NO FEES UNTIL WE WIN

FREE CONSULTATION

NO FEES UNTIL WE WIN

FREE CONSULTATION

Within a single year, four separate customer disputes have been filed against Stifel, Nicolaus & Company, Inc. Broker Michelle Stebbins, seeking combined damages of over $1.7 million. These aren’t minor disagreements; they are serious allegations that raise significant red flags for any current or former client. When a financial advisor faces a rapid succession of complaints, it demands closer scrutiny. This report provides a clear overview of the claims, including the specific allegations of supervisory failure against her firm. We will explain what these disputes mean, how to check your own advisor’s record, and what actions you can take if you suspect your own portfolio has been mishandled.

Michelle Stebbins is a financial advisor currently registered with Stifel, Nicolaus & Company in Southfield, Michigan. With a career spanning more than two decades, she has held significant roles in the financial services industry. Understanding a broker’s professional history and their stated approach to client relationships is a crucial first step for any investor. This information provides context for their investment advice and can help you identify potential red flags. When you entrust someone with your financial future, it’s important to have a clear picture of their background, their role at their firm, and how they claim to serve their clients’ interests. This is especially true when you encounter complex investment issues that may arise from their guidance.

Michelle Stebbins has a long history in the financial industry. According to public records, she began her career as a broker in 2000 with the Flint, Michigan office of UBS Financial Services. Other sources indicate her career in financial services spans over 25 years, during which she has managed regulatory, financial, and reputational risk. This kind of experience gives an advisor a deep understanding of the industry’s inner workings. However, a long career doesn’t guarantee protection from broker fraud and negligence. It’s always wise for investors to stay informed about their advisor’s complete professional history, including any past or present customer disputes.

At Stifel, Nicolaus & Company, Michelle Stebbins presents herself as a client-focused financial advisor. Her professional bio on the Stifel website emphasizes a hands-on approach, stating she “believes in doing business face to face.” She says, “I want to understand your unique financial objectives so that I can develop a strategy specific to your needs and long-term financial goals.” This message suggests a commitment to personalized service and building direct relationships with clients. While this is the ideal standard for any financial advisor, it’s essential to ensure their actions align with their words and that the strategies they develop are truly suitable for your financial situation.

As a financial advisor and Branch Manager at Stifel, Michelle Stebbins provides several financial services to clients from her office in Southfield, Michigan. Her stated goal is to help people meet their financial objectives through personalized planning and management. Understanding the services an advisor offers is the first step in evaluating whether their actions align with your best interests as an investor.

The core services she provides revolve around building financial strategies tailored to individual client needs. This includes managing investments, planning for major life events like retirement, and offering ongoing financial consulting. While these services are standard in the industry, the way they are implemented can make all the difference in protecting your financial future. It’s important for investors to know what to expect and to recognize when the advice they receive may not be suitable for their situation.

Michelle Stebbins’ primary service is investment and wealth management. This involves working with clients to manage their assets with the goal of long-term growth. A financial advisor in this role is responsible for understanding a client’s financial situation, risk tolerance, and goals to build an appropriate investment portfolio. This process should be collaborative and transparent, ensuring you are comfortable with the strategy being used. When an advisor recommends investments that are too risky or don’t fit your profile, serious investment issues can occur, potentially leading to significant financial losses.

Another key focus for Michelle Stebbins is retirement planning. According to her professional profile, she works to understand each client’s unique financial objectives to create a long-term strategy for their retirement. This is a critical service, as your retirement savings represent years of hard work and discipline. A sound retirement plan should provide security and peace of mind. Unfortunately, this is also an area where investors can be vulnerable to poor advice or mismanagement. Any signs of broker fraud and negligence should be taken seriously to protect your nest egg.

