NO FEES UNTIL WE WIN

FREE CONSULTATION

NO FEES UNTIL WE WIN

FREE CONSULTATION

You likely invested in a Master Limited Partnership based on a promise of reliable income and stability, perhaps as a cornerstone of your retirement portfolio. So when the distributions are cut and the value plummets, it can be devastating. Your financial advisor might blame market volatility, but that doesn’t always tell the whole story. These complex investments can fail due to conflicts of interest, misleading disclosures, or outright negligence. It’s crucial to understand the difference between a legitimate market loss and a loss caused by misconduct. An experienced MLP lawyer in Houston can analyze the intricate details of your investment to uncover the truth and fight to recover your hard-earned capital.

If you’ve invested in a Master Limited Partnership (MLP), you know they can be complicated. These unique business structures have their own set of rules and regulations, and when things go wrong, it can be hard to know where to turn. An MLP lawyer focuses specifically on these complex partnerships. They handle everything from the initial setup and transactions to ensuring the partnership complies with federal securities laws. For investors, a lawyer with this background is crucial for protecting your rights and addressing any financial wrongs that may arise from these intricate investments.

Master Limited Partnerships, or MLPs, are business structures that trade on public exchanges just like stocks but are taxed like partnerships. This setup offers the tax advantages of a private partnership with the easy-to-trade liquidity of a public company. You’ll most often find MLPs in the energy and natural resources industries, where they pass their cash flow directly to investors. While this structure can be beneficial, its complexity can also hide significant risks. When not managed properly, MLPs can lead to serious investment issues for those who have put their trust and capital into them. Understanding their fundamental structure is the first step in recognizing when something isn’t right.

An MLP lawyer provides critical legal services tailored to these unique entities. A primary role is structuring and negotiating transactions, ensuring they are fair and legally sound. They often represent special committees within the MLP, which are formed to review deals between the partnership and its affiliates. This oversight is meant to prevent conflicts of interest and ensure that all actions benefit the partnership as a whole, not just a few insiders. When these duties are neglected, investors can suffer. A lawyer can help determine if a transaction involved broker fraud or negligence and work to hold the responsible parties accountable for any losses.

MLPs must follow a complex web of rules, including regulations from the Securities and Exchange Commission (SEC). An MLP lawyer helps the partnership meet all its legal obligations, from filing the correct paperwork to responding to official inquiries. This ongoing compliance is essential for the lawful operation of the partnership and for protecting its investors. If an MLP fails to comply with regulations, it can face serious penalties and legal challenges. For investors or insiders who notice non-compliance, it’s important to know that there are avenues for reporting misconduct. An attorney can help you understand your options, including the possibility of becoming an SEC whistleblower.

The tax benefits are a major reason why MLPs are created. A lawyer with a deep understanding of tax law is essential for providing guidance on how to structure the partnership correctly. They advise on the tax consequences of major events like mergers, acquisitions, and other corporate restructurings. This planning ensures the MLP maintains its favorable tax status and that its financial operations are transparent and lawful. For an investor, improper tax structuring can turn a promising investment into a financial liability. If you suspect that mismanagement has negatively impacted your investment’s tax implications, legal guidance can help clarify your position and potential for recovery.

When your investment in a Master Limited Partnership (MLP) runs into trouble, the lawyer you choose can make a significant difference. While any attorney can read the law, one who specializes in MLPs—particularly one based in Houston—brings a distinct advantage. Houston is the epicenter of the energy industry, the primary sector for MLPs. A local attorney is immersed in this world, offering a level of insight that is difficult to find elsewhere. This isn’t just about convenience; it’s about having representation that understands the industry’s unique culture, key players, and economic pressures.

They have likely handled cases involving the very companies or financial structures you’re dealing with. They know the difference between a legitimate downturn in the energy market and a situation where a company’s management or your broker acted improperly. This specialized focus means they can more efficiently analyze your situation, identify potential wrongdoing, and build a strong case on your behalf. From complex transactions to the specific regulatory landscape governing these partnerships, a Houston-based MLP lawyer provides focused knowledge that can be critical when protecting your financial interests and holding negligent parties accountable. Choosing a lawyer with this background gives you a powerful ally who speaks the language of the energy sector.

