Are you questioning the advice you received from your financial advisor? Do the investments in your portfolio seem riskier than you were led to believe? These are valid concerns, especially for clients of Zachary Anderson at UBS Financial Services. Recent customer complaints allege that he misrepresented complex strategies and recommended unsuitable investments, leaving investors with unexpected losses. If these issues sound familiar, it’s time to get answers. This article will help you understand the red flags of broker misconduct and provide the information you need to evaluate your own situation, particularly if you suspect a UBS Financial Services Inc. Broker Zachary Anderson investment loss options plan went wrong.

Key Takeaways

- Recognize the Signs of Bad Advice: The allegations against Zachary Anderson—like misrepresentation and unsuitability—are common red flags. Review your own portfolio for investments that don’t match your goals or strategies you don’t fully understand.

- You Have a Path to Recover Your Money: If you suspect broker misconduct, you aren’t stuck. The primary route for investors to reclaim losses is through FINRA securities arbitration, a process designed to resolve these disputes.

- Take Control When Choosing a New Advisor: Before hiring anyone, use FINRA’s BrokerCheck to see their complaint history. Insist on working with a fiduciary who is legally required to put your interests first, and demand total transparency on fees.

What Are the Allegations Against UBS Broker Zachary Anderson?

If you’ve worked with Zachary Anderson of UBS Financial Services, it’s important to be aware of recent customer complaints filed against him. These allegations point to serious concerns about his investment advice and practices. Understanding these claims can help you review your own portfolio and determine if you may have experienced similar issues. The complaints center on several key areas of professional misconduct.

Misrepresenting Options Trading Strategies

One of the main allegations involves the misrepresentation of complex investment strategies. A customer complaint states that between 2021 and 2023, Anderson was not truthful about the nature and risks of the options trading strategies he was using. Misrepresentation occurs when a broker provides false or misleading information, causing an investor to make a decision they otherwise wouldn’t have. This type of broker fraud and negligence can lead to unexpected and severe losses, especially with high-risk products like options. When the risks aren’t clearly explained, investors can be left in a difficult financial position without understanding what went wrong.

Recommending Unsuitable Investments

Another serious claim against Anderson is that he recommended unsuitable investments. According to a complaint, he advised a client to invest in certain securities that were not appropriate for their financial situation or investment goals. Brokers have a fundamental responsibility to understand their clients’ risk tolerance, age, and objectives before making any recommendations. When they suggest investments that don’t align with the client’s profile, it’s known as unsuitability. These kinds of investment issues can expose your portfolio to unnecessary risk and undermine your long-term financial security, leaving you with investments that are a poor fit for your needs.

Breaching Fiduciary Duty

The complaints also allege that Anderson breached his fiduciary duty. This is a legal and ethical obligation requiring a financial advisor to always act in their client’s best interest, not their own. The claim suggests Anderson was negligent and failed to prioritize his client’s financial well-being. A breach of fiduciary duty is a significant violation of trust. It means the advisor may have put their own financial gains, such as earning higher commissions from certain products, ahead of your financial success. This is a serious form of misconduct that directly harms the client the advisor is supposed to be helping.

Failing to Communicate and Disclose Information

A failure to properly communicate and disclose critical information is another key part of the allegations. Brokers are required to be transparent about all aspects of an investment, including potential risks, fees, and any conflicts of interest. Rules like the SEC’s Regulation Best Interest (Reg BI) mandate that brokers act in their client’s best interest, which includes clear and honest communication. When a broker misrepresents a strategy or fails to disclose important details, they prevent you from making a fully informed decision about your money. If you believe your broker has not been transparent, it may be time to contact a legal professional to review your situation.

How Can You Recover Investment Losses from Zachary Anderson?

