After an investment fails, it’s natural to retrace your steps. You likely remember the pitch and the promises, but what about the paperwork? The Private Placement Memorandum (PPM) you received was supposed to be your guide, detailing all the potential risks alongside the opportunity. Unfortunately, these documents can sometimes be used to obscure facts rather than clarify them. If you suspect that key information was left out or that the risks were deliberately downplayed, the PPM is the first place to look for answers. A skilled PPM lawyer Houston can review the document with a trained eye, identifying red flags and building a case if you were a victim of misrepresentation.

Key Takeaways

- Focus on the “Risk Factors” Section: A Private Placement Memorandum is a legal disclosure, not a sales brochure. A legitimate PPM will candidly detail everything that could go wrong, so if this section seems vague or overly optimistic, treat it as a significant red flag.

- Prioritize Specialized Legal Experience: When you need help with a PPM-related issue, general legal knowledge isn’t enough. Your attorney must have a deep background in securities law to effectively identify misrepresentations and protect your rights as an investor.

- Transparency Is a Non-Negotiable Signal of Trust: Whether it’s in the investment document itself or in your conversations with a potential lawyer, a lack of clarity is a warning. A trustworthy opportunity and a dependable legal partner will always be upfront about risks, processes, and costs.

What Is a Private Placement Memorandum (PPM)?

When you consider investing in a private company—one that isn’t traded on a public stock exchange—you won’t find the same wealth of public information you would for a company like Apple or Ford. Instead, you’ll likely receive a Private Placement Memorandum, or PPM. Think of a PPM as the company’s detailed pitch and disclosure document all rolled into one. It’s a legal document used by private companies to outline the terms of an investment, provide information about the business, and, most importantly, disclose the potential risks involved. This document is your window into the opportunity, and it’s crucial to treat it as such.

For an investor, the PPM is your primary tool for due diligence. It should give you a clear picture of the company’s business model, financial health, management team, and how they plan to use your investment. It also details the structure of the investment itself—what kind of shares you’re buying, your rights as an investor, and the potential for returns. Reading this document carefully is a critical step in protecting yourself from potential investment issues and making an informed decision. A thorough, transparent PPM is a sign of a serious company; a vague or incomplete one can be a major red flag. Don’t just skim it. Pay close attention to the financial statements, the biographies of the management team, and the specific risks the company identifies. A well-written PPM empowers you to ask sharp, specific questions before you write a check.

How PPMs Help You Raise Capital

From the company’s perspective, a PPM is the key to legally raising money from private investors. It’s their formal way of presenting the investment opportunity. A well-prepared PPM is designed to give potential investors confidence by laying out all the necessary information in a professional format. It shows that the company has thought through its business plan and is serious about its legal obligations.

For you, the investor, understanding this purpose is key. The company uses the PPM to protect itself from future legal trouble, such as claims of broker fraud and negligence. By disclosing all the potential risks, the company can later argue that you were fully aware of the dangers before investing. This is why you must scrutinize the “Risk Factors” section. If the document seems to downplay significant risks or makes promises that sound too good to be true, it’s a warning sign.

Staying Compliant with PPM Legal Requirements

Even though private placements are not registered with the SEC like public offerings, they are still subject to federal securities laws. Specifically, companies are prohibited from making false or misleading statements to entice investors. A PPM is the company’s primary way of demonstrating compliance with these anti-fraud provisions. It serves as a record of the information provided to investors before they committed their funds.

A properly drafted PPM shows that the company is making a good-faith effort to follow the law. It should contain all the material information an investor would need to make a sound decision. If a company provides you with a PPM that contains false information or omits crucial facts, and you lose money as a result, that document can become a central piece of evidence in a legal action. Disputes over these investments are often handled through securities arbitration, where a lawyer can use the PPM to argue that you were misled.

Why You Need a PPM Lawyer for Your Business

When you’re raising capital for your business, creating a Private Placement Memorandum (PPM) can feel like just another item on a long to-do list. It’s tempting to find a template online and fill in the blanks. However, this document is far more than a formality—it’s a foundational legal instrument that protects both your company and your investors. Working with a lawyer who specializes in PPMs isn’t just about checking a box; it’s about building a secure and transparent foundation for your company’s growth. A well-constructed PPM demonstrates a commitment to transparency and legal diligence, which is exactly what serious investors want to see. It sets the stage for a relationship built on trust and clarity from day one.

