One of the most frustrating things about a variable annuity can be the feeling of being trapped. The surrender charges are often so high that accessing your own money feels impossible, forcing you to watch as high fees and poor performance eat away at your principal. This isn’t an accident; it’s a feature of a product that often benefits the person who sold it more than the person who owns it. If you were pushed into an annuity that locked up your funds when you needed liquidity, or if the risks were never properly explained, you may have been a victim of an unsuitable sale. It’s time to explore your options. A qualified variable annuity lawyer can review your situation and determine if you have a claim for your losses.

Key Takeaways

- Know What You Own: Variable annuities are notoriously complex and loaded with high fees that can drain your returns. If your broker didn’t clearly explain all the costs, risks, and surrender penalties, the investment may have been unsuitable for you from the start.

- Your Broker Has a Duty to You: Financial professionals are required to recommend products that are appropriate for your specific age, financial goals, and risk tolerance. An annuity that locks up your money for years or exposes you to market risk might be a great commission for them but a poor fit for you.

- Legal Action Is a Defined Process: If you suspect you were misled, you don’t have to face a brokerage firm by yourself. A securities lawyer can investigate your case and guide you through the FINRA arbitration process, which is specifically designed to resolve these types of investment disputes.

What Is a Variable Annuity?

So, what exactly is a variable annuity? Think of it as a contract between you and an insurance company that acts like a hybrid of an investment and an insurance policy. The “variable” part is key—it means the annuity’s value can change daily based on the performance of the investment options you choose. These options, often called sub-accounts, work a lot like mutual funds.

Brokers often pitch variable annuities as an ideal solution for retirement savings, highlighting features like tax-deferred growth and the promise of a future income stream. While they might be a reasonable fit for a small number of investors, their complexity and high costs can also create serious problems. Because these are such intricate financial products, a broker might emphasize the potential gains while downplaying the significant fees and risks involved. This is why it’s so important to understand exactly what you own. A lack of clarity is often the first sign that an investment may not have been in your best interest, and it’s a common theme in cases of broker fraud and negligence. These products are often misunderstood not just by investors, but sometimes by the very brokers selling them, leading to unsuitable recommendations and significant financial harm.

How They Combine Investing and Insurance

On the investment side, a variable annuity acts like a personal portfolio of mutual funds, where you allocate your money among different sub-accounts. Your account’s value then fluctuates with the market. The insurance component adds a few unique layers. First, your earnings grow tax-deferred, meaning you don’t pay taxes on them until you start taking withdrawals. Second, they typically include a death benefit, which ensures your beneficiaries receive a certain amount if you pass away. Finally, they offer the option to receive guaranteed income payments for life, which is the “annuity” part of the name. These features are often what brokers use to sell the product, sometimes without a full explanation of the costs involved.

Breaking Down the Fees and Charges

This is where things can get tricky. Variable annuities are known for their multiple layers of fees, which can seriously reduce your returns. You’ll often find mortality and expense (M&E) charges, administrative fees, and management fees for the underlying investment funds. On top of that, there are often steep surrender charges if you try to withdraw your money within the first several years—sometimes as long as a decade. Many annuities also come with optional riders for extra benefits, like enhanced death benefits or guaranteed income, which add even more to the cost. These combined fees can easily exceed 2% annually, making it a real challenge for your investment to actually grow.

