Trusting a financial advisor with your life savings is a significant act of faith. You rely on their guidance to secure your future and protect your family. But what happens when a feeling of unease starts to creep in? When your portfolio’s performance doesn’t match the promises made, or communication becomes strained? This is when it becomes crucial to look beyond the relationship and into the facts. Public records provide a transparent look into a broker’s history, including any customer disputes. A recent pending complaint against UBS Financial Services Inc. Broker Michael Meniktas, for example, highlights why this due diligence is so important for every investor.

Key Takeaways

- An Advisor’s History is Public Information: Use free tools like FINRA’s BrokerCheck to review a professional’s background, including their licenses and any customer complaints. This is a fundamental step for any investor to verify who is managing their money.

- A Healthy Advisor Relationship Requires Transparency: You have the right to clearly understand your investment strategy, the fee structure, and the reasoning behind every recommendation. Vague or dismissive answers are a significant red flag.

- Don’t Hesitate to Seek a Legal Opinion: If you suspect misconduct or your research uncovers concerning information, consulting with a securities attorney is a crucial step. They can help you review your situation and understand your options for recovering potential losses.

Who Is Michael Meniktas of UBS Financial Services?

When you trust a financial advisor with your money, it’s important to have a clear picture of who they are. Michael John Meniktas is a financial advisor currently registered with UBS Financial Services Inc. in Paramus, New Jersey. Understanding his professional history, credentials, and any disclosures on his record is a critical step for any current or potential client. This information gives you a more complete view of his career and helps you make informed decisions about your investments.

An advisor’s background offers valuable insight into their experience and qualifications. Publicly available records through the Financial Industry Regulatory Authority (FINRA) provide details on licensing, employment history, and any customer disputes or disciplinary actions. Reviewing this information is a fundamental part of due diligence for any investor. It helps you verify that the person managing your money has a track record that aligns with your expectations and financial goals. While an advisor may have numerous accolades, it’s the full story, including any instances of broker fraud and negligence, that truly matters.

His Professional Background

Michael Meniktas began his career in the financial services industry in 1999. According to his FINRA BrokerCheck report, he holds several key securities licenses, including the Series 7, Series 63, and Series 65. These licenses permit him to act as both a stockbroker and an investment advisor. He has been associated with UBS Financial Services Inc. since 2008, marking a significant portion of his career with the firm. Before joining UBS, he was registered with Citigroup Global Markets Inc. This long history in the industry provides a timeline of his experience working with client assets and navigating different market conditions.

His Industry Certifications

Beyond his required licenses, Michael Meniktas holds additional industry certifications. He is designated as a Chartered Retirement Planning Counselor (CRPC™) and an Accredited Asset Management Specialist (AAMS). These credentials show that he has completed specialized training and passed examinations focused on retirement planning and comprehensive asset management strategies. For investors, these certifications suggest a commitment to ongoing education in specific areas of financial planning. Understanding these qualifications can help you assess whether an advisor’s specialized knowledge aligns with your personal investment issues and long-term objectives.

His Recognition at UBS

Within UBS, Michael Meniktas has received internal recognition for his work. According to his team’s biography, he was named to the UBS Wealth Management Director’s Council in 2024. Firms often grant these types of accolades to advisors who meet certain benchmarks for performance, client satisfaction, and asset growth. While internal awards can highlight an advisor’s success within their company, they are just one piece of the puzzle. It’s important for investors to consider the entirety of an advisor’s record, including their formal regulatory history, when evaluating their professional conduct. If you have questions about your own advisor’s promises or performance, you can contact us for a confidential consultation.

What Services Does Michael Meniktas Offer?

According to his UBS profile, Michael Meniktas and his team provide a range of wealth management services that cover the different stages of a client’s financial life. These services are focused on creating personalized plans for investing, retirement, and legacy building, all organized within a specific framework used by UBS. Understanding what these services are supposed to entail is a key step in determining if your own portfolio was managed with your best interests in mind.

