You placed your financial future in the hands of a professional, believing they had your best interests at heart. Mutual funds were supposed to be a cornerstone of your portfolio—a diversified and relatively safe investment. The sense of betrayal is profound when you discover that trust may have been violated through negligence or outright fraud. Suddenly, your retirement plans feel uncertain, and you’re left wondering who you can turn to. You are not alone in this experience, and there is a clear path forward. This guide will help you understand the different forms of misconduct, what to do the moment you suspect a problem, and how a specialized mutual fund fraud lawyer Los Angeles can help you hold the responsible parties accountable and work to reclaim your assets.

Key Takeaways

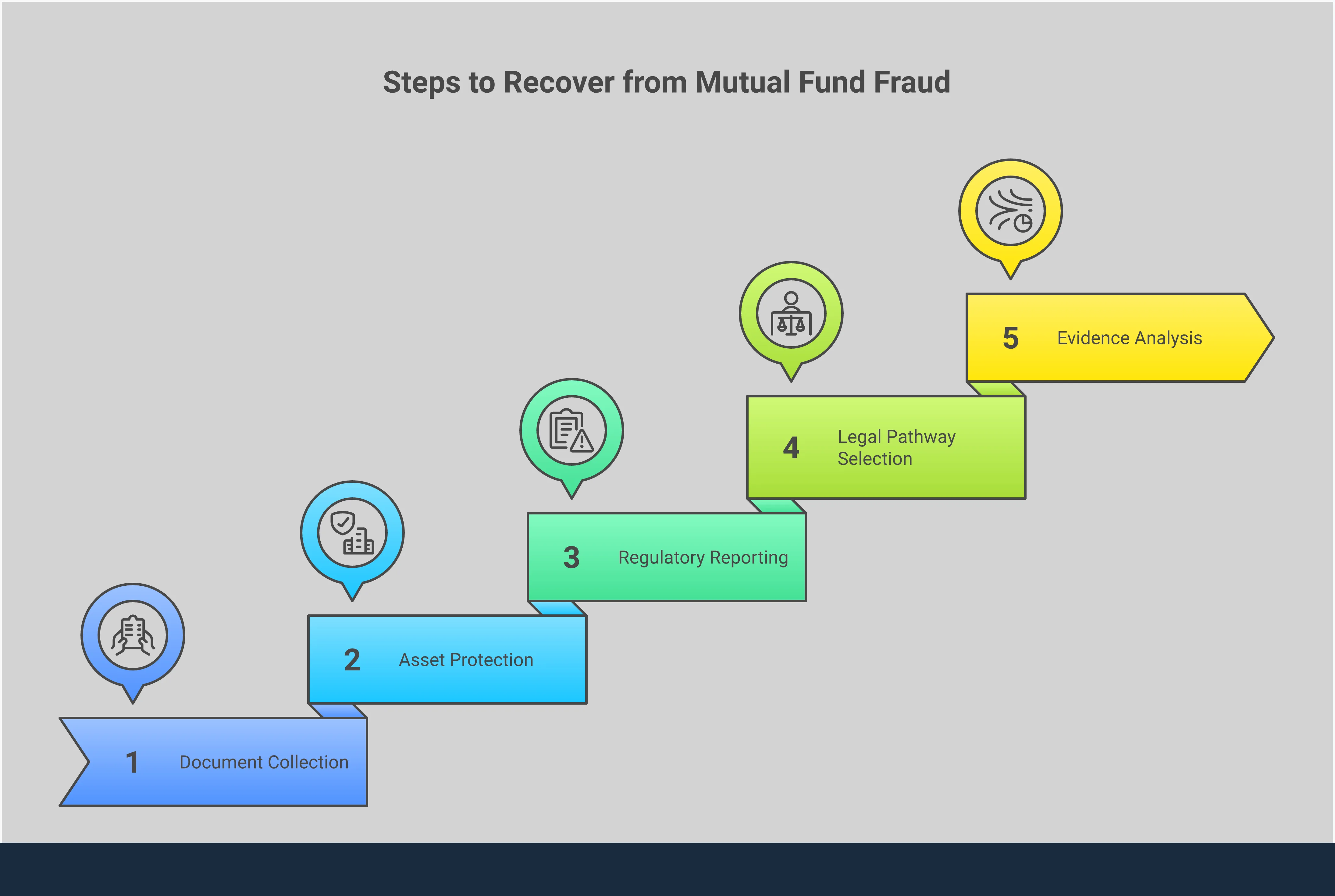

- Build Your Case with Documentation: Your most powerful first step is to gather evidence. Collect every account statement, email, and note from conversations to create a detailed timeline that will form the foundation of your claim.

- Recognize the Warning Signs of Fraud: Protect yourself by learning to spot red flags. Be wary of high-pressure tactics, overly complex strategies that can’t be explained simply, and any promises of guaranteed high returns.

- Engage a Specialized Securities Lawyer: You don’t have to face large financial firms alone. An attorney focused on investment fraud understands the specific recovery channels, like FINRA arbitration, and can build a strong case to help you reclaim your assets.

What Is Mutual Fund Fraud?

Mutual fund fraud happens when individuals or firms use deceptive practices to mislead investors and manipulate mutual funds for their own gain. It’s a serious form of investment fraud that can cost you your hard-earned savings. While mutual funds are often presented as a relatively safe way to invest, they aren’t immune to misconduct. This fraud can be orchestrated by fund managers, brokers, or other financial professionals who breach their duties to investors. Understanding what this misconduct looks like is the first step toward protecting yourself and recovering your losses.

The schemes can be complex, but the goal is usually simple: to enrich the fraudster at your expense. This can involve anything from hiding poor performance and charging excessive fees to more elaborate scams. Knowing the common tactics and red flags can help you identify potential fraud before it causes irreversible damage to your financial future.

Recognize Common Fraud Schemes