Michelle Stebbins states that she believes in doing business face-to-face to better understand a client’s specific needs. This personalized approach is intended to help her develop a financial strategy that aligns with your long-term goals. Building a direct, open relationship with your advisor is important. However, a friendly approach doesn’t replace the legal and ethical duties an advisor owes you. If you believe your advisor has failed to act in your best interest, regardless of your personal relationship, you have the right to explore your options for recourse through processes like securities arbitration.

Understanding how a financial advisor approaches their client relationships is key to knowing if they are a good fit for you. Every advisor has a philosophy that guides how they interact with clients, develop strategies, and manage investments. According to her public statements, Michelle Stebbins of Stifel, Nicolaus & Company emphasizes a personalized and collaborative approach. This method is centered on getting to know clients on an individual basis to build financial plans that align with their specific circumstances and future aspirations.

This client-centric model is what most investors hope for when they entrust someone with their financial well-being. The idea is to move beyond generic advice and create a strategy tailored to your life. For many, this involves in-depth conversations about everything from retirement dreams to family needs. When an advisor commits to this level of personalization, it can build a strong foundation of trust. However, it’s always important for investors to ensure the advice they receive truly matches their stated goals and risk tolerance, as misunderstandings or negligence can lead to significant investment issues. Below, we’ll look at the specific ways Michelle Stebbins describes her working relationship with clients.

Michelle Stebbins states that she believes in doing business face-to-face. Her professional profile highlights a desire to understand each client’s unique financial objectives to develop a specific strategy. This emphasis on in-person meetings is designed to foster a deeper connection and clearer communication. By sitting down with clients, an advisor can better grasp the nuances of their financial situation, answer questions directly, and build personal rapport. This hands-on approach is often seen as a way to ensure that both the client and the advisor are on the same page from the very beginning, establishing a clear path toward the client’s long-term goals.

A cornerstone of Michelle Stebbins’ stated approach is the creation of special, customized plans for each client. Instead of using a one-size-fits-all model, she says she tailors her strategies to an individual’s specific needs and financial objectives. This process involves analyzing a client’s current financial health, risk tolerance, and future goals to build a suitable investment portfolio. A personalized plan is critical in financial advising, as it helps ensure that investment recommendations are appropriate for the client. When this standard isn’t met, it can sometimes lead to claims of broker fraud and negligence, which is why a truly custom plan is so important.

According to her public information, Michelle Stebbins’s main goal is to help people reach their financial objectives by building long-term partnerships. This philosophy suggests a commitment that extends beyond single transactions, focusing instead on a lasting professional relationship. An advisor who acts as a long-term partner is expected to provide ongoing guidance, adjust strategies as a client’s life changes, and remain dedicated to their financial success over many years. This approach is meant to give clients confidence that their advisor is invested in their future. When that trust is broken, investors may need to explore their options for resolution, such as securities arbitration, to address their concerns.

When you trust someone with your financial future, learning about customer complaints can be unsettling. Recently, several serious disputes have been filed against Michelle Stebbins, raising questions for her clients. These aren’t minor disagreements; they involve significant sums of money and point to potential issues with how investments were managed. Understanding the details of these complaints can help you recognize similar red flags in your own portfolio and know what steps to take if you have concerns.

Several of Michelle Stebbins’ clients have recently come forward to file formal complaints. Within a single year, four separate customer disputes were lodged, seeking combined damages of over $1.7 million. This pattern of complaints in a short period can be a significant indicator of underlying problems. When multiple clients report substantial losses, it suggests the issues may be more widespread than an isolated incident. These disputes highlight the serious financial harm that can occur when your investments are not handled with proper care and diligence, creating complex investment issues for the people affected.

A central theme in the complaints against Michelle Stebbins involves the alleged failure of her employer, Stifel, Nicolaus & Company, to properly supervise her activities. Brokerage firms have a fundamental duty to oversee their financial advisors to ensure they are acting in their clients’ best interests. The allegations suggest that the firm may not have fulfilled this critical responsibility. This is an important point because it means the firm itself could be held accountable for an advisor’s misconduct. Cases of broker fraud and negligence often involve a lack of oversight, which allows harmful practices to continue unchecked.

