Have you ever looked at your investment statement and felt a sense of confusion or unease? Maybe you noticed transactions you don’t remember approving or saw losses in investments that seemed riskier than you were comfortable with. This feeling is a critical signal that something might be wrong. For some investors, this unease is connected to the advice they received from their financial professional. The public record for broker Brian Lesley and LPL Financial, LLC, includes customer disputes that echo these exact concerns, with allegations of unauthorized trading and unsuitable recommendations. By examining these claims, you can learn to identify specific warning signs in your own portfolio and understand your rights as an investor when the advice you receive leads to unexpected harm.

Key Takeaways

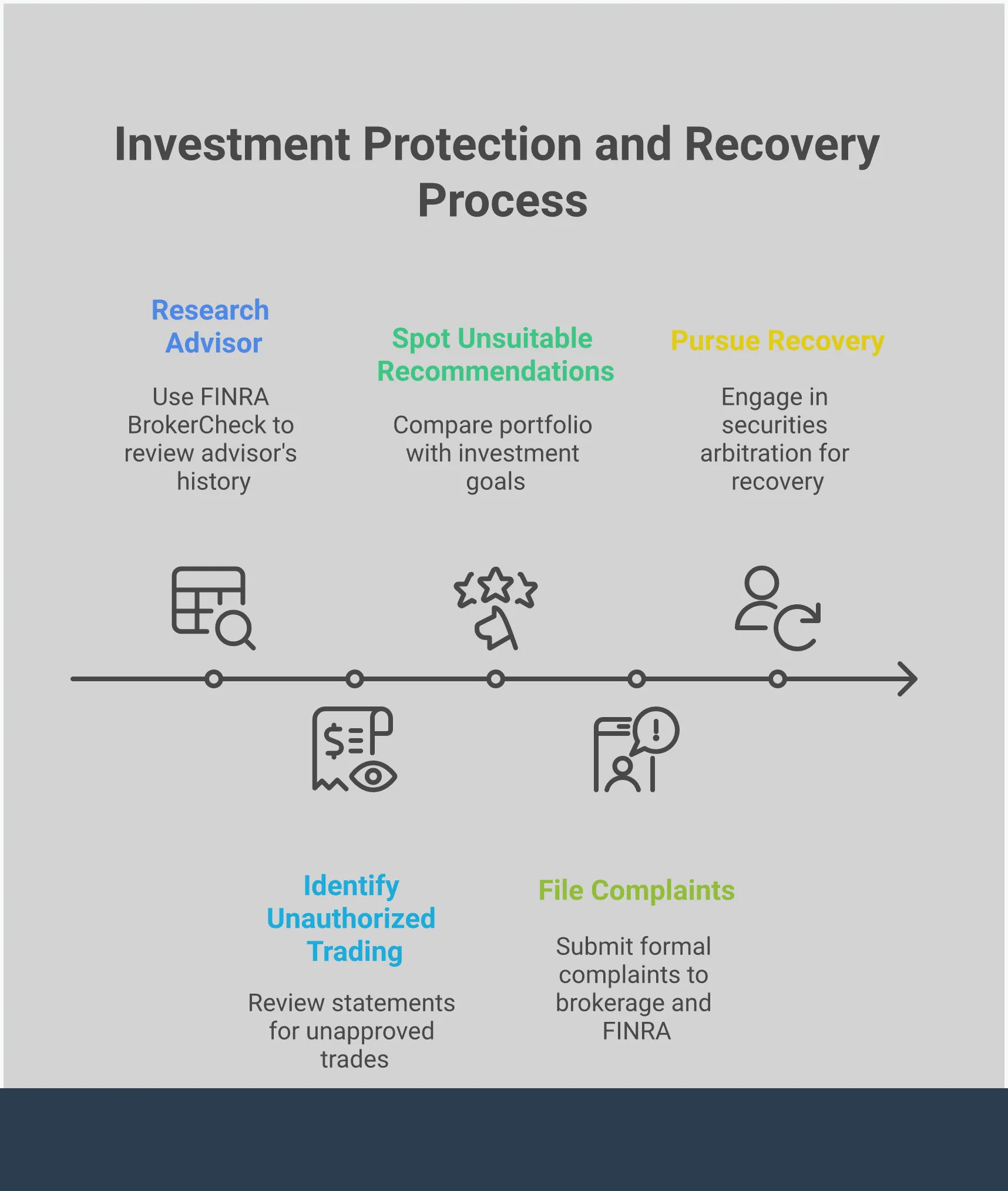

- Always research an advisor’s background: Use free tools like FINRA’s BrokerCheck to review a professional’s history for customer complaints, regulatory actions, and employment terminations. This simple step is your first line of defense in protecting your investments.

