NO FEES UNTIL WE WIN

FREE CONSULTATION

NO FEES UNTIL WE WIN

FREE CONSULTATION

When you’re an American living abroad, a dispute with your U.S. brokerage firm can feel like a problem without a solution. The distance alone can make you feel powerless, as if your only option is to accept the financial loss. But your rights as an investor don’t disappear just because you’ve moved. There is a clear and established path to hold negligent firms accountable, and you don’t have to fly back to the States to do it. This guide is designed to walk you through the process of FINRA arbitration for Americans in Australia. We’ll explain how this system works, how you can participate remotely, and what you need to do to build a strong case for recovering your hard-earned money.

If you have a dispute with your U.S.-based brokerage firm while living in Australia, you might feel stuck. The good news is there’s a direct path called FINRA arbitration. The Financial Industry Regulatory Authority (FINRA) oversees U.S. broker-dealers and runs a forum to resolve securities-related disputes. Think of it as a specialized court for the investment world, where impartial arbitrators hear your case instead of a judge. FINRA’s Dispute Resolution Services provides a fair and efficient way to handle claims of broker fraud and negligence. This process is often required by your account agreement and is designed to be faster than court, making it a practical option for resolving your claim from abroad.

FINRA’s arbitration process was created to protect investors. It gives you a way to hold brokerage firms accountable without a lengthy court battle. FINRA maintains a roster of over 8,000 qualified, neutral arbitrators to hear your case. The statistics are encouraging for investors. According to FINRA, 84% of customer arbitration cases result in a settlement or a monetary award. This high resolution rate shows the system provides a legitimate path to recover losses and levels the playing field between individuals and large financial institutions.

The process begins when you file a Statement of Claim and a Submission Agreement. The claim details what happened and the damages you suffered, while the agreement confirms you’ll abide by the final decision. FINRA serves the claim to the brokerage firm, which then files an answer. Next, both sides select arbitrators and exchange documents. The process culminates in a hearing where you present your case. Afterward, the arbitrators issue a final, binding decision called an award. FINRA’s arbitration process is structured to keep things moving efficiently.

Arbitration is generally faster and less complicated than a traditional lawsuit. Brokerage firms are required to participate, so they can’t ignore your claim. Independent arbitrators with industry knowledge review the facts instead of a judge. The biggest difference is the finality of the outcome. The arbitrators’ decision is binding, and there are very limited grounds for an appeal, unlike a court case that can be tied up in appeals for years. This means once a decision is made, you can get closure and move forward.

Living overseas doesn’t mean you’ve lost your rights as an American investor. If you have a dispute with a U.S.-based brokerage firm, you can still seek resolution through the Financial Industry Regulatory Authority (FINRA). The process is designed to be accessible, even from the other side of the world. Let’s walk through how it works for Americans in Australia.

Yes, you are. Your location in Australia doesn’t prevent you from filing a claim. According to FINRA, its Dispute Resolution Services are available to help investors and firms resolve securities-related disputes. This means that as an American investor, you have access to this forum regardless of where you currently reside. If your dispute involves a FINRA-member firm or an associated individual, you have the right to initiate an arbitration case to address your investment issues and seek recovery for your losses. The key is the connection to the U.S. securities industry, not your physical address.

FINRA arbitration covers a wide range of disputes. These can include claims of unsuitability, misrepresentation, unauthorized trading, or general broker fraud and negligence. The process itself is a formal but streamlined alternative to court. FINRA notes that arbitration is “usually quicker and less complicated,” and brokerage firms are required to participate. Independent arbitrators review the evidence from both sides and issue a final, binding decision. This structure allows you to have your case heard and decided by a neutral party without needing to appear in a traditional U.S. courtroom.

The logistics of participating from Australia might seem daunting, but FINRA’s processes account for remote parties. Virtual hearings are now a standard option, allowing you to present your case via video conference. This eliminates the need for international travel. However, it does require careful planning around time zones. It’s crucial to communicate your availability and any potential scheduling conflicts well in advance. FINRA’s rules include strict deadlines for certain requests, underscoring the importance of proactive case management when coordinating across continents. Staying organized is key to a smooth arbitration process.

Staying on top of your case from abroad is easier than ever thanks to modern technology. FINRA provides an online Dispute Resolution Portal where you can view case information and submit documents securely. This digital platform centralizes communication and ensures that you and your legal team can manage filings and correspondence efficiently, no matter the time difference. It removes the reliance on international mail and keeps the process moving forward. If you need assistance managing these digital tools and communications, our team is here to help you contact us to discuss your situation.