The financial damages sought in the individual claims are substantial, illustrating the real-world impact on her clients. The four recent claims seek $400,000, $299,009, $763,004, and $305,680, respectively. These are not small amounts; they represent significant portions of someone’s retirement savings, nest egg, or family inheritance. When investors suffer losses of this magnitude, it can completely alter their financial stability and future plans. Fortunately, investors who have been harmed have avenues for recourse, often through a process known as securities arbitration, which is designed to help them recover their losses.

When multiple complaints surface against a single financial advisor, it often points to a larger issue than just one person’s actions. The focus can shift to the firm that employs them and its responsibility to oversee its representatives. In the case of Michelle Stebbins, the allegations raise serious questions about her firm’s supervisory practices.

The recent disputes filed against Michelle Stebbins suggest a troubling pattern. In 2024 alone, four separate customer complaints have been lodged, seeking a combined total of over $1.7 million in damages. A common thread runs through these claims: the allegation that her employer, Stifel Nicolaus, did not adequately supervise her work with client investments. When several clients independently report similar issues over a short period, it signals that the problems may be systemic rather than isolated incidents. This concentration of complaints is a significant indicator that there may be a breakdown in the firm’s oversight procedures.

It’s important to understand that brokerage firms have a fundamental duty to monitor their financial advisors. Rules set by the Financial Industry Regulatory Authority (FINRA) require firms like Stifel to have a proper supervisory system in place to protect clients. If a firm fails in this duty, it can be held responsible for an investor’s losses. This concept, known as broker fraud and negligence, means that your claim may not just be against the individual broker but also against the company that failed to prevent the misconduct. This accountability is a key protection for investors, providing a path to potentially recover financial damages caused by a lack of oversight.

The situation involving Michelle Stebbins serves as a clear example of red flags that every investor should recognize. A rapid series of customer complaints against an advisor is one of the most telling signs of potential trouble. If you notice your advisor is facing multiple disputes or if you feel your concerns are being dismissed, it’s time to pay closer attention. Review your account statements carefully and document any communication that seems off. If the issues raised in these complaints sound familiar to your own experience, it may be a sign that your investments are at risk. Don’t hesitate to seek a professional opinion to understand your options.

Before you hand over your hard-earned money, it’s crucial to do your homework on any financial professional you’re considering. Think of it as a background check for one of the most important relationships in your financial life. Vetting an advisor isn’t about being distrustful; it’s about being a smart, informed investor. Fortunately, there are free, publicly available tools that make this process straightforward. Taking a few minutes to look into an advisor’s history can give you peace of mind and help you spot potential red flags before they become serious problems.

This research is your first line of defense in protecting your assets. You can verify an advisor’s credentials, check their employment history, and, most importantly, see if they have a history of customer complaints or disciplinary actions. This information is compiled by industry regulators and is available to you at no cost. Making this a standard step in your process will empower you to make better decisions and partner with professionals who have a clean and trustworthy track record. It’s a simple action that can save you from significant financial and emotional distress down the road.

The single most important tool for researching a broker or financial advisor is the Financial Industry Regulatory Authority (FINRA)’s BrokerCheck. This free online tool allows you to see a snapshot of an advisor’s professional history. FINRA rules are clear: brokers and their firms are required to report customer complaints and other financial issues, and this is where that information is stored. You can look up individuals and brokerage firms to view their employment history, licenses, and any regulatory actions, arbitrations, or complaints filed against them. Simply type in the advisor’s name, and you’ll get a detailed report that can help you make an informed decision.

While using BrokerCheck, pay close attention to the “Disclosures” section. This is where you’ll find any customer disputes or disciplinary actions. A single complaint isn’t automatically a deal-breaker, but a pattern of them should raise serious concerns. For example, records show that Michelle Stebbins has faced four customer complaints in 2024 alone. The total amount of money customers are seeking in damages from these four complaints is $1,767,693. Seeing specific details like this provides critical insight into how an advisor has treated past clients and can be a strong indicator of potential broker fraud and negligence.