Houston’s status as a global energy hub means that lawyers here have a deep, practical understanding of the industry. They are familiar with the nuances of midstream (transporting oil and gas) and upstream (exploration and production) companies, which are the most common types of MLPs. This industry-specific knowledge allows them to quickly grasp the operational and financial details of your investment. An attorney with this background can more effectively analyze whether your losses were due to market fluctuations or to misrepresentation or mismanagement, which is essential when building a case for investment issues.

MLP transactions are notoriously complex. They often involve intricate financial engineering and agreements that can create conflicts of interest, especially when related companies are involved. An attorney who regularly works with MLPs in Houston has seen these complicated deals before. They know what to look for in partnership agreements, offering documents, and financial reports. This experience is vital for identifying red flags, such as self-dealing or other forms of broker fraud and negligence that may have harmed your investment. Their ability to dissect these transactions is a key part of protecting your rights as an investor.

An attorney practicing in Houston has a home-field advantage. They understand the local market dynamics and are familiar with the reputations of the companies, underwriters, and financial advisors operating in the region’s energy sector. This local insight provides valuable context that can strengthen your case. They are part of the legal community that deals with these specific types of partnerships day in and day out. This familiarity with the local landscape can be a powerful asset when you are trying to recover investment losses and need representation that truly understands the environment where the deal was made.

MLPs are governed by a complex web of federal securities laws and specific IRS tax codes. A lawyer specializing in this area, particularly in Houston, is constantly engaged with these regulations. They have experience representing clients in matters involving the Internal Revenue Service and federal courts on issues directly related to MLPs. This focused experience means they are current on the latest legal interpretations and compliance requirements. For an investor, this is crucial. Your attorney can effectively determine if the MLP or your broker failed to meet their regulatory obligations, which could be a key factor in your claim.

Master Limited Partnerships can seem like attractive investments, particularly in the energy sector. However, their unique structure creates a distinct set of legal and financial hurdles. For investors, understanding these challenges is the first step in protecting your capital. From confusing tax rules to potential conflicts of interest, the complexities of MLPs can sometimes obscure serious issues. If something feels off with your investment, it’s important to know where problems commonly arise and what your rights are as a limited partner. Recognizing these potential pitfalls can help you identify red flags before they cause significant financial harm.

MLPs operate within a complicated framework of federal and state regulations. They have to follow specific rules set by agencies like the Securities and Exchange Commission (SEC) and the Federal Energy Regulatory Commission (FERC). For an investor, it’s nearly impossible to track whether an MLP is meeting all its obligations. Some people think lawyers just make things more complex, but when it comes to regulations, a good attorney clarifies your position and simplifies the process. When an MLP fails to comply with these rules, it can lead to investigations, fines, and a drop in value, directly impacting your investment. Understanding your options through securities arbitration is crucial if you suspect compliance failures have caused you losses.

One of the defining features of an MLP is its tax structure. As pass-through entities, MLPs don’t pay corporate income tax; instead, profits and losses are passed directly to the partners. Investors receive a Schedule K-1 form instead of the more common 1099-DIV, which can complicate tax filings. This intricate structure, while offering potential tax benefits, can also create confusion. The complexity can make it difficult for investors to fully grasp the financial health of the partnership. Unscrupulous general partners might even use these tax intricacies to hide poor performance or financial mismanagement, leaving investors in the dark until it’s too late.

In an MLP, the general partner manages daily operations while limited partners provide capital. This structure can lead to disputes when the interests of the two groups diverge. Conflicts often arise over management fees, the distribution of cash flows, or strategic decisions that seem to benefit the general partner more than the investors. The partnership agreement is supposed to govern this relationship, but these documents are often long, dense, and difficult to interpret. When a dispute occurs, you need a legal advocate who understands the specific dynamics of these agreements and can protect your rights from broker fraud and negligence.

Because units of an MLP are publicly traded, they are subject to federal securities laws designed to protect investors. These laws require the MLP to provide accurate and timely information about its business operations, financial condition, and any risks. If a general partner releases misleading statements, omits crucial information from public filings, or engages in any deceptive practices, they may be violating securities laws. These actions can artificially inflate the MLP’s value, and when the truth comes out, investors are the ones who suffer the losses. Reporting these violations is a critical step, and an SEC whistleblower attorney can guide you through the process.

