It’s a common belief that your investments are safe as long as your advisor works for a large, well-known company. Unfortunately, that’s not always the case. Brokerage firms have a duty to supervise their employees, but sometimes misconduct still falls through the cracks. The story of LPL Financial Broker Derek Lee Copeland, who was accused of raising nearly $11 million in unapproved private investments while registered with LPL, shows how an advisor can operate outside their firm’s oversight. This practice, known as “selling away,” leaves investors exposed to unvetted risks. Here, we’ll explore the details of the case and discuss how brokerage firms can be held liable for failing to supervise their representatives.

Key Takeaways

- Beware of “Off-the-Books” Investments: Any deal presented as a private or exclusive opportunity that doesn’t go through the brokerage firm’s official channels strips you of essential protections. Legitimate investments are transparent and will always appear on your official account statements.

- Keep Communication On the Record: An advisor asking to discuss investments via personal text or email is a significant red flag. Insist on using official, monitored channels to ensure there is a clear record of their recommendations and to maintain firm oversight.

- The Brokerage Firm Can Be Held Accountable: Firms have a legal duty to supervise their advisors. If you lost money because of an advisor’s misconduct, you may be able to recover your losses by filing a FINRA arbitration claim against both the individual and the firm that failed to supervise them.

Who Is Derek Lee Copeland?

Derek Lee Copeland was a financial advisor and stockbroker based in Charlotte, North Carolina, who built a career managing wealth for numerous clients. He was registered with several firms over the years, most recently LPL Financial, one of the largest independent broker-dealers in the country. On the surface, he appeared to be a successful advisor, even founding his own wealth management company, SilverRock Wealth Partners, which catered to a high-net-worth clientele, including professional athletes. This image of success can often make it difficult for investors to spot warning signs of trouble.

However, his career unraveled when his firm and financial regulators uncovered serious misconduct that was hidden from view. Copeland’s story is a critical reminder for investors about the importance of transparency and oversight. When an advisor operates outside of their firm’s supervision—engaging in what are known as “outside business activities”—it can expose clients to significant and unapproved risks. These off-the-books dealings often lack the compliance checks and balances that are designed to protect your money. The actions that led to his permanent ban from the industry left many of his clients facing uncertainty and potential financial losses. Understanding his background is the first step for any investor who worked with him and may now be questioning the safety of their investments.

Copeland’s Career at LPL Financial

As a registered representative of LPL Financial, Derek Copeland was required to follow both industry regulations and his firm’s internal policies. A key rule for any broker is to disclose all outside business activities to their employer. This allows the firm to supervise those activities and ensure they don’t create conflicts of interest or expose clients to undue risk.

According to public records, LPL Financial terminated Copeland’s employment in January 2023 for precisely this reason: he failed to inform them about his other business ventures. This failure to disclose is a serious form of broker negligence, as it prevents the firm from performing its supervisory duties and leaves investors without the standard protections they deserve when working with a registered advisor.

Managing $150 Million at SilverRock Wealth Partners

One of the undisclosed businesses Copeland was operating was SilverRock Wealth Partners. This wasn’t a small side project; it was a significant operation that reportedly managed around $150 million in assets for a client base that included professional athletes. The high-profile nature of his clientele may have given his other investors a false sense of security, making them believe their money was in capable and trustworthy hands.

By keeping SilverRock separate from his work at LPL, Copeland effectively removed a crucial layer of oversight. His clients at SilverRock may have believed they were receiving services backed by the resources and compliance standards of a major firm like LPL, when in reality, their investments were being handled off the books and without proper supervision.

What Did Derek Lee Copeland Do Wrong?

Derek Lee Copeland’s actions represent a serious departure from the standards financial advisors are required to uphold. Instead of operating under the supervision of his firm, LPL Financial, he allegedly engaged in a pattern of behavior that violated industry rules and put his clients’ investments at risk. His misconduct wasn’t a single mistake but a series of deliberate choices that prioritized his own financial gain over his clients’ best interests. These actions involved undisclosed private deals, unauthorized commissions, and secretive communications—all major red flags in the financial industry. Let’s break down exactly what he is accused of doing.