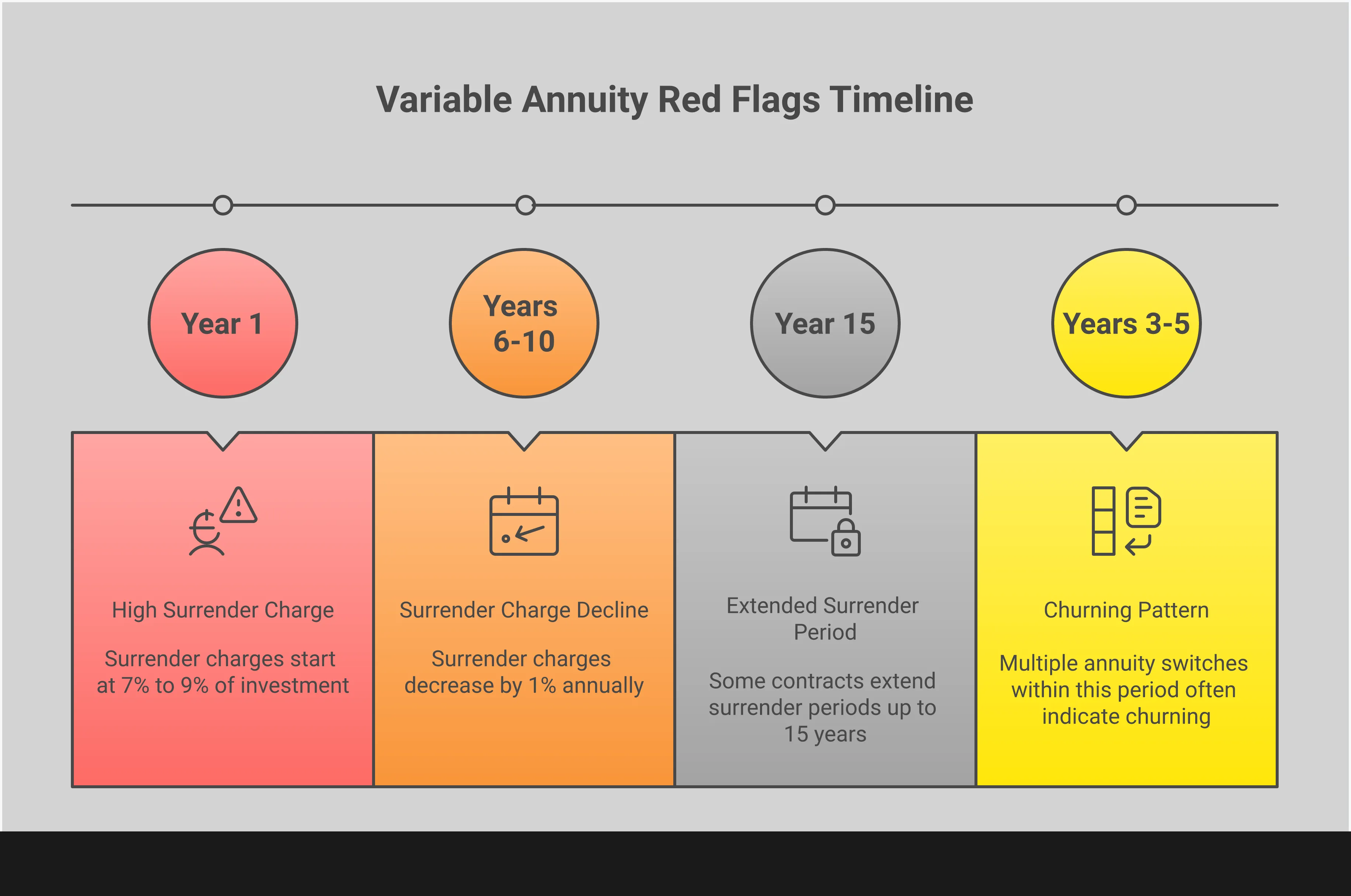

Red Flags: Common Problems with Variable Annuities

Variable annuities are complex financial products, and unfortunately, that complexity can sometimes be used to hide serious problems. Brokers might present them as a can’t-miss opportunity for retirement, but the reality can be quite different. Understanding the common issues associated with these products is the first step in protecting your financial future. If any of these situations sound familiar, it might be a sign that the investment wasn’t in your best interest.

Misleading Sales Tactics and Misrepresentation

When a broker presents a variable annuity, they should give you the full picture—the good and the bad. Misrepresentation occurs when a broker fails to adequately disclose key details. They might downplay the market-related risks, gloss over the hefty surrender charges you’d face for an early withdrawal, or misstate the nature of the investment altogether. You might be promised guaranteed returns that aren’t actually guaranteed or be led to believe the product is much simpler than it is. This type of broker fraud and negligence can lead you to put your money into a product you wouldn’t have chosen if you had all the facts.