A significant area of concern for MLP investors involves related-party transactions. These are deals made between the MLP and other companies owned or controlled by the general partner. A common example is a “drop-down” transaction, where the parent company sells assets to the MLP it controls. While these transactions are legal, they create a clear conflict of interest. The general partner is essentially sitting on both sides of the table. The key challenge is ensuring these deals are conducted at fair market value and are in the best interest of the MLP and its limited partners, not just the controlling entity. These are common investment issues that can harm unsuspecting investors.

Clear and thorough documentation is essential for all MLP operations, but it’s especially critical for related-party transactions. Every deal should be supported by transparent records that justify the terms and prove its fairness to the partnership. When documentation is missing, vague, or confusing, it should be treated as a major red flag. This lack of transparency can make it impossible for investors to verify that their capital is being managed responsibly. If you find that you can’t get straight answers or clear records about how the MLP is handling its business, it may be a sign of negligence or fraud. If you have concerns, it’s time to contact us for a professional evaluation.

When your investment is on the line, finding the right legal representation is critical. Master Limited Partnerships are unique financial instruments with their own set of rules and complexities, especially within the energy sector. You need an attorney who not only understands the law but also grasps the specific business and financial structures of MLPs. A general practice lawyer likely won’t have the focused knowledge required to handle these intricate cases. The right attorney can make all the difference in protecting your financial interests and holding the responsible parties accountable for any investment fraud or negligence. Look for a lawyer who demonstrates a deep understanding of this specific investment vehicle and has a track record of handling similar cases.

MLPs are heavily concentrated in the energy and natural resources sectors. Because of this, you should look for a lawyer with direct experience in this industry. They will be familiar with the common practices, potential pitfalls, and specific regulations that govern these partnerships. For example, many MLP transactions involve deals between related companies, known as “affiliated party transactions,” which can create conflicts of interest. An attorney who has handled these specific types of investment issues will know exactly what red flags to look for and how to protect your rights as an investor. Their industry-specific background provides a crucial advantage in building a strong case.

Since MLP units are publicly traded on stock exchanges, they are subject to federal and state securities laws. This means your attorney must have a solid foundation in securities law and litigation. They should understand the disclosure requirements, fiduciary duties, and anti-fraud provisions that protect investors. A lawyer with experience representing clients in securities arbitration will be prepared to fight for you in the appropriate forum. This background ensures they can identify when an MLP or its management has violated securities regulations, whether through misrepresentation, omission of material facts, or other fraudulent activities.

The tax structure of an MLP is one of its most defining and complicated features. MLPs are pass-through entities, meaning they don’t pay corporate income tax; instead, income and losses are passed directly to the unitholders. This creates a complex tax situation for investors. A lawyer who is considered an authority on energy tax matters and structuring will be invaluable. They can analyze whether the MLP’s tax reporting was accurate and whether you were properly advised on the tax implications of your investment. This specialized knowledge is essential for uncovering hidden issues and protecting your financial well-being.

Dealing with a legal issue involving a complex investment can be stressful and confusing. The last thing you need is a lawyer who speaks in jargon and doesn’t keep you updated. Competent lawyers communicate with their clients frequently and clearly. You should feel comfortable asking questions and confident that you will receive straightforward answers. A good attorney will take the time to explain the details of your case, outline your options, and keep you informed of every development. This open line of communication builds trust and ensures you are an active participant in your own case.

While you shouldn’t choose a lawyer based on awards alone, professional recognition from peers and clients can be a strong indicator of their skill and reputation. Look for testimonials or case results that speak to the attorney’s effectiveness. Comments from past clients describing a lawyer as a “tremendous resource” who gives “very practical advice” are telling. This kind of feedback suggests the attorney is not only knowledgeable but also responsive and client-focused. When you’re ready to take the next step, you can contact our firm to discuss your situation with a team that is committed to investor protection.

Master Limited Partnerships often appear attractive, promising steady income and unique tax advantages. However, behind that simple promise lies a web of complex legal and financial structures. For you as an investor, understanding the key legal services MLPs require is crucial because each one represents a potential point of failure. When there are breakdowns in legal oversight—whether in the initial setup, public offerings, or daily governance—your investment is put directly at risk.

While MLPs have teams of corporate lawyers working to protect the company’s interests, who is looking out for yours? Your financial advisor or brokerage firm has a professional duty to understand these complexities and recommend only suitable investments. They are supposed to cut through the jargon and ensure you are fully aware of the risks. Unfortunately, that doesn’t always happen. When brokers push these products without proper diligence or misrepresent their stability, they can be held accountable for the fallout. A lawyer who represents investors will carefully examine these operational areas to uncover the negligence or misconduct that led to your financial losses. It’s about holding the firms that sold you the investment accountable when they fail in their duty to protect you.

