NO FEES UNTIL WE WIN

FREE CONSULTATION

NO FEES UNTIL WE WIN

FREE CONSULTATION

You were likely promised that alternative investments would provide great diversification, stable returns, or protection from stock market volatility. It’s an appealing pitch, especially for those looking to secure their retirement. The reality, however, can be a harsh contrast: your money is locked up for years, high commissions have eaten away at your principal, and your “stable” asset has plummeted in value. If the promises you were sold don’t match the performance in your account statements, it’s time to ask some hard questions. This article is for anyone dealing with the fallout of that broken promise and facing significant Alternative Investment Losses, outlining the path from confusion to clarity and potential recovery.

When you hear the term “alternative investment,” it simply refers to financial assets that don’t fit into the usual categories like stocks, bonds, or mutual funds. Think of them as investments outside the mainstream. They aren’t typically traded on major public stock exchanges, which means they operate a bit differently from the investments you might see discussed on the evening news. This category is broad and covers a variety of assets, from private company shares to commodities.

Brokers often present these non-traditional investments as a way to diversify a portfolio and achieve higher returns. While they can sometimes offer unique opportunities, they also come with a distinct set of risks that aren’t always clearly explained. Understanding what makes these investments different is the first step in protecting your financial future. If you’ve been encouraged to put your money into a complex product you don’t fully understand, it’s important to know what you’re dealing with. Many of the investment issues we see arise from a lack of transparency around these very products.

The biggest difference between alternative and traditional investments comes down to three things: complexity, liquidity, and regulation. Alternative investments are often far more complicated than a simple stock or bond. They can have intricate structures and strategies that are difficult for even seasoned investors to grasp. They also tend to be illiquid, meaning you can’t easily sell them and convert them back to cash. Your money could be tied up for years, which is a significant risk if you need access to your funds.

Furthermore, many alternative investments don’t have the same level of regulatory oversight as traditional securities. This lack of transparency can make it easier for important details about risk and fees to be hidden. Because of these factors, they are generally considered riskier and may not be suitable for everyone, especially retirees or anyone with a low tolerance for risk.

You might be holding an alternative investment without even realizing it. Some of the most common types include hedge funds, which use complex strategies to generate returns, and private equity, which involves investing in companies that aren’t publicly traded. Other examples are non-traded Real Estate Investment Trusts (REITs), which invest in property but aren’t listed on a public exchange, and direct investments in oil and gas ventures.

While these investments can sound appealing, they carry substantial risks that are often downplayed. A broker might highlight the potential for high returns while glossing over the lack of liquidity or the high fees involved. This kind of misrepresentation is a serious problem and can be a form of broker fraud and negligence.

While brokers might present alternative investments as a great way to diversify your portfolio, they often come with significant risks that aren’t always clearly explained. Unlike traditional stocks and bonds, these investments operate in a less regulated space, which can leave you vulnerable to a number of problems. The complexity and lack of transparency can make it difficult to understand what you’re truly getting into.

Many investors are drawn to alternatives because of the promise of high returns, but these potential rewards are paired with equally high, if not higher, risks. These aren’t your standard market fluctuations; the dangers associated with alternatives are often built into their very structure. From the inability to access your money when you need it to hidden fees that eat away at your principal, the downsides can be substantial. Understanding these specific investment issues is the first step in protecting yourself and recognizing when a broker’s recommendation may not have been in your best interest.