Ensure You Comply with Securities Law

Raising private capital means you have to follow a complex set of federal and state securities laws. Getting it wrong can lead to serious consequences, including fines, SEC enforcement actions, and investor lawsuits. A lawyer helps you follow these rules carefully. A well-drafted and custom-tailored PPM will help to eliminate any questions about compliance, which in turn helps reduce the risk of facing civil litigation. This legal oversight ensures your offering qualifies for the right exemptions and includes all required disclosures. For investors, this compliance is a green flag, signaling that the company is operating professionally and transparently, which can help prevent future investment issues.

Protect Your Business and Your Investors

A PPM’s primary role is to provide full disclosure to potential investors, especially regarding the risks involved. This is where a lawyer’s guidance is invaluable. PPMs must be custom-made; you should not use a generic template found online. Each PPM needs to be specially written for your company and your specific deal to offer proper protection. A lawyer will work with you to identify and clearly articulate the unique risks associated with your business, industry, and financial situation. This protects your business from future claims that you misled or failed to inform investors. At the same time, it gives investors the clear, unvarnished information they need to make a sound decision.

Draft and Review Your Documents Correctly

There are many common mistakes businesses make when preparing a PPM, from using overly optimistic projections to poor organization and a lack of comprehensive risk factors. A lawyer experienced in securities offerings knows how to avoid these pitfalls. They will ensure that your PPM is drafted and reviewed correctly, making sure it is clear, comprehensive, and legally sound. This includes structuring the document logically, presenting financial information responsibly, and ensuring all material facts are disclosed. A polished, professional PPM shows investors you’re serious. It also reduces the chance of misunderstandings that could lead to disputes and costly securities arbitration down the road.

What to Look For in a Houston PPM Lawyer

When you’re reviewing a private placement investment or suspect you’ve been misled by one, the details matter. The Private Placement Memorandum (PPM) is the central document, and it can be dense with legal and financial jargon. If you need legal help, it’s crucial to find a lawyer who can dissect these documents and advocate for your rights as an investor. Not all attorneys have the specific background needed to handle these complex cases. Here are the key qualities to look for in a Houston lawyer to help with your PPM-related concerns.

Deep Knowledge of Securities Law

A PPM is a complex legal document designed to comply with federal and state securities laws. An attorney representing an investor must have a deep understanding of these regulations to be effective. They need to be able to identify red flags, such as inadequate risk disclosures or non-compliance with SEC rules, which can be the foundation of a legal claim. A properly drafted PPM is meant to protect the company issuing the securities, but when it contains misrepresentations or omissions, it can become key evidence in an investor’s case. Your lawyer’s ability to analyze these documents through the lens of securities law is fundamental to protecting your investment interests.

Familiarity with Your Industry

Every industry, from real estate to technology to energy, has its own set of common practices and inherent risks. A lawyer who is familiar with the industry of your investment can provide a significant advantage. They can more easily spot when a PPM includes overly optimistic or unrealistic financial projections that don’t align with industry norms. This specialized knowledge helps them ask the right questions and build a stronger argument that the investment opportunity was misrepresented. Understanding the business context is just as important as understanding the law, as it helps uncover hidden issues within the offering memorandum.

Clear Communication and Availability

Dealing with a potential investment loss is stressful enough without having to decipher complicated legal language. Look for a lawyer who speaks your language and takes the time to explain your options clearly. You should feel comfortable asking questions and confident that you understand the strategy for your case. A good attorney will be responsive and keep you informed about important developments. During your initial consultation, pay attention to how they listen and respond. You are looking for a partner who will guide you through the process, not just a legal technician.

Transparent Fee Structures

Before you commit to legal representation, you must have a clear and complete understanding of the fee structure. Ask directly whether the firm charges an hourly rate, a flat fee, or works on a contingency basis, where they are only paid if you recover funds. A reputable investor rights attorney will be upfront about all potential costs, so you aren’t hit with unexpected bills later on. Don’t hesitate to ask for the fee agreement in writing. This transparency is a sign of a trustworthy professional and ensures you can make an informed decision. You can schedule a consultation to discuss your case and the associated fees.