The way an MLP is first set up is its blueprint for success or failure. Corporate attorneys are hired to structure these partnerships to comply with specific tax and regulatory rules. However, if this foundation is flawed, or if the complex structure and its inherent risks were misrepresented to you by your broker, it can lead to devastating losses. Your financial advisor has a duty to understand and accurately explain the investments they recommend. If they sold you an MLP without a clear explanation of its unique structure and risks, it could be a sign of broker fraud and negligence.

When an MLP wants to raise money from the public, it goes through a securities offering. Lawyers are heavily involved in preparing the extensive documents for these offerings, ensuring they comply with securities laws. These documents are supposed to give you, the investor, a complete and honest picture of the investment. Unfortunately, they can sometimes contain misleading information or omit critical risks. If you decided to invest in an MLP based on false promises or incomplete data provided during an offering, you may have been a victim of misrepresentation. A careful review of these offering documents is a key step in resolving investment issues.

Think of corporate governance as the official rulebook for running a company fairly and ethically. Attorneys advise MLP boards on how to follow SEC rules and manage potential conflicts of interest, all to ensure they act in the best interest of the partners. When the people in charge fail to follow these rules—perhaps by making decisions that benefit themselves over investors—it can erode and ultimately destroy the value of your investment. A thorough legal investigation into an MLP’s governance can uncover breaches of fiduciary duty that have harmed investors and form the basis of a legal claim.

MLPs often engage in complex deals, including mergers, acquisitions, and transactions with related companies. To ensure fairness, they often form special committees to oversee these deals. But what happens when a transaction isn’t fair? If a deal is structured to benefit insiders at the expense of public unitholders like you, it’s a major red flag for self-dealing and corporate misconduct. A securities lawyer dedicated to investor protection can analyze these transactions to determine if they were handled properly. If you suspect a deal was designed to improperly siphon value away from investors, it’s time to contact us.

MLPs have their own lawyers to represent them in disputes with government agencies like the IRS or in court. But who is there to represent you when your investment collapses due to fraud or mismanagement? When you suffer financial losses, your dispute is likely with the brokerage firm that sold you an unsuitable or misrepresented MLP investment. These cases are typically resolved through a specific legal process known as securities arbitration, where an attorney dedicated to investor rights can fight on your behalf to recover your hard-earned money.