- Trust your gut and check your statements: Be on the lookout for red flags like trades you didn’t authorize or investment recommendations that feel too risky for your goals. These are serious signs that your advisor may not be acting in your best interest.

- You have the right to recover your losses: If you believe broker misconduct caused you financial harm, you have options. A securities attorney can help you build a case and pursue recovery through formal processes like securities arbitration.

Who Is Brian Lesley?

When you place your financial future in an advisor’s hands, you’re placing a great deal of trust in their judgment and integrity. That’s why understanding an advisor’s professional background is a crucial step in protecting your investments. Brian Lesley is a financial advisor who has been named in customer disputes, which makes it important for his current and former clients to be aware of his professional record. This information can help you recognize if you’ve faced similar issues and decide what actions you can take.

Knowing the details of an advisor’s career, their firm, and the services they offer provides the context you need to evaluate your own portfolio and the recommendations you’ve received. It’s about making sure the guidance was truly appropriate for your financial situation and long-term goals. If you have any concerns about your accounts, reviewing the specifics of your advisor’s history is a practical and empowering place to start.

His Role at LPL Financial

Brian Lesley has been a registered financial advisor since 1998. He has been affiliated with LPL Financial LLC, one of the country’s largest independent broker-dealer firms, since March 2012. Working from an office in Statesville, North Carolina, he provides financial guidance and investment services to clients under the LPL Financial name. As a registered representative, he is authorized to buy and sell securities for his clients. This relationship is important because LPL Financial is responsible for supervising his activities to prevent broker fraud and negligence.

Investment Services Offered

Mr. Lesley provides a wide range of financial products and services. His practice includes investment planning using stocks, bonds, and mutual funds. He also works on long-term strategies like retirement and college savings through financial tools such as IRAs, annuities, and 529 plans. Beyond investment management, he offers insurance products, including life, disability, and long-term care insurance. When an advisor manages such a diverse portfolio of products, it is vital that their recommendations fit a client’s specific needs and risk tolerance. When they don’t, significant investment issues can develop, potentially causing major financial losses.

What Is LPL Financial, LLC?

If you’ve worked with a financial advisor, you may have come across the name LPL Financial. It’s one of the largest independent broker-dealers in the country, serving as the backbone for thousands of financial advisors and investment programs. Founded in 1989, LPL Financial provides the technology, brokerage services, and support that independent advisors use to run their own practices. With nearly 28,000 advisors under its umbrella, the firm has a massive footprint in the investment world.

Understanding the structure of a firm like LPL is important because it shapes how your advisor operates and the oversight they receive. While many advisors provide excellent service, the sheer size of these networks means that instances of broker fraud and negligence can and do occur. Knowing the relationship between your advisor and their affiliated broker-dealer helps you understand where responsibility lies if something goes wrong with your investments.

The Independent Broker-Dealer Model

LPL Financial operates on what’s known as an “independent broker-dealer” model. This means that financial advisors who affiliate with LPL are not employees in the traditional sense, like they might be at a large wirehouse firm. Instead, they are independent business owners who pay LPL for access to its platform, tools, and services. This structure gives advisors more freedom in how they run their practice and manage client relationships.

From an investor’s perspective, you are the client of the independent advisor, who in turn uses LPL for executing trades and other back-office functions. While this model allows for a more personalized approach, it also places a significant compliance and supervision responsibility on the parent firm, LPL, to ensure its thousands of independent representatives are acting in their clients’ best interests.

Regulatory and Compliance Rules

Like all broker-dealers, LPL Financial is regulated by the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC). These organizations set strict rules designed to protect investors from misconduct. However, a firm’s regulatory history can tell you a lot about its compliance culture. LPL has faced public regulatory actions in the past, including a significant settlement in 2018 related to the sale of unregistered securities.

When a firm fails to adequately supervise its advisors, investors can suffer financial harm. If you have a dispute, the case is often handled through securities arbitration, a formal process for resolving these issues. It’s a reminder that no matter the size or reputation of a financial firm, staying informed about your advisor’s record and your rights as an investor is always a critical step.

What Are the Allegations Against Brian Lesley?

When you work with a financial advisor, you place a great deal of trust in their judgment and integrity. It can be distressing to learn that your broker is facing complaints from other clients. Public records show that Brian Lesley, a securities broker at LPL Financial LLC, has been the subject of customer disputes. These allegations center on core responsibilities that every broker owes to their clients, including acting with permission and recommending appropriate investments. Understanding these claims can help you recognize similar issues in your own portfolio and know what to look for when vetting an advisor. The disputes raise questions about unauthorized trading and the suitability of his investment recommendations.