Investment and Portfolio Management

Michael Meniktas and his team at The Meniktas Wealth Management Group state that they help clients plan their investments to achieve specific life goals. Their process involves creating tailored investment strategies that are meant to align with an individual’s financial objectives and tolerance for risk. This personalized approach is intended to ensure clients can manage their portfolios effectively. When an advisor fails to align strategies with a client’s actual needs, it can lead to serious investment issues and significant financial harm. A properly managed portfolio should always reflect your stated goals and risk level, not the broker’s preferences.

Retirement and Legacy Planning

Beyond day-to-day investment management, Michael Meniktas also provides services in comprehensive retirement and legacy planning. This includes developing strategies for clients to accumulate wealth for their retirement years and planning how to eventually pass that wealth on to family members or charitable organizations. This type of long-term planning requires a high degree of trust between a client and their advisor. Clients depend on their advisor’s guidance to ensure their financial legacy is preserved and distributed exactly as they wish, making any mismanagement in this area particularly damaging to a family’s future.

The UBS “Wealth Way” Method

Michael Meniktas reportedly uses the UBS “Wealth Way” method to organize his clients’ financial lives. This framework separates a client’s resources into three distinct categories: Liquidity, for short-term needs; Longevity, for long-term financial stability; and Legacy, for wealth transfer plans. This structured approach is designed to provide clarity and help clients manage their assets for different purposes. While systems like this can be beneficial, their effectiveness depends entirely on diligent and appropriate management by the advisor. Any deviation from a client’s best interests could constitute broker fraud and negligence.

How Does the UBS Wealth Way Approach Work?

Many financial firms use specific frameworks to help clients visualize their financial goals, and UBS is no different. The “Wealth Way” is their proprietary approach to organizing your financial life. The core idea is to separate your money into three distinct strategies based on your needs and timeline: one for the short term, one for the long term, and one for the wealth you plan to leave behind.

Understanding the methodology your advisor uses is a critical step in protecting your assets. A clear strategy can provide a roadmap, but it’s just as important to know how that strategy is being implemented with your specific investments. When a plan is overly complex or doesn’t align with your personal financial situation, it can sometimes obscure serious investment issues. By breaking down the Wealth Way approach, you can get a clearer picture of how your money is intended to be managed and ask more informed questions about your portfolio.

Liquidity for Short-Term Needs

The first component of the Wealth Way framework is “Liquidity.” Think of this as the money you need to access in the near future, typically within the next few years. This pool of funds is meant to cover your day-to-day living expenses, any planned major purchases like a car or a home renovation, and a cash reserve for emergencies. The primary goal for this portion of your portfolio is preservation and accessibility, ensuring the money is there when you need it without being exposed to significant market risk. It’s the foundation of the financial plan, designed to provide peace of mind for your immediate needs.

Longevity for Long-Term Goals

The second strategy is “Longevity,” which is designed to fund your life over the long haul, particularly through retirement. This is the money you’ll rely on for decades to come. Because this capital has a much longer time horizon, the investment strategy here typically focuses more on growth. The goal is to ensure your assets last as long as you do, covering your expenses throughout your retirement years. This is where you’ll see investments intended to grow over time, helping your portfolio keep pace with inflation and support your desired lifestyle long after you’ve stopped working.

Legacy for Wealth Transfer

The final piece of the puzzle is “Legacy.” This strategy addresses the wealth you want to pass on to others, whether it’s for your children, grandchildren, or charitable causes that are important to you. This money is earmarked for goals that extend beyond your own lifetime. The planning for this component often involves estate planning, trusts, and other tools to ensure your assets are transferred smoothly and according to your wishes. Protecting this part of your portfolio is crucial, as broker fraud and negligence can unfortunately jeopardize the financial future you intend to leave for others.

What Is on Michael Meniktas’s Regulatory Record?

