Discovering that your financial advisor is the subject of customer complaints can be unsettling. It’s a situation that calls for clarity, not confusion. For clients of LPL Financial, LLC Broker Shannon Moore, recent allegations of unsuitable investment advice have created uncertainty. A pending dispute seeks $200,000 in damages related to a real estate investment a client claims was inappropriate for their financial situation. This isn’t just an isolated incident; it points to a pattern of concerns that investors need to understand. This article breaks down the timeline of these complaints, explains what constitutes “unsuitable” advice, and provides clear, actionable steps for what to do if you’re worried about your own investments.

Key Takeaways

- Scrutinize Your Portfolio for Unsuitable Investments: The core issue in the complaints against Shannon Moore involves recommendations that didn’t fit the client’s financial situation. Regularly review your own investments to ensure they align with your stated risk tolerance and goals, especially if they are concentrated in complex or illiquid assets.

- Independently Verify Your Advisor’s Record: A friendly personality doesn’t guarantee sound financial advice. Use FINRA’s BrokerCheck tool to get an objective look at your advisor’s professional history, including any customer disputes or disciplinary actions, to make a fully informed decision.

- Know Your Rights When You Suspect a Problem: If you believe you’ve lost money due to poor advice, you have options. You can hold your advisor and their firm accountable by pursuing a claim through established channels like FINRA securities arbitration to recover your losses.

Who is Shannon Moore of LPL Financial?

If you’ve worked with Shannon Moore or are considering it, understanding his professional background and business affiliations is a critical first step. Knowing who you are trusting with your financial future is essential for any investor. Mr. Moore is a financial advisor who has been the subject of customer complaints, making it especially important for his current and potential clients to be fully informed.

What is His Professional Background?

Shannon Dwain Moore is a financial advisor and stockbroker based in Jefferson City, Tennessee, with 26 years of experience in the financial industry. He is currently registered with LPL Financial LLC. When you partner with an advisor, you place significant trust in their professional judgment and integrity. It’s this trust that makes potential instances of broker fraud and negligence so damaging to an investor’s financial health and peace of mind. An advisor’s history, including any disputes or complaints filed against them, provides a fuller picture of their professional conduct and how they have handled client relationships in the past.

How is He Affiliated with First Peoples Bank?

It’s also important to understand the different names associated with his practice. While Shannon Moore is an advisor with LPL Financial, he also conducts business as Moore Investment Services and First Peoples Financial Services. He is a financial advisor located at First Peoples Bank. This structure is fairly common in the industry—an advisor works from a local bank while being affiliated with a larger, national broker-dealer like LPL. For investors, this can sometimes create confusion about who is responsible for oversight and which entity is accountable if investment issues arise from the advice given.

What Services Does Shannon Moore Reportedly Offer?

Based in Jefferson City, Tennessee, Shannon Moore operates as a financial advisor for LPL Financial, also doing business as Moore Investment Services and First Peoples Financial Services. To his clients, he presents a broad suite of financial services designed to cover nearly every stage of an investor’s life. The services offered are typical for a financial advisor and are meant to help individuals and families manage their money, plan for the future, and build wealth over time.

From managing investment portfolios to detailed retirement planning, the scope of his practice appears comprehensive. This wide range of services positions him as a one-stop shop for financial guidance. For many investors, finding an advisor who can handle everything from college savings to estate strategies feels convenient and secure. However, it’s crucial to understand exactly what these services entail and the responsibilities an advisor has to you, the client, when providing them. When an advisor offers guidance across so many critical areas of your financial life, the quality and suitability of that advice are paramount.

Investment and Portfolio Management

At its core, investment and portfolio management is about growing your money. An advisor in this role helps you select and manage a mix of investments—like stocks, bonds, and mutual funds—that align with your financial goals and comfort with risk. As an LPL Financial advisor, Shannon Moore provides these services, guiding clients on where to put their money. This relationship is built on the trust that your advisor is acting in your best interest. When that trust is broken through poor recommendations or mismanagement, it can lead to serious financial harm. Understanding the signs of broker fraud and negligence is a key step in protecting your assets.

Retirement and Financial Planning

According to his firm’s website, Moore Financial Services provides extensive financial planning, including “retirement planning services, estate planning strategies, planned giving, [and] college planning.” These are critical services that shape your family’s long-term security. Planning for retirement or a child’s education requires careful, prudent advice tailored to your specific circumstances. Investors rely on their advisor to create a sound strategy to meet these future needs. When the advice given is inappropriate or leads to losses, it can jeopardize your entire financial future. These situations are among the most common investment issues that require legal attention to resolve.

