NO FEES UNTIL WE WIN

FREE CONSULTATION

NO FEES UNTIL WE WIN

FREE CONSULTATION

Many American investors living abroad believe that if they fall victim to investment fraud, they have no real options. They assume the process is too expensive, too complicated, or that their physical distance from the United States puts them at an impossible disadvantage. These are common myths, and they often prevent people from taking action to recover their losses. The reality is that a powerful system is in place to protect you. The Financial Industry Regulatory Authority (FINRA) provides a streamlined arbitration process designed for these exact situations. Understanding the rights of American investors overseas in FINRA arbitration is crucial because it dispels these myths and shows you the clear, accessible path forward to fight for your financial future.

If you’re an American living abroad and suspect you’ve been a victim of investment fraud, you might feel isolated and unsure of your options. The good news is that you have rights and a clear path for seeking justice through the Financial Industry Regulatory Authority, or FINRA. FINRA provides a specific process called arbitration to handle disputes, and it’s accessible even if you’re not currently in the United States. This process is designed to be a more direct way to address grievances against brokers and their firms, helping you hold them accountable for misconduct. Understanding how this system works is the first step toward protecting your financial future, no matter where you are in the world.

FINRA is a private, self-regulatory organization that oversees brokerage firms in the U.S. A key part of its mission is protecting investors. To do this, FINRA offers Dispute Resolution Services to help investors and firms solve problems related to investments. Think of it as a specialized forum for settling disagreements fairly and efficiently. When you have a dispute involving broker fraud and negligence, FINRA provides the framework to hear your case and make a binding decision. This service is a cornerstone of investor protection, ensuring that there is a formal system in place to address your complaints.

While arbitration has similarities to a court proceeding, it’s generally a faster and less complicated process. In a traditional lawsuit, you might face years of complex legal maneuvers. In contrast, securities arbitration is designed to be more streamlined. One of the most important aspects is that brokerage firms registered with FINRA are required to participate in arbitration if an investor files a claim against them. They can’t simply refuse to engage. This mandatory participation ensures you have a venue to have your case heard by a neutral panel of arbitrators who will issue a final, binding decision.

To be eligible, your claim must be related to the securities industry. FINRA doesn’t handle disputes against professionals in other fields, like doctors or lawyers. Your complaint must stem from business you conducted with a securities brokerage firm or a broker. It’s also crucial to act in a timely manner. Generally, you have six years from the date the problem occurred to file an arbitration claim. This is a strict deadline, so if you believe you have a case involving unsuitable investment issues, it’s important to understand your timeline and take action before your window of opportunity closes.

When you’ve lost money due to what you believe is misconduct, it’s easy to feel powerless, especially when you’re living abroad. But you have more rights than you might realize. The Financial Industry Regulatory Authority (FINRA) provides a specific forum to handle these disputes, and understanding your rights within this system is the first step toward holding a broker or firm accountable. This process was designed to protect you, the investor. Knowing the rules of the road can help you feel more confident as you decide on your next steps. Let’s walk through the fundamental rights you have when you file a FINRA arbitration claim.

First and foremost, you have the right to a regulated marketplace. FINRA is the self-regulatory body that creates and enforces the rules for brokerage firms and their brokers in the United States. Its primary mission is investor protection. This means that any FINRA-member firm you worked with, even from overseas, is subject to these rules. If a broker engaged in misconduct or broker fraud and negligence, they violated the standards they are required to uphold. Your right to file a claim is rooted in this fundamental protection, ensuring that firms can’t simply operate without oversight. This framework is what allows you to seek recourse when things go wrong.

You have the right to a clear and accessible path for resolving disputes. FINRA’s Dispute Resolution Services offers a formal process for investors to settle disagreements with their brokerage firms. This isn’t some informal complaint box; it’s a structured system of arbitration and mediation designed to be a fair and efficient alternative to going to court. You have the right to access this system and present your case. The process is laid out with specific rules and procedures, giving you a roadmap to follow. This ensures that your claim is heard by a neutral party and that the brokerage firm is required to respond and participate.