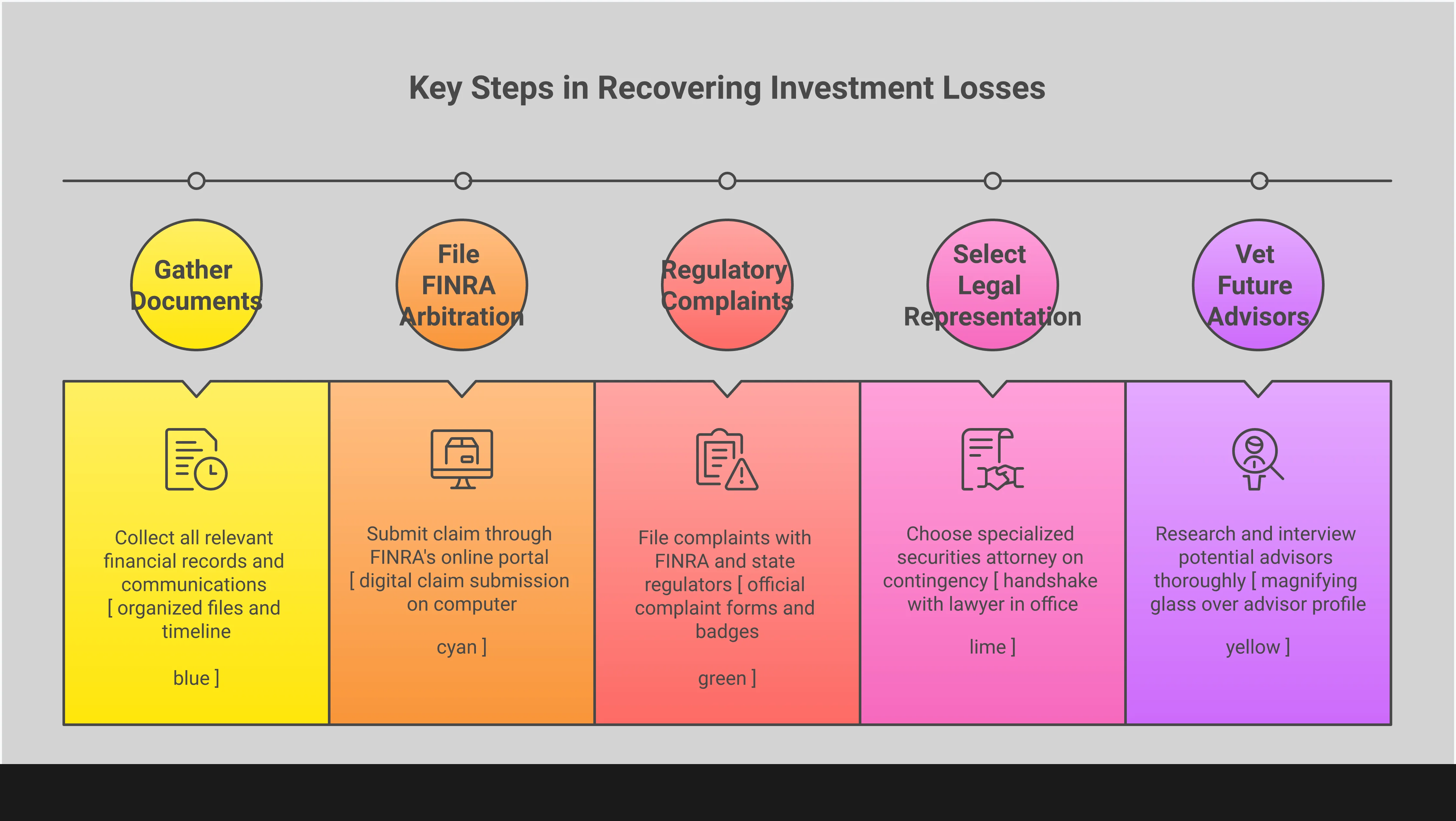

Discovering that you may have lost money due to your broker’s actions can be incredibly stressful and confusing. It’s easy to feel powerless, but it’s important to know that you have rights and there are established pathways to recover your losses. If you believe you’ve suffered financial harm because of investment advice from Zachary Anderson at UBS, you don’t have to accept it. There are several concrete steps you can take to hold your broker accountable and work toward getting your money back. The key is to understand your options and act on them. From formal arbitration to filing complaints with regulatory bodies, you can take control of the situation.

Pursue FINRA Securities Arbitration

For many investors, the most direct path to recovering losses is through securities arbitration. Think of it as a specialized, private court system for the financial industry, overseen by the Financial Industry Regulatory Authority (FINRA). Instead of a lengthy and public court battle, your case is presented to an impartial arbitrator or panel who will issue a final, binding decision. This process is typically faster and more cost-effective than traditional litigation. If you lost money on investments recommended by Zachary Anderson, filing a FINRA arbitration claim against him and his employer, UBS Financial Services, is a powerful tool for seeking compensation for the damages you’ve incurred.