Real Estate Investment Advice

Beyond traditional stocks and bonds, Shannon Moore also reportedly provides advice on real estate investments. While real estate can be a valid part of a diversified portfolio, some real estate ventures carry significant risk. According to reports from former clients, Moore recommended real estate investments that were not a good fit for their financial situations. When an investment is not aligned with a client’s age, income, or risk tolerance, it is known as an “unsuitable” recommendation. Disputes over unsuitable investments are often resolved through securities arbitration, a process designed to help investors recover losses caused by improper financial advice.

What Are the Allegations Against Shannon Moore?

Understanding the specific claims against a financial advisor is a critical step for any investor. Publicly available records and recent complaints outline a pattern of concerns related to Shannon Moore’s investment recommendations, particularly involving real estate. These allegations center on the idea that the advice given was not appropriate for the client’s financial situation or risk tolerance. When an advisor recommends an investment that doesn’t align with your goals, it can lead to significant financial harm.

The complaints filed against Moore raise serious questions about the suitability of her investment strategies. For investors who worked with her, reviewing these allegations can provide context for their own experiences and help them decide on the next steps to protect their assets. It’s a reminder that all investors have the right to receive advice that is genuinely in their best interest. If you feel your portfolio has suffered due to questionable recommendations, exploring the details of similar complaints can be an informative first step. These are not just abstract legal filings; they represent real people who trusted an advisor with their financial future, only to face potential losses. Examining these situations can help you identify similar red flags in your own interactions and understand that you are not alone in your concerns.

The $200,000 Real Estate Investment Dispute

A significant complaint has been filed against Shannon Moore, seeking $200,000 in damages. According to reports, this claim stems from a real estate investment that the client alleges was inappropriate for their financial needs. This type of dispute is common when an investor is placed in a high-risk or illiquid asset that doesn’t match their stated objectives. The amount requested in damages reflects the substantial losses the client claims to have suffered as a direct result of following Moore’s advice. This pending case highlights the serious financial consequences that can arise from unsuitable investment guidance and serves as a stark reminder of the importance of diligent oversight of your portfolio.

Claims of Unsuitable Investment Advice

The core of the issue in the complaints against Shannon Moore revolves around claims of unsuitable investment advice. An unsuitable recommendation occurs when a broker suggests a product that is not consistent with the client’s financial profile, including their age, income, and risk tolerance. In this case, customers allege that Moore recommended problematic real estate investments that were not a good fit for them. These types of investments can often be complex and carry risks that may not have been fully disclosed, leaving investors exposed to unexpected losses. Financial professionals have a duty to recommend only suitable products to their clients, and a failure to do so can be a form of negligence.

A Timeline of Investor Complaints

The allegations against Shannon Moore are not isolated to a single event. According to her public disclosure records, a new complaint was filed in June 2024 concerning a real estate investment she recommended back in 2016. This followed another complaint from May 2024, also related to a risky real estate venture, though that claim was later withdrawn. This timeline suggests a potential pattern of similar recommendations that have led to client disputes over several years. For investors, seeing a history of complaints can be a crucial piece of information when evaluating their own situation and considering whether they may have grounds for a securities arbitration claim.

What Do Client Reviews Reveal?

When you’re evaluating a financial advisor, looking at what other clients have to say can offer some insight. However, it’s important to look at the complete picture, from communication style to the actual investment strategies being used. Reviews for Shannon Moore show a mix of experiences, highlighting a friendly demeanor that may stand in contrast to more serious concerns about her investment advice. Understanding this contrast is key for any investor trying to protect their assets.

Reported Communication Style

Several online reviews point to a positive and direct communication style from Shannon Moore. One client mentioned she was “more than helpful when it came to explaining things,” which is a quality many people look for in an advisor. Another review praised her for telling it “like it was” and ensuring they were taken care of. This kind of feedback suggests an advisor who is responsive and clear in her day-to-day interactions. While good communication is important, it doesn’t guarantee that the financial advice itself is sound or appropriate for your specific situation. A friendly personality can sometimes mask underlying problems with an investment strategy.