$11 Million in Undisclosed Private Deals

According to FINRA’s findings, Copeland raised nearly $11 million from investors through 74 private securities transactions. The critical issue here is that he never disclosed these activities to his employer, LPL Financial. This practice, known as “selling away,” is a serious violation. When an advisor sells investments that haven’t been approved or vetted by their firm, investors lose a crucial layer of protection. The firm has no way to supervise the transaction or determine if the investment is legitimate and suitable for the client. This kind of behavior is a clear example of broker fraud and negligence, as it exposes clients to unvetted and potentially high-risk ventures without their knowledge.

$173,000 in Unauthorized Commissions

From those undisclosed deals, Copeland personally collected approximately $173,000 in commissions. This creates a significant conflict of interest. An advisor’s recommendations should be based on what is best for the client, not on which product pays the highest commission. By engaging in private deals, Copeland was motivated by personal profit rather than his clients’ financial goals. This incentive can lead advisors to push unsuitable investment products that may not align with an investor’s risk tolerance or objectives. When an advisor profits from unapproved outside business activities, it fundamentally breaks the trust that is essential to the client-advisor relationship.

Taking Business Communications Off the Record

FINRA also found that Copeland regularly communicated with clients using unapproved channels. Financial firms are required to monitor and archive all business-related communications to ensure compliance and protect investors. By moving conversations to personal text messages or email accounts, an advisor can operate outside of their firm’s supervision. This prevents the firm from seeing what is being promised or recommended to clients. It also makes it incredibly difficult for investors to prove misconduct later on, as there is no official record of the conversation. This secrecy is a tactic often used to conceal improper activities from regulators and the employing firm.

Ignoring Firm Rules on Outside Business

Ultimately, Copeland’s actions showed a complete disregard for the rules designed to protect investors. His involvement in private securities transactions and use of unapproved communication methods violated multiple FINRA regulations and LPL Financial’s internal policies. Financial advisors have a duty to follow these rules, which serve as a critical safety net for their clients. When an advisor chooses to ignore them, they operate without oversight and accountability. This is precisely why systems like securities arbitration exist—to provide a path for investors to hold advisors and their firms responsible for the harm caused by such misconduct.

How Did FINRA Hold Copeland Accountable?

When a broker sidesteps their firm’s rules, the Financial Industry Regulatory Authority (FINRA) is the regulatory body responsible for investigating and taking disciplinary action. In Derek Lee Copeland’s case, FINRA conducted a thorough review of his activities after he left LPL Financial. Their findings confirmed that Copeland had engaged in serious misconduct that put his clients’ investments at risk.

The investigation revealed a pattern of behavior that directly violated industry regulations designed to protect investors. By holding him accountable, FINRA not only penalized Copeland for his actions but also sent a clear message to the industry about the consequences of such violations. For investors, this process is a critical, though often slow, part of the system designed to maintain integrity in the financial markets.

The Investigation and Its Findings

FINRA’s investigation uncovered that between March 2020 and January 2023, Copeland raised nearly $11 million through 74 private securities transactions. The key issue was that he never disclosed these deals to his employer, LPL Financial. This practice, known as “selling away,” is a serious form of broker fraud and negligence. When a broker engages in outside business activities without firm approval, they prevent the firm from performing its due diligence. LPL Financial had no opportunity to vet these investments, leaving Copeland’s clients without the standard protections and oversight they deserved. The findings painted a clear picture of a broker operating outside the established rules.

A Permanent Ban from the Industry

As a result of its findings, FINRA took decisive action. Derek Lee Copeland was permanently barred from associating with any FINRA member firm in any capacity. This is one of the most severe sanctions FINRA can impose, effectively ending his career in the securities industry. The ban was based on his engagement in undisclosed private securities transactions and his use of unapproved methods to communicate with customers. This disciplinary action underscores the gravity of his violations. While a FINRA ban holds the individual accountable, it doesn’t automatically return lost funds to investors. Recovering those losses often requires a separate legal action, such as filing a securities arbitration claim.

How Does This Affect Copeland’s Clients?

When a financial advisor operates outside the rules, it’s their clients who are left to deal with the consequences. The regulations that advisors like Derek Copeland are accused of breaking aren’t just bureaucratic red tape; they are essential safeguards designed to protect your money. His actions allegedly exposed his clients to unvetted investments and stripped away the standard protections that every investor deserves. For those who trusted him with their financial future, the impact can be devastating, extending beyond monetary loss to a profound breach of trust. Understanding how this misconduct directly affects you is the first step toward seeking accountability and exploring your options for recovery.