Beyond complaints, you should also assess an advisor’s overall professional background. BrokerCheck provides a full employment history, showing you every firm they’ve worked for and when. For instance, the database shows that “Michelle Stebbins launched her career as a broker in 2000.” This timeline helps you verify their level of experience and see if they have frequently jumped between firms, which can sometimes be a red flag. Understanding the length and breadth of their career helps you determine if their background aligns with your specific financial needs and goals. This is a key step in avoiding future investment issues.

When you entrust your money to a financial advisor, you’re placing a significant amount of faith in their judgment and integrity. It can be devastating to discover that this trust was misplaced. The good news is that you are not powerless in this situation. The financial industry is regulated, and there are specific rules and systems in place designed to protect you. Understanding these rights is the first step toward holding a negligent broker or firm accountable and working to recover your losses.

These protections aren’t just suggestions; they are enforceable rules that brokerage firms are required to follow. A key rule involves supervision. Firms have a duty to reasonably supervise their employees to ensure they are acting in their clients’ best interests. When they fail to do so, they can be held liable for the harm caused by their brokers. This means you have avenues to pursue a claim not just against an individual advisor, but against the entire company. Knowing your rights empowers you to take action and seek a resolution.

The Financial Industry Regulatory Authority (FINRA) is a private organization that regulates brokerage firms and their brokers in the United States. One of its most important rules is that firms must properly supervise their financial advisors. This means the company is responsible for overseeing a broker’s actions and can be held liable for any money you lost due to their failure to supervise. If an advisor engages in misconduct, the firm they work for may be responsible for the damages. This is a critical protection that provides a clear path for investors to address broker fraud and negligence.

If you have a dispute with your broker or their firm, you likely won’t end up in a traditional courtroom. Most investor agreements include a clause that requires disputes to be settled through a process called securities arbitration. This is a formal hearing where both sides present their case to an impartial arbitrator or panel, who then makes a binding decision. It’s generally a more streamlined and efficient process than court litigation. An experienced attorney can represent you throughout the arbitration process to help you build a strong case to recover your investment losses.

In addition to seeking financial recovery through arbitration, you can also file a formal complaint with regulators like FINRA or the Securities and Exchange Commission (SEC). FINRA rules require brokerage firms to report all customer complaints, which become part of the broker’s public record. Filing a complaint triggers a regulatory review and can lead to investigations, fines, or even suspension of the broker’s license. While this process doesn’t directly recover your money, it holds the wrongdoers accountable and helps protect other investors from suffering similar harm.