A Strong Professional Reputation

You want an attorney with a proven track record of successfully representing investors. Look for a law firm that focuses on securities law and has a history of handling cases similar to yours. You can often find client testimonials, case results, or peer reviews that speak to their reputation and experience. A lawyer known for their dedication to fighting broker fraud and negligence brings a level of credibility and experience that can make a real difference in the outcome of your case. Their reputation is a reflection of their ability to handle complex claims and their commitment to their clients.

How to Choose the Right PPM Lawyer in Houston

Finding the right legal partner is one of the most important steps you can take after discovering a potential investment issue. When your case involves a Private Placement Memorandum (PPM), you need a lawyer who understands the complexities of these documents and knows how to fight for investors. This isn’t the time for a general practitioner; you need someone who lives and breathes securities law. The right attorney will not only review the PPM for misrepresentations or omissions but will also build a strong case to help you recover your losses.

Your initial consultations are your chance to interview potential lawyers and find the best fit for you and your case. Think of it as a two-way street: you’re learning about their approach, and they’re assessing the details of your situation. A good lawyer will make you feel heard and respected, taking the time to understand your story and answer your questions clearly. This process is about finding a dedicated advocate who can guide you through the legal system with confidence and care. Use this time to gauge their experience, communication style, and overall strategy.

Ask These Questions During Your Consultation

Walking into a consultation prepared with the right questions can make all the difference. This isn’t just about finding a lawyer; it’s about finding your lawyer. Start by asking about their specific experience with cases like yours. You might ask, “How many cases involving broker fraud and negligence have you handled?” or “What is your background in representing investors in private placement disputes?”

It’s also helpful to understand their process. Ask what the next steps would be if you decide to work together and how they approach securities arbitration. A clear, straightforward answer shows they have a well-defined strategy. Finally, ask how they keep clients informed. Consistent communication is key to a healthy attorney-client relationship, so you want to feel confident you’ll be kept in the loop.

Clarify Their Fee Arrangement

Let’s talk about money, because it’s important. Before you sign any agreement, you need to have a crystal-clear understanding of the lawyer’s fee structure. Don’t be shy about asking for a detailed explanation. Many securities fraud attorneys work on a contingency fee basis, which means they only get paid if you win your case. This arrangement can be a huge relief for investors, as it means you won’t have to pay legal fees out of pocket while you’re already dealing with financial losses.

Ask if they work on contingency and what percentage they take. Also, inquire about case-related expenses, like filing fees or costs for hiring an expert, and who is responsible for paying them. A trustworthy lawyer will be transparent about all potential costs and provide a written fee agreement that outlines everything.

Check Their Experience and Ask for References

You wouldn’t hire a plumber to do heart surgery, and the same logic applies here. You need a lawyer with a deep and proven background in securities law and a track record of successfully representing investors. Ask them directly about their experience with complex investment issues similar to yours. Look at their website for case results, client testimonials, and articles they’ve written. This research gives you a sense of their history and the types of outcomes they’ve achieved for past clients.

While client confidentiality may prevent them from giving you specific names as references, you can still gauge their reputation. Look them up on state bar association websites and other professional legal directories to see their standing in the legal community.

Red Flags to Watch For

Just as important as knowing what to look for is knowing what to avoid. A major red flag is any lawyer who guarantees a specific outcome or promises you’ll win a certain amount of money. The legal process is unpredictable, and making such promises is not only unethical but also unrealistic. You should also be wary of anyone who uses high-pressure tactics to get you to sign an agreement on the spot. You should feel comfortable taking the time you need to make an informed decision.

Another warning sign is poor communication. If they are hard to reach, dismiss your concerns, or use confusing legal jargon without explaining it, they may not be the right fit. You deserve an advocate who listens and communicates clearly. If something feels off, trust your gut and contact a different firm for a second opinion.

Common Mistakes to Avoid When Hiring a PPM Lawyer

Choosing a lawyer to draft your Private Placement Memorandum is one of the most important decisions you’ll make when raising capital. The right attorney not only ensures your documents are compliant but also acts as a strategic partner in protecting your business and your investors. Unfortunately, it’s easy to make a misstep in the hiring process that can have long-term consequences.