Facing Financial Losses from Unapproved Investments

The most immediate and painful impact for clients is often significant financial loss. Derek Copeland allegedly raised nearly $11 million through 74 private securities deals that were never disclosed to or approved by his employer, LPL Financial. When you invest through a registered advisor, you assume their firm has vetted the investment for legitimacy and suitability. By engaging in these outside transactions, Copeland bypassed that critical oversight. This left his clients putting their money into ventures without the firm’s due diligence, exposing them to unmanaged risks and, in many cases, substantial losses. This type of behavior is a classic example of broker fraud and negligence.

A Breach of Trust and Investor Protections

Investing is built on a foundation of trust. You trust your advisor to act in your best interest and follow industry rules. Copeland’s alleged actions represent a serious breach of that trust. By concealing his outside business activities and private deals from LPL Financial, he deliberately sidestepped the very systems designed to protect investors. These disclosure rules ensure that a brokerage firm can supervise its advisors and shield clients from unsuitable or fraudulent schemes. When an advisor goes rogue, they don’t just break a rule—they dismantle the protective framework that gives investors confidence in the market, leaving their clients vulnerable to a wide range of investment issues.

Losing Key Safety Nets

Every investor who works with a registered brokerage firm is entitled to certain safety nets. These include the firm’s compliance reviews, supervision of its advisors’ activities, and due diligence on recommended products. When Copeland allegedly conducted business off the record, his clients lost these essential protections. LPL Financial couldn’t monitor transactions it didn’t know existed, leaving investors without the firm’s oversight as a line of defense. This failure to supervise can make the brokerage firm liable for the advisor’s misconduct. If you’ve lost money in unapproved investments, you may be able to recover your losses through a process like securities arbitration, which holds both the advisor and their firm accountable.

Why Do Some Advisors Go Rogue?

It can be unsettling to hear stories like Derek Copeland’s, and it’s natural to wonder why a financial professional would risk their career and their clients’ trust. While the vast majority of advisors follow the rules, some are tempted to operate outside the system for personal gain. This often happens when the potential for high, unsupervised commissions outweighs their duty to act in their clients’ best interests.

These situations almost always involve two key elements: a broker motivated by financial incentives and a failure in the brokerage firm’s supervisory systems. When a broker intentionally sidesteps their firm’s compliance procedures, they create an environment where misconduct can go undetected. They might push unapproved investments or make promises they can’t keep, all while leaving their clients exposed to significant financial risk. Understanding these dynamics is the first step in recognizing the warning signs and protecting your portfolio from similar situations.

The Lure of Unsupervised Commissions

One of the biggest motivators for broker misconduct is the opportunity to earn commissions on deals their firm doesn’t know about. This practice, known as “selling away,” involves recommending and selling securities that have not been approved by the brokerage firm. In Derek Copeland’s case, he allegedly raised nearly $11 million through 74 private securities transactions without ever disclosing them to LPL Financial.

When a broker engages in this type of broker fraud and negligence, they are often pursuing investments that are too risky, illiquid, or illegitimate for their firm to approve. By keeping the deal off the books, the broker can collect fees and commissions directly, without sharing them or undergoing the required compliance review. This creates a direct conflict of interest, as the broker’s primary motivation becomes their own profit rather than your financial well-being.

Exploiting Gaps in Firm Oversight

Brokers who sell unapproved investments must find ways to hide their activities from their employers. A common tactic is to move conversations with clients off of official, monitored platforms. FINRA investigators found that Derek Copeland frequently used unapproved channels to communicate with clients and colleagues, bypassing the systems LPL Financial had in place to supervise its advisors.

Brokerage firms are required to monitor their employees’ communications to prevent fraud and ensure all recommendations are suitable for clients. When an advisor asks you to communicate via personal text, email, or a third-party messaging app, they are deliberately stepping outside of their firm’s supervision. This allows them to operate without a compliance trail, making it easier to facilitate unauthorized investment issues and private deals. This not only violates industry rules but also strips you of a critical layer of protection.

