NO FEES UNTIL WE WIN

FREE CONSULTATION

NO FEES UNTIL WE WIN

FREE CONSULTATION

On the surface, an advisor’s record can seem impeccable, filled with decades of experience and recognition from respected financial publications. But a deeper look can sometimes uncover red flags that every investor should know how to spot. Customer disputes and allegations of misconduct provide crucial insight into an advisor’s practices. The professional background of Merrill Lynch, Pierce, Fenner & Smith Broker Reed Smith presents such a scenario. While his career is marked by numerous awards, it is also shadowed by serious client allegations. This article examines his history to help you understand how to evaluate your own advisor beyond the polished credentials.

If you’ve invested with Reed Smith of Merrill Lynch or are considering his services, it’s important to have a clear picture of his professional background. As a financial advisor based in Houston, Texas, he has a long history in the industry. Understanding a broker’s career, their team’s structure, and their overall experience provides crucial context for any investor. This information can help you make more informed decisions about who manages your money and how to address any concerns that may arise.

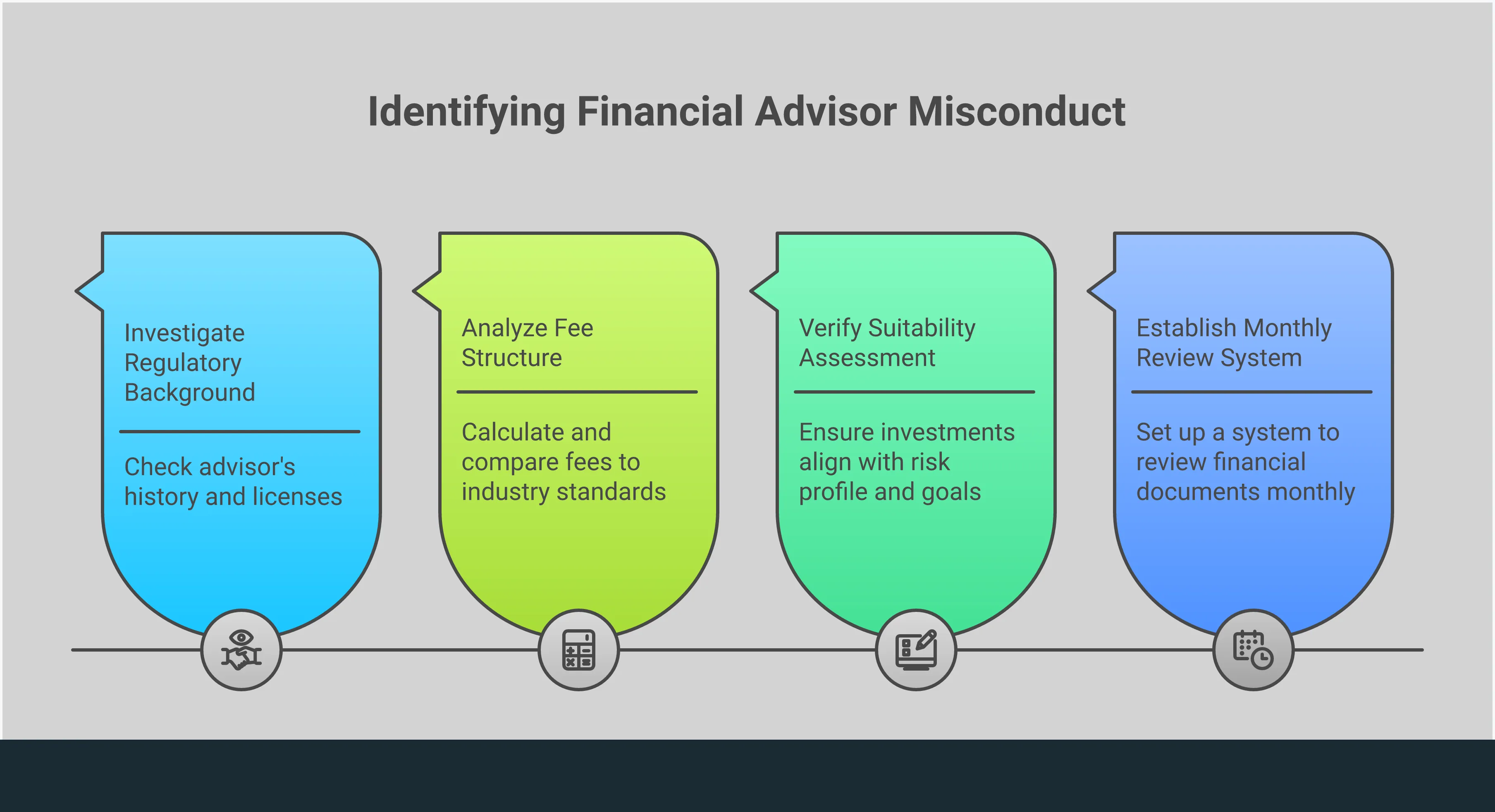

When you entrust your financial future to an advisor, you have a right to know their professional history. Examining a broker’s background is a fundamental step in protecting your assets from potential broker fraud and negligence. Let’s look at the publicly available details of Reed Smith’s career.

Reed Smith has been a registered broker with Merrill Lynch, Pierce, Fenner & Smith Incorporated since 1996. His continuous registration with the same firm for over two decades is a significant part of his professional record. For investors, a broker’s employment history can offer insights into their stability and experience within a particular corporate culture. It also provides a clear timeline to review when looking into their client service record and any disclosures that may have been filed during their tenure. This long-standing association with a major financial institution like Merrill Lynch is a key element of his professional identity.

Reed Smith conducts his business as part of the Smith Warren and Associates team, which is a group of Merrill financial advisors located in Houston, TX. This team offers clients a suite of financial and wealth management services. It’s common for advisors at large firms to work in teams to manage client relationships and provide comprehensive financial guidance. The services provided by such teams often cover a wide range of complex investment issues, from portfolio management to retirement planning. Understanding this team structure helps clarify who may be involved in handling your accounts and making investment decisions on your behalf.

Reed Smith’s career in the financial industry spans more than 30 years. According to his public records, he has been in practice for 31 years, with the last 15 years spent registered at Bank of America, N.A., the parent company of Merrill Lynch. This extensive history means there is a long track record available for review by clients, regulators, and legal professionals. An advisor’s decades-long career provides a substantial amount of data, including their history of client interactions, investment strategies, and any customer disputes or regulatory actions that may have occurred over the years. This history is essential for a complete evaluation of an advisor’s professional conduct.

