NO FEES UNTIL WE WIN

FREE CONSULTATION

NO FEES UNTIL WE WIN

FREE CONSULTATION

That sinking feeling when you suspect your investment isn’t what it seemed is a difficult experience, made even more complicated when you’re living overseas. You might feel isolated, unsure of the local laws, or simply overwhelmed by where to even begin. Before you do anything else, know this: your power lies in your paperwork. The foundation of any successful claim is a well-organized collection of evidence that tells the story of what happened. We’re here to provide a clear roadmap, starting with the most critical question: what documents do expats need to file an investment fraud claim to hold the responsible parties accountable?

Living and investing abroad comes with its own set of challenges, and unfortunately, that can include being a target for financial fraud. Because you may be navigating different financial systems and regulations, it’s important to understand the specific risks you might face. Scammers are skilled at exploiting the complexities of cross-border finance to their advantage. They create sophisticated schemes that can look legitimate on the surface, making it difficult to tell a real opportunity from a trap. Knowing what to look for is the best way to protect your hard-earned money while you’re away from home.

Living abroad opens up a world of opportunities, but it can also expose you to unique financial risks. Certain investment scams are designed specifically to target the expat community. For instance, property investment schemes are particularly common, where fraudsters present attractive but ultimately fake deals that can lead to major financial losses. You might also encounter scams involving offshore investments that promise high returns with little to no risk. These schemes often prey on the fact that you’re managing finances across borders, which can make due diligence feel more complicated. Understanding these common investment issues is the first step in protecting your assets while living overseas.

Scammers often see expats as prime targets for a few reasons. You might be less familiar with local investment laws, or you may be managing assets in multiple currencies, which adds a layer of complexity that fraudsters exploit. They create polished websites and use convincing sales pitches to build a false sense of trust. We’ve seen a rise in cases where investors, especially expats, are told they must pay a large capital gains tax bill before they can access their funds. This is a manipulation tactic designed to extract more money from you. If you’ve encountered a situation like this, it’s not your fault. These are sophisticated operations designed to deceive even careful investors.

Trusting your instincts is crucial, but knowing specific red flags can help you spot trouble early. Be cautious of anyone promoting unregistered products, from stocks and bonds to crypto assets. If a professional credits a highly complex investing technique for their success, take a step back. Reputable advisors want you to understand where your money is going. One of the biggest signs of broker fraud and negligence is pressure to make an immediate decision. Phrases like “you have to act now” or “this is a limited-time opportunity” are designed to make you bypass your better judgment. Always be wary of promises of “risk-free” investments or guaranteed high returns—they simply don’t exist.

