NO FEES UNTIL WE WIN

FREE CONSULTATION

NO FEES UNTIL WE WIN

FREE CONSULTATION

After years of hard work and careful saving, you placed your trust in a financial advisor to protect your retirement. Discovering that your nest egg is at risk due to misconduct is devastating. Unfortunately, senior investors are often targeted with unsuitable investment strategies or complex products they were assured were safe. This breach of trust can leave you feeling vulnerable and unsure of where to turn. It’s important to know that you have rights and there are legal professionals dedicated to defending them. An experienced Huntsville, Alabama investment fraud attorney understands the specific challenges faced by senior investors and can provide the compassionate, firm advocacy needed to hold wrongdoers accountable and fight to recover your hard-earned assets.

Investment fraud happens when someone uses deceptive practices to mislead you into making poor financial decisions. It can take many forms, from a stockbroker recommending an unsuitable product to a complex, large-scale scheme. These actions often involve false promises or outright lies designed to take advantage of your trust and your hard-earned money. If you suspect you’ve been misled, it’s important to understand that you are not alone and that systems are in place to help you seek justice. Recognizing the signs and knowing your rights is the first step toward taking back control.

Fraud can be sophisticated, but many schemes follow familiar patterns. One common type is a Ponzi scheme, where money from new investors is used to pay returns to earlier investors, creating the illusion of a profitable enterprise until it collapses. Another is affinity fraud, which preys on the trust within tight-knit groups, like religious or community organizations. Beyond these, investors often face issues related to broker fraud and negligence, such as churning (excessive trading to generate commissions) or the recommendation of unsuitable investments that don’t match your financial goals or risk tolerance. Understanding these tactics can help you identify when something isn’t right.

Trusting your intuition is crucial when it comes to your finances. A major red flag is feeling pressured to make quick decisions without enough information. Fraudsters often create a false sense of urgency to prevent you from doing your due diligence. Be wary of promises of high, “guaranteed” returns with little to no risk—every investment carries some level of risk. Other warning signs include documents that look altered or don’t match up with what you were told, unexplained money problems with your account, and difficulty withdrawing your funds. If you notice any of these signs, it’s time to start asking serious questions.

As an investor, you have fundamental rights. Financial advisors and brokers are expected to adhere to specific standards of conduct and provide recommendations that are in your best interest. When they fail to do so, whether through negligence or intentional deceit, you have the right to hold them accountable. The financial industry is regulated, and there are formal processes, like securities arbitration, designed to resolve disputes and help you recover your losses. An attorney can ensure your rights are protected throughout this process, making your case their priority and giving you the support you need to move forward.

If you believe you’ve been a victim of investment fraud, time is of the essence. There are strict deadlines, known as statutes of limitations, for filing claims. Waiting too long could mean losing your right to pursue recovery altogether. Acting quickly also increases the chances of preserving crucial evidence and tracking down assets before they disappear. The sooner you take action, the better your position will be to build a strong case. Don’t let uncertainty or hesitation prevent you from exploring your options. A confidential consultation can help you understand the steps you can take to protect your financial future.

Discovering you may be a victim of investment fraud can feel isolating and overwhelming. The financial system is complex, and the rules governing it can be confusing. This is where a dedicated investment fraud attorney can make a significant difference. Instead of trying to figure out the next steps on your own, you can partner with a legal professional who understands this specific area of law. They can help you understand your rights, investigate what went wrong, and build a case to recover your hard-earned money. An attorney acts as your advocate, handling the legal complexities so you can focus on moving forward.

When you’re dealing with a complex financial matter, it’s important to work with someone who speaks the language. Securities law is a highly specialized field, and a general practice lawyer may not be familiar with the specific regulations and procedures involved. An attorney who focuses on broker fraud and negligence understands the tactics brokers and firms use and knows the industry rules inside and out. This specialized knowledge is a powerful advantage. It ensures that the nuances of your case are fully understood and that your claim is built on a solid legal foundation from the very beginning.

A skilled investment fraud lawyer does more than just file paperwork. They act as your private investigator, digging deep to uncover the truth. Your attorney will meticulously review your account statements, trade confirmations, and communications with your broker to piece together exactly what happened. They gather the evidence needed to prove misconduct, whether it was an unsuitable recommendation, an unauthorized trade, or a misleading statement. This thorough investigation is the cornerstone of a strong claim and is essential for holding the responsible parties accountable for the losses you’ve suffered.