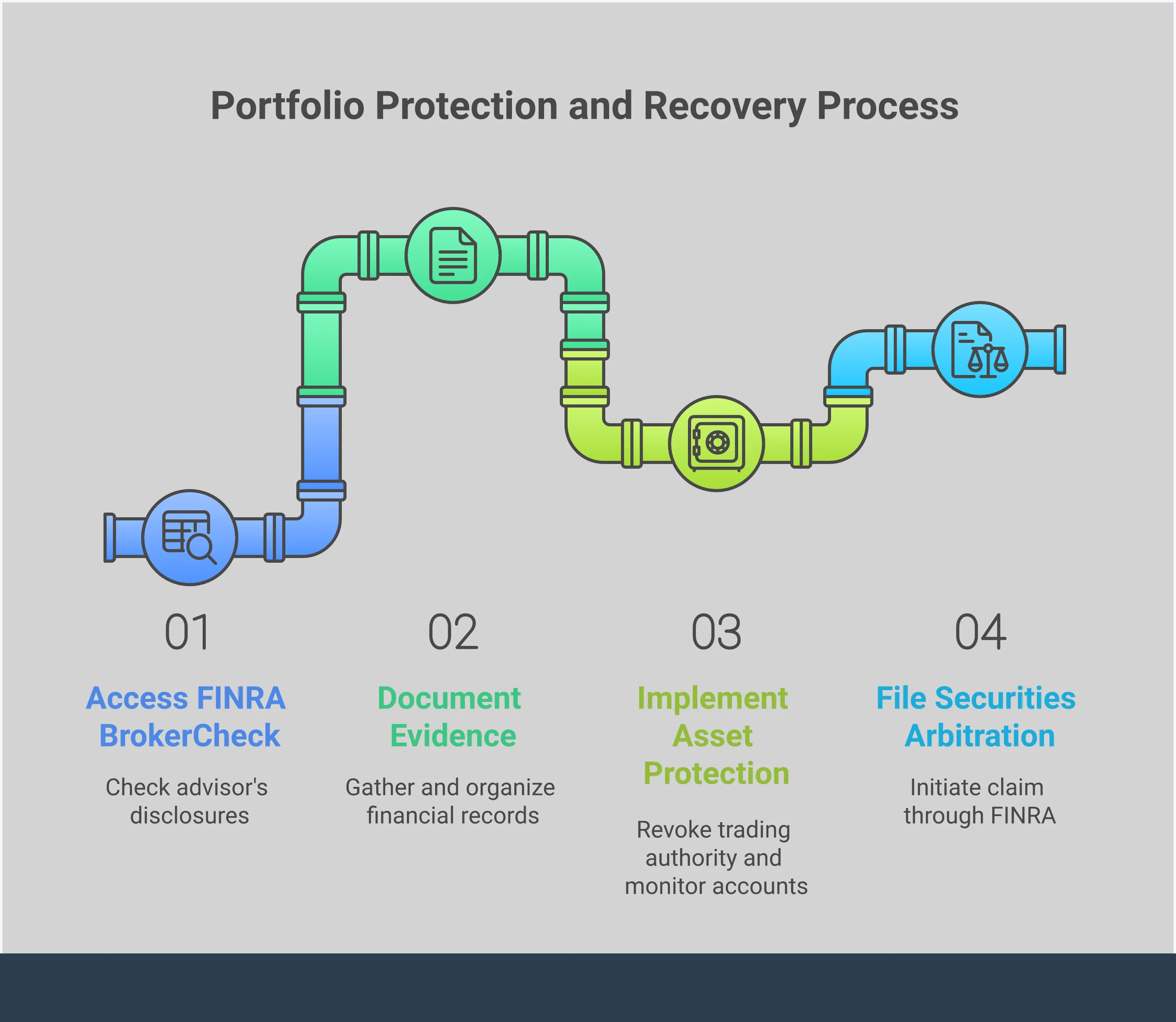

If you have a gut feeling that something is wrong with your investment accounts, it’s important to trust that instinct and take clear, methodical steps. Acting quickly can help you understand the situation and protect your financial future. Here’s what you can do.

First, start gathering all your records. Think of yourself as a detective building a case file. Collect all your account statements, trade confirmations, and any emails or letters you’ve exchanged with your broker. It’s also a great idea to start a log of every phone call or meeting. Note the date, time, and a summary of what was discussed. This paper trail creates a clear timeline and can be incredibly valuable if you decide to move forward with a claim. Having organized documentation helps you get a full picture of your investment issues and provides solid evidence of your broker’s actions and advice over time.

While you’re gathering information, you should also take immediate action to safeguard your remaining assets. You have the right to instruct your broker not to make any further trades without your express written consent for each specific transaction. It’s important to be proactive, as you can’t always rely on a brokerage firm’s internal supervision to catch every problem. In many cases of broker fraud and negligence, a firm’s failure to properly supervise its employees is a central part of the issue. Taking control of your accounts and carefully monitoring all activity is a critical step in preventing more losses while you figure out what happened.