When you entrust someone with your financial future, you deserve to have a clear picture of their professional history. The Financial Industry Regulatory Authority (FINRA) maintains public records for all registered brokers, providing transparency for investors. This record, known as a BrokerCheck report, details a broker’s employment history, licenses, and any customer disputes or disciplinary actions.

Reviewing this information is a critical step for any investor. It helps you understand who you’re working with and can reveal potential red flags. According to his public FINRA record, Michael Meniktas has a pending customer complaint filed against him. Understanding the details of this complaint and the disclosure process can help you make more informed decisions about your own investments.

The Pending Customer Complaint

According to his FINRA BrokerCheck report, a customer complaint was filed against Michael Meniktas on July 2, 2024. The complaint, which is currently pending, alleges issues that occurred between 2015 and 2023 and requests damages of $1,036,306.00. While a pending complaint is not a final finding of wrongdoing, it is a significant piece of information for any current or potential client to consider. This type of disclosure is a key part of the system designed to protect investors from potential broker fraud and negligence.

What Are FINRA Disclosures?

FINRA requires all individuals registered to sell securities or offer investment advice to disclose certain events to the public. These disclosures include customer complaints, regulatory actions, and arbitrations. The goal is to create a transparent environment where investors can see a professional’s track record. When a customer files a formal complaint alleging misconduct, the broker must report it, and it becomes a permanent part of their public record. This system ensures that investors have access to information that could impact their financial decisions, including disputes that may proceed to securities arbitration.