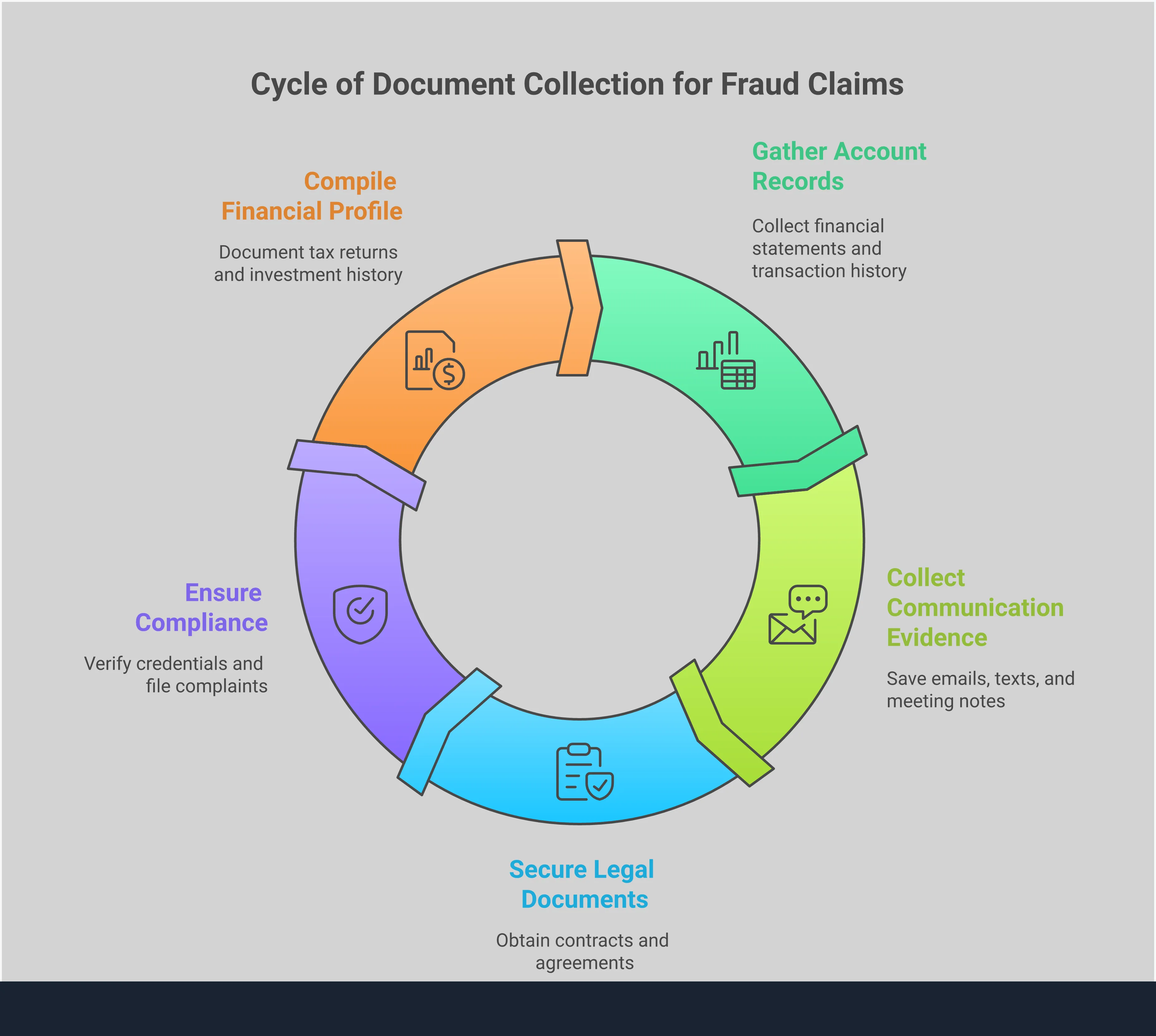

When you realize you may be a victim of investment fraud, the path forward can feel unclear. The single most important first step you can take is to gather your documents. Think of it as building the foundation for your case. Solid paperwork creates a clear, factual story of what happened, making it much harder for brokers or firms to dispute your claim. This process might seem daunting, but organizing your evidence into categories makes it manageable. By collecting these records, you are taking control and preparing to hold the responsible parties accountable for their actions.

Your account statements are the official record of your investment journey. Start by gathering all monthly and quarterly statements for the investment in question, from the very beginning until now. These documents provide a detailed history of every transaction, fee, and change in value. Also, look for any trade confirmations or valuation statements you received. Together, these papers create an undeniable financial map, showing exactly how your money was handled and illustrating the losses you sustained. They are the primary evidence used in any securities arbitration to prove financial damages.

Go back to the beginning and find the original agreement or contract you signed with your financial advisor, broker, or investment firm. This document is critical because it outlines the terms of your relationship, the scope of their services, and the investment objectives you both agreed upon. It’s the legal backbone of your arrangement. If the actions taken with your money deviate from what’s written in this contract—for example, if you agreed to a low-risk strategy but were placed in high-risk ventures—this document becomes a key piece of evidence in demonstrating a breach of contract or negligence.

The story of what you were told often lies in your communication history. Collect every email, letter, text message, and even handwritten notes from conversations you had with your advisor or broker. These records can reveal promises of high returns, downplayed risks, or pressure to invest. Misleading communication is a hallmark of broker fraud and negligence. A single email with a misleading statement can be incredibly powerful. Be thorough and save everything, as even a seemingly minor exchange could be the detail that strengthens your claim significantly.