Unauthorized Trading Claims

As an investor, you have the final say on every transaction in your account, unless you have given specific written permission for a broker to trade on your behalf. One of the most serious allegations a broker can face is making trades without a client’s consent. A former client accused Brian Lesley of this exact practice, alleging that he engaged in unauthorized trading that resulted in stock market losses. This is a significant breach of trust and a violation of industry rules. According to public records, LPL Financial LLC chose to settle this case, paying the client $35,000 to resolve the dispute.

Unsuitable Investment Recommendations

A financial advisor has a duty to recommend only those investments that are a good fit for your specific circumstances. This includes considering your age, income, risk tolerance, and financial goals. Another client filed a complaint against Brian Lesley, claiming he made unsuitable recommendations that led to losses in mutual funds. Essentially, the client alleged that the investments suggested were not right for their situation. While LPL Financial LLC denied this particular complaint, the allegation itself points to a fundamental aspect of an investor’s rights: the right to receive advice that is genuinely in your best interest and aligned with your personal financial profile.

Inappropriate Debt Securities

Digging deeper into the suitability claims, one complaint specifies that Brian Lesley recommended debt securities that were inappropriate for the customer. Debt securities, like bonds, can be complex, and their risk levels vary widely. Recommending a high-risk bond to a retiree who needs stable income, for example, could be considered an unsuitable recommendation. The allegation claims the investments did not match the customer’s financial situation or long-term objectives. This highlights the importance of ensuring your advisor not only understands your goals but also selects specific products that help you meet them without exposing you to unnecessary risk.

How Were These Allegations Resolved?

When an investor files a complaint against their broker, the path to resolution can vary. Some cases end in a settlement, where the firm agrees to pay a certain amount to resolve the claim. Others may be denied by the firm, or they may proceed through a formal dispute resolution process. In the case of Brian Lesley, public records show a mix of outcomes, including a settlement and pending disputes that are still under review. Understanding these resolutions can provide insight into how firms handle allegations of misconduct and what you might expect if you find yourself in a similar situation.

Settlement Details and Client Payouts

At least one of the disputes involving Brian Lesley has been resolved through a financial settlement. A client alleged that Lesley engaged in unauthorized trading, which occurs when a broker makes trades in an investor’s account without their explicit permission. This specific claim, which involved losses in stocks, was settled by LPL Financial for $35,000. A settlement is not an admission of guilt, but it is a formal resolution where the firm pays the client to close the dispute. This outcome returns a portion of the lost funds to the investor and concludes the matter without further legal proceedings.

Status of Open Disputes

Not all disputes end in a payout. In another case, a client accused Brian Lesley of making unsuitable recommendations, and LPL Financial denied this complaint. More recently, another customer complaint has been filed with FINRA against Lesley. This pending dispute includes allegations of both unsuitable investments, specifically related to debt securities, and unauthorized trading of stocks. The term “pending” means the case is currently active and being reviewed through the securities arbitration process. A final decision has not yet been reached, and the outcome remains to be determined as the regulatory body examines the evidence from both sides.

How to Research a Financial Advisor’s Background

Before you trust a professional with your life savings, it’s essential to do your homework. Just as you’d check references for a contractor, you should vet any financial advisor or broker who will be managing your money. Fortunately, there are free and reliable public tools that can give you a clear picture of a professional’s history. Taking the time to conduct this research is a critical step in protecting yourself from potential broker fraud and negligence. It empowers you to make an informed decision and helps you avoid individuals with a history of misconduct.

Using FINRA’s BrokerCheck Tool

Your first and most important stop should be FINRA’s BrokerCheck. This free tool is a comprehensive database that helps you find information about financial professionals. You can use BrokerCheck to see an advisor’s employment history, their licenses, and any reported disclosures. These disclosures are the most critical part of the report, as they detail customer complaints, regulatory actions, and other disciplinary events. Think of it as a background check for your financial life. A clean report is a good start, but a report with disclosures gives you specific events you need to examine more closely before moving forward with an advisor.

Reviewing Public Filings and Complaints

BrokerCheck is your starting point, but the details within the disclosures matter most. When a client files a complaint against a broker for issues like unauthorized trading, it becomes part of that broker’s public record, even if the firm denies the claim. This creates a paper trail you can follow. For example, a dispute might allege that a broker made trades without getting the client’s permission, leading to stock losses. Reading through these filings gives you insight into how a broker has treated past clients and whether a pattern of unsuitable investment practices exists. Don’t just look at the outcome; pay close attention to the nature of the complaints themselves.

