NO FEES UNTIL WE WIN

FREE CONSULTATION

NO FEES UNTIL WE WIN

FREE CONSULTATION

It’s one thing for an advisor to make a poor investment choice; it’s another for them to deliberately hide their activities from their employer and their clients. The disciplinary action against Suspended Investment Advisor Muhammad R. Wahdy reveals a troubling pattern of deception. By allegedly lying on compliance forms to conceal his outside business and private deals, he broke the fundamental rules of his profession. This case underscores the importance of investor vigilance. We’ll look at the specific FINRA rules that were broken and explain the practical steps you can take to verify your advisor’s record and protect your assets.

When a financial advisor faces disciplinary action, it’s important for investors to understand exactly what happened and why. The case of Muhammad R. Wahdy is a clear example of why industry regulations are in place and the serious consequences that follow when they are ignored. Let’s look at his professional background and the specific actions that led to his suspension by the Financial Industry Regulatory Authority (FINRA), the organization that oversees brokerage firms in the U.S.

Muhammad R. Wahdy is a San Francisco-based investment advisor and the founder of his own firm, Wahdy Capital. Before his suspension, he built a career with several major brokerage firms, most recently with Merrill Lynch. His time there ended abruptly in May 2023 when the firm terminated his employment. The stated reason was his failure to disclose an outside business activity—his own investment advisory firm, Wahdy Capital. This termination was a major red flag and set the stage for the regulatory action that would soon follow from FINRA.

FINRA’s investigation found that Wahdy’s failure to disclose his outside business was not a simple mistake. He allegedly operated Wahdy Capital while employed at Wells Fargo, Ameriprise Financial, and Merrill Lynch, all without seeking the required approval from these firms. This kind of undisclosed activity is a serious breach of industry rules designed to protect investors. To make matters worse, Wahdy is accused of actively hiding this information. He allegedly misrepresented his activities on internal company forms, falsely stating he had no outside business activities to report. This type of dishonesty points to a pattern of broker fraud and negligence and is precisely the kind of behavior that regulatory bodies work to prevent.

FINRA’s disciplinary action against Muhammad R. Wahdy wasn’t the result of a single mistake. Instead, it stemmed from a pattern of serious misconduct that broke fundamental rules designed to protect you, the investor. The investigation revealed a series of deliberate choices that created major conflicts of interest and put client money at risk, all while his employer remained in the dark. These actions fall into three main categories: operating an unapproved business, selling investments his firm hadn’t vetted, and actively lying on compliance paperwork to cover his tracks.

Each of these violations on its own is a serious breach of trust. When combined, they paint a picture of an advisor who knowingly sidestepped the systems put in place for investor safety. These rules aren’t just bureaucratic red tape; they are the guardrails that ensure your advisor is acting in your best interest and that their firm is properly supervising their activities. Understanding the specific ways Wahdy broke these rules can help you recognize similar red flags and better protect your own financial future.

Financial advisors are required to tell their brokerage firm about any outside business activities, a rule Wahdy ignored. He acted as the owner and CEO of his own investment advisory firm, Wahdy Capital, without ever disclosing it to his employers. This lack of transparency is a serious problem because it prevents the brokerage firm from supervising its advisors and managing potential conflicts of interest. When a broker runs an unapproved side business, they may be tempted to prioritize their own financial interests over their clients’ well-being. This failure of oversight is a classic example of broker fraud and negligence that can leave investors vulnerable.

Wahdy also engaged in a practice known as “selling away” by offering private investments to a client that were not approved by his firm. He sold limited partnership interests that had not gone through his employer’s due diligence process. This is incredibly dangerous for investors. When you work with an advisor at an established firm, you have a right to expect that the investments they recommend have been properly vetted for legitimacy and suitability. By going around his firm, Wahdy exposed his client to a product that lacked this critical layer of protection, creating significant investment issues and putting their capital at risk.

To keep his unapproved business and private sales hidden, Wahdy repeatedly lied on official documents. On multiple compliance forms submitted to his employer, he falsely stated that he had no outside business activities or private securities transactions to report. This wasn’t a simple clerical error; it was a calculated deception designed to mislead his firm and its compliance officers. This dishonesty shows a clear intent to violate industry rules. When an investor suffers losses due to this kind of misconduct, their primary path to recovery is often through the securities arbitration process, where they can hold both the broker and the supervising firm accountable.

When a financial advisor breaks the rules, the repercussions are not just a slap on the wrist. The actions taken by regulators and employers are meant to hold them accountable and protect the public. For Muhammad R. Wahdy, the consequences were significant, impacting his finances, his employment, and his professional future. These disciplinary measures are public record, serving as a clear warning to the industry and a validation for investors who have been harmed.