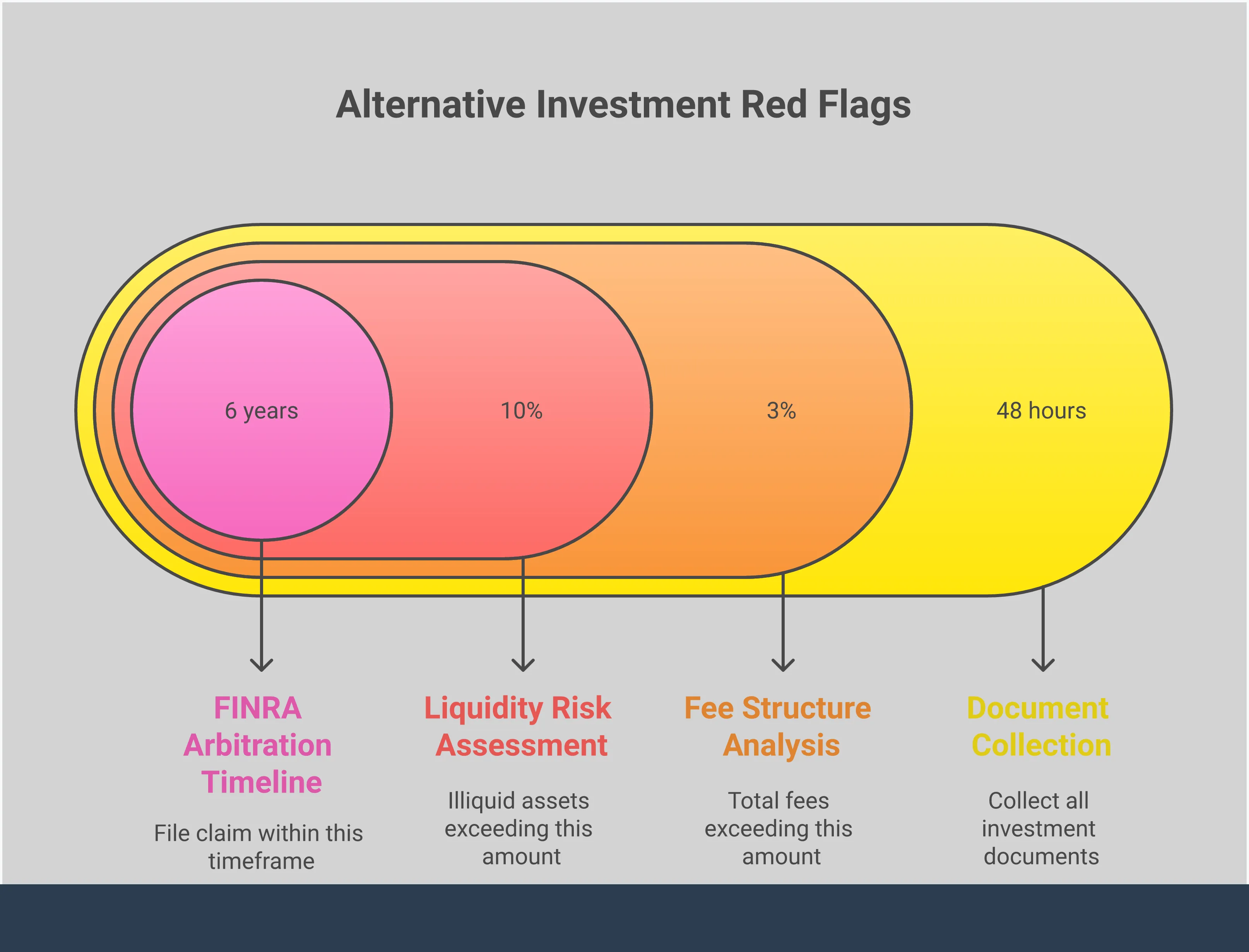

One of the biggest challenges with alternative investments is their lack of liquidity. In simple terms, this means you can’t easily sell them and convert them back into cash. Unlike a stock you can sell with a click of a button, an alternative investment might require you to hold it for years, even if it’s performing poorly. You’re essentially locked in.

On top of that, these investments can be incredibly volatile. Their values can swing dramatically and unpredictably because they aren’t traded on public exchanges. This combination of being hard to sell and having an unstable value creates a serious risk. If you suddenly need access to your funds, you may be forced to sell at a massive loss—if you can find a buyer at all.

Alternative investments are notorious for their high and often hidden fees. Brokers may receive hefty commissions—sometimes as high as 8% or more—that are baked directly into the investment’s price. This means a significant portion of your money is gone from day one, making it that much harder to see a positive return.

Beyond the initial commissions, there are often ongoing management fees, administrative costs, and other charges that slowly erode your investment’s value over time. These complex fee structures are frequently buried in lengthy, complicated documents that are difficult for even a seasoned investor to decipher. These costs directly impact your bottom line, and in many cases, they can turn a seemingly good investment into a losing one.

Unlike stocks and bonds that are traded on public exchanges, many alternative investments operate with far less regulatory oversight. This means there’s less publicly available information and fewer built-in protections for you as an investor. The lack of transparency can make it nearly impossible to get a clear picture of the investment’s performance, management, or underlying assets.

This environment can unfortunately create opportunities for broker fraud and negligence. When information is scarce and oversight is minimal, it becomes easier for brokers to misrepresent the risks or recommend products that are completely unsuitable for their clients, particularly for retirees or anyone with a conservative risk tolerance. Many losses in this space aren’t just bad luck; they’re the result of a broker’s failure to act in their client’s best interest.