Investment fraud isn’t a single act but a category of deceptive practices. Some of the most common schemes include Ponzi schemes, where money from new investors is used to pay off earlier ones, creating the illusion of profitability. You might also encounter pump-and-dump scams, where fraudsters artificially inflate a stock’s price only to sell off their shares, leaving other investors with worthless stock. More specific to your situation, you may be dealing with broker fraud and negligence. This occurs when a broker misrepresents information, recommends unsuitable investments for your goals, or excessively trades in your account to generate commissions.

Spot the Red Flags

Trusting your intuition is important, but knowing specific warning signs is even better. Fraudsters often rely on similar tactics. Be wary of anyone who credits their success to a highly complex investing technique that they can’t explain clearly. Reputable professionals should be able to describe their strategy in plain language. High-pressure sales tactics are another major red flag; no reputable investment professional should push you to make an immediate decision. Always pay attention to the paperwork. If documents are vague, incomplete, or full of jargon, it could be a sign that something is wrong. Finally, be cautious of unregistered products. FINRA provides a helpful guide on how to watch for red flags to keep your money safe.

How Fraud Affects Investors

The impact of investment fraud goes far beyond just financial loss. While losing a significant portion of your savings or retirement fund is devastating, the emotional toll can be just as severe. Victims often feel a sense of betrayal, especially if the fraud was committed by a trusted advisor. The stress and anxiety can affect your health, relationships, and overall well-being. Recovering from fraud is about more than just getting your money back; it’s about regaining your sense of security and justice. The financial losses can derail your life plans, from retirement to funding your children’s education. Understanding the full scope of these investment issues is crucial when you decide to take action and hold the responsible parties accountable.

What to Do if You Suspect Fraud

That sinking feeling in your stomach when you suspect something is wrong with your investments is a difficult experience. It’s easy to feel panicked or overwhelmed, but the steps you take right now are critical. Acting quickly and deliberately can protect you from further financial harm and set the foundation for recovering your losses. Your immediate goal is to stop any ongoing damage and begin creating a clear, factual record of everything that has happened.