The penalties imposed by the Financial Industry Regulatory Authority (FINRA) and his former employer, Merrill Lynch, underscore the seriousness of his misconduct. While these actions provide a measure of justice, they don’t automatically return lost funds to investors. For those who have suffered financial losses due to an advisor’s wrongful actions, pursuing a claim through securities arbitration is often the necessary next step to recover what is rightfully theirs. Wahdy’s case illustrates the clear line between acceptable and unacceptable behavior in the financial industry and the severe fallout that occurs when that line is crossed.

FINRA took decisive action against Muhammad R. Wahdy, imposing a 15-month suspension from the securities industry and a $10,000 fine. This penalty was a direct response to his multiple violations, which included operating an unapproved outside business and engaging in private securities transactions without his firm’s knowledge or consent. Such disciplinary measures are not taken lightly. They are designed to penalize the individual broker and send a strong message to the entire industry that this type of behavior will not be tolerated. The suspension effectively removes him from the field, preventing him from causing further harm to investors while it is in effect.

In addition to the regulatory sanctions, Wahdy faced immediate consequences from his employer. Merrill Lynch terminated his employment in May 2023, citing his failure to disclose his outside business activities. Brokerage firms have a duty to supervise their employees to prevent and detect misconduct. When an advisor like Wahdy goes to great lengths to hide their actions, it represents a serious breach of company policy and industry regulations. His termination shows that major firms will act to distance themselves from advisors who engage in deceptive practices, though it also raises questions about the effectiveness of their initial supervision.

The formal sanctions and job loss have created lasting damage to Muhammad R. Wahdy’s career. A public disciplinary history, including a FINRA suspension and a termination for cause, is a permanent mark on a broker’s record. This information is readily available to potential employers and clients, making it incredibly difficult to rebuild trust within the industry. Between 2019 and 2023, Wahdy reportedly collected around $148,000 in fees from his secret advisory firm, but the long-term cost to his reputation and earning potential will likely far exceed that amount. These events highlight the severe professional risks associated with broker fraud and negligence.

To understand the seriousness of Muhammad R. Wahdy’s actions, it helps to look at the specific rules he broke. The Financial Industry Regulatory Authority (FINRA) sets clear guidelines for financial advisors to ensure they act in their clients’ best interests. These rules aren’t just red tape; they are fundamental safeguards for your investments. Wahdy’s case highlights violations of two critical rules designed to prevent the exact kind of broker misconduct that can lead to significant investor losses. When an advisor ignores these foundational rules, they put their clients’ financial security at risk.

FINRA Rule 3270 requires financial advisors to provide written notice to their firms before engaging in any outside business activity. This means if your broker wants to start a side business, especially one related to finance, they must get their employer’s approval first. This rule ensures the brokerage firm knows what its representatives are doing and can manage any potential conflicts of interest. In this case, Wahdy ran an entire investment advisory firm, Wahdy Capital, on the side without ever informing his employers at Merrill Lynch or LPL Financial. This complete lack of transparency is a major red flag and a direct violation of his duties.

This rule addresses what are known as “private securities transactions.” Essentially, FINRA Rule 3280 prohibits brokers from selling any investment products to clients that have not been approved by their firm. Think of it as staying on the official menu of investment options. By stepping outside of his firm’s approved products, Wahdy engaged in what’s commonly called “selling away.” He sold limited partnership interests to at least one investor without getting permission from his firm. This action put the investor’s capital into a product that had not been vetted by the brokerage firm for legitimacy, suitability, or risk, creating a dangerous situation for the client.

Rules 3270 and 3280 work together to prevent a practice called “selling away.” This happens when a broker sells you an investment that their firm doesn’t know about or hasn’t approved. These unvetted products often carry high risks or can even be part of a fraudulent scheme. Brokerage firms have a duty to supervise their advisors, and that includes reviewing and approving the investments they recommend. When a broker “sells away,” they sidestep that crucial oversight. This leaves investors exposed to potentially devastating losses from unsuitable investment practices that a firm’s compliance department would have likely rejected.

Cases like this serve as a critical reminder that the systems designed to protect you aren’t foolproof. While most financial advisors work diligently for their clients, misconduct can and does happen. Understanding the responsibilities of a brokerage firm and the ways an advisor can violate your trust is the first step in safeguarding your financial future. This situation highlights why investor vigilance and awareness are so important. When an advisor sidesteps the rules, it’s often the client’s life savings on the line. Knowing what to look for and what questions to ask can make all the difference.

