NO FEES UNTIL WE WIN

FREE CONSULTATION

NO FEES UNTIL WE WIN

FREE CONSULTATION

It’s a deeply unsettling feeling to look at your investment account and suspect that something is wrong. That sense of unease is often your first sign that you need to dig deeper and ask questions. A recent customer complaint against LPL Financial LLC Broker Brian Lesley illustrates a scenario that many investors fear, involving allegations of unsuitable investments and trades made without proper authorization. Understanding the specifics of this pending case can help you learn to identify potential red flags in your own portfolio. It empowers you to move from a place of uncertainty to one of informed action, ensuring you are an active participant in your financial journey.

When you trust someone with your financial future, it’s essential to understand their professional background and history. Brian Lesley is a financial advisor currently associated with LPL Financial LLC. With a career spanning several decades, he has worked with numerous clients on their investment strategies. For any investor, a crucial first step is to review the publicly available information on their financial professional. This helps you make informed decisions and understand who is managing your money. Let’s look at the details of Brian Lesley’s career in the securities industry.

Brian Lesley began his career in the investment industry in 1998. According to records from the Securities and Exchange Commission (SEC), he has been a registered financial advisor for over 25 years. He has been registered with LPL Financial LLC since March 2012, where he provides investment advice to clients. His long tenure in the industry means he has experience across various market conditions. Understanding this history is important, as it provides context for his professional conduct and the types of investment issues that can arise between advisors and their clients.

You can find detailed information about any broker’s career through the Financial Industry Regulatory Authority (FINRA). FINRA’s BrokerCheck tool is a free resource that provides a snapshot of a broker’s employment history, certifications, and, most importantly, any customer disputes or disciplinary actions. Brian Lesley’s profile shows his long-standing association with LPL Financial and lists his qualifications. Reviewing a broker’s complete history is a key part of due diligence and can help you spot red flags that might indicate a history of broker fraud and negligence. This public record is one of the most valuable tools available for protecting your investments.

Understanding the full range of services a financial advisor provides is a critical step in evaluating the advice you’ve received. Brokers often have access to a wide array of financial products, from simple stocks to complex insurance policies. Their fundamental duty is to recommend products that align with your specific financial situation, goals, and risk tolerance. When brokers fail in this duty, whether through carelessness or intentional misrepresentation, it can lead to significant financial harm. This failure is a form of broker fraud and negligence. It’s not just about picking a losing stock; it’s about a professional failing to uphold their responsibility to you, the investor.

According to public information, Brian Lesley, through his affiliation with LPL Financial, offers clients a suite of services that span investment management, retirement planning, and insurance. Familiarizing yourself with these offerings can help you contextualize the investments in your own portfolio and determine if the strategy recommended to you was truly in your best interest. For example, was a complex, high-fee product pushed on you when a simpler, more cost-effective option was available? Were the risks properly explained, or were you only told about the potential upside? These are the kinds of questions that can arise when you take a closer look at the services offered. Below is a breakdown of the primary services he provides to clients.

At the core of his services, Brian Lesley provides investment planning using a variety of financial instruments. This includes common securities like stocks, bonds, and mutual funds, as well as more specialized tax-advantaged investments. While these are standard tools for wealth management, each carries a distinct level of risk. A broker has an obligation to ensure that the specific investment issues and risks associated with any product are fully disclosed and that the investment is suitable for the client. A portfolio heavily weighted in high-risk stocks, for example, may be inappropriate for an individual nearing retirement who needs to preserve capital.

Planning for long-term goals like retirement and education is a cornerstone of financial advising. Brian Lesley offers guidance on a number of accounts designed for these purposes, including Traditional and Roth IRAs, SIMPLE IRAs, and annuities. For education savings, he provides options like Coverdell Education IRAs and 529 Plans. These accounts are powerful tools for securing your future, but they can also be mishandled. An unsuitable annuity with high fees and long surrender periods, for instance, can lock up your funds and damage your retirement prospects, making it a poor choice for someone who needs liquidity.

To round out his financial planning services, Brian Lesley also offers insurance products, such as life insurance, disability insurance, and long-term care insurance. These are often presented as essential components for protecting your assets and providing a safety net. While insurance can be a vital part of a financial plan, these products can also be complex and expensive. It’s important that any recommendation for an insurance product is based on a genuine need and not on the high commissions it might generate for the broker. A holistic approach should always prioritize your financial security above all else.