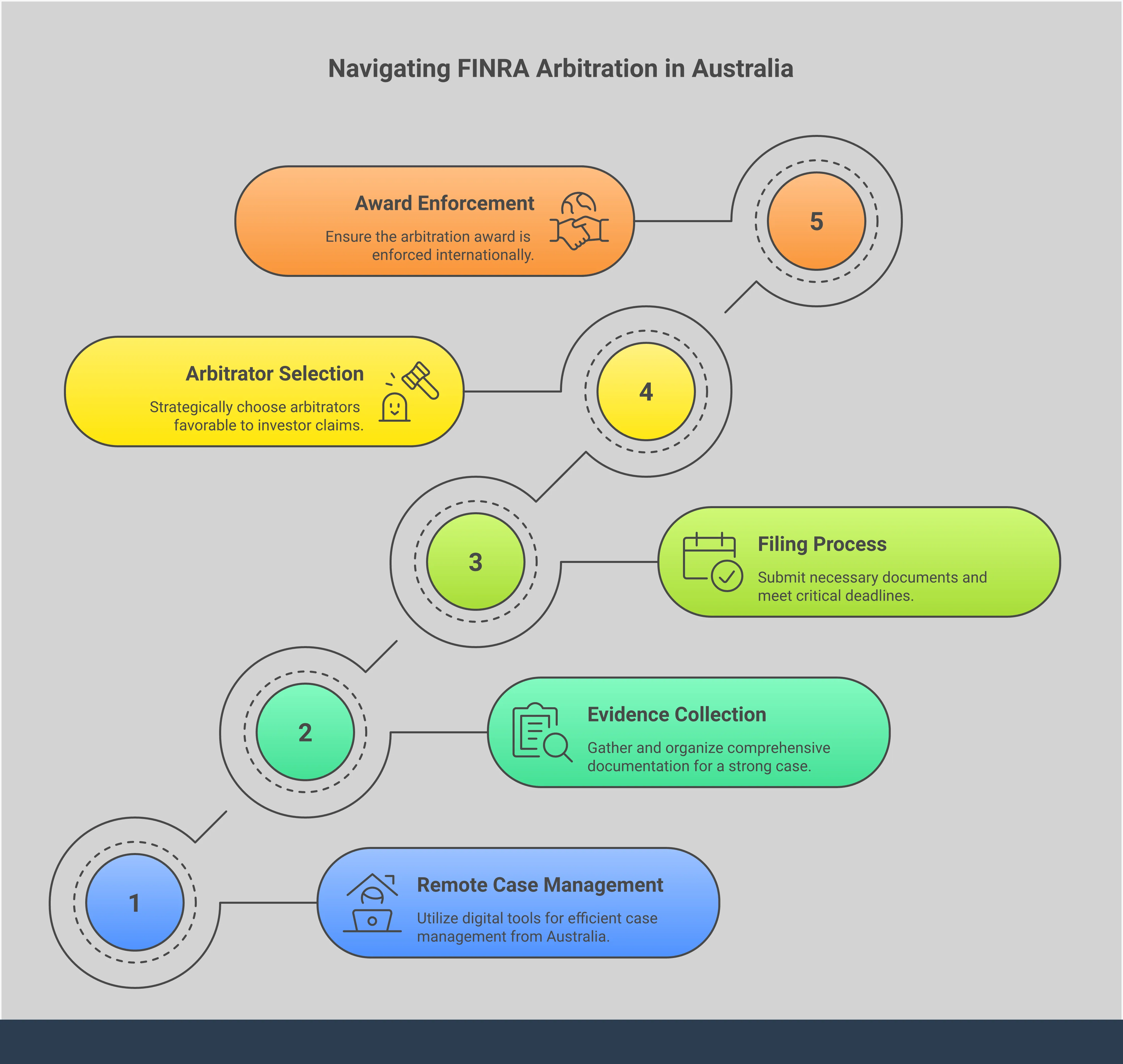

Filing a FINRA claim from another country might seem daunting, but the process is more accessible than you might think. Thanks to digital tools and clear procedures, you can pursue your claim effectively without having to travel back to the United States. The key is to be organized and understand the steps involved. Think of it as a project with a clear beginning, middle, and end. By breaking it down into manageable tasks, you can confidently move forward with holding a negligent broker or firm accountable for your investment losses.

Before you can initiate a claim, you need to assemble all your relevant paperwork. The cornerstone of your submission is the Submission Agreement, a document that officially names the parties involved and confirms that FINRA will handle the case. Beyond that, you should collect everything that supports your claim. This includes account statements, trade confirmations, emails, letters, and any notes you took during conversations with your broker. Having these documents organized will help you build a clear and compelling story of the broker fraud and negligence you experienced. The more detailed your records are, the stronger your position will be from the start.

