. When a broker engages in deceptive practices, they are not just breaking your trust—they are likely breaking state law. These regulations give you a direct path to hold them accountable for the financial harm they’ve caused.

Federal Laws That Protect You

In addition to state-level rules, a powerful set of federal laws provides another layer of protection. Victims can sue under federal and state laws, including the Securities Act of 1933 and the Securities Exchange Act of 1934. These landmark laws hold people strictly responsible for fraud related to securities. The 1933 Act focuses on ensuring you receive all the important financial information about a security before you invest, while the 1934 Act regulates the market and created the Securities and Exchange Commission (SEC). These federal statutes are foundational to preventing broker fraud and negligence and give you strong legal standing to pursue a claim.

Understanding Filing Deadlines

When you suspect investment fraud, time is of the essence. There are strict deadlines, known as statutes of limitations, for filing a claim. It’s critical to act quickly, because the longer you wait, the harder it can be to get your money back. These deadlines vary depending on the type of claim and whether it falls under state or federal law. Missing a deadline can mean losing your right to recover your losses forever. This is why it’s so important to speak with an attorney as soon as you notice something is wrong. They can help you understand the specific time limits that apply to your situation and ensure you contact us to file all necessary paperwork on time.

What Damages Can You Recover?

If your case is successful, you may be able to recover more than just your initial losses. The goal of a legal claim is to make you whole again. You might get back your lost investments, which are known as compensatory damages. In some cases, you could also receive extra money as punishment for the wrongdoer (punitive damages) and even compensation for emotional distress. The specific damages you can recover will depend on the details of your case and the venue where your claim is heard, such as a FINRA arbitration panel. An experienced attorney can evaluate your situation and give you a clear idea of the potential compensation you could pursue.

How to Build a Strong Case

When you realize you’ve been a victim of investment fraud, taking action can feel overwhelming. It’s easy to feel lost, but building a strong case is about methodically putting the pieces together to tell your story clearly. This process requires careful organization and a clear understanding of what’s needed to prove your claim. While your attorney will guide you through the legal complexities, your role in gathering information is vital. Think of it as taking back a bit of control in a situation that made you feel powerless.

By focusing on these concrete steps, you can create a solid foundation to pursue the recovery you deserve. This preparation is the first and most important step toward holding the responsible parties accountable for their actions. It transforms a confusing and emotional experience into a structured narrative that can be presented effectively. Your efforts here will directly support your legal team as they work to build the strongest possible argument on your behalf, setting the stage for the entire process.

Gather the Right Documents

Your first step is to pull together every piece of paper and digital file related to your investment. Think of yourself as an archivist for your own case. This includes account statements, trade confirmations, contracts you signed, and any prospectuses or marketing materials you were given. Don’t forget to collect all correspondence, such as emails, letters, and even text messages between you and your broker or advisor. A lawyer specializing in investment fraud can help you identify which documents are most critical and ensure you don’t make errors that could harm your case. Having these materials organized and ready will save time and help your legal team get started right away.

Collect Key Evidence

Beyond official documents, other evidence can be just as powerful. Start by writing a detailed timeline of your relationship with the financial professional. When did you first meet? What did they promise you? When did you invest, and when did you start noticing problems? Include notes from any phone calls or meetings, writing down what was said to the best of your memory. An investment fraud lawyer’s role is to hold accountable those who violate their duties. Your detailed account provides the personal context that brings the documents to life, showing how their broker fraud and negligence directly impacted your financial well-being.

What is the Timeline for a Fraud Case?

It’s natural to want to know how long it will take to resolve your case, but the truth is, there’s no simple answer. These types of cases can be extremely complex, and no two are alike. The timeline depends on many factors, including the complexity of the fraud, the amount of evidence, and whether the other party is willing to negotiate. Many investment disputes are resolved through securities arbitration, which has its own set of procedures and timelines. While it can be a lengthy process, a dedicated attorney will keep you informed at every stage, from the initial investigation and filing of a claim to the final resolution.

Understanding Your Potential Compensation

At its core, investment fraud occurs when a financial professional uses deceptive practices to mislead you and cause financial harm. The goal of a legal claim is to recover the losses you suffered as a result. This compensation, often called “damages,” is meant to make you whole again. It typically includes the actual money you lost from your investment. In some cases, you may also be able to recover interest, attorney’s fees, and other costs associated with the case. Your attorney will carefully analyze your situation to determine the full extent of your losses and fight for the maximum compensation you are entitled to for the investment issues you faced.

How to Choose the Right Attorney for You

Finding the right legal partner is one of the most important steps you’ll take toward recovering your losses. After the stress and uncertainty of investment fraud, you need an advocate who not only understands the law but also understands what you’re going through. The attorney you choose can significantly shape the outcome of your case, so it’s worth taking the time to find a firm that feels like the right fit. When you start your search, focus on a few key areas, including the attorney’s specific experience, a clear fee structure, and how to prepare for your first meeting. This process is about finding someone you can trust to guide you through the legal system and fight for your financial recovery.