When you entrust your financial future to a broker, you expect them to act with your best interests at heart. Unfortunately, that doesn’t always happen. Examining customer complaints filed against a broker can offer valuable insight into their practices. A recent complaint filed with the Financial Industry Regulatory Authority (FINRA) against Brian Lesley of LPL Financial brings to light serious allegations that every investor should understand.

The claims against Mr. Lesley touch on two critical areas of an investor’s rights: the suitability of investments and the authority of a broker to make trades. These aren’t just minor disagreements; they represent fundamental duties a financial professional owes to their clients. Understanding the specifics of these allegations can help you recognize potential red flags in your own investment accounts and know what to look for when working with a financial advisor. Let’s break down the key issues raised in the complaint.

One of the core allegations against Brian Lesley is that he recommended unsuitable investments. The complaint specifies that these included debt securities that were not appropriate for the customer’s financial situation or goals. An “unsuitable” investment is one that doesn’t align with your risk tolerance, objectives, age, or overall financial profile. Brokers have a regulatory obligation to know their clients and recommend products that fit their specific needs. When they suggest high-risk products to conservative investors or illiquid investments to those needing access to their cash, they may be committing broker fraud and negligence. This type of misconduct can lead to significant and unexpected financial losses.

The complaint also raises concerns about unauthorized trading. According to the filing, the customer claims that Mr. Lesley sold stocks in their account without their permission and in a way that did not serve their best interest. Unless you have given your broker discretionary authority in writing—which allows them to make trades without your prior approval—they must get your consent for every transaction. Unauthorized trading is a serious violation of industry rules and investor trust. It can completely undermine your investment strategy and may be a sign that a broker is churning your account to generate commissions rather than working to grow your portfolio.

It’s important to note that this customer complaint is currently pending. This means that FINRA is actively reviewing the allegations, and a final decision has not yet been reached. The process can involve gathering evidence, hearing from both parties, and determining if any rules were violated. For investors, a pending complaint on a broker’s record is a significant piece of information. While an allegation is not proof of wrongdoing, it signals a potential issue that warrants caution. If you find yourself in a similar situation, understanding the securities arbitration process is a crucial step toward protecting your rights and potentially recovering your losses.

Before you entrust anyone with your hard-earned money, it’s essential to do your homework. A little research upfront can save you from significant financial and emotional distress down the road. Taking the time to vet a potential broker or financial advisor is one of the most important steps you can take to protect your investments. Fortunately, there are free and reliable tools available that make this process straightforward, giving you a clear picture of who you’re about to work with. Think of it as a background check for your financial future, putting you in control of your decisions.

One of the most powerful resources at your disposal is FINRA’s BrokerCheck. This is a free tool that gives you a detailed look into the professional history of brokers and investment advisors. You can see a person’s employment history, their certifications, licenses, and, most importantly, any regulatory actions, violations, or customer complaints filed against them. BrokerCheck provides a comprehensive overview of a broker’s professional background, which is exactly what you need to make an informed decision. It’s a simple first step that can reveal critical information you wouldn’t find otherwise.

Using BrokerCheck is simple. You can search by a broker’s name or their unique CRD (Central Registration Depository) number. The report will show you their past jobs, any special training or certifications they hold, and the licenses that permit them to give investment advice. Pay close attention to the disclosure section, which details any past customer disputes, disciplinary actions, or legal issues. This information is crucial for assessing the reliability and trustworthiness of a broker. A long history of complaints related to issues like broker fraud and negligence is a major red flag that shouldn’t be ignored.

Your research shouldn’t stop with an online search. When you meet with a potential broker, come prepared with questions. Don’t be afraid to ask directly about their experience, their investment philosophy, and how they get paid. You should also ask about any disclosures or complaints you found on their BrokerCheck report. Their willingness to discuss these issues openly can tell you a lot. If a broker is evasive or dismissive of your concerns, that’s a sign to walk away. If you’ve already lost money because of a broker’s actions, you should contact a securities attorney for a clear understanding of your situation and options.

When you entrust your money to a financial professional, you aren’t just hoping for the best—you are protected by a specific set of rights. These rules and regulations exist to ensure that brokers and financial advisors act responsibly and prioritize your financial well-being. Understanding these rights is your first line of defense against potential misconduct. It empowers you to ask the right questions, spot red flags, and take action if you feel something isn’t right. The financial industry can seem complex, but your rights as an investor are straightforward and designed to keep you safe.