Excessive Fees and Hidden Costs

One of the biggest drawbacks of variable annuities is their cost structure. They often come with multiple layers of fees that can significantly eat into your returns. These can include mortality and expense charges, administrative fees, underlying mutual fund fees, and extra costs for special features or riders. It’s not uncommon for these yearly costs to exceed 2% of your investment value, making it incredibly difficult to earn a profit. A broker who doesn’t clearly explain this fee structure is not acting in your best interest. These hidden costs are among the many investment issues that can quietly drain your retirement savings over time.

Unsuitable Investment Recommendations

Financial professionals have a duty to recommend products that are suitable for their clients’ specific circumstances. A variable annuity might be a poor fit if you are nearing retirement or have a low tolerance for risk. Because these products often tie up your money for many years, they are generally unsuitable for investors who may need access to their funds in the short term. If your broker pushed you into a variable annuity without a thorough discussion of your financial goals, age, income, and risk tolerance, they may have sold you an unsuitable investment. This is a serious violation of industry rules.

Frequent and Unnecessary Switching (Churning)

“Churning” is a deceptive practice where a broker persuades you to sell an existing variable annuity and buy a new one for the primary purpose of generating a fresh commission for themselves. This is often framed as an “upgrade” or a move to a “better” product. However, this switching rarely benefits you. Instead, it can restart the surrender penalty period, locking up your money for another several years and adding new layers of fees. If your broker has encouraged you to switch annuities multiple times, it could be a sign of churning, a practice that can be grounds for a securities arbitration claim.

How a Lawyer Can Help You Recover Losses

If you suspect your variable annuity losses are due to your broker’s actions, you might feel overwhelmed and unsure of what to do next. This is where a securities lawyer can step in. Taking on a large brokerage firm alone is a difficult task. These firms have teams of lawyers dedicated to defending their interests. A lawyer who understands the securities industry can level the playing field, acting as your advocate and guide through the entire recovery process.

From the moment you hire them, they begin working to untangle the complexities of your case. They handle the paperwork, communicate with the opposing side, and build a strategy tailored to your situation. Their involvement allows you to focus on your life while they manage the legal details. A lawyer’s job is to interpret the intricate rules governing financial products and use that knowledge to fight for your financial recovery. They can help you understand your options and pursue the compensation you deserve for the harm you’ve suffered.

Investigating Broker Misconduct

The first step a lawyer takes is a deep investigation into what happened with your investment. They will carefully review all your account statements, the annuity contract, and any correspondence you had with your broker. A knowledgeable lawyer can interpret the complex securities laws and regulations to pinpoint exactly where broker fraud and negligence may have occurred. Was the annuity unsuitable for your financial situation? Did the broker misrepresent the risks or fees? This detailed analysis is crucial for uncovering the evidence needed to prove misconduct and build a strong foundation for your claim.

Filing a FINRA Arbitration Claim

Most disputes between investors and brokerage firms are not resolved in a traditional courtroom. Instead, they are handled through a process called securities arbitration, which is typically overseen by the Financial Industry Regulatory Authority (FINRA). Variable annuities are a common source of these complaints. A lawyer can manage the entire arbitration process for you, from drafting and filing the initial Statement of Claim to representing you at the final hearing. They ensure all deadlines are met and that your case is presented clearly and effectively to the arbitration panel, giving you a solid opportunity to recover your losses.

Building a Case for Fraud

Proving fraud requires more than just a feeling that something went wrong. It requires concrete evidence. A lawyer will work to gather all the necessary documentation to support your claim that you were misled or that the annuity was an unsuitable investment. Many arbitration proceedings involve claims related to the sale of variable annuities and other complex investment issues. Your attorney will construct a compelling narrative that demonstrates how the broker’s actions led to your financial harm, using financial records and industry rules to substantiate your case for the arbitrators.