Making the wrong choice can lead to a poorly drafted PPM, which might fail to disclose critical risks or comply with securities regulations. For investors, this can mean putting their capital into an opportunity without understanding the full picture. For your business, it can open the door to serious legal challenges, including investor disputes and regulatory enforcement actions. By being aware of the common pitfalls, you can select a lawyer who will help you build a solid legal foundation for your offering. Let’s walk through the key mistakes to sidestep so you can find a Houston PPM lawyer who truly has your back.

Don’t Focus Only on Cost

While it’s tempting to look for the most affordable option, choosing a lawyer based on price alone can be a costly mistake. A low fee might indicate that the lawyer uses generic templates or rushes through the process, leaving your PPM with gaps and vulnerabilities. A well-drafted PPM is a custom document tailored to your specific business, industry, and offering. This level of detail is an investment in your company’s future and in building trust with your investors. Cutting corners here can lead to significant problems later, including claims of broker fraud and negligence if disclosures are inadequate. Think of it as paying for prevention rather than a cure.

Don’t Neglect to Verify Their Experience

Not all business lawyers are equipped to handle the complexities of securities law. Drafting a PPM requires a specific skill set and deep knowledge of federal and state regulations. When vetting potential attorneys, ask directly about their experience with private placements in your industry. A lawyer who has successfully guided other companies through the process will understand the nuances of risk disclosure and compliance. This experience is crucial for avoiding common investment issues that can arise from a poorly structured offering. You want someone who has been down this road before and knows how to anticipate and address potential challenges.

Don’t Settle for Poor Communication

Clear and consistent communication is non-negotiable when working with an attorney. If a lawyer is difficult to reach, doesn’t explain complex legal concepts in a way you can understand, or seems disorganized, consider it a major red flag. The process of creating a PPM is collaborative; your lawyer needs your input to accurately describe the business and its risks. Poor communication can lead to misunderstandings, errors, and a final document that doesn’t fully protect you or your investors. You should feel like you have a partner who is responsive, transparent, and invested in your success.

Don’t Overlook Their Compliance Knowledge

The entire purpose of a PPM is to ensure you are compliant with securities laws. Your lawyer must have a thorough understanding of SEC regulations, including Regulation D, and any applicable state “Blue Sky” laws. A compliant PPM serves as your proof that you provided investors with all material information and did not make any misleading statements. This is your primary defense if a dispute arises. An attorney with strong compliance knowledge will help you structure the offering correctly and make the necessary disclosures, which is essential for avoiding future securities arbitration. Don’t be afraid to ask specific questions about their approach to regulatory compliance.

Don’t Ignore Local Market Experience

While federal securities laws are uniform, state regulations can vary. Hiring a lawyer with experience in the Houston market and a firm grasp of Texas securities laws adds an important layer of protection. They will be familiar with local market conditions, industry trends, and the specific expectations of Texas regulators. This local insight can be invaluable in tailoring your PPM to be as effective as possible. An attorney who understands the regional landscape can provide more relevant advice and help you avoid state-specific compliance issues that a non-local lawyer might miss.