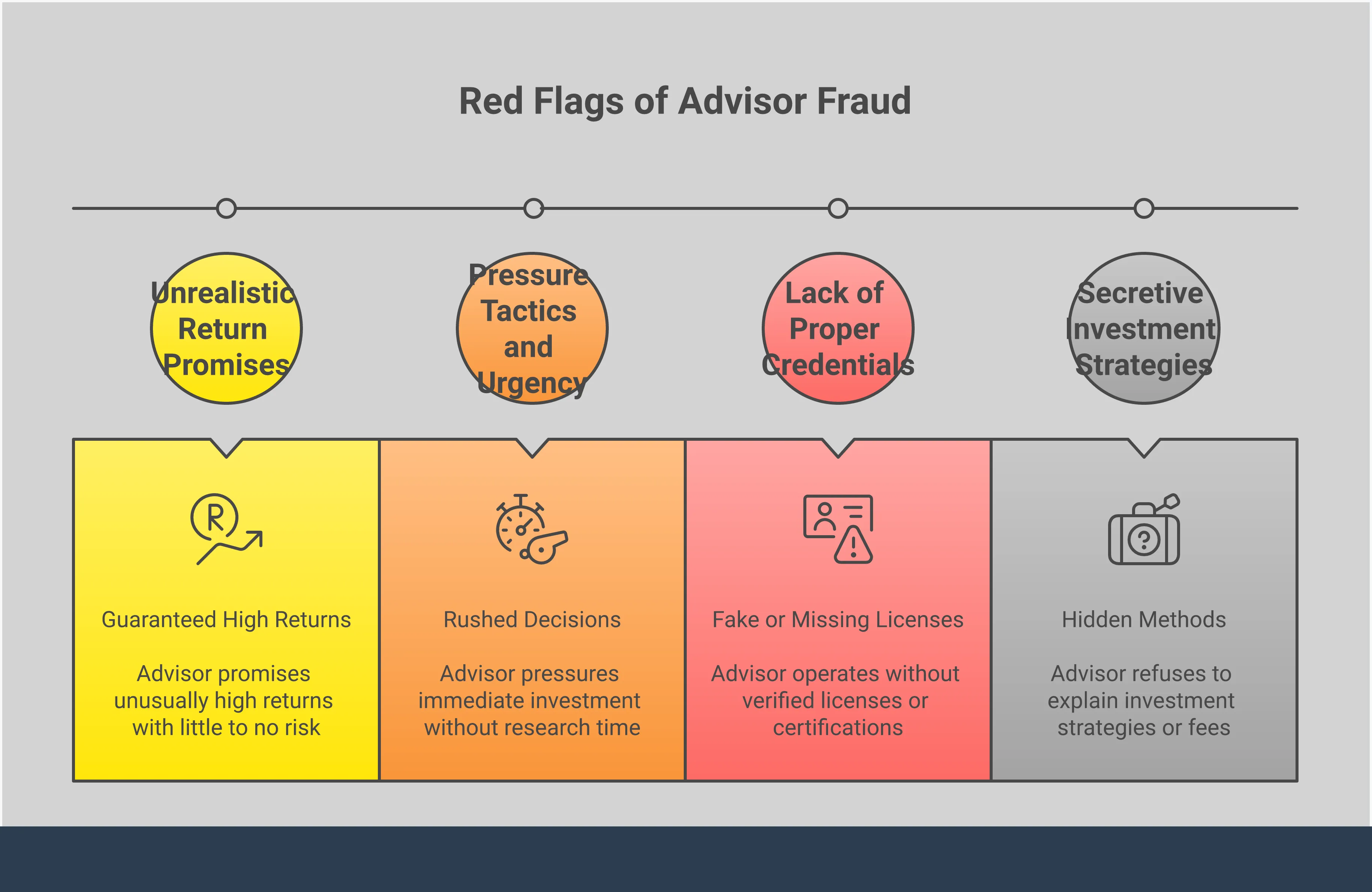

What Are the Red Flags of Advisor Misconduct?

Trust is the foundation of your relationship with a financial advisor, but it’s also important to be aware of behaviors that can signal trouble. Understanding the warning signs of misconduct can help you protect your financial future. The actions of brokers like Derek Lee Copeland serve as a real-world lesson in what to look out for. When an advisor steps outside their firm’s rules, they often leave a trail of red flags.

Recognizing these signs isn’t about being cynical; it’s about being an informed and empowered investor. Misconduct often happens behind the scenes, away from the oversight of the brokerage firm. An advisor might suggest an “exclusive” deal or ask you to communicate through personal email or text. These actions may seem harmless, but they are often deliberate attempts to bypass compliance and accountability systems designed to protect you. Knowing what constitutes broker fraud and negligence is the first step in safeguarding your portfolio. If something feels off, it probably is, and paying attention to these details can make all the difference.