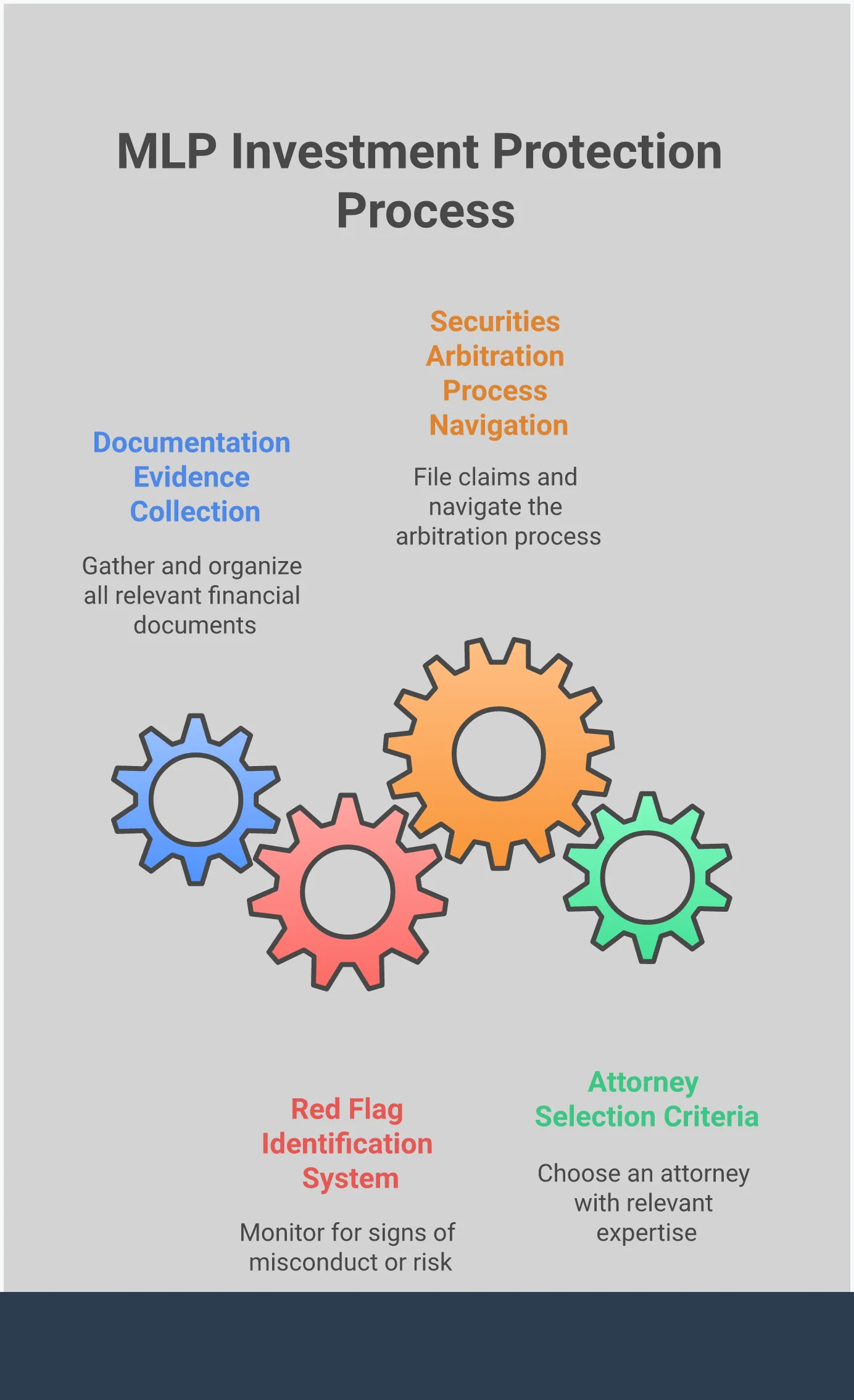

Investing in Master Limited Partnerships comes with its own set of complexities. While the potential returns can be attractive, it’s just as important to be proactive about protecting your capital. Taking a few key steps can help you stay informed and safeguard your financial interests from potential mismanagement or fraud.

A solid investment plan always includes a strategy for managing risk. This isn’t about avoiding risk altogether, but about understanding it and having a plan to address it. A systematic approach involves identifying potential downsides, assessing their likelihood, and taking steps to mitigate them. For MLPs, this could mean diversifying your portfolio so you aren’t over-exposed to one partnership or sector. It also means setting clear boundaries for what level of risk you’re comfortable with. When brokers fail to manage these risks appropriately, it can lead to significant losses from issues like broker fraud and negligence.

MLP investments aren’t something you can just set and forget. They require continuous monitoring to ensure they are performing as expected and adhering to all regulatory standards. Your financial advisor should have the resources and knowledge to conduct ongoing research and analysis. You should receive regular, clear updates on your investment’s performance and any changes in its structure or compliance status. If communication is vague or your advisor seems unable to answer specific questions, it could be a red flag for larger investment issues. Staying engaged and asking questions is a key part of protecting your assets.

Keeping thorough records is one of the most practical steps you can take to protect your investment. You should maintain a file with all relevant documents, including your initial investment agreement, account statements, trade confirmations, and any correspondence with your broker or the MLP. This paper trail is incredibly valuable. Should a dispute arise, this documentation provides the evidence needed to support your case. Having everything organized can make a significant difference if you ever need to pursue a claim through securities arbitration.

Ultimately, you are your own best advocate. It’s crucial to understand your rights as an investor and to take action if you suspect something is wrong. This means setting clear guidelines with your financial advisor and monitoring your investments to ensure those guidelines are followed. If you notice unauthorized trades, misrepresentations, or feel your funds are being mishandled, don’t hesitate to seek a professional opinion. An experienced securities attorney can help you understand your options and take corrective action. If you have concerns about your MLP investment, you can contact us for a confidential evaluation.

Finding the right attorney can feel like a monumental task, especially when you’re already dealing with the stress of a significant investment loss. But think of this as choosing a partner who will guide you through a complex process and fight for your financial recovery. You want someone with the right background, a communication style that works for you, and a clear approach to your case. Taking the time to carefully select your legal representation is one of the most important steps you can take to protect your interests and work toward a positive resolution. It’s about finding a firm that not only understands the law but also understands what you’re going through.