What to Expect When Developing Your PPM

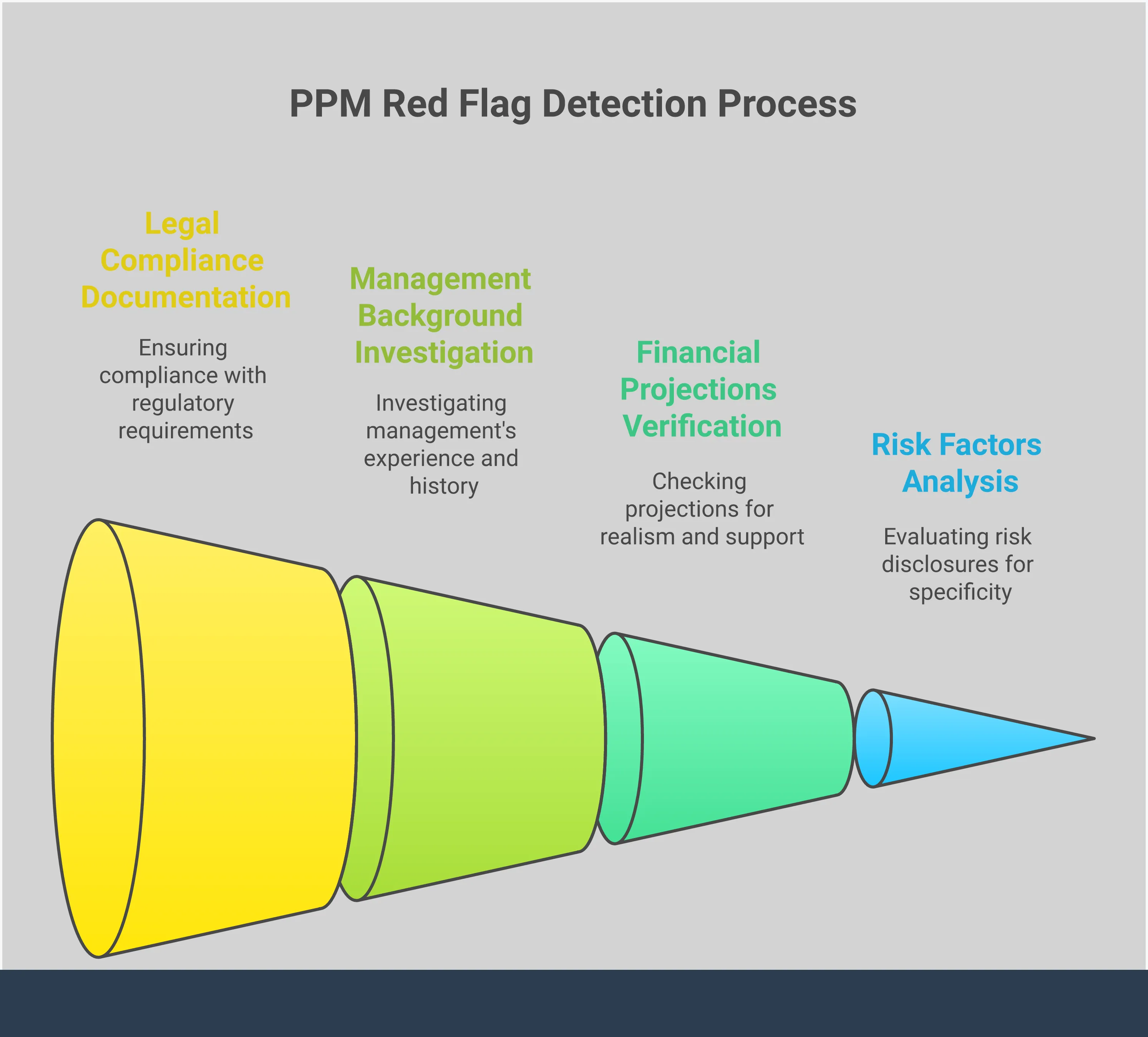

Creating a Private Placement Memorandum (PPM) is a meticulous process, not a simple box-ticking exercise. For you as an investor, understanding how a legitimate PPM is built is one of the best ways to protect yourself. When a company follows the right steps, it shows they are serious about transparency and legal compliance. If they cut corners, it’s a significant red flag.

A properly developed PPM is a sign of a well-run operation. It means the company has worked closely with a knowledgeable attorney to define the terms of the investment, identify potential risks, and ensure everything complies with securities laws. This process isn’t just about protecting the business from future legal trouble; it’s about giving you, the investor, a clear and honest picture of the opportunity. The journey from an idea to a finalized PPM involves several distinct stages, each designed to build a compliant and comprehensive document. Let’s walk through the four key steps a company and its legal team should take.

Step 1: Initial Consultation and Strategy

The process begins with an in-depth strategy session between the company and its PPM lawyer. This isn’t a quick phone call; it’s a foundational meeting to discuss the business model, fundraising goals, and target investors. The attorney’s job is to understand the company inside and out to structure the offering correctly. A custom-tailored PPM is essential for compliance and helps reduce the company’s risk of facing future litigation or SEC enforcement actions. For you, this means the investment terms are more likely to be clear and legally sound. A company that uses a generic, one-size-fits-all template might be trying to save money, but it could signal bigger problems with their approach to legal and financial diligence.