Negotiating a Fair Settlement

Many investment fraud cases are resolved through a settlement before the final arbitration hearing. Brokerage firms are often motivated to settle to avoid the risk and expense of a full hearing. An experienced attorney is essential in these negotiations. They can assess the strength of your case to determine a fair settlement amount and handle all communications with the firm’s legal team. Their goal is to protect your interests and secure a settlement that adequately compensates you for your losses. If you believe you have a case, the first step is to contact a law firm for a review of your situation.

Know Your Rights as an Investor

Understanding your rights is the first step toward protecting your financial future. When you work with a financial professional, you aren’t just hoping for the best—you are protected by a system of rules and regulations designed to ensure you are treated fairly. These rights are not just suggestions; they are enforceable standards that brokers and financial firms must follow. If they fail to meet these obligations, you have avenues for recourse. Knowing what to expect from your broker and what protections are in place can help you identify red flags and take action when something feels wrong with your investments.

What Your Broker Is Required to Disclose

Transparency is a cornerstone of your rights as an investor. Your broker has a fundamental duty to provide you with all the essential facts about any investment they recommend, including a variable annuity. This means they must clearly explain the product’s features, risks, and costs. If a broker recommends a variable annuity, they must fully disclose the potential for market loss, the impact of high fees, and the steep surrender charges for early withdrawals. Hiding these details or glossing over them is a serious violation and can be a form of broker fraud and negligence. You should never feel pressured to invest in something you don’t completely understand.

The Suitability Standard and Fiduciary Duty

An investment recommendation must be right for you, not just a good product in general. Financial Industry Regulatory Authority (FINRA) rules, like Rule 2330 for variable annuities, enforce what is known as the “suitability standard.” This means your broker must have a reasonable basis for believing their recommendation fits your specific financial situation, investment objectives, and risk tolerance. They need to consider your age, income, and financial goals before suggesting a product. A variable annuity might be suitable for one person but completely inappropriate for another, and it’s your broker’s job to make that distinction. This responsibility is a key part of the investment issues that can lead to disputes.

Deadlines for Filing a Claim

If you believe you’ve suffered financial losses due to broker misconduct, it’s important to know that your time to act is limited. Statutes of limitation set strict deadlines for filing a legal claim. Waiting too long can unfortunately mean losing your right to recover your money, even if your case is strong. Because variable annuities often have restrictive features and penalties for early withdrawal, investors sometimes don’t realize there’s a problem for years. If you suspect that your investment was misrepresented or unsuitable from the start, it is critical to explore your options promptly. Don’t hesitate to contact a legal professional to understand the specific deadlines that apply to your situation.

How the SEC and FINRA Protect You

You are not alone in holding financial professionals accountable. The U.S. Securities and Exchange Commission (SEC) and FINRA are the primary regulators protecting investors. Because variable annuities are considered securities under federal law, they fall under the jurisdiction of these powerful organizations. The SEC and FINRA create and enforce the rules that govern the sale of investment products and the conduct of brokers. When a dispute arises, FINRA provides a mandatory forum for resolution through a process known as securities arbitration. This system is designed to handle investment disputes more efficiently than traditional court litigation, giving you a clear path to seek justice.

What to Look For in a Variable Annuity Lawyer

When you realize you might have been misled about a variable annuity, finding the right legal partner is a big step toward holding your broker accountable. But not just any lawyer will do. This area of law is highly specialized, and you need someone who understands the specific challenges of these cases. The right attorney can make all the difference in your ability to recover your losses.

Your search should focus on a lawyer or firm with a deep background in securities law and a history of standing up for investors. They should be able to clearly explain your options and guide you through the process with confidence. Here are the key qualities to look for when choosing a variable annuity lawyer.

Experience with Securities Law and FINRA

Variable annuities are complex securities, and any related legal claims are governed by intricate laws and regulations. A lawyer who primarily handles other types of cases, like personal injury or family law, simply won’t have the background to effectively manage your claim. You need an attorney who lives and breathes securities law.