Think of yourself as an investigator building a case. Every piece of paper, every email, and every note you’ve taken could be important. While it might feel like a huge task, breaking it down into manageable steps makes it much more approachable. The following actions will help you take control of the situation and prepare for what comes next. You don’t have to figure this all out on your own; getting guidance from a legal professional who handles complex investment issues can provide clarity and direction. These initial steps are your first move toward holding the responsible parties accountable and working to reclaim your financial security.

Document Everything Immediately

Before you do anything else, start gathering every document related to your investment. Your priority is to create a comprehensive paper trail. Collect all account statements, trade confirmations, prospectuses, and any marketing materials you received. Don’t forget digital communications—save and print emails, text messages, and any other correspondence. If you had phone calls or meetings, write down your notes from those conversations, including the date, time, and what was discussed. This collection of evidence is the bedrock of your potential claim, providing a factual account of the promises made and the actions taken with your money.

Halt All Transactions

Your next move is to protect yourself from any additional losses. Stop sending money to the broker or firm immediately. If you are being pressured to invest more funds or pay fees to “release” your profits, refuse. This is a common tactic used to extract more money from investors who have already been victimized. Contact your bank or financial institution to alert them to the potential fraud. They may be able to stop any pending transfers and can place alerts on your accounts for suspicious activity. Cutting off the flow of money is a crucial step in containing the damage.

Report the Fraud

Reporting the misconduct is not only important for your own case but also helps protect other investors from falling into the same trap. Official reports create a record of the fraud and can trigger investigations by regulatory authorities. You should file a complaint with the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC). These agencies oversee the securities industry and are responsible for enforcing its rules. Filing a claim with FINRA is often the first step toward initiating a formal dispute resolution process, such as securities arbitration, which is designed to resolve investor complaints.

Collect Your Evidence

Once you’ve gathered all your documents, the next step is to organize them into a clear and compelling narrative. This goes beyond simply having a pile of papers; it’s about structuring the information so that it tells your story effectively. Create a detailed timeline of events, starting from your very first interaction with the broker to the moment you realized something was wrong. Arrange your communications chronologically and highlight any specific promises or guarantees that were broken. This organized file will be essential when you explain your case to regulators or an attorney, as it forms the basis of a claim for broker fraud and negligence.

How a Mutual Fund Fraud Lawyer Can Help

When you realize your investments may have been mishandled, it’s easy to feel overwhelmed and unsure of what to do next. This is where a lawyer specializing in mutual fund fraud can step in. They have the specific skills to handle these complex cases and can guide you through the process of seeking recovery. Working with a legal professional ensures you have a dedicated advocate fighting to reclaim your financial security.

Why Specialized Knowledge Matters

Securities law is a highly specific and intricate field. A general practice attorney likely won’t have the focused background needed to effectively handle your case. A lawyer who concentrates on investment issues understands the complex products, industry regulations, and tactics used to mislead investors. This specialized knowledge is a critical asset when it comes to identifying misconduct and protecting your portfolio. They can spot the subtle signs of fraud that others might miss, giving you a much stronger foundation for your claim.

Investigating Your Claim

One of the first and most important steps your lawyer will take is a deep dive into your investment history. They will thoroughly investigate your losses by analyzing account statements, fund prospectuses, and all communications between you and your broker. This process helps uncover the evidence needed to prove misconduct, such as unsuitable recommendations or misrepresentation of risk. A skilled attorney knows exactly what to look for when reviewing cases of potential broker fraud and negligence, building a strong case on your behalf to fight for the recovery of your losses.

Building a Strong Case

Once the investigation is complete, your lawyer will use the evidence to construct a compelling legal argument. This involves more than just stating that you lost money; it requires clearly demonstrating how the brokerage firm or advisor breached their duties. Your attorney will prepare and file a detailed claim, often through the securities arbitration process with the Financial Industry Regulatory Authority (FINRA). They handle the complex legal procedures and paperwork, translating the facts of your situation into a powerful case designed to hold the responsible parties accountable.