Step 2: Drafting the Document

Once the strategy is set, the lawyer begins drafting the PPM. This legal document is the centerpiece of the private offering, outlining all the critical information you need to make an informed decision. It serves as the official guide to the investment opportunity, detailing the terms, the company’s financial condition, and management’s background. Key sections will describe the securities being offered, how the funds will be used, and the subscription procedures for investors. A well-drafted PPM is clear, thorough, and leaves no room for ambiguity. If you find a PPM that is confusing, vague, or missing key information, it could be a warning sign of underlying investment issues.

Step 3: Analyzing Risks and Disclosures

This is arguably the most important step for investor protection. A responsible company will work with its attorney to conduct a comprehensive risk analysis and disclose all potential downsides. The goal is transparency, not a sales pitch. A common mistake issuers make is downplaying or omitting risks to make the opportunity look perfect. A legitimate PPM will include a detailed “Risk Factors” section that candidly discusses everything that could go wrong, from market competition to operational challenges. As an investor, you should read this section carefully. If the risks seem glossed over or the document paints an unrealistically rosy picture, proceed with caution. Full disclosure is essential for protecting you from future problems.

Step 4: Final Compliance Review

Before the PPM is ever shown to an investor, it must undergo a final, rigorous compliance review. During this stage, the attorney scrutinizes the entire document to ensure it meets all federal and state securities regulations. This final check catches any mistakes or omissions that could lead to significant legal trouble for the company and financial harm to its investors. This step is a crucial safeguard that helps prevent disputes that might otherwise end up in securities arbitration. A company that is diligent about this final review demonstrates a commitment to doing things by the book, which is a positive sign for any potential investor.

How Are PPM Legal Fees Structured?

Understanding how a lawyer charges for their services is a critical step in the hiring process. When it comes to creating a Private Placement Memorandum (PPM), legal fees can vary, but a straightforward conversation about costs from the start will prevent any unwelcome surprises down the road. A transparent fee structure is a good sign that you’re working with a professional who values clear communication. Before you agree to anything, make sure you have a complete picture of the potential costs involved in drafting and reviewing your investment documents. This clarity helps you budget effectively and builds a foundation of trust with your legal counsel.

Common Fee Structures

Most PPM lawyers use one of two primary fee structures: a flat fee or an hourly rate. A flat fee covers the entire project from start to finish, giving you a predictable, all-in cost. An hourly rate means you pay for the actual time the attorney spends on your case. It’s important to ask which method they use during your initial consultation. You should also ask about their experience with cases similar to yours. Understanding their background in handling specific investment issues helps you gauge the value you’re receiving for their fee and ensures they have the right skills for the job.

What About Additional Costs?

Beyond the primary legal fee, other costs can pop up. Simple mistakes like poor organization or trying to handle legal matters without proper guidance can lead to more billable hours and higher expenses. A well-prepared PPM is your first line of defense against future complications. A thorough, custom-drafted document helps reduce the risk of facing civil investment fraud litigation or an SEC enforcement action. Investing in proper legal support from the beginning is a proactive step that can save you significant time, money, and stress later on by ensuring your offering is compliant from day one.

Weighing the Cost Against the Value

While it’s tempting to focus solely on the price tag, it’s more productive to weigh the cost against the value and protection you receive. A PPM provides documented proof that you have disclosed all material information to your investors, which can be invaluable if a dispute ever arises. A knowledgeable attorney understands the common pitfalls in private placement offerings and can help you avoid them. This guidance protects not only your business but also the investors who place their trust in you. The fee you pay is for peace of mind and a strong legal shield against potential broker fraud and negligence claims.

Building a Strong Partnership with Your PPM Attorney

Working with a lawyer to create your Private Placement Memorandum is more than just a transaction; it’s the beginning of a crucial professional relationship. Think of your attorney as a key partner in your capital-raising efforts. The goal is to work together to produce a document that is not only compliant with securities laws but also clearly communicates your vision to potential investors. This process relies on mutual trust, transparency, and a shared understanding of your business objectives.

A strong partnership ensures your PPM is meticulously crafted to protect your business from future liability. When you and your attorney are on the same page, it’s easier to identify potential risks and address them head-on in your disclosures. By laying a foundation of clear communication and collaboration from the start, you set your offering up for a smoother, more secure process. The following steps will help you build and maintain a productive working relationship with your legal counsel.