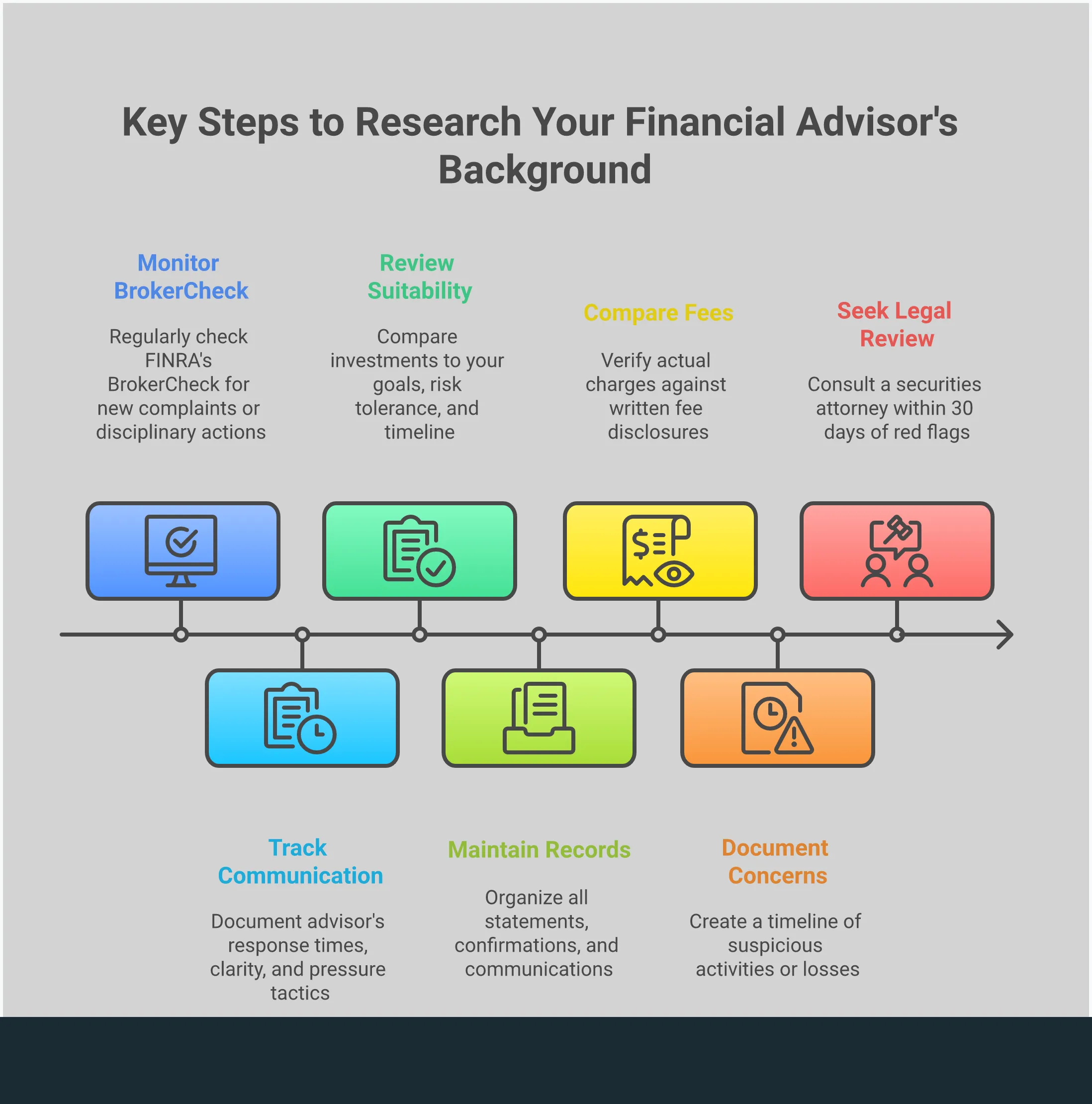

How to Research Any Financial Advisor

You can and should research any financial advisor you’re considering working with. The best place to start is with FINRA’s free BrokerCheck tool. Simply type in the advisor’s name to see their employment history, qualifications, and any disclosures on their record. Reading this report allows you to verify the information your advisor has given you and check for any past issues. It’s a straightforward but powerful way to perform your due diligence and take an active role in protecting your investments. If you find something concerning, it may be time to ask more questions.

What Are the Warning Signs of Investment Problems?

Trusting someone with your financial future is a major decision, and it’s natural to feel uneasy if things don’t seem right. Your intuition is often your first line of defense. If you’re questioning your broker’s actions or the performance of your portfolio, it’s wise to pay close attention. Recognizing the warning signs of potential investment issues is the first step toward protecting your assets. These signs can range from subtle shifts in communication to glaring inconsistencies on your account statements. Understanding what to look for can help you identify problems early and take action before significant damage is done. The key is to stay informed and proactive about your investments and the professionals you entrust them to.

Red Flags in Your Broker Relationship

A healthy relationship with your financial advisor should be built on clear communication and trust. When that foundation starts to crack, you should take notice. One of the most significant red flags is discovering a pending customer complaint on your broker’s record. For instance, a complaint was filed against broker Michael Meniktas with a damage request of over $1 million. Other warning signs include a broker who is difficult to reach, dismisses your concerns, or pressures you into making quick decisions. If your advisor can’t explain their investment strategy in a way you understand, or if you notice transactions you didn’t authorize, it’s time to start asking more serious questions.

Common Types of Investment Misconduct

Investment misconduct isn’t always as dramatic as a massive fraud scheme; often, it’s more subtle. One of the most frequent forms of broker fraud and negligence involves unsuitable investment recommendations. These are suggestions that simply don’t fit your financial profile. A recent case involving the Meniktas brothers at UBS, for example, centered on allegations of more than $1 million in unsuitable investments. Other types of misconduct include excessive trading (known as “churning”) to generate commissions, misrepresenting the risks of an investment, or concentrating too much of your portfolio in a single, high-risk asset. These actions can jeopardize your financial security for the broker’s personal gain.

What Are Unsuitable Recommendations?