It’s easy to feel overwhelmed by the complexities of the financial world, but you don’t have to be a market analyst to protect yourself. The core issue often comes down to two key areas: the brokerage firm’s responsibility to watch over its employees and the fundamental trust you place in your advisor. When either of these breaks down, the consequences can be devastating. This is why regulations exist—to create a framework of accountability that puts your interests first. Learning about these protections can empower you to spot red flags and take action before it’s too late. The story of one advisor’s suspension is more than just a headline; it’s a lesson in how quickly things can go wrong when rules are ignored and supervision is lax. It underscores the reality that your financial security depends not just on your advisor’s performance, but on their integrity and their firm’s commitment to ethical conduct.

Brokerage firms have a fundamental duty to supervise their financial advisors. This isn’t just a suggestion; it’s a core regulatory requirement. This supervision acts as a crucial safeguard, ensuring that the investments recommended to you are suitable for your financial situation and have been properly vetted by the firm. When this oversight fails, it can lead to significant investor harm through broker fraud and negligence. The firm is responsible for knowing what its representatives are doing. If an advisor is engaging in unapproved outside business or selling unvetted products, the firm may be held liable for failing to detect and stop the misconduct.

The relationship between an investor and a financial advisor is built on a foundation of trust. When an advisor engages in misconduct like “selling away”—offering investments not approved by their firm—that trust is broken. These rules exist for a clear reason: to protect you from risky or fraudulent products that haven’t been reviewed. An advisor who violates these rules is putting their own financial interests ahead of yours. This behavior not only harms the individual investor but also damages confidence in the financial system. It’s a serious breach that can lead to a wide range of investment issues for the client, turning a promising portfolio into a source of financial distress.

Learning about cases like Muhammad R. Wahdy’s can be unsettling, but it highlights the importance of being proactive with your investments. While your brokerage firm has a legal duty to supervise its advisors, you also have the power to protect your financial future. Taking a few straightforward steps can help you spot red flags and safeguard your portfolio from potential harm.

It starts with doing your homework before you invest a single dollar and continues with staying informed throughout your relationship with an advisor. Understanding the rules that govern financial professionals and knowing your rights as an investor are your first lines of defense. If you suspect something is wrong, it’s crucial to know where to turn for help. By being vigilant and informed, you can significantly reduce your risk of falling victim to broker fraud and negligence.