What Documents You’ll Need to Provide

To draft an effective PPM, your attorney needs a comprehensive understanding of your business. You can speed up the process and ensure accuracy by gathering key documents ahead of time. Be prepared to provide your business plan, detailed financial statements and projections, articles of incorporation, and biographical information for your entire management team. You’ll also need to supply the specific terms of the offering, such as the type of securities being sold and the total amount of capital you intend to raise.

The more detailed information you can provide, the better your attorney can tailor the PPM to your specific situation. A custom-drafted document is your first line of defense, helping to mitigate the risk of facing civil litigation or SEC enforcement actions down the road.

Setting a Realistic Timeline

Drafting a thorough and compliant PPM doesn’t happen overnight. It’s a detailed process that requires careful attention to legal nuances and business specifics. The timeline typically includes an initial discovery phase, multiple rounds of drafting and revision, a deep dive into risk factors, and a final compliance review before the document is ready for investors. Your attorney will also need to prepare and file necessary paperwork, such as a Form D, with the SEC.

Rushing this process can lead to critical errors or omissions that expose your business to unnecessary risk. A typical timeline can range from a few weeks to a couple of months, depending on the complexity of your offering and how quickly you can provide the required information. Discuss the timeline with your attorney during your initial consultation to set clear expectations for everyone involved.

Establishing Clear Communication

Open and consistent communication is the backbone of a successful attorney-client relationship. From the very beginning, establish how you and your legal team will stay in touch. Decide on a preferred method—whether it’s email, scheduled phone calls, or video conferences—and agree on a reasonable cadence for updates. It’s also important to clarify who your main point of contact at the firm will be.

You should always feel comfortable asking questions and confident that you will receive clear, understandable answers. A responsive attorney who keeps you in the loop is a sign of a healthy partnership. If you have questions for our team, you can always contact us to start a conversation.

Planning for Ongoing Support

The relationship with your PPM attorney often extends beyond the final draft of the document. As you begin presenting your offering to investors, questions or unique situations may arise that require legal input. Your attorney can serve as a valuable resource for reviewing subscription agreements, answering investor inquiries, and ensuring all follow-up actions remain compliant.

Furthermore, as your business grows, your legal needs will evolve. You might pursue additional funding rounds, explore mergers or acquisitions, or require advice on corporate governance. Discussing the potential for ongoing support with your attorney from the outset can ensure you have a trusted advisor ready to help you handle future investment issues and opportunities.

Related Articles

- Your Guide to PPM Lawyers in Los Angeles – The Frankowski Firm

- Private Placement Investments – The Frankowski Firm

Frequently Asked Questions

As an investor, why is the Private Placement Memorandum so important for me to read? Think of the PPM as the official rulebook and warning label for your investment, all in one. It’s the company’s detailed explanation of the business, how your money will be used, and, most importantly, all the things that could go wrong. Reading it carefully is your best tool for spotting potential problems before you invest. If a dispute arises later, this document becomes a key piece of evidence showing what you were told about the opportunity.

What’s the biggest red flag to watch for when reviewing a PPM? A major red flag is a vague or overly brief “Risk Factors” section. A serious company will be very clear and specific about the challenges it faces, from market competition to operational hurdles. If this section feels glossed over or generic, it suggests the company isn’t being fully transparent. You want to see an honest assessment of the potential downsides, not just a sales pitch.

If a company provides a PPM, does that mean the investment is legitimate and safe? Not necessarily. A PPM is a required legal document for disclosure, not a stamp of approval from a regulatory agency. Its existence simply means the company has created the paperwork for a private offering. A fraudulent operation can still produce a PPM that is filled with misleading information or omits crucial facts. The quality and truthfulness of the information inside the document are what truly matter.

I received a PPM and invested, but now I think I was misled. What should I do? Your first step is to gather all the documents related to your investment, especially the PPM and any emails or correspondence you had. Then, you should speak with an attorney who concentrates on securities and investment fraud. They can review the PPM to see if the company made false statements or left out critical information that you needed to make an informed decision.

The PPM I read seemed very optimistic. Is that normal? While a PPM is designed to present an investment opportunity, it must be balanced with a realistic discussion of the risks. It’s normal for a company to highlight its strengths, but this should not come at the expense of transparency. If the document feels more like a marketing brochure and lacks a substantial, candid section on potential challenges and financial risks, you should be cautious. Projections should be based on reasonable assumptions, not just best-case-scenario promises.