Pressure to Invest in “Secret” Opportunities

Be cautious if your advisor presents an investment as a “secret” or “exclusive” opportunity that isn’t on your official account statement. Derek Lee Copeland allegedly raised nearly $11 million through private deals that he never disclosed to his firm, LPL Financial. This is a classic red flag. When an advisor pushes an off-the-books investment, they are sidestepping the firm’s due diligence process. This means the investment hasn’t been vetted for legitimacy or suitability, placing your capital at significant risk. Legitimate investments are transparent and well-documented through official channels.

Requests to Communicate Off-Platform

Your advisor should always communicate with you through official, firm-approved channels, like their company email or recorded phone lines. FINRA investigators found that Copeland often used unapproved platforms to talk with clients. This is a major warning sign because it suggests an advisor is trying to hide their conversations from compliance oversight. Moving discussions to personal text, social media, or private email allows them to make promises or recommendations without leaving a record. Insist on keeping all investment-related communication on the record to protect yourself from potential investment issues.

Missing Paperwork and Firm Approval

Every investment you make should come with a stack of official paperwork, including a prospectus and trade confirmations, all bearing the firm’s name. The absence of proper documentation is a serious problem. Copeland’s actions violated multiple FINRA rules because his private deals lacked firm approval and the required disclosures. If your advisor can’t provide official documents or if the transaction doesn’t appear on your account statement, the investment is likely unauthorized. This leaves you without the firm’s protection, and recovering your funds may require a formal process like securities arbitration.

What Can You Do If You’ve Lost Money?

Discovering that your financial advisor may have mishandled your money is a deeply unsettling experience. It’s not just about the financial loss; it’s a violation of trust that can leave you feeling vulnerable and unsure of where to turn. The good news is that you don’t have to face this alone, and there are established procedures to help you recover what you’ve lost. If you believe you were a victim of Derek Copeland’s misconduct or any other form of broker negligence, you have options. Taking clear, deliberate steps can put you on the path toward holding the responsible parties accountable and reclaiming your financial security.

The financial industry has a specific system in place to handle these disputes, designed to be more direct than traditional court proceedings. This system allows you to bring a claim not only against the individual advisor but also against the brokerage firm that was supposed to be supervising them. Firms like LPL Financial have a duty to monitor their advisors’ activities to prevent misconduct. When they fail in that duty, they can be held liable for the resulting investor losses. Understanding your rights within this system is the first step toward justice. The following sections will walk you through the process, from understanding the legal channels available to preparing a strong case. It’s about taking back control when you feel like it’s been taken from you.

Using FINRA Arbitration to Recover Losses

For investors who have lost money due to a broker’s actions, the primary path for seeking recovery is through FINRA arbitration. This is a dispute resolution process specifically designed for the securities industry. Instead of a lengthy court battle, your case is presented to an impartial arbitrator or a panel of arbitrators who will issue a final, binding decision. Clients who lost money with Derek Copeland can use this process to sue him and his former firm, LPL Financial. Pursuing a claim through securities arbitration is often more efficient and less formal than traditional litigation, allowing you to resolve your claim and potentially recover your losses sooner.

Understanding Your Options for Filing a Claim

The first step in this process can feel overwhelming, which is why it’s so important to get guidance. If you lost money while Derek Copeland was your stockbroker, you should talk to an investment fraud lawyer who can help you understand your rights. An attorney with experience in these specific types of cases can review your account history, identify instances of broker fraud and negligence, and explain the strength of your potential claim. They will handle the complex paperwork and deadlines involved in filing an arbitration claim, allowing you to focus on moving forward while they manage the legal strategy and fight for your interests.

How to Prepare Your Case

To build a strong case, you’ll need to gather all relevant documentation. This includes account statements, trade confirmations, emails, text messages, and any notes you took during conversations with your advisor. These documents create a timeline and provide evidence of the advice you were given. Many people worry about the cost of legal help, especially after suffering a financial loss. Most investment fraud cases are handled on a “contingent fee basis.” This means you only pay legal fees if the law firm successfully recovers money for you. This arrangement ensures your legal team is motivated to secure the best possible outcome. If you’re ready to explore your options, you can contact us for a confidential review of your situation.

How Can You Protect Your Investments?

