NO FEES UNTIL WE WIN

FREE CONSULTATION

NO FEES UNTIL WE WIN

FREE CONSULTATION

A long career in the financial industry can suggest stability, but it’s no guarantee of ethical behavior. Curtis W. Smith worked as a broker for almost 40 years before his misconduct came to light. He was accused of serious violations, from making trades without permission to impersonating a client to hide his actions from his firm. These events show why it’s so important to look beyond tenure and regularly check your advisor’s record. The recent decision where FINRA suspends financial advisor Curtis W. Smith is a clear signal that even seasoned professionals are held accountable for their actions.

When you trust someone with your financial future, you expect them to act with integrity. Unfortunately, that trust is sometimes broken. The case of Curtis W. Smith is a stark reminder of why it’s so important for investors to stay vigilant. FINRA, the industry’s self-regulatory body, took disciplinary action against Smith for a series of violations that put his clients at risk. Understanding what happened can help you recognize red flags and protect your own investments.

Curtis Wayne Smith (CRD#:1383235) was a broker and investment advisor with a long history in the financial industry, starting his career in 1985. Over nearly four decades, he was associated with several firms, including Pruco Securities, SCF Securities, Kovack Securities Inc., and most recently, United Planners’ Financial Services of America. A long career can often suggest experience and stability, but as this case demonstrates, it doesn’t guarantee ethical behavior. It’s crucial for investors to look beyond tenure and regularly check their advisor’s record for any disciplinary actions or complaints.

In April 2025, FINRA suspended Smith after its investigation uncovered a pattern of serious misconduct. The regulator found that Smith had engaged in multiple wrongful acts, including impersonating a customer, making trades without permission, and taking steps to hide his actions from his firm. Furthermore, he was found to have lied to his company and used unapproved personal email addresses for business matters. These actions are serious violations that fall under the umbrella of broker fraud and negligence. When an advisor engages in such behavior, they violate the fundamental trust placed in them by their clients.

The investigation brought some specific and concerning actions to light. In May and June 2024, Smith allegedly called an annuity company four times, pretending to be one of his clients. He did this to get the paperwork needed to move the client’s annuity into a different investment account without their consent. He also allegedly made trades in a client’s account without getting their written permission first. To keep these activities hidden, Smith used two personal email accounts to communicate with clients and annuity companies, which was against his firm’s rules. When his firm asked about his communications, he lied, saying he only used approved channels. These are significant investment issues that can lead to devastating losses for investors.

The actions taken against Curtis W. Smith weren’t just a slap on the wrist. They involved direct penalties from financial regulators and significant damage to his career. When a financial advisor engages in misconduct, the consequences can be swift and severe, coming from both regulatory bodies and their own employer. For Smith, this meant a formal suspension, a monetary fine, and the loss of his job, creating a permanent mark on his professional record. Understanding these outcomes is important for investors, as it shows the accountability mechanisms in place and highlights the seriousness of such violations.

In April 2025, the Financial Industry Regulatory Authority (FINRA) took formal action against Curtis W. Smith. He received a three-month suspension, which prohibits him from working with any FINRA-member firm in any capacity during that period. Alongside the suspension, FINRA imposed a $10,000 fine. These penalties are a direct result of their investigation into his misconduct. When an advisor is found to have violated industry rules, FINRA uses tools like suspensions and fines to enforce standards, often through a process known as securities arbitration. This disciplinary action becomes a public part of the advisor’s record, accessible to any investor.

Even before FINRA’s official ruling, Curtis Smith faced serious career repercussions. His employer at the time, United Planners’ Financial Services of America, terminated his employment in August 2024. The firm fired him for the very actions that led to the FINRA investigation: impersonating a client and using unapproved email addresses for business communications. This termination shows that brokerage firms have their own internal compliance standards and can take action independently of regulators. For an advisor, being fired for cause is a major red flag that can make it incredibly difficult to find work elsewhere in the industry, especially when it involves issues of broker fraud and negligence.

Understanding the sequence of events can help clarify how misconduct is identified and addressed. The case against Curtis W. Smith developed over several years, starting with initial red flags and leading to regulatory action. This timeline breaks down the key moments that led to his suspension.

The first documented issue arose in April 2022. Smith was accused of engaging in unauthorized trading, which means he made trades in a client’s account without getting their prior written consent. This practice is sometimes called “exercising discretion” without approval, and it’s a serious violation of industry rules. When a broker makes decisions without your explicit permission, it can lead to unsuitable investments and significant financial losses. This type of action is a clear example of broker fraud and negligence and often serves as an early warning sign of more serious misconduct.

The situation took a more serious turn two years later. Between May and June 2024, Smith allegedly impersonated a client during four separate phone calls with an annuity company. The purpose of these calls was to get the necessary paperwork to move the client’s annuity to a different investment account under his management. Impersonating a client is a profound ethical breach that completely undermines the trust essential to the advisor-client relationship. This action demonstrated a clear intent to bypass standard procedures and act without the client’s knowledge or consent, raising major concerns about his professional conduct.