The FINRA arbitration process follows a structured path. It begins when you file your Statement of Claim, which details what happened and the damages you are seeking. After your claim is submitted and reviewed, it is served to the brokerage firm or individual you are filing against (the respondent). They will then have a chance to respond. From there, both parties participate in selecting an arbitrator or a panel of arbitrators who will hear the case. The process culminates in a hearing where you present your evidence. Understanding this sequence helps you anticipate what’s next and prepare for each stage of the securities arbitration journey.

Meeting deadlines is critical in any legal process, and FINRA arbitration is no exception. From the initial filing window to deadlines for responding to information requests, staying on top of dates is essential to keeping your case on track. For example, if you need to request a waiver for certain fees due to financial hardship, you must do so no later than 60 days before the first hearing. Missing a deadline can have serious consequences for your claim. We recommend keeping a detailed calendar of all important dates and working closely with a legal representative who can help you manage the timeline. If you have questions about your specific deadlines, it’s always a good idea to contact a legal professional.

Living in Australia doesn’t prevent you from fully participating in your FINRA arbitration case. FINRA’s Dispute Resolution Portal is an online platform that allows you to submit documents, view case information, and manage your claim from anywhere in the world. When it comes time for the hearing, you can typically attend virtually through a video conference. This remote access removes the significant burden of international travel and allows you to present your case effectively from your home or office. These virtual options ensure that geography is not a barrier to seeking justice for your investment losses.

When your investment dispute crosses international borders, the legal landscape can feel a bit tangled. But there are established rules designed to manage these situations, making the process more straightforward than you might think. Understanding a few key legal points about how U.S. and international laws interact can give you confidence as you move forward with your claim from Australia. The system is built to be consistent and fair, no matter where you are.

This framework ensures that your rights as an investor are protected and that decisions are respected globally. Let’s walk through the essential legal concepts you’ll encounter in a cross-border arbitration case.

One of the most important things to understand about the U.S. system is that the outcome of a securities arbitration is binding. This means the decision made by the arbitrators is final and legally enforceable for everyone involved. Unlike a court trial, where appeals can drag on for years, an arbitration award can only be challenged on very limited grounds. This finality is designed to make the dispute resolution process more efficient and conclusive, so you can get a clear resolution and move forward. It provides a sense of closure that is often missing in other legal proceedings.

While your claim against a U.S. brokerage firm is handled through FINRA, it’s helpful to know that Australia also has a modern and well-regarded legal framework for arbitration. Australian law is based on an international standard known as the Model Law, which aligns it with many other countries. This harmony between legal systems is important because it simplifies the process if you need to enforce your FINRA award in Australia. It means the local courts are already familiar with the principles of arbitration, creating a smoother path for you to collect any funds you are awarded.

A common question we hear is, “If I win my case, how do I actually collect the money in Australia?” This is where a critical international treaty called the New York Convention comes into play. This agreement makes decisions from international arbitrations enforceable in the 170+ countries that have signed it, including both the United States and Australia. Thanks to this convention, a final award from your FINRA arbitration is generally recognized and can be enforced by Australian courts. This powerful tool ensures that a successful outcome has real-world impact, allowing you to recover your losses from broker fraud and negligence.

A core idea in arbitration worldwide is “minimal court intervention.” This principle means that courts in different countries agree to interfere as little as possible with the arbitration process. This standard is crucial because it respects the decision you and the brokerage firm made to resolve your dispute through arbitration rather than in court. It also helps keep the rules consistent across borders, which adds predictability and fairness to the process. This global commitment to upholding arbitration outcomes strengthens the entire system and ensures your case is handled according to a clear, established set of rules. If you have questions about these standards, our team is here to help you understand your options.

Building a strong case for FINRA arbitration is all about preparation. While the idea of confronting a brokerage firm can feel daunting, especially from overseas, a well-organized approach can make all the difference. Think of it as building a story, piece by piece, with clear evidence to support your claim. The process is structured and methodical, and by taking the time to prepare thoroughly, you put yourself in a much better position for a favorable outcome. It starts with gathering your documents and understanding the steps that lie ahead. With a clear strategy, you can confidently present your side of the story, no matter where in the world you are. Your legal team can guide you through each stage, but your active participation in preparing the case is invaluable.

Your first and most important task is to gather every piece of paper and digital communication related to your investment account. This includes account statements, trade confirmations, emails, text messages, and any notes you took during conversations with your broker. Strong documentation is the foundation of your claim. The FINRA arbitration process moves through several stages, including filing the claim, discovery, and the final hearing. Having your evidence organized from the start will streamline every step. If you believe you’re a victim of broker fraud or negligence, these documents will be the proof that tells your story and demonstrates how you were wronged.