Understanding the services a financial advisor offers is the first step in evaluating whether their actions were appropriate for your financial situation. Advisors at large firms like Merrill Lynch typically provide a comprehensive suite of services aimed at managing and growing wealth. Reed Smith and his team, Smith Warren and Associates, position themselves as offering a “boutique-style” service model within the larger corporation. This often means promising personalized attention across various financial disciplines.

These services generally cover everything from day-to-day investment decisions to long-term legacy planning. However, when an advisor fails to tailor these services to a client’s specific needs, it can lead to significant financial harm. If you’ve worked with an advisor and suspect their recommendations weren’t right for you, it’s important to understand what they were supposed to be doing on your behalf. This knowledge is crucial when considering legal action like securities arbitration.

Wealth management is an umbrella term for a wide range of financial services combined into one. For high-net-worth individuals, this often includes investment management, retirement planning, and even philanthropic guidance. The goal is to create a holistic strategy that addresses all aspects of a client’s financial life. When managed correctly, this approach can be beneficial. However, problems arise when advisors recommend products or strategies that generate high commissions for them but are not in the client’s best interest. This can be a clear example of potential broker negligence.

At its core, the role of a financial advisor like Reed Smith involves providing investment and portfolio advice. This means helping you select, buy, and sell securities like stocks, bonds, and mutual funds to build a portfolio that aligns with your goals and risk tolerance. According to his public records, Reed Smith has been a financial advisor for over three decades, a career that involves countless investment decisions for clients. A key responsibility in this role is to perform due diligence on investments and ensure they are suitable. When an advisor fails this duty, investors may suffer preventable losses from problematic investment issues.

Planning for retirement and the transfer of wealth are critical services offered by financial advisors. This involves creating long-term strategies to ensure you have enough money to live comfortably in your later years and can pass on your assets as you wish. Merrill Lynch specializes in providing these services, which include asset management and estate planning guidance. These are areas where trust is paramount, as the decisions made can affect your family for generations. An advisor who mismanages retirement funds or provides poor estate planning advice can jeopardize your entire financial future, leaving you with little recourse outside of legal help.