What first convinced you to invest? Find any brochures, presentations, pamphlets, or website pages that were used to sell you the investment. These marketing materials contain the promises and claims that were made to you. When you can show a direct contrast between what was advertised and what actually happened with your investment, you build a strong case for misrepresentation. For instance, if a brochure promised a “safe, secure” investment that turned out to be highly speculative and resulted in major losses, that material becomes direct evidence of the misleading information you were given.

Following the money is essential. You need to prove that you funded the investment and show the exact amount you lost. Gather bank statements, wire transfer confirmations, and copies of canceled checks that show money moving from your personal accounts to the investment account. These documents provide concrete proof of your financial commitment. Additionally, having financial statements or tax returns from the period before you invested can help establish your financial standing and risk tolerance, further supporting claims that the investment was unsuitable for your situation.

As an expat, confirming your identity and place of residence is a necessary step. Make copies of your passport, visa, driver’s license, and recent utility bills. These documents help establish the proper jurisdiction for your claim, which can be a complex issue when you live abroad. They verify who you are and where you were living when the investment was made and managed. While it may seem like a basic formality, having these papers in order ensures there are no administrative delays or challenges to your standing as you move forward with your case.

When you realize you’ve been a victim of investment fraud, taking organized, deliberate steps can make all the difference in your ability to recover your losses. Building a strong case hinges on your ability to present a clear, evidence-backed story of what happened. It’s not just about what you know; it’s about what you can prove. Think of yourself as the lead detective in your own case. Your job is to gather every piece of the puzzle so your legal team can put it together effectively. This means collecting documents, creating a timeline, and meticulously recording every detail. A well-organized case file is your most powerful tool as you move forward.

A clear timeline is the backbone of your claim. It creates a narrative that helps others understand the sequence of events from your perspective. Start from your very first interaction with the broker or advisor and move forward chronologically. Note the dates of every meeting, phone call, and email exchange. Include when you received marketing materials, when you signed contracts, and when each transaction occurred. Be sure to pinpoint the moment you first felt something was wrong and what prompted that feeling. This detailed account will help your attorney identify key moments of misrepresentation or negligence and build a compelling argument on your behalf.

To make a claim, you need to clearly show how much money you’ve lost. This requires more than just a ballpark figure; it requires concrete proof. Gather all your valuation statements, dealing instructions, and the original bond or fund application forms. These documents are essential for calculating the exact financial damage. You’ll want to track the flow of your money—how much you invested initially and on what dates, versus the current value of those investments. This documentation provides undeniable evidence of the financial impact of the investment issues you’ve faced and is fundamental to recovering your hard-earned money.

Every email, letter, text message, and even handwritten note from your interactions with a financial advisor can serve as critical evidence. These communications can reveal what you were promised versus what was actually delivered. Be sure to save everything, including promotional brochures and website printouts. If you had phone calls, write down your notes from those conversations with the date and time. This collection of correspondence can expose patterns of broker fraud and negligence and demonstrate how you were misled. Don’t dismiss any piece of communication as unimportant; it could be the key to proving your case.

Your financial standing at the time of the investment is a crucial piece of the puzzle. You should gather your personal and business tax returns for the three years prior to the transaction, along with any financial statements showing your assets and liabilities. This information helps establish your investor profile and risk tolerance. For example, if you were a conservative investor and were placed in a high-risk, speculative product, these documents can help prove the investment was unsuitable for your situation. This evidence is often a central part of a securities arbitration claim, as it demonstrates that the advice you received was not in your best interest.

It’s important to ensure the documents you’ve received are legitimate. Fraudsters sometimes create fake statements or contracts to maintain their deception. Look for red flags, such as unprofessional formatting, typos, or unofficial email addresses. Be especially wary of any documents that include suspicious requests, like demands for upfront fees or taxes before your investments can be released. Legitimate firms do not operate this way. If you have any doubts about a document’s authenticity, set it aside and flag it. An experienced attorney can help verify your paperwork and identify fraudulent materials. If you have questions, it’s always a good idea to contact a legal professional for guidance.

Once you’ve gathered your documents and built a timeline, the next step is to formally file your claim. This part of the process can feel intimidating, but understanding what’s ahead can make it much more manageable. Filing a claim isn’t just about sending off a form; it’s a structured legal process that involves meeting specific deadlines, submitting the right paperwork, and working within a system that can be complex, especially for expats. Each step is designed to ensure your case is presented clearly and effectively.