Patterns in Investment Strategy

Beneath the surface of positive communication reviews, a troubling pattern regarding investment strategy appears. Shannon Moore is currently facing accusations involving an alleged $200,000 in unsuitable real estate investments. An unsuitable investment is one that doesn’t match a client’s financial goals, risk tolerance, or overall situation. Brokers have a fundamental duty to recommend products that are right for their clients, and when they fail to do so, it can lead to significant financial harm. These allegations suggest a potential disconnect between her advice and her clients’ best interests, which is a serious concern.

Common Client Concerns

The central theme in complaints against Shannon Moore is the recommendation of unsuitable real estate investments. A recent claim filed in June 2024 alleges she recommended a “bad real estate investment” back in 2016. This type of concern points to a specific area of broker fraud and negligence, where an advisor may push a particular type of product, like real estate, even when it’s too risky or illiquid for a client’s portfolio. When an advisor’s recommendations seem to follow a pattern that benefits them more than their clients, it’s a major red flag that every investor should take seriously.

What Red Flags Should Investors Look For?

Knowing what to look for can be your first line of defense in protecting your financial future. While every situation is unique, certain behaviors and recommendations from a financial advisor should make you pause and ask more questions. Trusting your intuition is important, but recognizing specific red flags is even better. These warning signs aren’t always obvious, but they often follow patterns. Understanding these patterns can help you identify potential problems before they cause significant harm to your portfolio.

The allegations against brokers like Shannon Moore highlight several common red flags. By examining these claims, we can see real-world examples of what broker fraud and negligence can look like and learn how to spot similar issues in our own financial dealings. Being an informed investor means staying vigilant and questioning advice that doesn’t feel right.

Warning Signs of Unsuitable Advice

One of the most critical responsibilities of a financial advisor is to recommend investments that align with your specific financial situation, goals, and tolerance for risk. A major red flag appears when this doesn’t happen. For instance, recent allegations claim that Shannon Moore recommended unsuitable investments to a client. This type of advice occurs when a broker suggests a product that is too risky, too complex, or simply not a good fit for the investor’s stated objectives. If your advisor is pushing an investment that seems out of sync with the long-term plan you’ve discussed, it’s time to get a second opinion.

High-Risk Real Estate Tactics

Real estate can be a valid part of a diversified portfolio, but not all real estate investments are created equal. Be cautious if an advisor recommends complex or high-risk real estate ventures, especially if they are illiquid, meaning you can’t easily sell them for cash. In Shannon Moore’s case, she faces claims of suggesting bad real estate investments that were not appropriate for her clients. These types of products can carry hidden fees and significant risks that may not be fully disclosed. It’s crucial to question any recommendation that concentrates a large portion of your money into a single, speculative venture, as these are common investment issues that can lead to major losses.

Pressure to Make Fast Decisions

A trustworthy advisor should give you ample time to review documents, ask questions, and make a thoughtful decision. If you feel rushed or pressured to act immediately, consider it a serious red flag. High-pressure tactics are designed to prevent you from doing your due diligence. A complaint filed against Shannon Moore alleges she recommended a problematic real estate investment years ago, suggesting a potential pattern of pushing clients into decisions without proper consideration. An advisor who insists you must “act now” or miss out on a “once-in-a-lifetime” opportunity may not have your best interests at heart. If you feel pressured, it may be time to speak with a securities attorney to understand your rights.

How Can You Check a Broker’s Record?

Before you entrust your hard-earned money to a financial advisor, it’s essential to do your homework. Even if you’ve worked with someone for years, performing regular checks on their professional record is a smart way to protect your investments. Think of it as a routine check-up for your financial health. Fortunately, regulators have made it straightforward for the public to access this information. Taking a few minutes to review a broker’s history can give you peace of mind or reveal critical red flags that you need to address.

This process isn’t about mistrust; it’s about being an informed and proactive investor. Understanding a broker’s background, including their employment history, qualifications, and any past disciplinary actions, empowers you to make better decisions. It helps you confirm that your advisor is who they say they are and that their record is clean. If you uncover issues, it gives you the chance to ask questions or seek different advice before a problem escalates. The tools are free, easy to use, and can save you from significant financial and emotional distress down the road.