Most disputes between investors and brokerage firms are not resolved in a traditional courtroom. Instead, they are handled through a mandatory process called securities arbitration, which is typically overseen by the Financial Industry Regulatory Authority (FINRA). This forum has its own unique set of rules and procedures. An investment fraud attorney is experienced in this specific setting. They know how to present evidence, question witnesses, and argue a case effectively before an arbitration panel. Going into this process alone means facing the brokerage firm’s seasoned legal team by yourself, but having your own representation levels the playing field.

The ultimate goal is to recover the money that was wrongfully taken from you. An investment fraud attorney will analyze your situation to determine the full extent of your financial damages and create a tailored strategy to pursue them. Many firms, including ours, work on a contingency fee basis. This means you don’t pay any attorney’s fees unless they successfully recover money for you. This arrangement aligns your interests with your attorney’s, as you both share the same goal. If you’re facing specific investment issues and aren’t sure what your options are, a legal professional can provide the clarity you need.

Unfortunately, senior investors are often prime targets for financial fraud. Scammers may exploit the trust built within a community or take advantage of an investor’s lack of familiarity with complex financial products. An attorney experienced in investment fraud recognizes the patterns of elder financial abuse and is dedicated to protecting vulnerable clients. They fight to recover stolen assets and hold those who prey on seniors accountable for their actions. If you or a loved one has been targeted, it’s important to know that help is available. You can contact a legal team to discuss your situation and learn how to protect your financial future.

Finding the right legal partner after experiencing investment fraud can feel overwhelming, but it’s one of the most important steps you can take toward recovery. You need someone who not only understands the law but also appreciates what you’re going through. The goal is to find a firm that focuses specifically on securities law and has a history of helping investors like you. Think of this process as hiring a specialist for a specific problem—you wouldn’t see a foot doctor for a heart condition. Taking the time to vet your options ensures you have a dedicated advocate ready to fight for your financial future.

When you start your search, concentrate on attorneys who dedicate their practice primarily to investment fraud. A general practice lawyer may not have the specific knowledge required for these complex cases. Don’t hesitate to ask about their background and direct experience with claims similar to yours. Look for proof of their work, such as client testimonials or case results, which can give you confidence in their abilities. An attorney focused on broker fraud and negligence will understand the industry’s tactics and how to build a strong case on your behalf. This specialization is often the key difference in a successful recovery effort.

Experience in this specific field is non-negotiable. Securities law is intricate, with its own set of rules and procedures, particularly when it comes to the FINRA arbitration process. An attorney with a proven track record in handling investment fraud cases already knows the landscape. They understand how to investigate financial records, depose brokers, and present evidence effectively in a securities arbitration setting. This isn’t just about knowing the law; it’s about knowing how to apply it against well-funded brokerage firms. Choosing a lawyer with significant, relevant experience ensures your case is in capable hands from day one.

Concerns about cost should never prevent you from seeking justice. Most reputable investment fraud attorneys work on a contingency fee basis. This means they only get paid if they successfully recover money for you. The fee is typically a percentage of the amount recovered, so there are no upfront costs or hourly bills to worry about. If the case is not successful, you owe no attorney fees. This structure aligns your interests with your attorney’s—they are motivated to secure the best possible outcome for you. It makes quality legal representation accessible to everyone, regardless of their current financial situation.

Your initial consultation is your opportunity to interview a potential attorney and see if they’re the right fit. Come prepared with a list of questions to guide the conversation. You might ask:

This meeting is the first step toward forming a partnership. A good attorney will listen to your story, answer your questions clearly, and explain how they can help before asking you to sign an agreement. You should feel heard and confident in their ability to represent you.

One of the biggest misconceptions is that hiring a lawyer is an expense you can’t afford or an unnecessary step. Some investors believe they can handle the claim themselves to save money. However, going up against a large brokerage firm and its legal team alone is an uphill battle. These firms are prepared to defend themselves vigorously. An experienced attorney levels the playing field. They handle the complex paperwork, deadlines, and legal arguments, allowing you to focus on moving forward. Rather than an expense, hiring the right lawyer is an investment in your chances of recovering your hard-earned money from serious investment issues.