Spotting Warning Signs in an Advisor’s Record

As you review an advisor’s record, it’s important to know what to look for. A pending complaint is a significant warning sign. Even without a final judgment, it shows that another investor has raised serious concerns that have not yet been resolved. Beyond their official record, be wary of certain behaviors during your conversations. High-pressure sales tactics, recommendations for investments that don’t align with your stated goals, or a lack of clarity around fees and risks are all red flags. If your gut tells you something is off, it’s often right. When you see these signs, it may be time to discuss your options with a legal professional.

How to Vet a Financial Advisor

Choosing a financial advisor is one of the most important decisions you’ll make for your financial future. You’re entrusting someone with your life savings and your goals, so it’s essential to do your homework before signing any agreements. Taking the time to properly vet an advisor isn’t just a good idea—it’s your first line of defense against potential misconduct. A thorough background check can reveal critical information that helps you make an informed choice and protect your assets from unnecessary risk.

Think of it like hiring any other professional. You wouldn’t hire a contractor without checking their references and past work, and the same principle applies here. Fortunately, there are free and accessible tools that allow you to look into an advisor’s professional history. By asking the right questions and knowing what warning signs to look for, you can feel more confident in your decision and build a relationship based on trust and transparency.

Key Due Diligence Steps

Before you commit to working with an advisor, it’s crucial to conduct some initial research. A great place to start is with FINRA’s BrokerCheck tool. This free online resource lets you look up a broker’s employment history, licenses, and, most importantly, any customer complaints or disciplinary actions filed against them. This report provides a clear picture of the advisor’s professional background and credibility. Reviewing this information can help you avoid individuals with a history of broker fraud and negligence. Taking this simple step can save you from significant financial and emotional distress down the road.

Questions to Ask Before You Hire

When you meet with a potential financial advisor, come prepared with a list of questions. Don’t be afraid to ask about their experience, the specific services they offer, and how they get paid. It’s also perfectly acceptable to ask directly if they have any past complaints or disciplinary actions on their record. A trustworthy advisor will be transparent and willing to discuss their history. Understanding these key aspects of their practice will help you determine if they are a good fit for your financial needs and goals. If their answers seem vague or evasive, that in itself is a warning sign.

Red Flags to Watch For

Be on the lookout for red flags when evaluating a broker. High-pressure sales tactics are a major one; you should never feel rushed into making a decision about your money. Another warning sign is if an advisor suggests investments that don’t seem to align with your stated financial goals or risk tolerance. Be wary if they are not clear about fees and potential risks. A pending complaint against a broker is also a serious concern, as it indicates another client has already raised significant issues about their conduct. If you notice any of these red flags, it may be time to walk away and contact a legal professional to discuss your concerns.

What Are Your Rights as an Investor?

When you entrust your money to a financial advisor, you’re not just hoping for the best—you’re protected by a set of established rights. Understanding these rights is the first step toward protecting your financial future and holding professionals accountable for their actions. If you feel something isn’t right with your accounts, it’s important to know the rules that are in place to protect you.

Protections Under Securities Law

As an investor, you have the right to expect that brokers will prioritize your financial interests. Brokers are required to recommend products that are suitable for you, rather than simply those that yield them higher commissions. This means their advice must align with your personal financial situation, investment goals, and tolerance for risk. For example, a high-risk, speculative product is likely unsuitable for a conservative investor nearing retirement. These protections are designed to shield you from various investment issues and ensure your advisor acts in your best interest.

How to File a Formal Complaint

If you believe your advisor has engaged in misconduct, taking organized steps is key. If you suspect any wrongdoing, it is crucial to gather and preserve all relevant communications, account statements, and trade confirmations, as these documents serve as important evidence in any dispute. You can also take proactive measures. Before making any investment decisions, utilize free resources like FINRA’s BrokerCheck to investigate a broker’s professional history, including any customer complaints or disciplinary actions. This simple check can reveal a history of broker fraud and negligence and help you make an informed choice.

The Securities Arbitration Process

When a dispute can’t be resolved directly, many investors have an effective path for recourse. Securities arbitration is a widely used method for investors to resolve disputes and seek recovery for losses incurred due to broker misconduct. This process is often more efficient than traditional court proceedings. Instead of a lengthy and public court battle, arbitration is a more streamlined, private process overseen by an impartial arbitrator or panel. It’s designed specifically to handle these types of financial disputes, allowing you to present your case and work toward a resolution.

