NO FEES UNTIL WE WIN

FREE CONSULTATION

NO FEES UNTIL WE WIN

FREE CONSULTATION

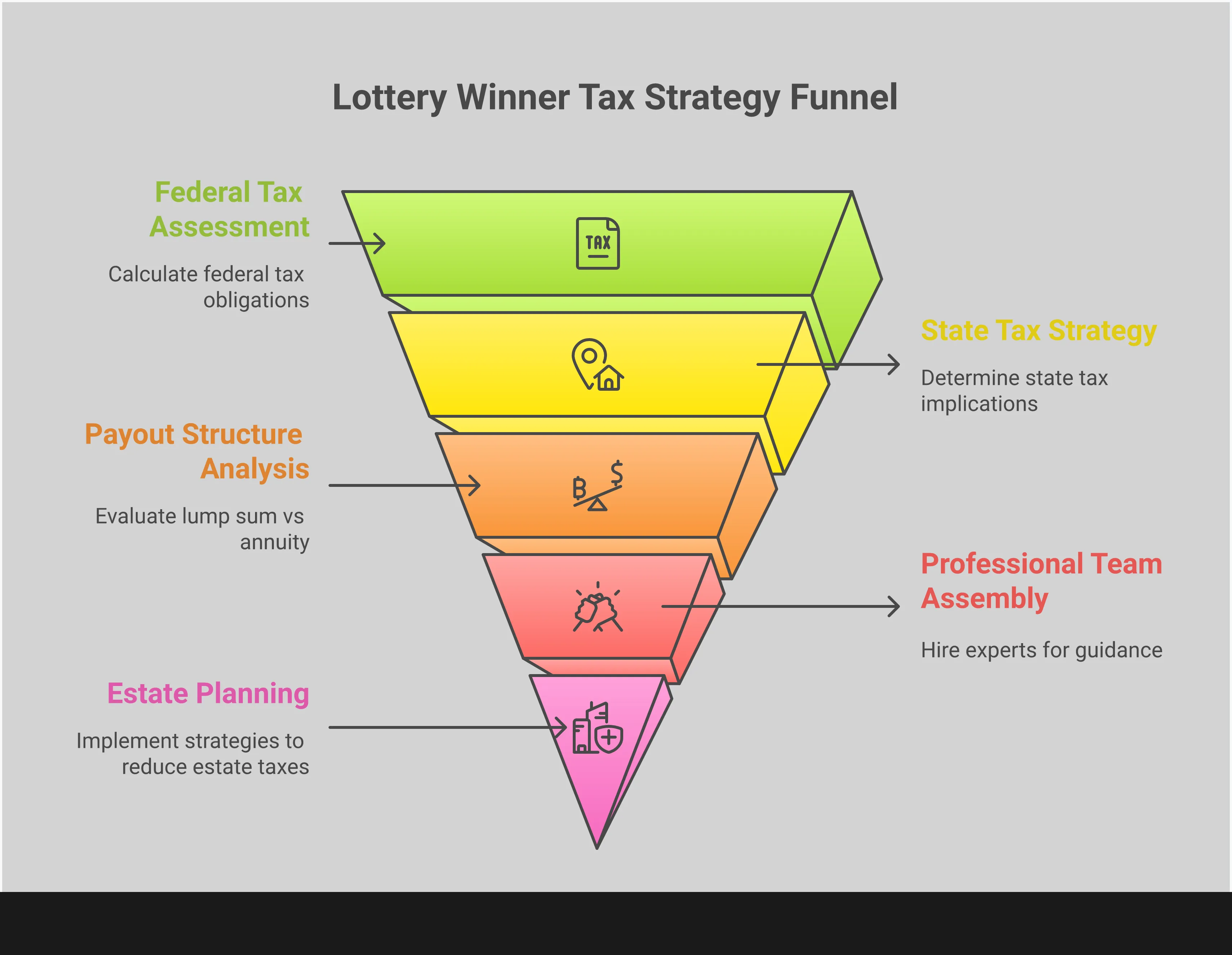

We’ve all heard cautionary tales of lottery winners who lose it all. Often, their financial troubles begin with a single, critical misstep: underestimating their tax bill. Understanding how much tax on lottery winnings you will owe is the most important first step toward preserving your wealth. The government takes a significant share right away, and you will likely owe even more when you file your annual return. This article will provide a clear breakdown of the federal and state tax implications, explain the difference between a lump sum and an annuity, and offer strategies to manage your new financial reality, helping you avoid becoming another statistic.

Winning the lottery is an incredible feeling, but it’s important to remember that your prize is considered taxable income. Before you start making plans for your winnings, you need to understand how the federal government will tax your new fortune. The process starts the moment you claim your prize with an automatic withholding, but that’s just the beginning. Your final tax bill will depend on the size of your winnings and your overall financial picture for the year.

The first thing to know is that you won’t walk away with the full jackpot amount. For any prize over $5,000, the lottery agency is required to withhold 24% for federal income tax before you see a dime. Think of this as a down payment on your taxes. It’s an automatic step in the process. So, if you win $1 million, you can expect to receive a check for around $760,000 after this initial withholding. While it can be a shock to see a quarter of your prize disappear, this rule ensures a significant portion of your tax obligation is covered from the start.

That 24% withholding is just an estimate, and your actual federal tax rate will likely be higher. A large lottery prize can instantly push you into the top federal income tax bracket, which is currently 37%. Our tax system is progressive, meaning you won’t pay 37% on the entire amount—different portions of your income are taxed at different rates. However, a substantial win means a large chunk of it will be taxed at that top rate. This is why careful planning is crucial to handle various investment issues that arise with sudden wealth and to avoid any unpleasant surprises when you file your annual tax return.

