NO FEES UNTIL WE WIN

FREE CONSULTATION

NO FEES UNTIL WE WIN

FREE CONSULTATION

It’s a common feeling: a sense of unease about the investments your broker is recommending. You might wonder if they truly align with your goals or if they seem too complex or risky for your comfort level. This isn’t just paranoia; it’s a valid concern that deserves attention. A recent customer complaint filed against Wells Fargo Advisors Financial Network, LLC broker Jamie Estrada highlights this exact issue. The allegations center on unsuitable investment advice, where a client was allegedly sold products that didn’t fit their needs. This situation underscores why it’s so important to trust your instincts and understand your rights.

When you entrust your financial future to a broker, you deserve to know who you’re working with. Understanding a broker’s professional history and their stated approach to investing is a crucial first step for any investor. This information provides a baseline you can use to evaluate their actions and recommendations. Let’s look at the publicly available information for Jamie Estrada, a broker currently registered with Wells Fargo Advisors Financial Network, LLC.

According to public records, Jaime Estrada has been a registered broker since 2010. He joined Wells Fargo Advisors Financial Network, LLC in 2022. His professional journey is built on a foundation of formal education and industry licensing. He holds a Bachelor’s degree in Business Administration from Clarke University in Dubuque, Iowa. In addition to his securities registrations, he also holds life and health insurance licenses. This background paints a picture of a financial professional with experience across different sectors of the industry. Understanding a broker’s history is a key part of spotting potential broker fraud and negligence.

Many financial advisors publish a philosophy or mission statement to explain how they work with clients. According to his professional profiles, Jamie Estrada’s approach centers on creating personalized plans. He states that he focuses on helping clients achieve their financial goals by prioritizing their needs and encouraging informed decisions. One profile notes, “Knowing everyone’s path in life is different, Jamie enjoys learning about his clients’ unique goals and situations.” Based on this understanding, he says he creates strategies to address various investment issues that may involve both securities and non-securities products. This stated client-first approach is what every investor should expect, but as we’ll see, allegations from customers can sometimes tell a different story.

When you entrust your money to a financial professional, you expect them to act with your best interests at heart. Unfortunately, that doesn’t always happen. A customer complaint filed against Jamie Estrada, a broker associated with Wells Fargo Advisors Financial Network, LLC, highlights a common and serious issue: unsuitable investment recommendations. This case serves as a crucial reminder for all investors to stay vigilant and understand their rights.

The allegations against Estrada center on the claim that he recommended investments that were not appropriate for the customer’s financial situation and personal circumstances. This isn’t just a matter of poor performance; it’s about a fundamental responsibility that brokers have to their clients. When a broker fails to align their advice with a client’s needs, it can lead to significant financial harm. Understanding the specifics of this complaint can help you recognize similar red flags in your own portfolio and know when to seek help.

The core of the complaint against Jamie Estrada is the allegation of “unsuitable” advice. This term has a specific meaning in the financial industry. It suggests that the broker recommended investments that didn’t match the customer’s age, financial goals, risk tolerance, or overall needs. Every investor has a unique profile, and financial professionals are required to consider these factors before making any recommendations. When they don’t, it can be a form of broker fraud and negligence. The complaint raises serious questions about whether Estrada fulfilled his duty to place his client’s interests first.

The complaint specifically points to debt securities and annuity products that Estrada allegedly recommended. While these financial products can be appropriate for some investors, they can also carry risks or features that make them unsuitable for others. For example, certain annuities can tie up your money for long periods and come with high fees, which might not be right for someone who needs liquidity or is in a later stage of life. The concern here is that these specific products may not have been a good fit for the client, suggesting a failure to adhere to industry regulations that protect investors from such investment issues.

To put the financial impact into perspective, the customer is seeking $67,000 in damages. This figure represents the tangible losses the investor claims to have suffered due to the allegedly unsuitable advice. It’s a stark reminder that poor recommendations aren’t just a theoretical problem—they have real-world consequences that can significantly damage a person’s financial security and retirement plans. When losses of this magnitude occur, it’s often a sign that something is seriously wrong with the investment strategy being recommended. This is why it’s so important for investors to understand their options for recourse, such as filing a formal complaint or pursuing securities arbitration.