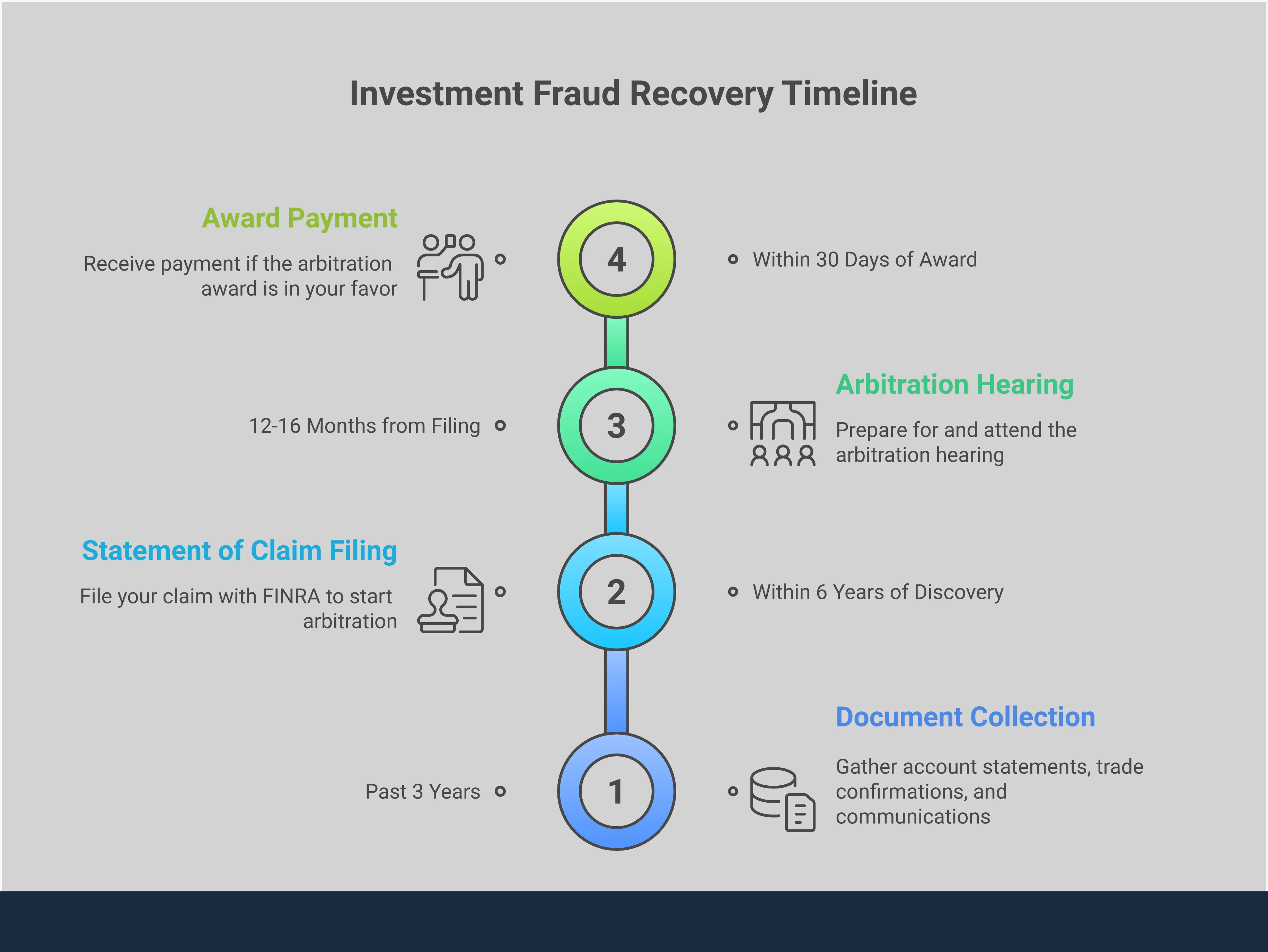

Taking legal action after losing money to investment fraud can feel overwhelming, but understanding the process can make it much more manageable. When you work with an attorney, you’re not just hiring a legal representative; you’re gaining a partner who will guide you through each stage. The journey to recovering your losses follows a structured path, designed to build a solid claim and pursue the compensation you deserve. It starts with a simple conversation and moves through a series of deliberate steps, from investigation to resolution.

The process typically begins with an initial review of your situation to see if you have a case. From there, your legal team will dig into the details, gathering all the necessary evidence to construct a powerful argument on your behalf. Many cases are resolved through negotiation, where your attorney advocates for a fair settlement. If a settlement isn’t possible, the next step is often arbitration—a formal hearing where your case is presented. Throughout it all, you’ll have a clear understanding of what’s happening and what to expect next. Let’s walk through each of these steps so you know exactly what lies ahead.

The first step is a conversation about what happened. During your initial case review, you’ll share your story and provide any documents you have, like account statements or communications with your broker. This meeting is a crucial, no-pressure opportunity for an attorney to assess the details of your situation. They will listen carefully to understand the full scope of your potential losses and determine the viability of your claim.