Beyond income tax, you might face other federal taxes depending on what you do with your money. One of the most common is the gift tax. If you plan on sharing your winnings with family and friends, you need to be strategic. The government allows you to give up to a certain amount to any individual each year without tax implications. If you give more than that annual exclusion amount, you may have to pay a federal gift tax on the excess. Understanding these rules is key to protecting your wealth and ensuring your generosity doesn’t create an unexpected tax burden for you.

After the federal government takes its share, your state—and possibly even your city or county—will likely want a piece of the pie. State and local taxes vary dramatically across the country, and where you bought the winning ticket plays a huge role in how much you’ll ultimately keep. Understanding these rules is critical for anyone dealing with complex investment issues that arise from a sudden windfall. It’s not just about the state you live in; it’s often about the state where you purchased the ticket.

A handful of states are particularly lottery-friendly because they don’t levy a state tax on your winnings. These states include California, Florida, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming. If you’re lucky enough to buy your winning ticket in one of these locations, your tax burden will be significantly lower. However, it’s crucial to remember that this only exempts you from state-level taxes. You are still responsible for paying federal income tax on the full amount, which is a substantial tax bill on its own. Living in or purchasing a ticket in one of these states simply removes one layer of taxation.

On the other end of the spectrum, some states have high income tax rates that apply directly to lottery winnings. New York, for instance, has one of the highest rates at around 10.9%. Other states with hefty tax bills include Maryland (8.75%), Oregon (8%), and New Jersey (8%). These state taxes are in addition to the 24% federal withholding, so winners in these areas see a much larger portion of their prize disappear before they even receive it. This significant difference in state tax policy can mean a difference of millions of dollars on a large jackpot, highlighting how important location is.

A common question is what happens if you live in one state but buy a winning ticket in another. In most cases, you pay taxes based on where the ticket was purchased, not where you live. Most states do not tax the lottery winnings of non-residents. However, there are a couple of key exceptions. Arizona and Maryland, for example, will tax the winnings of non-residents who win multi-state lotteries like Powerball or Mega Millions. If you live in a state with an income tax, you may also owe tax to your home state, though you can often get a credit for the taxes you paid to the other state.