When you see allegations like the ones made against Jamie Estrada, it’s natural to wonder what safeguards are supposed to prevent this from happening. The financial industry has a framework of rules designed specifically to protect investors from harm. These regulations set clear expectations for how brokers must conduct themselves and handle your money. Understanding these rules is the first step in recognizing when a line has been crossed and knowing what you can do about it. The allegations of unsuitable recommendations are a direct challenge to some of the most important investor protection standards in the industry.

Think of Regulation Best Interest (Reg BI) as a core promise your broker must make to you. This rule requires financial professionals to act in your best interest when they recommend an investment or strategy. It means they can’t put their own financial gains—like a higher commission—ahead of what is genuinely right for your financial situation. Reg BI mandates that brokers prioritize your needs, ensuring the advice you receive is based on your specific goals, risk tolerance, and financial circumstances. It’s a fundamental standard of care that shifts the focus from merely selling a product to providing advice that truly serves you.

A key part of acting in your best interest is the duty to recommend suitable investments. The complaint against Estrada, which alleges he recommended investments inappropriate for the client’s age and needs, points directly to a violation of this duty. This type of broker fraud and negligence occurs when a financial advisor pushes products that don’t align with your profile. For example, placing a retiree with a low risk tolerance into a volatile, high-risk security would be a classic example of an unsuitable recommendation. Brokers are obligated to have a solid understanding of your financial picture before suggesting any course of action.

These rules aren’t just guidelines; they are the bedrock of accountability. Regulations like Reg BI are essential for holding brokers and their firms responsible when they fail to protect their clients. They require brokers to fully understand the risks, costs, and characteristics of the investments they recommend. More importantly, they provide a clear standard against which a broker’s actions can be measured. When an investor suffers losses due to unsuitable advice, these rules provide the framework for seeking recovery through processes like securities arbitration. They ensure that your trust is backed by enforceable standards.

Trusting a financial professional with your hard-earned money is a significant decision. While many brokers act in their clients’ best interests, some recommend investments that are simply not a good fit. This is known as “unsuitable” advice, and it’s a serious breach of a broker’s duty. Recognizing the warning signs can help you protect your portfolio from unnecessary risk and potential losses. If something feels off about the investments your broker is pushing, it probably is. Pay attention to these common red flags that may indicate you’re receiving poor financial advice.

Your investment strategy should be as unique as you are, tailored to your specific life stage and financial objectives. A major red flag is when a broker suggests products that don’t align with your personal situation. For example, a retiree who needs stable income shouldn’t be placed in highly speculative, long-term investments. We’ve seen cases where brokers recommend investments like debt securities and annuities that are completely wrong for a client’s age and needs. This type of broker fraud and negligence can put your financial security at risk. Always question an investment that doesn’t seem to fit your timeline, risk tolerance, or goals.

When you first meet with a broker, you discuss your comfort level with risk. If you state that you are a conservative investor looking to preserve capital, your portfolio should reflect that. It’s a significant warning sign if your broker starts pushing high-risk or complex products into your conservative portfolio. Brokers are required to recommend investments that are suitable for their clients’ financial profiles. Placing aggressive investments in an account designated for low-risk holdings is a direct contradiction of this duty. If you notice your account is filled with products you don’t understand or that seem much riskier than you agreed to, it’s time to ask some hard questions about these investment issues.

Fees can quietly eat away at your investment returns over time, so transparency is key. A trustworthy broker will be upfront about all costs, commissions, and charges associated with your investments. If your advisor is vague about fees or you notice charges on your statement that you don’t understand, consider it a red flag. Regulations require brokers to understand and consider the costs of investments when making recommendations. Evasive answers about fees or pressure to invest without a clear breakdown of expenses could be a sign that the broker is prioritizing their commission over your financial well-being. If a dispute over fees arises, you may need to consider securities arbitration to resolve it.

