Placing your financial future in someone’s hands is a profound act of trust. You rely on their guidance to protect your life savings and help you reach your goals. But what happens when that trust is broken? For some investors, this is the reality they face when allegations of misconduct surface against their advisor. The recent customer complaints filed against Raymond James & Associates, Inc. broker Pasquale Evangelista serve as a critical reminder of this vulnerability. With claims involving unsuitable recommendations and conflicts of interest, clients are left questioning the advice they received. Here, we’ll explore the details of these allegations and discuss the rights you have when a broker’s actions cause financial harm.

Key Takeaways

- Your Broker Has a Duty to You: Financial professionals are bound by regulations like the FINRA suitability rule and Regulation Best Interest, which require them to recommend investments that genuinely fit your financial profile and goals, not their own.

- Trust Your Gut and Verify the Facts: Be wary of high-pressure tactics, recommendations that seem misaligned with your objectives, or a lack of transparency. Always use FINRA’s free BrokerCheck tool to review a financial professional’s history before entrusting them with your money.

- You Have a Clear Path to Recovery: If you suspect misconduct has led to financial losses, you are not without options. The FINRA arbitration process is the primary avenue for investors to resolve disputes, and consulting with a securities attorney can help you understand your rights and build a strong case.

Who is Pasquale Evangelista?

If you’ve worked with Pasquale Evangelista, a broker at Raymond James, you might be following recent news about customer complaints. Understanding a broker’s professional history is a key step in figuring out what recent allegations could mean for you and your investments. When you place your financial future in someone’s hands, you deserve to have a clear picture of who they are and how they operate.

Evangelista’s Professional Background

Pasquale Evangelista, who also goes by Pat Evangelista, has been a financial advisor and securities broker for decades. His career in the investment world began in 1994, giving him extensive experience in the financial services industry. Since March 2010, he has been registered with Raymond James Associates Inc. in Naples, Florida. When an investor trusts a broker with their life savings, they expect professional and ethical conduct. Unfortunately, sometimes issues of broker fraud and negligence arise, leaving clients with significant losses and many unanswered questions.

His Role at Raymond James

During his time at Raymond James & Associates, INC., Evangelista’s work has centered on advising clients about investment strategies and helping with their financial planning. While his role is to help clients meet their financial goals, his record has recently been marked by serious customer complaints. These complaints specifically question whether the investments he recommended were actually suitable for the clients he was advising. The concept of suitability is a cornerstone of investor protection, and when it’s ignored, it can lead to devastating financial consequences for individuals and families who were counting on sound advice for their investment issues.

Customer Complaints Against Pasquale Evangelista

When you trust a financial professional with your money, you expect them to act in your best interest. Unfortunately, that doesn’t always happen. Recent records show that Pasquale Evangelista, a broker with Raymond James & Associates, Inc., is facing customer complaints that raise serious questions about his conduct. Understanding the details of these claims can help you spot similar red flags in your own portfolio.

A Look at the FINRA Claims

The Financial Industry Regulatory Authority (FINRA) is a watchdog organization that oversees brokers and brokerage firms. Its records are a public resource for investors, and according to FINRA, Pasquale Evangelista has recent customer complaints filed against him. These aren’t just minor grievances; they are formal claims alleging significant financial misconduct. When a broker has a history of complaints, it can indicate a pattern of behavior that puts clients’ savings at risk. This type of broker fraud and negligence is precisely what regulatory bodies like FINRA aim to prevent and penalize.

Timeline of Allegations

The complaints against Evangelista aren’t isolated to a single event. The alleged misconduct reportedly took place over a five-year span, from August 2018 to August 2023. This extended period suggests a potential pattern of questionable advice rather than a one-time error in judgment. More recently, a client took formal action by filing a securities arbitration case against Evangelista on June 21, 2024. This timeline is important because it shows that the issues are current and that investors are actively seeking to hold him accountable for his alleged actions during his time at Raymond James.

Which Investments Are Involved?