When you file a claim, you have the right to a fair and impartial hearing. The securities arbitration process is like a simplified court case—it’s less formal and generally faster, but it is still a serious legal proceeding. One of your most important rights is that FINRA-member firms are required to participate in arbitration if an investor files a claim against them. They cannot refuse or ignore it. This mandatory participation ensures you get your day in a neutral forum where you can present evidence, call witnesses, and argue your case before an arbitrator or a panel of arbitrators who will issue a binding decision.

While you have the right to file a claim, that right isn’t open-ended. You must adhere to strict deadlines. Generally, you have six years from the date of the event you’re complaining about to file a FINRA arbitration claim. However, different states have their own time limits, known as statutes of limitations, which can be much shorter. Missing these deadlines can prevent you from ever being able to recover your losses, no matter how strong your case is. Because these timelines can be complex, it’s important to act quickly and understand which deadlines apply to your specific situation. If you think you have a claim, it’s wise to contact a legal professional to ensure you don’t lose your right to file.

If the arbitrators rule in your favor, you have the right to collect the monetary damages they award you. This decision, known as an “award,” is legally binding and can be confirmed in court, turning it into a judgment. The process begins by properly filing your claim through FINRA’s online portal. While collecting an award can sometimes present its own challenges, FINRA has rules in place to suspend or expel firms that fail to pay. This gives the arbitration award real teeth and provides a powerful incentive for the firm to comply. Your goal isn’t just to win, but to recover your losses from various investment issues, and the right to collect your award is the final, critical piece of that process.

Taking the first step to reclaim your financial security can feel like a huge hurdle, especially when you’re managing it from another country. But the process for initiating a FINRA arbitration case is more straightforward than you might think. It all begins with getting your story and documents in order. By understanding these initial steps, you can approach the process with confidence, knowing you’re on the right path to holding negligent parties accountable. Let’s walk through exactly what you need to do to get your case off the ground.

To officially begin the FINRA arbitration process, you’ll need to submit a couple of key documents. The first is your Statement of Claim, which we’ll cover in more detail next. The second is a signed Submission Agreement. This document is essentially a contract where both you and the brokerage firm agree to abide by FINRA’s arbitration process and accept the final decision of the arbitrators as legally binding. Think of it as the formal handshake that gets both parties to the table. Your attorney will handle the specifics, but knowing these two documents are the starting point helps demystify the process from the very beginning.

The arbitration process officially kicks off when you file a Statement of Claim with FINRA. This document is your opportunity to tell your side of the story. It must clearly outline the dispute, specify the alleged misconduct or broker fraud and negligence, and state the amount of money you are seeking to recover. You’ll also include any supporting documents you have, like account statements, emails, or notes from conversations. A well-written Statement of Claim sets the stage for your entire case, so it’s crucial that it is detailed, accurate, and persuasive. It’s the foundation upon which your entire claim is built.

Once your claim is filed, the next step is to select the people who will hear your case. These individuals are called arbitrators. FINRA will provide both you and the opposing party with a list of potential arbitrators, complete with their professional backgrounds. You’ll then go through a selection process, which usually involves striking a certain number of names from the list. The remaining individuals form the arbitration panel. This process is designed to create an impartial panel to hear your securities arbitration case and ensure a fair and unbiased outcome.

Yes, and this is a game-changer for investors living abroad. FINRA allows for virtual hearings, which means you can participate fully in the process without the expense and hassle of international travel. You can present your case, provide testimony, and attend the entire hearing from your home or office through a secure video conference platform. This accessibility ensures that your location doesn’t become a barrier to seeking justice. It levels the playing field, allowing you to pursue your claim effectively no matter where you are in the world.

Preparing for a FINRA arbitration hearing can feel like a monumental task, and doing it from another country adds another layer of complexity. But distance doesn’t have to be a disadvantage. With a focused approach, you can build a strong case from anywhere in the world. The key is to be methodical and proactive. Think of this preparation phase as building the foundation of your case—the stronger it is, the better your chances of a favorable outcome.