Before you ever get to a hearing, there are a few key procedural steps. The process officially begins when you file a Statement of Claim, which is a written narrative of what happened, and a Submission Agreement. The Submission Agreement is essentially a contract where all parties agree to let FINRA administer the case and to be bound by the arbitrators’ decision. This pre-hearing phase involves a lot of information exchange between you and the brokerage firm, a process known as discovery. It’s a critical period for building your case and understanding the other side’s arguments, setting the stage for the securities arbitration hearing itself.

Choosing the person or people who will decide your case is a crucial step. Arbitrators are neutral individuals who review the evidence and arguments from both sides. FINRA will provide a list of potential arbitrators, and both you and the brokerage firm will have a say in who is selected. You can review arbitrator backgrounds and past decisions to help you make an informed choice. FINRA’s Dispute Resolution Portal is a useful resource where you can view case information and learn more about the selection process. Your attorney will help you choose an arbitrator who is fair and well-suited to hear your specific type of case.

Some investment fraud cases involve complex financial products or strategies that are difficult to explain. In these situations, an expert witness can be incredibly helpful. An expert witness is a professional with specialized knowledge—like a forensic accountant or a securities industry veteran—who can analyze your case and explain technical details to the arbitrators in an easy-to-understand way. They can help calculate your financial losses or testify about whether your broker’s actions fell below industry standards. While not every case needs one, an expert can add significant weight to your arguments when dealing with particularly complex investment issues.

Understanding the costs is a crucial step before starting FINRA arbitration. While it’s typically less expensive than a lawsuit, it isn’t free. You’ll generally face two types of expenses: administrative fees paid to FINRA and the costs for legal representation. Planning for these can make the process feel much more manageable, especially when you’re coordinating everything from Australia.

When you file a claim, you’ll first pay fees directly to FINRA to cover the cost of administering your case. This starts with submitting a Submission Agreement, which officially lists the parties involved. The filing fee amount is based on how much money you are trying to recover, and FINRA provides a clear schedule on its website. This initial payment is what gets the administrative side of your case moving.

While you can represent yourself, working with a lawyer who understands broker fraud and negligence can greatly improve your chances of a successful outcome. Legal fees are separate from FINRA’s costs and vary by firm. Many securities law firms work on a contingency fee basis, meaning they only get paid if you win your case. An initial consultation can help you understand the potential costs and determine if your claim is strong before you commit.

FINRA makes paying fees straightforward. After you file, your case administrator will give you instructions on how and when to pay. Staying on top of these payments is important to avoid delays. If you have questions about costs or need special services, like an interpreter, be sure to communicate with your administrator. Being proactive helps you understand your financial obligations throughout the securities arbitration process.

Don’t let costs stop you from seeking justice if you’re facing financial difficulties. FINRA has provisions to help, allowing you to request a waiver for certain fees by demonstrating hardship. You’ll need to submit this request to your case administrator well before your hearing. FINRA also offers a special helpline for older investors with questions, providing another layer of support even if you’re already in the arbitration process.

When you enter into securities arbitration, it’s helpful to understand that it’s a structured process with clear expectations for everyone involved. Both you and the brokerage firm have specific rights and responsibilities that keep the proceedings fair and moving forward. Think of it as the rules of the road—knowing them helps you understand what’s happening at every turn and what’s required of you to build a strong case.

For investors, especially those managing a claim from Australia, clarity is key. Your main responsibility is to initiate the claim and agree to the process. The brokerage firm, on the other hand, has an obligation to participate. This isn’t an optional invitation for them; it’s a requirement of their FINRA membership. Understanding these roles can take some of the uncertainty out of the process. It also highlights the built-in protections designed to give you a fair chance to recover your losses from broker fraud and negligence. From filing your initial claim to collecting a potential award, knowing your rights helps you stay in control of your case. This section will walk you through what’s expected of you, what the firm is required to do, and what happens after a decision is made.

Your primary responsibility as an investor is to kick off the legal process. The first official step is to file a Submission Agreement with FINRA. This document formally lists everyone involved in the case and confirms that you agree to have FINRA administer the proceedings. By signing it, you also agree to abide by the arbitrators’ decision if the case goes to a hearing. This commitment is the foundational step that gets your claim in motion and officially puts the brokerage firm on notice. It’s your way of formally saying you’re ready to move forward and see the process through to its conclusion.