What to Look For in an Attorney

When you’re looking for an attorney, specific experience matters. Investment fraud cases have unique complexities, so you’ll want a lawyer who concentrates on this area of law. A general practice attorney may not be familiar with the specific rules and procedures of the Financial Industry Regulatory Authority (FINRA) or the nuances of broker fraud and negligence. Look for a firm whose primary focus is representing investors. Their background in handling cases similar to yours means they already know the challenges and strategies involved. This specialized knowledge is a powerful asset when you’re trying to hold financial professionals accountable and recover your hard-earned money.

Understand the Fee Structure

Concerns about legal fees are completely normal, but don’t let them stop you from seeking help. Most reputable investment fraud attorneys work on a contingency fee basis. This means you don’t pay any attorney’s fees unless they successfully recover money for you. The firm’s fee is a percentage of the amount they recover on your behalf. This arrangement allows you to pursue justice without needing to pay for legal services upfront. During your initial consultation, which is typically free, be sure to ask for a clear explanation of the fee structure and any other potential costs. A trustworthy attorney will be transparent about all financial aspects of your case from the very beginning.

Prepare for Your Consultation

To make your first meeting as productive as possible, take some time to gather all your documents. This preparation helps an attorney get a clear picture of your situation and provide you with tailored advice. Collect everything related to your investment, including account statements, trade confirmations, emails or letters from your broker, and any notes you took during conversations. Create a simple timeline of events, noting when you opened the account, when key transactions occurred, and when you first suspected something was wrong. Bringing this information allows the attorney to conduct a more thorough evaluation of your potential investment issues and outline your legal options.

Key Questions to Ask Your Attorney

Your initial consultation is a two-way street. It’s your chance to interview the attorney just as much as it is for them to evaluate your case. Don’t hesitate to ask direct questions to make sure you feel confident in their ability to represent you.

Consider asking questions like:

- How many cases like mine have you handled?

- What is your approach to the securities arbitration process?

- Based on what you see, what are the potential outcomes for my case?

- Who will be my main point of contact at the firm?

- How will you keep me updated on my case’s progress?

The right attorney will answer your questions clearly and directly, helping you understand what to expect moving forward.

What Does the Recovery Process Look Like?

After discovering you’ve been a victim of investment fraud, the path to getting your money back can feel overwhelming. It’s completely normal to feel uncertain about what comes next. The good news is that there are established procedures designed to help investors recover their losses from financial misconduct. Understanding these steps can bring a sense of clarity and control back into your life. The journey involves several key stages, from filing a formal claim to presenting your case, and having a dedicated legal team by your side can make all the difference.

The most common route for investors is through an arbitration process, which is a more streamlined alternative to a traditional court battle. However, other options like mediation or even a lawsuit might be more appropriate depending on your situation. Each path has its own timeline and set of procedures. While it’s impossible to predict exactly how long it will take, knowing the general framework helps set realistic expectations. The ultimate goal is to hold the responsible parties accountable and work toward restoring your financial stability.

The FINRA Arbitration Process, Step-by-Step

Most disputes between investors and their brokerage firms are handled through the Financial Industry Regulatory Authority (FINRA). Think of it as a specialized court system for the investment industry. The process begins when your attorney files a Statement of Claim on your behalf, detailing the misconduct and your losses. From there, both sides select an impartial arbitrator (or a panel of them) to hear the case. You’ll then go through a discovery phase to exchange documents and evidence. The process culminates in a hearing where your attorney presents your case, and the arbitrators make a final, binding decision. This securities arbitration process is often faster and less formal than going to court.

Explore Other Resolution Options

While FINRA arbitration is common, it isn’t the only way to resolve a dispute. Mediation is another option, where a neutral third party helps you and the opposing side negotiate a mutually agreeable settlement. It’s less adversarial than arbitration and can sometimes lead to a faster resolution. In some specific circumstances, filing a lawsuit in state or federal court might be the right strategy, though this is generally a more complex and lengthy process. The best approach for your case will depend on the unique details of your investment issues and the nature of the fraud you experienced. An attorney can help you weigh the pros and cons of each option.

How Long Does Recovery Take?

One of the first questions on every investor’s mind is, “How long will this take?” Unfortunately, there’s no single answer. The timeline for recovering your losses can vary significantly. A straightforward case that settles early might resolve in a matter of months. However, a more complex case that proceeds through a full arbitration hearing could take a year or longer. Factors that influence the timeline include the complexity of the fraud, the amount of evidence to review, and the willingness of the other party to negotiate. While the process requires patience, a thorough approach is essential to building a strong case and working toward a meaningful recovery.

Protect Your Financial Future

Attempting to recover funds alone can be risky. Simple mistakes in filing paperwork or missing a critical deadline could potentially harm your case or limit the amount you can recover. Working with an attorney who focuses on broker fraud and negligence ensures that your rights are protected every step of the way. A legal professional can handle the complexities of the legal system, gather the necessary evidence, and build a compelling argument on your behalf. This support allows you to focus on your well-being while a dedicated advocate works to secure your financial future. If you’re ready to explore your options, you can contact us for a confidential consultation.