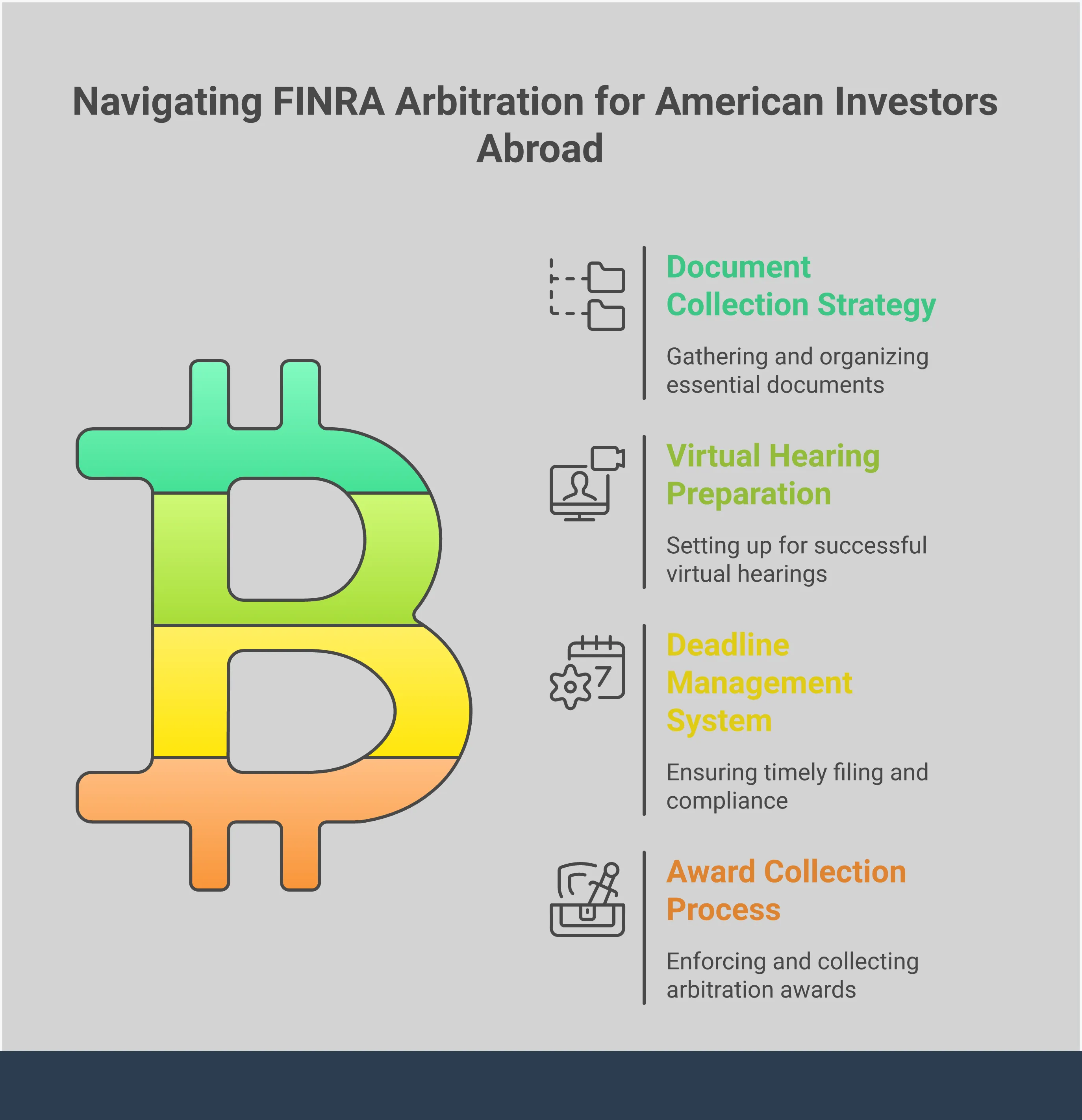

Your preparation will center on three main areas: collecting and organizing your evidence, working closely with your legal counsel, and understanding the steps that lead up to the hearing itself. Each piece is critical. Your evidence tells your story, your legal team provides the strategy and procedural knowledge, and your understanding of the process helps you stay grounded and focused. By tackling these elements one by one, you can manage the process effectively, no matter how many time zones separate you from the hearing room.