They are built on principles of fairness, transparency, and accountability. Key among these is the right to receive recommendations that are genuinely in your best interest, not just profitable for your broker. You also have the right to access clear, honest information about a broker’s professional history and the investments they suggest. Knowing these fundamentals helps you build a more secure financial future and provides a clear path forward if you ever encounter issues with broker fraud and negligence. Being aware of your rights transforms you from a passive client into an active, informed participant in your financial journey.

A key rule designed to protect you is called Regulation Best Interest (Reg BI). In simple terms, this regulation requires brokers to put your interests ahead of their own. They cannot recommend an investment product just because it pays them a higher commission or helps them meet a sales quota. Their advice must be based on a solid understanding of your personal financial situation, investment goals, and tolerance for risk. This means every recommendation should be made with your financial well-being as the primary goal, ensuring the advice you receive is tailored to you.

The Financial Industry Regulatory Authority (FINRA) is an independent organization that oversees brokerage firms in the U.S. to protect investors. One of the most powerful tools it provides is BrokerCheck, a free online database. You can use this tool to research the professional history of any broker or investment advisor. BrokerCheck gives you access to their employment history, licenses, certifications, and—most importantly—any customer complaints or disciplinary actions. A quick search can provide valuable peace of mind or reveal critical red flags before you invest a single dollar.

Beyond acting in your best interest, a broker has an obligation to recommend investments that are suitable for you. This means they must have a reasonable basis for believing a particular stock, bond, or fund aligns with your specific circumstances. For example, recommending a high-risk, speculative stock to a retiree who depends on a stable income would likely be considered an unsuitable recommendation. If a broker suggests investments that don’t match your financial profile or risk tolerance, they may be violating their duties. These situations are central to many investment issues that require legal attention.

It’s easy to feel intimidated when discussing finances, but you should never feel pressured or confused by the person managing your money. A trustworthy broker will prioritize your financial well-being and communicate clearly. When that trust is broken, the consequences can be devastating. Recognizing the warning signs of misconduct is the first step toward protecting your assets. These red flags aren’t just about a broker having a bad day; they can point to serious issues like negligence or even fraud. Paying attention to these behaviors can help you identify problems early and take action before significant losses occur.

Feeling rushed to make a significant investment decision is a major red flag. A broker should give you ample time and information to feel comfortable, not create a false sense of urgency. Another serious concern is when a broker suggests investments that don’t align with your financial goals, age, or risk tolerance. For example, a recent complaint against broker Brian Lesley of LPL Financial alleged he recommended unsuitable investments, including debt securities. This type of broker fraud and negligence occurs when a broker prioritizes their own commission over your financial security, placing your capital in inappropriately risky positions. Your portfolio should always be a reflection of your personal financial situation, not your broker’s sales targets.

Take a close look at your account statements. Do you see a lot of buying and selling that you don’t understand or didn’t authorize? This could be a sign of “churning,” a practice where a broker makes excessive trades solely to generate commissions for themselves. The complaint against Brian Lesley also included a claim that he sold stocks without acting in the customer’s best interest. This is a direct violation of a broker’s duty to you. Frequent, unexplained trading activity that doesn’t seem to benefit your portfolio’s performance is a clear warning sign of potential investment issues that require immediate attention.

You have a right to know exactly what you’re paying for and the risks involved with any investment. If your broker is vague about fees, commissions, or the potential downsides of a product, proceed with caution. They should be able to explain their compensation structure and the risks in a way that is easy to understand. A lack of transparency can hide conflicts of interest or excessive costs that eat away at your returns. If you find it difficult to get straight answers or feel that information is being withheld, it may be time to seek a second opinion. If you have questions about your broker’s conduct, you can always contact us for guidance.

Realizing that something might be wrong with your investments is a deeply unsettling feeling. You’ve placed your trust—and your financial future—in the hands of a professional, and now you’re questioning their actions. It’s easy to feel overwhelmed or unsure of where to turn. The most important thing to remember is that you have rights, and there are clear, actionable steps you can take to protect yourself.