The core of the allegations revolves around the suitability of the investments Evangelista recommended. One client claims she lost money on investments tied to mortgage products. Another complaint specifies that Evangelista recommended unsuitable debt investments. An “unsuitable” investment is one that doesn’t align with a client’s financial goals, age, or risk tolerance. Brokers have a duty to recommend products that are appropriate for their clients, and a failure to do so can lead to devastating losses. These types of investment issues are a serious breach of a broker’s professional responsibility.

What Are the Core Allegations?

When you place your financial future in a broker’s hands, you have a right to expect that your interests will come first. The customer dispute filed against Pasquale Evangelista points to a situation where this fundamental trust may have been broken. The claims outline a pattern of conduct that raises serious questions about the advice given and the management of the client’s funds. These allegations aren’t just numbers on a page; they represent significant financial and emotional distress for the investor involved. Let’s look at the specific claims to better understand what reportedly happened.

Alleged Conflicts of Interest

One of the central claims is that Evangelista faced a conflict of interest. The client alleges this conflict arose because he was simultaneously managing her account, her sibling’s account, and a related trust. A broker must provide undivided loyalty to their client. When a broker manages interconnected family accounts, it can become difficult to make recommendations that serve each individual’s best interest without being influenced by the needs of another account. This type of situation can lead to decisions that benefit the broker or another family member at your expense, which is a serious form of broker misconduct.

Recommending Unsuitable Investments

The complaint also raises concerns about the suitability of the investments recommended. According to the filing, these issues took place over a five-year period, from August 2018 to August 2023. Brokers have a duty to recommend investments that align with their client’s financial situation, investment goals, and risk tolerance. An investment that is perfect for one person might be completely inappropriate for another. Allegations of unsuitable recommendations suggest that the broker may have failed to uphold this core responsibility, potentially placing the client’s capital in harm’s way by suggesting strategies that did not fit her financial profile or objectives.

Pressure to Liquidate Assets

Perhaps the most troubling allegation involves pressure to sell investments. The client claims Evangelista pushed her to liquidate assets to pay off a loan, even though her account was not the primary one associated with that loan. Following this transaction, her account was reportedly frozen. To make matters worse, more of her investments were sold off after the account’s value fell below a certain threshold relative to the loan. This chain of events highlights how aggressive or inappropriate advice can lead to devastating and irreversible financial losses, creating complex investment issues for the client.

The Financial Impact on Investors

When you trust a financial professional with your savings, the last thing you expect is to suffer significant losses because of their advice. The allegations against Pasquale Evangelista are a stark reminder of the real financial damage that can occur when a broker’s recommendations are not aligned with their client’s best interests. These aren’t just abstract numbers; they represent retirement funds, college savings, and the financial security that families work for decades to build.

The claims filed highlight specific and substantial monetary damages. For investors, seeing these figures can be alarming, but it’s important to understand the mechanics behind them. The financial impact often goes beyond the initial loss on a single investment. It can create a ripple effect, leading to forced sales of other assets, missed opportunities for growth, and a long-term setback to your financial goals. Understanding the scope of these potential losses is the first step toward holding responsible parties accountable for the harm caused by various investment issues.

Clients Seek $277,686 in Damages

A pending customer complaint against Pasquale Evangelista is seeking $277,686.00 in damages. This figure represents the amount one client believes they lost directly due to the broker’s actions. When an investor files a claim, they must calculate the specific financial harm they’ve endured. This isn’t just a random number; it’s often the result of a careful analysis of account statements, transaction histories, and the performance of the unsuitable investments compared to what a more appropriate strategy would have yielded. A claim of this size indicates a serious breakdown in the advisory relationship and points to substantial portfolio damage that can take years to recover from, if ever.

Losses from Forced Sales

The financial damage can be more complex than a simple drop in an investment’s value. In one claim, a customer alleges Evangelista pressured her to sell investments to pay off a loan. After she did so, her account was reportedly frozen, and more of her investments were sold because the account balance fell below a required minimum. This situation illustrates how one piece of poor advice can trigger a cascade of negative consequences. Forced liquidations often happen at the worst possible time, locking in losses and preventing you from benefiting from any potential market recovery. This kind of pressure is a major red flag for broker fraud and negligence.