How to Safeguard Your Investments

Protecting your hard-earned money is just as important as growing it. While investing is a powerful tool for building wealth, it’s also an area where bad actors try to take advantage of others. The key is to be proactive and informed. By understanding the landscape and knowing what to look for, you can build a strong defense against potential fraud. It’s about creating a process for yourself—a set of checks and balances that you follow with every investment decision. This doesn’t mean you have to live in fear of being scammed; it just means you’re investing wisely and with your eyes wide open. Taking a few extra steps to verify information and trust your instincts can make all the difference in keeping your financial future secure.

Practice Smart Due Diligence

Before you invest a single dollar, do your homework. This means thoroughly researching not only the investment opportunity itself but also the person or firm recommending it. Look them up on FINRA’s BrokerCheck to review their credentials, employment history, and any disciplinary actions. Don’t just rely on the materials they provide you. Ask plenty of questions and make sure you get clear, straightforward answers. If an investment seems overly complex or you can’t get a solid explanation of how it works, that’s a major red flag. Understanding the common investment issues that can arise will help you know what questions to ask and what to look for.

Recognize Warning Signs Early

Investment fraud often involves deceptive practices designed to mislead you and cause financial harm. Learning to spot the warning signs is one of your most effective tools. Be wary of anyone promising guaranteed high returns with little to no risk—every investment carries some level of risk. High-pressure sales tactics, like being told you have to “act now” on a limited-time offer, are another common sign of trouble. If a financial professional is being evasive, discouraging you from seeking a second opinion, or making it difficult to withdraw your money, it’s time to step back. These tactics are often associated with broker fraud and negligence.

Helpful Resources for Alabama Investors

You don’t have to figure everything out on your own. Several organizations are dedicated to protecting investors. The Alabama Securities Commission offers local resources and a place to check on the registration of financial professionals in the state. On a federal level, the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) provide a wealth of information and tools. If you uncover significant wrongdoing, you might even be able to report it as an SEC whistleblower. An investment fraud lawyer’s role is to hold accountable those who break the law, making them another crucial resource if you suspect something is wrong.

Take Protective Measures

Always keep detailed records of all your investment-related conversations, transactions, and statements. This documentation can be invaluable if a dispute ever arises. Don’t be afraid to trust your gut; if something feels off, it probably is. It’s better to miss out on a supposed opportunity than to lose your savings to a fraudulent scheme. If you suspect you’ve been misled, it’s important to act quickly. These cases can be extremely complex, and an attorney with a deep understanding of securities law can help you understand your options and protect your rights. You can contact us to discuss your situation and figure out the next steps.

Related Articles

- Red Flags of Investment Fraud | Investment Fraud and Scams

- Investment Fraud Lawyer Near Me: Recovering Your Losses

- California Investment Fraud Lawyer: A Victim’s Guide

- Choosing a Washington DC Investment Fraud Lawyer

- SEC.gov | Investor Alert: Ponzi Schemes Targeting Seniors

Frequently Asked Questions

How can I tell the difference between a normal investment loss and actual fraud? This is a common and important question. All investments come with some level of risk, and markets go up and down. A loss from a market downturn is different from a loss caused by misconduct. Fraud often involves deception, such as a broker misrepresenting the risks of an investment, recommending something completely unsuitable for your financial situation, or making trades without your permission. If you feel you were misled or that your broker wasn’t acting in your best interest, it’s worth looking into, even if the market was also performing poorly at the time.

I’m worried about the cost of hiring a lawyer after losing money. How are legal fees handled? It’s completely understandable to be concerned about costs, especially in this situation. Most investment fraud attorneys handle cases on a contingency fee basis. This means you don’t pay any legal fees upfront. The law firm only gets paid if they successfully recover money for you, and their fee is a percentage of that recovery. This approach allows you to seek legal help without adding another financial burden during a stressful time.

What if I don’t have a lot of paperwork or written proof? Can I still make a claim? Even if you don’t have a perfect paper trail, you may still have a strong case. While account statements and emails are helpful, they aren’t the only form of evidence. Your own detailed notes about conversations, meetings, and promises that were made can be very powerful. An experienced attorney knows how to use the legal process, such as discovery, to obtain necessary documents and records directly from the brokerage firm to help build your case.

How long does the process to recover my money usually take? The timeline for an investment fraud case can vary quite a bit. There isn’t a one-size-fits-all answer because each situation is unique. A case that settles early through negotiation might be resolved in several months, while a more complex case that goes through a full FINRA arbitration hearing could take a year or more. The key is to be patient and allow your legal team to build a thorough and compelling case, which gives you the best chance at a meaningful recovery.

Is it worth pursuing a claim if my losses aren’t in the millions? Absolutely. There is no “minimum loss” required to stand up for your rights. Financial firms and brokers have a duty to treat all of their clients fairly, regardless of their account size. Any significant loss can have a major impact on your financial security and future plans. A consultation with an attorney can help you understand the potential for recovery in your specific situation, allowing you to make an informed decision about how to proceed.