Unlike you, the brokerage firm doesn’t have a choice about whether to participate. FINRA rules are clear: member firms are required to take part in arbitration when a claim is filed against them. This is a critical protection for investors, ensuring that firms can’t simply ignore your complaint. Both you and the firm will use FINRA’s online Dispute Resolution Portal to view case information and submit documents. This system is particularly helpful for managing your case from Australia, as it centralizes communication and keeps everything organized, ensuring you have access to the same information as the opposing party, even from a distance.

If the arbitration panel rules in your favor, you will be issued an award. The brokerage firm is expected to comply with the decision and pay you the specified amount promptly. While most firms do, sometimes a firm may delay or refuse to pay. If you don’t receive your payment in a timely manner, you may need to take additional legal steps to enforce the award. This can involve filing a court action to confirm the award and convert it into a legal judgment, which provides more powerful tools for collection. If you find yourself in this situation, please contact us for guidance.

Once the arbitrators have heard all the evidence, they will deliberate and issue a formal written award that is sent to all parties. It’s important to understand that this decision is generally final and binding. The grounds for appealing or modifying an arbitration award are extremely limited under the law, which is a major difference from a court trial where appeals are more common. Because the decision is so difficult to challenge, it underscores the importance of preparing a thorough and compelling case from the very beginning. You essentially have one shot to present your evidence and arguments effectively.

Going through an arbitration process can feel overwhelming, especially when you’re managing it from another country. The good news is you don’t have to figure it all out on your own. FINRA and other organizations provide a wealth of information and tools to help you prepare your case and understand your rights. Knowing where to look for help is the first step toward taking control of the situation.

FINRA’s main goal is to protect investors, and they offer several online resources to support that mission. Their Dispute Resolution Services (DRS) is the primary forum for these cases. As FINRA states, its purpose is to “provide a fair, efficient and effective forum for resolving disputes involving brokerage firms and their brokers.” This is your starting point for understanding the official process and accessing the systems designed to manage your claim, no matter where you are located.

Once you begin the process, you’ll rely heavily on the Dispute Resolution Portal. Think of it as your digital command center for the entire case. Through this portal, you can “view case information and submit documents,” which is incredibly convenient when you’re dealing with different time zones. This online system ensures that you can manage your filings, track progress, and stay organized without needing to send physical mail across the globe. It’s a critical tool for keeping your case moving forward from Australia.

You don’t have to go into this process blind. FINRA provides extensive educational materials to help you understand what to expect. On their site, you can find all the “rules, scripts, templates and forms that parties and neutrals will need during the course of an arbitration or a mediation.” Taking the time to review these rules and case resources can demystify the process and help you feel more prepared for each step, from filing your initial claim to attending the final hearing.

While FINRA provides the forum and resources, it doesn’t offer legal advice. Having a lawyer who understands the nuances of securities arbitration is essential for building a strong case. Professional legal representation ensures your rights are protected throughout the proceedings. Organizations like SIFMA have even highlighted that certain brokerage firm practices can undermine “the principles of investor protection and public interest.” An attorney can help you address these complex issues and work to secure a fair outcome. If you need guidance, you can contact us to discuss your situation.

How long does the FINRA arbitration process usually take? While every case is different, you can generally expect the process to take between 12 and 18 months from filing to a final decision. This is significantly faster than a traditional lawsuit, which can be tied up in court for several years. The structured nature of arbitration, with its clear deadlines and procedures, is designed to resolve disputes efficiently so you can get closure.

Do I really need a lawyer to file a FINRA claim? Although you are permitted to represent yourself, it’s highly recommended that you work with an attorney who specializes in securities law. Brokerage firms will always have skilled legal teams defending them, and going up against them alone can be incredibly challenging. An experienced lawyer understands the specific rules of the arbitration process and knows how to build a compelling case on your behalf.

What if the brokerage firm I have a dispute with has gone out of business? You may still be able to recover your losses even if the firm has closed its doors. Many firms are required to carry insurance that can cover claims like these. The process can be more complex, but it doesn’t automatically mean you’re out of options. This is a situation where consulting with a legal professional is essential to determine the best path forward.

Will I have to travel to the U.S. for any part of my case? No, you should be able to handle the entire process from Australia. FINRA has adapted to a global environment by creating an online portal for submitting documents and managing your case. Hearings are now commonly held via video conference, which removes the need for international travel and allows you to present your case effectively from wherever you are.

What is the very first thing I should do if I suspect I have a claim? The most important first step is to gather all of your documents. Collect every account statement, trade confirmation, email, and any personal notes you took during conversations with your broker. Organizing this evidence will give you a clear picture of what happened and is the foundational work you’ll need before speaking with an attorney to evaluate the strength of your claim.