The Challenge of Recovering Losses

Seeing these kinds of allegations can feel overwhelming, and you might wonder if it’s even possible to get your money back. The truth is, recovering investment losses is a complex process, but it is possible. Investors have rights, and there are established procedures for resolving these disputes. The primary avenue for investors to seek recovery from their brokerage firm is through the securities arbitration process, which is run by the Financial Industry Regulatory Authority (FINRA). You don’t have to face this process alone. Working with a legal team that understands the system can help you build a strong case to reclaim your hard-earned money.

Understanding the Rules Brokers Must Follow

When you entrust your money to a financial professional, you’re placing a great deal of faith in their judgment. It’s important to know that this relationship isn’t just based on trust—it’s governed by a strict set of rules designed to protect you. Brokers and financial advisors have specific duties they owe to their clients. Understanding these obligations is the first step in recognizing when something has gone wrong. If a broker sidesteps these rules, it can lead to significant financial harm and may be a clear sign of broker fraud and negligence. Knowing the standards they are held to empowers you to identify red flags and take action to protect your financial future.

The FINRA Suitability Rule

One of the foundational rules comes from the Financial Industry Regulatory Authority (FINRA). The FINRA suitability rule requires that any investment a broker recommends must be suitable for their client. This isn’t a vague suggestion; it means the broker must have a solid reason to believe a specific investment aligns with your unique financial situation. They need to consider your age, income, other investments, financial goals, and how much risk you’re comfortable taking. A recommendation that is perfect for a young, high-risk investor could be completely inappropriate and devastating for someone nearing retirement. When a broker ignores these factors, they are not just giving bad advice—they are breaking a critical rule.

Regulation Best Interest (Reg BI)

Regulation Best Interest, or Reg BI, takes investor protection a step further. This rule mandates that brokers must act in their customer’s best interest and cannot put their own interests—like earning a higher commission—ahead of yours. It’s not enough for an investment to be merely “suitable.” If there are better, more cost-effective options available, the broker has a duty to recommend what is truly best for you. This regulation was created to address the conflicts of interest that can arise when a broker’s compensation is tied to the products they sell. It’s a higher standard of care for some of the most common investment issues investors face.

Disclosing Conflicts of Interest

Transparency is key to a healthy client-broker relationship. Brokers have an obligation to disclose any potential conflicts of interest. A conflict of interest arises in any situation where the broker’s personal interests could potentially compromise their recommendations to you. For example, if a broker is managing accounts for multiple family members with competing financial goals, that could create a conflict. Another common issue is when a broker pushes proprietary products from their own firm that pay them more, even if those products aren’t the best fit for the client. If you’ve been harmed by an undisclosed conflict, you may have a path to recovery through securities arbitration.

How the Allegations May Violate Regulations

When you entrust your money to a financial advisor, you’re not just hoping they’ll do a good job—you’re counting on them to follow a strict set of rules designed to protect you. These regulations are not suggestions; they are foundational to the industry. Financial professionals have a duty to recommend investments that align with your financial situation, goals, and risk tolerance. The claims against Pasquale Evangelista suggest a potential disregard for these fundamental obligations.

The allegations of recommending unsuitable investments and operating under a conflict of interest are serious because they cut to the core of an investor’s trust. If a broker prioritizes their own interests or the interests of another client over yours, it can lead to significant financial harm. Understanding the specific rules that may have been broken is the first step in recognizing broker fraud and negligence and knowing what your rights are. These regulations exist to ensure the advice you receive is sound and tailored specifically to you.

Breaching the Suitability Standard

One of the most important rules brokers must follow is FINRA’s “suitability” rule. In simple terms, this means a broker must have a solid reason to believe that any investment they recommend is appropriate for their client. The allegations claim Evangelista pressured a client to sell investments to cover a loan, even when her account wasn’t the main one tied to it. This action could be considered unsuitable if the sale didn’t align with her personal financial goals or risk profile. The alleged conflict of interest, stemming from managing accounts for multiple family members, further complicates the matter, as it can make it difficult to provide suitable advice for any single individual.