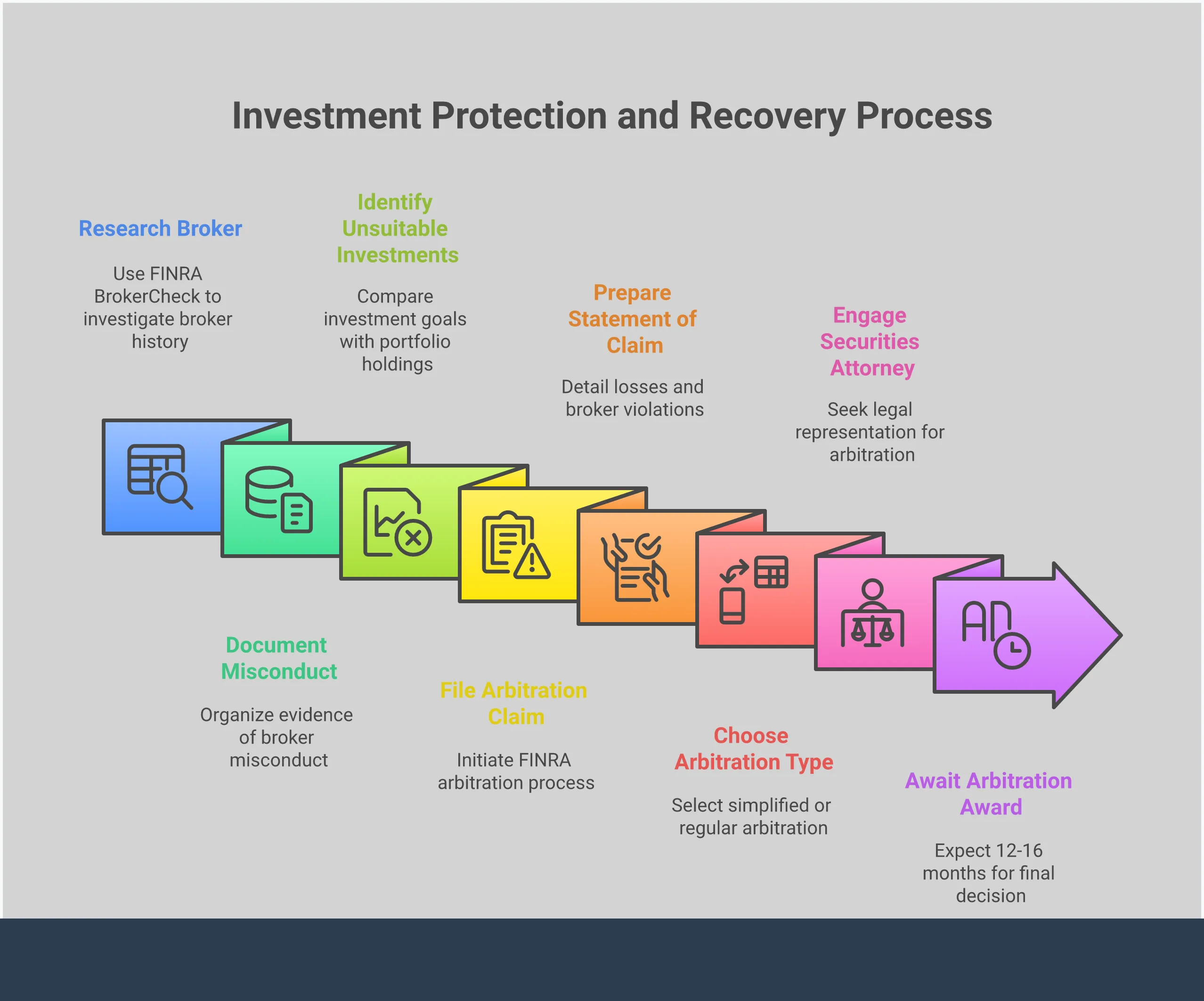

Taking immediate and organized action is key. The initial steps you take can significantly impact your ability to address the situation and potentially recover your losses. Instead of letting uncertainty paralyze you, focus on gathering information and understanding your options. This process begins with meticulous record-keeping and familiarizing yourself with the proper channels for raising your concerns. By approaching the situation methodically, you can build a strong foundation for any action you may decide to take later. The following steps will guide you through what to do if you suspect your broker has engaged in misconduct.

Your first move should be to gather and organize every piece of paper and digital communication related to your account. Think of yourself as a detective building a case file. This documentation is your most powerful tool, serving as crucial evidence if you pursue a complaint. Keep a detailed record of all conversations, including dates, times, and notes on what was discussed. Save all emails, account statements, trade confirmations, and any promotional materials your broker gave you. This paper trail helps create a clear timeline and can highlight inconsistencies or unauthorized actions. Having organized records is fundamental to addressing cases of broker fraud and negligence.

Once you have your documents in order, it’s helpful to understand the formal avenues for reporting misconduct. The Financial Industry Regulatory Authority (FINRA) is the primary regulator for brokerage firms in the United States. You can use their free BrokerCheck tool to review your broker’s employment history, credentials, and any past disciplinary actions. While you can file a complaint directly with FINRA, it’s often wise to first seek legal advice. An attorney can help you understand the complexities of the process and determine the most effective strategy for your specific situation, which may involve a securities arbitration claim to recover your losses.