Use FINRA’s BrokerCheck Tool

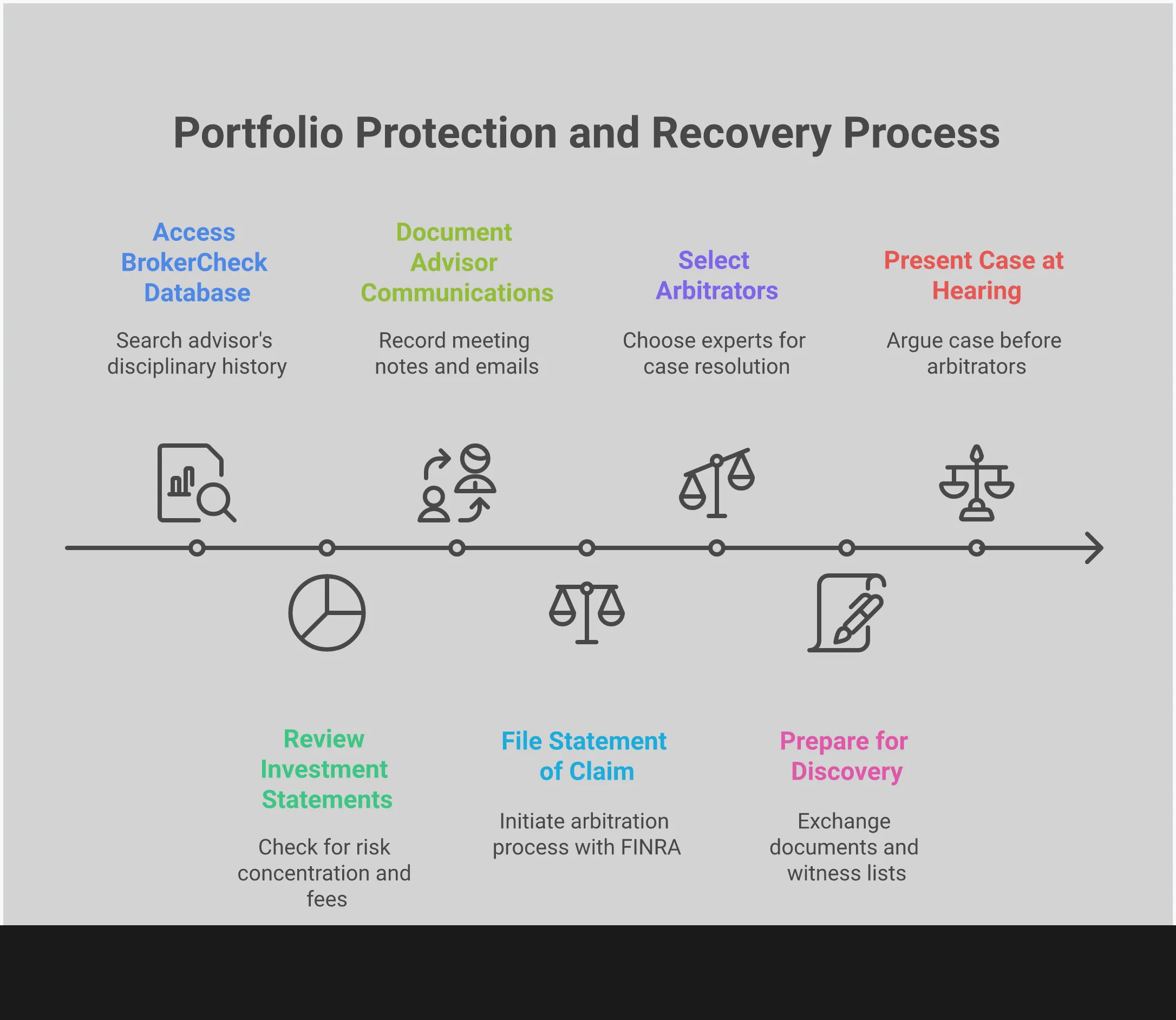

The first and most important resource for any investor is the Financial Industry Regulatory Authority’s (FINRA) BrokerCheck tool. This free online database provides a comprehensive snapshot of a broker’s professional life. As a trusted tool, BrokerCheck shows you employment history, certifications, licenses, and any violations for brokers and investment advisors. You can search by name or registration number to pull up a detailed report. This isn’t just a summary; it’s the official record that regulators use. Making this your first stop can quickly tell you if the person you’re considering has a history of broker fraud and negligence.