Failing the “Best Interest” Duty

Beyond suitability, brokers are also held to a standard known as Regulation Best Interest (Reg BI). This rule requires them to act in their customer’s best interest and not place their own financial interests ahead of their client’s. Reg BI demands that brokers fully understand the risks and costs of an investment, know their customer’s financial situation, and suggest options that are genuinely best for that person. The claim that Evangelista managed accounts for a client, her sibling, and a trust at the same time raises questions about whether he could truly act in any one person’s best interest without being influenced by the needs of the others. When these duties are ignored, investors may have grounds to pursue a claim through securities arbitration.

Red Flags to Watch for With Any Broker

While the details of any single case are unique, certain behaviors can signal trouble with any financial professional. Learning to spot these warning signs is one of the most important things you can do to protect your portfolio. It’s about being an informed and proactive investor. Trusting your intuition is a great start, but knowing the specific red flags gives you concrete reasons to question a broker’s actions. If something feels off, it’s worth taking a closer look.

A History of Customer Complaints

A broker’s professional history is public information for a reason. Before working with anyone, you can and should look them up using FINRA’s free BrokerCheck tool. While a single complaint isn’t always a definitive sign of wrongdoing, a pattern of similar allegations is a major red flag. For example, the claims against Pasquale Evangelista are part of his public record. A history of complaints can indicate a broker has a habit of putting their own interests ahead of their clients’. This is a classic sign of potential broker fraud and negligence that you should never ignore.

Recommendations That Don’t Fit Your Goals

Your broker has a fundamental responsibility to recommend investments that are suitable for you. This means their advice must align with your financial situation, risk tolerance, and stated goals. If a broker suggests a strategy that seems out of sync with what you’ve discussed, it’s time to ask questions. In one claim against Evangelista, a client alleged she was pressured to sell investments to pay off a loan that wasn’t primarily tied to her account. This is a prime example of a recommendation that may not serve the client’s best interests and can lead to serious investment issues.

Pressure and a Lack of Transparency

You should never feel rushed or confused when discussing your finances. A trustworthy advisor will take the time to explain their strategy, including all potential risks, and make sure you understand completely before you commit. High-pressure tactics or vague explanations are serious warning signs. If a broker urges you to act immediately or dismisses your concerns, they may be hiding something. The consequences can be severe, as seen in cases where accounts are frozen or assets are sold unexpectedly. If you feel pressured or left in the dark about your own money, it may be time to contact a lawyer for an unbiased opinion.

Your Rights When Facing Broker Misconduct

Discovering that your broker may have mishandled your investments can feel overwhelming. It’s easy to feel powerless, but it’s important to remember that you have rights and clear pathways to seek justice. Financial industry regulations are in place to protect investors like you, and understanding your options is the first step toward holding a negligent broker accountable and potentially recovering your losses.