Protecting Your Rights as an Investor

Throughout the legal process, your lawyer acts as your personal advocate. They level the playing field, ensuring you are not taken advantage of by large financial institutions and their legal teams. They will handle all communications and negotiations, shielding you from the stress of direct confrontation. It’s crucial to understand the difference between negligence and fraud, as it affects the legal strategy, and your attorney will clarify these points for you. If you believe your rights have been violated, the first step is to contact a firm that can help protect your interests.

Explore Your Legal Options for Recovery

Discovering you’ve been a victim of mutual fund fraud can feel overwhelming, but it’s important to know that you have options. The financial industry has established specific legal channels to help investors recover their losses. Depending on the details of your situation, you might pursue your claim through arbitration, a civil lawsuit, or by joining a class action. Each path has its own process and potential outcomes.

Investment fraud can be complex, involving anything from broker misconduct to misleading information about a fund’s performance. The right strategy for you will depend on who is responsible for your losses and the agreements you signed when you opened your accounts. Understanding these avenues is the first step toward taking control of the situation. A securities lawyer can help you evaluate the specifics of your case and determine the most effective course of action to help you recoup your lost assets.

The FINRA Arbitration Process

If your losses are tied to a brokerage firm or a registered broker, your case will likely be handled through securities arbitration. The Financial Industry Regulatory Authority (FINRA) runs a dispute resolution forum that is the mandatory venue for most investor claims against their brokers. This process is typically faster and more streamlined than a traditional court case. An arbitrator or a panel of arbitrators, who have knowledge of the securities industry, will hear the evidence from both sides and make a final, binding decision. This is the primary path for investors seeking to hold their brokerage firms accountable for misconduct.

Considering Securities Litigation

While arbitration is common, it isn’t the only option. In some cases, filing a lawsuit in state or federal court—a process known as securities litigation—is the appropriate step. This might be the case if the fraud was committed by an entity not regulated by FINRA, such as an unregistered investment advisor. It’s crucial to understand the difference between broker fraud and negligence, as this distinction can significantly affect the legal strategy for recovering your losses in court. A lawsuit allows for a more extensive discovery process, which can be beneficial in uncovering complex fraudulent activities.

Joining a Class Action Lawsuit

Sometimes, a particular mutual fund or financial institution engages in fraudulent practices that harm a large number of investors in a similar way. In these situations, joining a class action lawsuit can be a powerful tool. This allows a group of investors to bring a single lawsuit together, sharing legal resources and strengthening their collective position. While individual recoveries may be smaller than in a direct claim, a class action holds fraudulent parties accountable on a broad scale. Reporting financial fraud helps regulators and law enforcement stop the misconduct and prevent others from being harmed.

What Damages Can You Recover?

The primary goal of any legal action is to recover the money you lost. In a successful claim, you may be able to recoup your out-of-pocket losses—the actual amount of money that was lost due to the fraud. Depending on the circumstances, you might also be awarded interest on that amount, as well as reimbursement for legal fees and other costs. The objective is to be made “whole” again, as if the fraud never occurred. The specific damages you can pursue will depend on your case and the legal path you take. To understand what you may be entitled to, it’s helpful to discuss your situation with an attorney.

How to Choose a Securities Lawyer in Los Angeles

Finding the right legal representation is a critical step when you’ve been a victim of mutual fund fraud. The attorney you choose will be your advocate, guiding you through a complex legal landscape to help you recover your hard-earned money. It’s not just about finding someone with a law degree; it’s about finding a partner who understands the specifics of securities law and has a genuine commitment to protecting investors.

When you start your search in a large market like Los Angeles, the number of options can feel overwhelming. To make a confident choice, you’ll want to focus on a few key areas: their specific qualifications in securities law, their track record with cases like yours, how they structure their fees, and how you can best prepare to meet with them. Taking the time to carefully evaluate these points will put you in a much stronger position to move forward and seek the justice you deserve.

Look for Key Qualifications

When you’re vetting a securities lawyer, start with their qualifications. You need someone whose practice is centered on securities and investment law, not a generalist who handles a wide variety of cases. A lawyer focused on this area will have a deep understanding of the regulations that govern the financial industry and the common tactics used in fraud schemes. They should be able to clearly explain how they investigate broker fraud and negligence and build a compelling case on your behalf. Look for a firm that is dedicated to fighting for investors and has the resources to stand up to large financial institutions.