The path to recovering your losses requires careful attention to detail. From ensuring your documents are properly translated to understanding the unique challenges of a cross-border dispute, every action you take is a building block for your case. Think of this phase as formally presenting your story to the people who can help. With the right preparation and guidance, you can move through the process with confidence, knowing you’ve taken the necessary steps to seek justice. This is where your hard work in gathering evidence pays off and moves you closer to a resolution.

When it comes to filing a legal claim, time is of the essence. Every jurisdiction has strict deadlines, known as statutes of limitations, for bringing a case forward. If you miss this window, you could lose your right to recover your losses, no matter how strong your case is. These time limits can vary depending on the type of claim and where you’re filing, which adds a layer of complexity for expats. Acting quickly is crucial. The moment you suspect fraud, you should start looking into your options. The process of securities arbitration, a common path for resolving investment disputes, also has its own set of timelines that must be followed precisely. Don’t let a technicality prevent you from pursuing your claim.

Submitting a claim requires a specific set of documents, and getting this part right is fundamental to your case. You’ll need to complete official claim forms, which can be complex and require detailed information about your situation. Alongside these forms, you’ll submit the evidence you’ve gathered, including account statements, bond application forms, and any contractual documentation you have. Think of this as your official evidence packet. Leaving out required paperwork or filling out forms incorrectly can cause significant delays or even lead to the dismissal of your claim. If you’re unsure about what’s needed, it’s always better to seek guidance. An experienced legal team can help ensure your submission is complete and accurate from the start.

For expats, filing an investment fraud claim comes with a unique set of challenges. You may be dealing with financial institutions, laws, and regulatory bodies in multiple countries. What’s standard practice in one country might be completely different in another. For example, the rules for handling broker fraud and negligence can vary significantly across borders. This international element can complicate everything from submitting documents to enforcing a judgment. Understanding the jurisdiction where you should file your claim is a critical first step. This is often where professional legal help becomes invaluable, as they can guide you through the international complexities and represent your interests effectively, no matter where you or the opposing party are located.

If your documents are in a different language than the one required for the legal proceedings, professional translation is a must. This isn’t a place to cut corners with online tools. Every word in a contract, email, or financial statement matters, and a small translation error could change the meaning of a critical piece of evidence. Your goal is to present a case that is clear, accurate, and leaves no room for misinterpretation. Ensure that your translations are certified and handled by a professional who understands legal and financial terminology. This attention to detail shows that you are serious about your claim and helps build a foundation of credibility with arbitrators or court officials.

The actual submission of your claim is a formal step that sets the legal process in motion. This is typically done by filing a Statement of Claim with the appropriate dispute resolution forum, like the Financial Industry Regulatory Authority (FINRA) in the United States. This document outlines the facts of your case, the misconduct you’re alleging, and the damages you’re seeking. Be wary of anyone who asks for unusual fees or taxes upfront to “release” your investment returns during this process; this is often another red flag. An attorney can handle the submission for you, ensuring it’s filed correctly with the right organization and that all procedural rules are followed. This lets you focus on what’s important while they handle the complex mechanics of the filing.

When you’re dealing with the fallout of investment fraud, the legal system can feel overwhelming. Bringing in a lawyer who focuses on securities law isn’t just about filing paperwork; it’s about having a dedicated advocate on your side. They can help you understand your rights, outline your options, and handle the complex procedures required to pursue your claim. A good legal team will work with you to piece together what happened and build a strong case to recover your losses. This partnership is crucial, as it allows you to focus on moving forward while they handle the legal heavy lifting.

Finding the right lawyer is a critical first step. You need someone who specializes in securities and investment fraud, not a general practice attorney. This area of law is highly specific, with its own set of rules and procedures. When you’re vetting potential attorneys, ask about their experience with cases like yours. It’s also wise to check their credentials and professional history. An attorney who understands the tactics used by fraudulent brokers and the process of securities arbitration will be better equipped to represent your interests. This ensures you have someone who can anticipate challenges and effectively argue your case.