Once you have your documents in order and have secured your accounts, it may be time to speak with a legal professional. If you’ve lost a significant amount of money that you believe is due to your broker’s misconduct or unsuitable advice, a securities attorney can help you understand your rights. They can review your situation, explain the complex rules of the financial industry, and outline your options for recovery. Many investor claims are resolved through a process called securities arbitration, which is a specialized forum for these types of disputes. Consulting with an attorney can give you a clear, strategic path for holding your broker accountable.

When you suspect your financial advisor’s actions have led to significant losses, it’s easy to feel overwhelmed and unsure of what to do next. This is where a securities attorney can step in. They work to untangle complex financial situations, determine if misconduct occurred, and guide you through the process of holding the responsible parties accountable. An attorney acts as your advocate, handling the legal complexities so you can focus on moving forward. They can assess your case, explain your options clearly, and build a strategy aimed at recovering your hard-earned money.

Brokerage firms are required to supervise their financial advisors to ensure they are acting in their clients’ best interests. When they fail to do so, and an investor suffers losses as a result, it can be a case of negligence. For example, when multiple complaints arise against a single broker, it raises questions about the firm’s oversight. A securities attorney investigates these situations to determine if there was a failure in supervision. They will review your account statements, communications with your broker, and the firm’s history to build a case around claims of broker fraud and negligence. Their goal is to show that the firm is responsible for the losses you incurred due to their lack of proper oversight.

One of the most important goals when pursuing a claim is to recover the money you’ve lost. In some cases, the financial damages can be substantial. For instance, in recent disputes involving just one broker, customers are seeking to recover over $1.7 million in damages. A securities attorney will carefully calculate the full extent of your financial losses, including the money you invested and potential growth that was lost due to unsuitable recommendations or misconduct. They then pursue recovery through negotiation or, more commonly, a process known as securities arbitration. This is a formal dispute resolution process where your attorney presents your case to a panel of arbitrators who will issue a binding decision.

Taking legal action is not just about recovering past losses; it’s also about safeguarding your financial future. By holding brokers and their firms accountable, you help enforce industry standards and protect other investors from similar harm. An attorney can help you understand the red flags you may have missed, empowering you to make more informed decisions with future investments. Addressing these investment issues head-on provides a sense of closure and allows you to regain control over your financial life. It sends a clear message that misconduct will not be tolerated and helps you move forward with confidence and a greater awareness of your rights as an investor.

What are the main allegations against Michelle Stebbins? The recent complaints center on the claim that her employer, Stifel, Nicolaus & Company, failed to properly supervise her actions. Several clients have filed disputes alleging this lack of oversight led to significant financial losses. In total, the four most recent claims seek to recover more than $1.7 million in damages.

The post mentions “supervisory failures.” What does that mean for me as an investor? Brokerage firms have a legal responsibility to monitor their financial advisors to ensure they are acting appropriately and in their clients’ best interests. When a firm doesn’t provide this oversight and an investor loses money as a result of an advisor’s misconduct, the firm itself can be held accountable for those losses. This is a critical protection that allows you to pursue a claim against the company, not just the individual advisor.

What’s the first thing I should do if I’m concerned about my investments with any advisor? Start by gathering your documents. Collect all of your account statements, trade confirmations, and any written communication you have. Review these records carefully for any activity that seems unusual, unauthorized, or doesn’t align with the goals you discussed. If you see anything that raises a red flag, your next step should be to get a professional opinion on your situation.

If I lost money due to my broker’s actions, will I have to go to court? It’s unlikely. Most disputes between investors and brokerage firms are resolved through a process called securities arbitration. This is a formal and binding method of dispute resolution that is handled outside of a traditional courtroom. An impartial arbitrator or panel hears both sides of the case and makes a decision on how to resolve the issue, which can include an award to recover your financial losses.

Why should I consider hiring a securities attorney for this? While you can file a claim on your own, brokerage firms have powerful legal teams dedicated to defending themselves. A securities attorney understands the complex rules of the financial industry and the arbitration process. They can build a strong case on your behalf, handle the legal procedures, and work to level the playing field so you have a fair chance at recovering your money.