The tax obligations don’t always stop at the state level. Some cities and counties impose their own local income taxes, which can apply to lottery winnings. For example, residents of New York City face an additional local tax on top of their state and federal taxes. These local taxes can add several percentage points to your overall tax bill. Because these rules are so specific to your location, it’s easy to overlook them. Failing to account for local taxes can lead to an unexpected and costly tax bill down the road, so it’s important to get a clear picture of your total liability.

Deciding between a lump sum and an annuity is one of the first, and most critical, choices you’ll make after receiving a large financial windfall. This isn’t just about when you get your money; it’s about how much of it you get to keep after taxes. Each option has significant tax implications that can shape your financial future for decades.

The lump sum gives you all the cash upfront, but it also hands you a massive, immediate tax bill. The annuity, on the other hand, provides a steady stream of payments over many years, which spreads out your tax liability. There’s no single right answer, and the best path forward depends entirely on your personal financial situation, your long-term goals, and your comfort with managing a large amount of money. Understanding the tax consequences of each is the first step toward making a sound decision.

Opting for the lump sum payout feels like the most exciting choice—you get millions of dollars all at once. However, the tax reality can be sobering. This entire amount is treated as income in the year you receive it, which instantly pushes you into the highest federal income tax bracket. After the automatic 24% federal withholding, you will still owe more come tax time. When all is said and done, you could see 30% or more of your prize disappear to taxes in that first year. For example, an $826 million cash prize could shrink to around $520 million after federal taxes alone, and that’s before state taxes are even considered.

Choosing an annuity means you’ll receive your winnings in annual installments, typically over 30 years. The primary advantage here is tax management. Instead of taking one colossal tax hit, you pay taxes on each smaller payment annually. This strategy can help keep you out of the highest possible tax bracket each year, potentially saving you a significant amount of money over the long term. An annuity also imposes a level of financial discipline, providing a predictable income stream that is easier to manage than a single, massive windfall. This structured approach can help protect your wealth from impulsive decisions and ensure it lasts for years to come.

Regardless of which payout you choose, the most common mistake is rushing into major life changes without a solid financial plan. It’s easy to get caught up in the excitement, but taking the time to think strategically is essential for long-term security. Before you decide, you need a clear picture of what you want your future to look like. This decision is the foundation of your entire financial strategy. Working with a team of trusted advisors can help you understand the various investment issues and opportunities that come with newfound wealth, ensuring your choices align with your goals.

Ultimately, the choice between a lump sum and an annuity is deeply personal. A lump sum offers you complete control and the opportunity to grow your wealth through investments, assuming you have the discipline and guidance to manage it well. An annuity provides stability, a predictable income, and a more manageable tax situation year after year. Consider your own financial habits, your risk tolerance, and what kind of lifestyle you envision. Because this decision has lasting consequences, it’s wise to get in touch with legal and financial professionals who can help you weigh the pros and cons based on your unique circumstances.

Winning the lottery is exciting, but the advertised jackpot isn’t what lands in your bank account. Between federal, state, and other potential costs, your take-home amount will be significantly smaller. Calculating your net winnings ahead of time helps you set realistic expectations and make smarter financial decisions from day one. It’s about understanding the complete picture so you can protect your new wealth effectively. Let’s break down how to figure out what you’ll actually have left to work with.

The first thing to know is that the IRS takes its share immediately. A mandatory 24% federal withholding is taken from your winnings before you even see the money. Think of this as a down payment on your taxes, not the final bill. Your actual federal tax rate will likely be higher, potentially reaching up to 37%, depending on your total income for the year. Your winnings will push you into the highest tax bracket, so you’ll owe the difference between the 24% withholding and your final tax rate when you file. A lottery tax calculator can help you estimate these numbers.