You might hear the term “Power of Attorney” (POA) and wonder if it applies to your situation. A POA is a legal document that gives another person the authority to make financial or legal decisions on your behalf. This can be useful if you are unable to manage your affairs due to health reasons or other circumstances. In an investment fraud case, having a POA in place can allow a trusted family member or your attorney to access necessary documents and communicate with financial institutions for you. Whether you need one depends entirely on your personal situation, and it’s a conversation worth having with your legal team.

Your case will be built on evidence, which means your documents are incredibly important. Before you even speak with a lawyer, start gathering every piece of paper and digital file related to your investment. This includes account statements, trade confirmations, application forms, and any contracts you signed. Don’t forget marketing materials, emails, and text messages. Create a folder—either physical or digital—and organize everything chronologically. This preparation will save time and help your attorney quickly assess the strength of your claim and identify the specific investment issues at play. A well-organized file is one of your most powerful tools.

Open and honest communication with your lawyer is essential. Remember those polished websites and convincing sales pitches that led you here? Share every detail with your legal team, even if it feels embarrassing. Your memory of conversations and promises made can provide crucial context. Your lawyer should also keep you informed about the progress of your case in a way you can understand. Don’t be afraid to ask questions if something is unclear. A strong client-attorney relationship is built on trust and transparency, ensuring you both work together toward the same goal. If you’re ready to discuss your situation, contact us to see how we can help.

When you’re dealing with the stress of potential investment fraud, paperwork can feel like the last thing you want to handle. But getting your documents in order is one of the most powerful steps you can take. Think of these papers as your evidence—the concrete proof that tells the story of what happened to your money. A well-organized file can make a significant difference when building your case and can help your legal team fight for you more effectively. It ensures that every detail is accounted for and that you have the backup needed to challenge wrongful actions. Taking the time now to gather and protect these records will save you headaches later and strengthen your position as you move forward with a claim.

Your investment documents are the foundation of your case, so it’s essential to keep them somewhere safe. Create a dedicated folder, either physical or digital (or both, for backup), for everything related to your investment. This includes the initial contract or agreement you signed, all correspondence with your advisor, and any marketing materials you received that made promises about the investment’s performance. Keeping these records organized will help you and your legal team substantiate claims of broker fraud and negligence. Make copies of everything and consider storing them in a separate location, like a secure cloud service or a safe deposit box, to protect against loss or damage.

In our digital world, a lot of communication happens online. Be sure to save every email, text message, and social media exchange you’ve had regarding your investment. A common red flag is a sudden request for fees or a “capital gains tax” before your funds can be released. Legitimate financial institutions don’t operate this way. If you receive messages like this, don’t delete them—they are critical evidence. Take screenshots and save digital files in their original format without making any changes. This digital trail can be crucial for proving various investment issues and showing a pattern of fraudulent behavior.

It can be tough to know what’s important and what’s not. To be safe, keep everything. However, some documents are especially vital for your case. Be sure to locate and set aside your valuation statements, which show the supposed value of your investment over time. You’ll also need any dealing instructions, which are records of your requests to buy or sell. The original application forms and the terms and conditions of the investment or bond are also key pieces of the puzzle. Having these specific documents ready will make the claims process much smoother and provide your attorney with the detailed information they need to build a strong case on your behalf.

If you’re being asked for more money or personal details, it’s time to pause and verify. Before you ever send funds or sensitive information, confirm the credentials and licenses of the person you’re dealing with. A surprising amount of investment fraud originates from individuals who aren’t properly registered to give financial advice. If you suspect something is wrong or feel pressured to act quickly, it’s a sign that you should seek a second opinion. Don’t respond to suspicious requests without first getting sound legal advice. If you’re unsure about a situation or need help understanding your rights, please contact us for guidance.

When you’re dealing with an investment fraud claim across borders, the paperwork can get a bit more complex. Different countries have their own rules and expectations for legal documents, and what works in one place might not hold up in another. Paying attention to these special requirements from the start can make a huge difference in the strength and smoothness of your case. It’s about making sure every piece of evidence you present is seen as credible and official, no matter which jurisdiction you’re dealing with. Taking these extra steps helps ensure your documents are accepted without question, preventing frustrating delays and strengthening your claim from the ground up. Think of it as building a solid foundation—the stronger it is, the better your chances of a successful outcome.