So, what exactly makes a recommendation “unsuitable”? It happens when a broker suggests an investment that doesn’t match your specific financial circumstances, goals, or tolerance for risk. Every investor is different—a strategy that’s perfect for a young person with a high-risk tolerance would be completely inappropriate for someone nearing retirement. The core issue in the Meniktas brothers’ case was that the investments allegedly did not align with the client’s financial situation and objectives. Your broker has a duty to know your financial standing and recommend products that are truly in your best interest, not just products that offer them a high commission.

What to Do if You Suspect a Problem

If you suspect a problem with your broker or your investments, don’t ignore it. The first step is to do your own research. All registered financial advisors are required to disclose customer complaints and disciplinary actions. You can and should investigate your broker’s professional history using FINRA’s BrokerCheck, a free and easy-to-use tool. Gather all your documents, including account statements and communications with your advisor. If your findings confirm your suspicions, or if you simply feel you need guidance, it may be time to speak with a securities attorney who can help you understand your rights and options.

How to Evaluate Your Financial Advisor

Trusting someone with your financial future is a major decision. While building a good relationship with your advisor is important, it’s equally crucial to stay informed and proactive about your investments. Regularly evaluating your financial advisor isn’t about being distrustful; it’s about being a responsible and empowered investor. This means asking the right questions, understanding the costs, and knowing where to look for important information. Taking these steps helps ensure your financial strategy aligns with your goals and that the person managing your money is acting in your best interest. If you ever feel uncertain or in the dark about your accounts, it’s a sign that you need to take a closer look.

Key Questions to Ask About Their Strategy

It’s your money, so you have every right to understand the strategy behind how it’s being managed. Don’t hesitate to ask direct questions about your advisor’s approach and philosophy. The California Department of Justice advises investors to “evaluate the background of any financial advisor…before you hand over your hard-earned money.” Start by asking how they determine which investments are suitable for you, what benchmarks they use to measure performance, and how often you can expect to receive updates. If their answers are vague, overly complex, or dismissive, consider it a red flag. A trustworthy advisor should be able to explain their strategy in a way that you can clearly understand and feel confident about.

How to Understand Their Fee Structure

Fees can significantly impact your investment returns over time, yet they are often one of the most confusing parts of the client-advisor relationship. You need to know exactly how your advisor is compensated. Are they paid through commissions on the products they sell, a flat fee for their services, or a percentage of the assets they manage? The CFP Board’s standards require financial professionals to provide written documentation outlining their compensation. Make sure you get this in writing and review it carefully. If you see terms you don’t recognize or charges you didn’t expect, ask for a detailed explanation. Transparency is non-negotiable when it comes to fees.

How to Review Their Disciplinary History

Before you hire an advisor or if you have growing concerns, one of the most important steps you can take is to check their professional background. The Financial Industry Regulatory Authority (FINRA) offers a free tool called BrokerCheck that allows you to do just this. As FINRA notes, registered advisors are required to disclose “customer complaints and arbitrations, regulatory actions,” and other important information. This public database shows an advisor’s employment history, licenses, and, most critically, any past disciplinary actions or investor complaints. Reviewing this record is a simple but powerful way to vet a professional and protect yourself from potential broker fraud and negligence.

When to Get a Second Opinion from a Lawyer

If your advisor’s explanations don’t add up, you’re seeing unexpected losses, or you simply feel that something is wrong, it may be time to get a second opinion. While many people think of consulting another financial advisor, sometimes the best person to talk to is a securities attorney. An attorney can review your account statements and communications for signs of misconduct that you might not recognize, such as unsuitable recommendations or excessive trading. Financial products are increasingly complex, and if you suspect your advisor isn’t being fully transparent or competent, you shouldn’t hesitate. Protecting your financial health is the priority, and a legal professional can help you understand your rights and options if you have investment issues.

What Are Your Options if You Suspect Broker Misconduct?

Realizing something might be wrong with your investments can be unsettling, but you aren’t powerless. If you have a gut feeling that your broker isn’t acting in your best interest, it’s important to know what steps you can take. You have rights, and there are clear paths you can follow to get answers and protect your financial future. Taking action starts with understanding your options and knowing where to turn for guidance.