When Should You Contact a Lawyer?

It can be incredibly stressful to realize your investments aren’t performing as expected, and even more so if you suspect your broker is to blame. Trusting your gut is important, but knowing the specific signs of misconduct can help you decide when it’s time to seek legal advice. If you’re feeling uncertain about your financial situation and your broker’s actions, understanding your options is the first step toward taking control. Recognizing the warning signs and knowing who to turn to can make all the difference.

Signs of Broker Misconduct

Keep an eye out for red flags that might indicate a problem. Have you noticed trades on your account statement that you never gave the green light for? That’s called unauthorized trading, and it’s a serious form of broker fraud and negligence. Another warning sign is when a broker pushes investments that don’t fit your financial goals, age, or risk tolerance. For example, putting a retiree’s nest egg into high-risk stocks could be an unsuitable recommendation. Even if a firm dismisses a complaint against a broker, that complaint becomes part of their public record. A pattern of complaints can signal a history of misconduct that you should not ignore.

How a Securities Attorney Can Help

If any of those signs sound familiar, you don’t have to figure out the next steps alone. Consulting with a securities attorney can bring much-needed clarity to a confusing and overwhelming situation. A lawyer who focuses on these specific investment issues can review your case, explain your rights in plain English, and outline the legal options available to you. They can guide you through the complex process of filing a claim and act as your advocate, working to hold the responsible parties accountable for their actions. Having a professional in your corner ensures your side of the story is heard.

Options for Recovering Your Losses

When you’ve lost money due to a broker’s misconduct, your primary goal is recovery. Fortunately, there are established pathways for investors to reclaim their funds. The most common route is securities arbitration, a formal process designed to resolve disputes more efficiently than a lengthy court battle. It’s a private forum where an arbitrator or a panel hears both sides and makes a binding decision. Working with an experienced attorney can significantly improve your chances of a favorable outcome. They understand the rules of arbitration and can build a strong case on your behalf to help you recover what you’ve lost.

Related Articles

- LPL Broker Vincent Pallitto, Jr.: Investor Complaints & Disputes | The Frankowski Firm

- Claims Against LPL Financial Broker Shannon Moore | The Frankowski Firm

- LPL Broker Bentley Beard: Investor Allegations & Recourse – The Frankowski Firm

- LPL Financial Fined $11.7M

- Investigating LPL Financial LLC Broker Brian Lesley | The Frankowski Firm

Frequently Asked Questions

What should I do if I see trades in my account that I didn’t approve? Discovering unfamiliar transactions in your account statement can be alarming. This is known as unauthorized trading, and it’s a serious violation of your rights as an investor. Your first step should be to gather all your recent account statements and any written communication you have with your advisor. You have the right to question every single transaction, and your broker is obligated to have your permission before making trades unless you’ve signed a specific discretionary agreement.

Is there a simple way to check if my own financial advisor has complaints against them? Yes, and it’s a step every investor should take. The Financial Industry Regulatory Authority (FINRA) provides a free tool called BrokerCheck. You can use it to look up any advisor by name and see their employment history, licenses, and any disclosures. These disclosures are key, as they detail past customer complaints, regulatory actions, or other disciplinary events. Reviewing this report gives you a clear, unbiased look at who is managing your money.

My advisor recommended investments that lost money and felt too risky for me. Is that my fault? Not necessarily. A financial advisor has a professional duty to recommend investments that are suitable for your specific financial situation, age, and risk tolerance. If you expressed a desire for low-risk, stable investments but were placed in volatile products that resulted in losses, that could be considered an unsuitable recommendation. It’s your advisor’s job to understand your goals and align their advice accordingly, not to push products that don’t fit your profile.

If my broker did something wrong, is it actually possible to get my money back? Yes, there are established processes for recovering investment losses caused by broker misconduct. The most common path is through securities arbitration, which is a formal process designed to resolve these disputes without a lengthy court case. While no outcome is guaranteed, arbitration provides a direct forum for you to present your case and seek a financial recovery for the damages you’ve suffered.

My advisor is ‘independent’ but works with a big firm like LPL. Who is responsible if something goes wrong? This is a great question that highlights an important industry structure. While your advisor may operate as an independent business, the large broker-dealer firm they affiliate with, like LPL Financial, has a legal duty to supervise their activities. This means the firm is responsible for ensuring its advisors follow industry rules and act in their clients’ best interests. If misconduct occurs, both the individual advisor and the supervising firm can be held accountable.