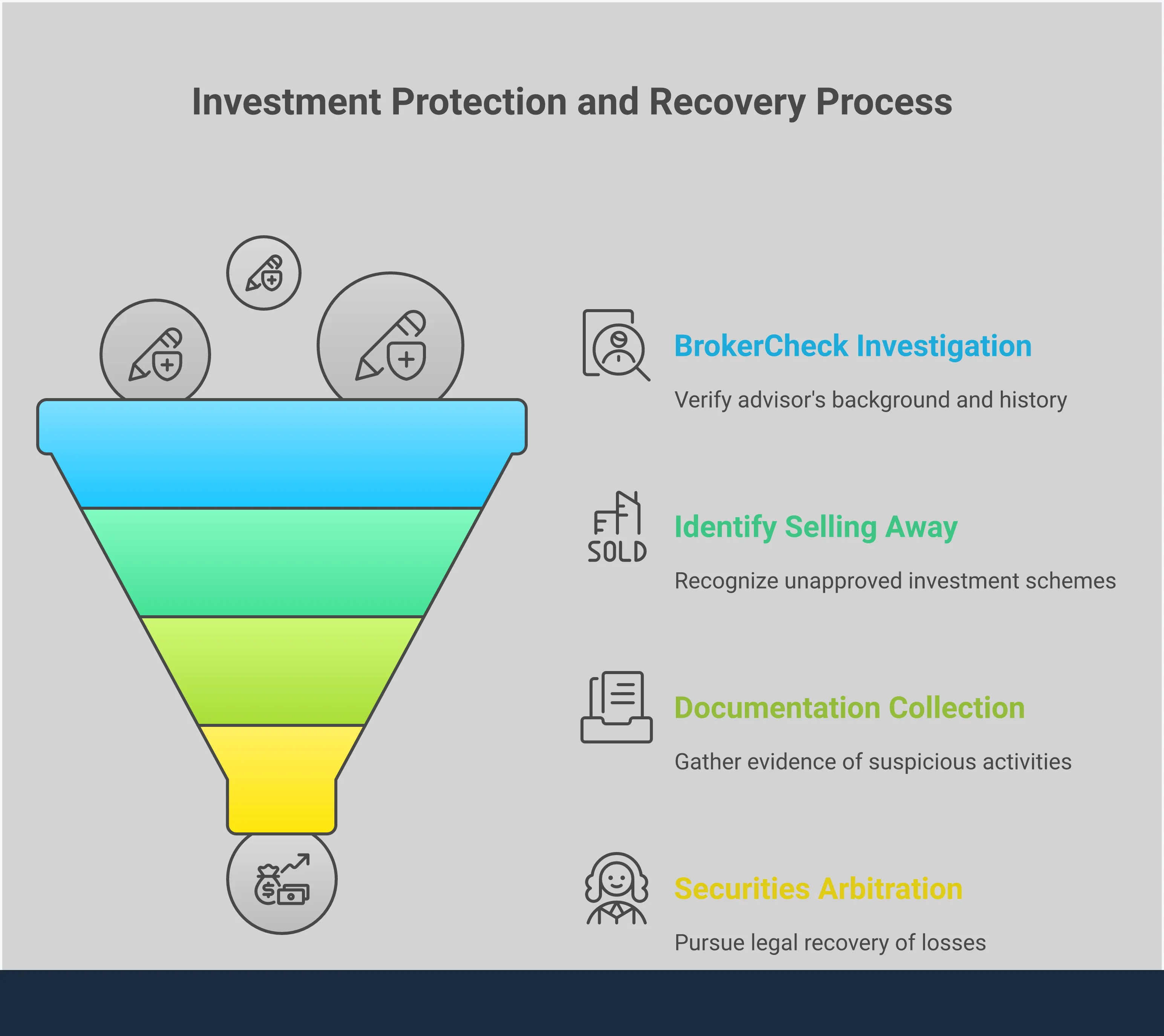

Before you trust anyone with your hard-earned money, take a moment to vet them. The Financial Industry Regulatory Authority (FINRA) offers a free and easy-to-use tool called BrokerCheck. This database allows you to see an advisor’s employment history, licenses, and, most importantly, any customer disputes or disciplinary actions on their record. For example, a quick search would have shown that Muhammad R. Wahdy faced a FINRA suspension for misconduct. Using BrokerCheck is a simple, essential step in your due diligence process. It gives you a clearer picture of who you’re dealing with and helps you make a more informed decision about your financial future.

As an investor, you are entitled to transparency from your financial advisor. They are required to be upfront about their business activities and the investments they recommend. A serious violation of this trust is a practice known as “selling away,” where an advisor sells you investments that haven’t been approved by their firm. This is exactly what Muhammad R. Wahdy did. These unapproved products often carry higher risks and are sold without the brokerage firm’s oversight, leaving you unprotected. Understanding your rights helps you identify when an advisor is crossing a line and dealing with questionable investment issues.

If you believe you’ve lost money due to an advisor’s misconduct, you don’t have to face the situation alone. A securities attorney can review your case, explain your legal options, and help you take action to recover your losses. These cases are often resolved through a process called securities arbitration, which is a specialized forum for handling investment disputes. An attorney who understands this landscape can represent your interests and work to hold the responsible parties accountable. If you suspect you’ve been a victim of investment fraud, you can contact us to discuss your situation.

What exactly does “selling away” mean? Think of it this way: when you work with an advisor at a brokerage firm, there’s an official menu of investments that the firm has reviewed and approved. “Selling away” is when your advisor tries to sell you something that’s not on that menu. These off-the-books investments haven’t been vetted by the firm for safety or suitability, which puts your money at significant risk.

How can I find out if my financial advisor has a disciplinary record? The best tool for this is FINRA’s BrokerCheck. It’s a free, public database where you can look up any advisor or firm. The report will show you their employment history, licenses, and any red flags like customer complaints, regulatory actions, or terminations. It’s a simple but powerful first step you should take before working with any financial professional.

Is the brokerage firm responsible if my advisor did something wrong? In many situations, yes. Brokerage firms have a legal duty to supervise their employees to ensure they are following industry rules and acting in your best interest. If an advisor engages in misconduct and the firm failed to reasonably detect or prevent it, the firm itself can be held liable for your losses under a “failure to supervise” claim.

My advisor is recommending an investment that isn’t listed on my official account statement. Is this a red flag? Yes, that is a major red flag. All of your investments should be clearly documented on the official statements you receive from the brokerage firm, not from the advisor directly. If a transaction or holding doesn’t appear there, it could be a sign of an unapproved private investment or another serious issue. You should always question anything that doesn’t show up on your official account records.

What’s the first step I should take if I suspect my broker has lost my money through misconduct? If you believe your losses are due to your advisor’s wrongful actions, the first step is to gather all your relevant documents, including account statements, trade confirmations, and any communications you’ve had with them. The next step is to speak with a securities attorney who can review your situation and explain your options for recovering your funds, which often involves filing a claim through securities arbitration.