A knowledgeable lawyer can interpret the fine print in your contract and understand the specific rules brokers must follow. Crucially, they must have extensive experience with the Financial Industry Regulatory Authority (FINRA). Most disputes between investors and brokerage firms are resolved through securities arbitration, a unique legal forum with its own set of procedures. An attorney who is familiar with this process is essential for building a strong case on your behalf.

A Proven Record in Investment Fraud Cases

Variable annuities are a frequent source of complaints against financial advisors and brokerage firms. Because of this, you’ll want a lawyer who has a demonstrated history of handling these specific types of cases. Ask about their track record with claims involving unsuitable recommendations, misrepresentation, and other forms of broker fraud and negligence.

A firm that concentrates on investment fraud cases will be familiar with the common sales tactics and defenses that brokerage firms use. They can anticipate the other side’s arguments and know how to counter them effectively. This background gives them the insight needed to gather the right evidence and present a compelling argument that shows how you were wronged and why you deserve to be compensated for your losses.

Deep Knowledge of Complex Financial Products

Annuity contracts are often filled with confusing language, hidden fees, and complicated features. A qualified lawyer can be crucial in cases of mis-selling or disputes over this complex contract language. They should be able to cut through the jargon and clearly explain the financial and legal implications of your investment.

This deep product knowledge is vital for proving your case. Your attorney needs to understand the mechanics of surrender periods, mortality and expense charges, administrative fees, and the underlying investment sub-accounts. This allows them to pinpoint exactly how the annuity was unsuitable for your financial situation or how the broker misrepresented its benefits and risks. A thorough understanding of these investment issues is fundamental to recovering your hard-earned money.

When Is It Time to Contact a Lawyer?

Deciding to seek legal help can feel like a big step, but it’s often the most important one you can take to protect your financial future. If your gut tells you something is wrong with your variable annuity or your broker’s advice, it’s worth listening to. Trusting your intuition and knowing the signs of trouble can help you take action before the situation gets worse. Recognizing these red flags is the first step toward holding a negligent financial professional accountable.

Warning Signs of Broker Misconduct

It can be tough to tell when a poor-performing investment is simply the result of market fluctuations versus actual broker fraud and negligence. A major red flag is if your broker frequently recommends switching your annuity for a new one. This practice, known as “churning,” often generates high commissions for the broker at your expense. Another serious warning sign is a lack of transparency. If your broker pushed you into a variable annuity without clearly explaining the high fees, surrender charges, and investment risks, or if they failed to consider your financial situation and goals, you may have grounds for legal action.

Myths That Prevent Investors from Taking Action

Many people hesitate to question their broker because of common misconceptions about variable annuities. They might feel locked in by restrictive features or fear the substantial taxes and charges for early withdrawal. It’s important to remember that variable annuities are legally considered securities under federal law. This classification gives you specific rights and protections. Don’t let fear-inducing sales tactics or confusing contract language stop you from asking questions. Understanding that these products are regulated investment issues can empower you to challenge advice that doesn’t seem right for you.

First Steps to Take if You Suspect Fraud

If you believe you’ve been misled or your broker has acted improperly, the first step is to gather all your documents, including account statements, contracts, and any correspondence you have. The next, and most crucial, step is to speak with a lawyer who has a deep knowledge of these complex financial products. An attorney can review your situation, help you understand the fine print in your contract, and explain your legal options. Seeking a professional opinion is the best way to ensure your interests are protected and to find out if you have a case. You can contact our firm for a review of your situation.

What to Expect from the Legal Process

Taking legal action can feel like a big step, but understanding the path forward can make it feel much more manageable. When you work with a securities fraud attorney, you’re not going through it alone. The process is designed to be thorough and give you a clear opportunity to present your case. It generally involves a detailed review of your situation, a formal claims process through arbitration, and negotiations to recover your losses. Each step is handled by your legal team, allowing you to focus on moving forward while they handle the complexities of your claim.