Time is of the essence when you suspect investment misconduct. Strict deadlines, known as statutes of limitation, govern how long you have to file a legal claim. If you wait too long, you could lose your right to pursue recovery, regardless of how strong your case is. The clock often starts ticking from the date you discovered the issue—or reasonably should have discovered it. Because these timelines can be complex and vary depending on the circumstances, it’s critical to act promptly. Speaking with a securities attorney can help you understand the specific deadlines that apply to your case and ensure you don’t miss your window of opportunity to take action.

Discovering that you’ve lost money due to your broker’s actions can be incredibly disheartening, but it’s important to know that you have pathways to seek recovery. If you suspect misconduct, you don’t have to accept the losses without a fight. There are established procedures designed to help investors address grievances and reclaim their hard-earned capital. Taking the right steps can make a significant difference in the outcome of your situation. Understanding these options is the first step toward holding responsible parties accountable and working to make yourself whole again.

If you’ve suffered investment losses because of a broker’s poor advice or negligence, you may be able to recover them through the securities arbitration process. Think of it as a more streamlined and less formal alternative to a lengthy court battle. In arbitration, you present your case to a panel of impartial arbitrators who listen to both sides of the dispute. They then make a final, binding decision. This process is often faster and more efficient than traditional litigation, allowing investors to resolve their claims and move forward without getting tied up in the court system for years. It’s a common and effective way to handle disputes within the securities industry.

When you feel a broker hasn’t acted in your best interest, you have several legal remedies available. One common route is filing a claim with the Financial Industry Regulatory Authority (FINRA), the self-regulatory body for the brokerage industry. This can initiate an arbitration proceeding to resolve your dispute. It’s crucial to understand your rights as an investor and the different avenues you can pursue to recover your losses. Whether you’re dealing with unsuitable recommendations or other forms of broker fraud and negligence, knowing your options empowers you to take effective action and protect your financial future from further harm.

You don’t have to go through this process alone. Working with a qualified securities attorney can greatly improve your chances of recovering your investment losses. A lawyer who understands this specific area of law can guide you through the complexities of the arbitration process, help you gather the right documents, and build a strong case on your behalf. They act as your advocate, ensuring your story is heard and your interests are effectively represented. Many firms offer initial consultations to help you understand your situation and potential next steps. If you believe you have a claim, it’s worth it to contact a legal professional to discuss your case.

What does a “pending” complaint on a broker’s record actually mean? A pending complaint means that an allegation of wrongdoing has been formally filed and is currently under review by regulators like FINRA. It is not a final judgment or proof of misconduct. However, you should view it as a serious warning sign. It indicates that another client has raised significant concerns about the broker’s practices, which is important information to consider when evaluating your own relationship with that advisor.

How can I tell if an investment was truly “unsuitable” for me? An unsuitable investment is one that doesn’t match your specific financial situation, goals, or ability to handle risk. For example, if you told your broker you were a conservative investor saving for retirement in five years, a portfolio filled with speculative, high-risk stocks would likely be unsuitable. The key is whether the recommendation made sense for you personally, not whether it was a “good” or “bad” investment in general.

What’s the difference between a normal investment loss and actual broker misconduct? Losing money is an inherent risk in investing, and not every loss is the result of misconduct. The market goes up and down. Misconduct, on the other hand, involves a broker violating their professional duties. This could mean they recommended an unsuitable product, traded in your account without your permission, or misrepresented the risks of an investment. The focus is on the broker’s actions and whether they were negligent or fraudulent, not just on the investment’s performance.

My broker works for a large, reputable firm. Can misconduct still happen? Yes, absolutely. While large firms have compliance systems in place, they don’t catch everything, and individual brokers can still engage in improper behavior. A firm’s well-known name doesn’t guarantee that every one of its advisors is acting in their clients’ best interests. That’s why it’s so important to research your individual broker’s history and pay close attention to your own accounts, regardless of the company they work for.

What should I do if I suspect my broker is churning my account? If you notice excessive trading on your account statements that you didn’t authorize or that doesn’t seem to have a clear strategy, you should take action immediately. Start by gathering all your account statements and trade confirmations to create a clear record of the activity. The next step is to have this trading history reviewed by a securities attorney who can help determine if the activity was done simply to generate commissions at your expense.