How to Read Disciplinary Records

When you review a BrokerCheck report, pay close attention to the “Disclosures” section. This is where you’ll find the details that matter most. BrokerCheck will tell you if a broker has ever had any violations, which can include customer complaints, regulatory actions, terminations, or even criminal charges. For example, the report for LPL advisor Shannon Moore shows a pending customer dispute alleging unsuitable investment advice. Seeing a disclosure like this is a major red flag. It allows you to assess the broker’s history and make an informed decision based on any past or pending misconduct. Don’t just skim this section—read the details carefully.

Verify Professional Licenses

Beyond disciplinary actions, a BrokerCheck report also confirms a broker’s professional licenses and registrations. This information tells you what types of investments they are legally qualified to sell. If an advisor recommends a product, you can verify they are licensed for it. This is critical because a significant number of disputes arise from unsuitable recommendations. For instance, Shannon Moore is currently facing a significant complaint for allegedly recommending an investment that wasn’t right for a client. Checking a broker’s licenses helps you ensure they are operating within their qualifications and not pushing products that fall outside their area of registration.

What Are Your Rights as an Investor?

If you’ve lost money because of a broker’s advice, it can feel overwhelming and isolating. But it’s important to remember that you have rights and clear paths you can take to seek recovery. Understanding your options is the first step toward protecting your financial future and holding your broker accountable for their actions. Whether through arbitration, legal action, or regulatory complaints, there are established systems designed to protect people just like you from financial harm caused by negligence or misconduct. You are not alone in this, and there are concrete actions you can take starting today.

Your Options in Securities Arbitration

When you have a dispute with your broker, you don’t always have to go to court. Most cases are resolved through a process called securities arbitration. This is the standard method for handling claims against brokerage firms and their advisors, managed primarily by the Financial Industry Regulatory Authority (FINRA). Think of it as a more streamlined and less formal version of a court proceeding, where your case is heard by a panel of neutral arbitrators. If you’ve experienced losses due to a broker’s actions, filing a claim through FINRA arbitration allows you to present your case for financial recovery. The decisions are typically binding, making it a definitive way to resolve your dispute.

How to Recover Investment Losses

Figuring out how to recover investment losses can be complicated, but you don’t have to do it alone. If you believe you’ve lost money due to unsuitable advice or negligence, you should talk to a lawyer who handles broker fraud and negligence cases. A legal professional can review your account statements and communications, explain your options, and guide you through the steps of building and filing a claim. They will represent your interests and work to hold the responsible parties accountable for your financial harm. Taking the step to speak with an attorney can provide you with the clarity and support needed to move forward with confidence.

File a Complaint with Regulators

In addition to pursuing a legal claim, you can and should report your experience to financial regulators. Filing a complaint helps create an official record of misconduct and can prevent the same thing from happening to other investors. A great place to start is FINRA’s BrokerCheck, a free tool that allows you to look up information on brokers and their disciplinary history. By reporting your concerns, you contribute to a system of accountability that helps regulators identify patterns of bad behavior. This formal complaint can also serve as important documentation if you decide to move forward with an arbitration claim, strengthening your case.

How Should LPL Financial Supervise Its Advisors?

Brokerage firms like LPL Financial have a fundamental duty to supervise their financial advisors. This isn’t just a suggestion; it’s a core regulatory requirement designed to protect you, the investor. When an advisor recommends an unsuitable investment or engages in misconduct, the firm itself can be held responsible for failing to adequately monitor their activities. This oversight is meant to prevent the very issues that lead to significant financial losses and disputes.

A firm’s failure to supervise can take many forms, from not reviewing an advisor’s transactions to ignoring customer complaints or other red flags. Essentially, the firm is expected to have systems in place to detect and prevent broker fraud and negligence. When those systems fail, investors may have grounds to pursue a claim against not only the individual advisor but the entire firm for its supervisory lapses. Understanding this responsibility is the first step in holding the right parties accountable.

A Firm’s Responsibility to Supervise

LPL Financial states that it provides its advisors with a support structure to help them follow complex regulations. This includes offering training, oversight, and guidance from an internal compliance team. The stated goal of these resources is to protect both advisors and their clients by ensuring a compliant practice. For you as an investor, this means you have a right to expect that the firm is actively monitoring the advice you receive and the transactions in your account. This oversight should include reviewing communications, approving investments, and promptly investigating any customer complaints. When an advisor operates without this level of supervision, the risk of harm to your portfolio increases substantially.