File a Complaint with Regulators

Filing a formal complaint is another crucial step. When you report misconduct to regulatory bodies like FINRA or the Securities and Exchange Commission (SEC), you create an official record of the broker’s actions. Zachary Anderson already has a customer complaint on his record alleging misrepresentation of options trading strategies. Adding your voice can establish a pattern of behavior and may trigger a formal investigation by regulators. While filing a complaint doesn’t directly recover your money, it holds the broker accountable and can strengthen your individual arbitration case. It also helps protect other investors from potentially facing similar issues in the future.

Seek Legal Help to Recover Damages

You don’t have to go through this process alone. Navigating the complexities of securities law and FINRA procedures can be challenging, and having a dedicated legal advocate on your side makes a significant difference. An experienced securities fraud attorney can thoroughly review your case, gather the necessary evidence, and build a strong claim on your behalf. They handle the entire arbitration process, from filing the initial claim to representing you in hearings. If you’ve suffered losses from broker fraud and negligence, getting professional legal advice is the most effective way to understand your rights and pursue the compensation you deserve.

How Contingency Fees Work

Many people hesitate to seek legal help because they worry about the cost, especially after already losing money. That’s why most securities law firms, including ours, work on a contingency fee basis. This arrangement means you don’t pay any attorney’s fees unless we win your case and recover money for you. The firm’s fee is a percentage of the amount recovered. This approach allows you to pursue justice without any upfront financial risk. Initial consultations are also typically free, so you can have your case evaluated and understand your options without any obligation. It ensures that everyone has access to quality legal representation, regardless of their financial situation.

How to File a Complaint Against Zachary Anderson

If you’ve suffered investment losses while working with Zachary Anderson, taking action can feel overwhelming. But you don’t have to figure it out alone. There is a clear process for filing a complaint and seeking to recover your funds. The key is to be methodical and understand the steps involved. By gathering your information and knowing where to report the misconduct, you can build a strong case and hold your broker accountable for their actions.

Gather Your Documents and Evidence

Your first step is to collect every piece of information related to your investments with Zachary Anderson. Think of yourself as a detective building a case file. This includes account statements, trade confirmations, emails, text messages, and any notes you took during phone calls or meetings. All individuals registered to sell securities are required to disclose customer complaints, so having detailed documentation is essential for substantiating your claim. This evidence will form the backbone of your complaint and is critical for demonstrating the broker fraud and negligence you experienced. The more thorough your records, the clearer the picture of misconduct becomes.

Use FINRA BrokerCheck to Start the Process

The Financial Industry Regulatory Authority (FINRA) offers a powerful resource you should use right away. FINRA’s BrokerCheck is a free tool that allows investors to research the professional backgrounds of brokers and investment advisers. You can look up Zachary Anderson’s employment history, licenses, and—most importantly—any past customer disputes or regulatory actions. This official record can provide context for your own experience and may reveal patterns of misconduct. Having this information not only strengthens your complaint but also helps you understand the full scope of the issues at hand before you move forward with your claim.

Report to State Securities Regulators

In addition to filing a claim through FINRA, you should also report the broker’s actions to your state’s securities regulator. Each state has an agency responsible for enforcing its securities laws, often called “blue sky” laws. These regulators have the power to investigate and take disciplinary action against brokers who have harmed investors. Reporting the misconduct helps create an official record and can trigger a state-level investigation. Investors who have suffered losses are encouraged to contact their state securities regulators to report a broker’s actions. This is a vital step in protecting other investors and holding brokers accountable for their conduct.

Know the Statute of Limitations

It’s incredibly important to act quickly, as your right to file a claim is time-sensitive. Each state has its own statute of limitations for filing a complaint against a broker, which can range from one to six years depending on the nature of the claim. If you wait too long, you could lose your ability to pursue recovery for your investment losses, no matter how strong your case is. Because these deadlines can be complex and vary by jurisdiction, it is wise to understand the specific time limits that apply to your situation. If you have questions about the deadlines for your claim, you should contact an attorney to ensure you don’t miss your window of opportunity.

How to Choose Your Next Financial Advisor

After a negative experience with an advisor, the thought of trusting someone else with your finances can be daunting. But finding a trustworthy professional is possible when you know what to look for. Taking the time to vet your next advisor carefully is the best way to protect your financial future. Think of it as a job interview where you’re the one doing the hiring. By asking the right questions and doing your homework, you can find an advisor who genuinely has your best interests at heart.