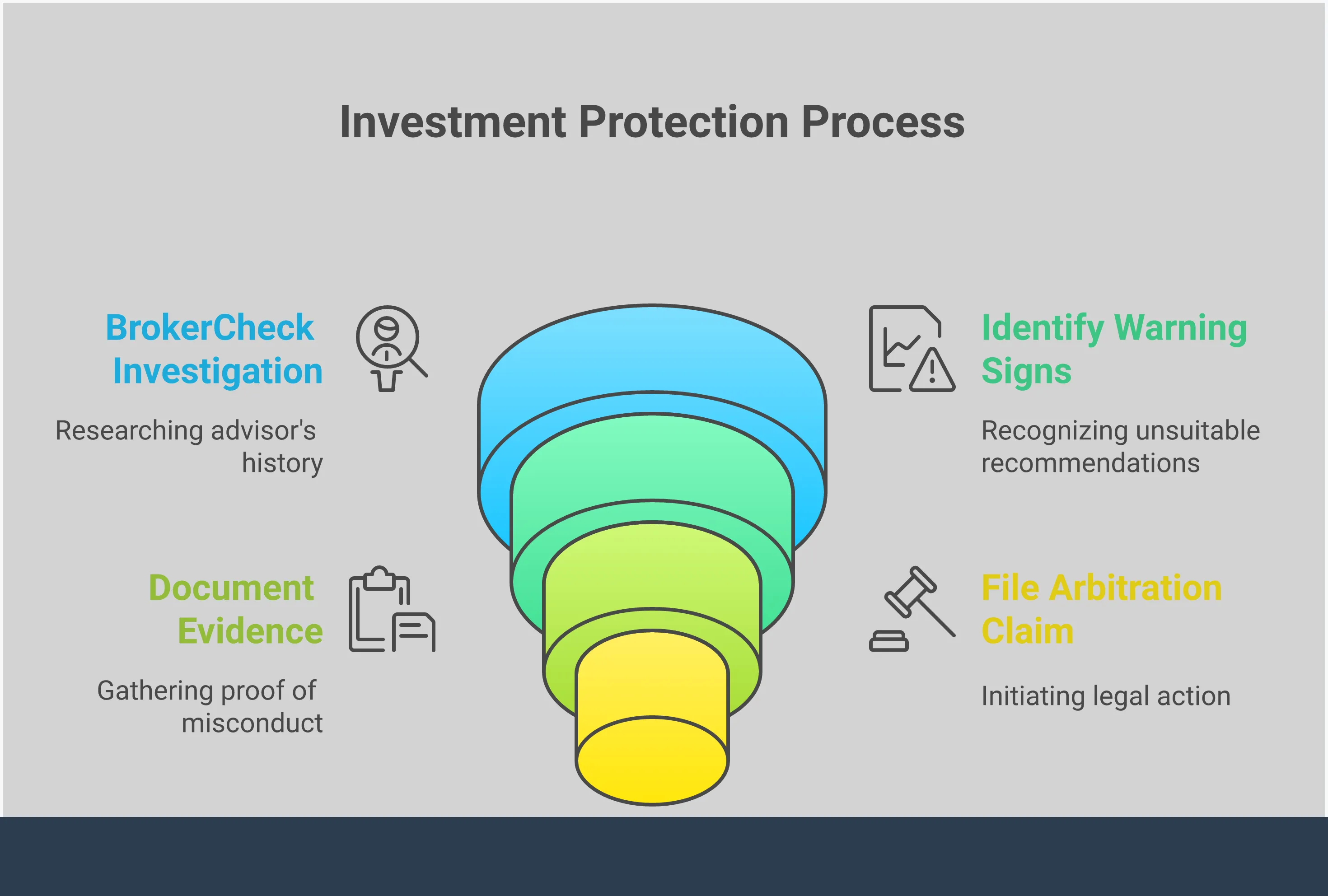

Trust is the foundation of your relationship with a financial advisor, but it’s always wise to verify their background. Doing your own research is a critical step in protecting your investments. Fortunately, regulatory bodies provide free and accessible tools that allow you to look into a broker’s professional history before you entrust them with your money. This simple due diligence can reveal past customer complaints, regulatory actions, and other red flags that aren’t always disclosed upfront. Taking a few minutes to check a broker’s record can save you from significant financial and emotional distress down the road. It’s an empowering step every investor should know how to take.

The most reliable resource for researching a broker’s background is the Financial Industry Regulatory Authority (FINRA)’s BrokerCheck tool. This free search tool is a trusted resource that shows you a broker’s employment history, certifications, licenses, and any past violations. You can look up individuals as well as brokerage firms to see if they have a history of misconduct. FINRA regulates brokerage firms in the United States, and its mission is to protect investors. Using BrokerCheck is a straightforward way to get an unbiased report on the person or firm managing your financial future. Simply type in the broker’s name, and you’ll get a detailed report.

When you pull up a BrokerCheck report, you’ll find a wealth of information. Pay close attention to the “Disclosures” section, as this is where you’ll find any reported customer disputes, regulatory actions, or terminations for cause. The report details the broker’s employment history, showing you how long they’ve been in the industry and which firms they’ve worked for. You can also verify their qualifications by checking their licenses and certifications. A clean record is what you hope to see, but any disclosure event warrants a closer look. Don’t just glance at the summary; read the details of any complaints to understand the nature of the allegations.