Stories like Derek Lee Copeland’s can be unsettling, but they serve as a powerful reminder that you are the most important guardian of your financial portfolio. Taking a proactive role in overseeing your investments is one of the most effective ways to protect your hard-earned money. It doesn’t require you to be a financial genius, but it does mean asking the right questions and knowing what to look for. By staying informed and vigilant, you can spot potential problems before they cause serious damage. The following steps can help you build a strong defense against misconduct and ensure your financial future remains secure.

Vet Your Financial Advisor Thoroughly

Before entrusting anyone with your money, do your homework. A great starting point is FINRA’s BrokerCheck tool, a free resource that provides a snapshot of a financial professional’s employment history, licenses, and any reported disputes or disciplinary actions. While a clean record is a good sign, your due diligence shouldn’t stop there. Remember, Derek Lee Copeland was an advisor at LPL Financial, a major firm, yet he still engaged in misconduct. It’s crucial to understand that even advisors at well-known companies can cause harm. If you ever feel that an advisor’s actions have led to financial losses, it’s important to know the signs of broker fraud and negligence.

Know the Rules of Disclosure

Financial advisors are required to disclose their outside business activities and any private investment deals to their brokerage firm. This process allows the firm to supervise their activities and ensure the investments are suitable for clients. When an advisor fails to do this, it’s called “selling away”—exactly what Copeland did when he raised $11 million through undisclosed transactions. Be cautious if your advisor pitches an “exclusive” or “private” deal that won’t appear on your official account statements. Similarly, if they ask you to communicate through personal email or text messages, it could be an attempt to hide their activities from their firm’s compliance oversight. These are significant red flags that can point to serious investment issues.

Verify Every Investment Opportunity

Trust, but verify. If an advisor presents you with an investment, especially one that is not a publicly traded stock or bond, ask for official documentation. This could be a prospectus or a private placement memorandum that details the investment, its risks, and its objectives. Cross-reference everything. Make sure the investment appears on the official statements sent directly from the brokerage firm, not just on a performance report generated by the advisor. If an investment is legitimate, the firm will have a record of it. If you have any doubts, don’t hesitate to call the firm’s compliance department to confirm the opportunity is approved. If you believe you’ve been misled, you can contact our firm to discuss your situation.

Related Articles

- LPL Financial Fined $11.7M

- FINRA Suspends Former LPL Broker

- LPL Broker Vincent Pallitto, Jr.: Investor Complaints & Disputes

- FORMER LPL BROKER CHERYL ANN STALLINGS BARRED BY FINRA FOR MISAPPROPRIATION OF CUSTOMER FUNDS

- Claims Against LPL Financial Broker Shannon Moore

Frequently Asked Questions

What does “selling away” actually mean? “Selling away” is when a financial advisor convinces a client to purchase an investment that has not been approved by the brokerage firm they work for. Because the firm hasn’t vetted the investment, it could be excessively risky or even fraudulent. Advisors often do this to earn higher, undisclosed commissions, which puts their personal financial gain ahead of your best interests.

I was a client of Derek Copeland. What should I do now? Your first step is to gather all your documents, including account statements, trade confirmations, and any communications you had with him. It’s important to get a clear picture of your investments, especially any that seem unusual or don’t appear on your official statements from LPL Financial. Then, you should speak with a lawyer who specializes in investment fraud to review your situation and understand your options for recovering your losses.

Why is the brokerage firm, like LPL Financial, responsible for an advisor’s actions? Brokerage firms have a legal duty to supervise their advisors to ensure they follow industry rules and act in their clients’ best interests. This includes monitoring their communications and reviewing their investment recommendations. When an advisor engages in misconduct like selling unapproved products, the firm can be held liable for its failure to supervise them properly.

My advisor wants to text me about an investment. Is that a problem? Yes, that can be a significant red flag. Brokerage firms are required to monitor and archive business-related communications to protect investors. When an advisor moves a conversation to a personal device or unapproved app, they are often trying to operate outside of their firm’s supervision. You should insist that all investment discussions happen through official, recorded channels.

What if I can’t afford a lawyer to help me recover my losses? This is a common concern, but you shouldn’t let it stop you from seeking help. Most investment fraud attorneys work on a contingent fee basis. This means they only get paid if they successfully recover money for you. This approach allows you to pursue a claim without paying legal fees upfront, ensuring your lawyer is motivated to achieve a positive outcome for your case.