Key Regulatory Compliance Standards

Advisors at LPL Financial are required to follow a strict Code of Conduct and a Code of Ethics, which mandate compliance with all applicable federal securities laws. According to LPL, the firm actively monitors the regulatory landscape to keep its advisors educated on any changes. This proactive approach is meant to create a culture of compliance. These internal rules are important because they establish the standard of care you are owed as a client. When these standards are not met and you suffer losses, it may be possible to recover those damages through securities arbitration. The firm’s own policies can become powerful evidence in demonstrating how their advisor failed to meet their obligations to you.

What Should You Do If You’re Concerned?

If the allegations against Shannon Moore resonate with your own experience, it’s completely normal to feel worried and unsure of what to do next. Taking a few clear, deliberate steps can help you regain a sense of control and figure out the best path forward for your financial future. The key is to be proactive. By gathering your information and understanding your options, you can make informed decisions about how to protect your investments and hold accountable those who may have caused you harm.

Document Your Investment History

First things first, gather all your paperwork. This includes account statements, trade confirmations, emails, and any notes you took during conversations with your advisor. Having a clear, chronological record is incredibly helpful. You can also use FINRA’s BrokerCheck tool to look up Shannon Moore’s employment history and any reported disciplinary actions. This public database provides valuable background information that can help you piece together the full picture of your financial dealings and identify any potential red flags in your own portfolio.

When to Speak with a Securities Attorney

If you’ve reviewed your documents and believe you’ve suffered financial losses due to unsuitable advice, it’s time to consider speaking with a legal professional. An investment fraud lawyer can review your case and explain your rights in plain language. You don’t have to figure this all out on your own. A consultation can clarify whether you have a viable claim and what the process of securities arbitration looks like. This step is about getting a clear, professional opinion on your situation so you can decide what to do next.

Protect Your Financial Interests

Taking action is the most important thing you can do to protect your financial interests. The claims against Shannon Moore involve allegations of recommending unsuitable investments, a serious issue that can lead to significant losses. If you suspect your portfolio contains high-risk products that don’t align with your financial goals, seeking legal counsel is a critical step. An attorney can help you understand the complexities of broker fraud and negligence and guide you through the process of recovering your hard-earned money.

Related Articles

- LPL Financial Fined $11.7M

- LPL Broker Vincent Pallitto, Jr.: Investor Complaints & Disputes

- LPL Loses $462,000 Arbitration | Charles Fackrell

- LPL Broker Kenneth South (CRD# 1387390): Investor Allegations & Disputes

- FINRA Suspends Former LPL Broker

Frequently Asked Questions

What exactly does “unsuitable investment” mean? An unsuitable investment is one that simply doesn’t match your personal financial situation. Your advisor has a duty to understand your age, income, financial goals, and how much risk you’re comfortable with. If they recommend a product that is too risky, too complex, or doesn’t align with the plan you’ve discussed, it could be considered unsuitable. This is a serious issue because it places your money in a position that isn’t right for you.

I think I might have lost money because of bad advice. What’s the very first thing I should do? Your first step is to gather your documents. Pull together your account statements, trade confirmations, and any emails or notes from conversations you had with your advisor. Having a clear record of your investment history and communications is the foundation for understanding what happened. Once you have your information organized, you can get a clearer picture of your situation.

Is a firm like LPL Financial responsible for the actions of its advisors? Yes, brokerage firms have a regulatory duty to supervise their advisors. This means they are required to have systems in place to monitor their advisors’ recommendations and activities to ensure they are following the rules. If a firm fails in this duty and an investor is harmed as a result, the firm itself can be held accountable for the losses.

Besides pushing specific products, what are some other warning signs I should look out for? A major red flag is feeling rushed or pressured to make a quick decision. A good advisor will give you time to think and ask questions. You should also be wary if your advisor is not transparent about fees or the risks involved in an investment. If you find it difficult to get clear answers or feel like your concerns are being dismissed, it might be a sign that something is wrong.

I’m concerned about my investments but worried about the cost of hiring an attorney. What can I expect? It’s completely understandable to be concerned about costs. Many securities law firms offer a free, confidential consultation to review your case and discuss your options. They can help you understand if you have a claim without any initial financial commitment. Often, these cases are handled on a contingency fee basis, which means the law firm only gets paid if you successfully recover your money.