Your first move is to pull together every piece of paper and digital file related to your investment. This is the raw material that will be used to build your case. A comprehensive review of your records is the starting point for your complaint. Look for account statements, trade confirmations, prospectuses, and any marketing materials you received. Don’t forget digital communications—scour your emails, text messages, and any saved chats with your broker. Even handwritten notes from phone calls can be valuable. This collection of documents will form the factual backbone of your claim and help substantiate the investment issues you experienced.

Your relationship with your legal team is your lifeline in this process, especially when you’re overseas. They are your boots on the ground and your strategic partner. Lean on them to handle the procedural complexities and guide you through each step. Regular communication is essential. Schedule calls to discuss strategy, review documents, and prepare for your testimony. Your attorney will help you understand the nuances of the securities arbitration process, from filing the initial claim to selecting arbitrators and attending pre-hearing conferences. They will ensure all deadlines are met and that your case is presented clearly and powerfully.

Once you have all your documents, the next step is to bring order to them. A well-organized file is much more effective than a simple pile of papers. Start by creating a timeline of events. Arrange your documents chronologically to build a clear narrative of what happened and when. This timeline will be invaluable for drafting your Statement of Claim—the formal document that outlines your allegations and initiates the arbitration process. Grouping related documents, such as all communications with your broker or all statements for a specific account, can also help you and your legal team quickly find what you need.

The period before the final hearing is not a waiting game; it’s an active phase of preparation. You’ll go through a process called “discovery,” where both sides formally exchange information and documents relevant to the case. This ensures there are no surprises at the hearing. You will also participate in a pre-hearing conference, which is typically a call with the arbitrators and the opposing side. During this conference, you’ll discuss scheduling, deadlines, and other logistical matters. This is a crucial step for clarifying the rules of the road for your hearing, especially when addressing issues of broker fraud and negligence.

Filing a FINRA claim from overseas comes with its own unique set of obstacles. While the process is designed to be accessible, living abroad adds layers of complexity that you’ll need to prepare for. Understanding these potential hurdles ahead of time can help you feel more in control and build a stronger case. Let’s walk through some of the most common challenges you might face as an American investor living abroad.

Trying to coordinate calls and meetings across different time zones is frustrating enough without adding a legal dispute to the mix. Scheduling hearings and communicating with your legal team can become a logistical puzzle. Beyond scheduling, language barriers can present a real challenge. Legal and financial documents are filled with complex terminology that can be difficult to understand even for a native English speaker. It’s important to work with a team that can clearly explain the process and ensure you fully comprehend every document and decision you need to make.

When you opened your brokerage account, you likely signed an agreement that included a FINRA arbitration clause. This clause typically requires any dispute to be resolved through the securities arbitration process rather than in court. However, this can create jurisdictional questions, especially for international investors. Arguments can arise over which state’s laws should apply to your case, which can impact the outcome. Having a lawyer who understands these nuances is critical to making sure your claim is handled in the most appropriate jurisdiction for your situation.

Building your case means gathering a lot of paperwork—account statements, emails, trade confirmations, and other records. When you live abroad, collecting this evidence can be complicated. Your documents may be stored in different countries, each with its own regulations on data privacy and access. The process of obtaining official records from foreign institutions can be slow and bureaucratic. Addressing these potential investment issues early on is a crucial first step in preparing your claim, so it’s wise to start gathering your documentation as soon as possible.

Winning your arbitration case is a huge victory, but the process isn’t over until the award is paid. If the brokerage firm that owes you money doesn’t have assets in the U.S., you may need to enforce the award in a foreign country. This can be a complex legal undertaking, as each country has its own laws regarding the recognition of foreign arbitration awards. This final step requires a clear strategy to ensure the award granted to you is honored, turning your win on paper into a real financial recovery from broker fraud and negligence.

When you realize your investments have been mishandled, it’s easy to feel overwhelmed, especially when you’re living abroad. But taking a few organized steps can make a significant difference in protecting your financial future. Think of this as your roadmap for getting started. By being proactive, you can build a strong foundation for your case and work toward a fair resolution. The process requires attention to detail, but you don’t have to go through it alone. Let’s walk through the essential actions you can take to safeguard your rights.