As a direct result of these allegations, Smith’s employment at United Planners’ Financial Services of America was terminated on August 1, 2024. According to reports, his termination came after he admitted to impersonating the client and using unapproved email addresses to communicate about business matters. Financial firms have strict policies to ensure all communications are recorded and supervised, and using personal email is a way to hide activities from compliance departments. This termination was a significant step, signaling that his firm found the investment issues and misconduct to be credible and severe.

The regulatory consequences followed several months later. On April 21, 2025, the Financial Industry Regulatory Authority (FINRA) officially suspended Curtis W. Smith from associating with any FINRA-member firm for three months. This suspension, set to end on July 20, 2025, is a formal disciplinary action that will be part of his permanent public record. A FINRA suspension is a serious penalty that reflects the gravity of the violations. For investors who have been harmed by such actions, the next step often involves pursuing a claim through the securities arbitration process to recover their losses.

When a financial advisor faces disciplinary action, it can leave their clients feeling uncertain and vulnerable. If you were an investor with Curtis W. Smith, or if you’re simply concerned about advisor misconduct, here’s what you need to understand about the situation and your path forward.

If you believe you suffered financial harm because of Curtis W. Smith’s actions, it’s important to know that you may have a path to recovery. You don’t have to accept these losses as a final outcome. Often, the most effective way to pursue a claim against a broker or their firm is through the securities arbitration process. This is a formal procedure designed to resolve disputes outside of a traditional courtroom. Seeking guidance from a legal professional can help you understand your specific situation and determine the best course of action to reclaim your funds.

The actions taken by FINRA and United Planners’ Financial Services show that industry regulations are in place to address wrongdoing. When a broker is suspended and fired for misconduct, it sends a clear message that violating rules has serious consequences. These rules, like FINRA Rule 2010, exist to ensure advisors act with high standards of commercial honor. However, these regulatory actions happen after the damage is done. For investors, this highlights the ongoing issue of broker fraud and negligence and reinforces the need for firms to properly supervise their employees to prevent harm in the first place.

Cases involving advisor misconduct can seriously damage the trust that is essential to a healthy investor-advisor relationship. When an advisor like Smith settles with FINRA without admitting or denying the findings, it can leave investors feeling like there’s no real accountability. This lack of transparency is frustrating and can make anyone wary of the financial industry. It serves as a stark reminder that your financial future is too important to be left to chance. Understanding common investment issues and staying vigilant about your accounts are critical steps in protecting yourself from potential harm and maintaining control over your financial well-being.