One of the first instincts for many winners is to share the wealth with family and friends. While generous, this can trigger the federal gift tax. You can give a certain amount to individuals each year without tax consequences, but large gifts can be subject to a hefty tax. For example, gifts exceeding the lifetime exemption—which is quite high—can be taxed at a rate of up to 40%. Planning these gifts carefully with a financial advisor is crucial. Understanding the gift tax implications ensures your generosity doesn’t create an unexpected tax burden for you or your loved ones.

Taxes aren’t the only thing that can shrink your prize. Many winners lose a significant portion of their money due to poor advice, pressure from others, or impulsive decisions. It’s a sad reality that sudden wealth can attract people who don’t have your best interests at heart. This is where having a solid plan becomes so important. You need to be prepared to handle complex investment issues and protect yourself from those who might try to take advantage of your new financial situation. Taking your time and vetting every piece of advice is one of the most important things you can do.

Finally, you must report every dollar of your lottery winnings to the IRS. It’s considered taxable income, and failing to report it can lead to serious consequences, including steep penalties, interest charges, and even criminal investigation. From the moment you claim your prize, keep meticulous records of everything. This includes the initial payout documents, tax forms, and any financial moves you make afterward. Staying organized and transparent with the IRS is non-negotiable. It’s a foundational step in managing your winnings responsibly and avoiding legal trouble down the road.

Winning a large sum of money is exciting, but it also comes with major financial responsibilities. The decisions you make right after you win can have a lasting impact on your wealth and your future. It’s not just about celebrating; it’s about creating a solid plan to protect your assets and make them work for you. This means thinking carefully about taxes, investments, and the team of professionals you’ll need to guide you. By taking a few smart steps from the beginning, you can set yourself up for long-term financial security and peace of mind, ensuring your windfall truly changes your life for the better.

Your first move after winning should be to pause and get professional help. This isn’t a situation to handle on your own. You’ll want to build a team of trusted advisors, including a tax professional, a financial advisor, and a lawyer who understands estate planning and complex investment issues. These professionals can work together to create a comprehensive strategy. They will help you understand the tax implications, protect your assets from potential risks, and plan for your family’s future. Having this team in place before you make any big decisions is the single most important step you can take to safeguard your new wealth.

While the IRS automatically withholds 24% of your winnings, it’s crucial to remember that this is usually just a down payment on your total tax bill. Your newfound wealth will almost certainly push you into the highest federal income tax bracket, which is currently 37%. This means you will likely owe a significant amount of additional tax when you file your annual return. A tax advisor can help you calculate this amount and make estimated tax payments throughout the year. Planning for this helps you avoid a shocking tax bill and potential penalties from the IRS come tax season.

How you receive your winnings—as a lump sum or an annuity—has a huge impact on your taxes. Taking the lump sum means you get all the money at once, but you’ll also face a massive tax bill in a single year. An annuity spreads the payments, and the tax liability, over several decades. Once you have your money, you’ll also need to invest it wisely. Working with a financial advisor is key to building a portfolio that aligns with your goals while minimizing your tax burden. It’s also vital to ensure your advisor is trustworthy to avoid any potential broker fraud or negligence.

If you have a cause you’re passionate about, charitable giving can be a wonderful way to make a difference while also managing your tax obligations. When you donate to qualified charities, you can receive a tax deduction, which lowers your overall taxable income for the year. This can be a particularly effective strategy in the year you receive a large lump-sum payment. You can establish a donor-advised fund or a private foundation to create a lasting legacy. A financial advisor or lawyer can help you explore the different ways to give back that align with your personal values and financial plan.

The excitement of winning the lottery is incredible, but what comes next is just as important: handling the taxes correctly. Filing your taxes after a big win might seem daunting, but breaking it down into manageable steps makes it much clearer. It’s all about being prepared and understanding your obligations to both the federal and state governments. Getting this part right ensures you can enjoy your new wealth without worrying about future tax troubles. Let’s walk through the essential forms, state-specific rules, the importance of keeping good records, and the common pitfalls to avoid so you can file with confidence. This proactive approach is the first step in responsibly managing your newfound financial situation and protecting your future.