Your records are the backbone of your case. Keeping detailed documentation of your investments and all communications with your broker is one of the most important things you can do. Before a claim is even filed, a thorough review of your investment records is necessary to prepare your complaint. Start gathering everything you have: account statements, trade confirmations, emails, and even notes from phone calls. Organize them chronologically. This paper trail provides concrete evidence of what happened with your money and what was said, which is invaluable in a securities arbitration proceeding.

Clear communication is vital from the very beginning. The first official step in the FINRA arbitration process involves submitting a Statement of Claim. This document is your opportunity to tell your story—what happened, when it happened, and how you were harmed. It needs to be clear, concise, and accurate. You’ll also submit a Submission Agreement, which is your formal agreement to arbitrate. Being precise in these initial filings sets the tone for your entire case. Vague or emotional language can weaken your position, so focus on presenting the facts as clearly as possible with the help of your legal counsel.

Having the right legal team on your side can dramatically influence the outcome of your case. An attorney who understands the nuances of broker fraud and negligence can guide you through every stage, from filing the initial claim and selecting arbitrators to preparing for the hearing itself. This support is even more critical when you’re managing the process from another country. Your lawyer acts as your advocate, handles the complex procedures, and ensures your rights are protected. They can help you understand your options and build the strongest possible case on your behalf.

While your legal team is your primary guide, there are other resources that can help you understand the journey ahead. FINRA provides information on its website that explains the arbitration process in detail. Familiarizing yourself with the steps can help you feel more in control. These resources can explain what to expect when filing your claim and what happens during a hearing. Using these tools, alongside the guidance from your attorney, ensures you are well-informed and prepared for what’s to come. Knowledge is a powerful asset in this process.

Receiving a favorable ruling in your FINRA arbitration case is a significant victory and a moment of relief. After all the preparation and stress, you have a decision in your favor. But what happens next? The award itself is a document, not a check. The final step is actually collecting the money you are owed, and this part of the process has its own set of procedures and potential hurdles, especially when you’re living abroad.

Understanding the collection process is key to turning your arbitration award into a financial recovery. It’s important to be prepared for the steps that follow the decision, from formal legal recognition to working through international laws. Let’s walk through what you can expect after you win.

An arbitration award is the final decision from the FINRA panel. It outlines the details of the case, the parties involved, and the specific amount of damages you’ve been awarded. Ideally, the losing party pays this amount promptly. However, that doesn’t always happen. If they don’t pay, you can’t just go to their bank and demand the money; you have to begin a formal collection process. This often starts with your attorney contacting the opposing party to arrange payment. If they refuse or delay, you may need to take legal action to enforce the award, which essentially turns it into a court judgment. The entire securities arbitration process is designed to be binding, and this final step ensures the decision is honored.

For Americans living overseas, collecting an award can be more complex. The primary challenge is that you may need to enforce the award in a different country, where the losing party or their assets are located. Each country has its own laws for recognizing and enforcing foreign decisions. While international agreements like the New York Convention are in place to streamline this, the process is rarely simple. You might face delays due to local court procedures, language barriers, or legal challenges from the opposing party. These cross-border issues are why having a legal team familiar with investment issues on an international scale is so important. They can help you anticipate and manage these unique obstacles.

Before you can collect your money in another country, you typically need a local court to formally recognize your FINRA award. This step confirms that your award is valid and enforceable under that country’s laws. The process usually involves filing a petition with the appropriate court in the foreign jurisdiction. The court will review the award to ensure it meets legal standards and doesn’t violate their public policy. This isn’t a retrial of your case, but rather a procedural confirmation. Successfully completing this step is critical, as it gives you the legal standing you need to pursue the other party’s assets within that country. It’s a detailed process where it’s helpful to have someone guide you, so feel free to contact us for assistance.

Jurisdiction is one of the most critical factors in collecting your award. The laws of the country where the broker or their assets are located will dictate exactly how you can enforce your award. Some jurisdictions are known for being “enforcement-friendly” and have straightforward processes, while others can be much more difficult. The location of the assets determines which court you’ll be working with and what legal tools are at your disposal, such as freezing bank accounts or placing liens on property. Understanding the jurisdictional landscape from the start helps set realistic expectations and allows your legal team to build an effective strategy for recovering the funds you are rightfully owed from instances of broker fraud and negligence.