Assess Their Experience

Experience is more than just the number of years a lawyer has been practicing. It’s about their specific history with cases similar to yours. Ask potential attorneys about their track record in handling mutual fund fraud claims and recovering losses for their clients. An experienced lawyer will be familiar with the common defenses that brokerage firms use and will know how to counter them effectively. They should also be well-versed in the different avenues for recovery, including the securities arbitration process with FINRA, which is often the required forum for these disputes. Their past successes can be a strong indicator of their ability to handle your case.

Understand the Fee Structure

Before you agree to work with an attorney, make sure you have a clear understanding of their fee structure. Many securities fraud lawyers work on a contingency fee basis, which means they only get paid if they successfully recover money for you. This arrangement can be beneficial for investors, as it means there are no upfront costs, and the lawyer’s interests are aligned with yours. Be sure to ask for a written fee agreement that outlines the percentage they will take and any other potential costs. Understanding the financial side from the beginning will prevent surprises down the road and help you make an informed decision about your investment issues.

Prepare for Your Initial Consultation

Your first meeting with a potential lawyer is your opportunity to assess if they’re the right fit and for them to evaluate the strength of your claim. To make this consultation as productive as possible, come prepared. Gather all the documents related to your investments, including account statements, trade confirmations, emails, and any other correspondence you had with your broker or financial advisor. Create a timeline of events as you remember them. This preparation allows the attorney to get a clearer picture of your situation and provide a more accurate assessment of your case. When you’re ready, you can contact a firm to schedule that first important conversation.

What to Expect from the Recovery Timeline

Realizing you’ve been a victim of mutual fund fraud can be overwhelming, and you’re likely wondering what comes next. The path to recovering your losses is a process, and while every case is unique, understanding the general timeline can help you feel more in control. It’s not an overnight fix, but a series of deliberate steps taken with a legal team that understands the system. The journey involves several key stages, from the initial review of your situation to the final resolution. Knowing what to expect at each step can demystify the process and prepare you for the road ahead.

The recovery timeline isn’t just a legal schedule; it’s a personal journey toward reclaiming your financial security. It begins the moment you decide to take action. The initial phases focus on investigation and evidence gathering, which lay the groundwork for a strong claim. From there, the process moves into the formal legal system, where your case is officially filed and presented. Throughout this time, communication with your attorney is crucial. They will be your guide, explaining the complexities and keeping you updated on progress. While the duration can vary based on many factors, having a clear picture of the stages—evaluation, documentation, filing, and the variables that affect the timeline—can provide a sense of stability during an uncertain time. It’s about taking methodical, informed steps to pursue the justice you deserve.

The Case Evaluation Phase

The first step is a thorough case evaluation. This is where a securities lawyer will carefully review the details of your situation to understand what happened and determine the strength of your claim. They will investigate your investment losses, analyze the conduct of the financial professionals involved, and identify potential instances of broker fraud and negligence. Think of this as the foundational stage where your legal team pieces together the puzzle. They’ll ask you questions, look at your initial documents, and give you an honest assessment of your legal options. This initial review is critical for building a strong strategy.

Gathering Required Documents

Once you decide to move forward, the focus shifts to gathering all the necessary documents. Your cooperation here is key to building a compelling case. You’ll need to collect any evidence related to the fraud, including account statements, trade confirmations, emails, and any other correspondence with your broker. These documents serve as the factual backbone of your claim, providing concrete proof of the transactions and communications that took place. Keeping everything organized will make the process smoother for both you and your legal team. Your attorney can provide a clear list of what’s needed.

The Filing Process

After your lawyer has evaluated your case and gathered the evidence, they will handle the formal filing process. For most investor disputes, this means initiating a securities arbitration claim with the Financial Industry Regulatory Authority (FINRA). Your attorney will draft and file the official complaint, known as the Statement of Claim, which outlines the details of the fraud and the damages you are seeking. This step officially puts the opposing party on notice and sets the legal proceedings in motion. Your role is to remain available to provide any additional information needed to support the claim.