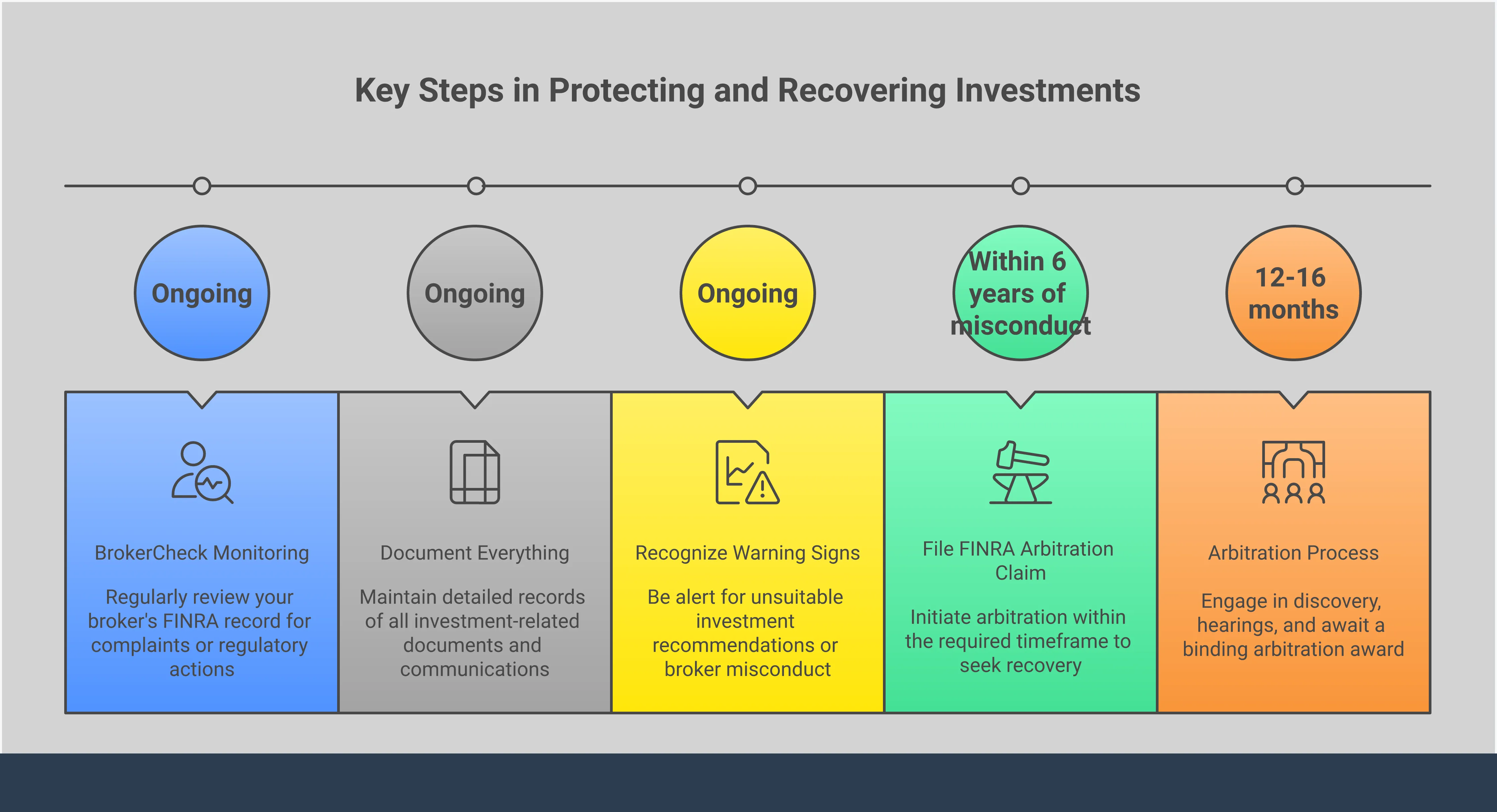

The FINRA Arbitration Process

When you open an account with a brokerage firm, you typically agree to resolve disputes through a specific process. Instead of going to court, most investor claims are handled through securities arbitration overseen by the Financial Industry Regulatory Authority (FINRA). FINRA has rules in place to protect investors, including the requirement that any investment recommendation must be suitable for your financial situation and goals. The arbitration process is designed to be a more efficient way to resolve these complex disputes. An impartial arbitrator or panel will hear the case and make a binding decision.

Your Options for Legal Action

You don’t have to go through this process alone. If you suspect you’ve lost money due to your broker’s actions, you can work with a securities fraud attorney to represent you. Many firms that handle these cases, including ours, offer a free, confidential consultation to review your situation and explain your options. We also work on a contingency fee basis, which means you don’t pay any attorney’s fees unless we successfully recover money for you. This approach allows you to pursue your claim without worrying about upfront legal costs. Taking the step to contact us can provide clarity and a path forward.

Why You Shouldn’t Wait to Act

Time is a critical factor when dealing with investment disputes. There are strict time limits, known as statutes of limitation, for filing a claim. If you wait too long, you could lose your right to pursue recovery altogether. As seen in the claims against Pasquale Evangelista, investors can face significant damages, with one client seeking over $277,000. Acting promptly allows your attorney to gather evidence while it’s still available and build the strongest possible case. Addressing potential broker fraud and negligence quickly is the best way to protect your financial interests and hold the responsible parties accountable for their actions.