A fundamental service any financial advisor should provide is a thorough assessment of your financial situation and tolerance for risk. This process informs every subsequent recommendation. The structure and fee models at large brokerage firms like Merrill Lynch can sometimes create conflicts of interest. A proper risk assessment should be an ongoing conversation, not a one-time questionnaire. If an advisor pushes you into high-risk investments that don’t match your stated comfort level, it may be a case of unsuitability. If you feel your concerns were ignored, it may be time to contact a lawyer to review your options.

When you place your financial future in the hands of an advisor, you expect them to act with your best interests at heart. Unfortunately, that doesn’t always happen. Even advisors with long careers and affiliations with major firms like Merrill Lynch can face serious allegations from clients. Reed Smith is one such broker. A review of his record reveals customer complaints that raise questions about his practices.

For any investor, seeing a complaint on a broker’s record is a significant red flag. These aren’t just minor disagreements; they often involve claims of financial harm due to a broker’s actions or recommendations. The allegations against Reed Smith touch on some of the most common and damaging types of broker fraud and negligence, including providing unsuitable investment advice and misrepresenting information. Understanding the specifics of these complaints can help you recognize similar issues in your own portfolio and know when it’s time to seek help.

One of the most serious duties a financial advisor has is to recommend investments that are suitable for their client’s specific situation. This means considering your age, financial goals, risk tolerance, and overall portfolio. A recent customer complaint filed against Reed Smith alleges that he failed to do this. The client claims that Smith recommended unsuitable investments, specifically pointing to debt-related products. When a broker pushes an investment that is too risky or doesn’t align with your objectives, it can lead to significant and unexpected losses. This type of action can be a breach of their duty to you as a client.

Trust is the foundation of the client-advisor relationship, and that trust is broken when a broker misrepresents information. The same complaint against Reed Smith includes claims of misrepresentation, alleging that he made false statements about money transfers and trading activities. According to the filing, these misrepresentations occurred over a 14-year period, from 2007 to 2021, and even appeared on monthly statements. Misrepresentation can conceal poor investment performance, hide unauthorized trades, or cover up other wrongful actions. If you suspect the information you’re receiving isn’t accurate, it’s a serious concern that warrants further investigation into potential investment issues.

Financial advisors and the firms they work for are governed by strict industry rules. One of the most important is the SEC’s Regulation Best Interest (Reg BI), which legally requires brokers to place their client’s interests ahead of their own. This means they cannot recommend a product just because it earns them a higher commission. The allegations of unsuitability and misrepresentation against Reed Smith stand in direct conflict with the principles of this rule. When disputes like this arise, they are often resolved through a process known as securities arbitration, which is a formal way to hold brokers and their firms accountable for misconduct.

Despite these serious allegations, Reed Smith continues to work as a financial advisor in Houston, Texas. It’s important for investors to understand that a customer complaint does not automatically result in a broker losing their license. The regulatory process can be slow, and firms may not take immediate action. This reality underscores why investors must be their own advocates. If you have experienced losses because of advice that seemed unsuitable or have noticed inconsistencies in your account statements, it’s crucial to take action. You have the right to question your advisor’s conduct and seek a professional opinion on your legal options.

When you’re vetting a financial advisor, their qualifications and industry recognition are often the first things you look at. These accolades can paint a picture of a successful and respected professional, and on paper, Reed Smith has a history of receiving industry awards and holds significant experience in the financial sector.

It’s important to remember, however, that awards and a long career don’t always tell the full story. Even advisors with impressive resumes can face customer disputes or engage in practices that lead to investor losses. Understanding the full scope of an advisor’s professional life, including both their achievements and any history of broker fraud and negligence, is key to protecting your financial future. Let’s look at the credentials and awards that have marked Reed Smith’s career.

Industry publications often compile lists to recognize top-performing financial advisors, and Reed Smith has appeared on several of these. According to his public record, he was named to Barron’s “America’s Top 1200 Financial Advisors State-by-State” list for nine consecutive years, from 2014 to 2022. This type of consistent recognition suggests a strong performance record within the industry.

In addition to the Barron’s features, Smith was also included on the Financial Times “400 Top Financial Advisers” list in 2017. These awards are often based on factors like assets under management, revenue generated, and the advisor’s regulatory record, highlighting his standing among peers in the financial community during those years.