Every country has its own system for regulating financial advisors and investments. A critical step is to verify the credentials and licenses of the advisor or firm you dealt with. Was a proper registration ever in place? The answer can be a powerful piece of evidence, as most investment fraud comes from individuals operating without the right registration. Understanding the specific regulations in the country where the investment was sold is key to building your case. These rules dictate what is considered broker fraud and negligence and can outline the specific legal avenues available to you. This research helps your legal team frame the misconduct within the correct legal context.

When you’re presenting documents in a foreign legal system, you may need to have them notarized. Notarization is a process where a certified official, a notary public, verifies the authenticity of a document or signature. This is especially important for key paperwork like contracts, power of attorney forms, and signed agreements. Having these documents notarized adds an official stamp of approval that can prevent the opposing side from questioning their validity. It’s a simple step that adds a significant layer of security and credibility to your evidence, making it harder for anyone to dismiss your claims based on a technicality.

Don’t underestimate the power of an official complaint. Filing a report with the appropriate financial regulators in the country where the fraud occurred, as well as in your home country, creates a formal record of your allegations. For instance, in the U.S., you might file a complaint with the SEC or FINRA. Some individuals may even qualify for the SEC Whistleblower program, which offers protections and potential rewards. These reports can trigger official investigations and provide you with a documented history of your attempts to address the fraud. This official paper trail can be invaluable, serving as crucial evidence that you took the matter seriously and reported it through the proper channels.

Beyond the basics, think about any other materials that can paint a fuller picture of your situation. This includes things like the original bond application form, detailed terms and conditions of the investment, and any written dealing instructions you gave or received. Did you get valuation statements that now seem inaccurate? Add them to the file. The goal is to collect every piece of paper related to the investment. If you’re unsure whether a document is relevant, it’s better to keep it. Your legal team can help you sort through everything to find what’s most impactful for your securities arbitration claim.

I think I’ve been scammed, but I’m overwhelmed. What is the absolute first step I should take? Take a deep breath. The most important first step is to stop all communication with the person or firm you suspect. Don’t send any more money or personal information, especially if they are pressuring you with deadlines or fees. Your next move is to gather every document you can find related to the investment and organize it chronologically. This simple act of collecting your records is a powerful way to take back control and prepare for what comes next.

What if I’m missing some of the documents you mentioned? Can I still build a case? Yes, absolutely. It’s very common for people not to have a perfect paper trail, especially when dealing with a deceptive broker. Do your best to gather what you can, such as bank statements showing the money transfers, emails, and any contracts you do have. An experienced legal team can often help you obtain missing account statements or other official records directly from the financial institutions involved. Don’t let a few missing pieces of paper stop you from seeking help.

How long do I have to take action? I’m worried I’ve waited too long. This is a critical question because there are strict time limits, often called statutes of limitations, for filing a claim. These deadlines vary depending on where you live and the specifics of your case. The most important thing to know is that the clock starts ticking from the moment you knew, or should have known, that something was wrong. Because of this, it is crucial to act as soon as you suspect fraud. The best way to understand the specific deadline for your situation is to consult with a legal professional right away.

My situation involves multiple countries. Does that make it too complicated to pursue a claim? While cross-border cases do have extra layers of complexity, they are not impossible to pursue. Many investment fraud claims involve international elements, especially for expats. The key is to work with a law firm that has experience with these types of cases. They can determine the proper jurisdiction for filing your claim and handle the specific requirements for dealing with different legal systems and regulations. Your location shouldn’t be a barrier to seeking justice.

Why can’t I just handle this directly with the firm that sold me the investment? You could try, but it’s often not in your best interest. These firms have their own legal teams whose job is to protect the company, not you. They may try to downplay your concerns, delay responding, or offer you a low settlement. Working with your own attorney ensures you have an advocate who is solely focused on your rights and recovering your losses. They know how to build a strong case and will handle all the complex legal procedures on your behalf, leveling the playing field significantly.