Understanding Your Rights as an Investor

As an investor, you have the right to be fully informed about the background of the person managing your money. Any professional registered to sell securities or offer investment advice must disclose customer complaints, arbitrations, and any regulatory actions taken against them. This isn’t just good practice; it’s a requirement. This transparency is designed to protect you. If you feel that you’ve been a victim of broker fraud and negligence, knowing these rights is the first step toward holding the responsible parties accountable for their actions.

How a Securities Attorney Can Help

If you suspect misconduct, you don’t have to figure things out on your own. Speaking with a securities attorney can provide much-needed clarity. A lawyer who focuses on these specific issues can review your situation, help you understand the details of your case, and explain your legal options, which may include securities arbitration. They can guide you through the process of checking your advisor’s history and determining if there’s a pattern of misconduct. Getting professional advice can help you make an informed decision about how to proceed and what steps are necessary to protect your assets.

Steps to Take to Protect Your Finances

Protecting your finances means being proactive. It’s always a good idea to ask direct questions and carefully evaluate the background of any financial advisor before you work with them. You can check for their licenses and look into any past disciplinary actions. Regulatory bodies exist to ensure advisors act ethically, and you should use these resources to safeguard your investments. If you’re currently working with an advisor and have concerns about specific investment issues, gathering your account statements and any written communication is a crucial step. Having your documents organized will be incredibly helpful if you decide to seek a second opinion.

Related Articles

- UBS To Pay $15M To Settle SEC Case – The Frankowski Firm

- UBS Broker William Meador: Investigating Investment Loss Claims | The Frankowski Firm

- Kyusun Kim Broker Investigation | The Frankowski Firm

- Morgan Stanley Broker Kenneth Maring: Investor Review – The Frankowski Firm

- FINRA Complaint Alleges Unsuitable Advice by Tsikitas

Frequently Asked Questions

What does a “pending customer complaint” on a broker’s record actually mean? A pending customer complaint means an investor has formally alleged that their broker engaged in some form of misconduct, and the case has not yet been resolved. While it isn’t a final judgment of wrongdoing, it is a serious flag that is required to be disclosed on the broker’s public record. It indicates that there is an active dispute that you should be aware of when evaluating who is managing your money.

My advisor uses a structured approach like the “Wealth Way.” Does that guarantee my investments are safe? Not necessarily. A structured financial framework can be a useful tool for organizing your goals, but it’s only as good as the person implementing it. The safety of your investments depends on whether the specific choices made within that framework are truly suitable for your financial situation and risk tolerance. A system can look good on paper, but it doesn’t prevent mismanagement or unsuitable recommendations from happening.

How can I tell if an investment recommendation is “unsuitable” for me? An investment is likely unsuitable if it doesn’t align with the financial goals, timeline, and risk tolerance you’ve clearly discussed with your advisor. For example, if you’re nearing retirement and need to preserve your capital, a high-risk, speculative investment would be unsuitable. If you feel an investment is too aggressive, doesn’t make sense for your situation, or seems to benefit your broker more than you, it’s a sign that it might not be the right fit.

I’m worried about my investments, but I’m afraid of causing trouble by asking my advisor too many questions. What should I do? It is your right and responsibility to ask questions about your own money. A trustworthy advisor should welcome your questions and provide clear, understandable answers. If you feel intimidated, dismissed, or confused by their responses, that in itself is a major red flag. Your peace of mind is important, and you should never feel hesitant to seek clarity about the strategies being used with your life savings.

If I find a complaint on my advisor’s record, should I immediately move my money? Discovering a complaint is a serious reason to pause and re-evaluate your relationship with your advisor. The first step isn’t necessarily to move your money, but to gather more information. You should carefully review your own account statements and document any concerns you have. This is also the right time to seek a confidential second opinion from a securities attorney who can help you understand the situation and advise you on the best course of action for your specific circumstances.