How to Protect Your Investments

Feeling uneasy about your investments is a stressful experience, but you aren’t powerless. Taking proactive steps can help safeguard your financial future and give you a clear path forward if you suspect something is wrong. It starts with being informed and diligent. By understanding the rules your broker must follow and knowing what to look for, you can better identify potential red flags. Keeping organized records and knowing when to seek advice are also crucial parts of protecting your hard-earned money. Here are a few actionable steps you can take.

Do Your Homework on a Broker

Before you trust anyone with your money, it’s essential to do some research. Brokers are required to follow specific rules, like Regulation Best Interest (Reg BI), which mandates that they act in your best interest, not their own. Additionally, FINRA rules require that any investment they recommend is suitable for your specific financial situation and goals. A great first step is to use FINRA’s free BrokerCheck tool to review a broker’s employment history, licenses, and any reported customer disputes. Understanding the signs of broker fraud and negligence can help you spot potential issues before they cause significant harm.

Keep Detailed Records

Documentation is your best friend when it comes to your investments. Make it a habit to save everything related to your accounts. This includes monthly statements, trade confirmations, and any written correspondence like emails or letters. It’s also a good idea to take notes during or after phone calls, jotting down the date, what was discussed, and any recommendations that were made. If a dispute ever arises over issues like an unsuitable investment or a conflict of interest, having a clear paper trail can be incredibly valuable. These records provide a timeline and can serve as critical evidence of the advice you were given.

Know When to Call a Lawyer

If you suspect misconduct or have suffered significant losses that you don’t understand, don’t wait to get a professional opinion. Many investors hesitate, hoping the market will turn around or feeling unsure if they have a valid case. Speaking with a securities attorney can help you understand your rights and what your options are. Most firms that handle these types of investment issues offer a no-cost consultation to review your situation. This initial conversation can provide clarity on whether you have a claim and what the process of securities arbitration involves, giving you the information you need to decide on your next steps.

Related Articles

- FINRA Fines Raymond James $17M

- FINRA January 2017 Disciplinary Actions

- Equitable Advisors Broker Terrell Bowman: Investor Complaints

Frequently Asked Questions

I was a client of Pasquale Evangelista. What should my next step be? If you have concerns about the advice you received or the performance of your investments while working with Mr. Evangelista, the first step is to gather your account statements and any communications you have. Reviewing these documents can help you get a clearer picture of your financial situation. The next step is to get a professional opinion on your account. We can review your case and help you understand if you may have a claim for your investment losses.

How can I tell if my broker recommended an “unsuitable” investment? An unsuitable investment is one that doesn’t match your specific financial circumstances, goals, or tolerance for risk. For example, a high-risk, speculative stock might be unsuitable for someone who is retired and needs to preserve their capital. If your broker recommended investments that resulted in significant losses or seemed inconsistent with the objectives you discussed, that’s a major red flag. It’s less about the investment itself and more about whether it was appropriate for you personally.

What is securities arbitration and is it different from going to court? Securities arbitration is the primary way investors resolve disputes with their brokerage firms. It’s a formal process, but it’s generally faster and less complex than a traditional lawsuit. Instead of a judge and jury, your case is heard by an impartial arbitrator or a panel of arbitrators who are knowledgeable about the securities industry. The outcome is a binding decision. Most brokerage account agreements require you to resolve disputes through this process rather than in court.

How can I find out if my own broker has customer complaints? The Financial Industry Regulatory Authority (FINRA) provides a free tool called BrokerCheck. You can use it to look up the professional history of any broker or brokerage firm. The report will show you their employment history, licenses, and, most importantly, any disclosures like customer complaints, regulatory actions, or terminations. Checking this public record is a simple and important step you can take to stay informed about the person managing your money.

I’m worried about the cost of hiring a lawyer. How does that work? That’s a very common and understandable concern. Most securities law firms, including ours, handle these cases on a contingency fee basis. This means you don’t pay any attorney’s fees upfront. We only get paid if we successfully recover money for you. This approach allows you to pursue a claim without the financial burden of legal bills, ensuring that your ability to seek justice isn’t limited by your current financial situation.