Losing money in any investment is tough, but when it comes to alternative investments, the losses can feel especially confusing and unfair. Often, these losses aren’t just a matter of bad luck or market downturns. They can be the direct result of specific actions—or inactions—by the financial professionals you trusted. Understanding the root cause is the first step toward figuring out what happened to your hard-earned money and what you can do about it.

Many investors are drawn to alternatives because they are marketed as a way to get higher returns or to diversify away from the traditional stock market. However, the complexity and lack of transparency in these products can create an environment where misconduct thrives. The most common reasons for significant losses often trace back to three key areas: outright deception from a broker, recommendations that were completely wrong for your financial situation, and misleading claims that downplayed the very real risks involved. Recognizing these patterns is crucial, as they can be signs of serious investment issues that may give you legal grounds to recover your funds.

One of the most direct causes of losses is broker fraud and negligence. This isn’t just about a bad stock tip; it’s about a deliberate breach of trust. Misrepresentation occurs when a broker intentionally lies, omits crucial information, or makes false promises about an investment’s potential returns or safety. They might tell you an investment is “low-risk” when it’s actually highly speculative, or they might fail to disclose exorbitant fees that will eat away at your principal. Many losses happen simply because of a broker’s carelessness or intentional deceit. This can include lying about the nature of an investment or not properly watching over your account to protect your interests.

Even without outright lying, a broker can cause you significant harm by recommending investments that are not right for you. Financial professionals have a duty to understand your financial situation, age, investment goals, and tolerance for risk. Alternative investments are generally higher risk and illiquid, making them unsuitable for retirees, conservative investors, or anyone who cannot afford to lose their principal investment. If your broker pushed you into a complex, high-risk product without considering your financial profile, they may have made an unsuitable recommendation. This is a form of negligence, and you shouldn’t have to bear the financial consequences of their poor judgment. Resolving these disputes often happens through securities arbitration.

Alternative investments are often pitched as a safe haven from stock market volatility. You may have heard claims that they offer stable income, are insulated from market swings, or provide excellent diversification. While they can sometimes serve these purposes, these claims can be deeply misleading. The truth is that alternative investments have their own serious and unique risks that are often downplayed by the people selling them. An investment that is not tied to the stock market is not automatically safe. It could be illiquid, meaning you can’t get your money out when you need it, or it could be tied to a volatile asset like real estate or private company shares. If you were sold an investment based on promises of safety and stability, only to suffer major losses, it’s time to contact us for a closer look.

Trusting someone with your hard-earned money is a significant decision. While most financial professionals are honest, some may engage in fraudulent or negligent behavior that puts your savings at risk. The key to protecting yourself is learning to recognize the warning signs. Many investment losses happen not because of market downturns, but because of a broker’s actions—or inaction. This can range from outright deception to simply failing to perform the due diligence required to protect your interests.

Understanding the difference between a bad investment and actual misconduct is the first step toward holding the right people accountable. It’s about knowing your rights as an investor and identifying when a line has been crossed. If your broker recommended an investment that was clearly wrong for your financial situation or failed to explain the true risks involved, you may have grounds for a claim. Recognizing these red flags early can help you prevent further losses and start the process of financial recovery.

Investment fraud often involves a broker intentionally misleading you for their own gain. Be wary of anyone who promises guaranteed high returns with little to no risk—this is almost always a sign of trouble. Another major red flag is pressure to make a decision immediately. A legitimate advisor will give you time to review documents and think things over. You should also be suspicious if a broker is vague about the details of an investment, avoids putting information in writing, or provides statements that are difficult to understand. Many devastating losses are the direct result of broker fraud and negligence, so it’s critical to question anything that doesn’t feel right.

Negligence is different from fraud because it isn’t always intentional, but it can be just as damaging. A negligent broker is one who fails to uphold their professional duties. This can include a lack of communication, making trades in your account without your permission, or failing to monitor your portfolio adequately. Your advisor has a responsibility to understand your financial goals, risk tolerance, and timeline. If they recommend products that don’t align with what you’ve discussed, or if they can’t clearly explain why an investment is suitable for you, they may be acting negligently. These types of investment issues can erode your portfolio over time and should be addressed immediately.