Factors That Influence Your Case’s Timeline

It’s natural to want to know how long it will take to resolve your case, but the timeline can vary significantly. Several factors influence the duration, including the complexity of the fraud, the amount of money involved, and whether the opposing party is willing to negotiate a settlement. The path you take—whether it’s arbitration or litigation—also plays a role. A straightforward case might be resolved in months, while more complex investment issues can take a year or longer. Your attorney will keep you informed of the progress and manage the case efficiently to move it toward a resolution.

Find Legal Resources and Protection

After discovering potential fraud, it’s natural to feel overwhelmed and unsure of where to turn. The good news is you don’t have to face this alone. A network of regulatory bodies, investor protection programs, and legal professionals exists to help you find a path to recovery. Understanding these resources is the first step toward holding responsible parties accountable and safeguarding your financial future. Taking action not only helps your own case but also contributes to a safer investment environment for everyone.

Key Regulatory Organizations

When you suspect fraud, one of the most powerful steps you can take is to report it. Key organizations like the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC) exist to enforce the rules of the investment world, and they rely on tips from investors like you. As FINRA states, “Reporting any financial fraud, no matter how small, helps law enforcement, regulators, government agencies, and other organizations put a stop to the fraud.” Your report could be a critical piece of a larger investigation and may even qualify you for an SEC whistleblower award.

Investor Protection Programs to Know

Beyond the main regulatory bodies, various programs are specifically designed to assist investors. You don’t have to figure out the entire system on your own. According to FINRA, “National, federal, and state regulatory agencies and self-regulatory organizations for investment products and professionals may be able to help.” These programs provide structured paths for resolving disputes. One of the most common is the securities arbitration process, which allows investors to bring claims against their brokers in a formal setting outside of a traditional courtroom. These systems are in place to give you a clear way to pursue your claim.

How to Protect Yourself in the Future

Once you’ve been through the experience of investment fraud, you become much more aware of the warning signs. To protect yourself moving forward, always be skeptical of promises that seem too good to be true. FINRA advises investors to “[avoid] anyone who credits a highly complex investing technique for unusual success.” Another major red flag is pressure to act quickly. As a rule, “no reputable investment professional should push you to make an immediate decision.” Always take your time, ask questions, and walk away from any situation that makes you feel rushed or uncomfortable. Understanding common investment issues can help you spot problems early.

Finding a Support Network

Building a strong support network is essential for your emotional and financial recovery. This includes leaning on trusted family and friends, but it also means finding the right legal guidance. A lawyer who understands securities law can help you make sense of what happened and outline your options. You can start by gathering any evidence you have, such as account statements, emails, and other documentation related to the fraud. This information is vital for building a strong case. An experienced legal team can review these documents to help you understand the strength of your claim and decide on the best course of action when dealing with broker fraud and negligence.

How to Strengthen Your Fraud Claim

When you realize you might be a victim of investment fraud, your next steps are critical. Building a strong claim isn’t just about what you know; it’s about what you can prove. Taking a methodical approach to gathering evidence will make a significant difference as you move forward. A well-documented case provides your legal team with the foundation they need to fight for your recovery. It helps create a clear, undeniable picture of the misconduct you experienced.

The process can feel overwhelming, but you can start by focusing on four key areas: organizing your documents, preserving all communications, analyzing your financial statements, and creating a detailed timeline of events. Each step helps piece together the puzzle, turning your suspicions into a solid claim. By taking control of your evidence now, you are taking the first powerful step toward holding the responsible parties accountable and working to get your money back.

Organize Your Documentation

Start by gathering every piece of paper and every digital file related to your investment. Think of yourself as an archivist for your own case. This includes account statements, trade confirmations, prospectuses, and any marketing materials you received. Don’t forget emails, letters, and any other documentation that tells the story of your investment. This evidence provides the necessary proof to support your claim and establishes a clear narrative of the fraudulent activities. Having these documents organized and ready will be invaluable when you discuss your case with a lawyer.