If your winnings are $600 or more, the IRS needs to hear about it. For U.S. citizens and residents, you’ll report your lottery income on your annual Form 1040. If you’re a nonresident alien, you’ll use Form 1040-NR instead. The organization that paid out your prize should send you a Form W-2G, which details the amount you won and any taxes that were already withheld. This form is your starting point for accurate reporting. Remember to file by the standard tax deadline, typically in mid-April, to avoid any late penalties. Staying on top of these key forms and dates is fundamental to a smooth tax season.

Federal taxes are just one piece of the puzzle; you also need to consider state taxes. These rules can differ dramatically from one state to another. Some states, like Florida and Texas, don’t have a state income tax, which means they won’t tax your lottery winnings either. However, most states do, and their tax rates vary. It’s crucial to understand the rules of the state where you bought the ticket, as that’s usually where the tax liability lies. Before you file, take the time to research your state’s specific requirements to ensure you’re paying the correct amount and aren’t caught by surprise.

Keeping meticulous records isn’t just good financial practice—it’s a necessity when you have lottery winnings. The IRS requires you to report all your gambling income, and failing to do so can result in steep penalties and interest. In more serious cases, it could even lead to legal trouble. Good records are also your best friend if you plan to deduct any gambling losses. The rule is that you can only deduct losses up to the amount of your winnings, so having a clear paper trail of both is essential for justifying your deductions and staying on the right side of the law.

It’s easy to get swept up in the excitement, but some common mistakes can have long-lasting financial consequences. One of the biggest is making drastic life changes without a solid financial plan. Another is automatically taking the lump sum without considering the tax implications versus an annuity. Rushing these decisions can lead to mismanagement of your new wealth. The smartest move is to pause and assemble a team of trusted advisors. Working with financial and legal professionals can help you address complex investment issues and create a strategy that protects your assets for the long term.

Winning the lottery is a life-changing event, but the decisions you make in the first few months are the most critical for your long-term financial health. Suddenly managing a large sum of money can be overwhelming and can make you a target for scams and poor financial advice. Before you make any big moves, your first priority should be to create a strategy to protect your assets. This involves slowing down, understanding the implications of your new wealth, and putting a solid plan in place to ensure your winnings last for generations. Taking these steps can help you avoid the common pitfalls that have led many lottery winners to financial ruin. It’s not just about having money; it’s about keeping it.

Before you buy a new house or quit your job, take a deep breath and pause. One of the most common mistakes winners make is rushing into major life changes without a financial safety net. The very first thing you should do is set aside a portion of your winnings—enough to cover at least six to twelve months of living expenses—in a separate, easily accessible savings account. This emergency fund acts as a buffer, giving you the time and space to make thoughtful decisions without pressure. It ensures that your day-to-day needs are covered while you work with financial and legal professionals to develop a comprehensive long-term plan for the rest of your assets.

Many people worry about how a large windfall will impact their government benefits. The good news is that lottery winnings are not considered “earned income,” so they won’t affect your Social Security retirement or disability benefits. However, other government programs, particularly those that are needs-based like Medicaid, Supplemental Security Income (SSI), and food assistance (SNAP), have strict income and asset limits. Receiving a large sum of money will almost certainly make you ineligible for these types of benefits. It’s important to report your winnings to any agency from which you receive assistance to understand how your eligibility will change and avoid any potential penalties for failing to report a change in your financial circumstances.