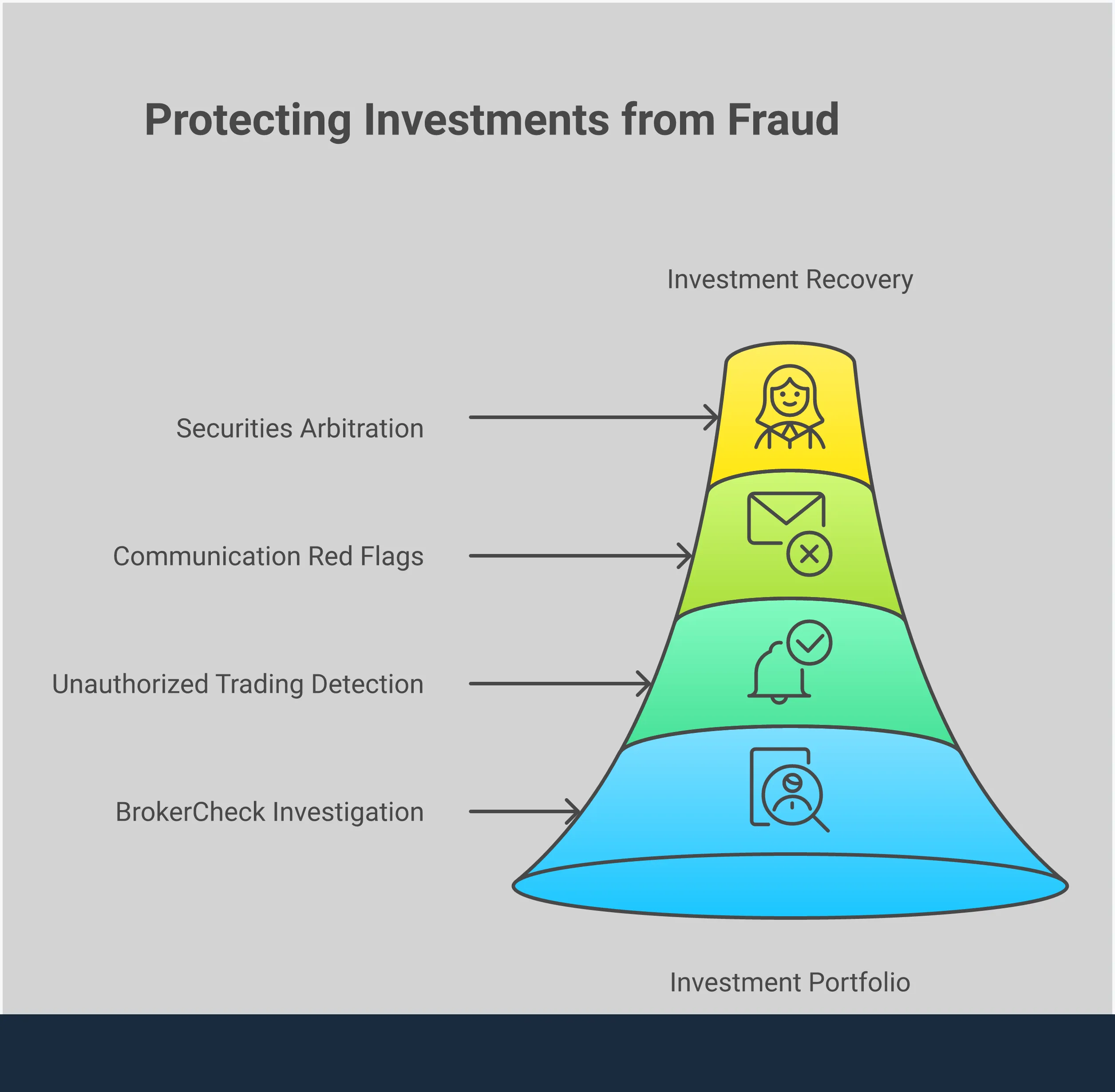

While stories of misconduct can be unsettling, they serve as a crucial reminder to be proactive in safeguarding your financial future. Knowing what to look for and what steps to take can make all the difference. Protecting your investments starts with being an informed and vigilant participant in your own financial journey. It’s about asking the right questions, recognizing red flags, and knowing when to seek help. By staying aware and taking a few preventative measures, you can build a stronger defense against potential misconduct and feel more secure about your financial decisions.

Trusting your intuition is important, but knowing the specific red flags of advisor misconduct is even better. If you notice any of these signs, it’s time to pay closer attention. These issues can point to serious problems, from simple mistakes to outright broker fraud and negligence.

Be on the lookout for:

These aren’t just minor issues; they can be indicators of serious misconduct that requires your immediate attention.

The best time to prevent a problem is before it starts. Before you hand over your hard-earned money, take the time to thoroughly vet any potential financial advisor. A reputable professional will welcome your questions and be transparent about their history. Always ask about their experience, the types of clients they typically work with, and their educational background. It’s also critical to ask if they have any past disciplinary actions or issues with regulators. You can independently verify an advisor’s history using FINRA’s BrokerCheck tool. This simple step is one of the most effective ways to avoid future investment issues and find a trustworthy partner for your financial goals.

If you’ve spotted the warning signs and suspect you’ve lost money due to your advisor’s actions, don’t wait. It can be intimidating to challenge a financial professional or a large firm, but you don’t have to do it alone. Seeking legal advice is a critical step toward understanding your rights and options. An attorney who focuses on investment fraud can help you determine if you have a case and guide you through the process of recovering your losses, which often involves a process known as securities arbitration. Taking prompt action is key to protecting your financial well-being. If you believe you may be a victim of investment fraud, please contact us to discuss your situation.

How can I find out if my financial advisor has a disciplinary record? The best resource for this is FINRA’s BrokerCheck tool. It’s a free, public database that allows you to see an advisor’s employment history, licenses, and any customer complaints or disciplinary actions on their record. Making it a habit to check this tool annually for any new updates is a simple but powerful way to stay informed about the person managing your money.

What exactly is “unauthorized trading”? Unauthorized trading happens when a broker buys or sells securities in your account without getting your permission first. Unless you have signed a specific agreement giving your advisor discretionary authority—which grants them permission to trade on your behalf—they must get your approval for every single trade. If you see transactions on your statement that you didn’t agree to, it’s a serious red flag.

If my advisor is fired or suspended, will their firm automatically return my money? Unfortunately, no. A regulatory action or termination doesn’t trigger an automatic refund for investors. While these actions hold the advisor accountable, recovering your personal losses is a separate process. Typically, you must file a formal claim against the brokerage firm to seek recovery, which is often handled through securities arbitration.

Why is it a problem for an advisor to use a personal email for business? Financial firms are required to monitor and archive all business-related communications to ensure they comply with industry regulations. When an advisor uses a personal email, they are intentionally moving conversations outside of this required supervision. This can be a way to hide unsuitable recommendations, unauthorized activities, or other misconduct from their compliance department and regulators.

I suspect my advisor has been dishonest, but I’m not sure what to do. What’s the first step? If your gut tells you something is wrong, the first step is to gather your documents, such as account statements and any communications you have with your advisor. Then, it is wise to speak with an attorney who focuses on securities law. They can review your situation, help you understand if your concerns are valid, and explain the options you have for holding the advisor and their firm accountable.