A history of customer complaints is a major red flag. Look for patterns of misconduct, such as multiple complaints alleging unsuitable recommendations or misrepresentation. Even a single complaint can be a serious warning sign, especially if it suggests the broker failed to act in their client’s best interest. For example, a complaint alleging a broker pushed high-risk annuities on a conservative retiree is a clear indicator of potential broker fraud and negligence. Other warning signs include frequent job changes between firms, regulatory sanctions, or personal financial issues like bankruptcies, which must also be disclosed on their record.

Discovering that your broker may have acted improperly can be incredibly stressful, but it’s important to know that you have clear avenues for recourse. Financial industry rules are in place to protect investors, and there are established processes for holding brokers and their firms accountable. If you suspect misconduct, you aren’t powerless. You can take specific, structured steps to address the situation, report the behavior, and work toward recovering your financial losses. Taking action is the first step toward getting answers and seeking a resolution.

Your first move should be to report the problem directly to the broker’s firm. Every brokerage firm has a compliance department responsible for supervising its employees and ensuring they follow industry regulations. Brokers are bound by rules like “Regulation Best Interest” (Reg BI), which legally requires them to act in your best interest, not their own. By filing a formal complaint with the firm, you initiate an internal review of the broker’s actions. This puts your concerns on the official record and gives the firm a chance to correct the wrongdoing.

If you don’t get a satisfactory response from the firm, your next step is to involve the Financial Industry Regulatory Authority (FINRA). FINRA is a government-authorized organization that oversees brokerage firms in the U.S. and runs a dispute resolution process specifically for investors. You can also use FINRA’s BrokerCheck tool to see a broker’s employment history, licenses, and any reported customer complaints or disciplinary actions. This public record can provide valuable context about the person managing your money and help you understand if you’re dealing with a case of broker fraud and negligence.

When broker misconduct leads to significant financial losses, you may need to pursue a formal claim to recover your money. For most investors, this means filing for securities arbitration. Instead of going to court, arbitration is a legally binding process where your case is presented to an impartial arbitrator or panel. This is the primary venue for resolving investment disputes. If your broker recommended unsuitable investments or failed to act in your best interest, as was alleged in the complaint against Jamie Estrada, arbitration provides a formal path to seek compensation for the damages you’ve suffered.

It can be confusing and stressful to realize your investment portfolio has taken a significant hit. While market fluctuations are normal, some losses are the direct result of a broker’s poor advice or misconduct. If you suspect your losses are due to more than just market risk, it might be time to speak with a securities attorney. Recognizing the signs of misconduct and knowing what steps to take can make all the difference in protecting your financial future and potentially recovering what you’ve lost.

Not every investment loss is grounds for a legal claim. The key is to figure out if the loss was caused by your broker’s failure to act in your best interest. For example, if a broker recommends investments that are clearly unsuitable for your age, risk tolerance, or financial goals, you may have a case. A recent complaint against broker Jaime Estrada alleged he recommended debt securities and an annuity that were inappropriate for the customer’s needs. This type of action can be a form of broker fraud and negligence. If your broker pushed you into high-risk products you didn’t understand or that didn’t align with your stated objectives, it’s a major red flag that warrants a closer look.

If you believe you have a claim, it’s important to act quickly. Strict time limits, often called statutes of limitation, govern how long you have to file a case. These deadlines vary depending on the situation and jurisdiction. Once that window closes, you may lose your right to recover your losses forever, regardless of how strong your case is. The complaint against Jaime Estrada, for instance, was filed on a specific date, highlighting that these deadlines are real and have consequences. The securities arbitration process, which is where most investor disputes are resolved, has its own set of timing rules. Don’t wait until it’s too late to explore your options.

Strong documentation is the foundation of a successful claim. Before you even speak to an attorney, start gathering all relevant paperwork. This includes account statements, trade confirmations, new account forms, and any written correspondence like emails or letters between you and your broker. If you had important phone calls, write down your notes on when they happened and what was discussed. Having these records organized will help an attorney understand what happened and evaluate the strength of your case. Once you have your documents in order, you can contact our firm for a review of your situation.