Your Initial Case Review

The first step is simply sharing your story. During an initial case review, a lawyer will listen to what happened and look over your account statements and any communications you had with your broker. This is a crucial conversation where an attorney with a deep understanding of intricate securities laws can assess the details of your situation. They will work to identify any potential broker fraud or negligence and determine the strongest legal options available to you. This review costs you nothing and is completely confidential, giving you a clear picture of whether you have a case without any commitment.

The FINRA Arbitration Process

Most disputes between investors and brokerage firms are resolved through the Financial Industry Regulatory Authority (FINRA) arbitration process, not in a traditional courtroom. This is a specialized forum designed to handle investment issues efficiently. FINRA has specific rules, like Rule 2330, which outlines a firm’s responsibilities when selling deferred variable annuities to protect investors. Your lawyer will prepare and file a formal claim on your behalf, presenting evidence of misconduct, such as the inappropriate “switching” of annuities that generates commissions for the broker at your expense. Your legal team will represent you through every stage of the securities arbitration.

Settlement Talks and Potential Results

Many cases are resolved through settlement negotiations before the final arbitration hearing. If your broker recommended a variable annuity without fully explaining the risks or considering your financial situation, you likely have strong grounds for legal action. An experienced attorney can build a compelling case and advocate for your rights during these discussions. Their goal is to negotiate a fair settlement that compensates you for your financial losses. While every case is unique, having a dedicated lawyer to guide you through your legal options is key to holding negligent firms accountable and working toward a favorable result.

Related Articles

- 5 Signs You Need a Georgia Variable Annuity Lawyer

- Variable Annuity Fraud Lawyer | Trusted Annuity Attorneys

- Variable Annuity Fraud – The Frankowski Firm

- How a Variable Annuity Fraud Lawyer Can Protect Your Investments – The Frankowski Firm

- FINRA Orders Morgan Stanley to Rescind Variable Annuity

Frequently Asked Questions

I was told my variable annuity was a “safe” investment for retirement. Why did I lose money? This is a common and frustrating situation. Brokers often highlight the insurance features of variable annuities, like a death benefit, which can make them sound safer than they are. However, the “variable” part means your principal is invested in sub-accounts that function like mutual funds. Their value is directly tied to the stock market, so your investment is absolutely at risk of loss. If your broker downplayed or failed to explain this market risk, they may have misrepresented the product to you.

I signed a lot of paperwork when I bought the annuity. Does that mean I can’t file a claim? Not at all. Signing a contract does not give a brokerage firm a free pass to engage in misconduct. The securities industry has strict rules requiring that investments be suitable for your specific financial situation and that all risks be clearly disclosed. If the annuity was misrepresented or was not an appropriate investment for you, the paperwork you signed does not protect the broker from accountability.

My broker says the market is just down and I should wait it out. Should I? While market downturns are normal, this can also be a tactic to delay you from looking deeper into the problem. The issue may not be the market, but the unsuitability of the product itself or the high fees that are eating away at your principal. It’s also important to remember that there are strict time limits for filing a claim. Waiting too long could prevent you from ever recovering your losses, so it’s wise to get a second opinion on your situation sooner rather than later.

It’s been several years since I bought the annuity. Is it too late to do anything? Not necessarily. The deadlines for filing a claim, known as statutes of limitation, can be complex. The clock doesn’t always start ticking on the day you purchased the investment. In many cases, it begins when you discovered or should have reasonably discovered the wrongdoing. Because the problems with an annuity might not become obvious for years, you may still be within the window to file a claim. The only way to know for sure is to have your case reviewed by a qualified attorney.

I’m worried about the cost of hiring a lawyer. How are legal fees typically handled in these cases? This is a very practical concern. Most securities law firms, including ours, handle these types of cases on a contingency fee basis. This means you do not pay any attorney’s fees unless they successfully recover money for you. The firm’s fee is a percentage of the amount recovered. This approach allows you to pursue a strong claim without having to worry about paying legal bills upfront.