Not every investment is right for every person. A key part of a broker’s job is to ensure the risk level of your portfolio matches your personal financial situation. Alternative investments, for example, are often complex, difficult to sell quickly, and come with high fees. These products are generally high-risk and are not appropriate for retirees, conservative investors, or anyone who needs easy access to their money. If your broker is pushing you into an investment that feels too complicated or risky for your comfort level, that’s a clear warning sign. You should never feel pressured to invest in something you don’t fully understand, especially if it doesn’t fit your long-term financial plan.

Discovering that your hard-earned money has vanished due to a risky alternative investment is a deeply frustrating experience. It’s easy to feel powerless, but you have options for holding negligent brokers and advisors accountable. The key is to understand the specific avenues available for seeking recovery. Many investors don’t realize that they don’t have to simply accept these losses, especially when they stem from bad advice or outright deception. The financial industry has established processes specifically for these situations. Depending on the circumstances of your case, you may be able to recover your funds through arbitration, a lawsuit, or a negligence claim. Each path is designed to address different types of financial misconduct, from misrepresentation to simple carelessness. Knowing which route to take can feel overwhelming, but it starts with recognizing that you have rights as an investor. Whether your broker pushed an unsuitable product, failed to disclose critical risks, or simply wasn’t paying attention to your account, there are formal channels to pursue justice and get your money back. Taking action is the first step toward getting back on solid financial ground.

For most disputes involving a brokerage firm, you won’t go to a traditional court. Instead, you’ll likely go through the Financial Industry Regulatory Authority (FINRA) arbitration process. This is a formal, legally binding method for resolving claims of broker fraud and negligence. Think of it as a private court system for the securities industry. You and your attorney will present evidence and arguments to an impartial arbitrator or a panel of arbitrators. They will then issue a final decision. Because this is a specialized legal field, working with a firm that understands the nuances of securities arbitration is essential to building a compelling case.

Sometimes, investment losses are the direct result of a broker’s dishonesty or extreme carelessness. This can include recommending investments that were completely wrong for your financial situation, lying about the risks involved, or failing to properly supervise your account. When misconduct is this clear, filing a securities fraud lawsuit may be the right course of action. This legal step allows you to formally accuse a broker or firm of wrongdoing in court. A successful lawsuit can help you recover your losses and holds the responsible parties accountable for their deceptive practices and failure to protect your interests.

Your financial advisor has a professional and ethical duty to act with your best interests at heart. This means they must perform due diligence on any investment they recommend, clearly explain all the potential risks, and ensure that the investment is truly suitable for your financial goals and risk tolerance. If they fail to meet these standards and you lose money because of it, you may have grounds for a negligence claim. This type of claim argues that your advisor failed in their professional duty, and their carelessness directly caused your financial harm. It’s a powerful way to get your money back when an advisor simply didn’t do their job right.

Discovering significant losses in your portfolio can be a jarring and stressful experience. It’s easy to feel overwhelmed, but taking immediate, calculated steps can make all the difference in protecting your rights and potentially recovering your money. Many investors find their losses aren’t just from bad market luck but from broker fraud or negligence. If you suspect your losses are due to misconduct, it’s time to get organized and take action. This isn’t just about damage control; it’s about taking back control of your financial future. The following steps will provide a clear path forward, helping you move from uncertainty to action.

Your first move should be to gather every piece of paper and digital communication related to the investment. Think of yourself as a detective building a case. Collect account statements, trade confirmations, marketing materials, prospectuses, and any emails or text messages you exchanged with your broker. If you took notes during phone calls, find those too. This documentation creates a timeline and a factual record of what you were told versus what actually happened. Having this evidence organized is crucial because it helps establish whether your broker’s recommendations were truly suitable for you or if there was misrepresentation involved.

Time is not on your side when it comes to recovering investment losses. There are strict deadlines, known as statutes of limitations, for filing claims. If you miss these deadlines, you could lose your right to pursue recovery, no matter how strong your case is. The clock often starts ticking from the moment you knew, or should have known, about the potential misconduct. Because these timelines can be complex, it’s important to act quickly once you suspect a problem. Don’t wait, assuming you have plenty of time. Understanding the process of securities arbitration and its deadlines is a critical step in preserving your options.

You don’t have to sort through this complex situation alone. Broker-dealers and investment advisors have a legal duty to recommend investments that are suitable for their clients’ financial situations and goals. If they fail to do their due diligence or misrepresent the risks, they can be held responsible for the losses. A securities attorney can review your evidence and determine if your broker breached their duty. They understand the specific investment issues that lead to claims and can guide you on the best course of action. Getting professional advice is the most effective way to understand your rights and explore the path to financial recovery.