Think of this as a fact-finding mission. The goal is to figure out the best course of action for your specific circumstances. Acting quickly is important, as a thorough initial review sets the foundation for your entire case. If you believe you’ve been a victim of financial misconduct, the best thing you can do is contact a law firm to get a clear picture of your legal options.

Once you decide to move forward, your attorney will begin the critical work of building your case. This is the investigation phase, where your legal team does the heavy lifting. They will meticulously gather and analyze all relevant evidence, which can include trading records, account statements, emails, and prospectuses. They will also identify the specific rules that were broken and the ways your broker or advisor failed in their duties.

This detailed approach is designed to create a compelling narrative that clearly demonstrates the broker fraud and negligence you experienced. Your attorney’s goal is to construct an undeniable claim backed by solid proof, putting you in the strongest possible position for recovering your hard-earned money.

With a strong case built, the next step is often to negotiate a settlement. Your attorney will present the evidence to the opposing party—the brokerage firm or advisor—and begin discussions to recover your losses. They will handle all communications and advocate fiercely on your behalf, aiming for a resolution that fairly compensates you without the need for a formal hearing.

Your lawyer will work diligently to negotiate a settlement that reflects the financial damages you incurred. You will be kept informed throughout the process and will have the final say on accepting any offer. Many investment issues are resolved at this stage, as firms are often motivated to avoid the time and expense of arbitration.

If a fair settlement cannot be reached, your case will likely proceed to arbitration. Most disputes between investors and brokerage firms are resolved through this process, not in a traditional courtroom. Arbitration is a formal hearing where both sides present their cases to an impartial arbitrator or a panel of arbitrators, who then make a final, binding decision.

This process is generally faster and less formal than a court trial. Your attorney will represent you at every step, from filing the claim to presenting evidence and making arguments at the hearing. Having a lawyer who understands the nuances of securities arbitration is essential, as they will know how to effectively present your case in this specific forum.

One of the most common questions investors ask is, “How long will this take?” The truth is, the timeline for an investment fraud case varies. Some cases can be resolved through settlement negotiations in a matter of months, while others that proceed to a full arbitration hearing can take a year or longer.

Several factors influence the timeline, including the complexity of the case, the amount of evidence involved, and the responsiveness of the opposing party. While there’s no one-size-fits-all answer, your attorney will be able to provide a realistic estimate based on the specifics of your situation. They will also keep you updated on progress and milestones, ensuring you know where your case stands at all times.

Once you’ve chosen an attorney, the work of building your case begins. This process is a partnership, and your active participation can make a significant difference in the outcome. By understanding your role and collaborating with your legal team, you can help create a clear path toward recovering your losses. A strong working relationship is built on preparation, open communication, and a shared understanding of the goals. Your attorney is your advocate, and working together effectively is the best way to address the financial harm you’ve experienced. Let’s walk through the key steps to ensure you and your lawyer are perfectly in sync from day one.

Your first step is to become a bit of a detective. Pull together every piece of paper and digital file related to your investments. This includes account statements, trade confirmations, contracts, and any emails or letters you exchanged with your broker. Don’t forget promotional materials or prospectuses that influenced your decisions. Organizing these documents gives your attorney the raw materials they need to build a strong case against broker fraud and negligence. Having everything ready from the start helps your legal team quickly identify misconduct and piece together the full story of your financial losses, saving valuable time and strengthening your claim.

A successful attorney-client relationship runs on clear and consistent communication. It’s essential that you feel comfortable sharing all the details of your situation and that your attorney keeps you informed about the progress of your case. Don’t hesitate to ask questions if something is unclear. Regular updates, whether through phone calls or emails, help build trust and ensure you’re never left in the dark. This open dialogue ensures your legal team fully understands your perspective and that you remain confident in the direction your case is heading. A good lawyer will make you feel heard and respected throughout the entire process.

Think of your case as a joint project. While your attorney provides the legal framework and experience, your input is invaluable. You should work closely with your lawyer to define your goals and concerns, which will shape the overall strategy. A collaborative approach ensures the legal plan aligns with what you hope to achieve. This partnership is especially important when preparing for processes like securities arbitration, where your personal account of events is critical. By combining your firsthand knowledge with your attorney’s legal insights, you create a much more powerful and effective approach to recovering your funds.

It’s important to have a frank discussion about potential outcomes and how your attorney gets paid. Most reputable investment fraud lawyers work on a contingency fee basis. This means they only receive a fee if they successfully recover money for you. This structure is beneficial because it aligns your attorney’s interests directly with yours—you both succeed together. This approach also removes the burden of upfront legal costs, allowing you to pursue justice without added financial stress. Be sure to discuss this arrangement clearly so you understand the process and can move forward with peace of mind. If you’re ready to discuss your options, contact us for a confidential review of your case.