Preserve All Communications

Every conversation you had with your broker or advisor is a potential piece of evidence. Save all emails, text messages, and voicemails. If you had phone calls or in-person meetings, write down your recollection of what was said, including the date and time. These records can be vital in demonstrating what you were told versus what actually happened. Keeping a detailed log of all communications related to your investments helps show a pattern of behavior and can be crucial for proving misrepresentation or negligence.

Analyze Your Financial Statements

Your account statements are more than just a record of your balance; they can hold clear signs of fraud. Look closely for any activity that seems unusual or that you didn’t authorize. For example, frequent, unexplained trades could be a sign of churning, where a broker trades excessively just to generate commissions. Scrutinizing your financial statements for these kinds of irregularities can uncover concrete evidence of fraudulent practices. If you see transactions you don’t recognize or understand, flag them immediately. These details can significantly strengthen your broker fraud and negligence claim.

Create a Detailed Timeline

A timeline is one of the most effective ways to tell your story. Start from your very first interaction with the broker or firm and map out every significant event in chronological order. Note when you opened the account, when key conversations took place, when specific investments were made, and when you first noticed something was wrong. Creating a timeline of events helps clarify the sequence of fraudulent actions and makes your case easier to understand. This detailed narrative will be essential when you present your claim to your attorney or during the securities arbitration process.

Related Articles

- Finding the Right Investment Fraud Lawyer in Houston | The Frankowski Firm

- Los Angeles Investment Fraud Lawyer: Protecting Your Assets | The Frankowski Firm

- Detroit Securities Fraud Attorney—Protect Your Investments

- Detroit Investment Fraud Lawyers: Protecting Your Investments | The Frankowski Firm

- Reclaiming Losses: Find a Jacksonville Investment Fraud Lawyer | The Frankowski Firm

Frequently Asked Questions

How can I tell the difference between a bad investment and actual fraud? This is a common and important question. Losing money doesn’t automatically mean you were a victim of fraud, as all investments carry some level of risk. The key difference often lies in the broker’s conduct. Fraud or negligence involves misconduct like misrepresenting the risks of an investment, recommending products that were clearly unsuitable for your financial goals, or making trades in your account without your permission. A bad investment is simply one that underperforms due to market forces, while fraud involves a breach of trust or violation of industry rules.

I’m worried about the cost. How much does it cost to hire a securities fraud lawyer? Most reputable securities law firms, including ours, handle these cases on a contingency fee basis. This means you don’t pay any attorney’s fees upfront. The firm is only paid if they successfully recover money for you, at which point they receive a pre-agreed-upon percentage of the recovery. This structure ensures that your interests are aligned with your lawyer’s and allows you to pursue a claim without worrying about out-of-pocket legal expenses.

My broker keeps telling me to be patient and that the market will recover. What should I do? While market fluctuations are normal, this can also be a tactic to delay you from investigating potential misconduct. A broker might say this to prevent you from discovering that the losses are due to unsuitable investments or negligence, not just a downturn. It’s wise to get an independent, third-party review of your account from a qualified securities lawyer who can determine if your losses are consistent with market trends or if they point to something more serious.

Is there a time limit for filing a claim for investment fraud? Yes, there are strict deadlines for filing a claim, which are known as statutes of limitation. For FINRA arbitration, the time limit is generally six years from the date of the event that gave rise to the dispute. However, other state or federal time limits could be even shorter. Because of these deadlines, it is crucial to act quickly once you suspect something is wrong. Waiting too long could prevent you from being able to recover any of your losses.

What if I don’t have all the documents and emails? Can I still build a case? You absolutely can. While it’s helpful to gather everything you have, don’t worry if your records are incomplete. A law firm that specializes in these cases has methods for obtaining necessary documents, like account statements and trade records, directly from the brokerage firm during the discovery process. The most important step is to start with what you have and consult with an attorney who can help you piece together the rest of the story.