Experience is another critical factor investors consider. Reed Smith has been in the financial services industry for over three decades. His record shows he has spent a significant portion of his career, the last 15 years, registered with Merrill Lynch, Pierce, Fenner & Smith Incorporated. A long tenure at a major firm like Merrill Lynch often indicates a deep familiarity with the firm’s products and wealth management systems.

While extensive experience can be a positive indicator, it doesn’t make an advisor immune to causing investment issues for their clients. It’s crucial for investors to look beyond the years of service and published awards to get a complete picture of an advisor’s practices and history.

When you entrust your financial future to an advisor, it’s vital to understand their methods and philosophy. Reed Smith and his team at Smith Warren and Associates operate under the Merrill Lynch umbrella, which has a distinct approach to wealth management. Knowing the specifics of their service model, fee structure, and any past client issues can help you make more informed decisions about your own portfolio and financial partnerships. Let’s look at the key components of his approach.

Reed Smith’s team, Smith Warren and Associates, markets its services as “boutique-like.” This approach typically means working with a select number of individuals and families to provide a highly personalized and detailed level of service. For clients, this can translate to more direct access to their advisor and financial strategies tailored specifically to their goals. The idea is to offer the resources of a large firm like Merrill Lynch but with the focused attention you might expect from a smaller, specialized practice. This model is built on creating close, long-term relationships with clients to manage their wealth across generations.

As a Merrill Lynch financial advisor, Reed Smith has access to a wide array of services, including investment management, retirement planning, and tax strategies. However, it’s worth noting that Merrill Lynch’s fee structures can sometimes be complex and are often considered to be on the higher end of the industry average. Understanding the full scope of advisory fees, transaction costs, and other charges is a critical step for any investor. Unclear or unexpectedly high fees can impact your returns over time, making transparency a key factor in any advisor relationship and one of many potential investment issues to watch for.

Even with a stated commitment to personalized service, client disputes can arise. A customer complaint was filed against Reed Smith on May 21, 2024, which is currently pending. The core of the allegation is that Smith recommended investments that were not suitable for the client’s needs and objectives. An advisor has a responsibility to recommend investments that align with your risk tolerance, financial situation, and goals. When they fail to do so, it can be a serious instance of broker fraud and negligence. This type of complaint serves as an important reminder to always review your portfolio and question strategies that don’t seem right for you.

What exactly is an “unsuitable” investment? An unsuitable investment is one that doesn’t match your personal financial situation, goals, or tolerance for risk. Your advisor has a duty to understand these factors before recommending any product. For example, placing a retiree who needs stable income into a highly speculative and risky investment would likely be considered unsuitable. It’s not about whether the investment made or lost money, but whether it was appropriate for you in the first place.

If an advisor has awards and a long career, doesn’t that mean they’re trustworthy? While industry awards and decades of experience can suggest a successful career, they don’t guarantee that an advisor will always act in your best interest. These accolades are often based on factors like the amount of money the advisor manages, not necessarily on client satisfaction or ethical conduct. That’s why it’s so important to look at the complete picture, including any customer complaints or disciplinary actions, rather than relying on awards alone.

Why is a single customer complaint considered a serious red flag? A formal customer complaint isn’t just a minor disagreement; it’s a serious allegation that often involves significant financial losses. The process to file a complaint is complex, so when a client takes that step, it usually means they believe serious misconduct occurred. It indicates a potential pattern of behavior, and for any investor, it serves as a critical warning to review your own accounts and interactions with that advisor carefully.

My account statements seem confusing or inaccurate. What could that mean? Inconsistencies or confusing information on your account statements should never be ignored. While it could be a simple error, it can also be a sign of a deeper problem, such as misrepresentation or unauthorized activity. An advisor might use confusing statements to hide poor investment performance or unauthorized trades. Trust your instincts—if something doesn’t look right, you have every right to ask for a clear explanation and seek a second opinion.

What should I do if I suspect my financial advisor has given me bad advice? If you believe your advisor’s recommendations have caused you financial harm, the first step is to gather all your relevant documents, including account statements and communications with your advisor. It’s important not to make any rash decisions with your portfolio. The next step is to get a professional review of your situation from a securities law firm to understand your legal options for recovering your losses.