Discovering you might be a victim of investment fraud is a deeply unsettling experience, but it’s important to remember that you have options and rights. Taking deliberate, informed steps can help you regain control of your finances and build a more secure future. Protecting your assets involves a combination of immediate action, ongoing diligence, and long-term planning. By understanding what to look for and who to turn to for help, you can create a strong defense against financial misconduct and work toward recovering what you’ve lost. The following steps can guide you through securing your accounts, monitoring your investments, and preventing future issues.

If you suspect something is wrong with your investments, you need to act quickly. The first priority is to stop any further financial damage. Contact your bank, brokerage firm, and any other financial institution where you hold accounts. Tell them about your concerns and ask them to freeze any suspicious activity or place a temporary hold on your accounts. This can prevent unauthorized withdrawals or trades while you investigate the situation. Document every conversation you have—note the date, time, and the name of the person you spoke with. Acting fast is your best first defense in protecting what’s left and setting the stage for recovery.

Getting into the habit of regularly reviewing your account statements is one of the most powerful things you can do to protect yourself. Don’t just glance at the summary page; look through every single transaction. Just as you would review a medical bill to ensure you were only charged for services you received, you should scrutinize your investment statements for unfamiliar trades, unexplained fees, or any activity you didn’t authorize. If something looks off, ask your financial advisor for a clear explanation immediately. Consistent monitoring helps you spot the early warning signs of broker fraud and negligence before a small problem becomes a major loss.

Being proactive is key to safeguarding your financial future. One of the most effective strategies is to build a team of professionals you can trust. This includes carefully vetting any financial advisor or broker you work with. Don’t be afraid to ask tough questions about their experience, credentials, and how they are compensated. It’s also wise to know where to turn if you suspect fraud. An experienced investment fraud attorney can be a crucial ally. Many work on a contingency basis, which means they only get paid if they successfully recover funds for you. Having legal support in place gives you a direct line to help when you face complex investment issues.

Investment and securities law is complicated, and you shouldn’t have to figure it out on your own. Building long-term financial security means understanding your rights as an investor and knowing how the system works to protect you. Partnering with a legal professional who focuses on securities law can help you make sense of the complexities. They can review your portfolio, explain the risks associated with certain products, and help you understand the dispute resolution process, such as securities arbitration. This knowledge empowers you to make more informed decisions and build a financial future based on a solid, secure foundation.

What if I’m not sure I have enough evidence to prove fraud? This is a very common concern, but you don’t need to have a perfect, organized case file to seek help. Your main responsibility is to gather what you can, such as account statements and emails. From there, a skilled attorney takes over. Their job is to conduct a thorough investigation, analyze trading data, and uncover the evidence needed to build a strong claim. Many signs of misconduct are hidden in complex financial records, and a legal team knows exactly where to look.

Will I have to go to court and testify? It’s highly unlikely that your case will end up in a traditional courtroom. Most disputes between investors and their brokerage firms are resolved through a process called FINRA securities arbitration. This is a more private and less formal setting than a court trial. While you will need to provide your account of what happened, your attorney will prepare you for every step and handle the legal arguments, ensuring the process is as straightforward as possible for you.

How much will it cost me to hire an attorney for this? Concerns about legal fees shouldn’t stop you from getting the help you need. Most investment fraud attorneys work on a contingency fee basis. This means you don’t pay any fees upfront. The law firm covers the costs of building and pursuing your case, and they only get paid a percentage of the money they successfully recover for you. If there is no recovery, you owe no attorney’s fees.

How long do I have to take action after discovering a problem? It is critical to act quickly. There are strict deadlines, known as statutes of limitations, for filing investment fraud claims. If you wait too long, you could lose your right to pursue recovery forever. The exact timeline can depend on several factors, so the moment you suspect something is wrong, you should seek a legal opinion. The sooner you start the process, the better your chances are of preserving evidence and meeting all the necessary deadlines.

My broker was a friend and I feel embarrassed. Should I still pursue a claim? Feeling embarrassed or betrayed is a completely normal reaction, especially when trust has been broken by someone you know. However, your personal relationship with a broker doesn’t change their professional obligations. Financial advisors are held to specific standards of conduct, and they must be held accountable when they fail to meet them. Pursuing a claim is about protecting your financial rights and recovering your hard-earned money, and you deserve an advocate who will handle your case with sensitivity and professionalism.