If you’re an investor living abroad, the idea of filing a claim in the U.S. can feel overwhelming. Misconceptions about the process often stop people from seeking the justice they deserve. You might worry that it’s too complicated, too expensive, or that the odds are stacked against you. It’s easy to see why these myths persist, but understanding the reality of securities arbitration is the first step toward protecting your rights.

The truth is, the FINRA arbitration process was designed to be a more efficient and accessible alternative to going to court. While it has its own set of rules and procedures, it’s not the insurmountable challenge many believe it to be. Let’s clear up some of the most common myths. Knowing the facts can help you make a confident, informed decision about how to move forward and recover your investment losses. If you have questions about your specific situation, a legal professional can provide clarity.

Many investors believe that fighting a large brokerage firm will drain their finances. In reality, FINRA arbitration is generally less expensive than a traditional lawsuit. The filing fees are scaled to the size of your claim, making it accessible for a wide range of cases. More importantly, many securities law firms handle these cases on a contingency fee basis. This means you don’t pay any attorney’s fees unless you recover money. This approach levels the playing field, allowing you to pursue your claim without a significant upfront financial burden. The process is also more accessible than ever for overseas investors, with options for virtual hearings that eliminate the need for international travel.

Another common fear is that your case will be tied up in legal proceedings for years. While every case is different, FINRA arbitration is structured to be much faster than court litigation. The discovery process is more limited, and the procedural rules are designed to move cases along efficiently. From the time you file your Statement of Claim to the final hearing, the process typically takes about 12 to 18 months. For investors who have suffered from broker fraud and negligence, this streamlined timeline means a quicker path to a potential resolution and financial recovery, allowing you to move forward sooner.

Receiving a favorable award from the arbitration panel is a major victory, but it’s not always the final step. A common misconception is that you are guaranteed to recover 100% of your losses or that the money will appear in your account immediately. Arbitrators have discretion in determining the amount of damages, which may be less than your total losses. Furthermore, collecting the award can sometimes present its own challenges, particularly if a firm or individual is no longer in business. This is why having an experienced legal team is so important; they can guide you through not only the arbitration hearing but also the process of enforcing and collecting your award.

Do I have to travel to the U.S. for my hearing? Not necessarily. One of the most significant developments in recent years is the option for virtual hearings. This means you can participate fully in your arbitration hearing from anywhere in the world using a secure video connection. This option removes the considerable expense and logistical challenges of international travel, making it much more practical for Americans living abroad to pursue a claim.

What if I can’t afford a lawyer to handle my case? This is a very common concern, but you have options. Many securities law firms, including ours, handle these types of cases on a contingency fee basis. This means the firm covers the upfront costs of building your case, and you only pay attorney’s fees if you successfully recover money. This arrangement makes quality legal representation accessible and allows you to hold a brokerage firm accountable without a large financial risk.

How much time do I really have to file a claim? Time is a critical factor, and the deadlines are strict. FINRA generally gives you six years from the date of the misconduct to file an arbitration claim. However, you also have to consider state-specific laws, called statutes of limitations, which can be much shorter—sometimes only two or three years. Because these timelines can be complex, it’s important to act quickly once you suspect a problem to ensure you don’t lose your right to file.

What kind of proof do I need to build a strong case? Your case is built on the documents that tell the story of your investments. You should gather all account statements, trade confirmations, and any communications you had with your broker, including emails, text messages, and even handwritten notes from phone calls. These records create a factual timeline and provide concrete evidence of the advice you were given and the actions taken in your account, which is essential for proving your claim.

Is the arbitrator’s decision final? Yes, for the most part. A FINRA arbitration award is legally binding, and the grounds for appealing it are extremely narrow. Unlike a court case, a brokerage firm can’t simply appeal the decision because they disagree with the outcome. This finality is a key feature of the arbitration process, as it provides a conclusive end to the dispute and prevents it from dragging on for years in the court system.