A comprehensive wealth protection plan is your roadmap to financial security. This plan goes beyond a simple budget; it addresses how you will manage, invest, and preserve your money for the future. A key part of this involves carefully considering your payout options. While a lump sum offers immediate access to your cash, it also comes with a massive upfront tax bill and the risk of mismanagement. Annuity payments provide a steady, predictable income stream that can be easier to manage over time. Your plan should also outline how to defend your assets from dishonest advisors and fraudulent investment schemes. Working with a qualified attorney can help you identify and avoid potential investment issues and protect you from financial predators.

Winning the lottery is an exciting thought, but the tax implications can be confusing. Many winners are caught off guard by how much they actually owe. Let’s clear up a few common myths so you can have a more realistic picture of what happens after you cash in that lucky ticket. Understanding these details is the first step toward protecting your new wealth and making smart financial decisions from day one. It’s about being prepared for the financial realities that come with a sudden windfall, which often involves more than just celebrating.

Many people assume the 24% that’s automatically withheld from big lottery prizes is the end of the story. Unfortunately, that’s rarely the case. Think of that 24% federal withholding as a down payment on your taxes, not the final bill. Your actual tax liability depends on your total income for the year. When you file your annual tax return, you’ll have to report your winnings, and it’s very likely you’ll owe more. Properly managing a sudden windfall involves navigating complex investment issues and careful tax planning to ensure you meet all your obligations without any surprises.

Another common misconception is that state tax rules are the same everywhere. In reality, they are all over the map. Some states, like Florida and Texas, don’t charge any state tax on lottery winnings. Others can take a significant bite. It’s also important to know that most states don’t tax non-residents, but there are exceptions—Arizona and Maryland do. The tax laws that apply are based on where you bought the ticket, so it pays to know the local rules before you even start dreaming about how you’ll spend the money.

Winning a large sum of money will almost certainly push you into the highest federal income tax bracket. This means a larger portion of your total income for the year—not just the winnings—will be taxed at a higher rate, which can be as much as 37%. This sudden shift can have a major impact on your overall financial situation. Understanding how this new income level affects your finances is crucial, and it’s wise to contact a professional to help you create a solid plan for the future and protect your assets.

What is the absolute first thing I should do if I win the lottery? Before you even claim your ticket, the most important first step is to pause and stay quiet. Resist the urge to tell everyone you know. Your next move should be to assemble a team of trusted professionals, including a lawyer, a tax advisor, and a financial planner. This team will help you create a strategy for claiming your prize and managing your wealth, ensuring you make sound decisions from the very beginning.

Is it true that I’ll lose almost half my winnings to taxes? While the tax bill is significant, it’s not always a flat 50%. The total amount you pay depends on several factors. The federal government will automatically withhold 24%, but you’ll likely owe more since a large prize will push you into the top tax bracket of 37%. After that, your state’s income tax rate plays a huge role. The final percentage can vary widely based on where you bought the ticket and which payout option you choose.

Can I start giving money to my family and friends right away? It’s a wonderful impulse, but you need to be strategic about it. The government has rules about how much money you can give to a person in a single year without tax consequences. If you give gifts that exceed this annual limit, you may have to pay a federal gift tax. A financial advisor can help you structure your gifts in a way that is tax-efficient and allows you to be generous without creating an unexpected tax bill for yourself.

Will taking the lump sum always leave me with less money than the annuity? Not necessarily. While the lump sum is a smaller amount upfront and results in a massive immediate tax bill, it gives you full control over the money. If managed and invested wisely, that lump sum has the potential to grow and eventually surpass the total amount you would have received from the annuity payments. The annuity, on the other hand, provides a steady, predictable income and a more manageable tax situation over time. The right choice depends entirely on your financial discipline and long-term goals.

How will winning affect my Social Security or other government benefits? This is an important question with a two-part answer. Your Social Security retirement or disability benefits will not be affected because they are based on your work history, not your assets. However, needs-based government programs like Medicaid, Supplemental Security Income (SSI), and food assistance (SNAP) have strict income and asset limits. A large financial windfall will almost certainly make you ineligible for these types of benefits.