When you’re looking for an attorney, you need someone who has specific, hands-on experience with Master Limited Partnerships and the unique investment issues they present. A general practice lawyer simply won’t have the focused knowledge required. Look for a legal team that has a track record of handling cases involving complex securities and has gone up against the brokerage firms that sell these products. Their background should show a deep understanding of how MLPs are structured, why they fail, and the specific types of broker fraud and negligence that lead to investor losses. This isn’t the time for a lawyer who is learning on the job; you need someone who already knows the playbook.

Legal matters can be confusing, and the last thing you need is an attorney who speaks in dense jargon. A good lawyer will be able to explain your situation and your options in a way that makes sense to you. During your initial conversations, pay attention to how they listen and how they respond to your questions. Do you feel heard? Do they provide clear, direct answers? You should feel like a respected partner in the process, not just another case file. Consistent and clear communication is the foundation of a strong attorney-client relationship and will give you confidence as your case moves forward.

Talking about money can be uncomfortable, but it’s absolutely essential. Before you sign any agreement, make sure you have a complete understanding of the attorney’s fee structure. Many securities fraud attorneys work on a contingency fee basis, which means they only get paid if you win your case. This arrangement can be a huge relief for investors who have already suffered financial losses. Ask for a detailed explanation of how fees and case expenses are calculated. A trustworthy attorney will be transparent about all costs and provide you with a written agreement that clearly outlines the terms. There should be no surprises when it comes to legal bills.

The first meeting is a two-way street. While the attorney is evaluating the merits of your case, you should be evaluating them. Come prepared with all your relevant documents, including account statements, trade confirmations, and any correspondence you have with your broker. A well-prepared attorney will have reviewed any information you sent ahead of time and will ask insightful questions. This initial interaction is a great indicator of their dedication and how they will handle your case. Use this opportunity to gauge their professionalism and to see if you feel comfortable entrusting them with your financial future. You can contact our firm to schedule a consultation.

To make the most of your consultation, have a list of questions ready. This will help you compare different attorneys and make an informed decision.

Here are a few key questions to get you started:

My financial advisor recommended an MLP, but I lost a lot of money. Isn’t that just a normal market risk? Not always. While all investments carry some risk, your financial advisor has a professional duty to recommend products that are suitable for your financial situation and risk tolerance. MLPs are complex and carry unique risks that are not always properly explained. If your advisor downplayed the risks, over-concentrated your portfolio in these investments, or failed to disclose conflicts of interest, your losses may be the result of negligence or misrepresentation, not just a market downturn.

The blog talks about holding my broker accountable, but shouldn’t I be going after the MLP company itself? This is a common and very logical question. While the MLP’s management may have made poor decisions, your primary legal relationship is often with the financial advisor or brokerage firm that sold you the investment. These professionals are responsible for conducting due diligence and ensuring the investment is appropriate for you. Legal action often focuses on the broker’s failure in this duty, as that is the most direct path to recovering your losses through the securities arbitration process.

Why is a Houston-based lawyer so important if my broker and I are in a different state? Because so many MLPs are tied to the energy sector, a huge portion of the industry’s operations, headquarters, and legal dealings are centered in Houston. A lawyer practicing there has a deep, firsthand understanding of the industry’s culture, key players, and economic pressures. This isn’t about geography; it’s about focused knowledge. They can more effectively analyze whether your losses stem from legitimate industry trends or from specific acts of corporate or broker misconduct.

I’m worried about the cost of legal action after already losing so much. How are these cases typically paid for? This is a completely valid concern. Most reputable securities law firms that represent investors handle these types of cases on a contingency fee basis. This means the firm fronts the costs of the case, and they only receive a fee if they successfully recover money for you. This approach allows you to pursue a valid claim without having to pay legal fees out of pocket while you are already dealing with financial strain.

What kind of documents should I gather if I think I have a case? Being organized is one of the most helpful things you can do. Start by collecting all of your account statements that show your MLP purchases and sales. Find any trade confirmations, marketing materials, or emails you have related to the investment. It’s also useful to write down your memory of the conversations you had with your advisor when they recommended the MLP. Having this information ready will help an attorney make a clear and thorough evaluation of your situation.