Taking control of your financial future means being proactive about protecting your investments. While all investing involves some level of risk, you shouldn’t have to worry about being exposed to dangers you didn’t sign up for, especially those stemming from bad advice or misleading information. Understanding how to shield your portfolio from unnecessary risk is one of the most powerful things you can do as an investor. It’s about asking the right questions, knowing what to look for in the fine print, and making sure your portfolio truly reflects your financial goals and comfort level.

We place a great deal of trust in financial professionals to guide us, but that trust requires them to act in our best interests. When an advisor recommends overly complex or high-risk products that don’t fit your needs, they expose you to potential harm. Being an informed and engaged investor is your best defense. By taking a few straightforward steps, you can build a stronger, more secure financial foundation and be better equipped to spot red flags before they become serious problems. The following practices are essential for anyone looking to safeguard their hard-earned money.

Before you commit your hard-earned money to any investment, especially a complex alternative one, it’s crucial to do your own research. Your financial advisor has a duty to carefully vet investments, explain all the potential risks, and ensure the product is a suitable match for your financial situation. Don’t hesitate to ask direct questions about the investment’s track record, the potential downsides, and why they believe it’s right for you. If you receive vague answers or feel pressured to make a quick decision, consider it a major red flag. A trustworthy advisor will welcome your questions and provide clear, understandable information.

High fees can quietly erode your investment returns over time. Alternative investments are particularly known for having steep fees and commissions—sometimes up to 8% or more—that are often buried in the fine print. These costs are frequently built into the investment’s price, making them difficult for investors to spot. Always ask for a complete and clear breakdown of all fees, commissions, and expenses. Carefully review the prospectus and other disclosure documents. If the fee structure seems overly complicated or isn’t clearly explained, it may be a sign of trouble with these types of investment issues.

You’ve probably heard the saying, “Don’t put all your eggs in one basket.” This is the core principle of diversification. Spreading your money across a variety of asset classes helps manage risk because you aren’t overly reliant on the performance of a single investment. Unfortunately, some brokers push alternative investments on clients even when they are too risky or complex, leading to a portfolio that is dangerously concentrated in one area. A properly diversified portfolio should align with your long-term goals and risk tolerance, not an advisor’s sales quota.

Alternative investments are generally higher-risk products and are not appropriate for everyone. They are often unsuitable for retirees, conservative investors, or anyone who needs to preserve their capital. It’s important to be honest with yourself about your own risk tolerance. Decide what percentage of your portfolio you are comfortable allocating to higher-risk, illiquid assets, and stick to that limit. If you feel that your advisor is pushing you into investments that make you uncomfortable, it could be a sign of broker fraud and negligence. Your portfolio should help you sleep at night, not keep you up with worry.

When it comes to investing, what you think you know can sometimes hurt you more than what you don’t. Certain myths about alternative investments are particularly dangerous, often circulated by brokers who prioritize their commissions over your financial well-being. Let’s clear up a few common misconceptions that can unfortunately lead to significant financial losses.

It’s easy to get drawn in by the promise of high returns, but the idea that alternative investments are a “safe bet” is a costly myth. The reality is that these investments are not suitable for everyone. Because they are often subject to limited regulation, they carry a much higher level of risk than traditional stocks and bonds. They can be illiquid, meaning you can’t easily sell them and get your money back when you need it. A broker might present them as a secure way to diversify, but for many investors, especially those with a lower risk tolerance, they are an inappropriate and dangerous choice.

A common sales tactic is to downplay the potential downsides of an investment. You might hear that an alternative investment is “stable” or that the risks are minimal, but this is rarely the case. These products are generally high-risk and are not a good fit for retirees, conservative investors, or anyone who isn’t prepared to lose their entire principal. If a broker recommends such an investment without thoroughly explaining the risks or confirming it aligns with your financial goals, it could be an unsuitable investment recommendation. Always remember that if an investment promises unusually high returns, it almost certainly comes with equally high risks, whether they are disclosed to you or not.

This is perhaps the most damaging myth of all. While you want to trust the person managing your money, you have to remember that not all brokers have your best interests at heart. Many investment losses are the direct result of broker fraud and negligence. This can involve anything from recommending unsuitable products to earn a higher commission to outright lying about an investment’s performance. Your financial advisor has a legal duty to do their homework and ensure an investment is appropriate for you. When they fail to meet that standard, either through carelessness or intentional deceit, they can and should be held responsible for the losses you suffer.