It’s a sinking feeling to realize your investment losses might stem from your broker’s poor advice or mismanagement. You’re likely wondering what to do next and if there’s any way to get your money back. This is where a securities attorney can step in to provide clarity and support. Their role is to analyze your situation, explain your legal options, and guide you through the process of holding a broker or their firm accountable. If you suspect your account was handled improperly, the most practical first step is to speak with a law firm that concentrates on securities law. Many firms offer a free, no-obligation consultation to review the details of your case. This initial conversation can help you understand whether you have a claim and what the path to recovering your losses could look like. An attorney will work with you to build a strong case, represent your interests, and fight for the financial recovery you deserve.

Your journey will likely start with a free case review, where an attorney will listen to your story and look at your documents. They’ll assess the specifics of your situation, such as the investments that were recommended and the advice you received. For instance, the complaint against Jaime Estrada mentions he suggested investments, like debt securities and an annuity, that were not a good fit for the customer’s age and financial needs. This is a classic example of potentially unsuitable advice. During a review, an attorney will investigate these details to see if you have a valid claim based on the rules of broker fraud and negligence. This process is all about determining the strength of your case and outlining a clear strategy.

Most disputes between investors and brokerage firms are settled through a process called arbitration, not a traditional court trial. A securities attorney will represent you in these proceedings, handling the legal complexities so you can focus on what’s important. Brokers are required to follow specific industry rules, including Regulation Best Interest (Reg BI), which legally obligates them to act in your best interest—not their own. When a broker fails to meet this standard, it can become a central point in your case. Having a lawyer who understands the details of securities arbitration ensures your side of the story is presented clearly and that your rights are protected throughout the process.

Ultimately, the goal is to recover the money you lost because of misconduct. A securities attorney acts as your advocate in the fight for your financial recovery. They build your case by gathering evidence, which includes looking into the broker’s professional history. The fact that Jaime Estrada has a public complaint on his FINRA record, for example, can be a crucial piece of information. A history of complaints can suggest a pattern of behavior or a failure to follow the rules designed to protect investors. Your attorney will use this and other evidence to construct a compelling argument aimed at securing a financial award or settlement for you. If you’re ready to explore your options, you can contact us to get started.

How can I tell if my investment losses are just from a bad market or from my broker’s bad advice? This is the central question for many investors, and it can be tough to untangle. While all investments carry some risk and markets go up and down, losses from misconduct often look different. They might stem from a strategy that was far too risky for your stated goals, a high concentration in one particular stock or sector you didn’t approve, or investments in complex products you were never properly told about. If your portfolio takes a nosedive while the rest of the market is stable, or if you feel your broker pushed you into something that didn’t match your financial situation, it’s a sign that something more than market fluctuation could be at play.

My broker recommended an annuity, which was mentioned in the complaint. Is that automatically a red flag? Not necessarily. Annuities and debt products can be legitimate tools for some financial plans. The problem arises when they are recommended to someone for whom they are clearly unsuitable. For example, an annuity that locks up money for a decade might be a poor choice for a retiree who needs ready access to their funds. The issue isn’t the product itself, but whether the recommendation aligned with your specific age, income needs, and risk tolerance. If you were sold a product that seems to contradict your financial profile, that is the real red flag.

What is “Regulation Best Interest” and how does it actually protect me? Think of Regulation Best Interest, or Reg BI, as a rule that requires your broker to put your financial interests ahead of their own. It means they can’t recommend a high-commission product to you if a more affordable and suitable option exists. This regulation provides a clear standard for a broker’s conduct. It protects you by making it their legal duty to act in your best interest, giving you a solid foundation to stand on if you believe their advice was self-serving and caused you financial harm.

I’m worried about the cost. What is involved in getting a lawyer to review my case? It’s completely understandable to be concerned about costs, especially when you’ve already lost money. That’s why most securities law firms, including ours, offer a free and confidential case review. This is an initial conversation where you can explain your situation and a legal professional can assess whether you might have a valid claim. There’s no obligation to move forward. The goal is simply to give you clarity on your options without adding any financial pressure.

I found a complaint on my broker’s record using BrokerCheck. What’s my next step? Discovering a complaint on a broker’s record can be unsettling, but it’s valuable information. A single complaint doesn’t automatically mean your broker is untrustworthy, but it does mean you should be extra vigilant. Your next step should be to carefully review your own account statements and investment strategy. Does the complaint mirror any concerns you’ve had? If you feel uneasy or see similarities between the complaint and your own experience, it may be a good time to seek a second opinion on your portfolio or speak with a securities attorney to understand your rights.