Check a Broker’s Credentials and History

Before you even sit down with a potential advisor, your first step should be a thorough background check. All individuals registered to sell securities or provide investment advice are required to disclose customer complaints, arbitrations, and regulatory actions. You can find this information for free using FINRA’s BrokerCheck tool. This database provides a detailed report on a broker’s employment history, licenses, and, most importantly, any disciplinary actions or investor complaints filed against them. Reviewing this report can help you avoid advisors with a history of broker fraud and negligence. Don’t just skim it; look for patterns of misconduct or a high number of complaints.

What Is a Fiduciary Duty?

Understanding the term “fiduciary” is critical. A financial advisor who operates under a fiduciary duty is legally and ethically bound to act in your best interest at all times. This is different from a “suitability standard,” which only requires that an investment is suitable for your situation, not necessarily that it’s the best possible option. Brokers must follow rules like the SEC’s “Regulation Best Interest” (Reg BI), which requires them to act in their client’s best interest and not put their own interests first. When interviewing a potential advisor, ask them directly: “Are you a fiduciary?” Their answer will tell you a lot about their commitment to your financial well-being over their own potential commissions.

Demand Clear Fees and Communication

Transparency around fees is non-negotiable. You have a right to know exactly how your advisor is compensated and what you’ll be paying for their services. Ask for a clear, written breakdown of all fees, including management fees, trading commissions, and any other administrative costs. It’s important to ensure transparency around fees; otherwise, financial planners and investment advisors may recommend investments that fit your needs under a less strict suitability standard. If an advisor is vague about costs or makes it seem complicated, consider that a major warning sign. Clear communication about fees is a hallmark of a professional who respects you and your money.

Spot the Red Flags Before You Invest

Trust your instincts during your initial conversations. If an advisor seems more interested in talking about themselves than listening to you, that’s a problem. As one financial professional noted, “A lot of folks in our industry will start talking about themselves, that’s a red flag.” The focus should be on your goals, your risk tolerance, and your financial situation. Be wary of anyone who promises guaranteed high returns, pressures you to make a quick decision, or avoids answering your questions directly. A good advisor will educate you and make you feel comfortable, not rushed or confused. If something feels off, it probably is. If you’ve already invested and are now seeing these red flags, it may be time to seek legal advice.

Related Articles

- FINRA Panel Orders UBS To Pay For Bond Losses

- UBS Broker William Meador: Investigating Investment Loss Claims

- Frankowski Firm Investigating UBS Broker

- UBS ORDERED TO PAY CUSTOMER OVER $564,000 FOR SALES OF PUERTO RICO MUNICIPAL BONDS AND BOND FUNDS

- UBS Loses Arbitration, Forced to Pay $200K

Frequently Asked Questions

What does it mean for an investment to be “unsuitable?” An unsuitable investment is one that doesn’t match your specific financial situation, goals, or tolerance for risk. Brokers are required to know their clients and recommend products that are appropriate for them. For example, a high-risk, speculative stock might be unsuitable for someone who is retired and needs to preserve their capital. When a broker recommends an investment that isn’t a good fit, it can expose you to losses you weren’t prepared for and shouldn’t have taken on.

I’m worried about my investments with my broker. What is the very first step I should take? The first thing you should do is gather all your documents. This includes account statements, trade confirmations, and any written communication you’ve had with your broker, like emails or notes from calls. Having this information organized will give you a clear picture of your situation. Once you have your documents, you can use FINRA’s free BrokerCheck tool to look up your advisor’s record for any past complaints or disciplinary actions.

If I file a claim to recover my losses, will I have to go to court? Most investment-related disputes are resolved through FINRA securities arbitration, not a traditional court trial. Arbitration is a more streamlined and private process where your case is heard by an impartial arbitrator who makes a binding decision. It is generally faster and less formal than going to court, which is why it’s the standard method for resolving these types of claims in the financial industry.

I’m concerned about legal fees. How can I afford an attorney after losing money? This is a very common and valid concern. Most securities law firms handle these cases on a contingency fee basis. This means you don’t pay any legal fees upfront. The attorney’s fee is a percentage of the money they recover for you. If you don’t win your case, you don’t owe any attorney’s fees. This structure allows you to pursue your claim without taking on additional financial risk.

What’s the difference between filing a complaint with a regulator and filing an arbitration claim? Filing a complaint with a regulator like FINRA or the SEC is about holding a broker accountable and creating an official record of their misconduct. It can trigger an investigation and helps protect other investors, but it won’t get your money back directly. To recover your financial losses, you need to file a separate FINRA arbitration claim. The two actions are distinct but can support each other; a regulatory complaint can sometimes strengthen your arbitration case.