It can be tough to know when a financial loss crosses the line from a market downturn to something more serious. Many investors hesitate, wondering if they’re overreacting or if the loss was simply a risk they accepted. But waiting too long can jeopardize your ability to recover your money. You don’t have to have definitive proof of wrongdoing to seek legal advice. If your gut tells you something is wrong or the numbers just don’t add up, it’s worth having a conversation. An attorney can help you understand if your situation was a result of bad luck or a breach of trust.

Losing a substantial portion of your savings is devastating, and it’s easy to blame yourself or market volatility. However, many investment losses aren’t just bad luck; they can be the direct result of a broker’s actions. Financial advisors have a professional duty to perform due diligence on the products they recommend, fully explain the risks, and ensure an investment is suitable for your specific financial situation. When they fail to meet these standards, you may have a valid claim. If you’ve lost a lot of money in alternative investments, it’s time to question whether your broker’s guidance was truly in your best interest or if it was a case of broker fraud and negligence.

Trust your instincts. If you feel uneasy about your broker’s behavior or the performance of your investments, pay close attention. Many investment losses happen because brokers are not acting honestly or competently. A major red flag is the incentive structure behind alternative investments, which often carry much higher commissions for the broker than traditional stocks and bonds. This can create a conflict of interest, motivating a broker to sell you a product that benefits them more than it benefits you. Other warning signs include feeling pressured to make a quick decision or having your questions dismissed. These are serious investment issues that warrant a closer look.

Facing significant financial setbacks from alternative investments can feel overwhelming, but it’s important to remember that you have rights as an investor. Your financial advisor has a professional duty to perform thorough due diligence, clearly explain all the risks, and ensure an investment is actually a good fit for your financial situation. If they fail to meet these obligations, you may have a strong case for recovering your losses.

Sometimes, investment losses aren’t just the result of a volatile market. They can happen because of broker fraud and negligence. It’s a tough reality, but your broker’s carelessness or intentional misrepresentation could be the real reason your investment failed. Holding them accountable is a critical part of the recovery process.

You should also be aware that brokers often make more money selling alternative investments than traditional ones. These higher commissions can create a serious conflict of interest, sometimes leading them to recommend products that benefit their bottom line more than your portfolio. This is a major red flag and a common reason for unsuitable investment recommendations.

If you believe your losses are tied to your broker’s misconduct, the most important step you can take is to get a clear picture of your legal options. Speaking with a law firm that focuses on securities arbitration can help you understand if you have a case. Taking action quickly is key to the recovery process and working to reclaim your funds. Please contact us to see how we can help.

My broker recommended this investment. How do I know if it was truly unsuitable for me? An investment is considered unsuitable if it doesn’t match your financial reality. This includes your age, income, investment goals, and how much risk you’re comfortable taking. For example, a high-risk, illiquid alternative investment is generally not appropriate for a retiree who depends on their savings for income. If your broker pushed you into a complex product without a thorough discussion of your financial situation or if it clearly conflicts with the goals you outlined, it was likely an unsuitable recommendation.

I lost money, but isn’t that just a normal risk of investing? While all investments carry some risk of loss due to market fluctuations, losses from broker misconduct are different. The issue isn’t that the market went down; it’s whether you were exposed to an inappropriate level of risk in the first place. If your losses happened because your broker misrepresented the investment, failed to disclose key information like high fees, or put you into a product that was far too risky for your profile, then it’s more than just bad luck. It’s a potential failure of their professional duty.

How can high commissions and fees contribute to my investment losses? High commissions create a significant hurdle from day one. If a large percentage of your initial investment goes directly to the broker, your investment has to perform exceptionally well just for you to break even. These costs are often not clearly explained and can be buried in complex documents. This structure can create a conflict of interest, motivating a broker to sell you a product that pays them well, rather than one that is actually good for you.

What is the most important first step I should take if I suspect my broker was negligent? Your first and most critical step is to gather all your documents. This includes account statements, trade confirmations, any marketing materials you were given, and all written communication with your broker, such as emails. This paperwork creates a factual record of what you were told and what actually occurred. Having this information organized will be incredibly valuable when you decide to have your situation reviewed by a legal professional.

Is there a time limit for taking action to recover my losses? Yes, there are strict deadlines for filing a claim, which are known as statutes of limitations. The clock usually starts running from the date you discovered or reasonably should have discovered the problem with your investment. If you miss this window, you may lose your right to pursue a claim, regardless of how strong your case is. This is why it’s so important to act quickly once you suspect something is wrong.